Tuesday 6 /30/2009

NOTE THIS HOTLINE's IP ADDRESS WILL CHANGE HERE WEDNESDAY NIGHT.

You should have been notified about the new address if your subscription is current.

Order form to Renew On-Line, "Nightly Peerless/TigerSoft Hotline " ($298)

. Previous Hotlines: 5/1/2009 - 6/11/2009

3/30/2009-4/30/2009

(C) 2009, William Schmidt, Ph.D.

Important Notice: Redistribution of any text or concepts here is a violation of copyright laws. This is valuable intellectual property.

All violators will be subject to legal action. Please visit www.tigersoft.com Goggle TigerSoft and a technical subject, to get

additional examples and a further discussion of concepts and terms used here. See also our Books for sale. .

Overnight Market Action: Bloomberg Futures around the world before the US Markets open.

Color Codes blue or green = new to this night's report or considered more important

black = from a previous night's report

Introduction. When reading this HOTLINE, please note the dates that show when the comments in a paragraph or set

materials were written. Always read the first comments at the top with the most recent date. They show the Buy or Sell

which now applies. Older comments are there entirely for background and to teach TigerSoft and Peerless technical analysis.

On a Peerless graph, only the new and latest signal applies. Again, always note the date at the top of a set of paragraphs.

INTRODUCTION.

Readers, our assessment of the stock market's future trends is based on the following.

Google TigerSoft and these subjects to get additional links, besides those shown below.

1) Peerless automatic Buys and Sells for intermediate-term trend.

Details of Peerless Signals are given here as they occur.

2) Price charts and moving averages.

3) Closing Power and Closing Power Percent for 2-4 week trends.

4) Accumulation Index to measure support on weakness or distribution on strength.

5) Volume (and OBV to a small extent).

6) Breadth: Advances minus Declines. P-Indicator, A/D Line

7) Stochastics when they are the best trading system. See QQQQ in 2003.

8) Relative Strength - QQQQ/DJI rising is bullish. Compare QQQQ Chart now, on this page, with 2003..

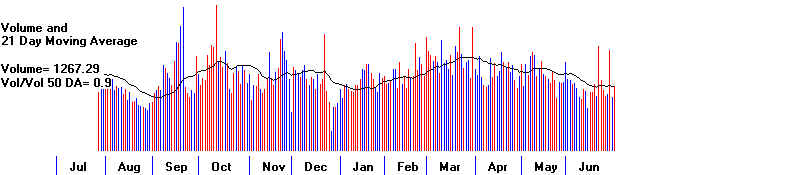

9) CURRENT Seasonality Updated 6/30

10.) CURRENT Sector Strength/Weakness Analysis. Updated 6/30

11) CURRENT NYSE/NASDAQ New Highs and New Lows. Interesting NH/NL Stocks. Updated 6/30

12) News and Political Economy. See Tiger Blog

See also Predicting The QQQQ Using TigerSoft's Opening Power,

Closing Power and Tiger's Day Traders' Tool: 1999-2008

DJI 8447 -0.97% SP-500 927 +0.91% NASDAQ 1835 -9.02 -0.49%

USO 37.93 -1.91% GLD 91.18 -0.93% SLV 13.38 -2.05% -2.05%

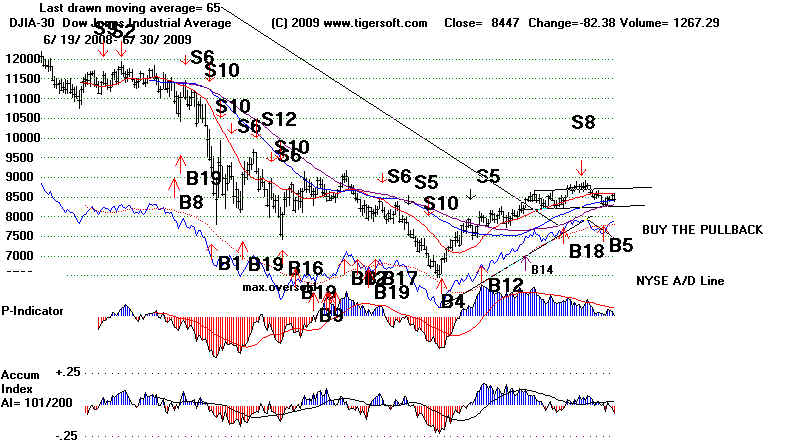

DJIA AND SUPER-IMPOSED PEERLESS SIGNALS STOCKS

6/30/2009 8447.00 cl/ma=.984 P=-.11 IP21= -.064 V= -158 Opct = -.221

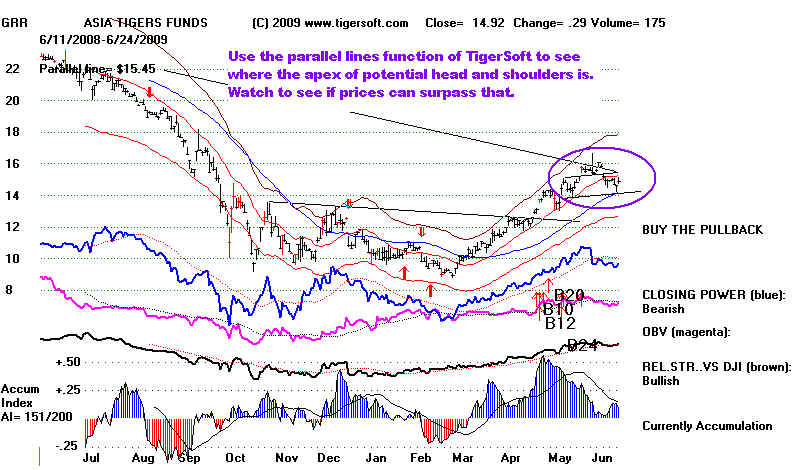

DIA - ETF for DJIA Chart Note the bearish head and shoulders pattern

that is developing with DIA's Closing Power. The DIA's price pattern shows such

a pattern is emerging. The DIA's red Buy is based on its upside penetration of 50-dma.

The DIA's Closing Power's downtrend has been penetrated for a trading Buy.

The Closing Power is bearishly below its falling mvg avg. Expect resistance at 86-87

as the DJI tests the right shoulder in a potential head and shoulders pattern. Support

is at 82. Wednesday'-Fridays are each up 50.9% to 52.9% for the last year. It's

Mondays (22.4%) and Tuesdays (48.1%) that longs have to be worry about.

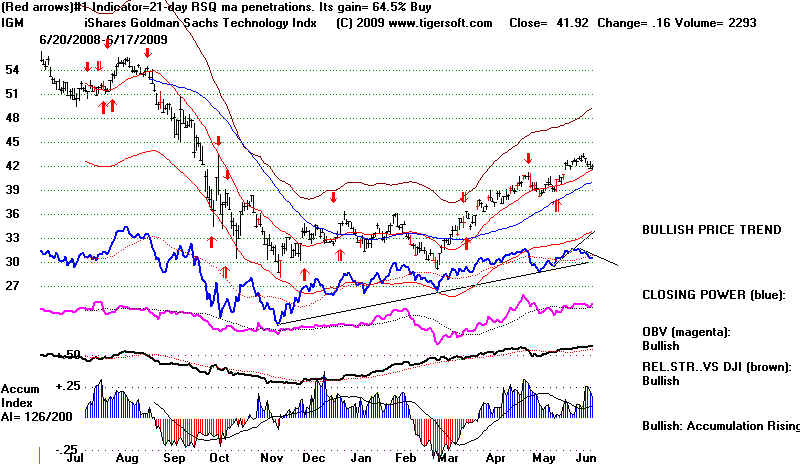

QQQQ Chart

The QQQQ is rebounding from its rising 50-day ma. Its internal strength readings are

rated "bullish". 38 is a reasonable target based on the height of its earlier trading

range, 26-32 and its breakout at 32 plus the height of the base pattern. The exceeded

April high at 35 did act as support. That is bullish. The QQQQ has been outperforming

the DJI for 5 months when one looks back 50 days and 7% over the last 50 trading days.

Mondays for the last year have brought a QQQQ gain only 33% of the time.

Wednesday, Thursday and Friday show a probability between 49% and 51%. It's

Accum. Index is still considered "bullish".

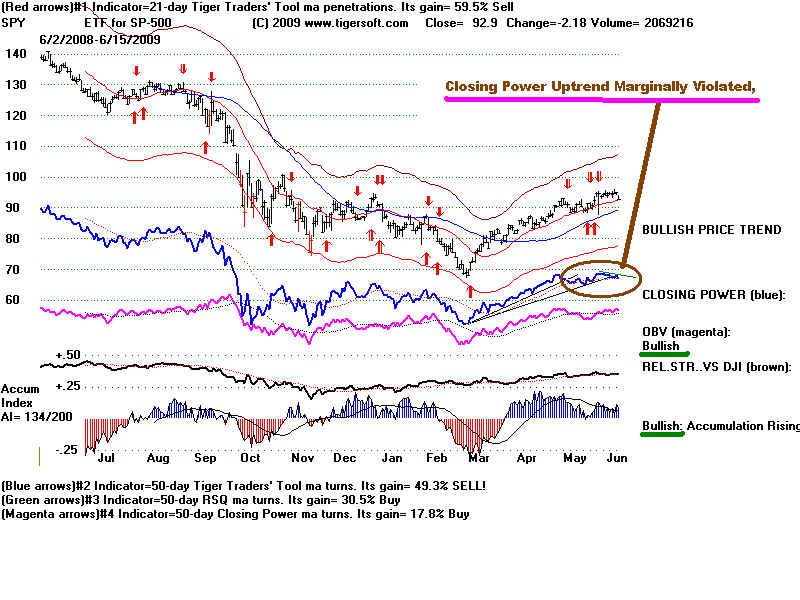

SPY Chart Note the emerging head and shoulders pattern. the neckline crosses

at 89.5. The Closing Power could not get past past its falling 21-day ma. The is also

forming what may become a head and shoulders top pattern

The SPY is now above its now rising 50-day ma and falling 200 day ma. Mondays

for the last year have brought an SPY gain only 33% of the time. Tuesdays and

Wednesdays rise 51.8% of the time. Thursday's are up 60% and Fridays 57%.

IWM - Chart

IWM has turned up from its rising 50-day ma. Its Closing Power downtrend has been

violated giving traders a Buy. Wednesday's are up 57% of the time, Thursday's

50% and Fridays 67%. Mondays - 32.6% and Tuesday's 51.8%.

6/30/2009 Buy B5 and pre-July 4th Bullish Seasonality

versus

Bearish DJIA's and SP-500's Head and Shoulders Pattern and

Concerns about the low volume and high amount of manipulative program

trading by Goldman Sachs, in particular.

The next ten trading days have been up 63% of the time since 1965. That is statistically

significant. Anything above 56% is worth noting. Bullish also is the still rising

NYSE A/D Line. Most completed head and shoulder patterns show weaker breadth,

where the head in the pattern is not accompanied by a confirming NYSE A/D Line. In our

case the A/D Line is stronger, not weaker, than the DJI. Until the A/D Line uptrend

is violated, we are safe.

The big concern is low volume on rallies in the last 16 trading days and on the right

shoulder of the head and shoulders pattern. This is a classic characteristic of a valid

pattern. This pattern is not recognizable by any computer algorithm I can write.

So, we just have to be on the alert. The negative readings from the Accumulation Index

are important confirmations that the pattern is, in fact, developing. The good news is that

a head and shoulders pattern appears in relatively few stocks now. Normally, we would

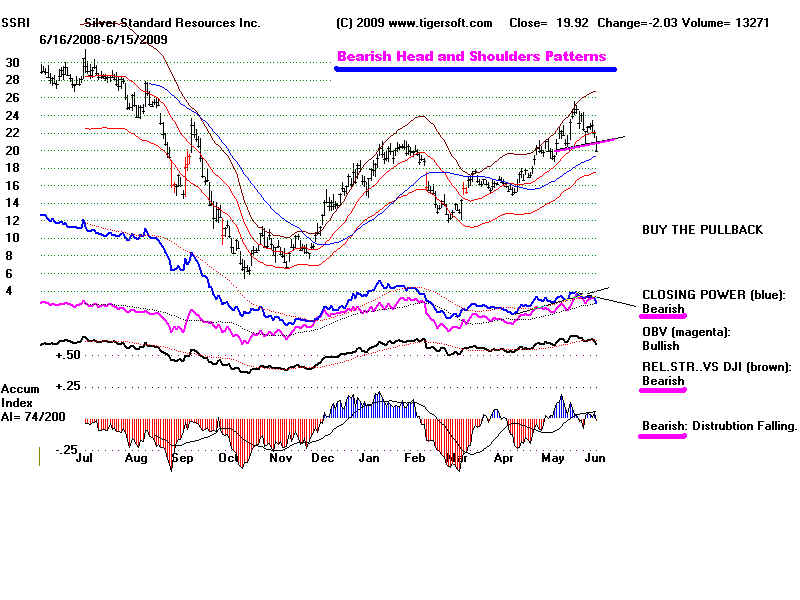

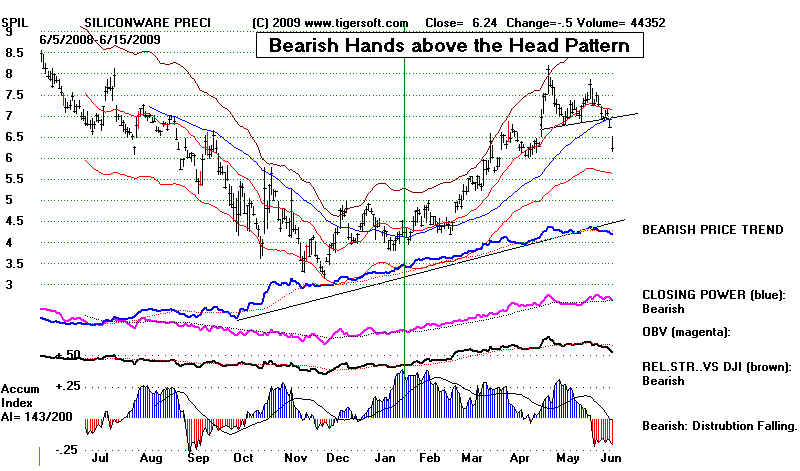

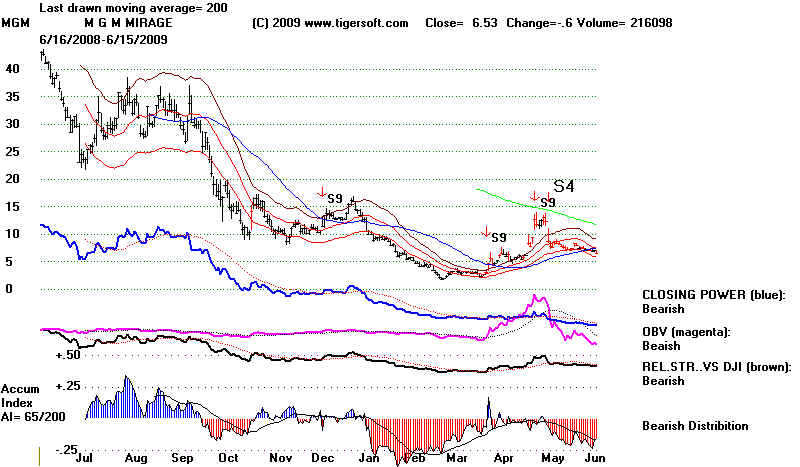

see more such patterns at a top. Here are more stocks with such patterns. It will be bearish

if they complete their pattern.

How much of the rally is a result of artificial program trading with taxpayer provided

TARP bailout money by companies like Goldman Sachs? Computer program trading

has certainly gotten more sophisticated and takes in many more stocks than before.

How extensively Goldman's trading now is can be gleaned from earlier statistics showing

that Goldman was by far the biggest program trader, nearly always trading for its

own account and constituted as much as 74% of the entire trading volume on the NASDAQ

for one week two months ago. Significantly, Goldman has leaned on the NYSE to stop

revealing this information. It is too incriminating! The Zero Hedge Blog writes:

"The NYSE has taken action to make sure that nobody will henceforth be able

to keep track of the complete dominance that Goldman Sachs exerts over the New York Stock

Exchange. This basically ends our weekly Program Trading updates disclosed every Thursday

indicating that Goldman has single-handedly captured all of NYSE's program trading. ..This is a

travesty, as well as a complete obliteration and a mockery of the move for transparency

that the Administration, Regulators and Exchanges have been posturing they support.

We advise all readers to contact the provided staff on the memorandum and voice your incredulity

with this brazen move to completely obfuscate Goldman's behind-the-scenes take over the world's

biggest stock exchange. Robert Airo, Senior Vice President, NYSE Euronext at (212) 656-5663 or

Aleksandra Radakovic, Vice President, NYSE Regulation at (212) 656-4144

Goldman Sachs has a long history of flagrantly manipulating markets, according

the lengthy, well-written and carefully researched article in the current Rolling Stone. He

counts four major bubbles that they created to fleece retail traders and investors:

1929 Bubble, Internet Bubble, Housing Bubble and Oil Bubble

Without any prompting, I reached the same conclusion last year as Paulson allowed his old

firm to transform itself in a blink into a commercial bank, so that it could get their hands on a

TARP handout. Paulson, of course, was the ex-CEO of GS. Shamelssly, as Secty of Treasury,

he refused to save Lehman Brothers, the primary competitor of Goldman but then

rescued AIG so that they could pay $13 billion to Goldman, all at taxpayers' expense.

I will write a summary of Matt Taibbi's many charges in a day or two, but it would be

good to read the original source. 1 year is only $14.97. By the way, Goldman has hardly replied.

==================================================================================

6/29/2009 Buy B5 but Note The Bearish Head and Shoulders Pattern

When a head and shoulders pattern appears, it gives us useful trading

points to watch: the apex of the right shoulder and the neckline. In addition, we

should watch the volume and the internal strength indicators. If the pattern is

to be acompleted and a new bearish reversal of trend is to occur, certain technical

signs usually are present. Use a checklist like this:

1) Is Volume MA waning on the right shoulder? DJI now - Yes

2) Is the Accumulation Index near or below 0 on the right shoulder? DJI now -.024

3) Is the A/D Line falling behind price? DJI - No. It is above its level on left shoulder

4) If the P-Indicator trending down and below zero? DJI - Yes but +101

The current DJI rally could be reversed by a head and shoulders pattern. That

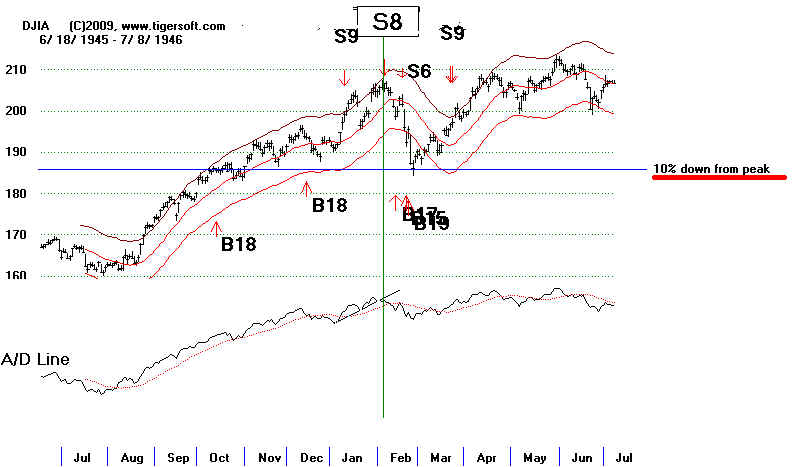

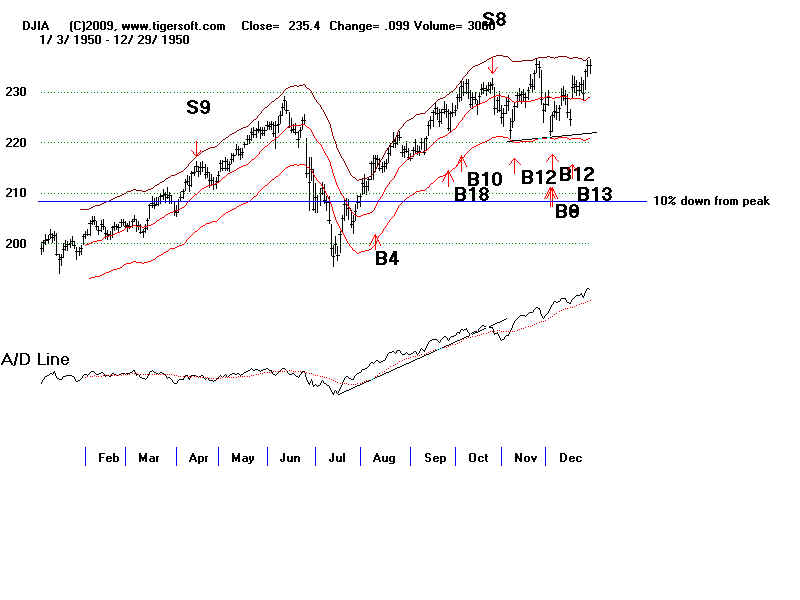

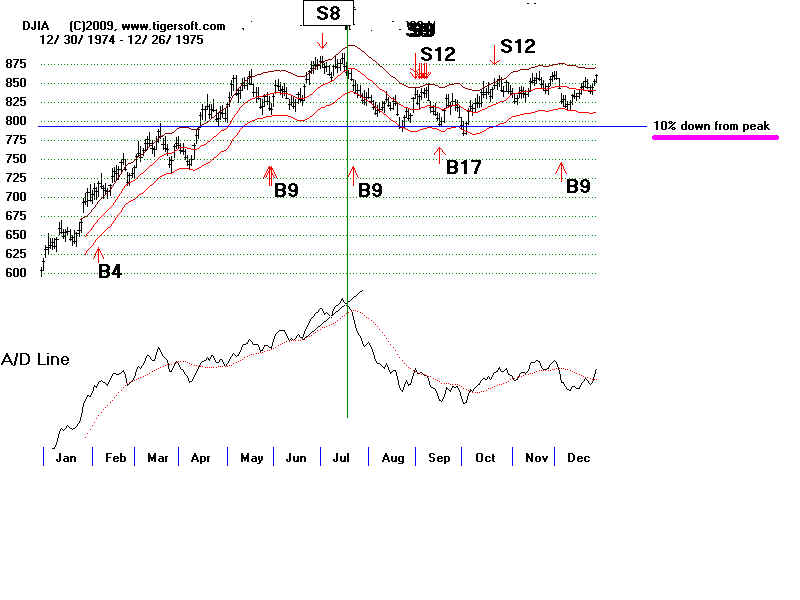

happened in 1930, 1931, 1932, 1938, 1940, 1941, 1974 when the DJI fell more than

40%. See the charts for these years in the study I did this past weekend.

Head and shoulders patterns since 1915.

A bearish reversal could happen without a Peerless Sell, though that only took place once

before, going back to 1928, following a Buy B5. See the discusson of Buy B5s

since 1928.

The distribution process takes time. The way a head and shoulders pattern

usually works is to allow significant distribution to take place over a few weeks

on the right shoulder. Time and Price symmetry are more common than not.

The right shoulder usually is similar to the left shoulder. The left shoulder in

the DJI's current pattern lasted about a month. The right shoulder here has only

been extant 3 days, so far. On this basis, even if this is a bearish top, the neckline

at 8100 may not be violated until early August. Knowing this, we can play the

strongest stocks a little while longer, I would think, even if a big decline lies ahead.

Usually if the market is about to reverse significantly, we see bearish head and

shoulders patterns in important stocks, too. Not many are now evident. There are four

developing head and shoulders patterns in key DJI and QQQQ stocks we should

probably watch watch: BA, UTX, IBM and JNPR.

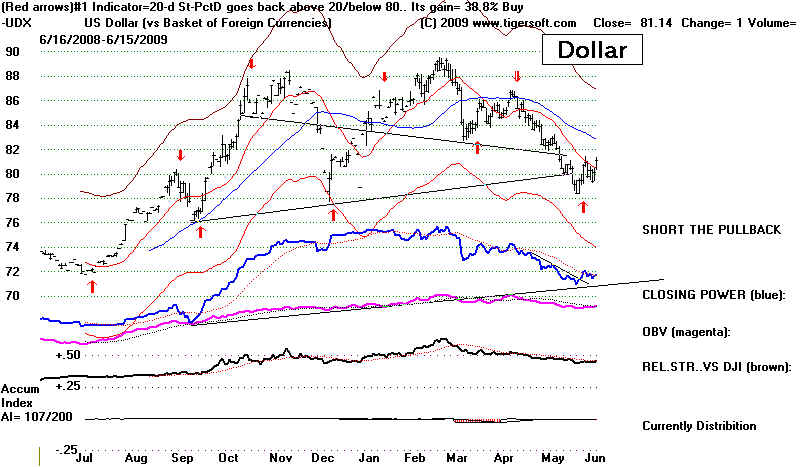

Also of interest is the US Dollar. The Chinese have become more vocal calling for

a new international currency other than the Dollar. The Dollar is holding up just

above the key 80 level.

Meanwhile, hot money is busy chasing a relatively small number of

explosive super stocks, up, up and still higher. Some of these are very over-extended.

In these cases, their rallies may continue only for one more day because of

window-dressing related buying. We have to be concerned that there is usually a

point, where super strength becomes sloppy, careless buying. Most of the stocks

zooming upwards now do show heavy insider buying and professional sponorship.

But how much of this is a new type of program trading? The broad public is not

in the market now. If they cannot be induced to enter this market, will the program

traders be forced to dump their holdings as they did leveraged oil futures last year?

Historically, bull market in secondary and low-priced "cats and dogs" are very

rare and last 6-7 months and then they may dry up. Here I'm thinking of

April 1968 - December 1968, the Prudhoe Bay Stocks' Boom and October 1999

- April 2000. Our Stocks' Hotline is still long many of these. The CLosing Power

up- trend is important to watch. A break after a long run is bearish. For now, we will

also watch the Low-Priced Stocks' A/D Line that TigerSoft's Index program builds.

It is testing its 21-day ma on a rebound.

6/26/2009 A Peerless Buy B5 is operative Peerless signal. This signal has

always eventually been profitable at the time of the next Peerless sell

signal. This weekend's TigerSoft Elite Stock Professional Report has found

a very high number of extraordinary volume Buy B12s. There is a lot of

evidence that Goldman Sachs program trading is making up a very large

proportion of all trading volume. Without fanfare, someone is buying all

the most heavily accumulated lower priced stocks with no fanfare. I am reminded

of 1968, except that then it was the small investor who was buying. Here

is an example. Transcend Medical Transcription Services.

But there is one case when a head and shoulders pattern developed

before a Peerless reversing Sell signal. Since we have a potential head

and shoulders pattern emerging with the DJI now, we will want to watch

to see how it unfolds. Selling if the neckline of the head and shoulders

pattern was violated would have worked out better than buying and holding

until the next Peerless Sell. Watch also the NYSE A/D Line. The extensive

study of head and shoulders shows the usefulness of simply getting out

when the A/D Line uptrend is broken if the head and shoulders pattern

plays out. See 1948-1949 chart below. For now look at the extensive

research I have just done on all head and shoulders patterns since 1915.

=================================================================================

6/25/2009

Volume was low. B5s are bullish. Look for a rally to the upper

band near 9000. There may be resistance at the apex of the right

shoulder in a potential head and shoulders pattern. That apex

high is 8663. Even if a head and shoulders pattern does develop

there is usually temporal symmetry, so that a right shoulder

may last as long as 3 weeks, before we get a resolution

and either a price breakout above 8680 or a price breakdown

below the neckline, the lows just seen. DJI stocks are not

where the upside action is. Look at the lengthening list of new highs

to get ideas. Most nights you will see some of them above at the

Introductory link that that says:

11) CURRENT NYSE/NASDAQ New Highs and New Lows. Interesting Stocks.

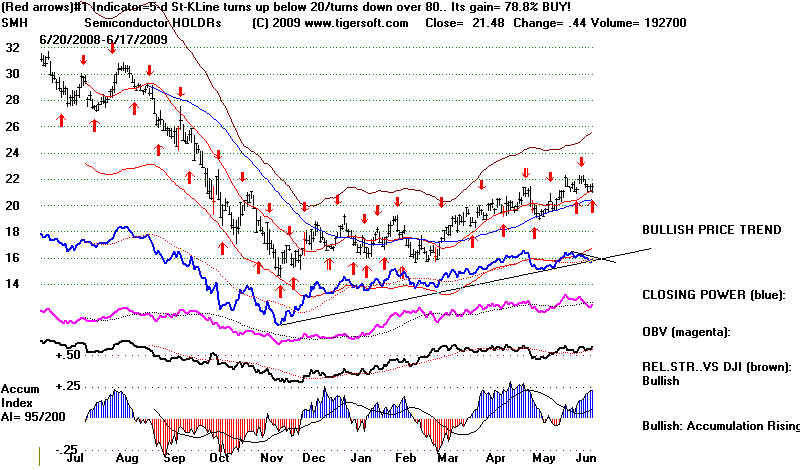

Some of these are getting quite extended. Find tech stocks showing lots of

accumulation with a CLosing Power making new highs ahead of price.

Some examples are EMC, MXIM and QCOM.

6/24/2009 Buy B5 Is Operative Peerless Signal

The hot money is still going into low-priced stocks showing bulging Accumulation and making

new highs. The sense that the Fed will guarantee the market against a worse decline gives lots

of help to speculative stocks. In many ways, this boom in low priced stocks is the equivalent of

the Fed induced boost to technology stocks in 1999-2000 and housing stocks from 2002-2004.

See some more examples of Explosive Super Stocks Today and read the Blog I wrote on June 6th.

The Great 2009 Bull Market. Why Is Wall Street Concealing The Huge Surges in

Low Priced Stocks?

I think it is very bullish for a few more months that hot money chooses to buy low-priced

stocks rather than drive prices down by buying leveraged short ETFs. Say what you will about

Goldman Sachs manipulating stock prices, even creating the booms and then the busts in a very

big way. I would much rather have them buying than selling short. Read The Rolling Stone's

Goldman Sachs: "Engineering Every Major Market Manipulation Since The Great Depression"

Compare it with the points I have been trying to make about Goldman's sinister dominance of |

US government economic policy making since the early 1994.

Since 1965, the DJI has risen 61.4% of the time in the 10 trading days following

June 25th. New investment money is most apt to come into the market the last few trading

days of the month and for a week after the first. With June's end comes 2nd quarter

window-dressing. That boost the strongest stocks. Low priced stocks and technology are

not the only ones favored. Since the market turned up the six biggest gain Fidelity Sector funds

are:

Automotive +136%

Paper-Forest +67%

Brokerage +63%

Financial +57%

Networking Infrastructure +50%

Technology +48%

Half the time in the past the DJI retreats 2% to 8% before making a significant recovery

following a Buy B5. Waiting for the Closing Power to break its downtrendline in what you Buy may

prove a reasonable course of action. But it also will force traders to buy on strength. Buying

the strongest of the general market ETFs would not have put you in the weak DIA. Unlike the

DIA, the QQQQ closed above it opening. That there were almost 3 times more stocks rising today

than falling stock is certainly a positive sign.

The DJI was much weaker. Its first hour 100 point jump and later 150 point fade

is clearly bearish action. Will its action continue? Who were the sellers for the last 4 hours?

It may well be that the DJI's weakness today owed to news which will not affect the whole

financial world. Much of the weakness in the DJI-30 today owed to the 6% drop in Boeing,

which announced serious delays in its new 787 aircraft. The second biggest loser in the DJI

was UTX. The Motley Fool explains: "A whole string of suppliers -- from Honeywell

(NYSE: HON) to United Tech (NYSE: UTX) to Spirit Aerosystems (NYSE: SPR) -- depend

on Boeing getting its act together so that they can bring parts operations up to speed. Meanwhile,

customers such as Continental (NYSE: CAL) and AMR (NYSE: AMR), parent company of

American Airlines, who have ordered large batches of 787s, need the plane desperately in order

to cut their fuel costs.

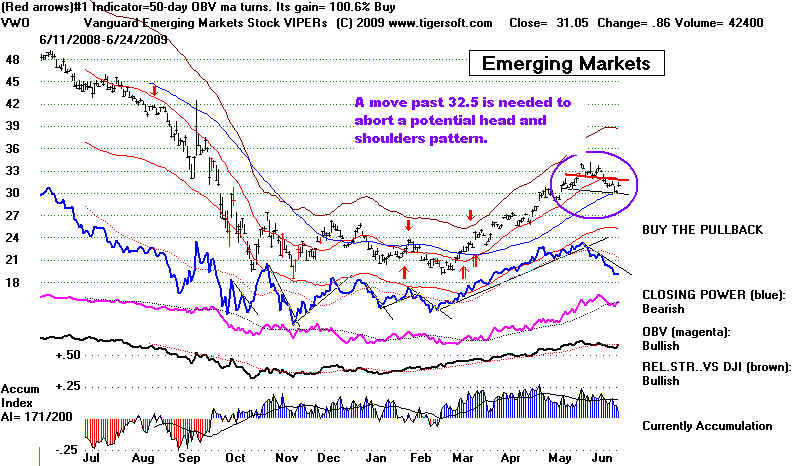

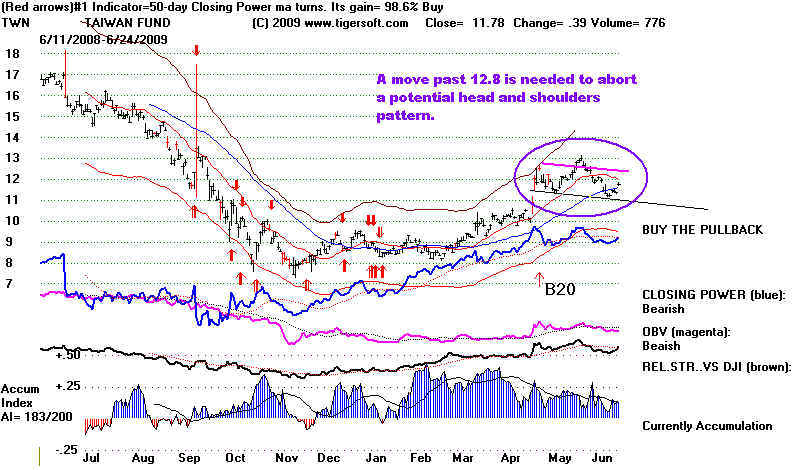

A market recovery is expected. But watch to see if the leaders can get past the apex of

. potential right shoulders in what would become bearish head and shoulders tops if their rally

fizzles. Here are some examples of ETFs and stocks that could become bearish head and shoulders

if prices cannot get past the lines shown.

=====================================================================================

6/23/09

New Buy B5 today.

Today brought a Buy B5 on the DJIA using

Peerless. With all three key

internal strength indicators (P-, IP21, Opct)

above zero and the DJI 3.2% below

the 21-day ma, A Buy B5 is seen in these

conditions as long the market has not

shown exceptional weakness in the last 4

months. In the 9 cases of Buy B5s since

1942, there have no losses. The average gain

was 7% at the time of the next major

Peerless Sell when we look at the period

1942-2008. It is important not to

use a Buy B5 within 8 weeks of a Sell S9/Sell

S12 See Buy B5

There are two

more cases in the period 1928-1942. These can be considered a test

of the Buy B5 principle, as they were in the

period used to develop the Peerless

system. *=Not an automatic signal

using previous S9/S12 rule.

12/11/28 Gain= 6.9% Cl/ma=.958

2/15/29 Gain = 5.7% Cl/ma=.967

*4/29/30 Gain = -1.2% Cl/ma=.966 Paper Loss = 278-255)/278

This was after S9/S12 and completed head and shoulders pattern.

In 6 of the 11 earlier Buy B15s the

DJI rallied without falling more than 1%.

In one case the DJI rallied only to

start falling back, so that the paper loss

was 8% before a very good rally 6

months later. And in 4 cases the DJI fell

between 2% and 5% before rallying

strongly. A decline below 7900 would

seem to be very unlikely before the

next Peerless Sell.

Traders may want to see more evidence that a bottom has been put

in place.

After all, the downside volatility was terrible 12

months ago. Summer may remind

traders of last year! Watching for the CLosing

Power downtrends to end will help

if you choose to take this independent approach.

But you should know that

the Peerless signals are worth taking, year in and

year out. Here are the results

after 9/15/2008

ETF Winning

Gains on Initial

$10,000 Reinvested

Biggest

and

with each reversing Peerless Buy

Paper Loss

Losing

and

positions closed out on next Sell.

Trades $40.

commission and slippage allowed

for with each trade. Trades taken

at opening day following signal

===== =====

============================== =========

DIA

4 vs 2

+22.6%

-16%

SPY

5 vs 1

+32.0%

-16.2%

QQQQ 4 vs 2

+37.2%

-11.4%

IWM 5 vs 1

+61.9%

-16.5%

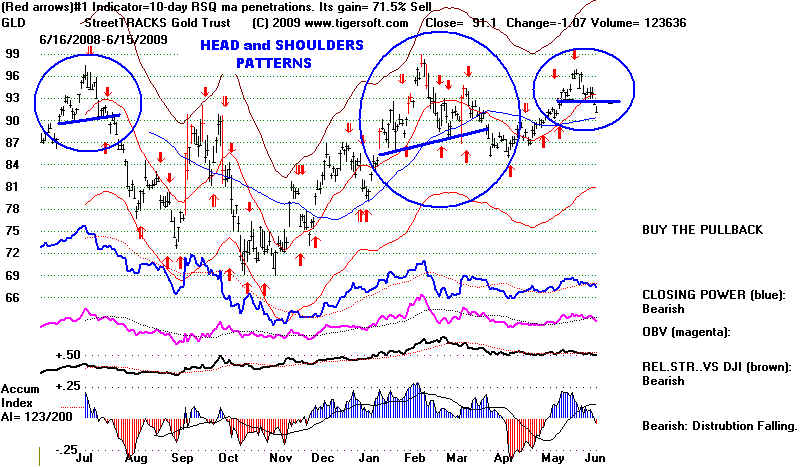

GOLD STOCKS' MADE BIG MOVES UP TODAY

Our report on health insurance stocks must be delayed until this weekend. Several

Gold stocks look attractive for purchase. Normally, we don't put stock picks here.

They belong on the Tiger Elite Stock Professional Service. But this shows what

we look for when Peerless gives a reversing Buy signal. Of interest here is that

the Fidelity Gold Fund (FSAGX) was the biggest gainer today among 42 its 42 Select

Industry fund. Readers will be intrigued by the fact that Gold Stocks were

among the

best performers

using Peerless Buys and Sells. All markets seem integrated

as never before to the DJIA. (The Biggest gainer today among foreign ETFs

was CEE - Central Europe.)

==================================================================================

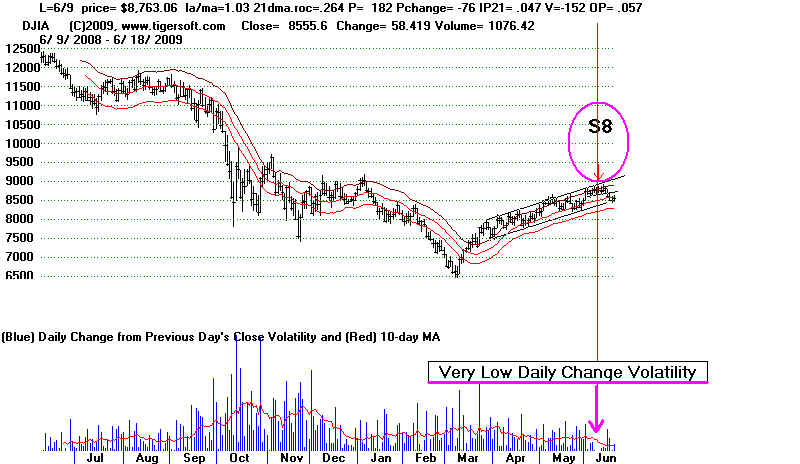

6/22/2009 Sell S8 Is Still Operative.

The DJIA

has reached its lower 3.0% band. The internal strength indicators are close to

giving

a Buy B9 for this

time of the year, from April to June But they did not. The key thresholds for cases

where the

la/ma=.97 are:

1) a P-Indicator at 107 or higher;

(2) the current Accum. Index (IP21) above .005 and

(3) the V-Indicator above -70. None of these condition are true. All need to

be.

The DJI has

also retreated to the support of its rising 50-day ma. Starting bull markets usually

do not drop below this ma,

but do sometimes. Should a penetration of the 50-day ma be taken

as a reinforcing sell?

Looking back to 1915, I count 16 cases where a simple penetration of a 50-day

ma after the first rally from

a bear market led to a significant decline of at least 5% more on the

DJI. But in 25 cases,

using a 50-day ma to buy and sell would have led to a whip-saw. Better would

have been to use a two day

penetration of a 65-day ma. That would have reduced the number of

whipsaws to 17.

Where there has been shown to be extreme downside volatility. it is

better to be

occasionally whip-sawed than

stuck in a serious or growing loss for 6 months. Use a two day violation

of the 65-day ma to avoid 1/3

of the whip-saws.

In our present case, we note that the 65-day ma crosses at 8250,

about where the support of the lows

of May 15 and May

22nd are also. In addition, we would require that the Accumulation Index to be

negative and the

Closing Power be below its falling 21-day ma..

Penetrations of the 50-day ma after a recovery

rally from

what seems a bear market: 1915-2003

Whipsaw Cases using 50-day ma = 25

Whipsaw Cases using 2-day penetration of 65-day ma = 17

Declines continued after violation of 50-day ma = 16

50-day ma

May 1918 . 78

Whipsaw...fell

to a 75.60 low two weeks after violating the ma and then rallied. t

Feb 1921 75

Whipsaw..fell to 73 after breaking 50-dma and rallied to 80 and then fell

to 64.

May 1921 77

fell to 65 in August 1921 and rallied

Oct 1924 103

Whipsaw.. fell to 99 and then began bull market

Sept 1930 234

fell to 157 and began bear market rally.

March 1931 173 fell from 172 to 121 and began bear market rally.

July-August 1931 140 whip-sawed

between 133 and 143.

August 1931 140 fell to 87 and began brief bear market rally.

Nov 1931 108

fell

to 70 and began brief bear market rally.

March 1932

78 fell to 41 and then rallied strongly to 80.

October 1932 67 fell to 57 and then began brief bear market rally.

February 1933 58 fell to 50 and then began bull market

March 1933

58 Whipsaw..

decline to 56 and two weeks later started bull market by surpassing 50-dma.

January 1938 122 Whipsaw....fell to 119 and then briefly rallied above 50-dma.

March 1938 125 fell to 100 and then began new bull

market.

August 1940 122 1-day whipsaw. Using 65-dma would have

avoided this.

August 1941 125 1-day whipsaw. Using 65-dma

would have avoided this.

Sept 1941

126 1-day whipsaw.

Using 65-dma would have avoided this.

Sept 1941

126 fell to 93

in April 1942

March 1947 177 fell to 164 two months later.

Sept. 1949 178 1-day whipsaw. Using

65-dma would have avoided this

Nov 1950 235

Whipsaws for

next next two month.

Nov 1958

541 1-day whipsaw.

Using 65-dma would have avoided this

June 1961 686

whipsawed -

declined only to 680 and rallied to new high and 725

Sept 1961 703

whipsawed - declined

only to 691 and rallied to new high and 735

April 1967

842 1-day whipsaw.

Rallied to 910

Oct 1970 754

1-day whipsaw.

Rallied to 840. Using 65-dma would have avoided this

Aug 1973 892

fell to 850 and rallied

Sept 1973

891 whipsawed

Nov, 1973 919 fell to 790 in a month.

1973-1974 bear market No violations of 50-day ma for 7 months. Almost.

65-dma = better.

June 1978

825 whipsawed. fell

only to 807 and rallied to 900.

1980 mini-bear. No violations for 5 months. whipsawed

and rallied from 925 to 975.

1981-1982 bear market. 1000 whipsawed 1-day violation. rallied to 1075.

Jan 1991 2509 whipsawed fell only to 2480. and rallied strongly,

Aug 2001 8342 whipsawed fell to 7290 in six weeks.

Jan 2002 9712 whipsawed fell only to 9630 and then rallied to 10600

April 2002 10136 whipsawed to

9820 and then 10300.

May 2002 10106 fell

to 7702 in 3 months.

Sept 2002 8671 fell to 7286 in 2 months

Dec. 2002 8365 whipsawed to 9820 and then 8304 and then rallied to 8800

Jan 2003 9129 fell to 7552 in two months.

Aug 2003 9061 1-day whipsaw. Rallied. Using

65-dma would have avoided this (Also Sept and Nov)

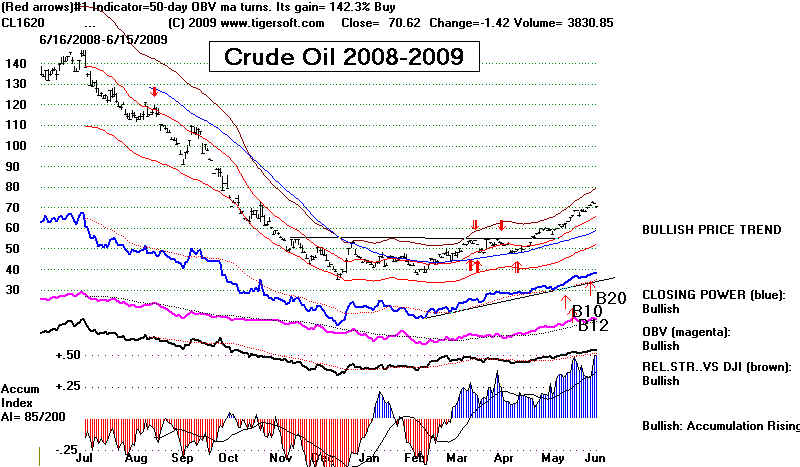

The Dollar is

hovering just above the key 70-level. Gold and Silver's Closing Power

are stuck in narrowing triangles. Interest rates look

weak and Crude Oil has violated its

rising Closing Power. Low-Priced Stocks broke their

uptrend and their uptrending A/D Line.

Distribution is very apparent. Watch to see if they

can rally and avoid dropping to a 2 month low,

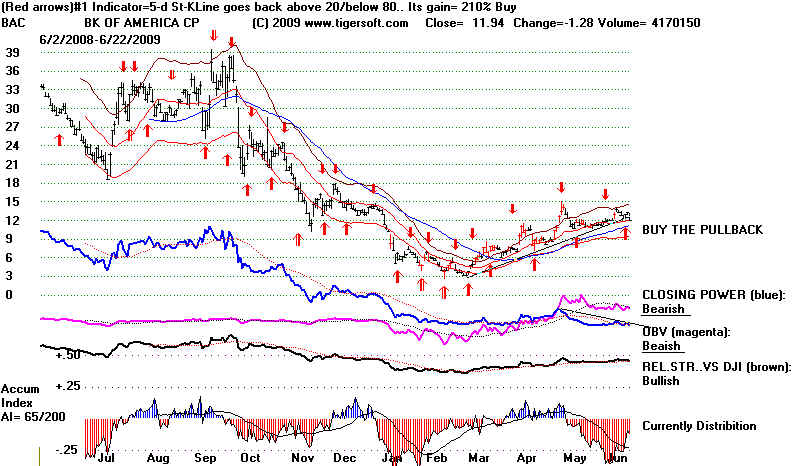

Bank stocks were weak. The Treasury Secretary says he will not let a monster

zombie bank fail.

That could, according to Roubini, cost the US taxpayer a trillion dollars. And

exactly what,

do we get for it? BAC is sitting on its rising 14 week uptrend.

Distribution and insider selling

continue. 22 of the 125 bank stocks we follow fell more than 9%,

Obama's decline in popularity is a direct threat to the big banks that are dependent

on their US Fed and Treasury benefactors. Rumor has it that Obama will not be able to get

a 75% popular public health insurance option through the plutocratic US Senate. He

has

raised expectations very high here. If he dashes these hopes, his popularity will

drop much

further. We will look at health insurance stocks tomorrow night.

===================================================================================

6/19/2009

PEERLESS Sell S8 on DJI. But Low-Priced "Cats and Dogs"

are running. Watch the NYSE A/D Line. It is Neutral, in that

it is sitting on its 21-day ma. Monday's Have Been Reliably

Bearish for The Last Year.

A Tale of Two Very Different Markets.

Many low priced stocks are still quite strong. As a whole,

they have not had much play

since the start of the 2003-2007 bull market. As a result, now they are considered

by

Wall Street pros to be oversold and cheap, as these stocks' 2009 bull market still

has

not been announced to the public by the talking heads of CNBC AND their Closing Powers

are in pronounced uptrends, for the most part, showing professional buying. All this

suggests more upside potential, even as the DJI retreats back to its support at

8300 and, below that, 8000. Low interest rates and traditional favoritism by

Democrats

of smaller tech stocks rather than mthe mega- Blue Chips also lies behind their

up-trend.

See again: June 6, 2009

The Great 2009 Bull

Market.

Why Is Wall

Street Concealing The Huge Surges in Low Priced Stocks?

The initial 2009 Low Priced stocks' A/D Line has been violated. But greed,

being what it is, I would expect another up-wave. How often do folks get a chance

to make 200%-400% in 6 weeks? This group has started to rebound from its

rising 50-day ma. two days ago. I will be looking to buy more low priced stocks this

week

on the Stocks' Hotline.

WHEN NASDAQ OUT-PERFORMS DJI FOR MORE THAN 6 Mo.

The NASDAQ is clearly out-performing the

DJI by a wide margin, Since January 15th,

the QQQQ's percent change minus the DJI's percent change over 50 days has been

has been positive. The difference is now 6% over the last 50 trading days. The

PEERLESS

NASDAQ chart features a unique relative strength indicator, the NASDJI. Study of all

4 earlier and comparable cases shows 8 months is the longest a secondary stocks rally

lasted; that the NASDJI always stops being positive after 7 months; Peerless called 3 of

the

4 tops very well; and we should be watching for a double top or a break in the second

NYSE A/D Line uptrend. See this

study and earlier NASDAQ charts.

6/18/09 Sell S8.

The Sell S8 is new. It

was introduced last week. It is based on very low day-to-day volatility

for 6 consecutive days. See details below. The documentation

appeared here in the last

week. I believe it should be used as a major and reversing sell signal. especially

as the NYSE

A/D Line uptrend has confirmed the S8. In 7 of 10 cases, the Sell S8 led to a

decline of at least

8% going back to 1928 when the DJI was not near an all-time high. The parallels to

August 1932

and July 1975 seem close. Practically, this has meant on our Stocks' Hotline, we

have reduce

by 1/2 the long positions and hedged with some short sales. The rising 21-day ma

very often

does act as support. And the QQQQ's internals are all considered "Bullish"

as it tests that

suppport. The bounce we are seeing over-night will help our high accumulation longs

more

than the short positions will hurt us if there is a 1% rally in the DJI on Friday.

Monday,

has the habit of declining. Since Juine 2nd, 2008, the DIA (ETF for the DJIA) rose

55.7%

of the time on Thursday and 53.8% on Friday but only 23.9% on Monday and 47.2% on

Tuesday.

Mondays are up 34% of the time for the QQQQ.

Yesterday the DJI broke its 21-day ma and its previously four-times tested uptrend.

Only

the P-Indicator, among our key internal strength readings for it, is still

positive. Volume

bearishly picked up on the small decline yesterday and fell on today's stunted

rally. The late

sell-off today makes the bounce seem unconvincing, though breadth was positive.

Today's rally in financials and the DJI owed to Wall Street's happiness that under

the Obama-Geithner Plan there will be no independent investigation of the regulatory

failures and banking excesses that led to the world-wide financial collapse of 2007-2009.

That

will all be quickly swept under the rug. Wall Street is very pleased that it will be

the Federal

Reserve which will police banks that are "too big to fail." There will be

no enforcement

of anti-trust laws against monster banks. There will no new requirements that

bankers'

executive compensation be limited or risk-adjusted. De facto hedge funds like

Goldman Sachs

will continued to get all the privileges and benefits of a real bank. So, Goldman

(+3.3),

Bank of America (+4.9%) and JPMorgan (+4.4%) and other non-DJIA banks are celebrating.

In the end, the big bankers know that the Fed is not an independent bureaucracy.

Rather,

apart from the Chairman who is appointed by the President, the Fed is essentially run and

staffed by and for bankers. The FED did not have the courage to step on toes and

regulate

the bankers when Geithner was the head of the NY Fed, exactly when conditions most cried

out

for such independence and courage. Not surprisingly, Wall Street reasons that the

banks

will find lots of ways to keep a more powerful Fed from rocking their boat.

Political scientists

have often pointed out that a regulatory agency is soon captured by those it is supposed

to regulate. Capturing will not be necessary under the Obama-Geithner plan.

Private

banks will run the show immediately.

But the big banks are not out of the woods, yet. They may still run short of funds

if

the economy and housing prices continue to fall. It will be much harder politically

for them to get

more TARP money, though Geithner says he is the giver that has the power to keep on

giving.

Showing his loyalty to banks is undiminished, he insists he needs to no new Congressional

authority. So, Obama is now perceived by them as the banks' protector. And

57% of Americans

still approve of his actions as President. As he strives straddles to straddle an

increasingly

polarized electorate, his approval ratings will weaken and Congress will become more

resistant

to his pro-bank policies.

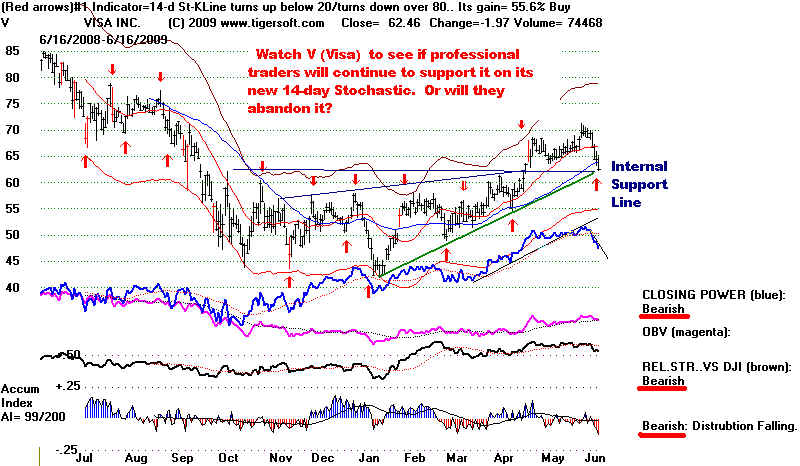

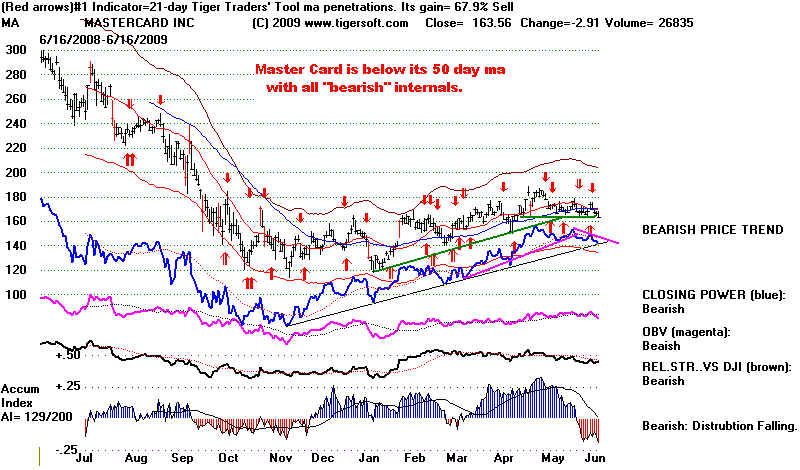

The central problem, of course, is that many, probably most, American consumers are

nearly tapped out. The charts of Master Card and Visa may reflect this by their confirmed breaks

below their 50-day ma. Housing stocks are turning weak again in the same way.

See HD LEN.

DJIA's SELL S8