TigerSoft and Peerless Hotlines |

|

6/11/2009 DJI 8739 +0.37% NASDAQ +.50% USO 38.97 +2.04% +.03% SLV -.13%

|

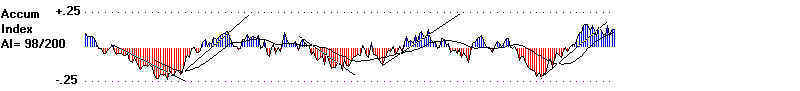

Readers, our assessment

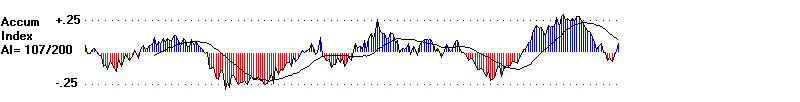

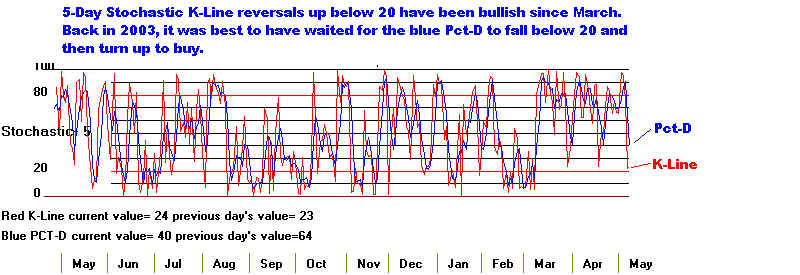

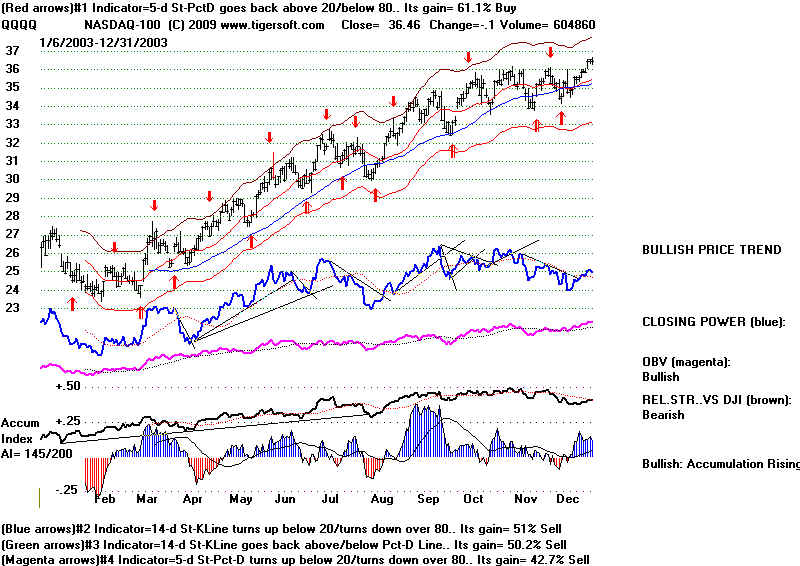

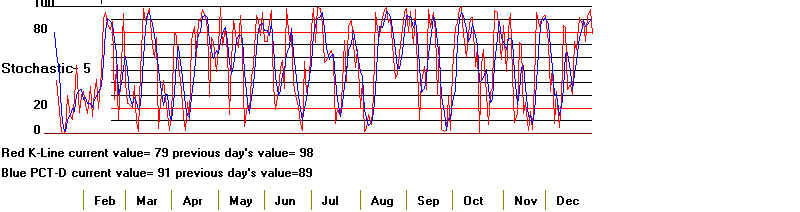

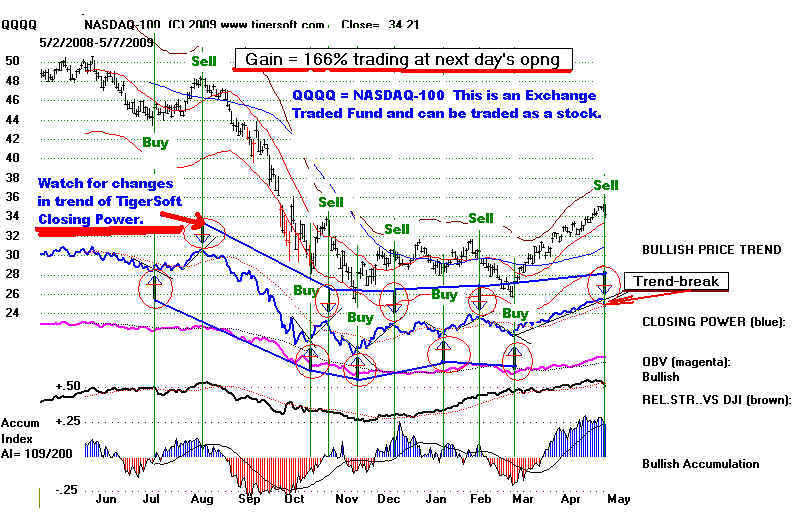

of the stock market's future trends is based on the following. Google TigerSoft and these subjects to get additional links, besides those shown below. : 1) Price charts and moving averages. 2) Peerless automatic Buys and Sells for intermediate-term trend. 3) Closing Power and Closing Power Percent for 2-4 week trends. 4) Accumulation Index to measure support on weakness or distribution on strength. 5) Volume (and OBV to a small extent) 6) Stochastics when they are the best trading system. 7) Seasonality. 8) Who's buying or selling and why. |

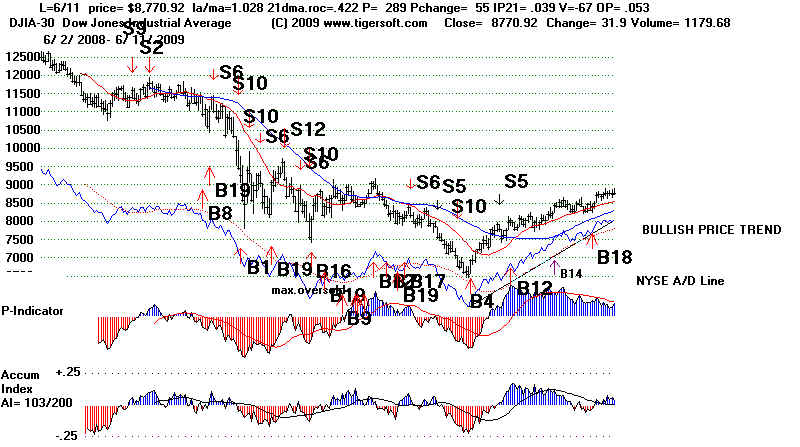

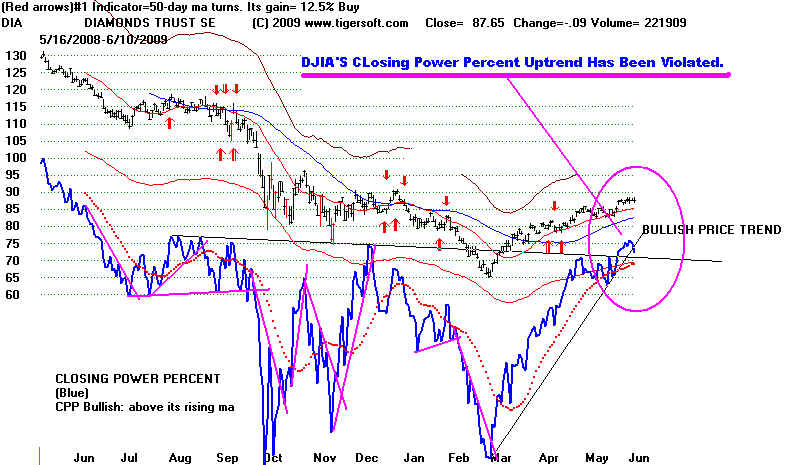

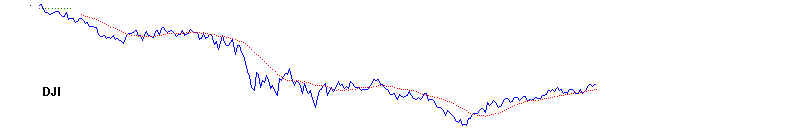

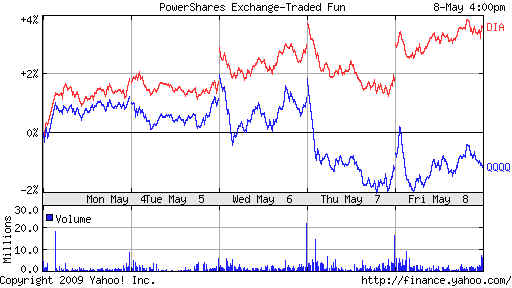

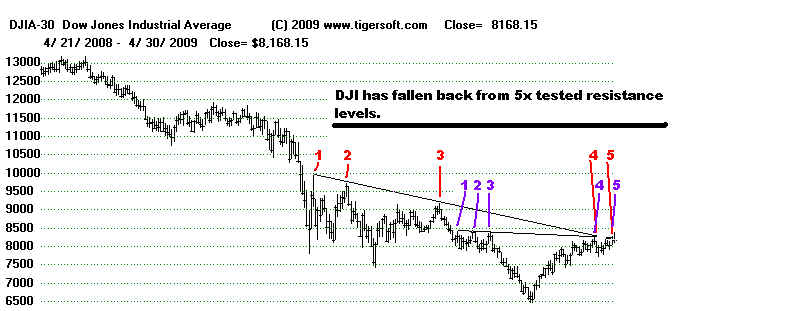

6/11/2009 The

DJI closed well off its and failed to hold its gains over 8850.

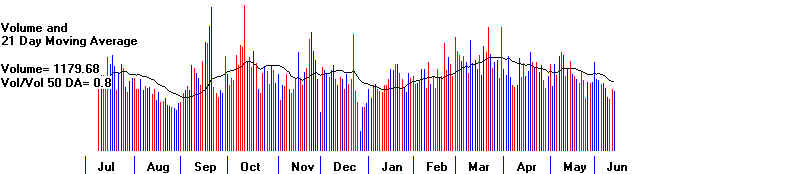

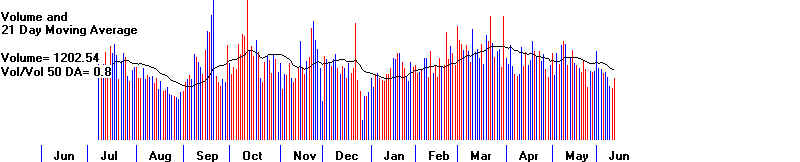

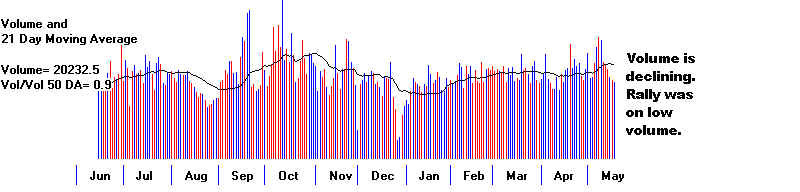

Volume remained low. Its

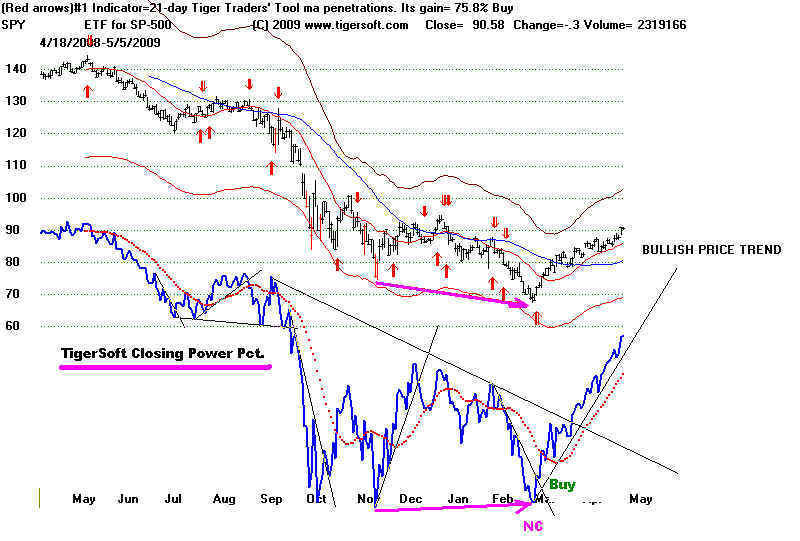

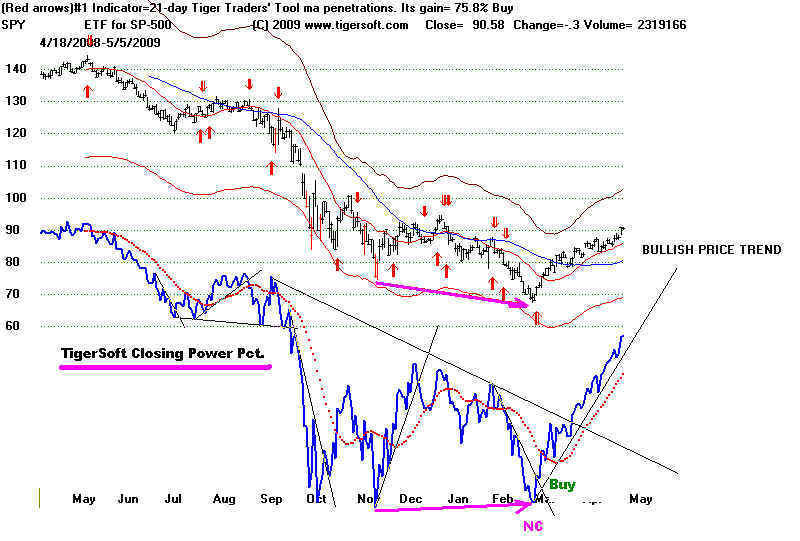

ETF's Closing Power Percent did break its uptrendline today.

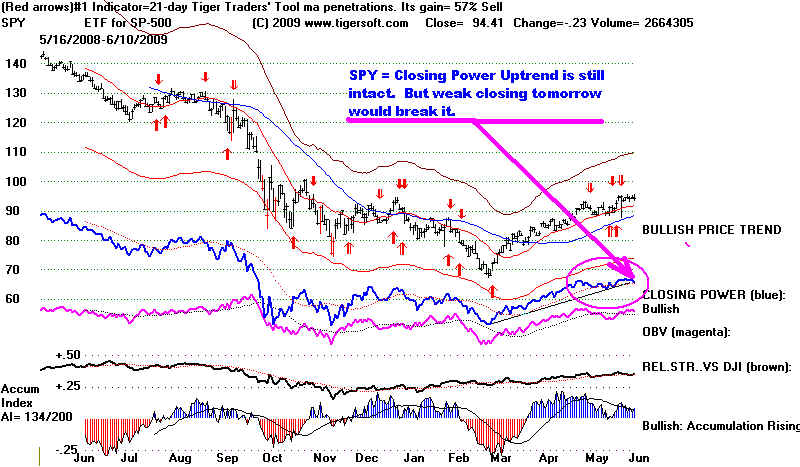

The Closing Power of the SPY could

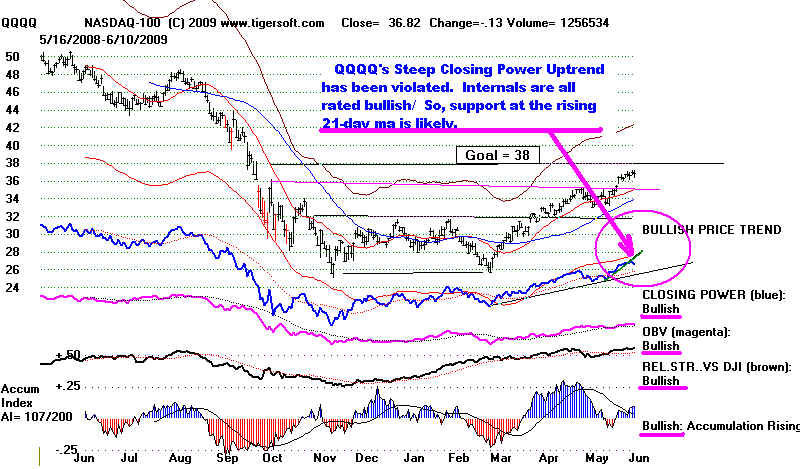

easily be broken tomorrow. Watch that. The QQQQ's

CP's steep uptrend has been

violated. But the internals suggest only a shallow retreat.

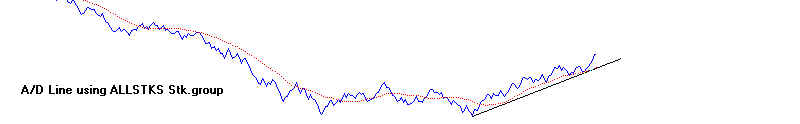

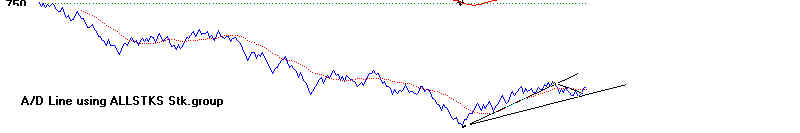

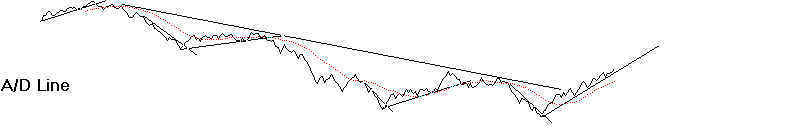

The NYSE A/D Line uptrend is still

intact. This helps hold up secondary stocks. Low priced

stocks rose sharply today as

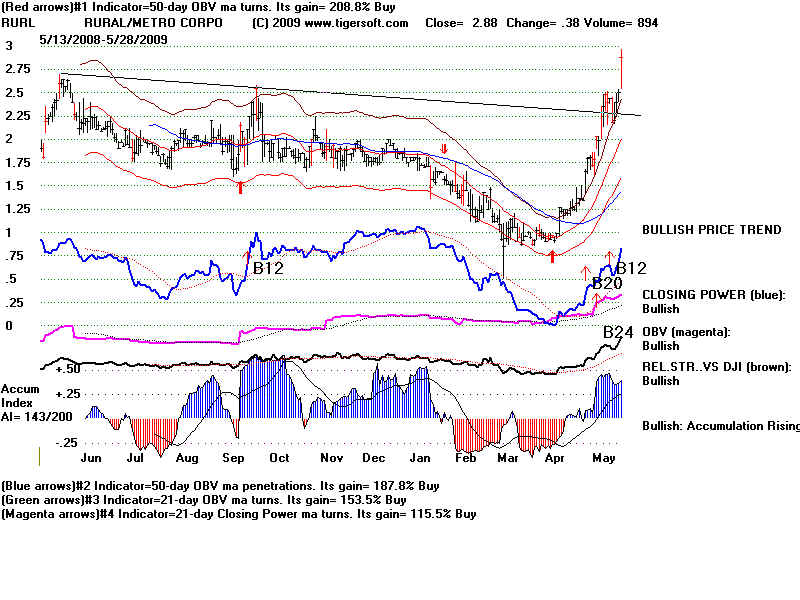

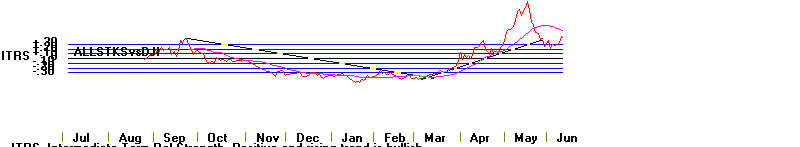

Treasury Note interest rates eased. The Tiger Index of Low

Priced Stocks' ITRS shows these

stocks have out-performed the DJI by 40% over the

last month.

The DJIA's very low volatility

after a big rally off a bear market bottom is associated

with a decline to at least the

lower band. As the DJI's internals are weakening, I would

think a decline to 8200 is more

likely than not. Low priced stocks may ignore this decline.

Look at them individually.

Bulging Accumulation means likely support. Don't sell

these. I have not put the new

S8 into the software yet. Consider it a minor signal

for now. I am not

recommending short sales on the DIA yet.

ITRS shows this index has outperformed the

DJI by 40% over last 50 days.

Key Charts: DJIA, SPY, QQQQ, DIA, Dollar, Gold, 10-Yr.Notes

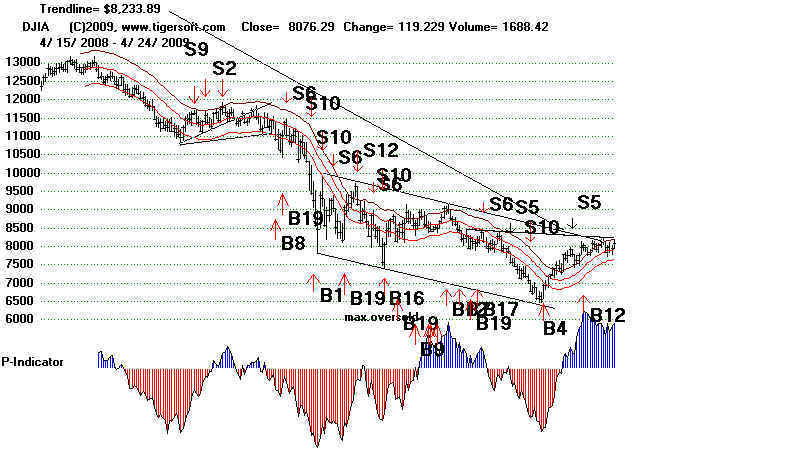

6/11/09 DJIA AND SUPER-IMPOSED

PEERLESS SIGNALS STOCKS

SPY

QQQQ

DIA

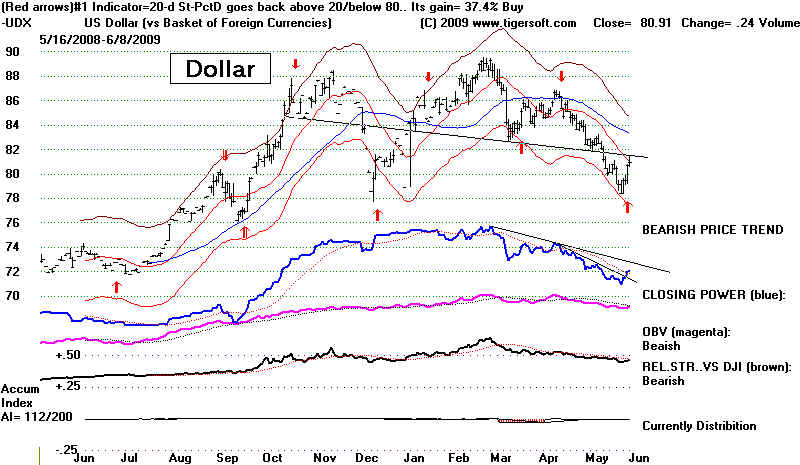

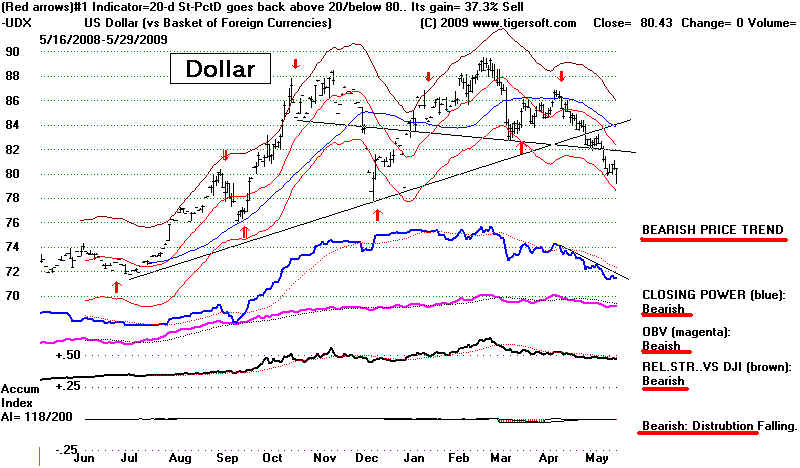

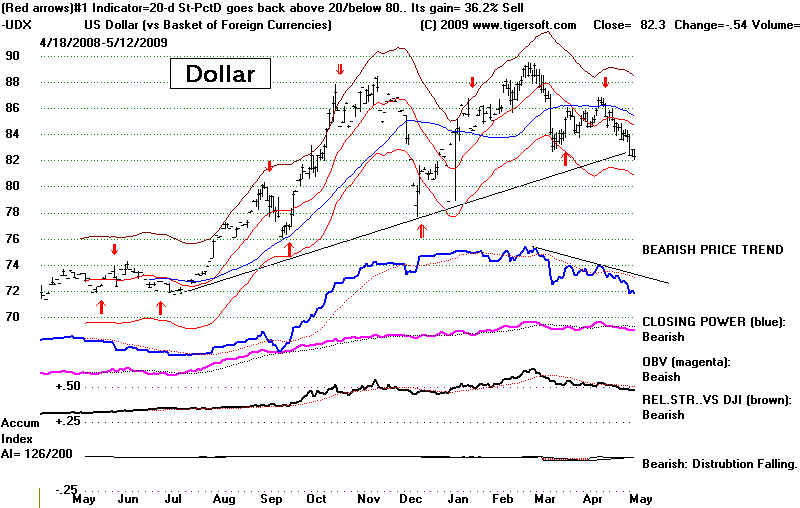

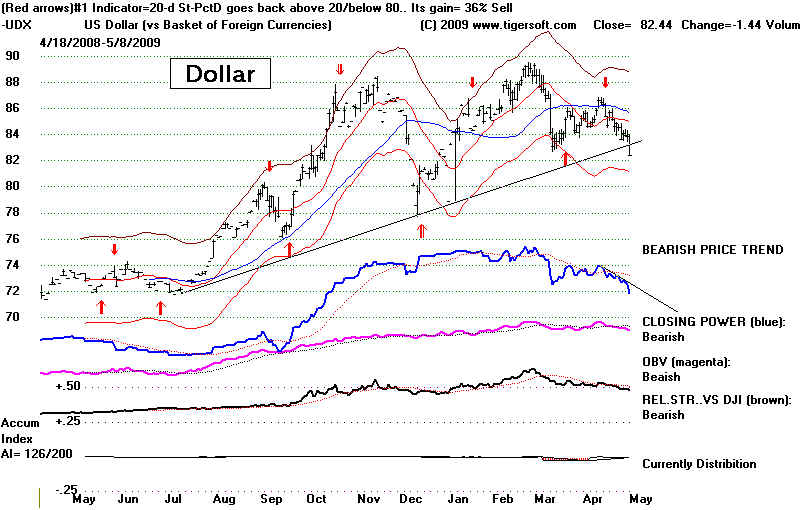

US DOLLAR

10-YEAR NOTES INTEREST

RATES

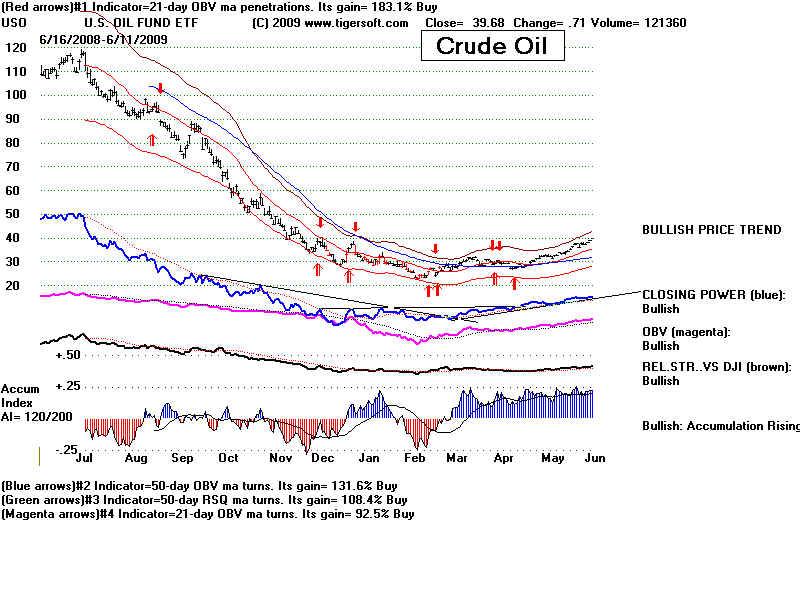

CRUDE OIL

====================================================================================

6/10/2009

Provisional New Sell S8 Based on Low Volatility on Big Rally after a

Bear Market.

The intermediate-term CLosing Powers' and the NYSE A/D Line uptrends are

still rising. But I think the

historical study of the new Peerless Sell S8 justifies profit-taking

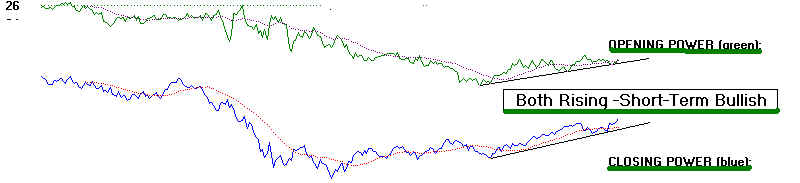

tomorrow. It's true that both the

Opening and Closing Powers are rising. That is a boost for

the bulls now. Traders may choose

to wait for a particular ETF's or stock's Closing Power

uptrend to be violated.

That's reasonable. But rather than sell when others are selling,

let's sell into the opening

tomorrow. See discussion of this signal on 6/9/2009. The exception

would be individual stocks showing very

high and rising Accumulation and Closing Power trends.

Broad weakness tomorrow would cause the

NYSE uptrend to be violated. If that takes place,

look for more selling among a broad group

of stocks for at least a few days, as the DJI

retreats probably back to its rising

50-day ma at 8275.

This S8

signal is not perfect. But in only 3 of the 11 parallel cases of S8s, did the DJI

rally

initially after this signal. These

rallies against the Sell S8s lasted only a week and ranged from

3% to 8%.

For a few hours this morning, it looked like we might be

getting a key reversal downwards,

where hey indices would open at their highs, turn down

sharply and close at their lows on higher volume.

But that was not to be, even though the interest rates on Treasury notes are rising sharply and that may

force the Fed to start raising interest rates, thereby

weakening the economic recovery. What caused

the turn-around was Obama's sudden reversal and shift to

the right (Where else? How many times have

we seen this pattern?) on the issue of the pay and bonuses

to be allowed bankers and CEOs getting

TARP billions money. Geitner, his Treasury Secretary, denounced a

$500,000 cap on such executives'

pay,

something Obama had campaigned for. That's when the market seemed to recover.

The moral

is that Wall Street holds the stock market hostage.

If Obama wants a recovery led by rising stock prices,

he's going to have to learn not to shake the boat and

threaten the power elite's privileges.

But the stock market is not out of the woods because of a 2 hour 100 point recovery.

We will

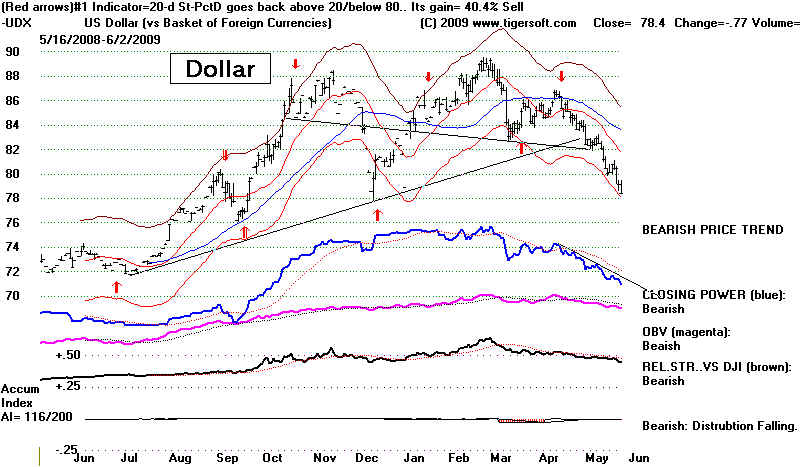

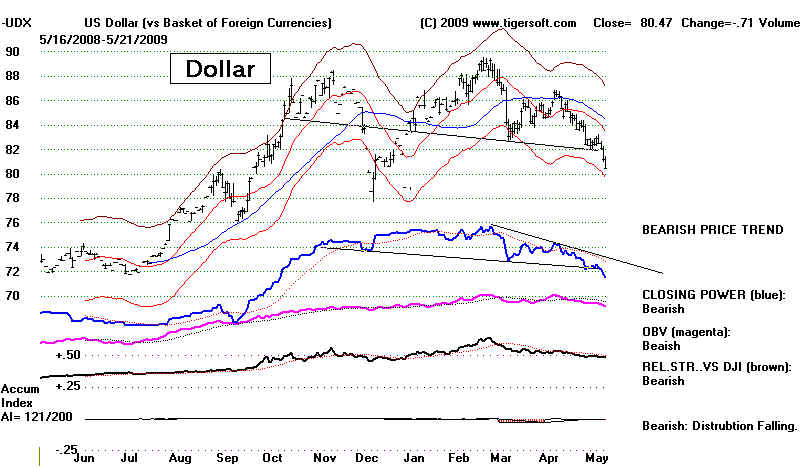

have to keep a watch on interest rates and the US Dollar.

A drop by the Dollar below 80, may get the

Fed to shift priorities towards protecting the Dollar with

higher interest rates. The alternative strategy,

Helicopter Bernanke's dropping billions on banks, is

starting to get a bad press, as it was reported that the

the Fed

lost $5.25 billion in the first quarter on just AIG and Bear Stearns. The Dollar

is still above 80.

Below that, the pressures to protect the Dollar will

probably win out, and interest rates will rise.

SELL S8 on 6/10/2009

Key Charts

6/10/09 DJIA AND SUPER-IMPOSED

PEERLESS SIGNALS STOCKS

![]()

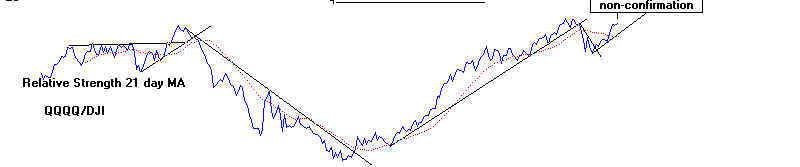

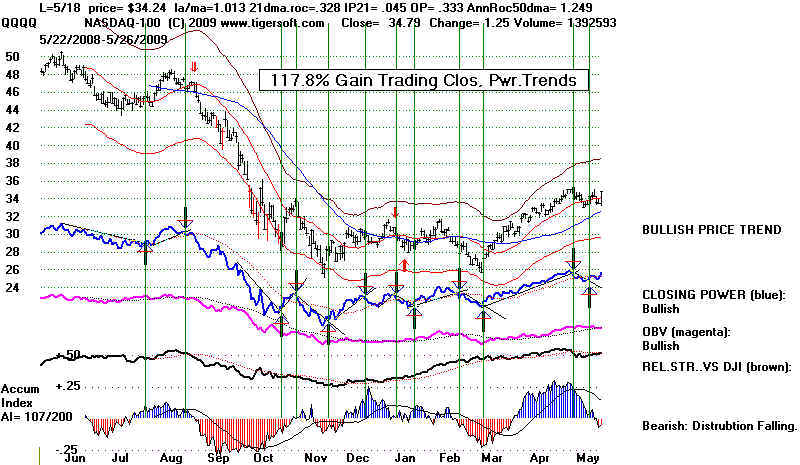

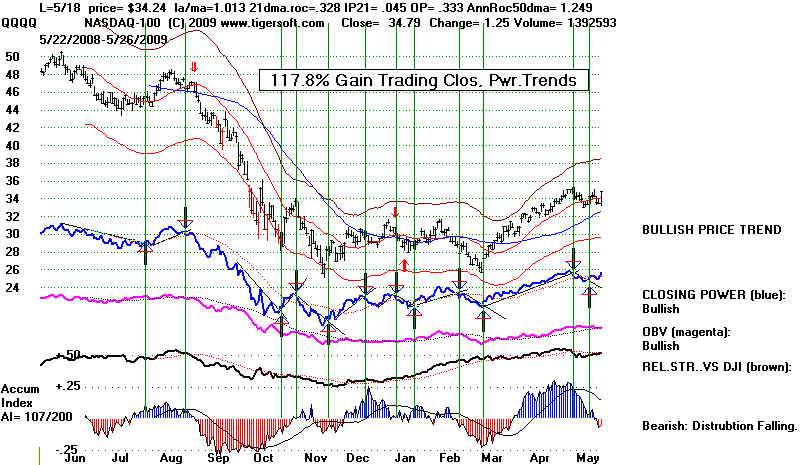

QQQQ Still shows slower Closing Power trend s

still up.

But the short-term uptrend has been violated. After a

long advance with Opening Power rising, it is usually

best for traders to abide by breaks in the steeper uptrend.

Opening Power (not shown) is rising.

OBV, Relative Strength and the

Accumuolation Index are

rated as bullish.

SPY

Still shows rising Closing Power trend.

But it is close to

being broken. With none of the

other indicators

considered "Bullish", a break in

Closing Power should be

considered a SELL for traders,

with the expectation

that a decline back to the

21-day and possibly the

50-day ma may ensue.

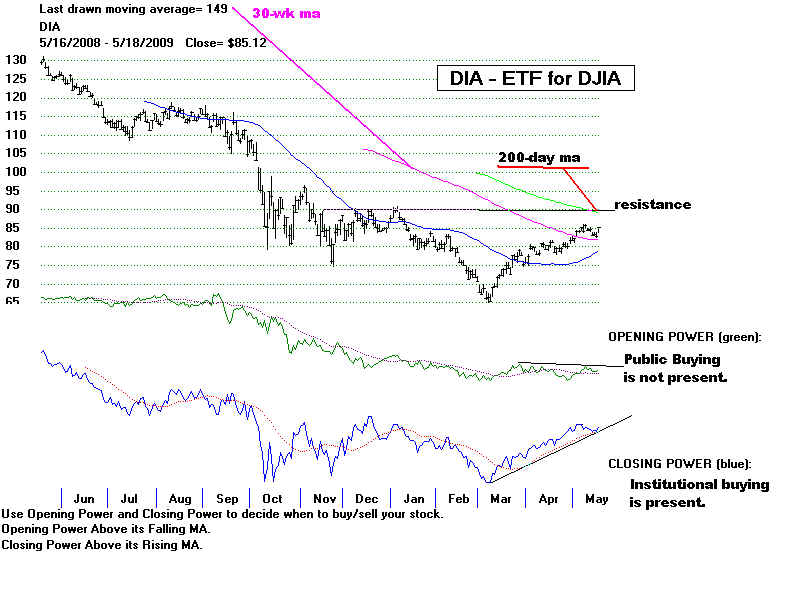

DIA Still shows rising Closing Power Percent

trend.

Opening Power is also rising (not shown).

Volatility keeps falling.

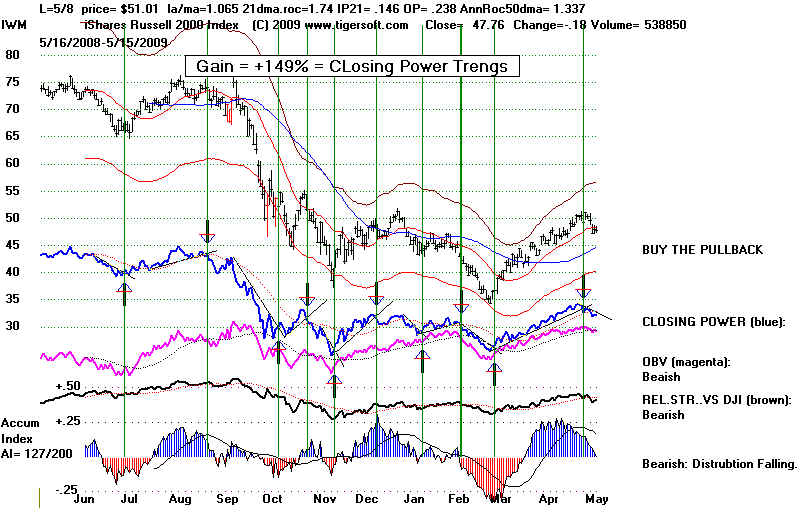

IWM - Russell-2000's steep Closing Power

uptrend has

been violated. Usually this invites a

further decline.

The longer term CLosing Power trend is still

intact,

but may be violated on further weakness.

Still on A Buy, but Such Low Volatility Is Usually Bearish.

Sell if There Are Closing Power Up-Trend-line Breaks.

6/9/2009 Have any of you noticed how prices in the stock market

sometimes pivot and

reverse after there has been a day of two of very little change in closing prices? The

October 1987 peak showed the DJI closing at 2639.20 on 10/1, 2640.99 on 10/2 and 2640.17

on 10.5.

From this point the DJI then declined all the way to 1738.74 on 10/19/74. Compare

this

with the DJI's closing of 8763,13, 8764,49 and 8762.06 on 6/5, 6/8 and 6/9, 2009,

We have no new Peerless Sell signals and the Closing Powers are still rising,

as is the NYSE A/D Line. But volatility has become dangerously low. This is

like taking

a walk on a high diving board. Or, mixing metaphors, we have reached a point in the

advance

where the cannon ball is no longer rising. Gravity then takes over. Traders

will start to

take profits The Accumulation Index is not high enough at .047 to give us much hope

that

there will be buyers just beneath the market. Obama

says he will impose limits on bankers'

salaries

and bonuses. I would think Wall Street will cry like a baby about this and try

to

force him to withdraw such proposals by showing him how stock prices can be dropped

quickly

if he become too much a populist. June is not a good month seasonally. So,

while the

market may go a little higher, and reach the 38 objective for the QQQQ and 9000 for

the DJI, be prepared to sell if the CLosing Power uptrends or the NYSE A/D Line uptrend

is violated. As you can see from the research I did tonight, a low volatility

"S8" probably

should be added to the Peerless arsenal. The main reason for not doing do is how

good the

breadth has been. I think selling half of our long positions tomorrow is reasonable

if

the CLosing Power uptrend-lines are violated. even if the existing Peerless system has not

yet given a Sell.

Click on some these charts to get an idea of how a new low volatility Sell signal has

worked:

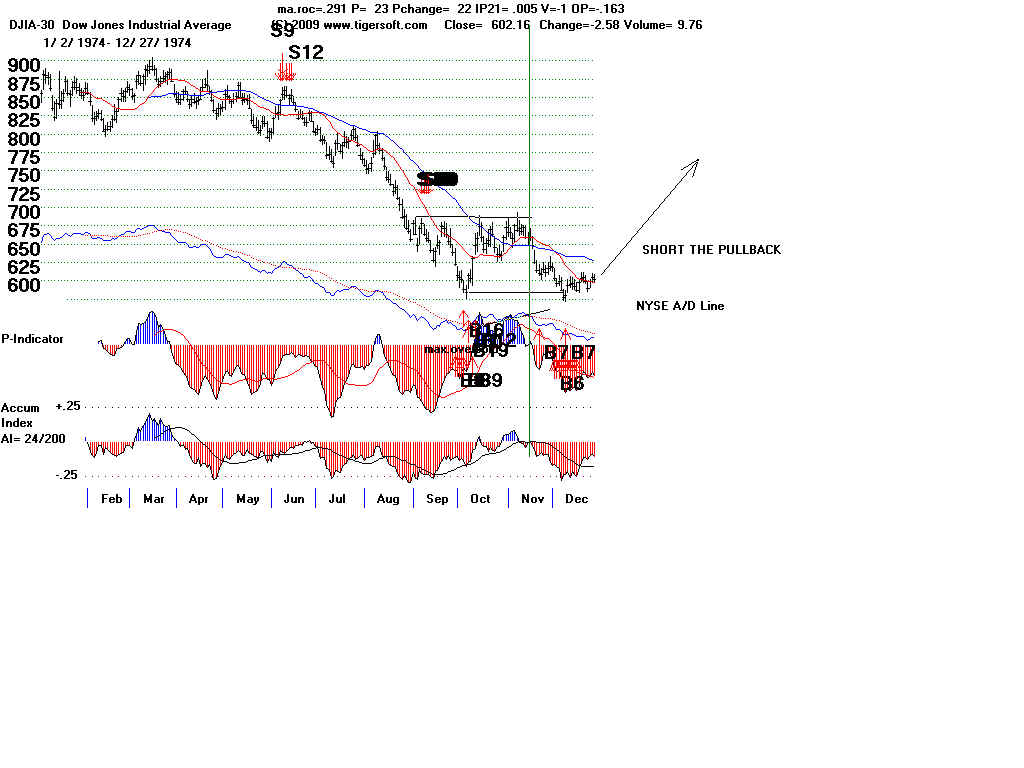

1932, 1933, 1935-1936, 1939, 1945-1946 and 1975

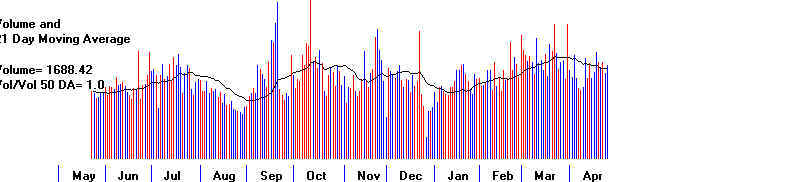

Low Volatility Sell Signal after Recovery Rally from 1973-1974 Bear Market.

================= 1975 ==================

Sell S8

|

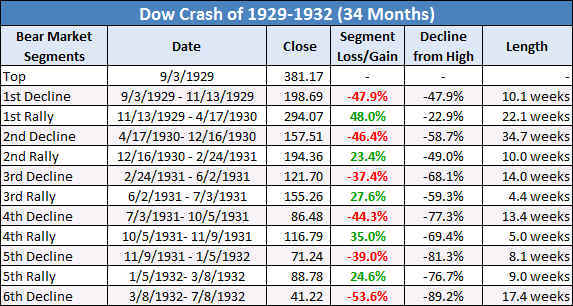

NEW SELL SIGNAL - Sell "S8" (That is its tentative name for now.) It is based on unusually low volatility after a 3-month rally of more than 10% by the DJIA, provided that index is not in all-time high territory where the path of least resistance is up. The rate of daily change in closing prices must have stayed under its 10-day ma for 6 straight days. This signal seems to work particularly well after there has been a substantial jump up from a bear market low. There have been 11 such earlier cases when the DJI was not in all-time high territory. In 8 cases the DJI fell more than 8%. There were only 2 cases where the paper loss was this big. Here are the cases since 1928 when the DJI was not in all-time high territory. DATE What DJI did subsequently Key values: last/21-dma, OBVPct., IP21 (Current AI), annualized rate of change of 21-dma (1) 8/30/1932 DJI moved up for a week from 74.30 to 80 and then fell to 58 in 2 months Key values: la/ma = 1.098 OBVPct= .246 ip21=.01 roc=3.46 This was on a recovery from a bear market low. 8% paper loss before a profit. More than 20% decline. (2) 9/29/1932 DJI fell from 71.50 to 59 in 2 weeks. Key values: la/ma =.988 OBVPct=-.107 ip21=-.069 roc=.46 This was just after a recovery from a bear market low. More than 15% decline. (3) 10/31/1932 DJI fell from 61.90 to 58 in a week, rallied to 67 and then fell steadily to 50 4 months later.. Key values: la/ma =. .97 OBVPct= -.087 ip21=-.139 roc=1.779 This was just after a recovery from a bear market low. 8% paper loss before a big profit. More than an 18% decline. (4) 7/14/1933 DJI rose from 105 to 109 in 3 days and then fell to 89 a week later. Key values: la/ma = 1.059 OBVPct= .17 ip21=-.103 roc=1.316 This was on a recovery from a bear market low. 4% paper loss before a profit. More than 15% decline. (5) 9/17/1935 DJI fell from 133.10 to 128 in a week and two mo later hit 148. Key values: la/ma = 1.027 OBVPct= .316 ip21=.04 roc=506 Only 3% profit before rally. (6) 3/25/1936 DJI rose from 157.90 to 162 in a week and fell, a month later hit to 143 Key values: la/ma = 1.017 OBVPct= .221 ip21=.016 roc=.546| 3% paper loss before a profit. More than 8% decline. (7) 7/31/1939 DJI fell from 143.30 to 131 in 3 weeks and then rallied to 156 2 weeks later. Key values: la/ma = 1.03 OBVPct= .328 ip=21.099 roc=1.03 This was on a recovery from a bear market low. More than 8% decline. (8) 9/27/1939 DJI from 150 went sidewise for 7 months and then fell to 114. Key values: la/ma = 1.028 OBVPct= .27 ip21=.068 roc=1.479 More than 22% decline. (9) 2/25/1946 DJI fell from 206.60 to 186 in 2 weeks and 5 weeks after that. rose to 208 Key values: la/ma = 1.024 OBVPct= .43 ip21=.268 roc=.877 More than 9% decline. (10) 10/25/1950 DJI fell from 231.50 to LB at 221 in 8 trading days and two weeks later hit 236. Key values: la/ma = 1.011 OBVPct= .286 ip21=.049 roc=.281 More than 5% decline. (11) 7/1/1975 DJI fell from 877.42 to 784, 10 weeks later. Key values: la/ma = 1.036 OBVPct= .01 ip21=.04 roc=.434 This marked the recovery high after the 73-74 bear market for 6 months. More than 9% decline. (12) 6/9/2009 Key values: la/ma=1.03 OBVpct= .059 ip21=.047 roc=.264 |

Why does Gold show a head and shoulders' pattern? Is the FED going to

raise interest rates? Is the US going to sell some of its gold?

==================================================================================

6/8/2009

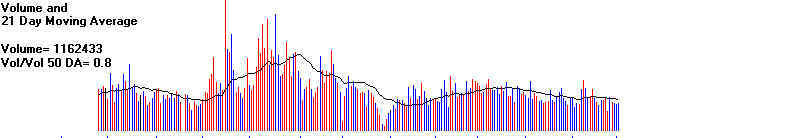

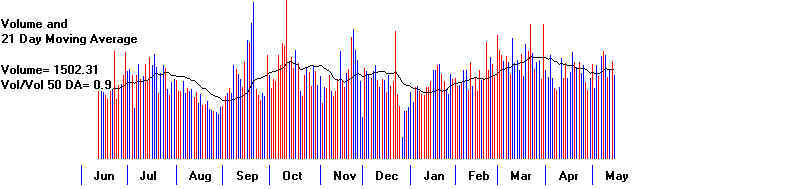

Peerless remains on a Buy and the internal strength indicators that we keep mentioning are

all still rising for the QQQQ, SPY, DIA and IWM. Volume and volatility are very low.

Have Buyers run out of gas? Or federal TARP money? Not so much, that they cannot bid

prices up off today's lows in the last hour. Sure, this is probably program trading,

But what

do these program traders know that the skeptical public does not? The rise in

interest rates

without weakness in the US Dollar or the stock market, I think,

bullishly suggests growing business

confidence and investment demand for capital is rising and

the FED has not yet communicated its

intentions to raise rates to its investment banking collaborators. So, we look for

stock higher prices,

but would be quick to take profits on a Peerless Sell or a break in the A/D Line or

Closing Power uptrend-lines. A DJI move above 9000 would get headlines and public

attention. That could be the cover under which the buyers for the last 2000 points

in the

DJIA take profits as better economic news is announced by an Administration eager to score

political points to maintain momentum for its political agenda before the Summer.

The number of Fidelity Select funds out of 42 that are up for the last 21-trading days has

stayed steady between 35 and 38. That's another sign of remarkable breadth since the

market has been rising now for three months.

We do become more cautious if we watch the Closing Powers of banks stocks:

BAC - quite bearish, except for

it being above its rising 50-day ma.

Short sellers are being run, it seems.

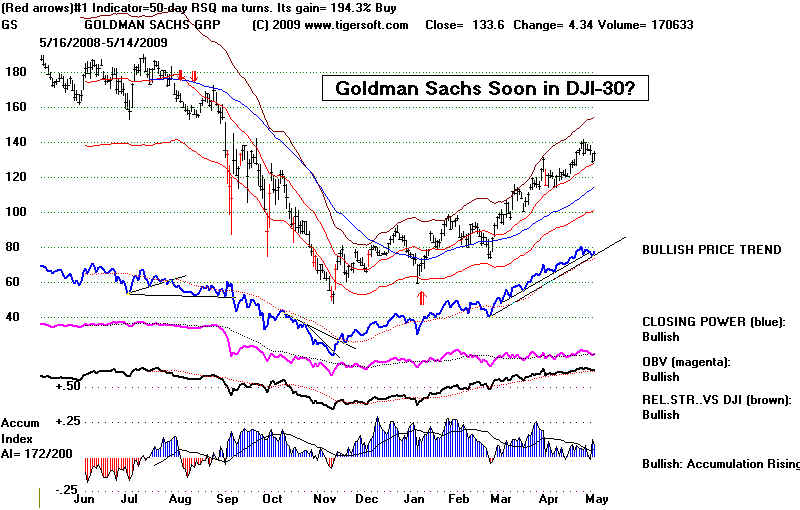

GS - Bearish rising wedge pattern, negative Accumulation but still rising CLosing Power

and 50-day ma

JPM - quite bearish, except for

it being above its rising 50-day ma.

WFC - neutral Closing Power and bullish Accumulation.

but the highest priced DJI stock and volatile tech stocks appear to be in firm uptrends::

IBM, AAPL, AMZN GOOG, RIMM - bullish internals and

rising CLosing Powers

and the volatile foreign ETFs that the Peerless Buys and Sells trade so well are mostly

in confirmed uptrends.

Russia - Bullish internals, but

Closing Power is sitting on its uptrend.

India - Negative Accumulation and

steep Closing Power uptrend has been violated.

Brazil - Bullish Relative Strength but CLosing Power is sitting on its uptrend.

Mexico - Closing Power has broken uptrend.

====================================================================================

6/5/2009

We have no Peerless Sell signal yet. Breadth will need to deteriorate more for a

Sell on

strength or for the NYSE A/D Line uptrend to be broken The Accumulation Index will

need

to drop below 0 to match its levels at the peaks in the DJI recovery-peaks in 1932, 1933

and 1938. It now stands at .023 with the DJI 3.4% over the 21-day ma. The

Closing Power

will need to break its uptrend to bring a short-term decline. It's true that

seasonality is now

bearish. But this is not a normal market. Breadth has been outstanding since

the March 9th

bottom. Look below for studies of this. Breadth has been bullish well beyond

past precedent.

Such good breadth trumps the low volume. The consequence is that we are seeing a

stealthy,

under-publicized bull market in lower priced stocks. I would say that this means

that Wall

Street is not yet inviting the public back to the party to buy the stocks they have bought

very cheaply, after scaring the public to justify their lavish government handouts.

Realize

that one out of every 100 stocks traded in the US is up 400% or more. Read the Blog

I wrote

this weekend:

The

Great 2009 Bull Market. Why Is Wall Street Concealing

The Huge

Surges in Low Priced Stocks?

The A/D Line of the 350 low priced stocks (#14

lowprice on Tiger Data page) is still uptrending.

When that line is violated, we can start to worry as investors in these stocks.

So, the DJI continues to trend up. An objective of 9000

still seems reasonable. That's where

the next well-tested, horizontal resistance level is. We can get such objectives by

measuring

the height of recent trading ranges have been and adding their heights to subsequent

breakouts. The DJI recently broke above its trading range, 8200-8600. Adding

that pattern's

height yields a target of 9000. If you carefully study charts from 1932, 1933, 1938,

1974-1975,

you will see this pattern in the advances off the bottoms as the tops are reached.

Another

element in 3 of 4 of these cases is that right before the top, there are 6 or 7 days of

declining

volatility, where we use our Peerless/TigerSoft measure of the daily change. As you

can

see from DJI chart above, we have seen only 4 such days most recently.

==================================================================================

6/4/2009 The DJI is apt to back and fill at the 200-day

ma resistance now reached. Volume is just

too modest to offer much hope of a powerful new surge. 9000 still seems a good

target. Big

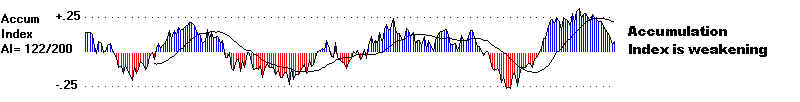

money accumulation has subsided significantly, if we judge this from the

Accumulation Index

on the DJI, NASDAQ or the major market ETFs. And that is not all. We

have now entered a

period when seasonality starts to be bearish both on a short-term and an intermediate-term

basis,

for all periods after this date since 1965 and for Junes in the years after a Presidential

Election

since 1917. These statistics are shown near the bottom of this page.

Fortunately, we still show

the last Peerless signal to be a Buy. The Closing Powers are all still rising.

So, is the NYSE A/D

Line. Hesitation and churning by the DJI as it approaches 9000 seems very likely.

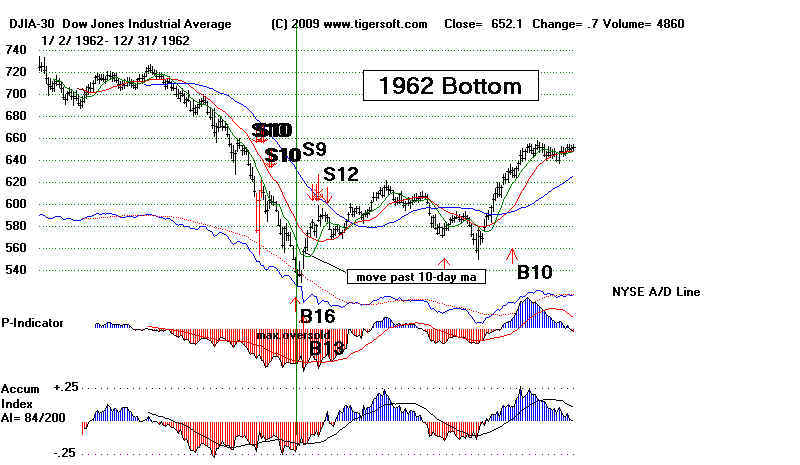

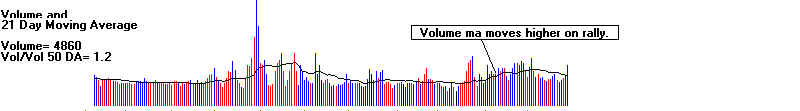

HOW WILL WE SPOT THE TOP TO THIS RALLY?

How might we expect to spot the signs of a top to this

rally? Let's look to the big rallies

off

the bottoms in the 1930's extreme bear markets. The DJIA rallied very strongly

off

the bear market low in July 1932 and peaked after almost doubling its value at its low.

It

did surpass its declining (green) 200-day ma at 70 after a hesitation and rose 13% more.

The

top took place on high volume churning with little price movement just below 80.

There

was

an Sell S12 and an S2 from the regular Peerless just before the market started declining.

The

Accumulation Index had turned negative (-.05) with the DJI closing at the 5.4% upper band.

The

next day the NYSE A/D Line uptrend was broken. Consider the second extreme 1930s

bear

market. The market peaked in July 1938, after the severe 1937-1938 (48% down)

bear

market, in a similar way. The DJI rallied 13% above the 200-day ma and peaked with a

Peerless

Sell

S12 at the top and then a break in the NYSE A/D Line uptrend. By comparison

now, the DJI

has

closed at the 200-day ma, and 3.3% above the 21-day ma and sports a +.046 reading

from

the

Accumulation Index. If the 1932 and 1938 experiences repeat here the DJI will go 13%

higher and reach 9800. The biggest difference is noteworthy. Then, volume was

very high on the

rally. That's why I think it will harder for the DJI to get much past 9000.

1932 DJI - How July-August Rally Ended

1938 DJI - How July-August Rally Ended

7/27/1938 S12 - la/ma=1.014

P-88 Accum. Index = -.009

V=131 Opct =-.011

SPECULATION IN "CATS AND DOGS" EVENTUALLY IS BEARISH.

Gaudy speculative advances usually are warnings. That was as true in 2008 (big

advances in low priced energy stocks) as it was in 1968 or 2000 with stock having a

tech sonding name. But for the time being, we are enjoying the advance, which may

well continue until the FED starts raising interest rates.

Until then, the gaudy recovery gains in many NASDAQ-100 and smaller stocks

will probably continue. This deprives investment capital from big DJI-30 stocks.

Note that

Democrats historically have tended to favor smaller technology stocks and low-priced

stocks.'

Their bull markets are too infrequent and afford way too much opportunity to now ignore.

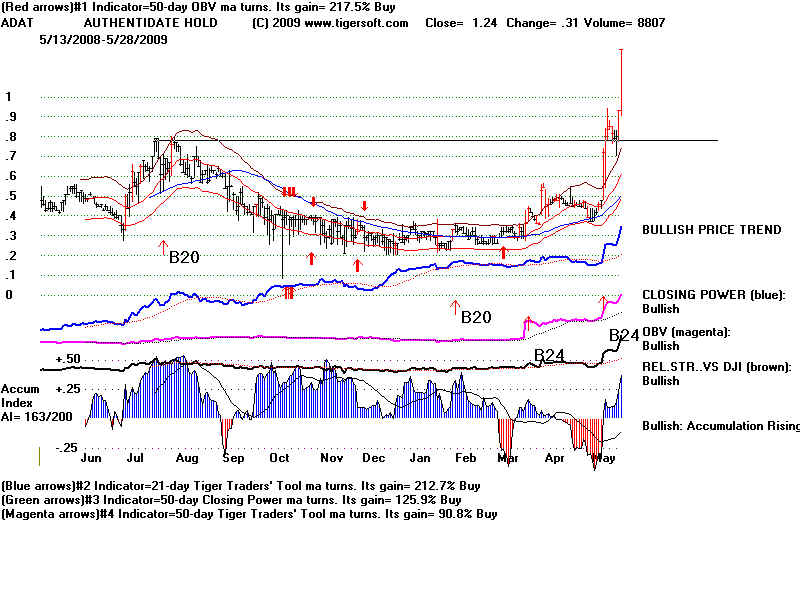

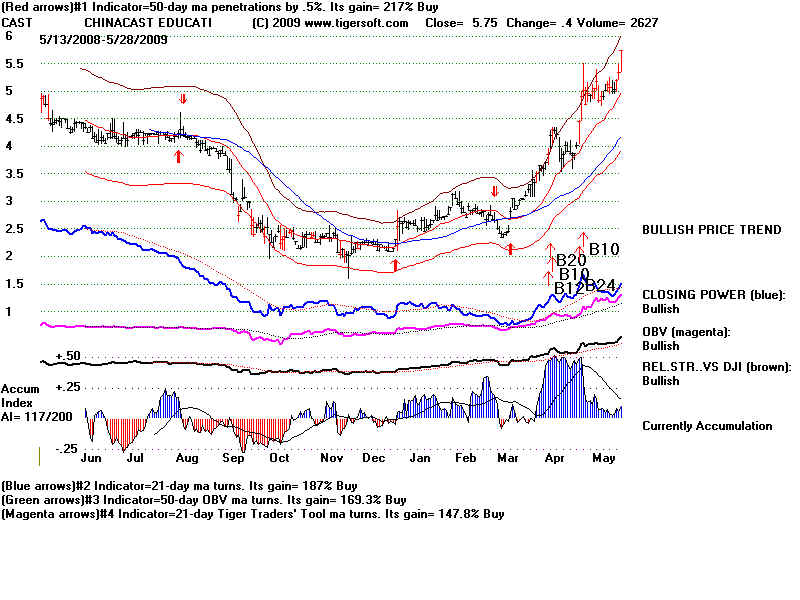

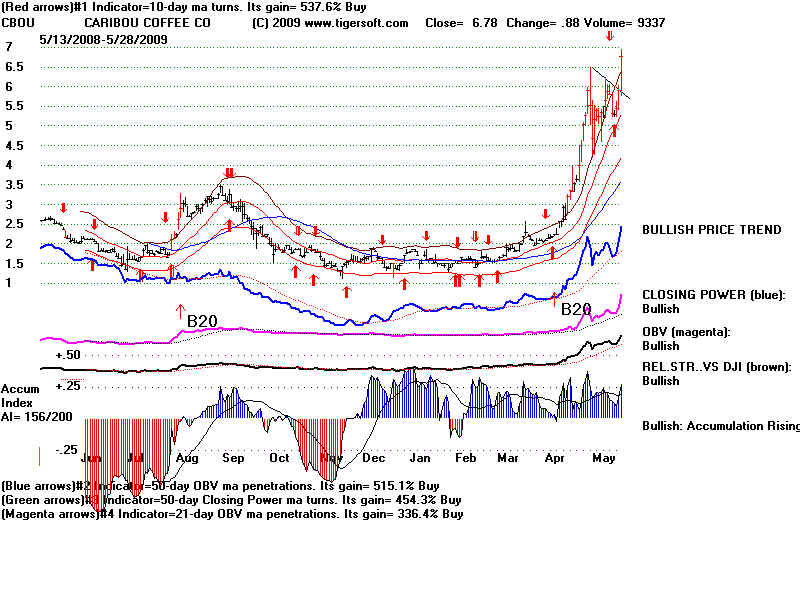

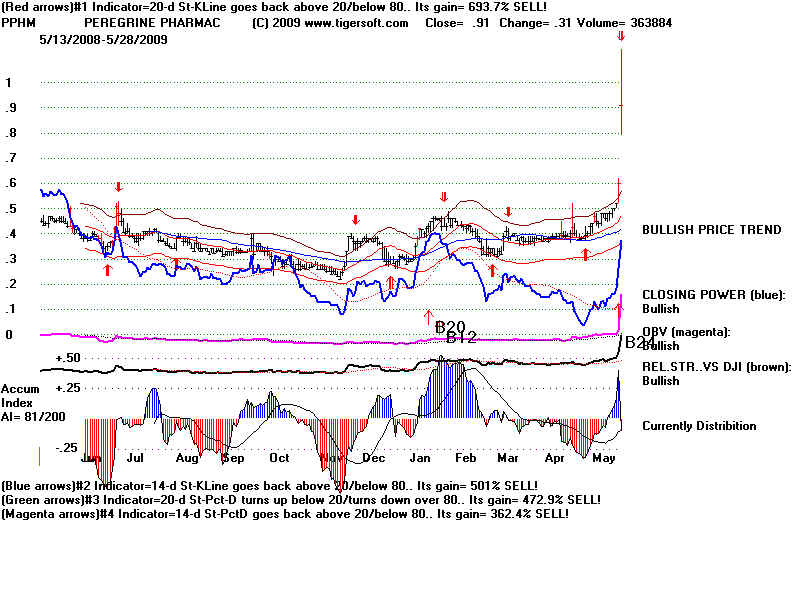

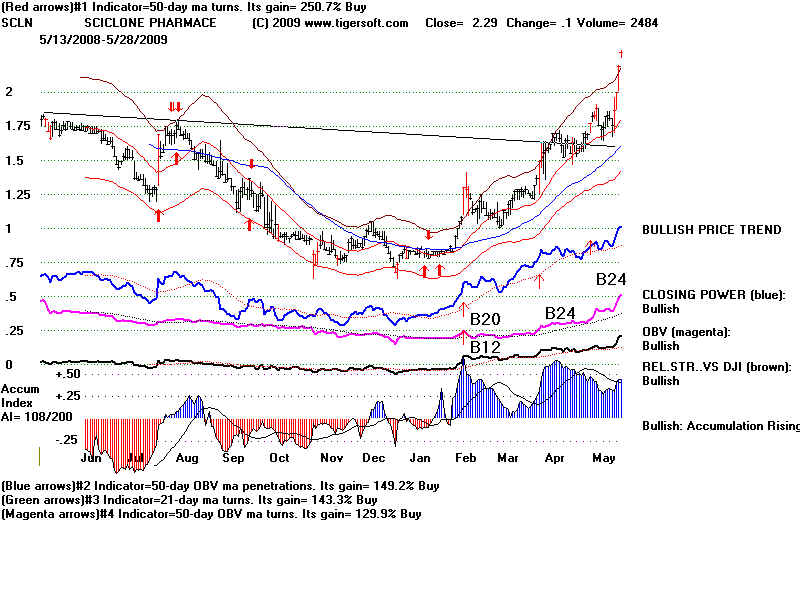

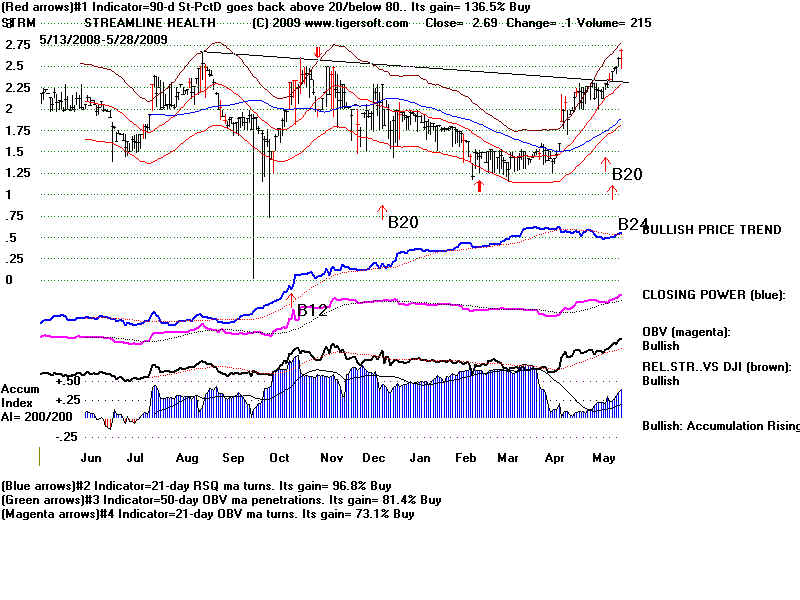

With low priced stocks, look for high accumulation bulges, strong closing powers and OBV

and

Relative Strength confirmed break outs on very high volume. A stock with a story

usually has

mor eupside potential. Check the story by searching the message boards of the stock

in question.

Generally, picking stocks like this work out well if we hold wuntil the stock's 50-day ma

is violated.

That is the main theme in my Explosive

Stocks book. But you have to diversify to be safe. There

are always unpleasant surprises, even for insiders, as when a Florida judge

suddenly says you must

turn over to

Spain all the gold you have recovered after years of research and underwater

exploration

from the wreck of a sunken 17th century Spanish gallion in internatinal waters.

Links - Explosive

Super Stocks now.

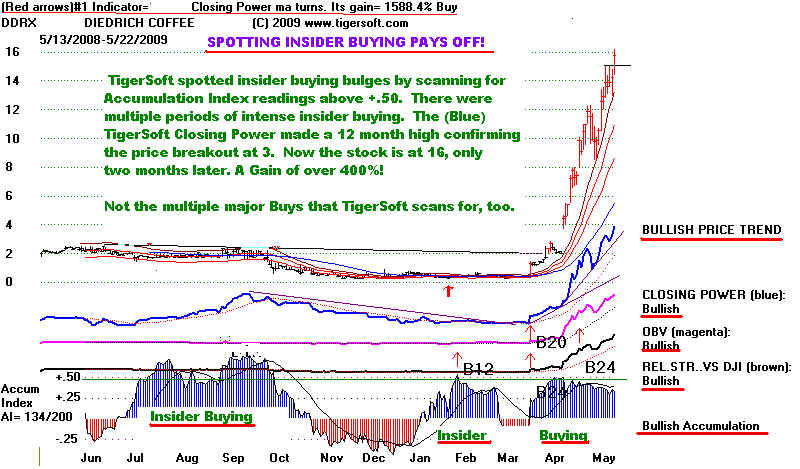

The importance of a strong Closing Power and bulging Accumulation can be seen in

many stocks making new highs today. Here are some examples: ARQL, ATRI, CLRT, DDRX (wow),

SHOR, SYMM

and VITA. By this reckoning, stocks whose

Closing Power is making new

12-month highs will soon be making 12-month price new highs. We can see

if this is true

by watching these NASDAQ-100 components.

Stocks

Price Now

12-month Price High

---------------------------------------------------------------------------------

AMZN

85.68

92.04

BIIB

53.43

73.45

FISV

44.68

54.68

GENZ

62.44

84.00

ORCL

20.34

34.62

People ask me if they should trade stocks, where the gains can be extraordinary,

or

major market ETFs. I think it's best to show trading skills and emotional

self-control

trading ETFs before one gets into stocks, where the volatility can be very challenging

and

where one should probably have 7 or 8 stocks at a time, for money management safety.

To

use Obama's favorite phrase, "that beong said" here are many key stock charts:

.

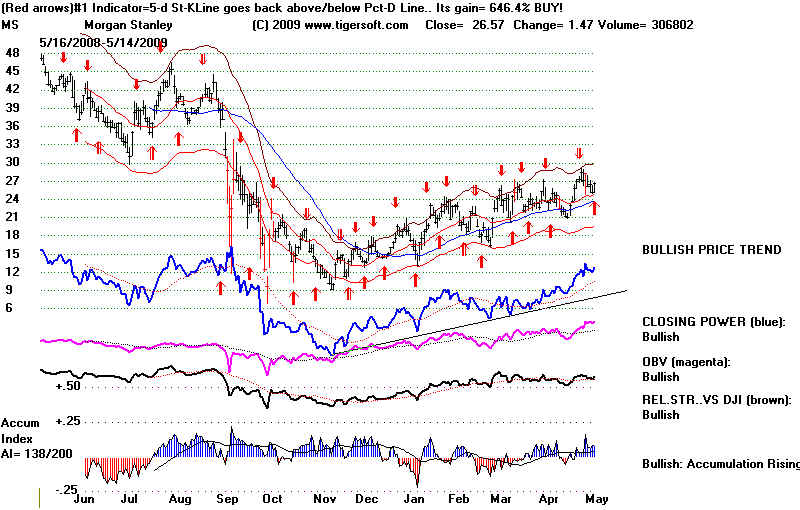

FINANCE STOCKS: GS, MS, V, MA

QQQQ - LEADING TECH STOCKS: AAPL, ADBE, QCOM, EBAY, RIMM

High Accumulation helps, too: EXPE and CTXS

GOLD, SILVER, USO, DOLLAR, 10-year Notes

and strong commodity - COCOA

SPY, DIA

=======================================================

6/3/2998

The DJI fell back from the 200-day ma resistance. But we still show the last

Peerless

signal to be a Buy. The Closing Power is still rising for all the key ETFs.

And, as important,

the NYSE A/D Line uptrend has not been violated. The weakening volume internals are

warnings

sufficient to adopt a wait and see approach, but not sufficient to sell.

The picture is mixed. Don't blame the messenger for this. Users of our

software will have to decide how they want to use all the main tools we emphasize.

What is important to see is this: The three best systems each work well in producing

Buys and Sells, even though they give somewhat different signals from time to time.

The point is that you can profitably Buy and Sell the major market ETFs using any

of these 4 tools and approaches:

1) The Peerless signals ( Peerless Signals ),

2) The Closing Power trend-breaks ( http://tigersoft.com/--1--/index.html

),

3) The NYSE A/D Line trend breaks,

4) Confirmed

Cross-overs of the 50-day ma. using the Accum Index.

If you are shell-shocked from last year's plunge, you could

apportion money in 3

parcels, using each system at this time. If you are not long, then wait to Buy. The

DJI has reached a point of resistance and volume still is too low to think that the market

will run away to the upside. You could also only take positions when all 3 systems

are

on Buys and wait for all systems to give Sells. That will be less profitable.

But it's

safer. The trend is our friend. Using confirmed cross-overs of the 50-day ma

works

very well over a year's time, though there can be whip-saws in the short-run. See

the

materials I have recently put on www.tigersoft.com

I try regularly to see if we can derive useful trading rules by

looking at the current

key

values and any statistics that stand out.and may prove to be salient when back-tested to

1928.

Tonight, I checked to see if the DJI's CCI indicator (Commodity Channel Index) falling

below

200 with comparable key values, negative Accumulation Index and negative OBV- Pct

but

positive breadth (P-Indicator) showed a pattern historically in what followed. Some

days

we

learn something useful. Today, the results are

ambivalent and inconclusive when

we use the data from 1928-1942 for study. The CCI's dropping

below 200 (oversold) is

not a

reliable Sell with key values like those shown today.

The key values we can generate easily for any day of data are a big part of how

Peerless was built and back-tested. The key indicators and today's key values

are

shown by putting a vertical line on a DJI chart. Here they are tonight:

LA/MA (DJI close divided by 21-day ma of daily closes)

1.027 (near upper band)

ROC (Annualized rate of change of the 21-day ma) .351 (moderate rise)

P-I (21-day ma of NYSE Advances/Declines) 221 (Moderately high)

IP21 (Current Accumulation Index) .008 (low compared to LA/MA)

V (21-day ma of Adj. Up Volume-Down Volume) -96 (bearish relative to LA/MA)

OBVPct -.018 (bearish relative to LA/MA)

We watch Gold,

Silver, Crude Oil and

the Dollar. A weakening Dollar puts pressure on

the Fed to raise

interest rates and brings back commodity inflation, something which

badly eats away

at consumer buying power. Watch the CLosing Power trends here.

They are still

rising for Gold, Silver and Crude Oil.

================================================================================

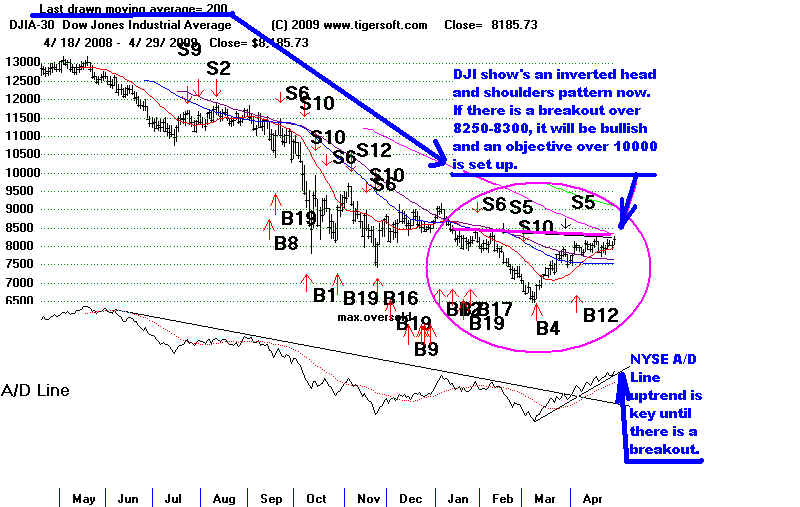

6/2/2009 The DJI has rallied and reached the twin resistance of

its inverted head and

shoulder

pattern's neckline and its 200-day ma. The financial stocks could bring the

DJI down

again. The weakest ones do look vulnerable: C, BAC amd JAM. Others

like GS and MS still have Closing

Power uptrends. The Advance-Decline Line for the

financial

stock is still in a weak uptrend. AXP. MA and V are neutral in that they show

conflicting internals after big rallies. .

Much more bullish are other sectors of the market, name the NASDAQ-100,

low

priced stocks, Chinese Stocks and foreign ETFs generally. The Tiger Index of these

groups shows much they are much stronger than the finance-stock laden DJI. Their

Advance-Decline Lines are in very steep uptrends. It would be difficult to stop so

much

upward momentum. See these charts below. And, of course, the DJI now has

two

stronger looking stocks, TRV and CSCO.

The biggest problem I can foresee comes from the possibility of a much weaker

Dollar than the Fed can tolerate. Extreme weakness would almost certainly cause

them to raise interest rates to attract foreing investors into Treasury instruments.

Chinese students are said to have laughed loudly and heartily when Geithner told them

that their country's investments in Treasuries were safe because the Obama administration

favored a strong Dollar.

TIGER INDEX OF NASDAQ-100 STOCKS

TIGER INDEX OF FOREIGN ETFS

TIGER INDEX OF CHINESE STOCKS

US DOLLAR IS BELOW $80.

FINANCE STOCKS AT FALLING 200-Day MA.

=======================================================

6/1/2009 Peerless Still on Bullish Buys.

The markets rose strongly today, despite the GM bankruptcy. The addition of

Travelers and Cisco to replace CitiGroup and General Motors in the DJI produces an

artificial and temporary surge in these stocks, as they are added to funds matching the

DJI-30.

The DJI has now reached its declining 200-day ma. That is usually resistance on the

first

tagging. Seasonality turns bearish after 3 more trading days. So, a pullback

would not be

surprising. But there is apt to be more strength first. The Closing Power

Lines for all the ETFs

are rising. So are the Opening Powers. That is a bullish short-term

combination, even when

volume is light, as now. I think it is reasonable to look for the DJI to reach 9000

on this move

and for the QQQQ to reach 38.

Many low priced priced stocks are enjoying a powerful advances. Breadth (NYSE

advances minus declines) is more than uptrending. It is uptrending in a way that is

unprecedented

The steadily very positive P-Indicator readings are much stronger than anything seen in

the

1930s. The economic woes of Main Street are not holding Wall Street back.

Bull

markets often start even when unemployment is very high.

|

Unemployment

Did Not Start Declining Significantly until Almost A Year after The Stock Market Turned up Sharply in August 1982. Expect More Bad Economics News But Don't Expect The Stock Market To Decline Much in It. Official Rate of Unemployment 1981-04-01 7.2

1981-05-01 7.5

1981-06-01 7.5

1981-07-01 7.2

1981-08-01 7.4

1981-09-01 7.6

1981-10-01 7.9

1981-11-01 8.3

1981-12-01 8.5

1982-01-01 8.6

1982-02-01 8.9

1982-03-01 9.0

1982-04-01 9.3

1982-05-01 9.4

1982-06-01 9.6

1982-07-01 9.8

1982-08-01 9.8 Stock Market Bottom and Powerful Rally

Fed Starts to lower interest rates.

7/20/1982 3rd Rate Cut 11.5% Bullish drop in Discount Rate after decline.

8/2/1982 11.00% Market explodes upwards

8/16/1982 10.5%

8/27/1982 10.0%

1982-09-01 10.1

1982-10-01 10.4

1982-11-01 10.8

1982-12-01 10.8 Peak

1983-01-01 10.4

1983-02-01 10.4

1983-03-01 10.3

1983-04-01 10.2

1983-05-01 10.1

1983-06-01 10.1

1983-07-01 9.4

1983-08-01 9.5

1983-09-01 9.2

1983-10-01 8.8

1983-11-01 8.5

1983-12-01 8.3

1984-01-01 8.0

(Source - http://research.stlouisfed.org/fred2/data/UNRATE.txt )

|

6/1/2009

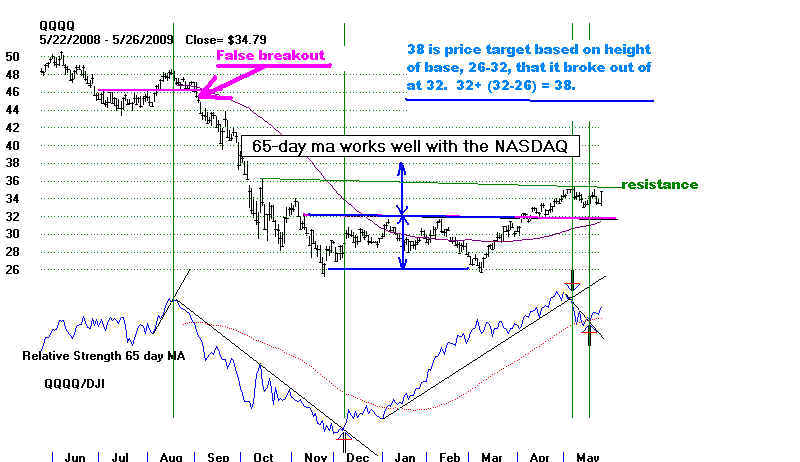

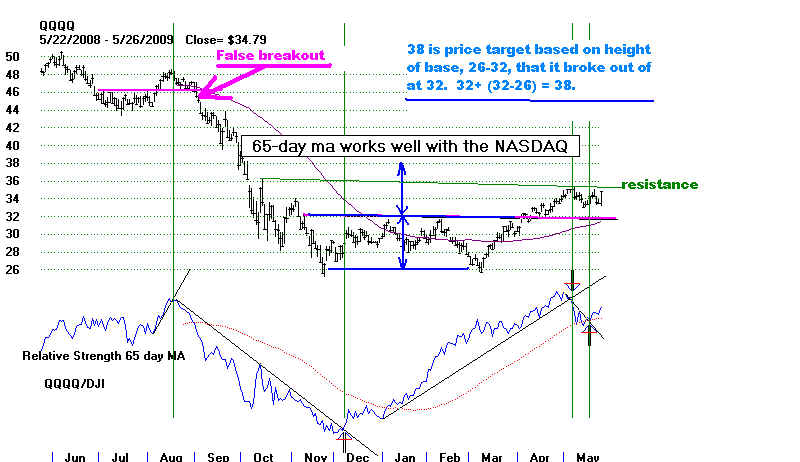

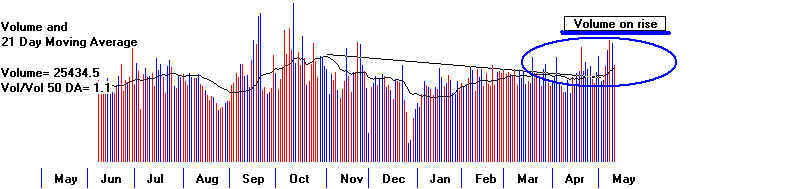

---------------------------------------------------- QQQQ

---------------------------------------------------------

38 is price target based on width of previous base, 26-32, and adding the

difference to the

point of breakout. The internal strength readings now offer agreement to the idea

that

the upside potential in the QQQQ is only modestly higher, under 10% higher.

Most important indicators:

Closing Power Percent: Still Bullish as new

price confirmed by CPP new high.

Relative Strength Quotient did not confirm

NH Still uptrending.

Volume did not confirm price breakout.

Opening and Closing Power - Both bullishly rising.

Accumulation Index - positive

but below its falling 21-day ma.

OBV (On Balance Volume) - uptrending but did

not confirm price breakout.

NH not confirmed by

Relative Strength Quotient

Travelers - TRV now in the

DJI-30

CISCO - CSCO now in the DJI-30

GOLDMAN SACHS - The most bullish of the big Wall Street firms still

shows a confirmed uptrend.

=====================================================================================

5/30/2009

Peerless is still on a Buy. The Dollar is

at important psychological support, 80.

Gold and especially

silver stocks are rising. The ETFs' Closing Powers are still uptrending. The

QQQQ's

relative strength is

bullish, suggesting speculators have confidence that prices will continue to rise.

The breadth has been

especially positive. See comments in previous hotlines. This is a

characteristic

of new markets.

The recent B18 never occurred using the data for the bleak 1930s and frequently

was seen two months

into a new bull market. We have been concerned about the low volume.

Friday the NYSE volume

rose quite auspiciously. The declining 200 day ma at 9000 seems a good

target for this move.

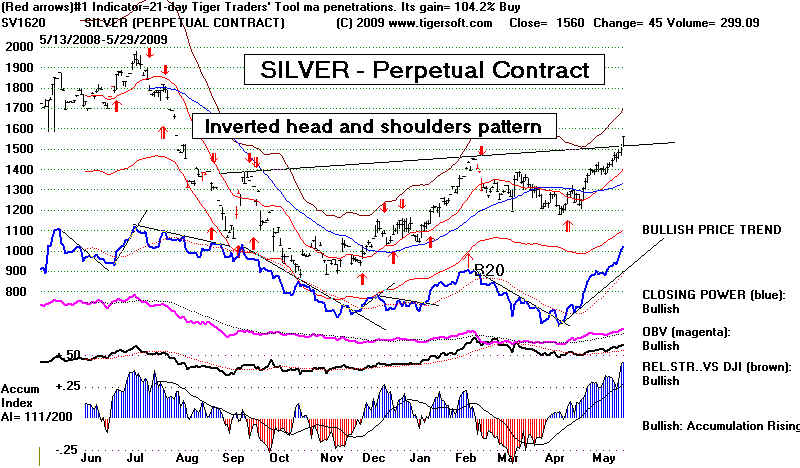

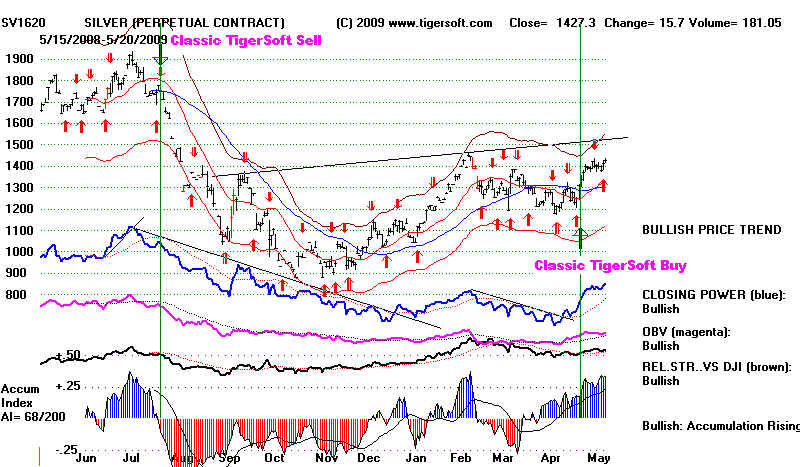

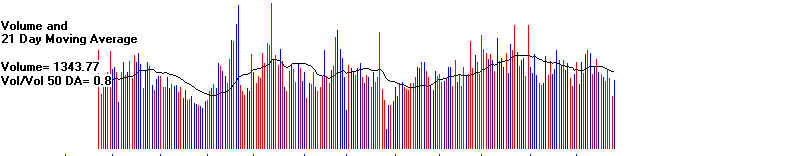

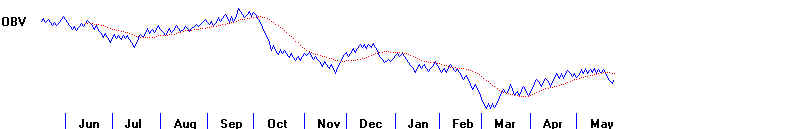

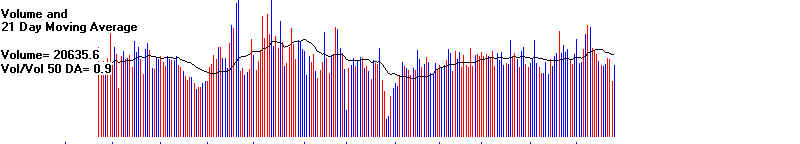

SILVER - PERPETUAL CONTRACT

COMPLETED INVERTED HEAD AND SHOULDERS PATTERN

QQQQ - STRONG CLOSING POWER

Price Objective 38-39

====================================================================================

5/28/2009 Today brought another bounce in

the narrow trading range that the DJI has been stuck

in for a month. Volume did not expand. That is what is needed. But the

day brought a Buy B18

from the Peerless system.

Almost 90% are profitable when reversed and the average gain

at the time of the next Peerless sell is more than 9%. What makes a B18 interesting

now is that

it often was followed by a strong new bull market: 1942-1944, 1949, 1958, 1985, 1995-1996

and

2003 and never occurred in the 1930s.

We need Closing Power breakouts to confirm any further advance by the QQQQ,

SPY, DIA, MDY or IWM.

Gold, Silver and Oil are benefiting from growing concerns that the Fed will

have to

print billions and billions of dollars, because it cannot find enough buyers of the

Treasury

instruments it wants to sell without raising interest rates.

At the bottom of this page are a number of lower priced stocks that are making new highs.

Low

priced stocks showing high accumulation and new Closing Power highs are making spectacular

advances. Is this because low-priced stocks have been beaten down for a long time

or does

it

have something to do with professionals not wanting to go short stocks ahead of the

SEC's

announcement in a few weeks about the new rules that will apply to shorting.

Goldman Sachs' chart is still point up sharply. Their control of

the Obama's decision-making

through

Geithner and Summers is not in jeopardy, hence we see rising financial stocks.

See

also http://www.tigersoftware.com/TigerBlogs/April-7-2009/index.html

======================================================================================

5/27/2009

There is still no

Peerless sell signal. The Buy B12 is the last major Peerless

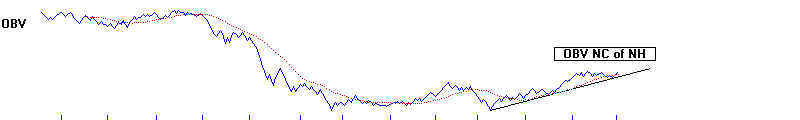

signal. But selling volume and big money distribution on strength are now

distinct problems. See how the OBV is falling for the DJI below. The

Accumulation

Index is now in red negative territory and below its 21-day mvg.avg. That the

Closing Powers are still rising gives us hope still that any decline from here will

be limited, as does the still rising NYSE A/D Line. 37 of the 43 Fidelity Select

Funds

are still up for the last month. The DJI is now 50 points below its 21-day ma.

With the P-Indicator a +313 now, a 2%-3% decline could easily bring a new

Peerless Buy signal. There are a number of NASDAQ low priced stocks that show

very high Accumulation and a rising Closing Power. These are the stocks we continue

to favor.

Could we have just seen the end of a bear market rally? 8-10 week bear market

rallies

were common between 1930 and 1933. We have to protect ourselves. Accordingly,

if the DJI were to fall below 7182, back more than 50% again from its highest close,

14164.53 in 2007, I would say that that would make us switch to the extreme bearish

mode.

We would have to prepare for the worse. This would have saved someone from

all manner of trouble in the next two years from 1930 to 1933. In 1930, when

the DJI

fell down more than 50% from its highest close in September 1929 (381.20), the bottom

fell out and prices plunged from 190 to 42.

That the DJI ran up twice as much from August 1982 to its top in October 2007

as the DJI did in the 25 years up to the September 1929 peak is quite worrisome

when you think about and wonder if Obama and his Wall Street minions really know

what to do now to avoid what happened in the 1930s.

But is a big plunge really about to start? We can learn a lot about bigger and

deeper bear

markets by studying the 1930s. Here is the chart for 1930. See how

Peerless

would have told you when to get out in the 2 month rally in the Summer. See the

Sell S9s and S12s.

A customer and colleague from Connecticut has just sent me breadth data for the period

I was missing, from 1926 to 1943. At his request, I can't release the data itself.

But this

data allow Peerless signals that use breadth to be seen for the first time in the charts

for

these years.

The really key lessons from my initial studying these charts are:

1) that there are always breadth divergences at the tops in the 1930s' bear

market rallies.

2) that there are always Sell S9s and or S12s.

Since breadth divergences and Sell S9s and S12s are not evident yet here, we should gather

some comfort. In addition, bearish head and shoulders patterns that are very

apparent

in these earlier formations are not evident now. On the other hand, while Buy B12s,

like the one we saw a month ago, occurred soon after the bottoms at key bottoms in

June 1932, March 1933 and June 1938, big surges in trading volume were also present.

There has been no such surge here. That has to cause concern now.

There is another difference

worth noting. The DJI was not able to rise above its 100-day

ma after mid 1930 until June 1932, except briefly in February 1931. When it exceeded that

ma after February in 1932, 1933 and 1938, the market was in the process then

of more

than doubling. By getting past 8050, the DJI surpassed the 100-day ma this April.

OBV Is Clearly Down-Trending

=========================================================================

5/26/2009 The DJI jumped up from its 21-day ma support today. It should

challenge its

8600 flat resistance. Volume did pick up on the rally. But it is still very

low,

suggesting to me the rally is alive courtesy of program trading banks flush with

TARP money. Shorts are unsure of themselves because the SEC is expected

to make their trading more difficult in a few weeks. The trend is still up.

The

NYSE Advance-Decline Line and DIA, QQQQ and SPY Closing Power Lines

turned up smartly today and are declining. Flat topped resistance like we see

for the DJI, DIA, NASDAQ and QQQQ are more likely NOT to be tops. I

believe a move to 9000 is still a possibility in the next few weeks. That the

DJI is above its 50-day ma and breadth has been very strong makes it more likely

that negative non-confirmations by the Accumulation Index will not bring a

big retreat. The P-Indicator needs to drop closer to zero to get a sell signal on

a new high. Presently, the P-Indicator is +319, while we do have negative readings

from the Accumulation Index (-.034), V-Indicator (-34) and the ObvPct (-.118).

Again today, there more than 2400 advancing stocks on the NYSE. This is the

15th such very good breadth day in 10 weeks. This has no precedent. Smaller

companies, technology stocks and blue chips are all rising. Watch to see

if the

NASDAQ can close above 1790, the QQQQ above 35.40, the SPY past 93.05,

MDY past 107 and IWM above 51.40. A valid breakout is more likely to see

breakouts in all these. Watch volume to. It should increase for the rally to

continue.

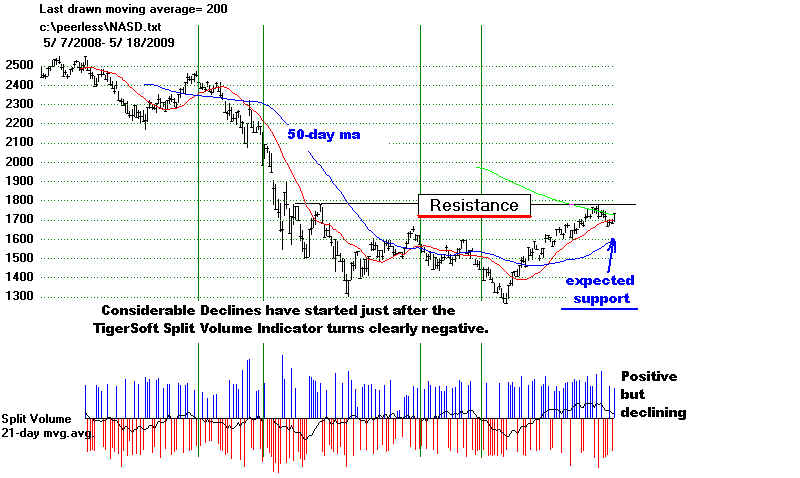

========== NASDAQ ===============

1790-1800 is flat resistance. Flat resistance is easier to ascertain. So, it is less

likely to be used by professionals and is more likely to be exceeded. On the

other hand, volume is low. Without more volume, a breakout past 1800 may well

be a trap for bears who are short.

QQQQ's Closing Power is trending up. Trading Closing Power trends

has been profitable this past year. Taking positions at the openings

and allowing for commissions and slippage, the gain is +117%.

========== QQQQ

===============

The QQQQ faces flat resistance at 35.5-36. A breakout there should

let an advance reach the 38-38.5 target obtained by using the size of the

base pattern it broke out of. The move may prove false, as did the August

breakout in 2008.

=============================================================================

5/24/2009

More Weakness Will Likely Mean A Decline to The Lower Band and 8000

If Volume Picks up on The Decline, A Deeper Decline Would Become Probable.

The Buy B12 still stands unreversed unless we change the Peerless rules. Presently

a Sell S12 can only appear when the P-Indicator has a much lower, closer to negative,

value

than it had last week when the DJI tagged the upper 3.5% band with negative readings from

the Accumulation Index and On-Balance-Volume Percent. A further review I did this

weekend

of allowing an S12 when the P-Indicator is quite positive but there is a negative

non-confirmation of

of an intra-day DJI rally to the upper band by the Accumulation Index is still

inconclusive. If we

also require the DJI to close well off the highs to get an S12, not more than 1.7% over

the 21-day ma,

that would, indeed, have given proper Sell S12s in January and last week. But these

are the only

two cases since 1942 and that is not enough for our standards.

What else can we read from the market's behavior?

The DJI has fallen back to the point of breakout in its inverted head and shoulders

pattern. If the breakout is valid, a subsequent decline should not go any

lower. But a decline

any lower would suggest a false breakout by the DJI. That would be bearish. It

would also

mean a closing below the flat 21-day ma. That would be bearish. In addition,

more weakness

this coming week would likely break the A/D Line uptrend and make the Closing Powers's

secondary uptrends be violated. Combined with the bearish June seasonality in years

after

a Presidential election, I would say that any more weakness from here is likely to

be compounding.

Certainly, that would likely bring a drop to the DJI's 50-day ma, which now crosses at

8000,

about where the lower 3.5% band is.

A decline below that could bring a retest of 6500. At this

stage, the internals of the market look too strong for that. But we will have to

watch volume.

If it starts to expand on a drop below 8000, it will look very much like what happened in

February.

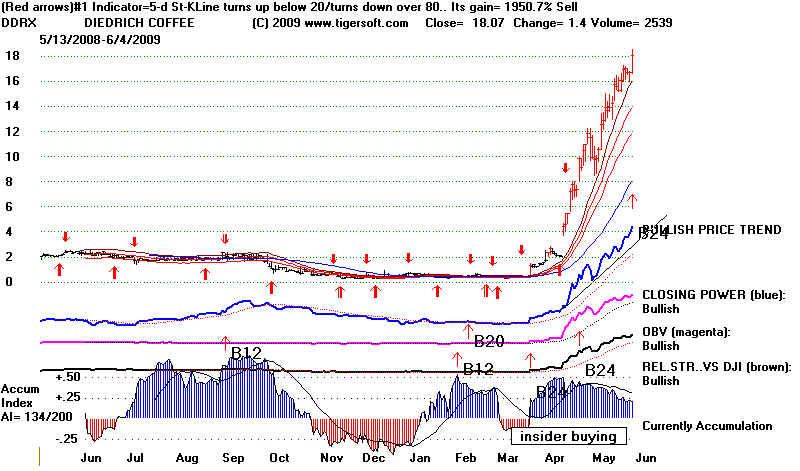

Too Much of A Good Thing, Too Quickly? Imagine being short this!

There have been some very dramatic and exaggerated moves in low

priced stocks. Many

seasoned traders would suggest this shows "sloppy trading", where too much money

is going

into too few stocks. Look at the chart of DDRX above. (If their coffee is as

potent as their stock,

get a swig before the next big sales meeting!)

Last week's rise in gold is also a warning. Too often, it signifies a weakening

Dollar. That in

turn, usually means higher interest rates, though Bernanke seems be resisting that.

Some say

he is using the printing press to buy new Treasury offerings, since China is not inclined

to buy

them as it once did. That, in turn, is boosting the price for imported oil. These

are bearish forces.

So will be the national protests against the Fed and Obama's multi-trillion dollar bailout

for banks

that are planned for June 10th. See - http://www.anewwayforward.org/doit.php

Some believe

that all currencies are now being debased. If true, that would help the Dollar, if

it is true. I note

late tonight that Gold has been hit by an overnight wave of selling.

Gold is above its rising 50-day

ma. So, this may make for a good point to buy in.

There have been five straight down

days. A recovery might be expected, except that

none appeared on Friday, when it should have started if pre-Memorial Day trading had been

typical.

Of greatest concern, was the low volume on the rally. That makes us suspect that too

much of the recent rally's buying was artificially created by the trading desks of banks,

such as Goldman Sachs, using TARP money to get their stocks up so that they

could get

investors to pay top dollar for their new shares' offerings.

Accordingly, we have reduced the number of stocks we are long on our hotline, but have not

recommended shorting

the major market ETFs.

QQQQ SPY DIA

Dollar Gold Silver Oil

Banks: GS MS V MA JPM BAC WFC

Technology IBM AAPL GOOG RIMM QCOM ADBE AMZN

=====================================================================================

5/21/2009

DJI -1.54% NASDAQ -1.89%

Another Rally Seems More Likely Than Not.

The NYSE A/D Line's secondary uptrendline is still intact. Breadth has been superb.

36 of

the 42 Fidelity Sector funds are up for the last month. The taste of fast profits is

in the mouths

of a number of early bulls. Look for them to add to positions on weakness. The

Closing Powers'

moving averages are still rising. And the rising 50-day should be expected to act as

good support.

Peerless still shows the last signal to be a Buy B12. A market recovery the day

before Memoral

Day would be of no surprise. There is a gap in prices up to 8400 that looks like it

should be

closed. I would think the high priced DJI stocks might bounce tomorrow.

The top highest

priced DJI stocks make up 35% of the DJIA average. IBM has a CLosing Power that is

sitting on its uptrend and could bounce. XOM is at its rising 50-day ma. With

oil prices still

uptrending at this time of year, CVX could also rebound, though it is below its 50-day ma.

Watch MMM and JNJ. Their CLosing Powers have reached their rising 21-day ma and

their

Accumulation indexes are positive. Next week, if the market history since 1965 is a

guide,

has a 61% chance of a rally. So, the Buy B12 may yet bring another rally from the

8200-8300

support. But, as you can see, the internals are all weakening and the flagrantly

negative

non-comfirmation of yesterday's rally was certainly a big caution, as I showed last

night.

In the back of all of our minds, I think, is a keen sense that it will take years to

repair the damage

done by unregulated banking excesses. It seems each new generation must learn the

mistakes

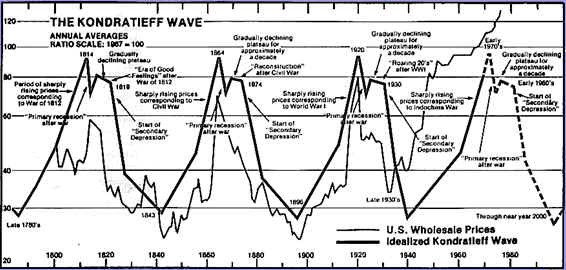

that previous generations learned the hard way. That is the message I derive when

looking

at the famous Kondratieff Wave. A retest of 6500 in the absence of a "B"

bottom is certainly

a reasonable expectation. Gold's rise is often a bearish sign, too. But,

first, let's see if there

isn't another rally into early June, as history suggests.

http://www.angelfire.com/or/truthfinder/index22.html

The Weakness in Bank Stocks May Get A Lot Worse

They have pulled back to their price-uptrendline. This is a high inflection

point.

I find it curious that the Fed would tell the world that its economic

projections for

2009

were too optimistic. Are they trying to talk down the stock market? If they

can

rekindle fear, investors will they may think, again buy Treasury notes and thus hold

up

the Dollar. And as a bureaucracy, they obtain have more power in bad economic times.

The Dollar's weakness is just starting, if the Gold Bugs are correct about fears of

hyper-inflation stemming from the Fed's extra-easy money policy. A much

weaker Dollar

could

mean a number of bad things, from higher energy prices to the disappearance of

consumer buying power. It would certainly put pressure on the FEDs to raise interest

rates

to

keep foreign banks from starting a run on the Dollar. That would choke off the

recovery

and

give even fewer incentives for banks to make loans again. Compounding this bleak

outlook, the Fed is being asked by Geithner and Obama to take on more and more

powers in the area of supervising banks getting TARP money and protecting shareholders

from

fraud, something which the SEC has failed miserably in doing. I predict that Obama

and

Geithner are unintentionally inviting much closer scrutiny of all the Fed's sub rosa

operations.

Ron

Paul sees a chance to open the eyes of more and more people to the dangers of giving

http://www.youtube.com/watch?v=7PC9fkLMZ...

http://www.youtube.com/watch?v=bW4YZ6R53

even

so much power to an agency which already essentially operates in secret with no

Congressional

control. A debate about the FED's powers and contempt for transparency is long

over-due.

It

will worry central bankers and Wall Street. That may be the next act of the drama

about

bailouts that may emerge this Summer, as Geithner insists any TARP money paid back, he

can immediately loan out again to banks without new Congressional

authorization. Nothing

good

in the short run can come from having light shine on Wall Street's dark side.

Gold Silver Crude Oil

Financials GS, WFC, JPM BAC

Technology Stocks: IBM. CSCO, AAPL, QCOM, GOOG, RIMM

=======================================================

5/20/2009 Buy B12. Should Today Have Given A New

Sell S12?

The DJI hit the upper band today. Why is there no Sell S12 with the

Accumulative negative?

The Accumulation

Index has dropped to -.038. The answer is that Peerless back-testing has

shown me that we

must also factor in breadth, NYSE advances minus declines. But what if we create

a new Sell S12

variation based on daily statistics like today's? That would mean creating an Sell

S12

variation based

on:

1) the DJI closing 1.6% or more over the 21-day ma

2) the DJI's high being 3.8% or more over the 21-day ma

3) the Accumulation Index being -.038 or lower.

4) the On-Balnace-Volume Pct. being =.035 or lower

Here are all the cases after 1942 when the daily key values

met this criteria:

Date DJIA

DJI Outcome

1.

12/7/1956 494.8

Fell to 470 2/5/57

2.

5/22/1961 702.4

Fell to 680 (3%) and then rallied to 735 and fell sharply the next

year

3.

10/12/1978 896.4 Fell 12.2% to next Buy. Also an S9

(8/18/1982 829.3 Rallied strongly. This can be eliminated by having B12 take-off

over-ride this.)

4.

12/7/1982 1056.94 Fell to lower band and Peerless buy.

5.

12/28/1982 1058.87 Rose

to 1092 and then fell

to lower band at 1030.17 and B9.

6. 4/8/1999

10197.69 Rose to 11107.19 on 5/13/1000

7. 12/7/1999 11106.65

Rose to 11722.98 on 1/14/2000 and then fell below lower

band. B17 10973.

8.

2/27/2002 10127.58 Rose

to 10632.35 and then started a bear market.

9.

12/5/2000 10898.72 Fell

to lower band at 10200. No Buy there. Next Buy 3/23/01 9504

10.

1/5/2009 8952.89 Fell to lower band 8448.56 and next Buy. Kept falling.

11.

5/20/2009 8422.04

In 4 or 5 of the 10 cases (We can leave out the case of 8/18/92 when

there was a high volume B12 just

before this

case.), the DJI fell immediately to at least the lower band. But in four cases it

kept

rising, by more

than 4%. This is not conclusive enough to use without more study. It does

suggest that

we must watch now

for more evidence that this will be one of the cases where there DJI falls to the lower

band.

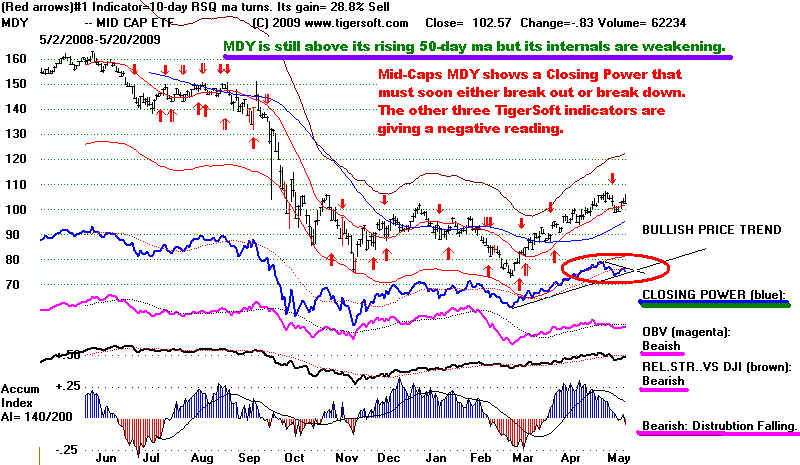

The market's internals are weakening. The Closing Powers for the DIA,

QQQQ, SPY, IWM and

MDY have now

dropped below their rising 21-day ma. Still. they cannot yet be said to be declining

until they

zig-zag to new lows. Even though that would be bearish, the rising 50-day ma would

limit

the resulting

decline, as discussed earlier.

The most bullish aspect of the current technicals remains in force. The NYSE A/D Line is

in a pronounced

and steep up-trend. The P-Indicator stands at a robust +406. Even after

today's

sell-off, there

were 123 more up than down on the NYSE. It seems clear that most stocks still look

very cheap

compared to last Summer. But "V" bottoms are rare. A 10% decline

followed by a

a high volume

recovery to new highs would probably put the market on more solid grounds. And

the nagging fear

remains that this is a program-traded rally made possible by taxpayer TARP money.

Finance stocks

are losing steam. Goldman Sachs, their leader, is about to show a broken Closing

Power uptrend.

The FED lowered expectations for a recovery in 2009. That will make it harder

for the public to

be induced to buy stocks away from the trading desks of Goldman Sachs on additonal

strength.

5/20/2009

The Dollar is breaking down and weakening. Silver has given

a classic Buy by making

a confirmed move above its 50-day ma with very positive Accumution. This is a

pattern

that produces very good advances in Silver. Note that the ETF for Silver. SLV, is

not as

good for watching internals.

Most DJI Stocks are giving off bearish short-term

warnings.

AXP - classic bearish head and shoulders

pattern.

Boeing - strong Accumulation, but at

resistance.

CitGroup - Closing Power is making new

lows.

Chevron drops fall below 50-day ma is

confirmed.

DIA - Closing Power may be topping out.

Key difference from earler CP tops: it is above its 50-day ma

DIS Closing Power uptrendline is being

tested.

Home Depot gives sell by confirmed falling

below its 50-day ma. But the 50-day ma is rising.

HPQ - shows emerging head and shoulders

price top and Closing Power is at its uptrendline.

IBM's Accumulation Index turned negative.

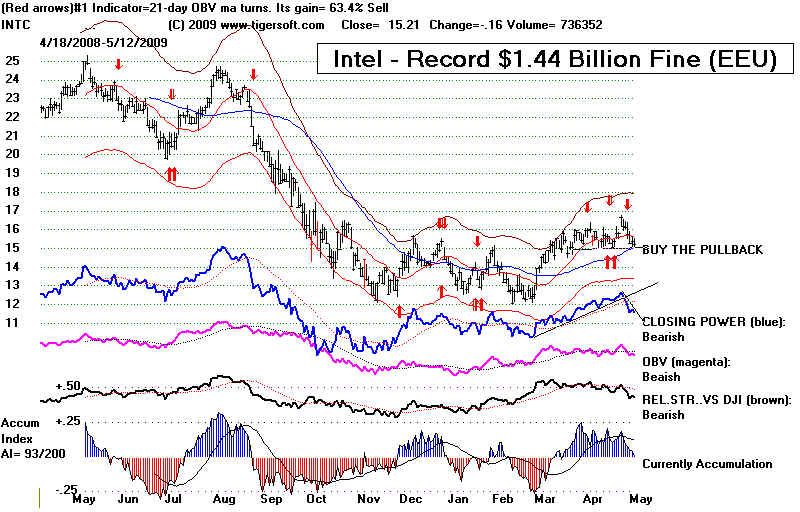

Intel is at apex of right shoulder in

head and shoulders pattern with weak AI being negative.

JPMorgan's Closing Power shows a

completed head and shoulders pattern.

KO shows a classic Red Stochastic Sell.

MSFT gives a Sell at flat resistance

with Accumulation Index negative.

AT&T gives classic bearish signs.

====================================================================================

519/2009 Buy B12 Still Operative. 9000 Remains

Our Target.

But The Accumulation Index Shows More and More Distribution.

If this were an extreme bear market rally, we would look for a top right about

now, as a 10 week

rally in these conditions is the average. But because the DJI has gotten back above

the earlier 40%

down-from-the-12-month high level at 7780, we think this is unlikely. That the

breadth has been

so good seems bullish enough to cancel the bearishness of the apparently low volume on the

rally.

The US Dollar may be turning down. That is inflationary. For the time being,

deflation and depression

are bigger concerns. But if the Dollar should decline sharply, that would bring the

FED to raise

interest rates and we would be locked into a world of "STOP-GO" Fed policies and

a return to

stagflation and markets like those between 1966 and 1982. Obama's expansion of the

war in

Afghanistan seems comparable to Nixon's expanding the war to Laos and Cambodia from

Viet Nam.

Peace would be better for the markets and the Dollar. General Dynamics made a

confirmed

recovery high today. The military industrual complex is safe with Obama!

US Dollar Looks "Toppy"

Watch the Secondary Closing Power

Uptrends

The last Peerless signal remains a mahor Buy B12. 8520 did act as resistance

today.

Volume is too low to eat up the overhead supply of stock quickly. Breadth was

positive despite

the late sell-off. The secondary Closing Power uptrends are still intact. A

breaking of them should

bring another retreat to 8250. The NASDAQ and NASDAQ-100 are now under-performing

the DJI. This is not necessarily immediately bearish. But it points to the

deterioration

we are seeing in the internal strength indicators, especially the Accumulation Index.

Watch how the NASDAQ behaves next. A move above 1800 would be very bullish,

especially if there is a rise in volume. On the other hand, greater weakness by the

NASDAQ

vis-a-vis the DJI will make the NASDAQ's RELDJI go more negative as it did last Summer.

I also take it as a bullish sign when the QQQQ outperforms the DJI, like it did in 2003.

This

shows that buyers want more speculative technology stocks. This shows

confidence.

NASDAQ

QQQQ - 2008-2009

Our concern for a month has been

that the rally has been artificial, in the sense

that it has pushed too much by banks bidding up their own or each others' shares with TARP

money

in order to make them attractive at higher prices for new stock offerings. That

notion was supported

today as Goldman Sachs got around to recommending Bank of America just as the latter was

raising

$13.47 billion by selling 1.26 billion shares at 10.77. Wells Fargo, Goldman and

Morgan

Stanley have each raised billions in private offerings.

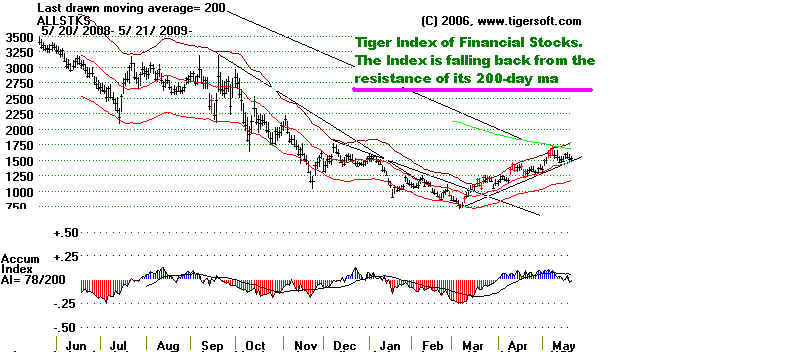

Tiger Index of Financials is still in uptrend. This group led the market

down. We have to

watch it for another down-ward leg. Its trend is still up, but you can see that the

Accumulation

Index is weakening.

Usually bigger declines start only after there are

important signs of internal strength

weakness on a rally to a high near the upper 3.5% band. We did reach that today.

Breadth and

the P-Indicator are still strong. But the Accumulation Index is bearishly only

slightly positive.

In normal markets, this would probably bring a retreat, at least, to the 21-day ma.

But volatility

since last October has made the "normal" 3.5% upper band too low. A 5%-7%

band has acted as

a better top bracket since then. The DJI's closing at its lows on high volume makes

the

Accumulation Index drop. A bigger move down here might also be expected to bring a

day or

two of "churning" near the upper band with little change in price, day to day.

Because the last Peerless signal is a Buy and the secondary CLosing Power uptrendlines

are still intact, I would stick with the upward momentum for now and see if the DJI is

able to make to 9000, where I reckon the strongest resistance is.

=====================================================================================

5/18/2009 DJI

+2.85% Buy B12 Still Operative. 9000 Seems A Good Target.

The DJI rebounded from the support of its rising 21-day ma

and the point of breakout

in the inverted head and shoulders pattern. The rally broke the steep downtrends of

the Closing

Power for the DIA, QQQQ and the SPY. Breadth was superb. There were 7 times more up

than

down on the NYSE. Up volume was 14 times down volume. This continues the

exceptionally good

breadth that is the basis of the rally. This means that nearly all stocks are recovering.

The best

action is on the NASDAQ and among lower priced stocks. 23

stocks made 12-month highs today

on

the NASDAQ.. See some of them at the bottom of this page. Today's

rally would seem to go

a long ways to remove our concerns about the broken NYSE A/D Line uptrend and the broken

Closing Power uptrend.

The DJIA is challenging the 8510 peak reached four trading days ago. I expect that

to be

exceeded quickly, if not tomorrow. Backing and filling, but moving higher, is one of

the characteristics of a market moving up through previous trading levels on relatively

low volume. 9000 seems a good target. You can see that the falling 200-day ma

crosses there

and there are peaks in this area from December 2008 and January 2009.

Volume remains low. Look at the NASDAQ below or the volume

for any of

the general market ETFs. This suggests that the rally may well be driven by banks

playing with

TARP money in an effort to raise capital to pay back what thy owe the government.

Nothing

in the TARP bailout required banks to make loans and not speculate with the taxpayers'

money!

The real intent of the money was never to free the frozen credit markets. It was to

save the

biggest banks, because they were a central part of the US elite's power . We can see

from the flat

Opening Power for the DIA for 6 weeks that the public (which pushes up openings when it is

bullish)

is not a positive factor in the market. Before the rally ends, I would expect the

public to have to

be brought back into the market as buyers to take away the stock bought at the trading

desks

of the biggest banks, like Goldman Sachs. Clearly, they want to raise

investment capital.

Typically underwriters for a secondary offering drive up prices and stabalize the market.

Prices are in the run-up phase now, I think.

Clearly the Accumulation Index is weakening. But the Split-Volume for the DJIA

is far away from turning negative. I would think the top on this move will occur

when the

DJIA makes a recovery high with the Accumulation Index and Split Volume much closer to

zero.

Peerless should then give a timely sell signal. Of course, a rupturing of the 50-day

ma would

change this still bullish outlook. For now that key ma is rising nicely and not

being threatened.

.. .

DIA - DJIA ETF

NASDAQ - 1800 Target.

Finance Stocks C, BAC, JPM, GS

Technology IBM

GOOG AAPL RIMM ADBE QCOM

ETFs QQQQ, IWM, SPY, DIA

Dollar Oil Gold-GLD Silver-SLV

Mexico - EWW

5/15/2009 Operative Peerless Buy B12 versus A/D Line and Closing Power

Uptrend Breaks

The Closing Powers are downtrending. Most stocks are likely to keep falling

back until

the CP downtrends, like that shown below forIWM, are breached to the upside. Similarly,

the

break in the well-tested NYSE A/D Line uptrend is reliably bearish. A big

decline and

a re-test of 6500 are not likely and not expected. Peerless still shows a Buy B12 as the

last

major signal. And the internals of the DJI's action offer hope that if the DJI does

violate the

8250-8300 support from the upside-penetrated neckline in the DJI's inverted head and

shoulders

pattern, the decline will not go below 7800-8000. The higher number is where the

lower band is.

7750-7800 was effective support a month ago. The rising 50-day ma in most stocks and

ETFs

should find a lot of buyers who are waiting for a pullback to buy. Examination

of many stocks

this weekend finds most are in simply pulling back after a big gain. Good short

sales, as we judge

them, are hard to find. Clearly lowprice stocks showing insider buying and

accumulation have

been favored since the market turned up. That seems still true.

Russell 2000 ETF

Key Charts:

NASDAQ - AI<its MA

QQQQ - falling Closing

Power. AI<its MA

SPY - falling Closing Power.

AI<its MA

MDY - falling Closing Power.

AI<its MA

IWM - falling Closing Power.

AI<its MA

Finance: BAC, C, JPM GS WFC

Key Tech Stocks: IBM APPL RIMM GOOG QCOM

Oil Gold Silver Dollar

5/14/2009

The DJI rebounded 46.4 from the 8300 point-of-Breakout and now support. It

is also

just above the

support of its rising 21-day ma. Instead of breaking down today after yesterday's

A/D Line

trend-break, the market turned up from support with the best gains going to the NASDAQ.

Peerless users

will appreciate that the Buy B12 has not yet been reversed with a Peerless sell signal.

But, I remain

cautious because the Closing Power uptrends were violated. These Closing Power

downtrends need

to reverse course to confirm the extant Buy B12. Also a plus, the QQQQ has

not yet closed

more than 2% below its rising 21-day ma. So, its behavior is still consistent with

the

start of a bull

market, such as in 2003. See how in

2003 the weakness in the relative strength of the

QQQQ versus the DJIA turned briefly

"bearish". (The Tiger program rates Relative Strength

"bearish" when the RSQ:QQQQ/DJIA Line is, as now and briefly in early 2003 below

its falling

21-day ma.

The bullish solution to this situation will be for the RSQ to go back above its own

21-day ma and for

its CLosing Power to rise back above its down-trend and start zig-zagging higher.

Cautious

bullishness is still our stance. A DJI close below 8200, breaking support, would then

mean a decline to

the lower band at about 8000. Since the P-Indicator is still quite positive, a

new Peerless Buy

signal there would seem likely. What bulls will not want to see is a much deeper

decline than

8000, as that would suggest that downside volatility is again expanding.

A Bear's Opinion

Resistance is

growing to Geithner's TARP-II. Here

are the opinions of one of those getting TARP

funds

from Geithner. Mark Patterson, chairman of MatlinPatterson Advisers, one of

those supposed

to be behind the

joint public-private rescue says: "It’s a sham. The banks are insolvent.

The US

government is

trying to sedate the public because they are down to the last $100bn (£66bn) of the

$700bn TARP

funds. They think they’re doing this for the greater good of society...“The US

government has

thrown 29pc of GDP at this crisis compared to 8pc in the early 1930s. The Fed’s

balance sheet has

risen from $900bn to $2.7 trillion to bail out the system. America has to do it

because the only

way out is to debase the currency, but that is going to lead to some very high

inflation three

years down the road....We’re going to see a

catastrophic increase in the number

of LBO’s

(leveraged buyouts) going into default because they’re knee-deep in debt and no

solution

exists since they

can’t refinance”.

Goldman Sachs and Morgan Stanley Keep Rising - The Rally Is Still Alive.

Key Charts:

NASDAQ - AI<its MA

QQQQ - falling Closing

Power. AI<its MA

SPY - falling Closing Power.

AI<its MA

MDY - falling Closing Power.

AI<its MA

IWM - falling Closing Power.

AI<its MA

Finance: BAC, C, JPM

Key DJIA Stocks: IBM, MMM, BA, UTX

5/13/2009

The NYSE A/D Line Uptrend Was Violated Today.

The DJI retreated today to the point of breakout, 8250-8300. where the neckline in an

inverted head and shoulders pattern had been reckoned. That "should" act

as support.

If it does not, a bearish "false" breakout is set up. The rising 21-day ma has

almost been

reached. Normally we would also expected this to act as support.

Similarly, the QQQQ

is retreating back to its base-pattern's breakout point at 32. It closed at 33.02,

so there is

more leeway there. These may levels may act as support, but today's break in

the NYSE

uptrendline and the breaks in the Closing Power uptrends are clearly bearish. Safety

requires doing some selling, even though there may still be a recovery.

Today the NYSE Clearly violated its uptrendline. In the original Peerless system,

first

published and sold in 1981, this would have been treated as a Sell S6. The NYSE A/D

Line uptrend is well tested and lasts the minimum of 4 weeks, showing there is something

to be reversed. These signals were left out of the automatic Peerless system because

of the difficulty in programming what is an acceptable trendline. But the concept is

still

valid and worthy of back-testing. Valid A/D Line trend-breaks tend to come in sets,

where they work very well for 6 months or a year at a time, each one. That has

certainly

been true here. Look atthe success of such a simple system here based on the these

A/D Line trend-breaks. These A/D trend-breaks would have gained +42% over the

past year. (The regular Peerless reversing signals would have gained 89%.).

The operative Peerless signal still remains a Buy B12. But how important is

an A/D

Line uptrend-break when a Buy B12 operates? I have earlier said that if the DJI

cannot

achieve a clear price breakout above its bottoming pattern's resistance, such a break

usually brings a decline to at least the lower band and sometimes a re-test of the

old lows. Volume is needed to confirm a price breakout. Volume has been

distinctly

missing on the advance above 8300. Moreover, the January Buy B12 failed (partly

because

the Accumulation Index was only barely positive when this signal took place) without there

being such a price breakout. The A/D Line uptrend was soon broken. The DJI

then fell to 6500.

We do not want to be in that position again.

I am looking back at the market history of the first A/D Line uptrend breakdowns following

a Buy B12. The conclusion I have tentatively reached looking at all the cases

between 1942

and 2009 is that such breaks usually bring a decline to the lower band and last at least

a month's decline, though there is considerable variation among these cases if one

includes

the cases where prices do achieve a breakout. Watching for the new NYSE A/D Line

downtrend

to end, brought excellent Buys. This study will be completed later tonight.

Here are the most

important earlier cases: 1947-1948,

1948-1949, 1950, 1950-1951, 1953, 1970,

1974, 1974-1975,

1975-1976, 1982

Adding to the short-term bearishness, today the TigerSoft Closing

Power uptrends

have been violated for the SPY and DIA. This indicator's uptrends were

violated Friday for

the QQQQ, MDY(Mid-Cap ETF) amd IWM Russell-2000 ETF). Bearishly,

the QQQQ,

MDY and IWM have downtrending Closing Power Lines. That is to say, there was a brief

rally

but today the Closing Power made a new low. See IWM below. Click the links just

above

for the charts.

From the break in the NYSE uptrend-line and the break in the Closing Power

uptrend-lines, I have conclude it advisable to take more profits in long stock

positions, unless

the market opens up tomorrow morning and stays positive. We don't want gains to turn

into losses.

Buy B12s do not always launch a bull market. They can also be part of the

base-building

process. See the 1957-1958 and 1974-1975

cases. Traders may want to use just these trend-breaks

to go long and short. I would prefer not to go short until we get a Peerless Sell

signal to reinforce

and validate the downtrends.

Other charts of interest:

Financials: C, BAC, MA

Technology: IBM, INTC

Dollar Gold Silver Oil

-------------- Russell 2000 ETF

---------------

5/12/2009 Watch Intel (INTC) To See How Strong

NASDAQ and QQQQ are.

DJI +0.60% NASDAQ -0.88% GLD +1.13% USO +1.05%

Nothing

has changed with today's mixed decline. The operative Peerless signal remains a Buy

B12. The

NYSE A/D

Line uptrend remains intact, but breadth was poor today (There were 470 more down than up

today.) and

the TigerSoft Closing Power uptrendline is also intact, but it could be broken tomorrow.

Breaks

in these

trendlines would almost certainly bring a decline to 81.80-82 on the DIA. Because the

internals of

the market

remain quite positive, it seems reasonable to think that DJIA-8000 will be very good

support.

It should be

noted that the QQQQ (NASDAQ-100) is now at the support its rising 21-day ma. Watch

to

see if it can

rebound from there. If the market is as strong as it was from April to June 2003,

when

a new bull market

was starting, the QQQQ should not close more than 2% below its rising 21-day ma.

The QQQ's CLosing

Power uptrend has already been violated and its Relative Strength line is now

bearishly below

its 21-day ma. I would guess that the point of breakout at 32 will have be be

tested.

Note the

deterioration in the QQQQ's Accumulation Index. When the QQQQ is below its falling

200-day ma, this

is most often a very good Sell signal. The situation now is ambiuous because

the 200-day ma is

falling but the QQQQ is sitting on its 200-day ma. The rising 50-day ma will

probably be

excellent support near 50 if the decline continues immediately. Seasonally,

the next

two weeks are up

only 47.8% of the time since 1966. The average decline is 0.6% for this period.

Watch INTC tomorrow. The European Economic

Union has this evening fined them more than $1 billion

for monopolistic

practices vis-a-vis competitors like AMD. The chart is at support.

It |would be

suprising if it

did not get hit tomorrow pretty sharply at the opening. This has been

anticipated.

INTC's internals

are all negative, even as the stock is at support. INTC is in the DJI-30.

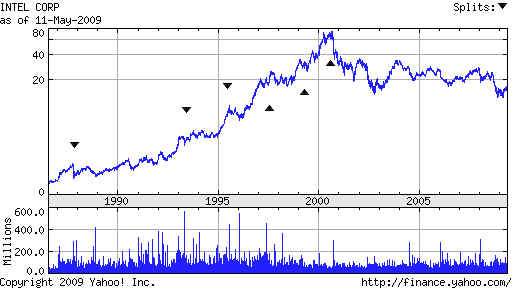

Long-Term INTC Chart

Finance Stocks in correction

C BAC JPM GS MA KEY

Dollar

MORE KEY CHARTS::

GOLD (stock) SLV IAG

QQQQ

SPY

DIA (1)

DIA (2)

5/11/2009

8 Weeks

of Rallying. Some Profit-Taking Was Due.

Peerless Still Is on A Buy. Watch Closing Power Uptrends.

News that Goldman Sachs will have to pay $60

million to the State of Massachusetts and

that state's

holders of toxic mortgages which it fraudulently sold as "AAA" might normally

have

been excpected to

shock Wall Street, since it gets to whether Wall Street should be trusted, or not.

Investors might

also have worried that other states would use this precedent also to go after Goldman

and other

brokerages that sold these mortgages. But apparently, either the market is very

strong

technically, or

investors are totally innured to Wall Street misconduct, or Obama has already let it

be known that he

will shelter Wall Street, because the decline was relatively contained.

And as if to prove the point that nothing dismays invetsors these days, the market

shrugged

off the spreading

news that the FED cannot account for a trillion dollars it has given or loaned to

banks. The

Fed's Inspector General seems not remotely up to the task of keeping the FED honest.

This is the same

Fed that Geithner and Obama would give more powers to, in the cases of

the need for a

government takeover of failing financial institutions.

Does Anyone at the Federal Reserve Know Where the 9 Trillion Is . The inspector general tasked with overseeing and auditing the Federal Reserve knows pretty much nothing about what the Fed is doing. That's the conclusion that comes from watching the exchange Tuesday between Rep. Alan Grayson (D-Fla.) and inspector general Elizabeth A. Coleman. Coleman could not tell Grayson what kind of losses the Fed has so far suffered on its $2 trillion portfolio, which has greatly expanded since September. |