10/13/2010 PEERLESS REMAINS ON A BUY.

Stick with the uptrend. It is supported

by rising CLosing Powers for the major market

ETFs, A/D Lines and Peerless.

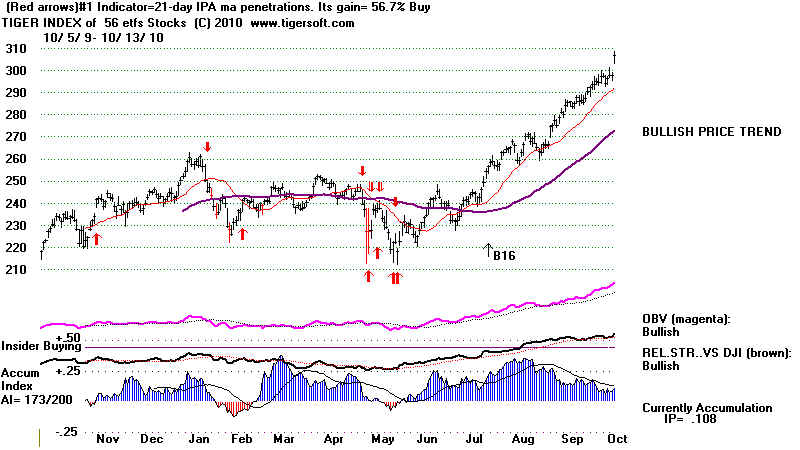

Look at how strong foreign ETFs are. This

is a direct result of the falling Dollar

and the Fed's low interest rate policies.

Foreign ETFs with high current Accumulation

levels (IP21) above .41 comprise 4 of the

top 6 ETFs. They are EWO, INP. PGJ and

CEE. High IP21 is one of the most important

factors to use in screening stocks to buy.

Foreign ETFs keep running to new highs.

Bernanke's weak Low Interest Rate/

Weak Dollar policies are clearly causing a lot

of big money to leave the US or go into

precious metals' stocks. These factors do

not help reduce unemployment in the US.

To do that the FED will need to make the Dollar

fall much further, so that American

exports become competitive. It is this

prospect plus the normal "Performance" rush into a

new hyperbolic speculative sector that makes

gold and silver still look very bullish.

Once this genie is out of the bottle, it cannot

be quickly or easily stopped.

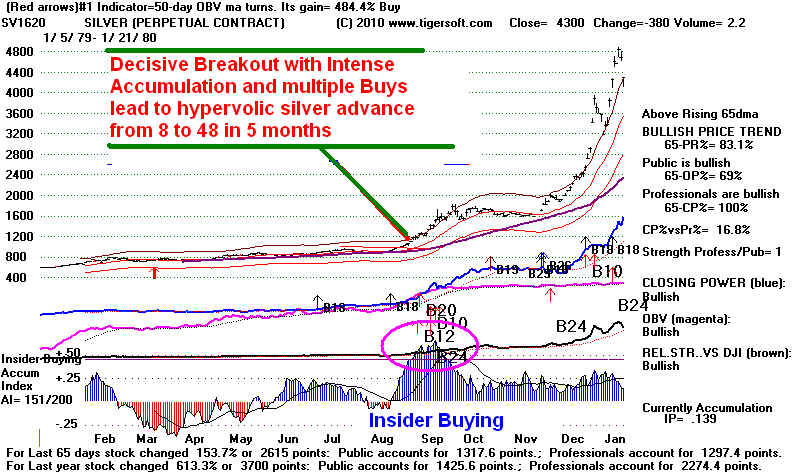

Our General Gold/Silver made a new high

breakout today on confirming red high

volume. I expect higher prices, but buy

selectively, using the screens below.

Gold/Silver stocks

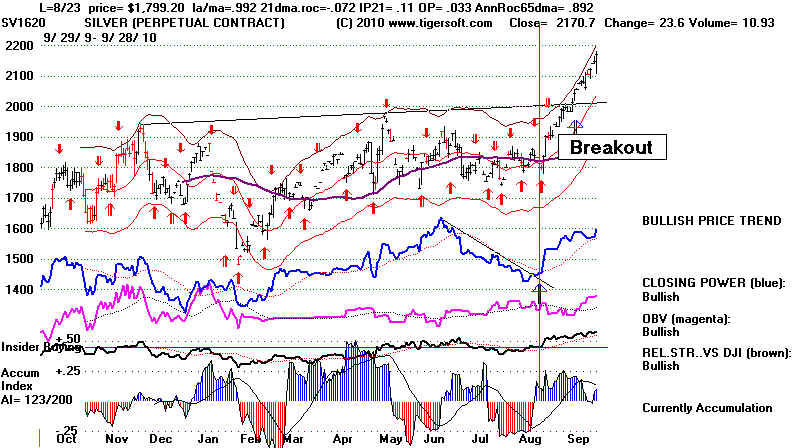

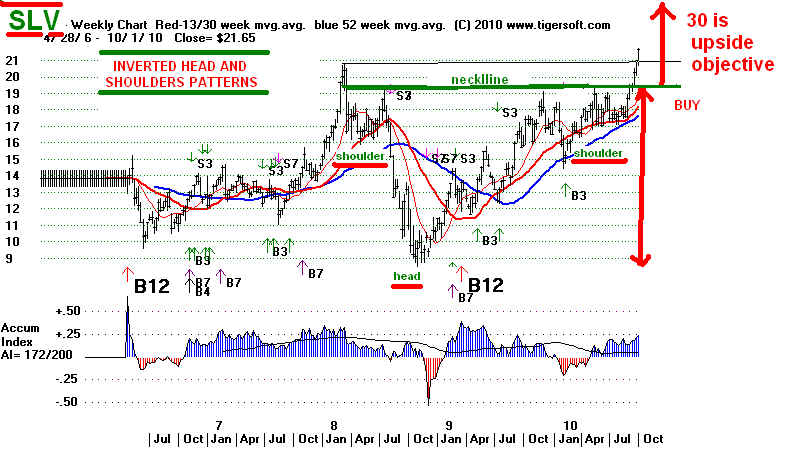

were the day's biggest gainers. Silver's breakout above

21 to a 29 year high was accompanied by high

Accumulation. The Accumulation Index

was not quite as high as in the second half of

1979 as silver began its dramatic 6 month rise

from 8 to 48, but it did reach the +.46 levels

I have set out as a sign of "insider buying".

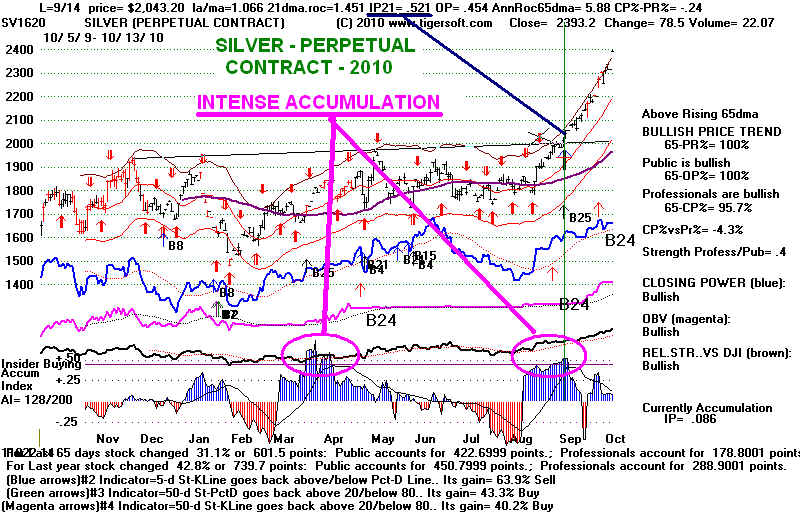

Further nelow are the perpetual contracts for

Silver 1979-1980, Silver 2010 and Gold 2010.

Note the huge bulge of Accumulation in the

perpetual contract of Gold at its bottom in 2010.

In both the SIlver cases it was the huge

vertical bulge of Accumulation that was the key to

spoting the start of the moves in 1979 and

2010. A long period of high (blue) Accumulation

was not present in 1979 or 2010. Gold's

Perpetual Commodity contract showed showed a

huge bulge of Accumulation right at the bottom.

The AI/200 level back in February and

March 2010 were not particularly noteworthy.

What

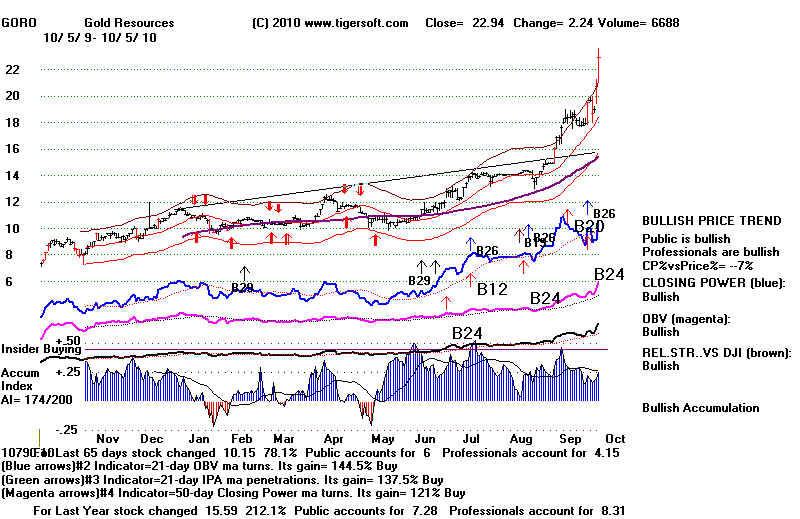

Gold Stocks to Buy

If we accept the premise that Gold and Silver

are in a major bull market that may last

another three or four months, at a minimum and

that is what the lesson of Silver in

1979-1980 suggests is a reasonable assumption,

then the Silver and Gold charts below

would also suggest that very high levels of

Accumulation are good ways of picking

the best Gold and Silver stocks.

TigerSoft gives us a nummber of ways of ranking

a universe of stocks like we see

in our current download of 71 gold and silver

stocks, ETFs and perpetual contracts.

Using simply the Tiger's "Most

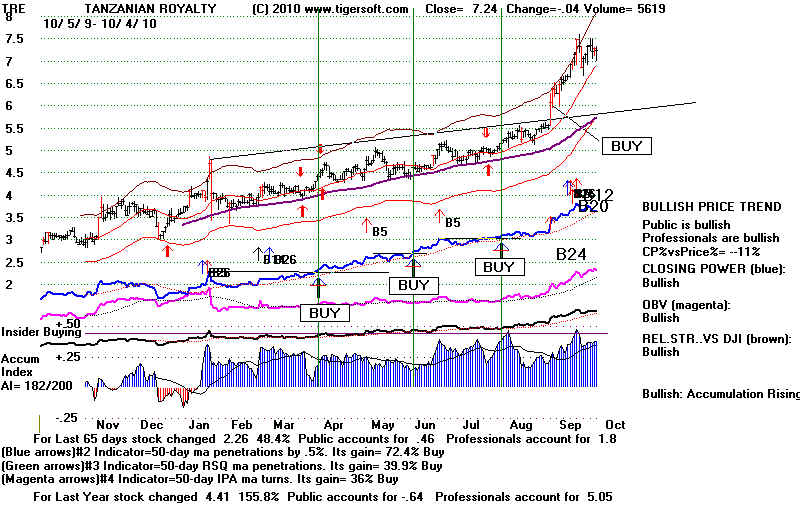

Bullish" Power Ranking, we would select TRE, CUM-T,

GORO and Gold (GLD).

The detailed survey below concludes that we

should also buy TGB. Below is the chart of

TGB. We especially like fresh new highs

on red high volume which show current

Accumulation Index readings above +.40.

Interestingly, TGB does not show up among the

top "Bullish" stocks because its

AI/200 score is only 132. I would discount completely

the red optimized Stochastic Sell because of

the breakout and very high Accumulation.

Professionals have not been buyers, judging

from how the blue CLosing Power

has lagged, but they are clearly getting aboard

now.

Rankings

Using TigerSoft Screens:

The simplest scan is the price change ranking since

the current rally began, from the

end of August. This uses the

"first-out-of-the-gate principle. Some have compared

Gold and SIlver's rise with the launching of

the big bull market in August 1982.

If true, this principle should work well again.

1. Gold/Silver

Vehicles: Ranked by Pct.Gain over the Last 30 trading days

Green

shows stocks with a current Accum. level above .23.

Only

those that meet this criteria in the top 5 are shown as RED.

In

this case, PINK means very bullish. RVMIF is eliminated if

we

add the requirement that the CP% be above 90% (Closing Power

more

than 90% of the way from its 65 day low to its high.)

Close

Pct Gain AI/200 IP21 65-Day CP% 12-momth high Closing

BULM 1.19

105%

141

-.17 100%

Yes

RVMIF .493

72%

106

.26 88.2%

No

This

also shows a bullish rank divergence -

Its

OBV% and IPA$ rankings are higher

than

its Pr% ranking over the last 21 days.

AZC 4.09

69%

114

.15

97.3%

Yes

CUM-T

4.8 69%

192

.07

98.5%

Yes

GORO

24.4 64%

174

.22

82.8%

YES

GRZ

1.49

63%

103

.19 24.8%

No

ANO 1.4

61%

134

.25 73.6%

No

AXU 6.56

61%

134

.25 100%

Yes

Note

high Accum bulge in Aug-Sept.

This

marks it as a special stock.

BAA 2.99

59%

75

.04 20.2%

No

TGB 6.89

56%

132 .45

100%

Yes

Note curent high Accum bulge.

This

marks it as a special stock.

2. Gold/Silver Vehicles: Ranked by Accumulation

Index (200 days)

The very highest AI/200 stocks have lots of big buyers

underneath current

prices

and are on the BUY lists of big Funds. If we use an AI/200 score of 140 or

above

to show this, we see that 3 of the 5 best performing Gold and Silver

stocks

since August 30th showed an AI/200 score of 140 or above:

Close

Pct Gain AI/200 IP21 65-Day CP% 12-momth high Closing

===>

BULM 1.19

105% 141 -.17 100%

Yes

RVMIF .493

72%

106

.26 88.2%

No

This

also shows a bullish rank divergence -

Its

OBV% and IPA$ rankings are higher

than

its Pr% ranking over the last 21 days.

AZC 4.09

69%

114

.15

97.3%

Yes

===>

CUM-T 4.8

69%

192

.07

98.5%

Yes

===>

GORO 24.4 64%

174

.22

82.8%

YES

Green shows stocks with highest Accum. Index scores.

Only

those that meet this criteria in the top 5 are shown as RED.

In

this case, PINK means very bullish.

Close

AI/200 IP21

CUM-T 4.8

192

.07 We found out about this only recently.

TRE

7.39

188 .34 We have recommended this since it was 5.

GO1620

1369.7 176 .08 Perpetual Conract for

Gold...We have recommended GLD

KRY

.38

176 .08 Too

low priced.

GORO

24.4 176

.22 This looks very good.

MMG

.623

172 .17

CQP

20.5

159 .20

PAL 4.64

150 .24

AU

48.12

146 .23

MVG

8.15

142 .19

3. Gold/Silver Vehicles: Ranked by Highest

Current Accumulation (IP21)

Green shows stocks with highest Accum. Index scores.

Only

those that in the top 5 that are at 12 month highs and

show

a 65-Day Closing Power Pct above 85% are shown

in

PINK, which means very bullish.

Close

AI/200 IP21 65-Day CP%

12-momth high

TGB 6.69 132

.45

100%

Yes

KRY

.38 176

.44

94%

No

SLV 23.45 94

.40

100%

Yes

GLD 134.07 140

.36

100%

Yes

TRE

7.39 188

.34

73.5%

7.6 would be a breakout.

ANO

1.49 110 .33

73.6%

No

BVN

50.88 91 .33

100%

Yes

Looks good!

HL

6.93 90

.26

97.1%

No

Bulges

of Accumulation at Important Launching Points

for

Big Advances by Silver and Gold

Silver 1979-1980

|

Silver 2010

|

Gold 2010

|

====================================================================================

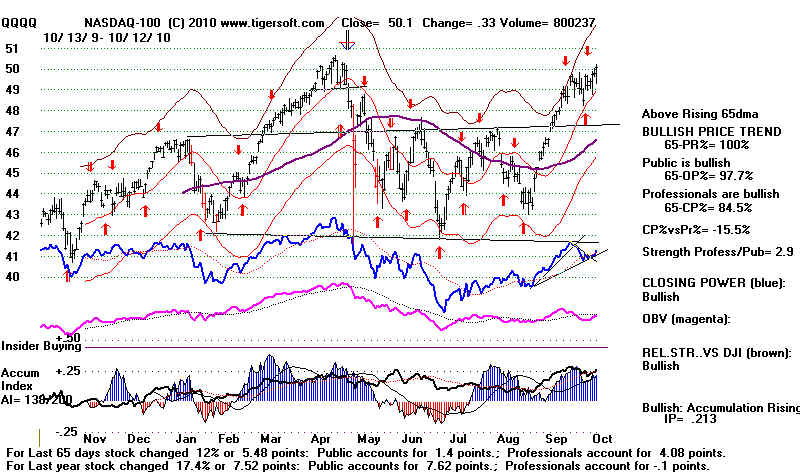

10/12/2010 PEERLESS REMAINS ON A BUY.

The NASDAQ jumped nicely up today. The ratio of

new highs to new lows

on the NYSE was 99 to 1. The

NASDAQ's is still a bullish 72 to 16. Having a good

number of new highs means that breakouts are

extending their gains. This

keeps the momentum players busy with the long side.

I certainly do not want

them to capture the downside as they did in 2008.

The CLosing Power's trend

for the QQQQ reflects much of their sentiment.

In the chart below, you can

see that the blue Closing Power has not confirmed the

recovery high. The statistics

on the right show that while prices are making a

65-day high, the 65day CP% is

only 84.5%. CP is only 84.5% of the way up from

its 65-day low to its high. This

yields a CP%vs Pr% bearish divergence of 15.5%.

A trend-break in the rising

CP is more reliably bearish after a such a divergence

or non-confirmation.

The good news is that both the Public and

Professionals are pushing prices

higher. This often yields very good returns

until the Professionals change their

minds and shift to net selling.

True, the DJI is losing momentum. But this is

not enough to get me to predict a 5% decline,

though, since all the Closing Powers are still

rising along with Openings.

The low interest rates that have fueled the September

rally may be in jeopardy.

A problem is developing with Bernanke's low interest

rates. The weak Dollar is

contributing, to a degree, to the sharp rise in food

commodities. Exports of

wheat and corn are made easier. Foes of

Bernanke's low interest rate policies

will use these numbers to show the costliness of

inflation. He will be hard pressed

to show that increased manufacturing exports

occasioned by the weak Dollar

have, so far, created enough new jobs to outweigh the

costs to consumers in

high food and fuel prices. Professionals may

see that the FED could become divided

if these price trends continue and gather steam,

especially if they start to make oil

prices rise as they did in th first half of 2008.

Bernanke's low interest rate policies

may lose critical support and he might even be

outvoted.

As a result, the Rates on the 10-Year Treasuries may

be bottoming. The Tiger CLosing

Power (CP) did not confirm the recent decline to new

lows. CP was enough off its 65-day

lows as Treasury interest rates made a new low to

bring a series of new Buy B7s. This

has not stopped the rises in

Gold and Silver. The highest Accumulation Gold and Silver

stocks

continue to advance or hold up best.

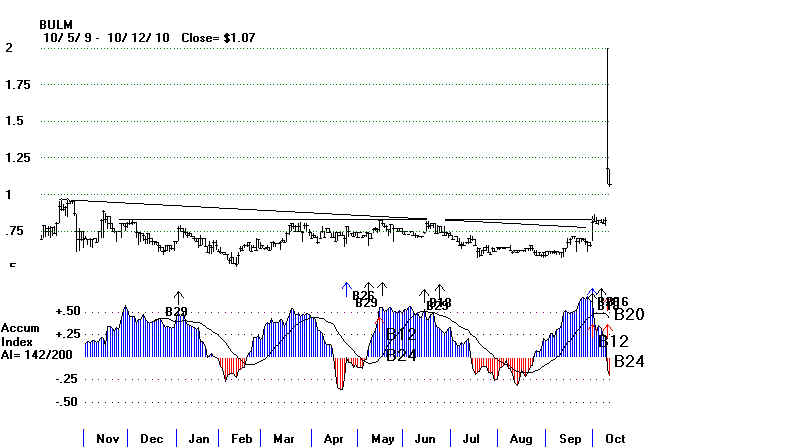

Look at the jump in low priced BULM

yesterday. Will KRY be next?

|

|

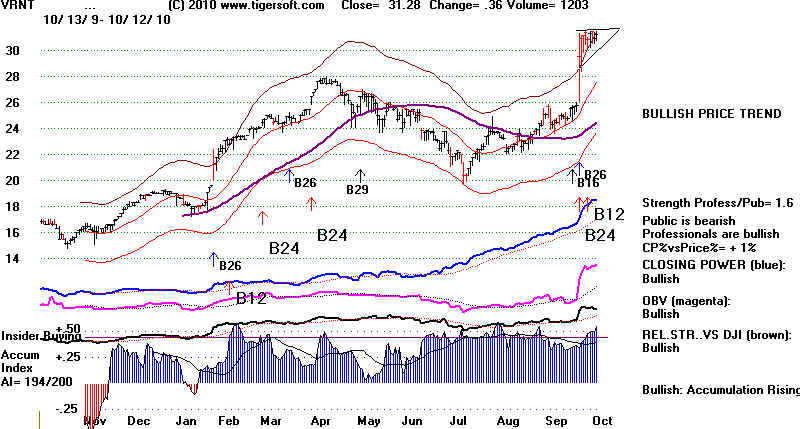

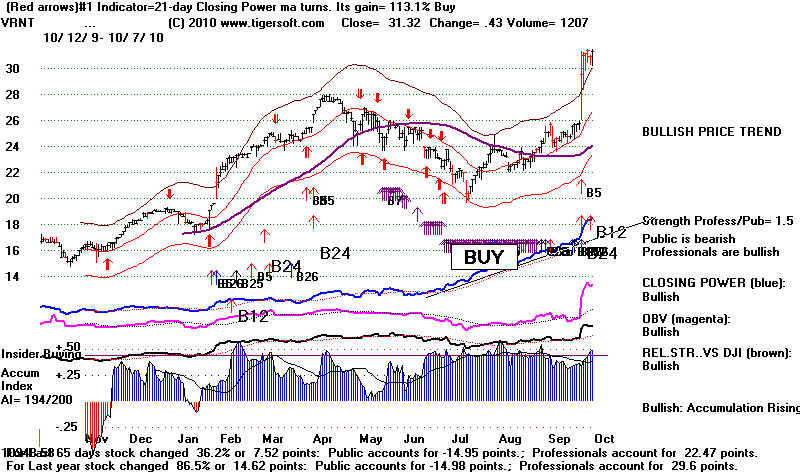

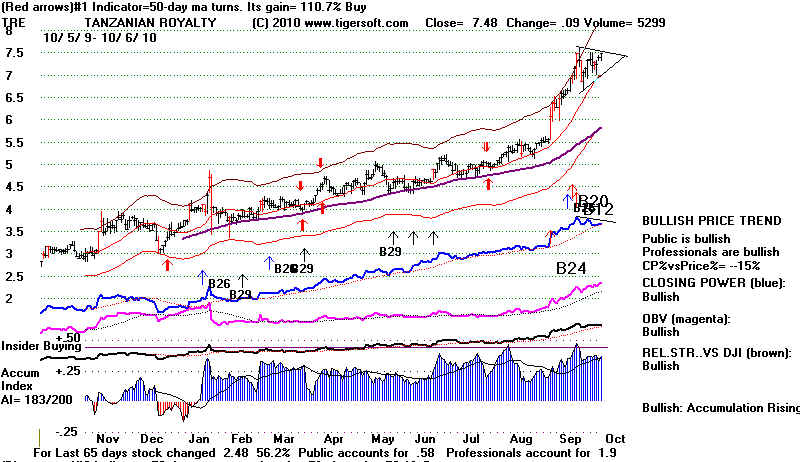

At this stage, short-term traders should get ready

for some blow-off upwards moves

in stocks that have flat topped hesitation patterns

following big run-ups if they

breakout above their flat tops. See the charts

of VRNT and TRE.

Traders Should Get Ready To Buy Breakouts

in Very Strong Stocks with Flat Tops.

Buying TRE and VRNT when prices surpass the recent highs

has a very good

chance to bring a steep rise that comes close to matching

the gains that preceeded

the pause.

====================================================================================

10/11/2010 PEERLESS REMAINS ON A BUY.

The DJI is running into the heavier resistance area above

11000. Internals are still

quite positive. The Closing Powers for the ETFs have

not broken their uptrends.

At this point in October, we can start to see some upside

daylight and stop worrying

about an October collapse. The next three trading

days after October 11th have fallen

51.3% of the time, but the DJI is higher a month from now

59% of the time going back

to 1965. If there is a retreat, look for the decline

to stop at the DJIA's 65-day ma now at 10500.

A break in the uptrending SPY Closing Power should set off

a 4% decline to 112 and

the 65-dma. That CP trendbreak should not be assumed.

We just have to wait for it

to occur.

The boost given the market by the weak Dollar may disappear

for a few days.

The Dollar's Closing Power broke its steep down-trendline.

Food prices popped upwards

today. That will put more pressure on Bernanke

to consider the inflationary

consequences of his low interest rate policy.

Corn rose 5% today. It has risen from

a low of 325 in June to 556 now. Live cattle

jumped 3.3% today. But they did close

at their lows. Gold is weaker this morning.

The bigger Gold Stocks have been pulling

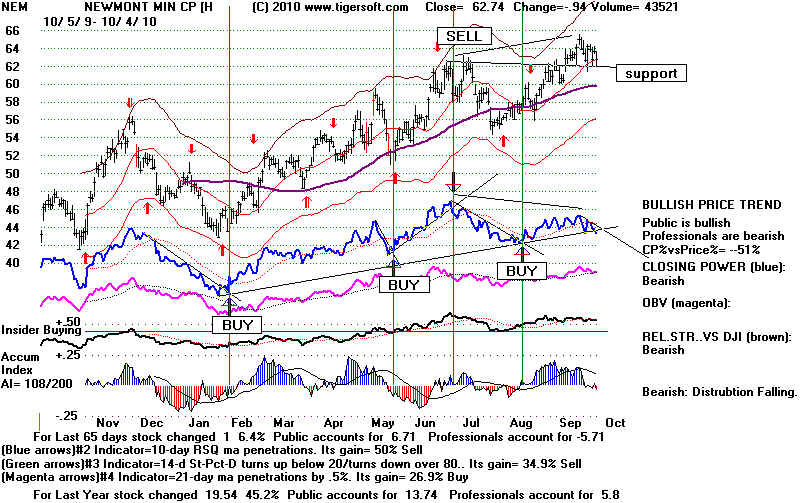

back even as Gold rose. So far, the decline in

NEM, for example is within normal

parameters. See the Blog I wrote tonight about Gold Stocks' Moving Out of Step

with Gold,

itself. We will want to start working with Relative Strength bands. (Some

more experimenting with these bands is needed, before

the software is released for

them. )

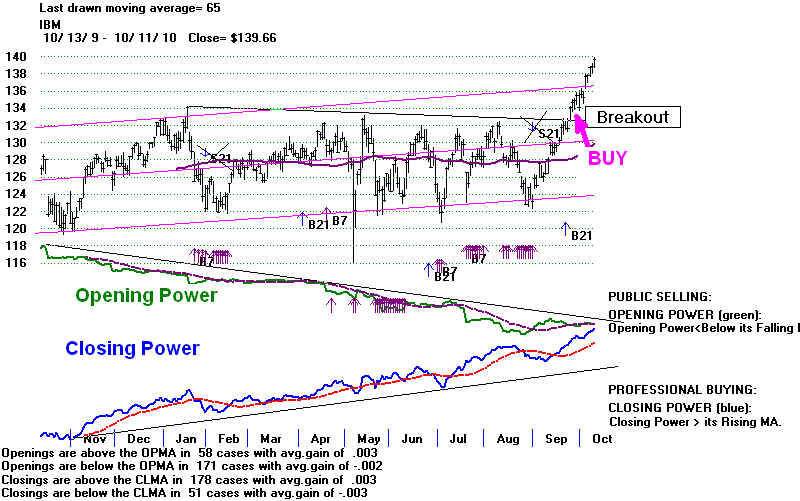

The DJI-30 stocks look firm with the exception of

BAC. IBM, up +.81, continues to give

its heavily weighted strength to the DJIA. The

higher priced DJI stocks are the leaders.

This is what often propels the market towards

the end of a surge. But until we see

divergences between prices and breadth, I think

we have to bet on higher prices.

Momentum traders can still find many more

strong stocks than weak stocks to look at .

There were 191 MAXCP stocks, i.e. Closing Power

made 12 month highs in last two days

and 37 MINCP stocks, that had Closing Power

make new lows... The ratio of NASDAQ

new highs to new lows is 59 to 15, much less

than the 121 to 1 ratio on the NYSE,

but enough to show the direction is still

probably up. The Bullish list from MAXCP holds

the same stocks mentioned frequently: GAS, EPD,

TUR 75.46 + 1.01 (ETF for Turkey).

TTM 27.23 +.54 (Tata Motors), NXTM and IFN and

IIF - India Funds. I am still weighting

for VRNT to breakout past its flat resistance

at 31.6. ABV - 133.33 +.67 and

a new stock JSM 20.45 which profits from

student loans.

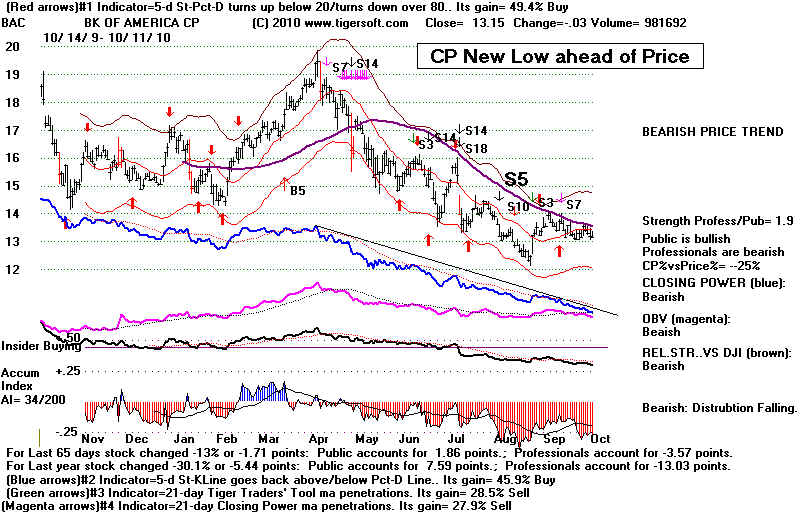

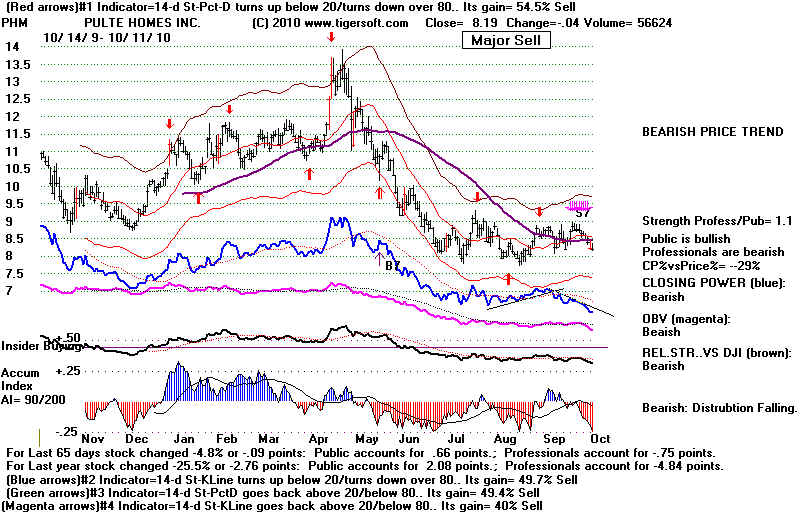

BAC remains a good short sale. Mounting

criticism of big banks for fraudulently

selling mortgages without proper paper work

will, no doubt, grow bigger as the Election

nears. PHM also shows significant red

distribution combined with CLosing Power

new lows. See Janet

Tavakoli's recent comments in Washington Post.

."This is the biggest fraud in the history of

capital markets..."

BAC and PHM

===================================================================================

10/8/2010 11006 la/ma=1.024 21-dmaROC=

+.656 P= 357 IP21=+.134 V= +48 OP= .283

PEERLESS REMAINS ON A BUY.

The NYSE

A/D Line keeps rising courtesy of Bernanke's low interest rate policy.

Critics

and bears want of the inflation these policies will cause

down the road. But with real

unemployment 17% and no plausible, much less practical,

alternative from either political

party, I don't see what will change the FED until after the

Election. Meanwhile, enjoy the ride.

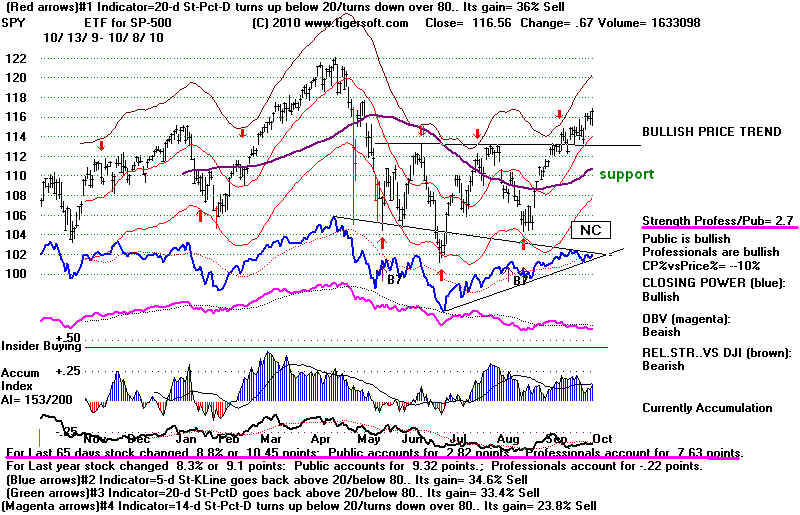

SPY does show an automatic red Sell signal. The

Closing Power has not confirmed

the recent advance. That makes any clear break in the

uptrend-line of SPY's Closing Power

a reliable short-term Sell. Another

relevant Closing Power principle is to become wary

when a Closing Power uptrend is broken in stocks or ETFs

that have both Opening and

Closing Power rising and are over-extended. Watch SPY

closely. A break in its CP uptrend

would likely bring a decline to its rising 65-day ma.

I do find encouragement when looking

at the new TigerSoft SPY chart. It shows that

Professionals' buying after the Opening

is 2.7 times more important than the gains occurring

overnight at the Openings.

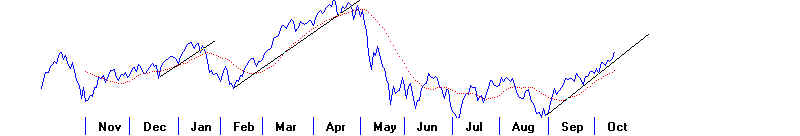

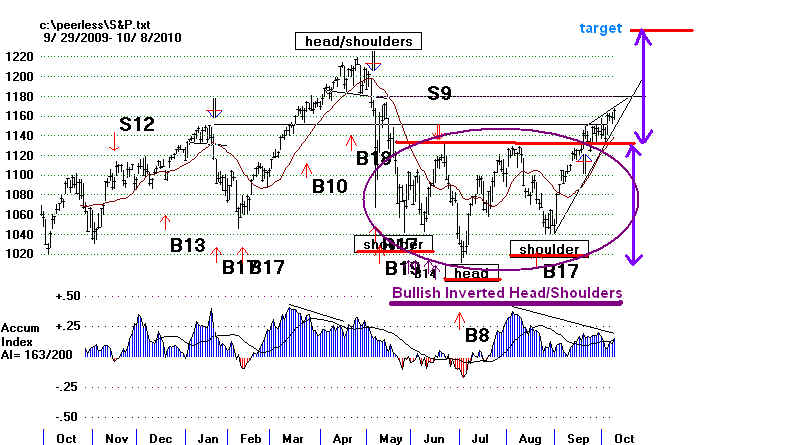

Some chartists point out the inverted head and shoulders

pattern in the SP-500 that

has been completed. The height of the pattern before

the breakout usually tells you

the minimum number of points upwards prices can run

once the necklne resistance is

exceeded. If true, we should expect the SP-500 to

make a new high above its 1220 April

peak. Such patterns usually see a big increase in

volume. Technicians now must

accept that a lot of volume in index Stocks is occurring

off the NYSE, which makes

our SP-500 charts suspect.

Inverted Head/Shoulders in SP-500

More Bullish Stocks Than Bearish Looking Ones.

This is clearly a market of stocks. Foreign ETFs and Gold stocks

are clearly favored

by the weak Dollar brought on by low interest rates and the

FED's buying of Treasury bills.

173 MAXCP

Stocks 95 NASDAQ New Highs

vs 39 MINCP and 11 NASDAQ

New Lows

Bullish MAXCP

GAS - Nicor NH AI/200=195

EPD - AI/200=195 IP21>.25

TUR - Turkey ETF AI/200=186 IP21>.40

TTM - Tata Motors - three bulges of intense Accum (insider buying)

IF - India Fund - Classic Sell B7 (Bullish CP Divergence) and intense Accum. (Classic)

NXRM - NXStage - Strength Profess/Public - +219!

IIF - Morgan Stanley India - Classic Buy B7 (

Bullish CP Divergence) and intense Accum. (Classic)

VRNT - frequently mentioned classic - Now Buy B12.

Classic Buy B7 (Bullish CP Divergence) and intense Accum. (Classic)

IGR - Price far behind internals.

ABV - 132.66 +2.72 Strength Profess/Public - +7.3

DEP - Duncan Energy AI/200=174 IP21>.40

TEG - Integrys Energy - Bulges of insider buying. Strength Profess/Public - +6.2

Bullish GOLD

TRE 7.28 AI/200=185 Wait for break in CP downtrend to Buy.

CUM-T 4.36 NH AI/200=192 Public buying is more important than

professional buying.

GORO 22.58 NH AI/200=174

IVN 24.56 +.83 CP is now downtrending.

ANV 26.56 +.05 CP is now downtrending.

AXU 5.95 +.11 AI bulge and breakout in hot group prodiced 25% gain this week.

Bearish MINCP IP21 (Current AI) <.20:

BAC falling back fromn 65-dma,

VXX 15.44 -.77 (Vix Short-Term Volilatility Index) AI/200=29

,

CFFN,

PHM 8.23 -.11 CP%-Pr% = -32 Recent Sell S7s and breaking of 65-dma -

Pulte Home

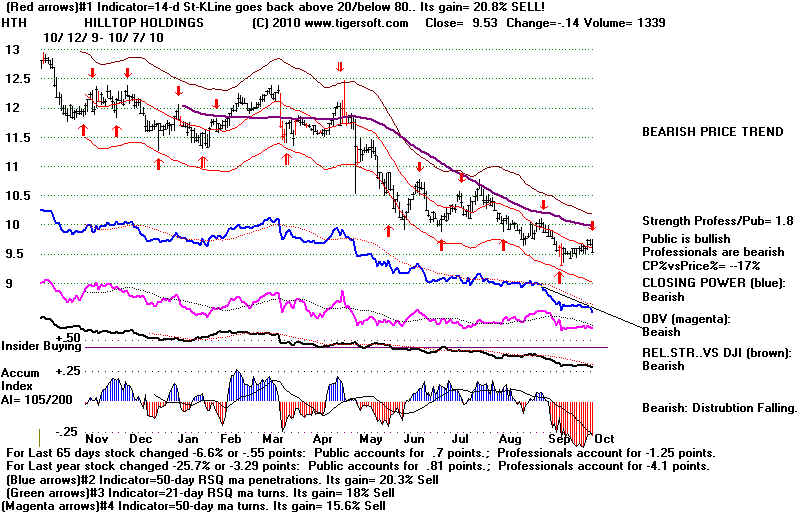

HTH

==================================================================================

PEERLESS REMAINS ON A BUY. Market Awaits Jobs Report.

High Priced DJI Stocks

and Very Low Interest Rates Should Prevent A Big Decline

until after the November Election.

The 10%+ rally since August 31 is starting to struggle.

Breadth deteriorated

for the second day. Even the precious metals were hit with profit-taking. The SPY

and DIA recovery highs were not

confirmed by the Closing Power making new highs.

That makes the uptrends of the CLosing Power lines more

important. A break in

in these CP uptrends would be bearish and further confirm

the red Sell signals on

these charts. A 4% decline would take DJIA back to

the expected support of its

rising 65-dma. The Closing Power for the QQQQ is downtrending already. Often

short-term tops develop when the DJI goes nearly flat for

five or six days in a row.

Let's see if it "flat-lines" a few more days, as

it did on 6/29/2009 when it produced

a Sell S8 which dropped the DJI back to the lower band.

The DJI has actually held up well given AXP's 4 point

decline this week as anti-trust

charges are levelled against it. CAT is the highest

AI/200 stock in the DJI and a

high priced DJI stock, thereby having relatively

heavy weighting. Its Closing Power

is only in a minor downtrend. CVX at 83.52 is another

heavily weighted stock in the

DJI. Both the Public and Professionals are

buying and there was an intense bulge

of Accumulation in it in August. These are

bullish signs and argue against a bigger decline..

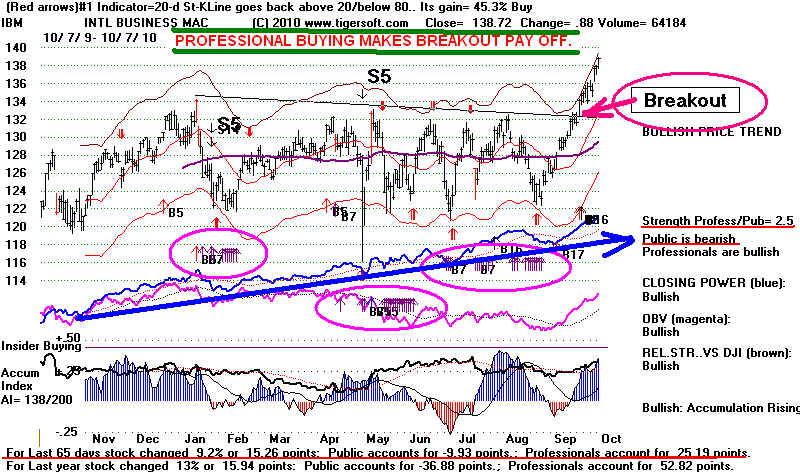

The real strength in the DJI is coming from the

recent breakout in IBM. The November

calls we recommended are looking very good.

Professionals are heavy buyers. The

Public does not believe the rally. IBM at

138.72 has 10 times the weight in the DJI

of very weak BAC at 13.31. You can see how the

way the DJIA is weighted as well

as its makeup - defensive blue chips that pay

dividends - that allows it to keep on rallying

even as other indexes start to falter. Late in

an intermediate-term rally, the best

of the high priced DJIA stocks tend to do well.

IBM below has a minimum priced

target of 146, based on the width of its pattern

before the breakout (134-121 or 13)

added to the point of breakout (133).

Breadth is still bullish and we have no Peerless

sell. That suggests any decline

over the next two weeks will be shallow and

short-lived. Fighting the FED has

been unprofitable and frustrating for short sellers

of the major market indexes

for most of the last year and a half. I think

that we can safely predict the FED will do all

it can to hold the market up until the election is

past. The NYSE ratio of NYSE highs

to new lows Thursday was still a bullish 86 to 3.

The NASDAQ is not so bullish

but it is a solid 42 to 9. A way to see how

professionals judge the market now is

simply to compare the 112 stocks in the MAXCP list

tonight with the 53 in the

MINCP list.

10/7/2010

MAXCP - Bullish Stocks - IP21>.25:

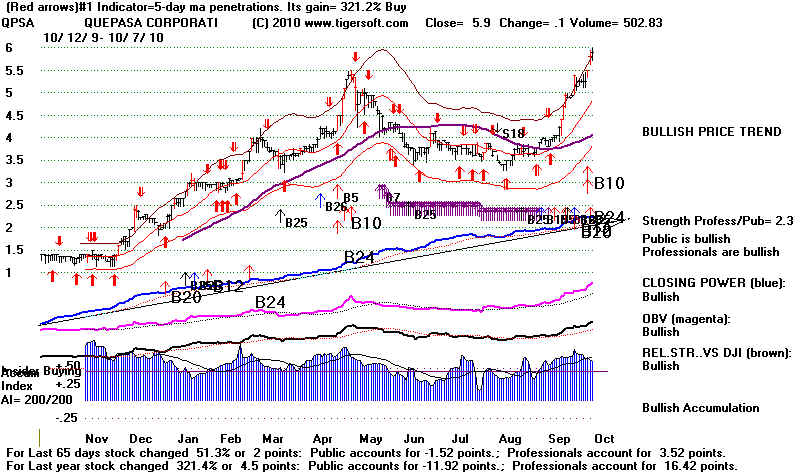

EPD, TCLP, PGP, NXTM, VRNT, SJI, IGR, QPSA, AVF, OKS,

LCAPA, JSM, DEP, FFC, SNP, ELE

The highest current Accumulation Index stocks from

this list are VRNT and QPSA.

Readers will remember QPSA as that odd little stock

at $1.50 that has such ridiculously

high levels of Accumulation. Click here to see

its chart at the end of 2009.

QPSA is thin and on the pink sheets, so buy just a

little with limits. VRNT still looks very

good and is apt to be resistant to a general market

decline. Notice the new Buy B7s.

They show where Closing Power is much closer or at

its 65-day ma while price

is still lagging, but should play catch up and make

new highs. On the right side

of the charts, you see a value for "Strength Profess/Public". This shows how much

of the change in price over the last 65 days owes to

higher closes from openings

(Professional Closing Power) versus overnight changes

in price (Public Opening Power).

A rato higher than 2.0 shows Professionals are

dominant.

A ratio under 1 shows the public is heavily in the

market. Openings are holding or

pushing prices up. At the top in 2000, March 24, the CP%-Pr% value was -.49.

At the end of the period shown in this chart

Professionals were bear and the Public

was Bullish, yet the "Strength Profess/Public" value was 6.4, which showed Professionals

were dominant and the CLosing Power downtrend should

be heeded. By contrast

at the end of December 1999, the "Strength Profess/Public" value was only .3. The

public (openings) accounted for 23.61 of the 30.6

points gain over the previous 65 days.

In this environment, it was best to play the rally

still on the long side, despite the Sell

S7 warnings. If this example here can be

generalized from, then we should respect

the uptrends of Silver (SLV)

now, where the the "Strength

Profess/Public" value is

also .3. Higher openings are likely to keep the

rallying going, though a break in the

Closing Power uptrend will cool the rally off some.

GLD is driven even more by higher

openings. Its "Strength Profess/Public" value is .1 Less than 10% of GLD's

advance

occurs after the Openings. Foreigners and the

US public buying at the opening account

for 90% of the 13.86 points advance over the last

65-days.

===> As long as the CLosing Power is rising, in a

stock dominated by Professionals and

showing heavy Accumulation, I think that we can be

bullish. The very high blue

Accumulation at the bottom shows (usually smart)

insider buying, prpsective

buying on future weakness as a cushion and a

tightening hold by insiders of the float

of the stock. The new TigerSoft is now available for subscribers to the Tiger ESP Page.

If you bought the software in the last 3 months,

I will send you an email this weekend

where you can get this update. Others

who want it, should contact me and we will work

something out. Documentation will be posted

this weekend, too.

|

|

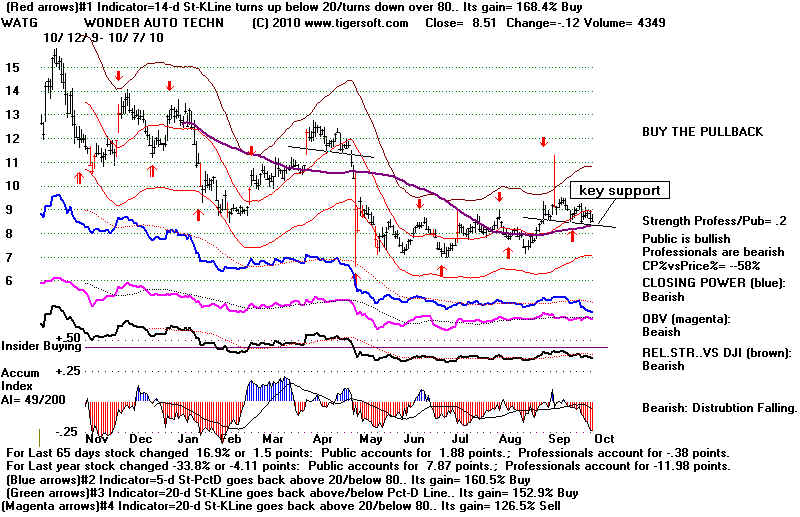

MINCP - Bullish Stocks - IP21< -.20:

BAC,

MON, WATG, CFFN, EUP, HTH

|

|

___________________________________________________________________________________

___________________________________________________________________________________

HOTLINE 10/6/2010 Peerless Remains on a

Buy. Gold and Silver Are Running!

The FED's Policy of Low Interest Rates Should Last Past The

November Election.

We will have to watch for signs of inflation that might bring a

change by the FED.

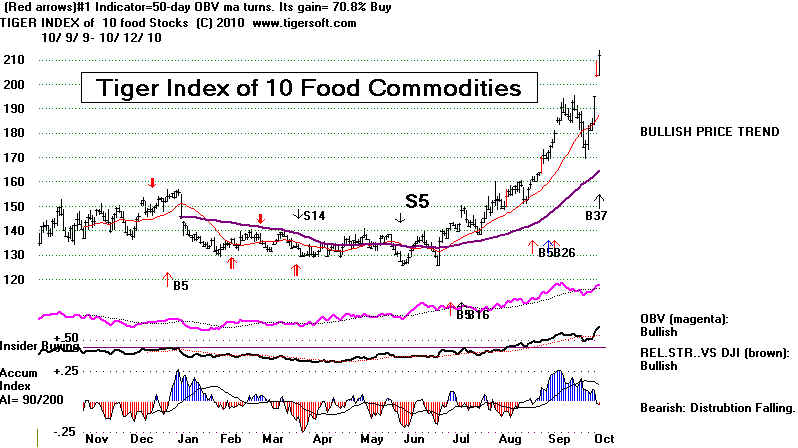

I will post the chart of Food Commodities more and more often.

See it at the bottom

of this night's hotline. Stay long GLD and SLV.

These are better plays now, I think, than

the major market ETFs.

The market still seems favorable for trading on the long side.

The ratio of NASDAQ

new highs to new lows is still a relatively bullish 49 to 10,

even as NASDAQ declined.

This is because its prices are still uptrending. There were 189

MAXCP (bullish) stocks

and only 31 MINCP (bearish) stocks.

Watch the Closing Power recoveries among the ETFs: DIA, QQQQ and SPY.

If they falter and turn down, Professional selling will resume

and the Sell signals

on the ETFs will likely play out with a shallow 4% or so,

decline. A bigger decline does not

seem likely, because we have no Peerless Sell and because the

internal strength indicators

are still quite positive.

New

research: when a stock makes much more

of its gain over the last 65 days from higher

openings than higher closes, respect the strength of public

buying if a new yearly

high is made above a flat top. Cover any short sales.

Traders can even go long.

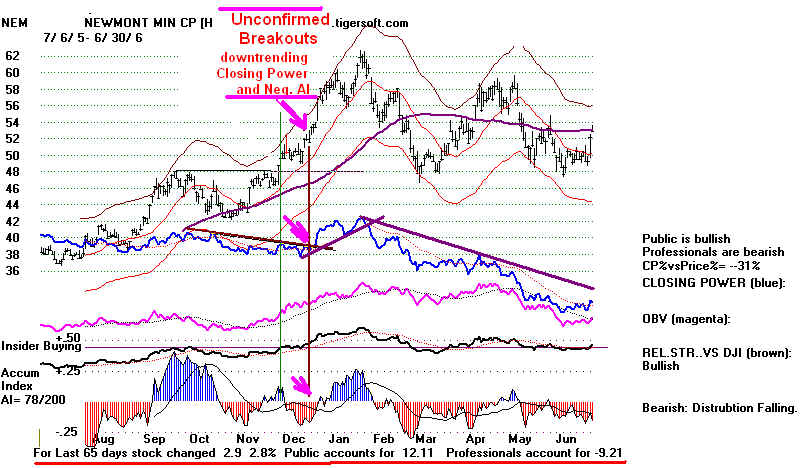

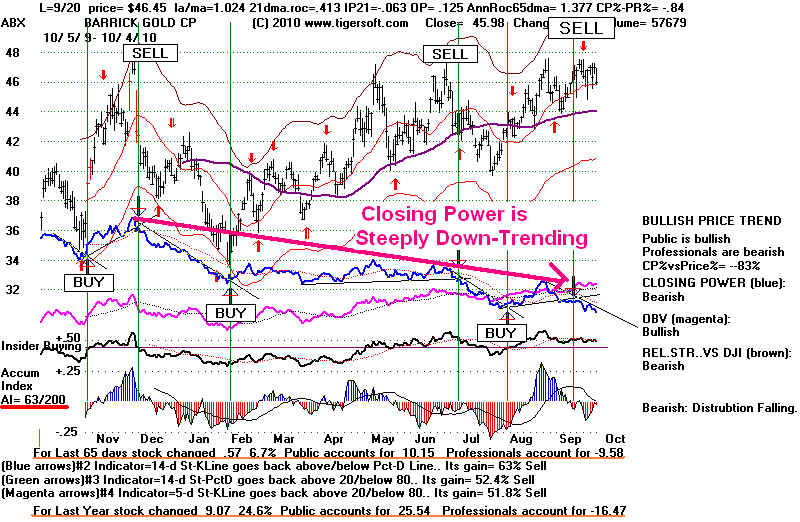

Compare ABX today with NEM back in 2005. The new

software release will post a message

at the bottom of the charts to this effect in such cases.

Watch ABX - Flat Topped Price-Breakout with Very

Negative Accumulation

and Steeply Declinng Closing Power

|

NEM Rose 20% after Unconfirmed Flat Topped

Breakout in December 2005.

|

How much can the market decline with interest rates this low and

falling?

So far, the answer is not much. The real risk is that

inflationary pressures will build

to a point where only a dramatic rise in interest rates will cool

them. But that is down

the road a ways, after the November 4th Election certainly.

Right now the 17%

unofficial unemployment must be dealt with and not be allowed to

worsen.

So, Bernanke and FED continue aggessively to push up the

stock market by buying Treasury

bonds and forcing interest rates down to

new lows today. This especially boosts

Gold, Silver

and foreign ETFs. They are making new highs.

The FED policies certainly

give a chance for the Gold bugs to shout about "currency

debasing" and government

defaults. But, in truth, there is little doubt that if it

wanted to, the FED could quickly

boost the Dollar. The governments of Argentina and Weimar

Germany had long lost

that power at the time their currencies fell apart.

See my Blog about Argentina.

Tiger Blog - 11/29/2007 - Vital Lessons for US from

Argentina's Currency Collapse of 2002...

HOT TRADES

Watch for more exciting moves, especially from

those stocks that show intense

Accumulation and then make new highs. This comes about

because of how

traders focus on stocks that move the most, because of short

covering as new highs

are made and because advances are easier with stocks more tightly

held, a result of

recent intense Accumulation. See such Gold/Silver charts at this link and just below.

Traders should note that TRE would seem to be preparing for a

breakout run something

like we saw today in AXU's 26% one day jump.

BREAKOUT AFTER INTENSE

ACCUMULATION

IN HOT INDUSTRY GROUP

|

|

10/6/2010 HOTLINE continued

The Dollar (77)

dropped further today, on it way down to 73, at a minimum, I think,

based on its completed head and shoulder pattern's objective.

Bernanke's cheap Dollar/

Low Interest strategy has not been challenged much by Democrats

or Republicans.

I think this is because neither party has a politically viable

alternative to risking much

higher unemployment. Bernanke's approach is considered

necessary to prevent

a Depression. Meanwhile, it helps Wall Street and

Retirement Accounts..

The weak Dollar has many consequences,

some good and some bad. Like all

government policies, it favors some groups and hurts others.

Exports will be favored

and US wages will become more competitive if the trend continues.

Debtors will pay back

Creditors with devalued money. US banks will have trouble

if the Dollar is used less as a

reserve currency. Only if there are much bigger swings in

the the Dollar will it work a hardship

international trade because of the added uncertainty volatility

imposes.

Remembering $5.00/gal fas prices, a

big jump in Crude Oil surely is real threat if OPEC

starts to use its power. Oil is rising now, but it is still

10% down from its 12 month highs.

This would seem to give the FED more time to continue to keep

rates low. US demand

for oil is still not robust because of the weak economic climate.

On the other hand, the

Tiger Index of food commodities show a 50% advance since June.

It takes a while before

this upswing gets translated into higher prices at the grocery

store. When consumers

become aware of this, there will be much more public and

political resistance to the

FED's low interest rates. This is not likely to be bought

up until after the November election.

USO - CRUDE OIL

TIGER INDEX OF 10 FOOD COMMODITIES

CORN (C_1620) COFFEE

(CC1620) COCOA (CO1620)

LIVE CATTLE (LC1620)

HOGS (LH1620)

OATS (O_1620) ORANGE JUICE (OJ1620)

SOYBEANS (S_1620)

SUGAR (SU1620)

WHEAT (W_1620) (Download these from Tiger Data page COMMOD.)

---------------------------------------------------------------------------------------------------------------------------------------------------

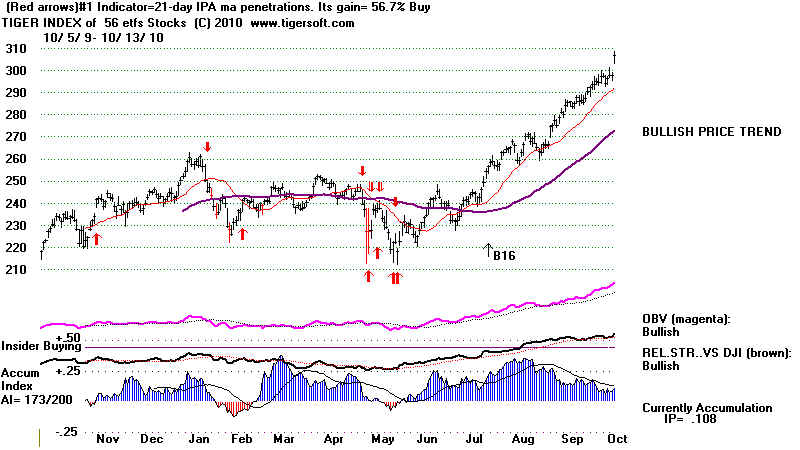

HOTLINE 10/5/2010

Peerless Remains on a Buy. Today we got a new short-term

Buy on the QQQQ from TigerSoft.

The CLosing Powers turned up sharply today from their 21-day ma

on the DIA, SPY and

QQQQ, casting doubt on their trend-breaks Friday. Breadth

was good. With 1900 more

up than down on the NYSE, its A/D Line made another new high

ahead of prices. Also

bullish, on the NYSE, there were 200 new 52-week highs and only 1

new low. On the

NASDAQ, the numbers were 128 new highs and 5 new lows. This

is too strong a market

to be short SPY or the DIA even for short-term traders....

Cover them.

GLD and SLV should be bought. Their runs are reminiscent of the

Fall of 1979.

Gold rose 600% with the Democrats in office from 1977-1981.

Silver zoomed from

under 8 to 48 between 1979 and February 1980. Pullbacks now

may be non-existent.

Do not underestimate the Gold-Bug feeding frenzy that can move up

these hedges

against a weak Dollar.

SLV (the ETF for Silver has completed a bullish inverted head and

shoulders pattern

and now has a minimum upside objective of 29-30. One should compare

the inverted

head and shoulders pattern just completed by SLV (silver) with

the same pattern

made by GLD as it broke out past 100.

Gold is running in all-time high territory, where the path of

least resistance is up. Compare this

with the markets of 1996-1999, as they surged higher and higher

into all-time high

territory. Silver and Gold have a history, like most

commodities, of going hyperbolic to

the upside.

See - September 29, 2010 SILVER is shining.

28 YEAR HIGH Invites Comparisons with 1978-1980.

March 6, 2008 Silver's

Potential 1979-1980 TigerSoft Chart of Silver.

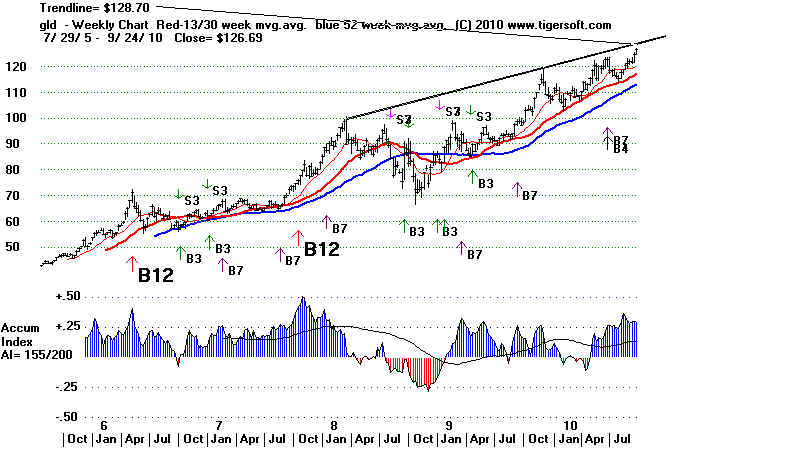

WEEKLY SILVER

WEEKLY GOLD

Bernanke reiterated for the upteenth time his determination

to keep interest

rates very low until such time as there is a broad economic

recovery in the US.

He should have added "or until such time as the

inflationary effects of a weak Dollar

create too much political headwind". The

Dollar continued to fall today, making foreign

and Gold stocks look very attractive.

The Dollar seems on its way

down 5 more points from 78, having completed its

head and shoulders pattern. Gold

and Silver are roaring upwards. Gold is in all-time

high territiory above all apparent resistance lines and

running freely. Silver has made

a 28 year high and has no real resistance until 25 is

reached. Both are recommended.

Using the Power Ranker's "BULLISH" screen

with Gold and Silver stocks over $4,

we get the following stocks for consideration:

Close AI/200 IP21 Remarks

TRE

7.39

182 .33 A move past 7.6 would likely start

another advance. 7 is support.

CP is making a NH. Buy at 7 or

7.6 stop.

CUM-T 4.15 192

.082 Running. Public buying is important here.

CP is not making a NH.

GORO

22.94 174 .25 Running wildly up. I wish we had added this to our data

base earlier.

Chasing this is too risky. Better

to buy it on a 10% pullback.

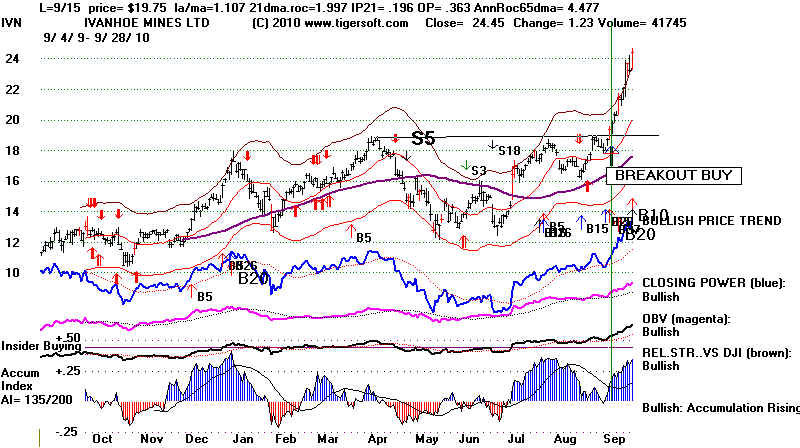

IVN 24.46 135

.256 Professionals are responsible for 70% of the advance

for last 3 mo.

Buy at 23.25

FR-T

7.24 121 .246

Professionals are pushing this higher.

The last high was confirmed by Closing Power. BUY.

DGP

38.24 117 .161 This is

double-leveraged Gold. It rose 64% for the last year.

GLD rose 31.2% over same time period. Buy DGP.

MVG 7.92 139

.218 Buy on move past 8.3 or if CP makes new high.

Using the Power

Ranker's "BULLISH" screen with Foreign ETFs' stocks whose

Closing Power is making a new high and the current Accum.

is above .18, we get the

following stocks for consideration:

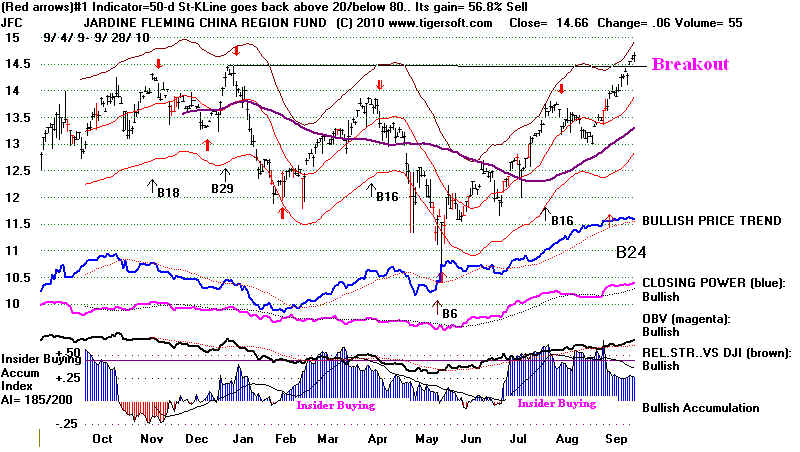

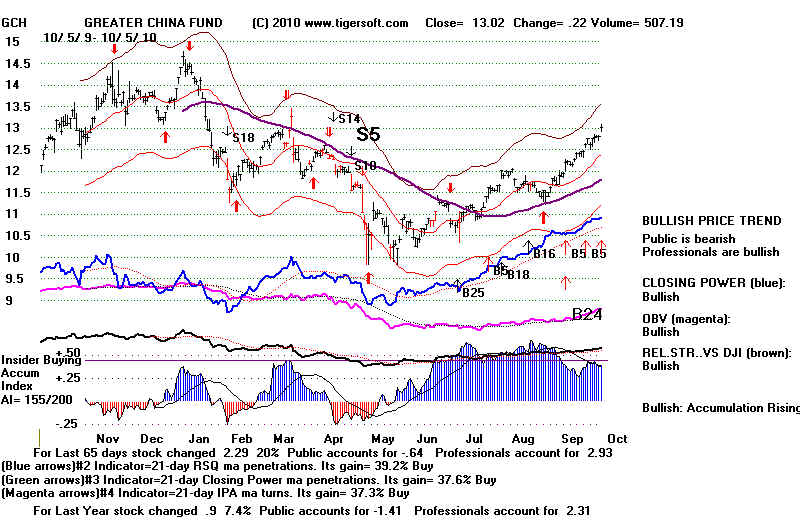

JFC

14.93 186 .262

China - Buy.

IFN 37.97

174 .185 India

Fund Confirmed breakout Buy

GCH

13.02 155 .395

Greater China Fund. Buy

BULLISH MAXCP STOCKS (Each looks like trading buys.)

NTCT 21.45 + .64

EPD 40.31 + .08

FSIV 111.5 +5.61 trading breakout.

RVBD 48.52 +.49

NXTM 20 +.65

VRNT 31.4 +.25

Most of the charts of

the stocks above can be see on this link.

===================================================================================

10/4/2010 HOTLINE No

Peerless Sell Signal Yet.

The

NYSE A/D Line has confirmed the advance, but the P- and Accum. Indicators did

not.

The Peerless internal strength indicators remain

positive. This means the market is

probably far too strong to suffer a big October decline.

The clinched TigerSoft

short-term Sell signals do predict a decline, however. Watch

the CLosing Power downtrends now in SPY,

QQQQ and DIA. They need to be

broken

in order for us to become short-term bullish.

Professional Selling has started in earnest. The CLosing Power uptrends

have been violated for SPY, DIA and QQQQ, thereby

"clinching" their current automatic

Sells. Except for precious metals and a few

stocks very much in the public eye like

APPL, the last few months' market has been dominated

by professionals. If they do change

their mind, and they are not known for loyalty to a

trend, then we are apt to see a decline

back to the rising 65-day ma in the DJI now at 46.

That would mean a 5% DJI decline.

Since Republicans are expected to do well in the

Congressional Elections, I would think

a rally into the Election Day on November 4th would

start from the next low.

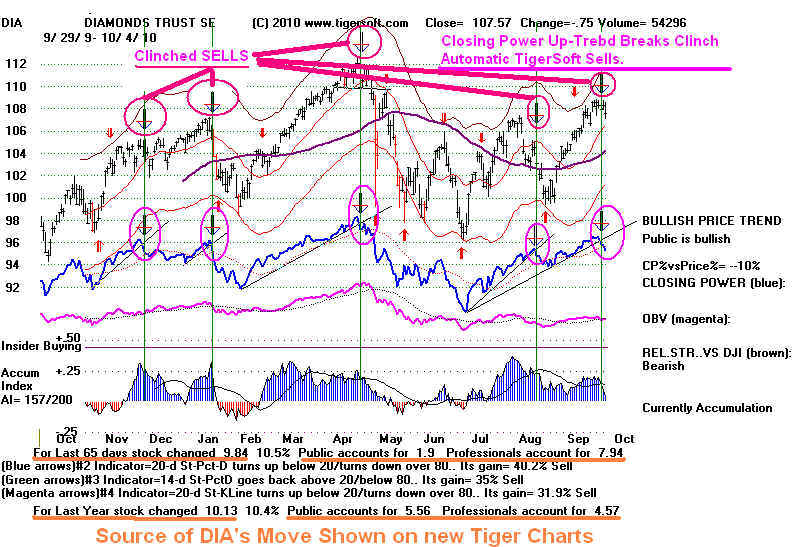

Who Are The Buyers? How Much Do They Matter?

The Public has not been in the market

much. I say this because the Openings which are

much more likely to be traded by the public and

overseas investors than professionals

presently account for only 1.9 points in the DIA's

gain of 9.84 over the last 65 days, while

the trading from the Opening to the Close accounts

for 7.94 of the 9.84 rise. The last 3 months

show a significantly higher ratio of Professional

(post Opening) buying relative to the gain

in this time than their gain over the last year when

Professional buying amounted to

4.57 points in the DIA's gain, while Openings brought

5.56 points, more than half of the

whole gain. When Professionals are net buyers,

we usually stay bullish. But they

can switch sides quickly.

Clinched Sell Signals Using Breaks in Closing Power Uptrends

DIA is ETF for DJIA

Since September

16th, professionals have been net flat the DIA, while the Public has become

net buyers. That is now worrisome. The

Public is more apt to be wrong in cases like this

when both the Opening and CLosing Power have been

rising. That is why we counsel

Selling "Both Up" (rising Opening and

CLosing Power) stocks and ETFs when their

CLosing Power uptrends are broke, especially after a

non-conifrmation....

See the DIA chart

below. The "B21"s show the "Both Up" condition. The "Both

Down" condition is shown by S21s. Right

now. Openings are showing a pattern of

being very much higher than the Closings the night

before. If this pattern continues,

we are apt to see higher openings and lower closings

until Professionals decide to

buy again. For now, we are short-term bearish.

New features on

TIgerSoft charts will be released in a few days. More details will

be provided.

Without a

Peerless Sell signal we cannot predict a decline even to the lower band.

The low interest rate environment should prevent a decline

of more than 5%, barring

unforeseen bearish international events. Food and

fuel prices are not rising so much

yet as to force the FED to change their policies.

Only the steepest NYSE A/D Line has

been violated. We did not see CP non-confirmations

for DIA, SPY or QQQQ.

WHAT TO DO?

Short-term traders should short DIA or

SPY. Take profits in stocks that have risen

more than 20% above support, especially if their steep

Closing Power uptrends

are violated and their AI/200 score is below 180.

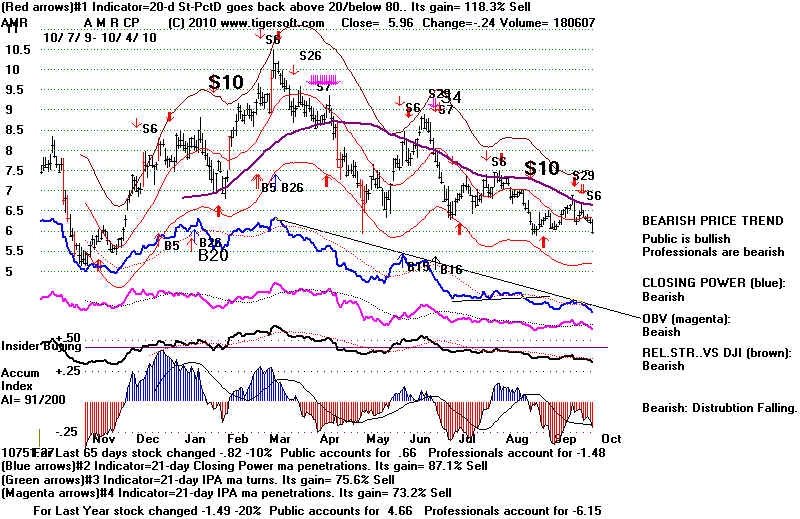

Here are some of the "bearish"

MINCP (80) stocks tonight. They should make good

short sales as long as their Closing

Power is falling: MTC, CX, TNE,

CFFN, ALNY, CBEH and AMR (below).

Gold stock ABX looks like a good Sell Short. Its Closing Power is making new lows

and it shows

stead red Distribution. We wil cover it when CLosing Power

breaks its downtrend.

See how much stronger are the internals of NEM at

the bottom. In

turn, it is not as strong as TRE.

PUBLIC SUPPORT CAN BOOST AND HOLD A STOCK UP,

BUT

| IT IS BEST TO

BUY WHEN CLOSING POWER DOWNTRENDS ARE BROKEN

OR STOCKS WHOSE CLOSING POWER HAS BEEN VERY STRONG.

Gold and Silver stocks in 2010 illustrate these principles.

Many Gold and Silver stocks made the biggest part of their moves overnight

this past year. But atfter after a

strong opening, they typically declined to the close.

Atypical behavior was significant,

however, When they did go up after the openings,

they got their best gains. You can

see this in the aftermath of their CLosing Power

downtrend-breaks.

Gold Stocks

NEM Points

Gained Gain At Opening Gain At Close

65-days

2.53

6.94

-4.41

1 year

20.48

13.93

6.55

ABX

65-days

2.01

10.32

-8.31

1 year

10.01

25.75

-15.65

AEM

65-days

10.4

10.14

0.26

1 year

4.72

20.68

-15.96

ANV (Good gainer)

65-days

7.0

5.92

1.08

1 year

17.9

5.1

12.8

TRE (Good gainer)

65-days

2.27

.52

1.75

1 year

4.45

-.63

5.08

Silver Stocks

PAAS

65-days

4.11

4.2

-.09

1 year

7.47

11.54

-4.07

SSRI

65-days

2.52

2.31

.21

1 year

-0.05

.25

-.30

SLW

65-days

6.67

6.44

.23

1 year

14.12

15.0

-.88

=================================================================================

10/1/2010

PEERLESS REMAINS ON A

BUY. The FED's Low Interest Policy Is Not Challenged

Yet by Rising Food or Oil Prices despite The Weak

Dollar. But Professionals Are Taking

Profits in DIA, SPY and QQQQ. We should expect

a minor 3%-4% retreat. See below

how the steep Closing Power uptrendline has been

violated, thereby clinching the

automatic red Sell. The red signals are based

on the best trading system our TigerSoft

program can quickly find from among 60 different

systems. It has gained 45.6% for

the last year buying and selling short. These

clinched signals offer tactics within

the extensively back-tested and intermediate-term

Peerless system's signals.

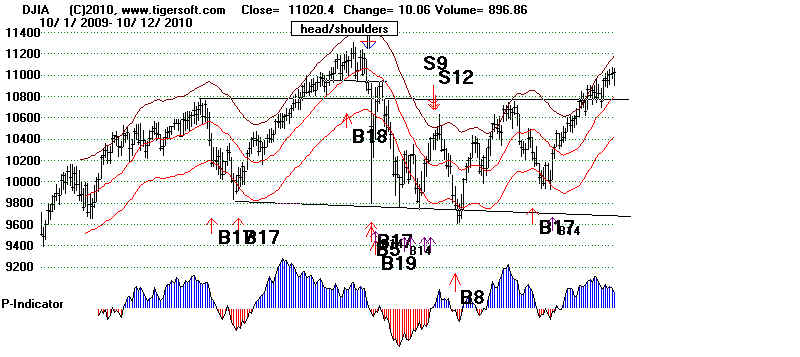

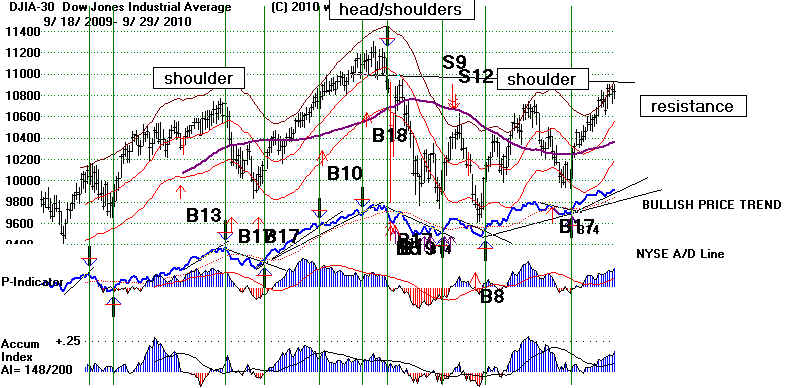

See how the head and shoulders pattern has been

bullishly aborted by the DJI'a

advance past 10750. The A/D Line for the

NYSE is still rising. Low interest rates

are working their bullish effect on the market,

even now 18 months after the

March 2009 bottom. The FED seems

determined to keep interest rates low, buying

if necessary, Treasury instruments with money

they can print. That has sent the Dollar

down below a bearish looking head and shoulders

pattern, neckline and using

classical technical analysis, sets up a target

near 72. Another drop of 8% by the

Dollar would certainly boost foreign ETFs, Gold and Silver. Most food commodities

are not looking strong enough to pose

inflationary pressures. That reduces the likelihood

of a coup within the FED against Bernanle's

leadersip. We will have to watch Crude Oil.

A move by USO to new highs might scare the FED

into reconsidering their policies.

That seems some time away, for now. So,

the Fed policies should continue and

keep the market from falling much this October,

even though we see clinched short-term

sell signals on the QQQQ,

SPY and DIA. The clinching has

occured because their

Closing Powers have broken their uptrends.

CLosing Power Divergence Signals

We have

seen that most of the time and with most investent vehicles the trend

of Closing

Power acts as a powerful predictor of future prices. Price changes due

strong or

weak openings tend to be deceptive. We can measure the degree to

which

Closing Power is bullishly or bearishly diverging from price using the

following

formula:

CP Divergence = CP% - Pr% for N

days,

where N = a time period (normally 65) and i = any day

and

CP% = (Closing Power (i) - Closing Power low for N Days back from day i)

----------------------------------------------------------------------------------------------------

Closing Power high for N days back from day i - CLosing Power low for N days back from day

I.)

Pr% = (Price(i) - lowest price for N days back from day I)

----------------------------------------------------------------------------------------------------

(Price high for N days back from day i

- Price low for N days back from day I.)

If we make a Buy B7 occur when the 65-day CP Divergence is above .35 from prices for their

65-day range, and cause a Sell S7 occur when the 65-day CP Divergence from Prices is below

-.35,

we see B7s in August on the chart for DIA below. Here

is a link to SPY charts showing key

B7 and S7 signals since 1999. These signals

are meant to be alerts to developing opportunities, so long

as professionals remain or become dominant and Opening changes in prices are not wildly

up or down from the previous day's close. When the Public is in the market, openings

range

widely from the previus day's close and the S7s are very pemature.

=====================================================================================

9/30/2010 PEERLESS REMAINS ON A BUY. The Intermediate-Term

Must

Still

Be Considered To Be Up.

But,

the steep uptrendlines of the QQQQ, SPY and DIA have been violated.

A minor

pullback therefore seems likely. As the DJI has reached the resistance of

the point

of breakdown in April, I think we have to expect a decline, probably

only to

just below the rising 21-day ma. That would mean support is expected

on DIA at

106, SPY at 112 and QQQQ at 47.5.

The facts

remain Peerless is still on a Buy and Octobers usually produce additional

rallies

after strong Septembers unless we get a major Sell. In these curcumstances,

I would

just wait for a pullback to Buy SPY or QQQQ.

Bullish

MAXCP stocks showing extreme bullish Closing Power divergences

usually

rise further. A good many of them turn out to be buy-outs.

See How To Spot A Stock about To

Get A Takeover Bid

VRNT

illustrates what we look for. It was up more than 12% today.

http://www.verint.com VRNT has been shown here recently, precisely because it

had the key

characteristics of heavy insider buying and a bullish divergence between

price and

Closing Power.

Insider Buying + Professional Buying Bullish

Divergence

===> Predictable & Profitable Advance

Some

bullish MAXCP stocks with a current Accumulation Index are:

HYT

11.55 IP21=.34 (Current Accumulation Index value)

TTF

13.83 .35

VRNT

29.55 .34

FFC 16.87

.34

OKS

74.92 .43

NTAP

49.75 .37

VSAT

41.11 .31

This weekend I hope to inveil a new indicator

showing the 65-day divergence

between

CLosing Power and Prices.

CAT is the

highest AI/200 stock in the DJIA. These can reliably be traded on

the long

side with each break in the Closing Power downtrend. Earth movers

are in big

demand as public works programs grow worldwide. Caterpillar's

stock is

responsible for 40 percent of the Dow's climb since the beginning of

the year.

http://www.cat.com

82 is the resistance from

earlier highs.

If you want

to hedge with short sales in the DJI, consider BAC and INTC.

Their

CLosing Powers are very weak; BAC shows red Distribution

and both

are falling back below declining 65-da mvg.avgs.

|

|

| |

-------------------------------------------------------------------------------------------------------------------------------------------------------

9/29/2010

PEERLESS REMAINS ON A BUY. The Market Rallys because It Foresees Gridlock.

The ratio of new highs to new lows bullishly remained over 10:1, on the NYSE (107:5)

and on the NASDAQ

(67:7). MAXCP stocks numbered 262 while MINCP stocks show

only 26 today,

Among the bullish MAXCP stocks, NTCT rose and shows an IP21

greater than +.50

and a recent Buy B12; TUR (Turkey ETF) has bullishly broken its rising

resistance line;

TTM (Tata Motors) has bullishly broken its rising resistance line;

AZO (Autozone

230.56 +2.36) and NXTM (19.4 +.32). These are the best momentum

plays now.

If you like trading range stocks, use the STOCH5 stocks, and know that

93 are on Buys

and 153 are on Sells. I would still use trend-breaks in CLosing Power

to clinch any new

Sells, like EPAY, MIR, PAG and SID. Significantly, the Tiger Index

of these Trading

stocks shows them to be on the verge of a bullish breakout and

77% of them are

now above their 65-day ma.

Today the DJI did fall back a little from the neckline from the head/shoulders pattern

of April.

But we still have no Peerless Sell, the NYSE A/D Line is rising and the

Closing Powers

for the ETFs are

still rising. I have shown that historically strong Septembers are very likely

to be followed by

a very good October. The weakness in the Dollar has made US

stocks look cheap

to foreigners; at the same time, the record low interest rates

are forcing US

investors out of money markets and CDs and into stocks.

While Gold and foreign ETFs are

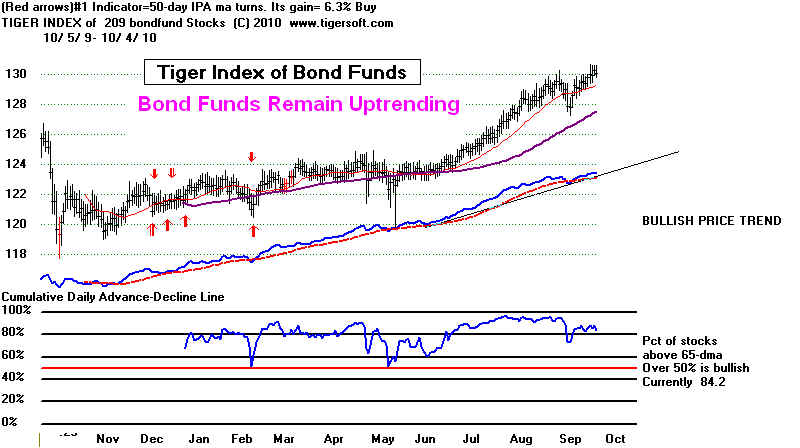

very strong, Crude Oil is not. And as long, as Crude Oil

does not breakout

and accelerate up, I would bet that the FED will stick to its low

interest

rate policies and continue to buy Treasuries with money it

creates/prints. That view is

consistent with

the continuing strength in the bond market and utilities.

There is some dissent

within the Fed about its buying US Treasuries, but most

political

economists see that necessary, so long as Democrats and Republicans neither

lead nor get

along well enough to govern. In my opinion, the Fed is now the main

barrier

preventing another market melt-down and Depression. Some inflation

is infinitely

better than a Depression. I think the Dollar will not collapse. There is

simply no

alternative to it presently in international trade.

The Gridlock Rally

Frozen, standstill, grid-locked government seems to lie ahead. The stock

market may be

celebrating this likely political scenario before the November

Election.

The reality and cost of political gridlock are not yet factored into the

market.

Will the US Constitution permit real and new economic leadership?

The truth is that

the "checks in balances" in the US Constitution and the undemocratic

Senate have

always worked against most new economic leadership and change.

Federalist Paper

author Alexander Hamilton's distrust of

Democracy is particularly clear.

Democratic change

would have been much easier to achieve in a parliamentary system.

But the founding

fathers replaced the Declaration of Independence's phrase "life,

liberty and the

pursuit of happiness" with "life, liberty and property". I

complain

about the

Senate's plutocratic ways. But the Senate's rule by 60% instead of a

simple majority

simply reflects the deliberately non-democratic character of the US

Constitution.

Republicans are right. We have a Republic where wealth was always

supposed to be

protected and treated specially. Checks and balances and the Senate's

undemocratic

makeup and 6-year terms were designed by James

Madison to prevent quick

changes

that might threaten the power and privileges of the wealthy. If you believe

as I do that too

much wealth in the hands of the few is a danger now to the economy

and the stock

market, just as it was in 1907 and 1929, then the Fed and Bernanke

are doing the

only thing they can to try to prevent another Depression, namely -

print lots of

money. Since the FED's cheap money policies in a Severe Recession go seem

to boost the

stock market while doing little to bring about fulll employment, it may be

that four to six

more years of very high unemployment may be necessary to create

the anger and

impatience needed to allow a much stronger political leader to come

to power in

Washington, in the vein of Teddy Roosevelt or Franklin Roosevelt.

DJIA and Peerless Signals/A/D Line Trend-Breaks

SPY (SP-500 ETF)

SPY (SP-500 ETF)

|

TigerSoft and Peerless Daily Hotline

TigerSoft and Peerless Daily Hotline

TigerSoft and Peerless Daily Hotline

TigerSoft and Peerless Daily Hotline