TigerSoft and Peerless Daily Hotline TigerSoft and Peerless Daily Hotline

(C) 2010 William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

===> The

HOTLINE ADDRESS CHANGES TUESDAY NIGHT.

LOOK FOR ITS NEW IP ADDRESS FROM US Monday.

===> Order form to Renew On-Line,

"Nightly Peerless/TigerSoft Hotline " ($298)

TigerBlogs for Hotline Subscribers

Overnight Market

Action:

Bloomberg Futures around

the world before the US Markets open.

CNN Futures before the Opening in NY

24-hour Spot Chart - Gold

24-hour Spot

Chart - Silver Dollar and Currencies

Daily NYSE and NASDAQ New Highs.

| CURRENT

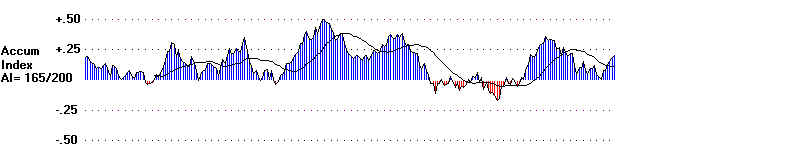

STATUS: KEY ETFs, Signals. Closing Power and A/D Line Trend

9/27/2010

Closing Power:Opening Power

UU = Both up. (initially reliably bullish)

DD = Both down (initially

reliably bearish)

UD = Opening Power up, Closing Power Down (bearish)

DU = Opening Power Down, Closing

Power Up (bullish)

Blue = Bullish Red = Bearish

Click Index Symbol Automatic

Closing Power

Pct of Stks over Opening Power

To See Graph

Signal

Trend

over 65-dma Closing Power

---------------------------------------------------------------------------------------------------------------------------------------

.

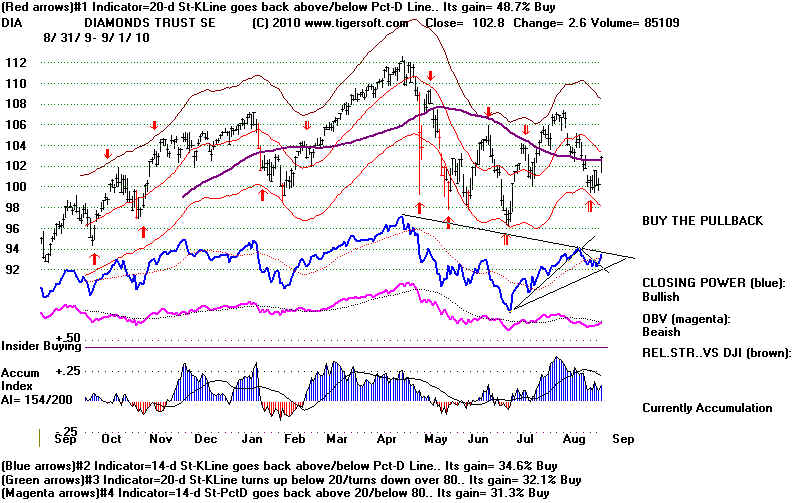

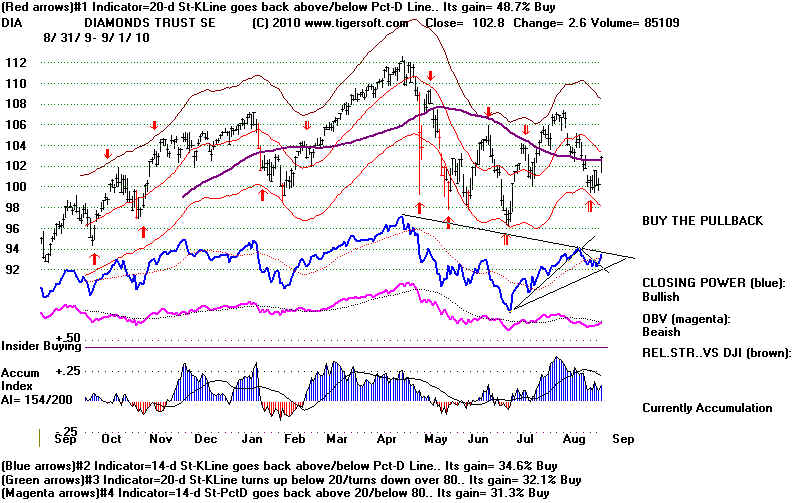

DIA

Red

Sell CP is rising

UU Bullish

DJIA-TGR-Index Red

Sell A/D Line broke uptrend

77% (-no change)

SPY

Red Buy CP is rising

UU Bullish

SPY-TGR-Index Red Sell A/D Line uptrend has been broken. 82% (-2%)

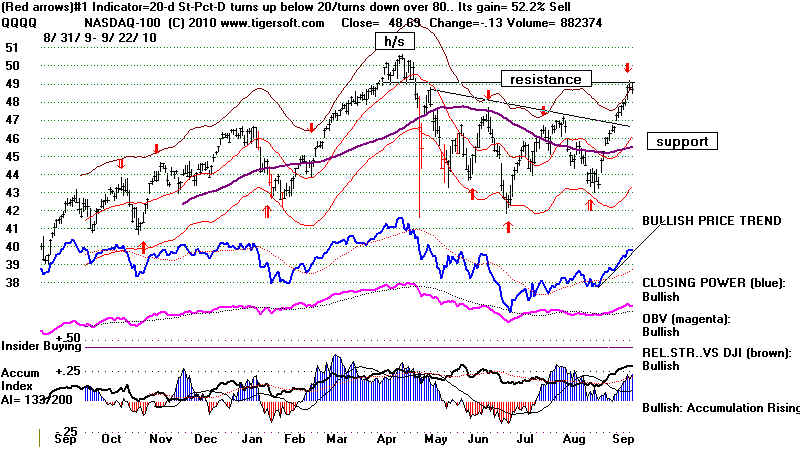

QQQQ

Red Sell CP is rising.

UU

Bullish

QQQQ-TGR-Index

Red Sell

A/D is rising.

83% (-4%)

QQQQ-10-TGR-Index Red Buy At Rising A/D Line

60%

(-no change)

Russell-2000 IWM Red Buy

CP is rising.

UU Bullish

Foreign ETFs

Red Buy A/D Line uptrending.NH 100% (no change)

Home

Building

Red Sell

A/D Line broke uptrend

78% (+4%)

Finance

Red Buy A/D Line

downtrending

49% (-9%)

5 buys / 6

sells 6 buys 5 sells 10 buys -

1 sells

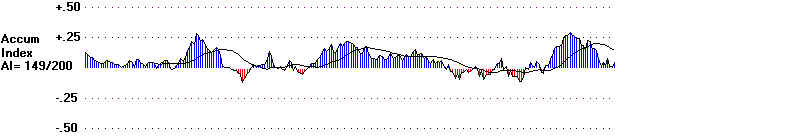

> NASDAQ 2369 -12 la/ma=1.047 (over-bought)

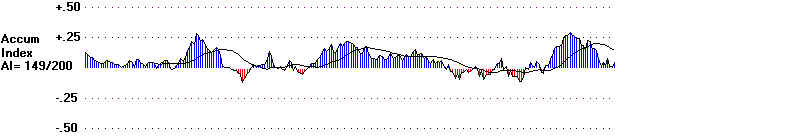

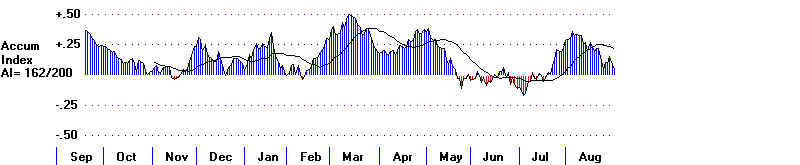

NASDJI positive AI (IP21)

=.25 >21-dma

> MDY Midcaps Red

Buy CP is at its rising trendline. UU

Bullish

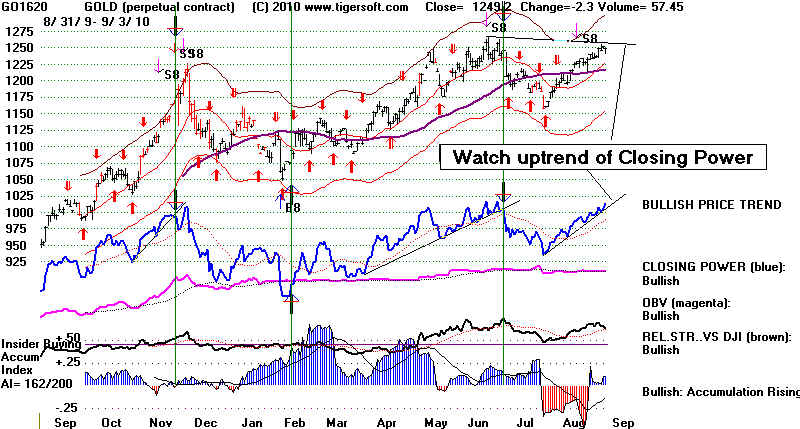

> GOLD STOCKS Red Sell AI-NNC-Stock S9 A/D Line rising. SLV

> DOLLAR Weak Red Sell CP downtrending.

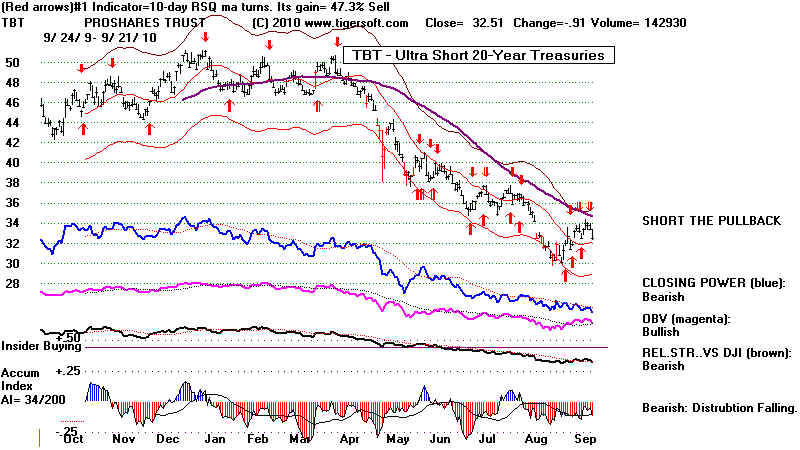

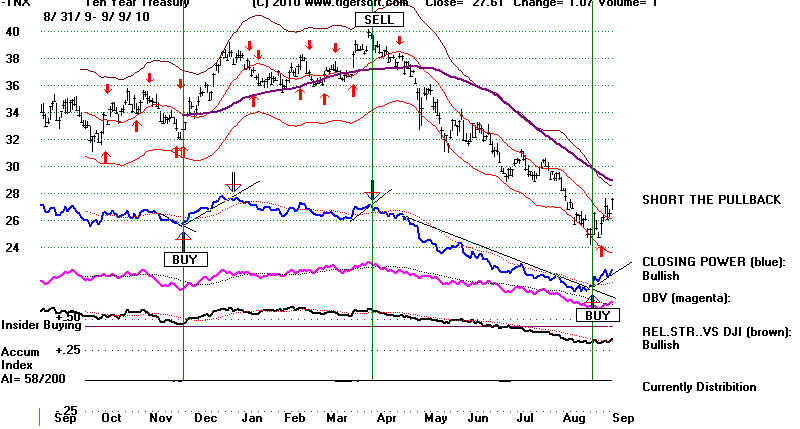

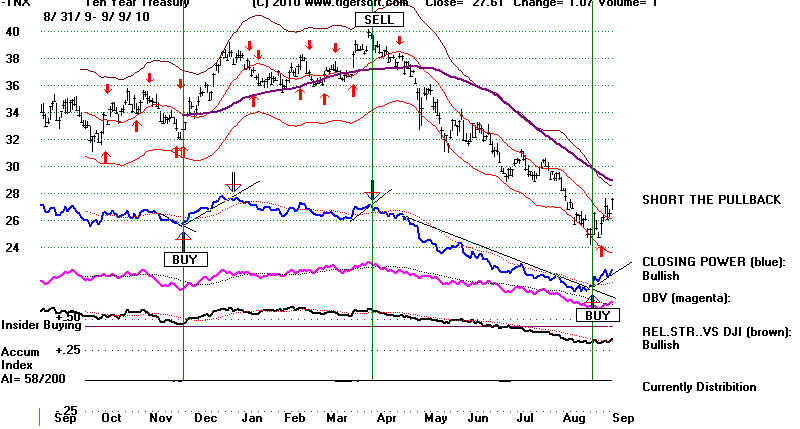

> TEN YR INTEREST RATES Red Sell (LOWER RATES) CP downtrending. |

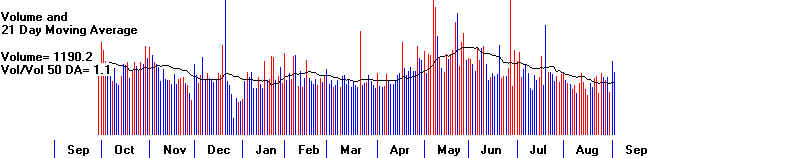

9/27/2010 Peerless

Remains on A Buy.

The

DJI's last hour 60 point sell off comes after a rise of 8% in September, one of the best

on record. The CLosing

Powers for the DIA, QQQQ, SPY and IWM are still rising.

Until the Closing Power

uptrends are broken, only a shallow retreat can be called for here.

Foreign

ETFs are very strong because an economic recovery is taking place outside the

US. The weak Dollar

will help US companies make sales overseas. The FED shows

no signs of preferring a

strong Dollar to keeping interest rates low and using its printing

presses to buy Treasury

bills. Fighting the FED is not advisable. However, Gold

and Silver are

falling sharply overseas

right now. That could mean interest rates are going to turn up.

That would be bearish. But,

as of the close on Monday, interest rates and the Dollar

are in

falling trends and that is bullish for stocks.

WARNING FOR SHORT TERM TRADERS

If the Closing Powers are

violated tomorrow, the rally may start to unravel enough for a decline

that would take the DJIA back

to its lower band or the more important support at

10000.

1)

Extra downside volatility is definitely a factor this year.

2) Dullness and low volume

after a rally in the major market ETFs is often bearish.

3) Once resistance has been

established in a trading range, prices usually have to fall

to the basic support zone.

That would mean a decline to 10000.

4) Last

Friday, we did see the third A/D NC (non-confirmation of a price new high) and/or

a Peerless Sell S13 on the present

rally. Three such instances wasenough to bring a decline

to the lower band on the last

three run-ups to the upper band,

ONLY

A SHALLOW DECLINE

Fortunately, a steep October

retreat is not likely without a Peerless Sell. If we did get a Sell S9

or S12, a big October decline

would then have to be predicted, because of the sell-offs of 1978, 1979,

1987, 1989, 1994 and 1997.

But presently the P-Indicator and V-Indicator are very positive.

Another technical condition

that is missing is a non-confirmation (NC) by the Clowing Power

of an SPY new high.

These are common at more important tops.

A strong September usually

means an up-October. Since 1929, when Septembers saw

the DJI rally with a rising

A/D Line, the market was much more likely to advance in

October than fall by very

much. There were 20 cases when the DJI rose, at least, until

October 26th, after a strong

September, when the DJIA and the NYSE A/D Line both rose.

There were only 3 cases of

steep declines in this situation below the lower band in

October. In additon,

there were just 2 cases where the DJI did fall, but only to the lower band.

Note also the 4 cases, in

which the DJI fell in October to a low half way between the 21-day ma

and the lower band

(1954, 1970, 1983 and 2009 after a rising September.

If we are take as significant

only the declines down to at least the lower band in October,

then we see just 5 cases.

This suggests the odds are 19 to 5 against a significant October

decline given September's

strength. This should make us trust Peerless if we are intermediate-term

traders. Short-term traders should, however, become bearish if the Closing Power

uptends are

broken.

==============================================================

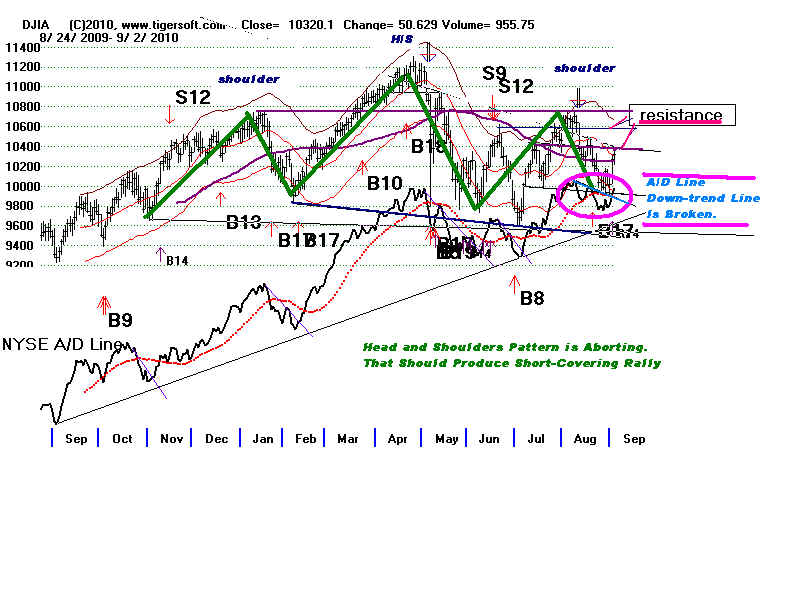

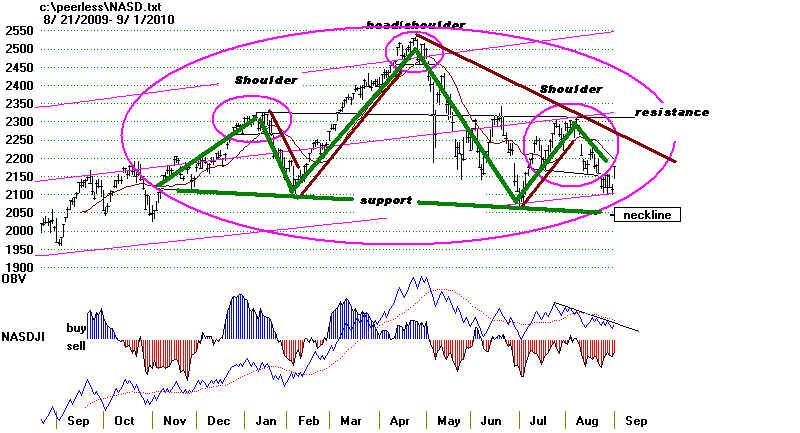

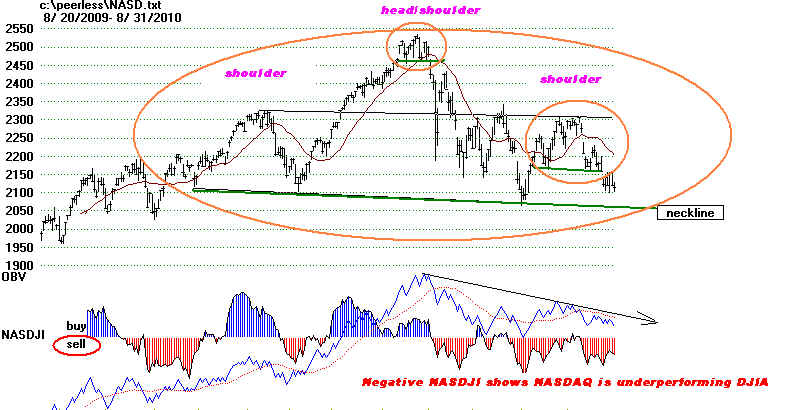

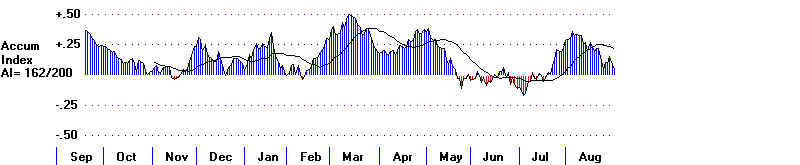

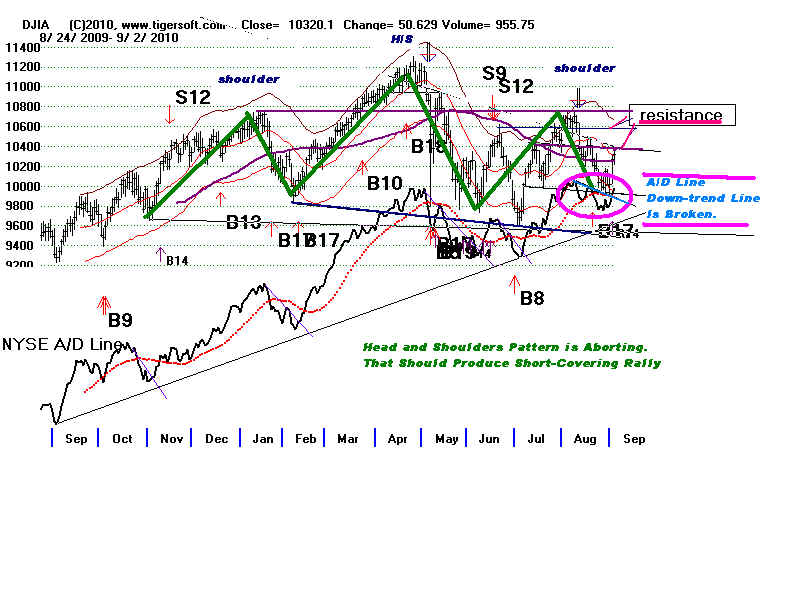

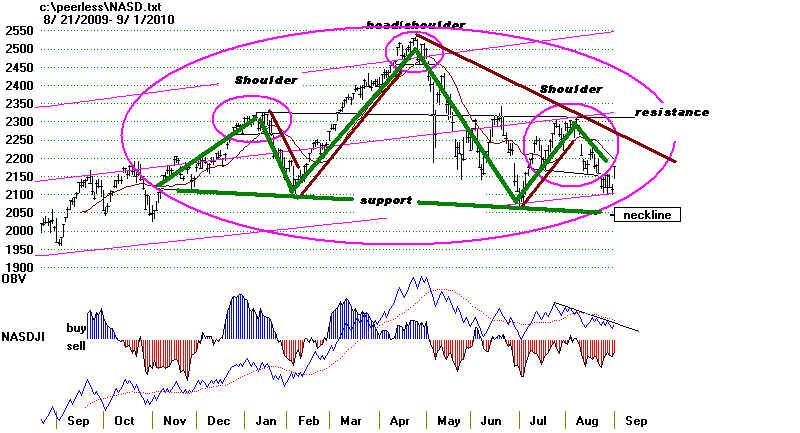

9/24/2010 Peerless Remains on A Buy.

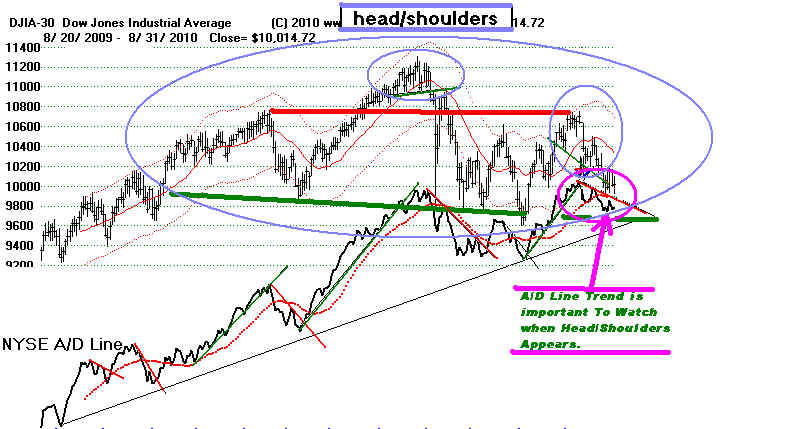

The DJI jumped 198 on Friday

on rising volume. The head and shoulders pattern that has

been scaring traders since June has

now become too distorted by the September rally to

be tenable. That should bring

more short covering. Though the recovery high was not confirmed

by the NYSE making its own high,

the internal strength indicators are too strong to give a

Peerless Sell. There were

exactly 2000 more up than on the NYSE. There were a bullish

124 on the NYSE and only 4 lows and

on the NASDAQ there were 100 new highs and only

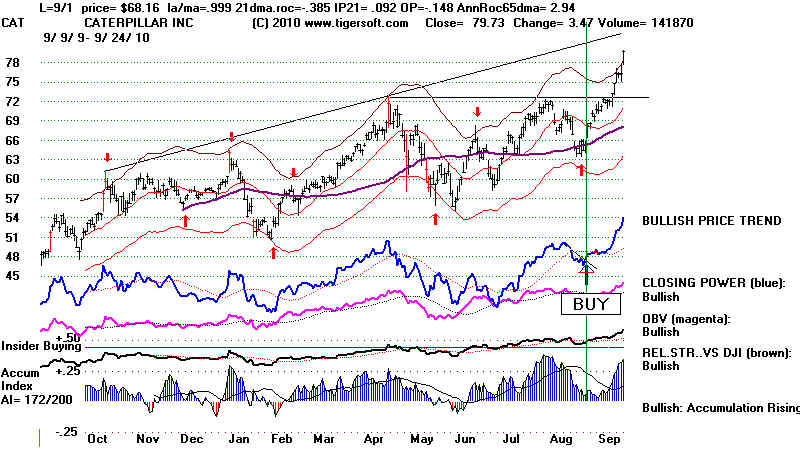

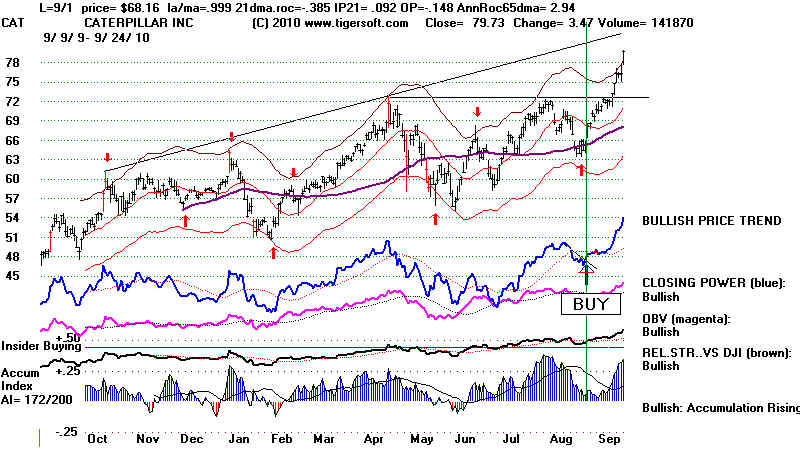

12 new lows. CAT, the highest AI/200 stock in the DJI-30, was its biggest gainer, up

4%.

IBM has been building a base just

below 134 for nine months. Its recent bulge of Accumulation

and CP confirmed breakout on Friday

should move up nicely from here, making 135 October Calls

appealing.

CAT (highest AI/200 stock in DJIA) and IBM (breaking out)

Bank/financial

stocks, like BAC, MBI and LM did particularly well. But much more

impressive, no less than 87% of the

NASDAQ-100 stocks are above their 65 day ma. With

both the Opening and Closing Power

bullishly rising for the DIA, QQQQ,

SPY, MDY and IWM,

it seems likely that their

March-April peaks will be reached. True, the SPY, now at 114.82, must

surpass 118, the broken

neckline-support in the quick March-April head and shoulders

pattern. As we approach the

end of the 3rd quarter,

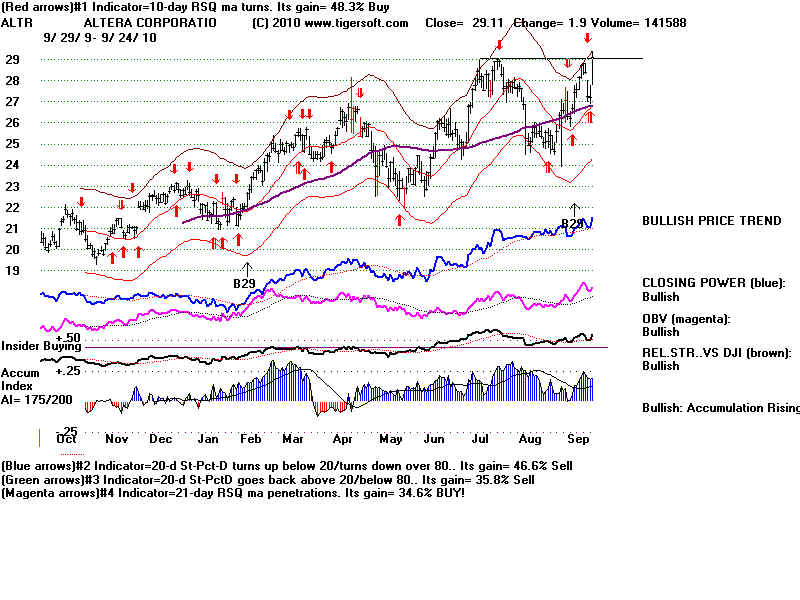

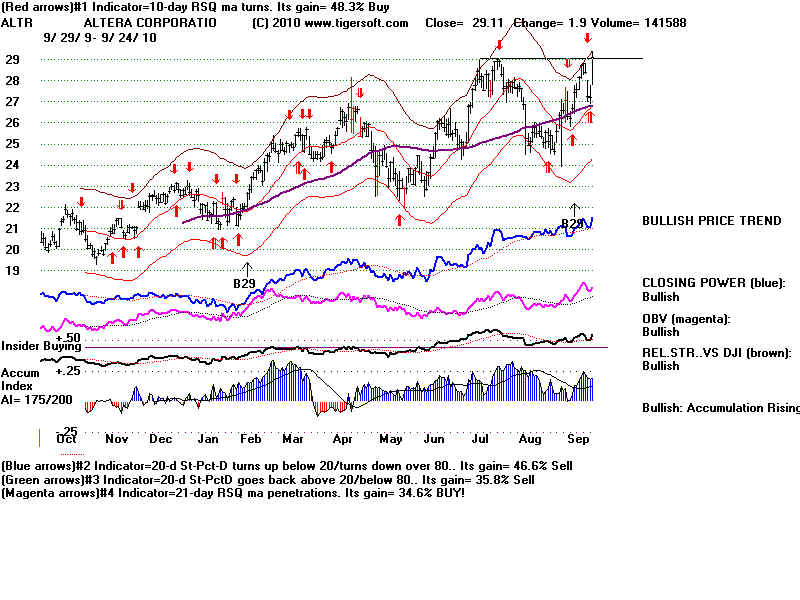

Tiger Tahiti system traders should

appreciate the high AI/200 score of ALTR in the

NASDAQ-100 and EMC (AI/200=187) in

SP-500. Both are in the process of making

bullish flat topped breakouts.

ALTR

|

EMC

|

Foreign ETFs are the

strongest sector, as hot

money flees the weakening Dollar. Their strength

begs the question of how much a tax

cut for the very wealthy will help American businesses.

With all the political backbone of

a one-celled protazoa, the Democrats have postponed

a vote on this important issue

until after the Election.

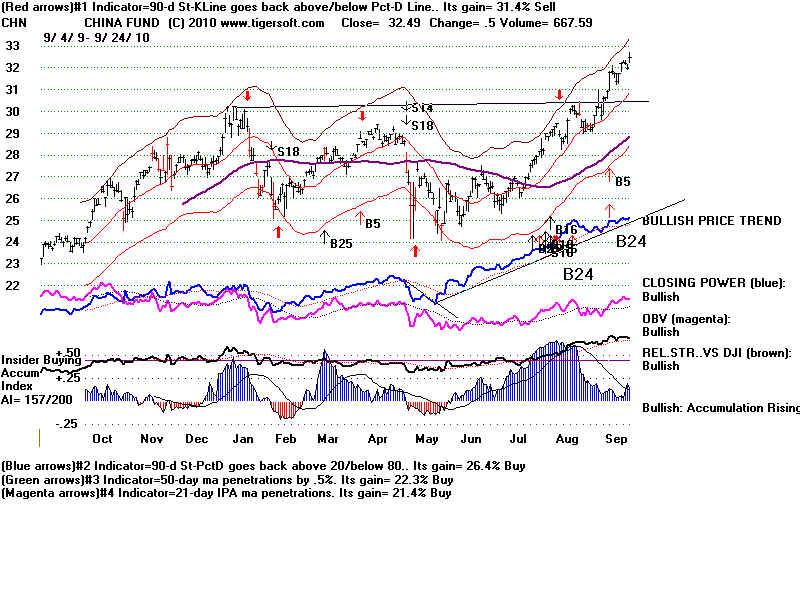

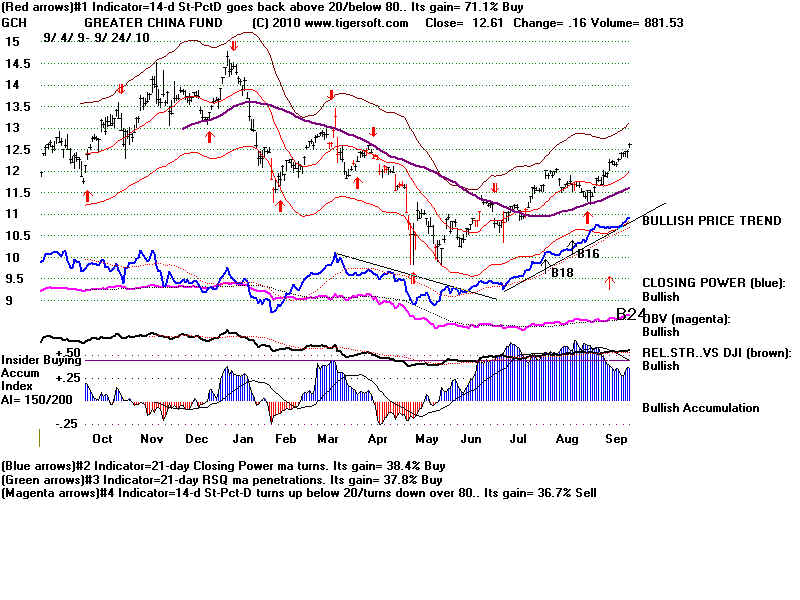

CHN - China Fund shows

intense insider buying in July and August and displays

a Closing Power maming 12 months

highs. GCH - Greater China looks equally impressive.

IFN recovered nicely on Friday.

You can see in its chart how a Closing Power new high

in June was the tip-off that there

would be a substantial run here.

====================================================================================

9/23/2010 Peerless

Remains on A Buy.

THE CUMUL. NYSE A/D LINE HAS NOT REGISTERED A BEARISH DIVERGENCE

ON THIS ADVANCE. IN 23 MARKET TOPS SINCE 1929 A BEARISH A/D

LINE

NON-CONFIRMATION (NC) OCCURRED ALONG WITH A PEERLESS SELL. IN ONLY

FOUR CASES, WERE THERE IMPORTANT TOPS WITHOUT AN A/D LINE

NC AT THE TOP. AND EACH OF THESE HAD A PEERLESS SELL. SO, THE

ABSENCE OF A PEERLESS SELL AND AN A/D LINE NC SHOULD MAKE US

DOUBT THAT A SEVERE DECLINE IS ABOUT TO OCCUR.

IF THE CLOSING POWER UPTREND-LINES ARE BROKEN, WE WOULD

HAVE TO BELIEVE THAT THE DJI'S MARGINAL BREAKOUT AT 10800 WOULD

THEN SEEM TO HAVE FAILED. IN THAT CASE, HAVING TESTED AND SUCCUMBED

TO THE CLEAR RESISTANCE AT 10750, GIVEN THE FLAT TRADING RANGE,

THE DJI WOULD THEN PROBABLY NOT TO FIND MANY BIDS UNTIL IT HAS

AGAIN TESTED THE BASIC SUPPORT AT 10000. SUCH ARE THE DICTATES OF

CLEAR, FLAT TRADING RANGES. THE MIDDLE OF THE RANGE AT THE 21-DAY MA

OR THE 65-DAY MA TYPICALLY HAS MUCH LESS SIGNIFICANCE IN A FLAT

TRADING RANGE. THEY WORK BETTER IN TRENDING MARKETS.

THE STEEP A/D LINE UPTREND HAS NOW BEEN VIOLATED. THE LESS

STEEP SECONDARY A/D LINE UPTREND WILL PROBABLY BE VIOLATED IF

WE CONSIDER THE SIMILAR EARLIER A/D LINE UPTREND-BREAKS THIS

PAST YEAR.

It's pretty easy now to paint the bearish

case: 1) October often brings the scariest declines

and that month's trading lies little more

than a week ahead; 2) the Dollar is in big trouble

and there could be a rush to sell

American Treasury instruments, whixh would drive up

interest rates; 3) US unemployment is

already starting to double-dip. 4) The massive

head and shoulders pattern will surely

bring a big break downwards, 5) Gold's steep rise

always brings a bear market, just to name

a few points.

The solid case can be made, no doubt, for

a bad market break. However, from my vantage point,

we would normally expect a major Peerless

Sell before such a decline. And there just has not

been one. Breadth, the ratio of

advances to declines on the NYSE, has been too bullish.

Very low interest rates has done what

it's supposed to do.

Bear markets almost always begin

after there has been a significant bearish divergence

between the DJI and the NYSE A/D

Line. In other words, market tops since 1928 - which

is when the breadth data starts -

almost always occur when the DJI makes a new high that

is not confirmed by the NYSE A/D

Line mking a new high. And making it still easier for us,

major Peerless Sells and bearish A/D Line divergences call all the

other major tops:

1929, 1930, 1937, 1939, 1946, 1948,

1957, 1959, 1961-1962, 1966, 1968-69, 1973, 1978, 1979,

1980, 1981, 1984, 1987, 1989, 1990,

1998, 2000 and 2007. There were 23 such cases.

See

the 23 charts here.

.

By contrast, there are only 4

exceptions:

1) Jan 1977 (We do see

an S8),

2) Jan 1994 (Here there was

an S4.) 10% decline

3) Sept 1997 (An S12 here.)

4) March 2002 (Earlier S9)

See the 4 charts here.

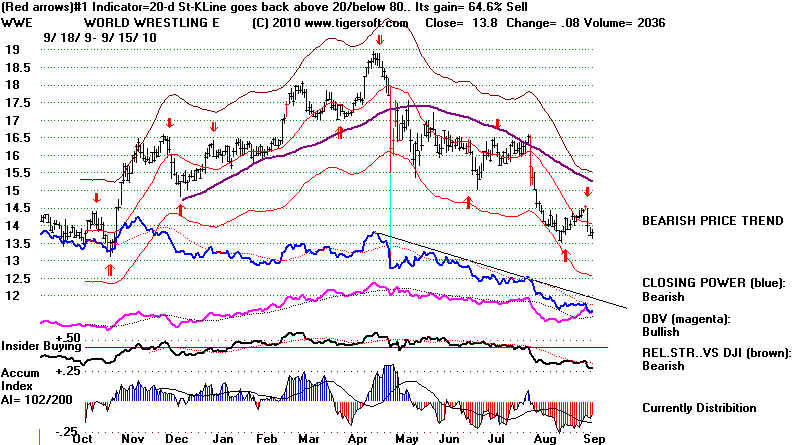

STOCKS TO BUY AND SELL SHORT

There were 183 MAXCP stocks

tonight, showing that professionals were still very bullish on them.

The most bullish of these with both Opening and Closing Power rising

(UU) were:

AAP, MNRO (Munro Muffler),

EMC. AZO (AutoZone), NXTM, VIT, TCLP, TTF (Thai Fund)

There were 54 MINCP stocks tonight,

showing that professionals were still very bearish on them.

The most bearish of these with both Opening and Closing Power falling

(DD) were:

AMAG 18.89 -1.17 and CGA (8.36

-.26). A rising Opening Power will most likely not prevent

the other "bearish" heavy

distribution MINCP stocks from declining further:

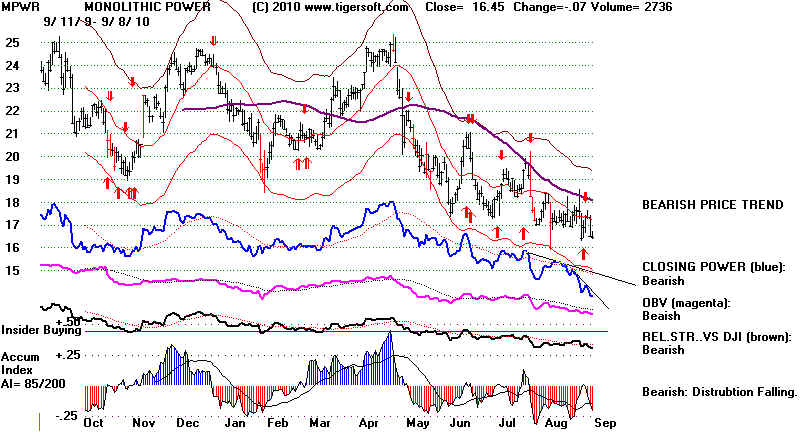

BAC, MPWR, ECA, CFFN, PBCT,

PNFP, BYD,

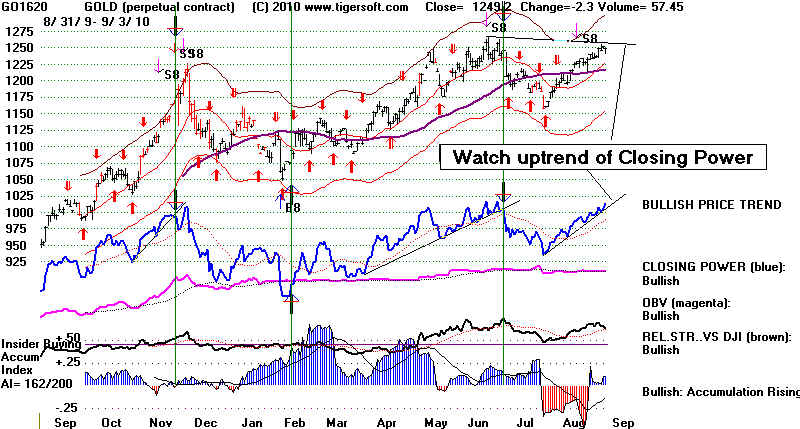

GOLD AND SILVER NEW HIGHS ARE BULLISH FOR PRECIOUS METALS

====================================================================================

9/22/2010 Peerless Remains on A Buy.

There were some shifts today in the

markets but the DJI's trend is still up. Both the Opening

and Closing Power are still rising

for each of the major market ETFs. This shows a strong uptrend.

Supplemental, added an hour into trading as a response to an email:

A market collapse in October some think is a possiibiity. I do not

see it without a major Peerless Sell. That would take everything down.

In a Congressional Election year that only happened in 1930, 1978, 1994

and those were after clear major Peerless sell signals. The high unemployment

released today still means the FED will keep interest rates low and so the cost of owning

gold

(where no dividend is paid) is low. Central banks raise interest rates to protect

their country's currency. The FED cannot safely do that now with such high unemployment.

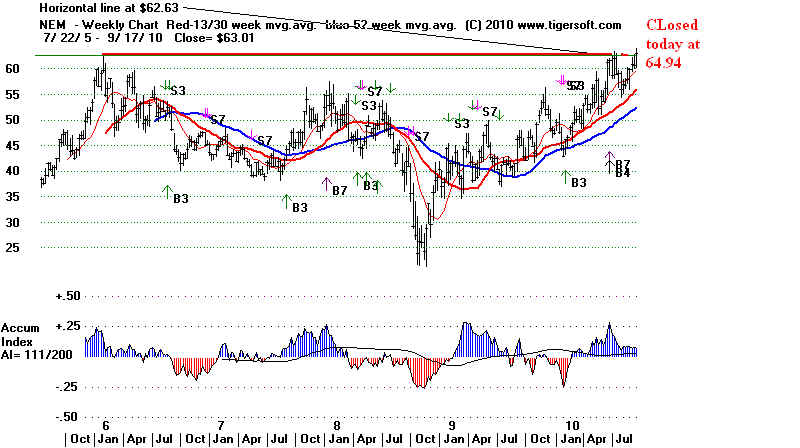

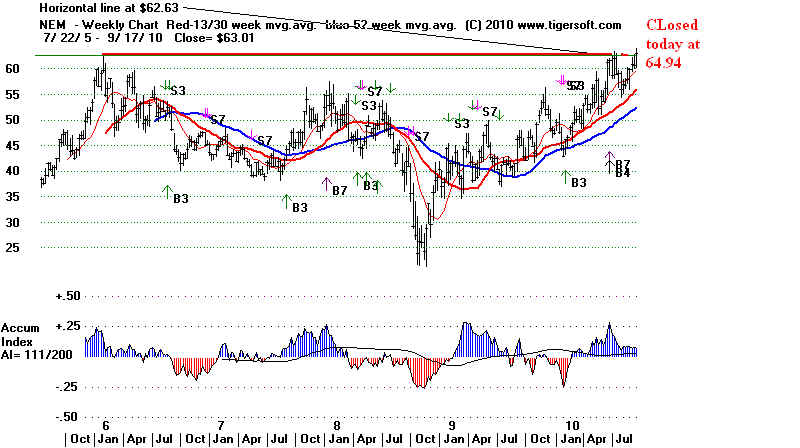

GOLD STOCKS ARE RUNNING

Gold stocks were the biggest

gainers today. The biggest, NEM, has broken out above very well-tested

resistance that goes back to 2005.

This must be assumed to be very bullish.

NEM is the mother ship. http://www.newmont.com It has gold mines in

United States, Australia,

Peru, Indonesia, Ghana, Canada, New

Zealand, and Mexico. The Closing Power for NEM is

lagging, but the all-time high

breakout is technically more important AND both its Opening

and Closing Power are now rising.

A steep rise in NEM and Gold

usually spell trouble for the equity markets because

the weakness they signify for the Dollar usually bringa the Fed to raise interest rates.

Presently interest

rates are falling and so is the Dollar. Volcker raised rates to 20% in 1980.

The result was the 1981-1982 bear

market. The Fed and Treasury have not agreed to

a public inventory of US Gold

supplies. This does not inspire confidence. On the other hand,

a weak Dollar helps creditors (pay

back loans in cheaper Dollars) and might help US manufacturing

get started again as imports become

more expensive. The big banks want a stable Dollar

because they want foreigners to

keep their deposits here and in dollar denominated assets.

The declining Dollar has also

caused US investors to put their money in overseas ETFs.

GOLD

Gold and silver stocks are

following NEM's lead. The most bullish Gold stocks with a Closing Power

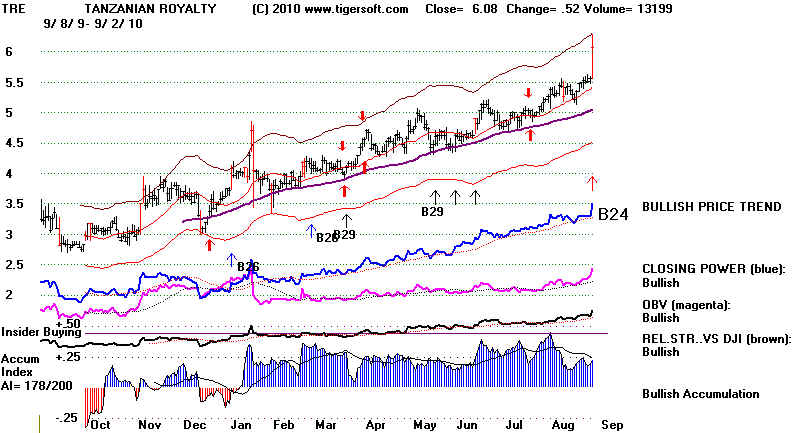

making new highs are TRE and IVN. As long as their

Closing Powers are rising, they can still be

bought and held. Of course,

these are not new recommendations, but this is probably the best

group to own now. Silver,

being used so much more for industrial purposes, is probably going to

lag gold for a while longer, until

there is more of an economic recovery.

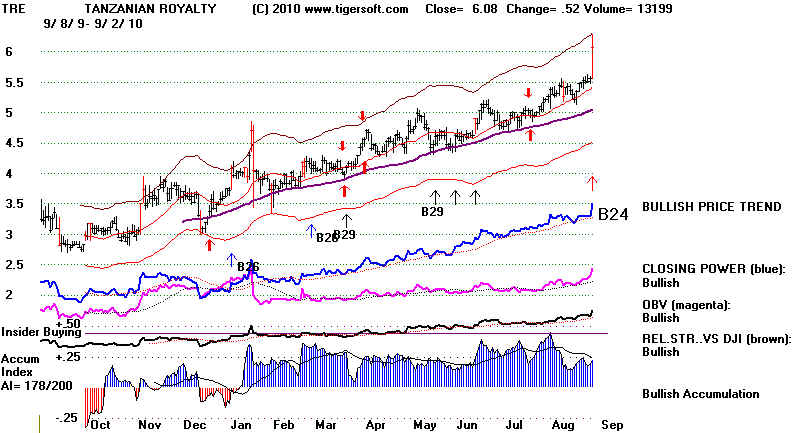

TRE 7.33 -.15 and up nearly 50%

since we first recommended it here in July when it crossed back

above $5 with a Closing Power

making new highs and showing heavy insider buying.

Tanzanian Royalty Exploration Corporation, an exploration stage company,

engages in the acquisition

and exploration of natural resource

properties. It primarily involves in the exploration of gold properties,

with a focus on exploring for gold

properties in Tanzania Though up a lot, TRE's internals are

superb: heavy insider and steady

Professional buying.

IVN 22.04

Ivanhoe Mines Ltd., through its subsidiaries, operates as

a mineral exploration and development company.

The company?s principal mineral

resource property is the Oyu Tolgoi copper and gold mine development

project located in southern

Mongolia. It also holds interests in the Ovoot Tolgoi Coal project located in

Mongolia; the Cloncurry project in

Queensland, Australia for the exploration and development of

molybdenum, rhenium, copper, gold,

and uranium; and the Kyzyl gold project located in Kazakhstan.

ANV 27.49 - runs only US gold

mines.

Allied Nevada Gold Corp., together with

its subsidiaries, engages in the evaluation, acquisition, exploration,

and advancement of gold exploration and

development projects in the State of Nevada. It principally

operates the Hycroft Mine, an open pit,

heap leach gold mine containing silver as a byproduct of the gold recovery

process located in Nevada.

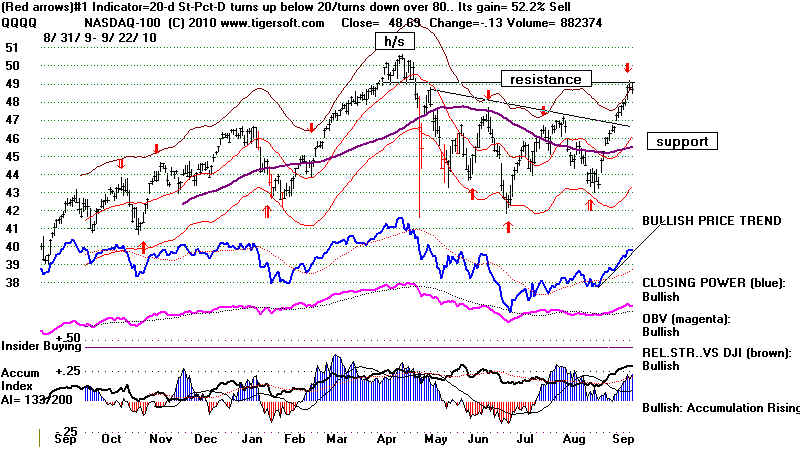

A handful of QQQQ stocks were sold off today on high volume. We will

watch to see if the NASDAQ

fails its recent breakout above the 2300

resistance. That would confirm an intermediate-term retreat

to its rising 65-day ma.

ADBE 26.67 -6.27

ADSK 31.66 -1.41 ALTR 27.25 -1.15 BIIB 54.86 -3.37

The QQQQ's Closing Power is still rising.

So, too, is its A/D Line/ Violation of these would

likely bring a decline back to 47 on the

QQQQ

To hedge with some short sales consider,

as usual, the most "bearish" MINCP stocks.

A handful of

Finance stocks also would seem to be candidates for short sale trades.

---------------------------------------------------------------------------------------------------------------------------

9/21/2010 Peerless Remains on A Buy.

Breadth did weaken today. There were a

whopping 863 more down than up on the NYSE despite

the DJI's 7 point advance. This is a big daily

divergence. It is clearly bearish. It is the second daily A/D

divergence on the current advance, where the

DJI rose from the previous day but there were more

stocks down than up. On September 16th,

the DJI rose 22 but there were 465 more down than up.

Weakening breadth is often based on a sense

that interest rates may go back up. Today, the

FED put on hold any further lowering of rates

despite the continuing high unemployment.

Bearish daily A/D divergences from the DJI not

on successive days tend to accumulate to the point

where there sufficient bearishness has

accumulated and an intermediate-term decline starts. This

can take some time. In 1929, 1937 and

1959, 1972-73 and 1999-2000, the A/D Line lagged a rising DJI

for more than 6 months. The divergence

here seems significant by comparison. Usually we get a

Sell S9 as the top is made. Often

multiple sets of S9s.

Minor breadth divergences do bring short-term

and intermediare-term declines. To this end,

in the original Peerless book of 1981, I talked

of minor divergences between the DJI and the

P-Indicator. I suggested watching for

minor non-confirmations. A practical rule of thumb is

to take as significant for trading purposes the

following. Watch for 50-day new highs by the DJI

where the P-Indicator is less than half of what

it was on the previous peak. A decline back to the

just below the 21-day ma is called for when

this happens. In this vein, on 8/4/2010 the P-Indicator

peaked at 714. Today on a new DJI high, it

stood only at 362. This is still more than half of its

previous peak, but not by much.

Another way to see a top coming is to watch

volume indicators, especially the V-Indicator.

The old Peerless S13s are useful here.

S13s are based on the V-Indicator being negative with

the DJI above the 2.7% band. These

Sell S13s have been classified simply as warning signals.

But we can count the daily A/D Line

non-confirmations coupled with multiple old Sell S13s

(warning signals). Four of these proved

to be correctly bearish signs of the tops in April, June

and July-August. We have had 3 so far on

this rally. So, I would still give the market more chance to

advance.

APRIL (4)

2/22/2010 10383.38 Old Sell S13

3/25/2010 10841.21 DJI up 5 but 1828 decliners and only 1269 advancers

4/15/2010 11144.57 (TOP) DJI up 21 but 1549 decliners

and 1449 advancers

4/19/2010 11092.05 DJI up 74 but 1735 decliners and 1343 advancers.

JUNE (5)

6/16/2010 10409.46 Old Sell S13

6/16/2010 10409.46 DJI up 5 but 1825 decliners and only 1270 advancers

6/17/2010 11434.17 Old Sell S13

6/17/2010 11434.17 DJI up 25 but 1545 decliners and 1525 advancers

6/18/2010 10450.64 (TOP)

JULY-AUGUST (4)

7/13/2010 10363.02 Old Sell S13

7/14/2010 10366.72 DJI up 4 but 1666 decliners and only 1366 advancers

7/22/2010 10322.30 Old Sell S13

8/9/2010 10698.75 (TOP) Old Sell S13

SEPTEMBER (3)

9/16/2010 10594.83 Old Sell S13

9/16/2010 10594.83 DJI up 22 but 1828 decliners and only 1269 advancers

9/21/2010 10761.03 DJI up 7 but 1942 decliners and only 1079 advancers.

The Closing Powers for the major market ETFs

are all still rising. In fact, the Opening Powers

are, too. This is a bullish combination.

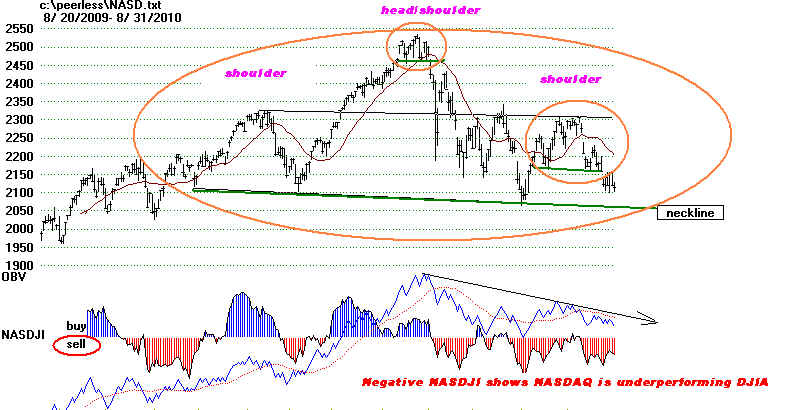

The NASDAQ has broken clearly out above the right

shoulder resistance. The DJI has

marginally. The SP-500 has also made a 3 month high, but is

still below the apex (1149) of its left

shoulder in December. That still may pose some resistence,

but with the breakouts, the path of least

resistance should be up for more stocks.

MAXCP stocks numbered 249 while MINCP stocks

showed only 39. The very strongest stocks

tend to go up the most in the last stages of

their rally. Here is a sample of the BULLISH

MAXCP stocks

Some of the BEARISH MINCP stocks are

getting much weaker. Hedging with short sales in

these is safe, as long as you are willing

to cover a short if the CLosing Power breaks its downtrend.

|

===============================================================

9/20/2010 Peerless Remains on A Buy.

The Closing Powers for the major market ETFs

are all still rising. In fact, the Opening Powers

are, too. This is a bullish combination.

The NASDAQ has broken clearly out above the right

shoulder resistance. The DJI has

marginally. The SP-500 has also made a 3 month high, but is

still below the apex (1149) of its left

shoulder in December. That still may pose some resistence,

but with the breakouts, the path of least

resistance should be up for more stocks. I would

cover most short sales if the Closing Power

downtrends are broken.

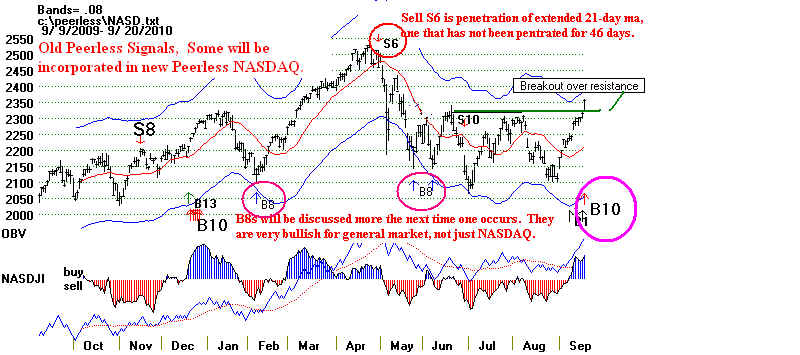

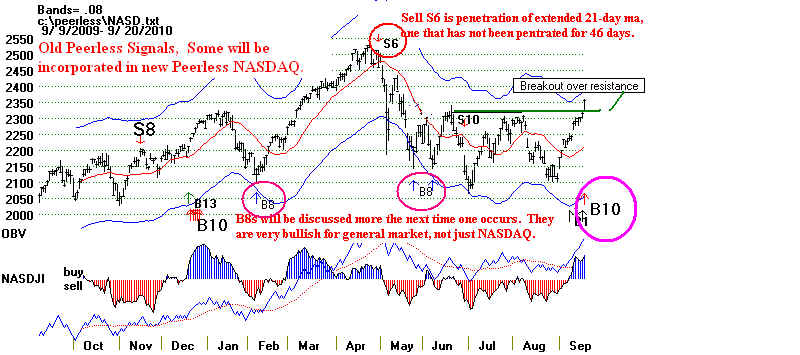

NASDAQ Buy B10

At the bottom of this

section is updated research on the type of breakout we saw today

with the NASDAQ. It shows that 11 of 13 old Peerless NASDAQ-Buy B10s - as

occurred today -

would have been profitably traded using current

Peerless Sells, penetrations of extended

21 and 65-day ma and head and shoulders

patterns. The gain would for such NASDAQ B10s

with the current

Accumulation Index (IP21) above +.15 would have been +7.6%. The next version

of Peerless to be released will have these and some

other NASDAQ signals in it. We do have to

be wary of false breakouts. But the history of these

signals is clearly bullish.

Internet security stocks remain the leaders.

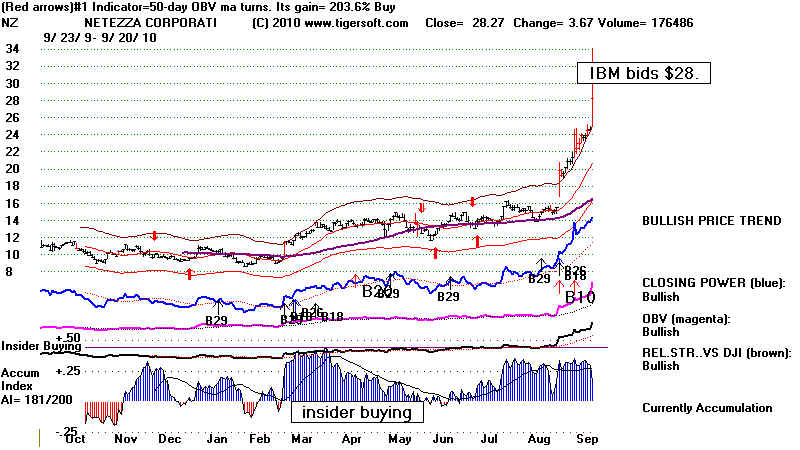

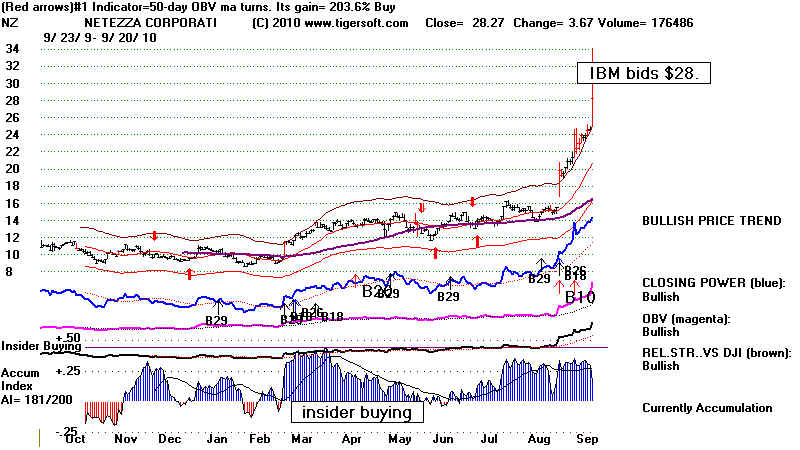

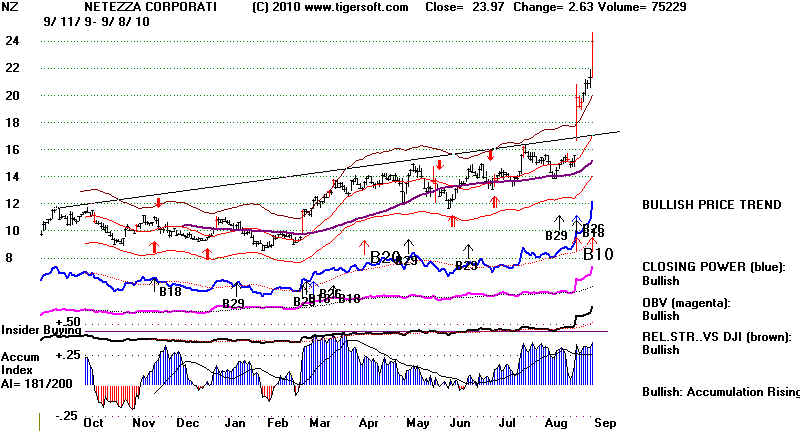

Today IBM offered $28 for NZ, but stock

traded significantly above that level, as

though there would be a higher offer forthcoming.

The advance has taken up a number of more

speculative stocks, as well as the usual dividend plays.

There were 319 MAXCP stocks. These are

stocks with their C;osing Power making new highs,

thereby showing very strong professional

buying. By contrast, the number of MINCP stocks

has dropped to 45. On the NYSE,

there were 204 more New Highs and only 2 New Lows.

Bullishly, there were 118 NASDAQ New

Highs and only 10 New Lows. As long as their Closing

powers are rising, the BULLISH CP stocks

should do very well.

BULLISH MAXCP STOCKS (not dividend plays):

PSMT 29.08 +.35 AI/200=189.

consumer warehouse clubs i

VOD 25.77 +.49 AI/200=195

mobile communications

VMW 87.43 +2.62

virtualization infrastructure software

ADVS 53.58 +.98 AI/200=197

software and services that automate work flows

TRE 7.16 +.17 AI/200=182

gold/copper

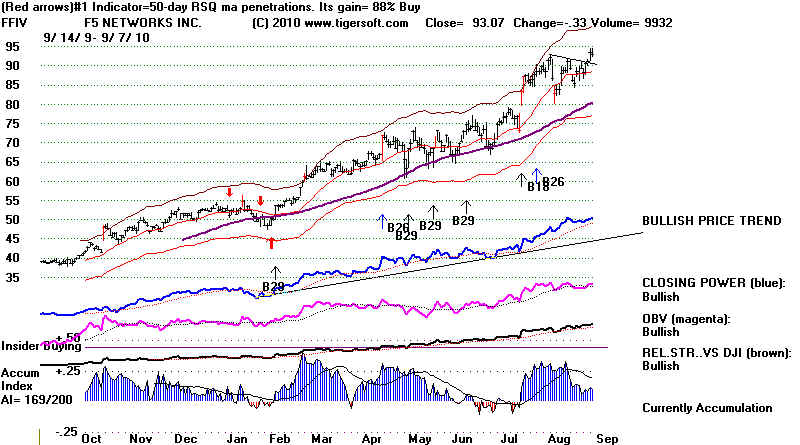

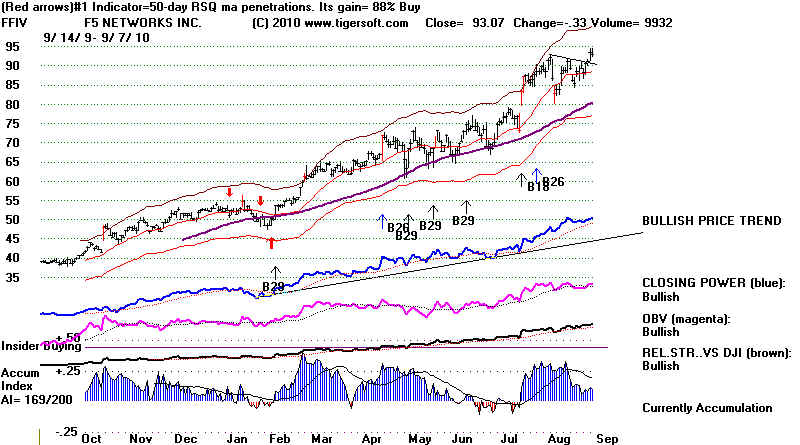

FFIV 104.64 +3.66 AI/200=169

technology that optimizes the delivery of network-based applications, incl. security

AAP 59.16 + 1.01 AI/200=180

retailer of automotive aftermarket parts

VRNT 25.05 AI/200=194

actionable intelligence solutions and value-added services worldwide

INTU 45.52 +.64 AI/200=169

raxes and financial management software

NR 9.42 +.44 AI/200=173 waste

disposal, and well site preparation products and services

WTR 20.78 +.30 AI/200=168

operates regulated utilities that provide water or wastewater services i

NZ 28.27 +3.67 AI/200 = 181

analytic and monitoring appliances to enterprises, etc.

NTCT 19.58 + 1.12 network

performance management solutions worldwide

GOLD Should Go Higher. Minimum Upside Target Remains 1300

See GOLD's Breakout

Past 1000/ounce into All-Time High Territory Invites Comparisons

with 1970s. October 6, 2009

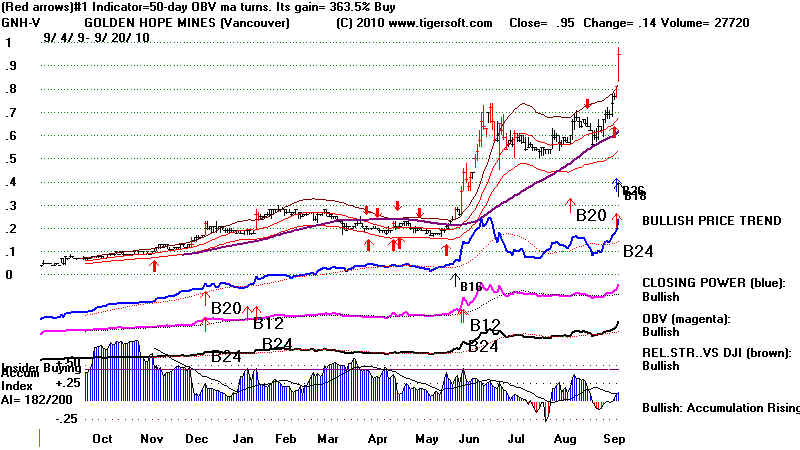

Low Priced Gold Stocks are getting lots of hot money interest, even though

some of the biggest Gold

stocks have not achieved breakouts and others

like ASA and GOLD show heavy distribution on their

new highs. Let's watch the higher

priced stocks for bullish breakouts, ABX 46.45 (Nov high of 48),

AU 44.07(Nov high of 48) and NEM 63.27 (64

recently).

Below

are the strongest Gold stocks. As long as their CLosing Powers are rising,

they will be good speculations in this market

environment with Gold having a

high minimum target and the last quarter of the year

tending to be bullish for it.

|

|

|

Why The Shorts Are Covering...

When a bearish-looking head and

shoulders' pattern is aborted by a close clearly above the

right shoulder's apex's resistance, the

market usually spurts forward as shorts cover. That started

today, set off, as it was, by the

government's accouncement that "the recession has ended"/

For whom, one might ask. This is a

jobless recovery, if ever there was one in the US. And

the market's decline ended 17 months ago.

Still, there is no question that overseas stock

markets

are doing very well. Another internet/security stock, NZ, was bid for today by a

Dow-30 stock. (IBM). I mentioned

UNP last night as a wellwether. It moved up, but has not made

a confirmed breakout. Other

railroads are also approaching breakouts, but have not succeeded

yet. (CP, CSX, KSU, NSC). The old

Dow Theory would say that today's breakout was not

confirmed by the rails.

i

NASDAQ Strength Usually Shows Healthy

Speculative Interest and Is Bullish

This will have be finished tomorrow.

The old Peerless (pre-2008) have a Buy B10 on the NASDAQ

breakout today,. Even though

this is not part of the

present Peerless programs we can see usefully look back at all the cases

of such Buy B10s and get a

sense of the importance of the breakout today.

Old Peerless NASDAQ B10's are

breakouts above 4x tested resistance. The average

gain on 9 trades between 1986

and 2002 was 7.8% at time of next NASDAQ Sell.

7 of these 8 trades were

profitable. The gains from these B10s between 2002 and 2006

will be posted tomorrow.

Below are the gains in the last 4 years.

Gains of B10s with Old Peerless on NASDAQ.

CL/MA NASDJI IP21 Gain

--------------------------------------------------------------------------------------------------------------------------------------

7/16/1987

1.015 Negative 0 +3.5%

Reversed by Peerless S9 on DJI on 10/1/87.

Note NASDAQ Sell Signals in Old Peerless that will have to be incorporated

in a new Peerless for NASDAQ.

Sell S2 - Penetration of 65-dma by -.5% for first time in 65-days.Not a short sale.

Sell S6 - Penetration of 21-dma by -.5% for first time in 46-days.Not a short sale.

Date

NASDAQ CL/MA NASDJI

IP21 Gain Next

Sell

----------- -------------

---------- ------------ ------- -------

----------------------------------------------------------------------------

1. 6/9/88 384.60

1.034

Negative .322 +2.8% Peerless Sell S1 on

7/6/88 with NASDAQ at 395.45

2. 8/3/89 456.93

1.018 Negative

.412 +4.9% Peerless Sell S9 on 10/4/89 with NASDAQ at 479.32

3. 5/17/90 445.74

1.039 Negative .198

+3.7% Peerless Sell S9 on 7/2/90 with NASDAQ at

462.04

4. 9/14/92 594.21

1.043 Positive

.309 +12.-% Old NASDAQ

Sell S2 on 2/16/83 with NASDAQ at 665.39.

+33% Peerless Sell S9 on 2/3/94 with NASDAQ at 797.79

NASDAQ fell to 565.21 right after this Buy signal and then revered powerfully up

after completing a 5-month lomg inverted head/shoulders bottom.

5. 10/22/92 597.12 1.031

Positive .299 +11.4%

Old NASDAQ Sell S2 on 2/16/83 with NASDAQ at 665.39.

+32% Peerless Sell S9 on 2/3/94 with NASDAQ at 797.79

6. 11/27/96 1287.32 1.027

Negative .358 -5.8%

Peerless Sell S9 on 4/22/97 with NASDAQ at 797.79

Much better would not to have a gain turn into a

loss and to have sold

on simultaneous penetration of 4x tested uptrendline - pentration of 65-dma

with NASDJI negative and IP21= -.056. This would have meant a gain of

+2.0%.

7. 6/30/99 2685.64 1.063

Positive .255 -0.5%

Peerless Sell S12 on

6/18/99 with NASDAQ at 2671.24

8. 11/1/99 2967.64 1.05

Positive .185

+33.8% Peerless Sell S9 on 12/28/99 with NASDAQ

at 3972.11

9. 12/29/2003 2006.48

1.042 Negative

.233 +4.1%

Peerless Sell S15 on 2/11/04 with NASDAQ at 2089.66.

10 11/10/05 2196.68

1.032 Positive .282 +6.6%

Peerless Sell S15 on 5/5/06 with NASDAQ at 2342.57

11. 3/29/2006 2337.78 1.018

Negative .091 +0.2%

Peerless Sell S15 on 5/5/06 with NASDAQ at 2342.57

NASDAQ completed head/shoulders on 5/11/2006 at 2276.70)

12 9/12/2006 2215.82

1.026 Positive .271 +9.9% Peerless Sell S9

on 1/5/07 with NASDAQ at 2435.

13 1/11/2007 2485.85

1.02 Negative .068 +8.0% Peerless Sell S9 on DJIA at 2712.29 on

7/17/2007

This was initially a false breakout as NASDAQ fell

back to 2350 before advancing.

14 4/25/2007 2547.89 1.028 Negative .30

+6.5% Peerless Sell S9 on DJIA at 2712.29 on

7/17/2007

15 4/24/2008 2428.92

1.031 Negative .15 +2.1%

Peerless Sell S15 on DJIA at 2480.71 on 5/1/2008

NASDAQ H/S neckline violation at 2394.01 on 7/17/2007.

Two warnings here: IP21 (Current AI) was under.151 and NASDAQ B10 was trying

to reverse operative S9s.)

> 11/16/2009 - There was a

simultaneous B10/S8 from old NASDAQ system here. So signals are nullified.

16 12/21/2009 2237.66 1.025

.194 +10.0% Reversed on 4/30/2010 by NASDAQ-Sell S6

Completed NASDAQ Head/Shoulders pattern

9/20/2010 2355.83 1.064 Positive

.273

Open

------------------------------------------------------------------------------------------------------------------------------------------------

13 CASES of NASDAQ B10s with IP21>,15.

Avg. Gain - 7.6% using Peerless Sells, NASDAQ S2s, S6s

and completed head and shouldrs patterns.

11 of 13 were profitable since 1987 when data starts

being available. .

===================================================================================

9/17/2010 Peerless Remains on A Buy. Short-Term Red Sells appeared

on Friday's QQQQ and SPY charts.

The Closing Powers for these are still rising. Until

the CLosing Power uptrends are broken or

we get a Peerless Sell, I would not sell these

or the DIA short. I would take more

profits in some of the most bullish stocks (Bullish MAXCP)

when their CLosing Power uptrends are

violated.

Indian, Chinese and

Emerging Markets remain strong, as do the internet-security

stocks.

. Watch bellwether Union Pacific for a bullish breakout

above a piggy back flat resistance. The

overseas markets are now lifting the US market

and economy, even if big banks won't make

loans to lots of American companies and

individuals.

The ratios of new highs to new lows on the NYSE is still bullish,

greater than 10:1. It is 141:11.

The NASDAQ's is much less bullish or

problematic. On Friday there were 57 new

highs

but also 21 new lows. The quality of the

new highs is of concern here. Our Tiger Data page shows

205 new highs, but only 60 are in the confirmed

new highs (NHCONF) set. Among the stocks

traded best with short-term stochastics

(STOCH5), there are 73 still on buys and buy 173 on sells.

A short-term pullback from resistance seems

likely. We will watch the internals of the market

if it pulls back to its 21-day ma to see if

this will be support. Usually without a Peerless Sell or

a head and shoulders top, declines are shallow

and brief.

BIOTECHS

The biotechs making new highs are of interest

as trades, as I explain below, even though their

strength may show traders are favoring biotechs

selectively. Only 3 of the 6 biotechs are making

confirmed new highs. That is a bearish

sign. We want to see a higher percentage of confirmed new highs.

ALKS Looks like a Sell. Red Sell, Negative current AI (IP21), CP

nearer new lows than new highs.

ATRC - thin but B10 B12 B20 and B24

CBLI - looks like a Sell. Red Sell, Negative current AI (IP21), CP

nearer new lows than new highs.

EXAS - high volume NH is not confirmed by IP21>.25 or Closing Power

making a new high.

ISLN - a runaway super stock. Illustrates TigerSoft's ideal in many ways.

SVNT -

Recent B10 B12 B20. CP is not yet at a new high.

Professionals mau have been surprised here.

MERGER MANIAs - A SIGN OF CORPORATE EXCESS AT A TOP?

The NASDAQ and QQQQ have been

out-performing the DJI since 9/3/2010. This is the

same day that the QQQQ closed back

above its 65-day ma and its Rel Strength Quotient Line

(QQQQ/DJI) broke its downtrend.

Where dividend plays were dominant, there has developed

among traders a keen sense of the

potential in take-over plays, especially in internet security

stocks. It is said that the big

corporations are gobbling up smaller companies with earnings

to make up for their own limited growth

and lack of willingness to invest directly in or expland their

core businesses. Perhaps. A

merger mania of sorts has clearly developed in a narrow group of

technology stocks. It really

started with the buy-out of McAfee (MFE) on August 19.

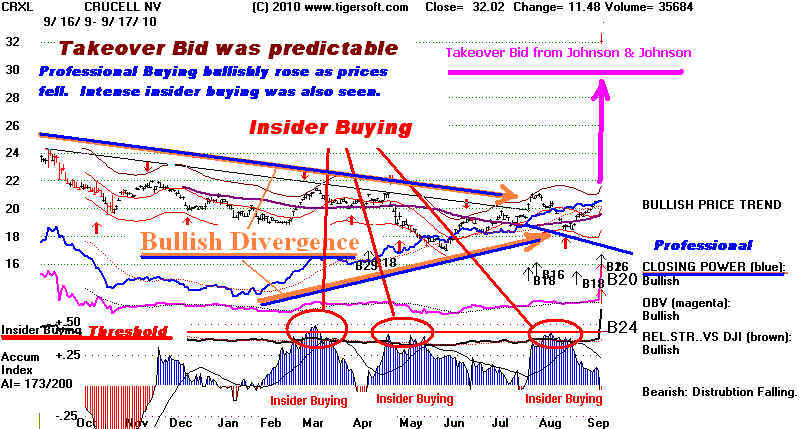

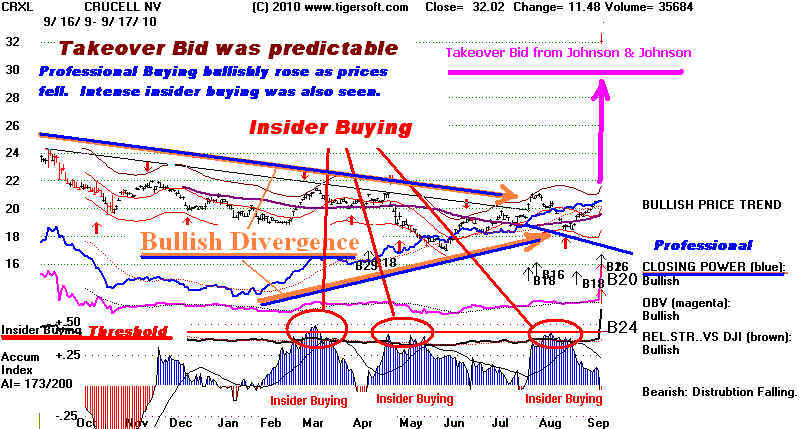

Tiger Insider Trading charts show when

such talk is heating up. There is some evidence

this takeover mania may spread to

biotechs. European CRXL jumped 55% on Friday on

Johnson and Johnson's bid.

How To Spot A Stock

about To Get A Takeover Bid

Will Biotechs Be The Next Big

Play for Take-Overs?

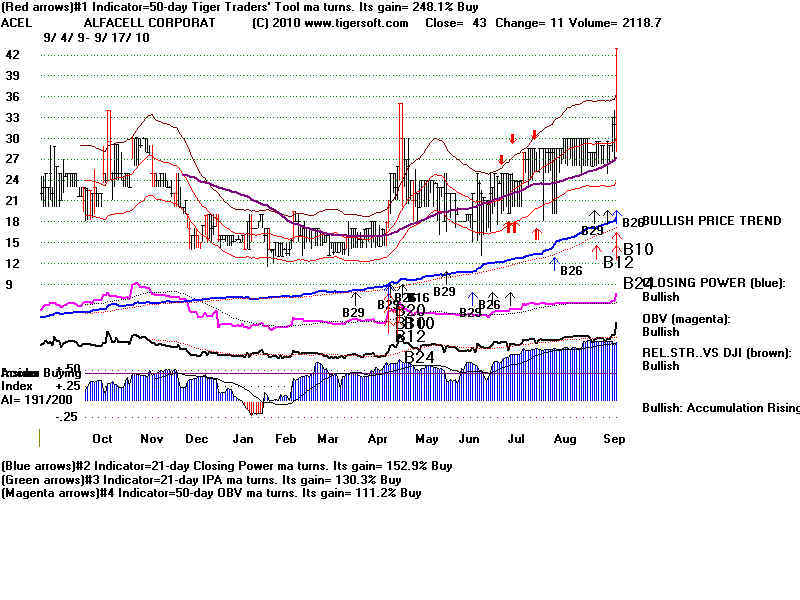

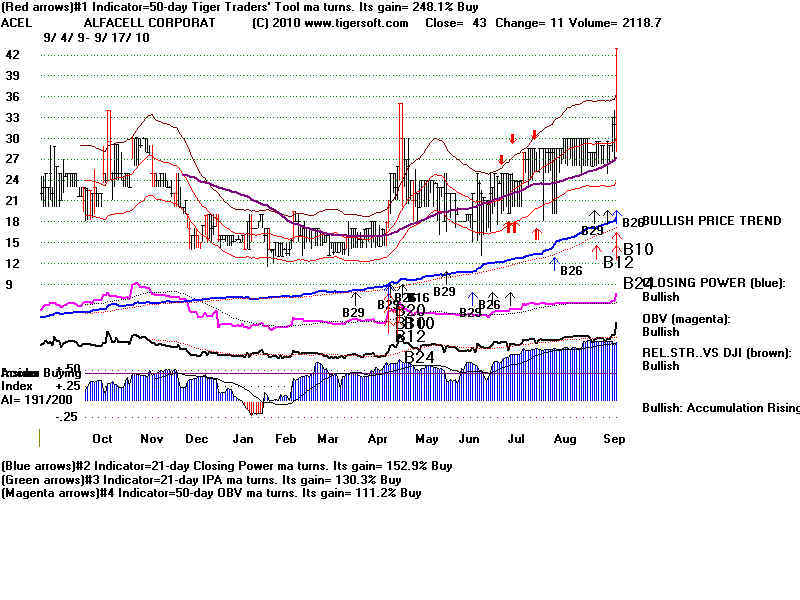

PENNY STOCK ACEL IS MOST

INTERESTING.

I searched our Biotechs for the stock

that most looks like the CRXL chart above, a classic

case of a buyout. ACEL seems the closest

parallel. I have multiplied the price data for ACEL

by 100 using the old Tiger program's EDIT

feature to let you better see its chart. I will

do this each night in the BIOTECH data.

As you can see, everything is great about ACEL,

except the fact that it is a penny stock that

is moving up late in the stock market's bullish cycle.

ACEL is now known as Tamir. Its website's announcements do look interesting. (I do not

own any of this stock. I do not know

anyone personally who owns it. And no one has paid

me to promote this stock.) This is apparently a pink sheet's stock. Yahoo Finance

does not cover it yet. You can get quotes

here:

http://quotes.nasdaq.com/asp/SummaryQuote.asp?symbol=ACEL&selected=ACEL

ACEL's Prices below are Pennies/Share.

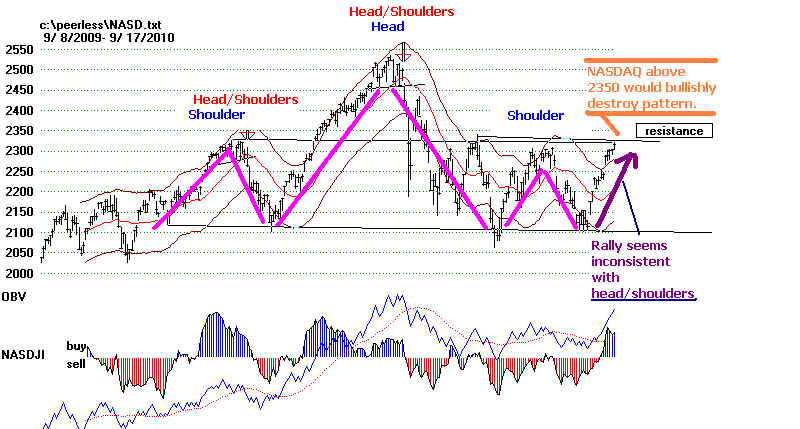

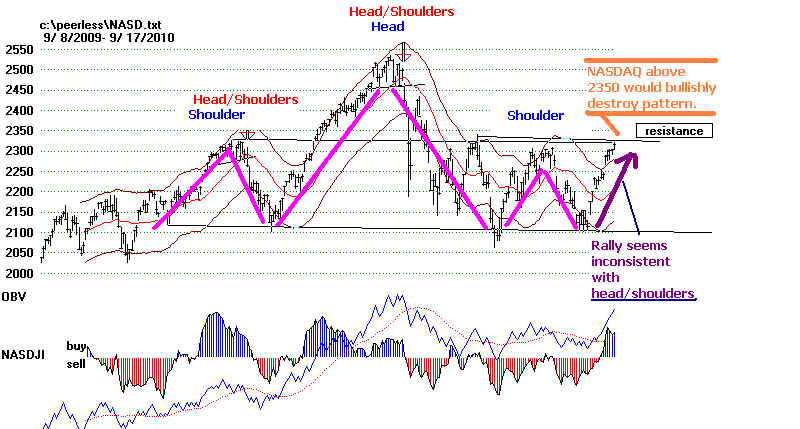

NASDAQ. "NASDJI" and Peerless

A NASDAQ move past 2350 would be very

bullish. It would destroy the head and shoulders

pattern even more conclusively than the

last rally. While the last two week's rally is inconsistent

with a symmetrical head and shoulders

pattern, there are many cases where there is not equality

in size or duration between the trading on left

side of the head with that on the right. So, the

NASDAQ's asymmetrical chart does not preclude a

decline. NASDAQ head/shoulders patterns

are actually uncommon. Tops in the

NASDAQ are best spotted with Peerless

Sell signals on the DJI and a NASDAQ "NASDJI" reading

that is negative at the time of the

Peerless Sell or down at least 70% from its

recent highs. More on this tomorrow.

NASDAQ

NASDAQ Tops since 1988

(Users choose:

Peercomm + Charts + Short-Term Indexes + User Choice + NASD89 -example)

10/10/1989 top before 15% decline. Perfect Peerless S9

on DJIA. NH but NASDJI was negative.

7/16/1990 top before 30% decline. Perfect

Peerless S9 on DJIA. NH but NASDJI was negative.

2/12/1990 top before 15% decline. Perfect

Peerless S9 on DJIA. NH but NASDJI was negative.

2/3/1994 top before 13% decline. Perfect

Peerless S4 on DJIA. NH but NASDJI was negative.

5/29/1994 top before 18% decline. Perfect

Peerless S1 on DJIA. NH but NASDJI down 75% from high.

10/7/1997 top before 13% decline. Peerless

S12s on DJIA. NH but NASDJI down 75% from high.

7/21/1998 top before 32% decline. Peerless

S9 on DJIA a week before.

Waiting for NASDJI to fall 75% from its high would have meant selling at 1881.

NASDAQ

did not bottom out until 1400.

7/16/1999 top before 13% decline. A Peerless S12 a month earlier but prices

rose from 2600 to 2864,

Waiting for NASDJI to fall 75% from its high would have meant selling at 2684.

NASDAQ

did not bottom out until 2490 two weeks later.

3/10/2000 top before 37% 2 mo. decline. No Peerless SELLon DJIA.

NH but NASDJI down 20% from high.

Waiting for NASDJI to fall 75% from its high would have meant selling at 4798.

NASDAQ

did not bottom out until 3100.

In the 2000-2003 NASDAQ bear market, selling short when NASDJI turned negative would have

worked fine.

Confirming this with negative readings from AI would have given more confidence in

short-selling.

>6/14/2001 NASDAQ Continuation Head/Shoulders at 2044. NASDAQ fell to 1420 low

in September.

1/21/2004 top before 13% decline. Peerless S9 on DJIA came two weeks later.

Waiting for NASDJI to fall 75%

from its high would have meant selling at 2014. NASDAQ did not bottom out until 1877

in May.

6/30/2004 top before 14% decline. No Peerless Sell on DJIA. Waiting for

NASDJI to fall 75% from its high

would have meant selling earlier on 6/14/2004 at 1970. NASDAQ did not bottom out

until 1752 in August.

1/3/2005 top before 13% decline. Perfect

Peerless Sell S8 on DJIA. NASDJI and NASDAQ AI were negative.

4/20/2006 top before 14% decline. Peerless Sell S9 on DJIA two weeks later. NASDJI was negative with S9.

Selling when NASDJI fell 75% from its recent high would have meant selling at 2330 on

April 25.

NASDAQ fell to 2100 in July.

7/19/2007 top before 12% decline. Perfect

Peerless Sell S9 on DJIA. NASDJI

was down 70% from its high.

10/5/2007 top before SEVERE decline. Peerless

Sell S4 on DJIA on 10/5/2007. NASDJI was negative when

S4 occurred. NASDAQ did rise 3 weeks long and show very

positive NASDJI, as it had in 2000.

|

==================================================================================

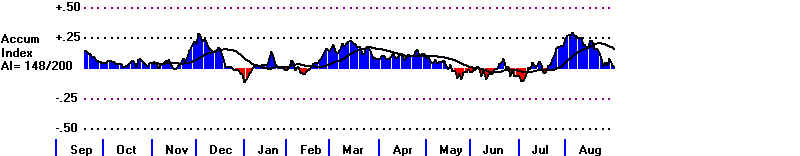

9/16/2010 Peerless Remains on A Buy. Short-term

Buys out-number Sells

above 7 to 4. MAXCP

Stocks Outnumber MINCP Syocks 5:1.

The Closing Powers and A/D Lines for the DJI, SP-500 and QQQQ are still

rising. This is

impressive since these

indexes have reached their resistance levels and seasonality

since 1965 is 67% bearish for

the DJIA over the next two weeks.

But, I have to note that

the A/D Line for the DJI failed to confirm the present advance today.

Though the DJI rose 22,

there were 475 more down than up on the NYSE. A/D Line

Non-Confirmations (NC) are

one of the most common characteristics seen at major tops.

In 20 of 25 cases of major

tops, This type of divergence nearly always sets up over a week

or more and is visually very

apparent if a big sell-off is in the offing. Look at my

study of all the major tops

since 1928,

http://www.tigersoftware.com/TigerBlogs/Sept-11-2010/index.html

The old Peerless did generate

a Sell S13 today. It works only 56% of the time

profitably from 1966 to 2000.

It occurs anytime the A/D Line did not

confirm a DJI new high.

This is designated as a AD-NC. I have tested this condition

tonight coupled with the DJI

being at least 2.85% over the 21-day ma, with the

IP21 at least -.072 and the

P-Indicator above +100 - which are all true conditions now.

The results show such a

signal is problematic since 1987. This is as far back as I

have tested it tonight.

While it improves the present 2010 Peerless system in 6 cases,

it is not as good in 7

cases. In 6 cases, it was significantly premature as a Sell.

As a result, these trades

were graded as "BAD" in the listing of its signals at the bottom

of today's hotline.

NYSE A/D Line NCs as MARKET PREDICTORS

WHAT TO DO.

If the A/D Line continues to

not confirm DJI advances it will certainly eventually set up a

bearish divergence. But

anyone looking at our back data will see that the A/D Line

can diverge for some time

before there is a big decline. The longer the divergence

lasts, usually the bigger the

subsequent decline. In such an advance, the

stocks that are still rising,

often go up the most in this environment. Hot performance

money is focusing on fewer

and fewer stocks.

In sum, I think

intermediate-term Peerless users should be long the major ETFs,

especially since both their

Opening and Closing Powers are now rising (a blow-off

bullish condition)

Short-term traders should probably be out of the DIA because

it gave a short-term red

Sell. The BOTHUP condition for QQQQ and SPY can be traded

on the long side, provided

you are quick and will sell if the CLosing Power uptrendlines

are broken.

BULLISH, BOTHUP MAXCP STOCKS

My preferred way to trade

this market, however, remains being long some of the

"BULLISH" MAXCP

stocks. These will have their Closing Powers making new highs

and show lots of blue

Accumulation. To hedge sell short some of the "BEARISH"

MINCP stocks.

BULLISH MAXCP STOCKS (205) on Red Buys with Current

AI>.25

Traders should also be

working with BOTHUP MAXCP stocks

like AKAM 52.26+.72 and TMRK 10.13 + .12.

CPV 25.68 +.43 dividend play.

AET 24.91 +.17 dividend

play.

TRE - Tanzanian Royalty

6.92 +.27 Above upper band and running as Gold/Copper stock.

FFIV - FS Networks.

This has not fallen below 65-da ma since February.

In hot internet security field.

GED - 25.56 +.24

dividend play.

NZ - 24.47 +.52

In hot internet security field.

DXB - 24.6 +.17

dividend play.

NTR - 9.47 +.17

NTCT 18.09

-.08 In hot internet security field.

BEARISH MINCP STOCKS (40) on Red Sells

ALJ 5.37 -.07

ECA 29.26 -.06

CFFN 24.99 -.20

PBCT 13.03 -.11

MGM 10.24 -.22

MKKD 5.93 -.13

AMAG 23.37 -.62

SHOULD A NEW A/D NC SELL BE USED?

HERE ARE RESULTS SINCE 1987

In 6 cases, it was significantly premature as a Sell and has been graded

as

"BAD" in red. In only one case,

would this signal have given a profitable new

set of trades.BAD 6/25/1987 2451.05 DJI rose to 2621 in August. There was a B4 that could

have cancelled this signal. No present signal here.

BAD 8/18/1989 2712.63 immediate pullback to 21-day ma and then rally

to upper band at 2799 in early October where a better S0 occurred.

BAD 7/13/1995 4727.48 immedate pullback to 21-day ma and then rally above

upper band. No present signal here.

SLIGHT IMPROVEMENT 2/23/1996 5630.49 immedate pullback to 21-day ma and

then rally above upper band in second half of 1996. Present system

gave Sell on 2/27/96 at 5549.

GOOD, NEW 7/24/1997 8116.93 immediate rally to 8220 and then DJI decline

below lower band to 7803. NOTE: There was no sell signal presently.

SLIGHT IMPROVEMENT 7/14/1998 9245.54 immediate decline of 20%.

NOTE: There was an earlier sell S9/S12 signal presently at 9085.

GOOD,NEW 11/19/1998 9056.05 immediate rally to 9374.26 and then decline to

8695.60 a month later. There was no sell signal presently.

BETTER 7/12/1999 11200.98 immediate decline to 10655 and lower band in 3 weeks.

Current system gives a Sell S12 on 10856.

BAD 11/16/1999 10932 immediate rally to 11722.87 and then decline to 9800.

Present signals did better here giving a Sell S9 at 11476.

SIMILAR 1/9/2003 8776 immediate decline to 7600 in two months. Present program

gave S12 at same top.

BAD 12/16/2004 10130 immediate rally to 10694 amd then decline to 10063.

Present Peerless signals did a better job here giving S8 at 10854 on

12/28/2004.

BAD 4/26/2007 13105 immediate rally to 14000 three months later.

Present Peerless signals did a better job here giving S9 at 13972 on

7/17/2007.

NOT AS GOOD 9/21/2007 13820 immediate rally to 14165 and then decline to 12600.

Present Peerless signals did a better job here giving S4 at 14066 on

10/5/2007.

SIMILAR 6/5/2009 8763 immediate decline to lower band at 6323 in 3 weeks.

Present program gave a simultaneous S8.

BETTER 10/15/2009 10063 immediate decline to rising 21-day ma and then rally.

Present program gave a Sell S8 at 9949.

--------------------------------------------------------------------------------

15 cases 7 instances gave bad trading results,

|

==============================================================

9/15/2010 Peerless Remains on A Buy

but DJI and other indexes

are at resistance. With volume low, the DIA on a Sell and the

bearish seasonaility ahead for the next two weeks, take some

profits. Because the Closing Powers are in uptrends for the

ETFs, no short-term short-sales are recommended. Intermediate-

term investors should wait for a Peerless Sell of a break in the

NYSE uptrendline.

Reviewing the "BULLISH" MAXCP (205) stocks comes up

with these

stocks showing heavy BLUE Accumulation and a

CLosing Power

that is leading prices to new highs.

Reviewing the "BEARISH" MINCP (43)

stocks comes up with these

stocks showing heavy RED distribution and a

CLosing Power

that is leading prices towards new

lows.

=============================================================

9/14/2010 Peerless Remains on A

Buy.

The

DIA has given a 20-day Stochastic Sell today. This is the optimum trading system

for the last year for the DIA. As it has

gained +52.5% buying and selling short, it should

respected I think by traders. Peerless is

intermediate-term. The Red Down-Arrow represents

a short-term Sell. In this situation,

I would look for the DIA to retreat only a little. BOTH

Opening and CLosing Powers are still rising.

Shorter-term, traders who want to go short the

DIA should wait, at least for the Red 20-day

Stochastic Down-Arrow Sell to be clinched by

having the Closing Power uptrend be violated.

This sacrifices little usually and makes for a

higher rate of successful trades. See rules for this

here.

If the DJI moves past

10700, the head and shoulders pattern will be largely destroyed and

that will force considerable short-covering.

The rising A/D Line is certainly bullish, but the low

trading volume, low level of the Tiger

Accumulation Index on the rally and the September-

October seasonality remains bearish.

The DJI has risen only 33% of the time since 1965

over the next two weeks. It rises only

48.7% of the time over the next month in this period.

If Gold keeps rallying, it will put pressure on

the Dollar and thereby add to inflationary fears that

central bankers and the FED always have.

The Dollar fell sharply today and completed a

bearish continuation head and shoulders.

Its Closing Power has bearishly broken its uptrend.

For now interest rates are falling. But

continued eakness in the Dollar and strength in Gold

and Japanese Yen will pose problems for the

FED, low interest rates and the stock market rally..

See notes above. DIA is now

on a short-term Sell. Although

Peerless is still on a Buy, we have

to be concerned about Gold

rising steeply, as this is usually

bearish for the general market

AND the big splashy jumps in some

of the internet security stocks.

This shows an emotional extreme and

an over-bought condition

developing.

Gold and Silver - Important New Highs

Gold Shows More Accumulation and Professional Buying.

GLD, SLV, TRE, NEM, IVN and AXU are

likely to move much higher.

The minimum upside target for GLD

is 130. Precious metals

often become hyperbolic as the

public starts buying. Each of

these and the silver stocks (PAAS

and SSRI) have BOTH

a rising OPENING and CLOSING Power.

This often leads to

big advances.

Make Money from Merger Manias

http://www.tigersoft.com/HOW-TO-SPOT-A-BUYOUT/index.htm

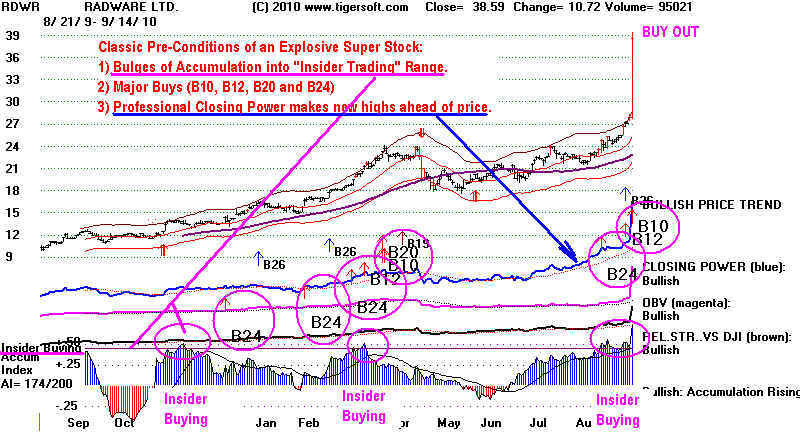

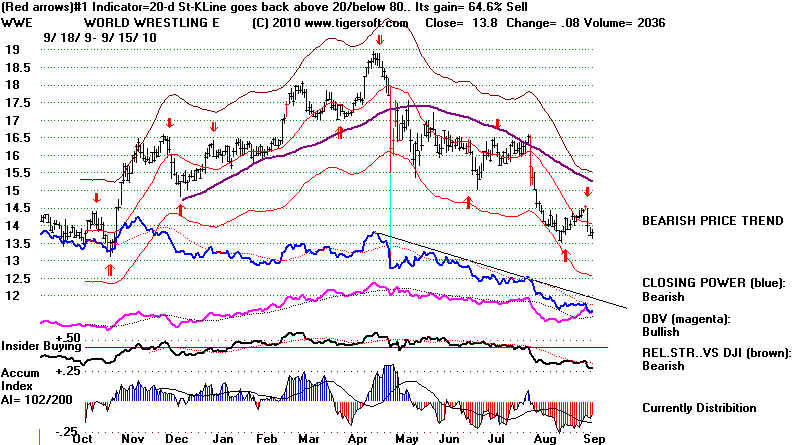

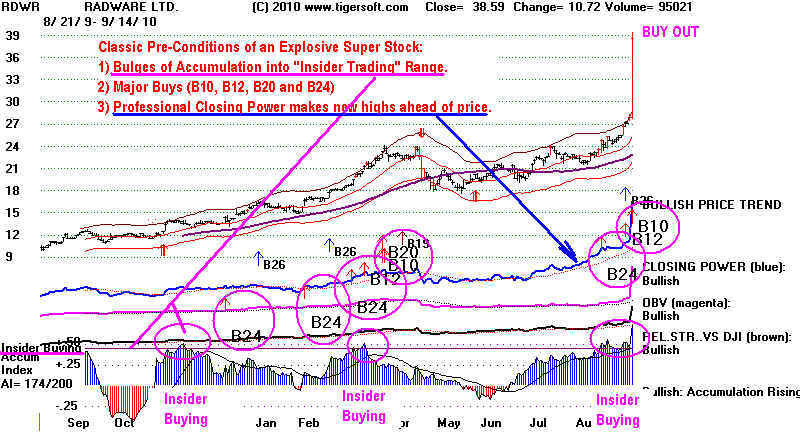

9/14/2010 Example -

IBM

or HP to Buy Radware: Report at TheStreet.com(Tues, Sep 14)

Previously Recommended RDWR + 25% Today.

===============================================================

9/13/2010 Peerless Remains on

A Buy. CLosing Powers Are Still

Rising and the QQQQ, SPY, DIA and IWM Are

on Still on Buys. With

their OPening Powers still rising, too,

the strength shown has

to be respected. Tiger's NASDAQ's

relative strength "NASDJI"

Indicator has turned positive, showing

the NASDAQ is outperforming

the DJI. IWM is too strong to hold

short, even as a hedge.

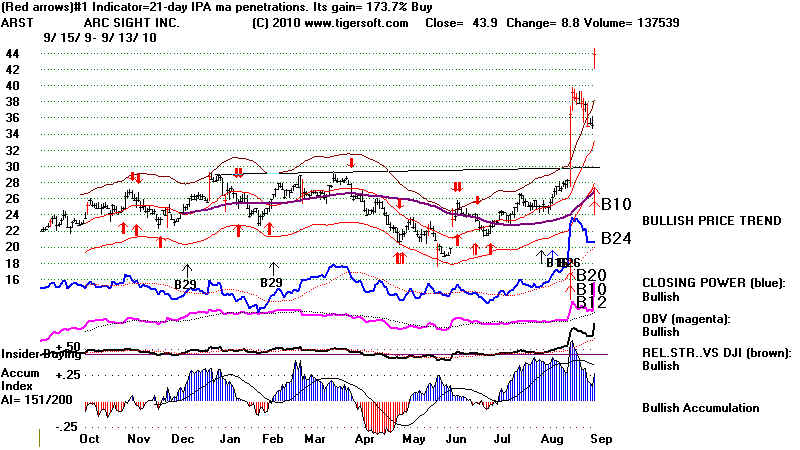

Watch to see if more of the High Techs

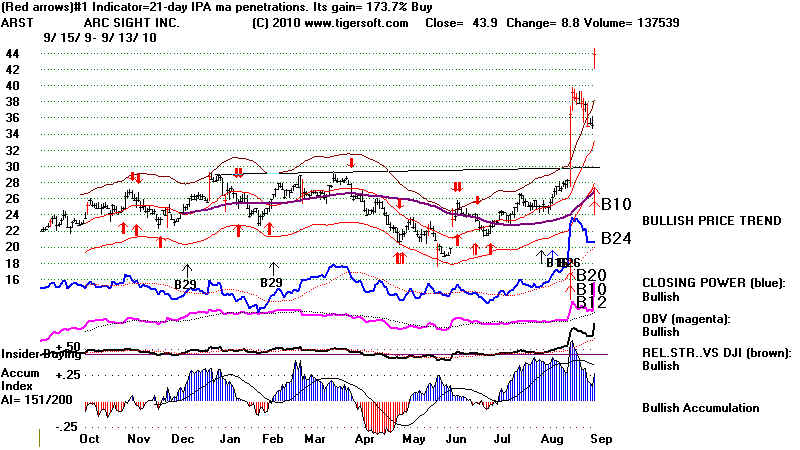

we mentioned are bid

for as a buy-out, like ARST was today by

HPQ...The bearish head and

shoulders pattern appears to breaking

down as the A/D Line

lifts prices to the edge of a breakout

past 10650.

The DJI is approaching the 10650

resistance we have mentioned.

Will there be a reversal? The DJI

closed 2.7% over the 21-day ma

with the current Accumulation Index

(IP21) only standing at +.041.

This shows distribution. In a

rising market, this combination would

have only minor significance. But

if we are still in a trading range,

and that is what the multiple head and

shoulders patterns warn,

and the low volume and bearish

seasonality also suggest, then we

should soon see a regular Peerless Sell

signal and a reversal

downwards. But we have no Peerless

sell yet.

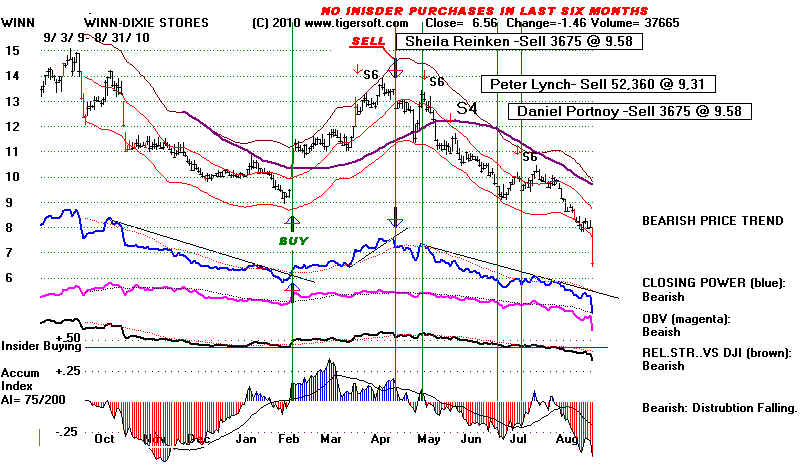

The lastest statistics on Insider Buying

and Selling show this

is not a rally for long-term investors:

"According to Bloomberg,

for the week ended September 10,

corporate insiders bought $0.5MM in shares in 4 different companies. This was

offset by sales of $332MM in 72 different companies, a ratio of 651 of sellers to

buyers."

(Source.)

The rallly

today has been attributed to

(1) Warren

Buffet's bullishness (which cynics would say is what one would expect him to say

on behalf

of his own investments),

(2) HP's

bid for ArcSight

and

(3)

bankers giving themselves 9 years to get financially sound. Finance Stocks Chart

This

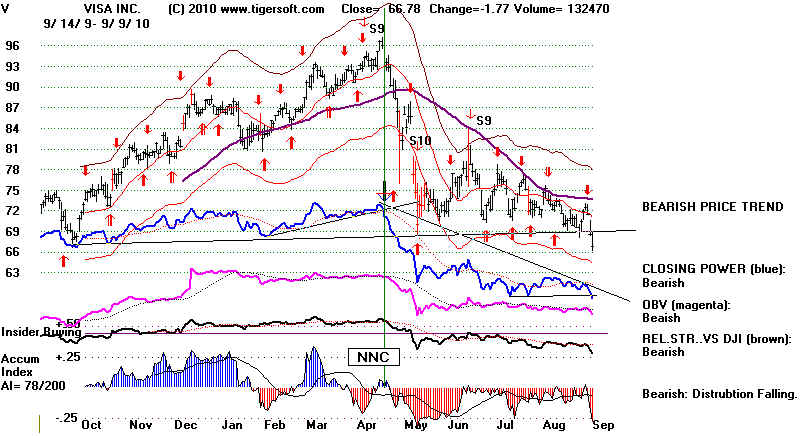

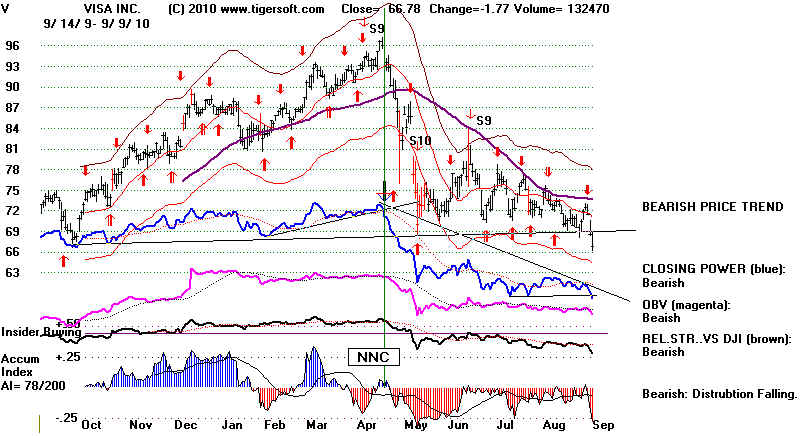

ignores the new 12-month low made today by weak-looking Visa (V)

What is

missing most in the discussion is the evidence that many of the world market's are

advancing

strongly and multinationals are going along for the ride. As investors, we have to

see

that we are

in a global market now. American jobs and prosperity are not synonymous with a

rising

stock market. Average Americans are not superfluous yet, but that's the trend.

The ease

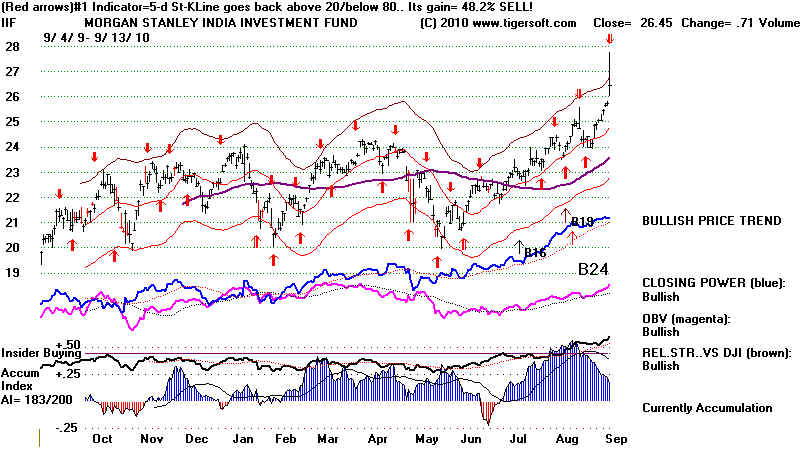

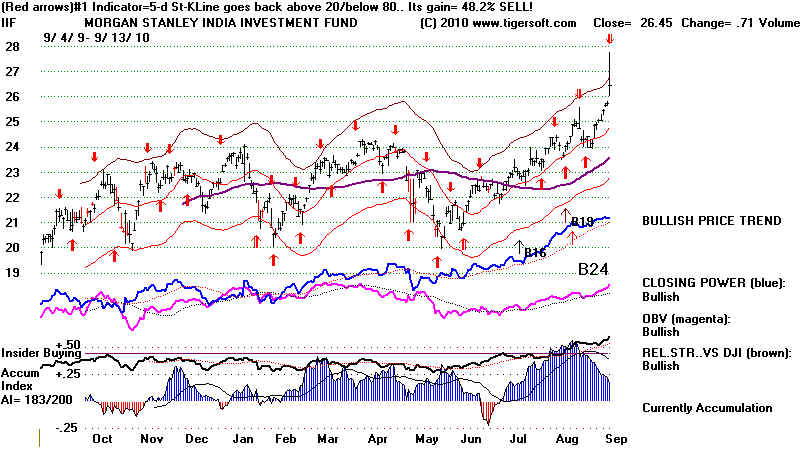

with which

American investors can now bet on the strong Indian market, for example, shows how

global the

markets have become and how and how and why hot money has come to consider America

a

"backwater"now. This is the inevitable result of "free"

international trade, something

which

Clinton, Rubin and now Obama and the University of Chicago "free traders" have

brought

to pass.

A part of me - my stomach - is very happy about globalization. Having grown

up in Ohio

when manufacturing was very big, I lament these loss of jobs now and wish Obama

was not so

dependent upon the thinking of the University of Chicago amd that he would

show some

originality courage, pugnacity and do more to promote jobs here.

Internationalism does bring some real benefits to American consumers, of course, just like

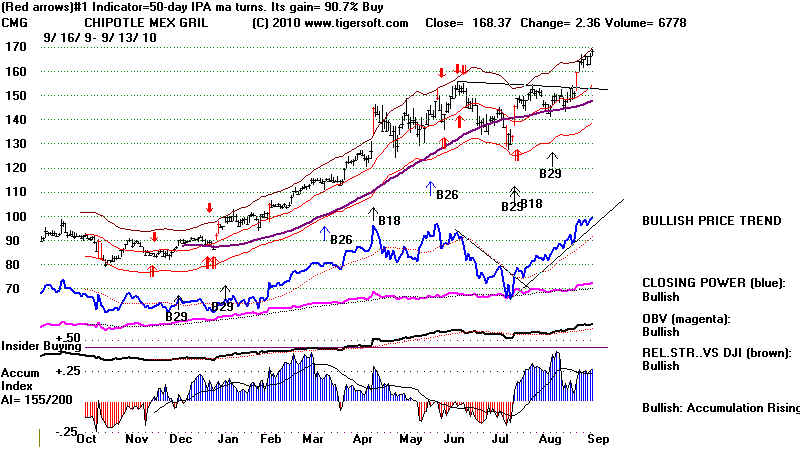

immigration

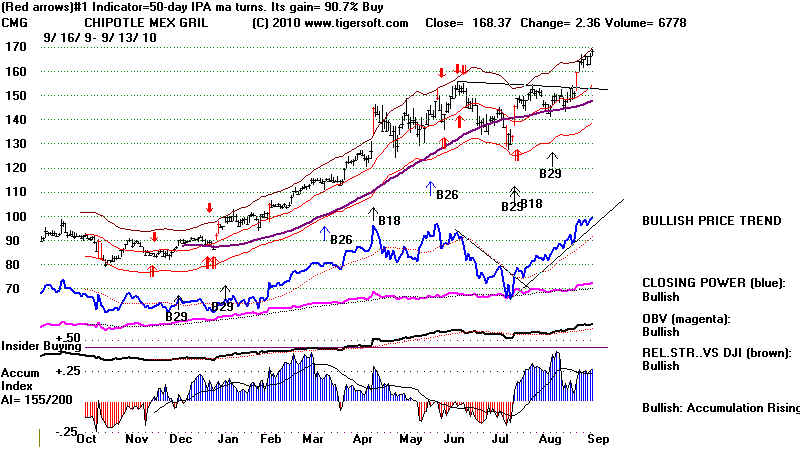

does. For example, have any of you tried the spicy chicken at Chipotle's Mexican

Restaurant

(XMG)? Gourmet at fast-food prices. The stock is cooking!

Chipotle's (CMG) Great Food and

Modest Prices.

11/23/2008

An unsolicited

testimonial from a hungry Tiger

TIGER TRANSPORTATION INDEX

and KEY TRANSORTATION STOCKS

BNI's ONLY RR COMPETITOR - UNP

--------------------------------------------------------------------------------------------------------------------------

ATTRACTIVE TRANSPORTATION-INDUSTRY,

CONFIRMED BREAKOUT - BEAV

|

INTERNET SECURITY STOCK #2 BUYOUT (#1 was MFE)

HP's BID FOR ARST WAS BEHIND ITS RECENT MAJOR TIGER BUYS.

Others in the general area are now distinct takeover possibilities:

ARST, BMC, CTXS, FFIV, MIPS, NTAP, NTCT, RDWR, RHT

and RVBD.

Deal-makers are being fed lots of ammunition now to promote these stocks.

These were picked out here two weeks ago using the "Bullish" screen

of MAXCP stocks.

|

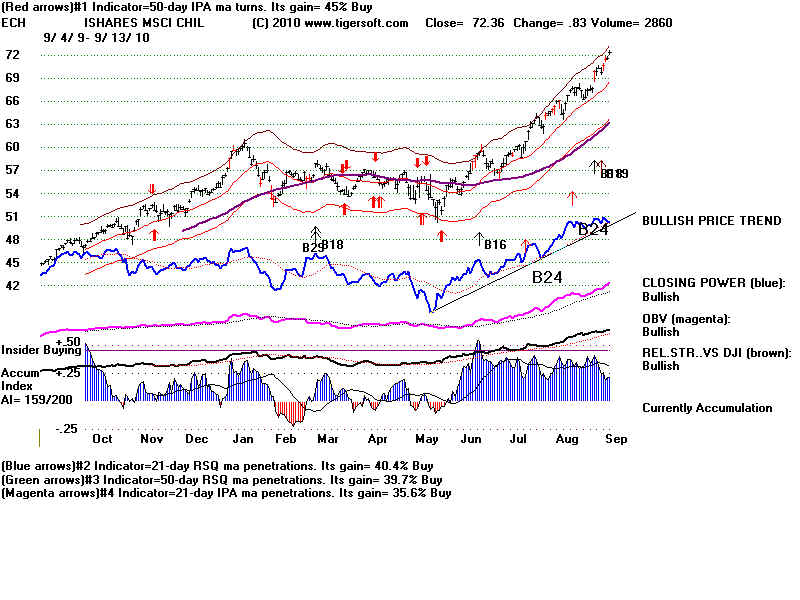

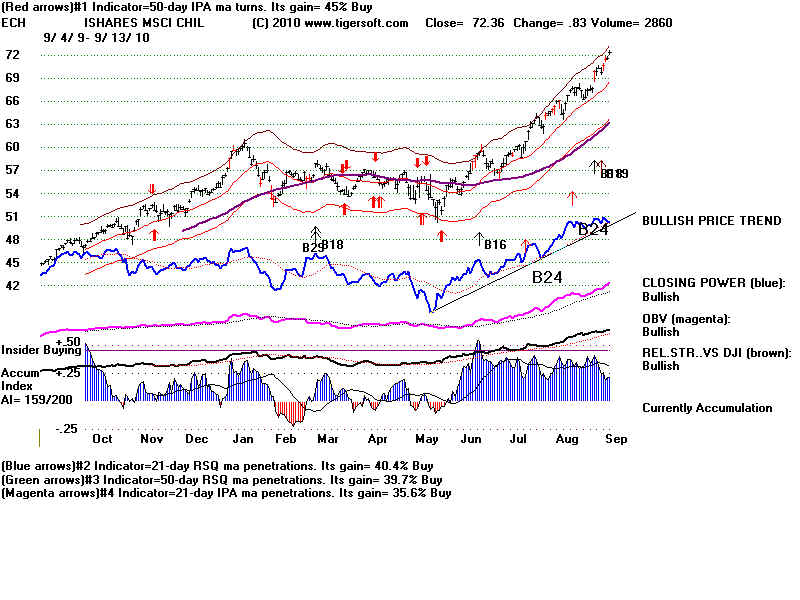

"BULLISH" COUNTRY FUNDS:

INDIA

CHILE

|

============================================================

9/10/2010 Peerless Remains on

A Buy. CLosing Powers Are Still

Rising and the QQQQ, SPY and DIA Are on

Still on Buys. Breadth

Improved Friday. Both the Opening

and CLosing Powers Are

Rising for SPY. This is normally

bullish.

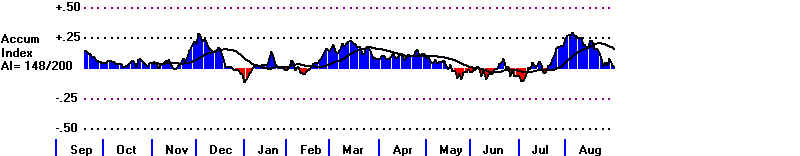

So far on the rally since March 2009, the NYSE A/D

Line has hardly lagged the DJI

at any time

and actually made a new high ahead of prices. In rising this week,

it is

shrugging off the rise in interest rates that has started,

In all

this, the NYSE A/D Line has correctly presaged higher prices, while the lagging

trading

volume has not had its usual bearish effect. Will the DJI and the other indexes

continue to

follow the A/D Line and themselves make new highs? It is highly unusual

for a major

top to occur in these circumstances. Look at the study I have just completed

of all the

major tops since 1928,

http://www.tigersoftware.com/TigerBlogs/Sept-11-2010/index.html

In 20 of

the 24 cases when a major DJIA top was made, the NYSE A/D Line failed to

confirm the

final high. Many times, the divergence was a small one, in that it developed

only in the

last month of the DJI's final rise. Unfortunately, we can't build a Sell

based on

A/D Line NCs. Such non-confirmations are too common to use them alone

to predict

a bear market. But their absence is generally reliably bullish. Looking at

the 4 cases

when the A/D Line confirmed what turned out to be a major final top,

we see head

and shoulders patterns were warnings in 2 two cases. In the third

case, 1969,

Sell S9s were produced on the first rally back towards the final highs.

In the

fourth case, only when the DJI fell more than 12% from its highs, did the

NYSE A/D

Line break down.

The cases

where the A/D Line remained strong were:

5/29/46 Earlier S9 and H&S

12/2/69 S1...later S9

9/21/76 Later S8

5/21/01 Earlier S9 and earlier S12. H&S

I think

this means that we just have to wait for a Peerless Sell at this juncture.

We are long

DIA and some bullish MAXCP stocks and short IWM as well a

handful of

bearish MINCP stocks. That seems to be working. So, stick with

this

scheme.

Tonight's

review of all stocks for the Elite Stock Professional Page could

not find

much to recommend buying. Most of the bullish stocks were dividend

plays which

I fear are very overbought now. VRNT, TRE and RDWR, which

have been

recommended here, do still like holds. Foreign stocks are also

leaders.

New highs with IP21>.25, AI/200>140 and CP at new highs.

ABV - Comp. de Beba - 115.34

ARMH - Arm Holdings ADS - 18.55

ECH - Ishares Chile 71.53

It is on

the short side that I can find a number of new trades from the new bearish

MINCP

stocks:

BEARISH

MINCP STOCKS TO CONSIDER FOR NEW SHORTING:

CFFN 25.25 -.08

COMV 6.2 -.27

CSKI 6.57 -.23

UNTD 5.15 +.10

CRK 20.9 -.03

CHBT 10.57 +.50

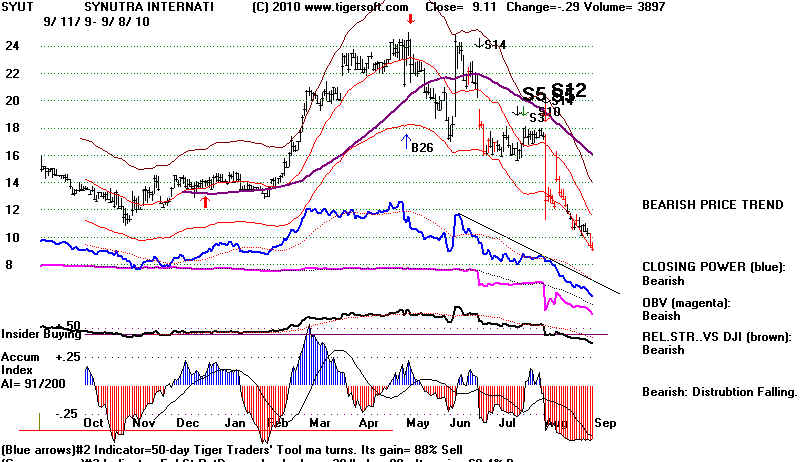

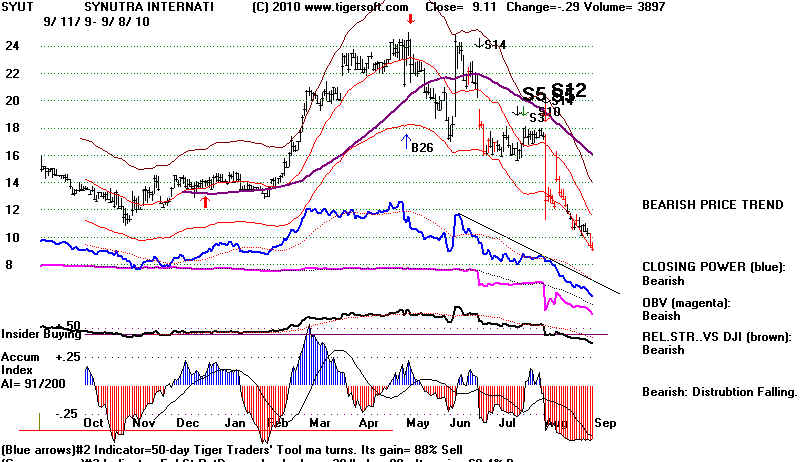

SYUT 9.15 -.16

PNEP 8.67 -.17

SWN 33.37 -.43

AMAG 25.19 -.04

9/10/2010

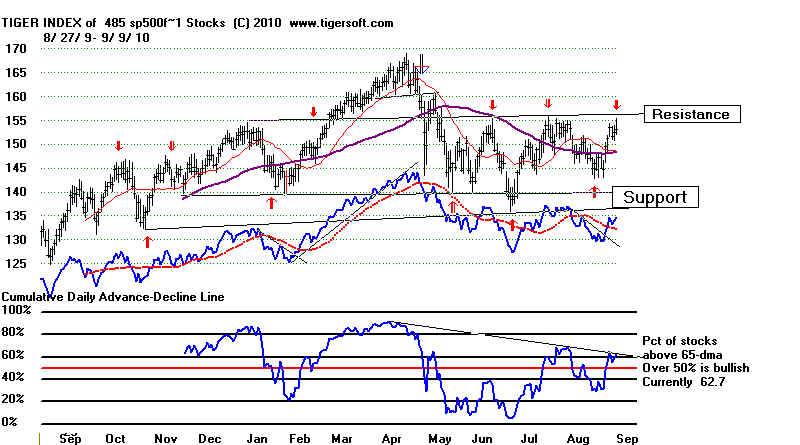

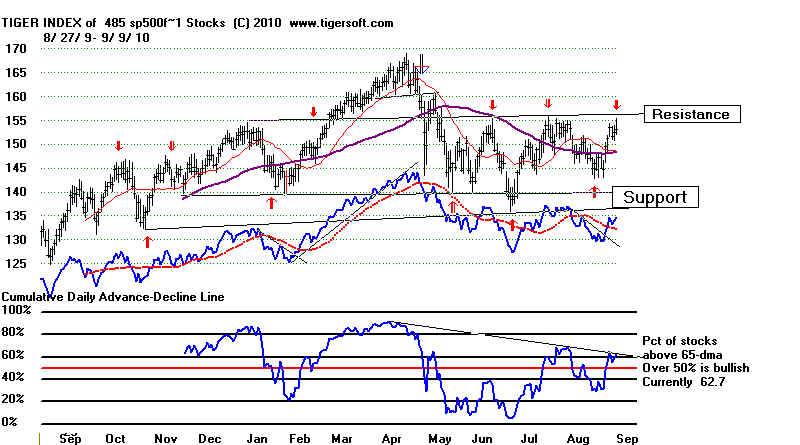

The major market indexes are close to resistance, especially the SPY and the

Tiger

Index of SP-500 stocks. See their charts just below. This means they are close

to a

high

inflection point, where after an upside breakout, a spirited advance is possible, OR if

there

is a

downward reversal, there will be a sharp sell-off.

|

============================================================

9/9/2010 Peerless Remains on

A Buy. CLosing Powers Are Still

Rising and the QQQQ,

SPY and DIA Are on Still on Buys.

But, IWM - the Russell-2000 - has given a new Sell, its

Accumulation Index is

negative and another down day will

likely break the

uptrend of its rising Closing Power.

More dangerously, if the DJI were to have its theoretical high spike

up another 100 points

with the internal readings we see today,

we would get a Sell

S12. And now that the K-Lines of the Stochastic-

20 are above 80, we may

get an automatic red sell in the DIA

in the next day or two.

It

has to be bearish that Master Card (MA) and Visa (V) broke to

confirmed 12

month lows today. MA's chart is shown below and

and V's is at the

bottom of this date's hotline further below.

Master Card (MA) Is Breaking Down.

Rising interest rates may be the trigger that sets this off. See the new

red Up-Arrow in the

chart of the 10-Year Treasuries below.

- TNA Ten Year Treasury

Watch to see how the SP-500

stocks behave over the

next few trading days. They

are just below well-tested resistance.

At the same time, we now see a red

Stochastic Sell from the

optimum trading system.

Tiger Index of SP-500 Stocks with A/ D Line

Princeton's Paul

Krugman now believes a new Depression is

all but unavoidable

because Obama will not support a massive

public works program

and by talking about budget balancing

in the middle of a deep

recession he is making the same mistake

that FDR did in 1937.

The A/D Line is much stronger now.

Interest rates are much

lower. But since banks are not making

more loans, will

monetary policy make the difference as

Bernanke and Obama

think and Friedman thought.

Monetary policy is not

only limited by business and consumer

demand, it is also

subject to international forces outside its

control. What

would happen if China starts selling some of its

Treasury bonds to

remind the US that it (China) has the

upper hand when it

comes to its trade and currency policies?

See - my 9/9/2010

comments at

http://www.tigersoftware.com/news_updates_to_tigersoft_blogs_.htm

In the past, Krugman has also been very critical of the

hold the

University of Chicago's

laissez-faire economic thinking has

over Obama, Axelrod and

Emmanuel. This influence lies behind,

for example, Obama's

pointed refusal to say he would veto extension of

Bush tax cuts for

the wealthy. Obama wants to keep the stock market

moving higher. If

the very wealthy are taxed, they will sell stocks.

Unlike FDR who savored advisers with different viewpoints, Obama

has surrounded himself

with very like-minded Chicago school economists.

They all celebrate and

protect the general status quo. They blame government

for the Crashes of

1929-1932, 1937-1938 and 2007-2009. Progressive and

populist critics of

Obama's economic policies do not understand this source

for Obama's rigid

adherence to laissez-faire views on health care, Wall Street banking,

social inequalities and

exorbitant CEO pay. They do not detect the U of Chicago's

dogmatic anti-Keynesian

resistance to the potential role government could play

in creating jobs and

promoting a business revival...

BEARISH MINCP STOCKS

HAWK 7.61 still on a Red Buy.

ALNY 14.16 Distribution, on red Sell...Declining Closing Power. (looks like a short

sale to me.)

KNDL 8.36 On Red Buy, but heavy Distribution and falling CLosing Power.

CFFN 25.33 -.15 Very weak but thin...

COMV 6.47 +.02 Distribution, on red Sell...Declining Closing Power.

Visa (V) 93.61 Serious

breakdown. Sell Short.

==============================================================

HOTLINE

9/8/2010

Peerless Remains on A Buy. CLosing Powers Are Still

Rising. The QQQQ,

SPY and DIA Are on Still on Buys.

You can see the

internals of the market are weakening, other

than the NYSE A/D

Line, whose strength owes to the very low

interest rares.

The NASDAQ shows only 40 new highs and 20

new lows, while the

same numbers are 113 and 7.

The DJI is 1.2% over

the 21-day ma with the P-Indicator at -16 and

Accum. Index is only

+.01. The V-Indicator is -128 and the

OPct is -.104.

Right shoulder apexes in head and shoulders

patterns ordinarily

have low volume. The last two days' volume

is the lowest since

last December. Breadth was good today,

but it did not make up

for Monday's weakness. If the DJI's

hypothetical high was

to jump by 200 points, with no changes

in the internals, we

would get a major Sell. Of course, that

has not occurred yet

and may not, but we should be ready to

reverse to a Sell.

Hedging by being long DIA and and some

of the bullish MAXCP

stocks and short IWM and some of the

bearish MINCP stocks is

recommended.

The multiple head and

shoulders patterns are worrisome,

as is the bearish

September seasonality and Gold's strength

now. A

rally in Gold and Silver often warn of a coming general

market

decline. Both close to making new highs.

Perpetual Contract of

Gold

Perpetual Contract of

Silver

Bullish MAXCP Stocks

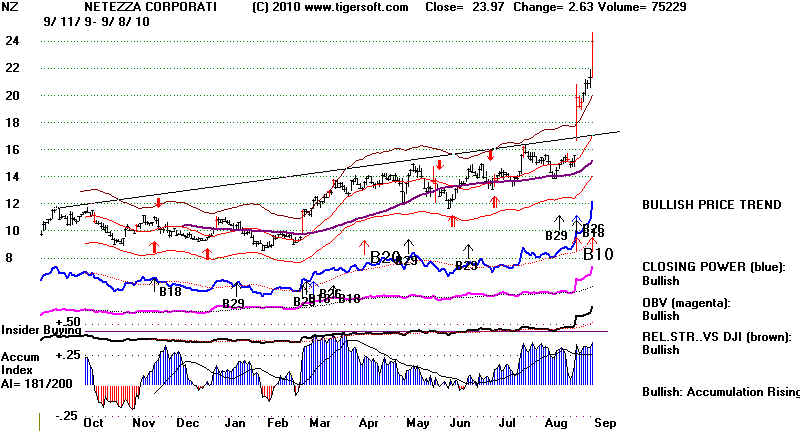

VMW +1.3 FFIV +3.59 VRNT +.88 NZ +2.63

Verint Systems Inc. provides actionable intelligence solutions and

value-added services worldwide.

Its solutions capture, distill, and analyze underused information sources, such as voice,

video, and unstructured text.

42 is all-time high.

Netezza Corporation provides data

warehouse, analytic, and monitoring appliances

to enterprises, mid-market companies, and government agencies in the United States

and internationally. It offers TwinFintm and Skimmertm data warehouse products, which

integrate database, server, and storage platforms in purpose-built units to enable queries

and analyses on stored data. 17

was an all-time high.

Bearish MINCP Stocks

COMV

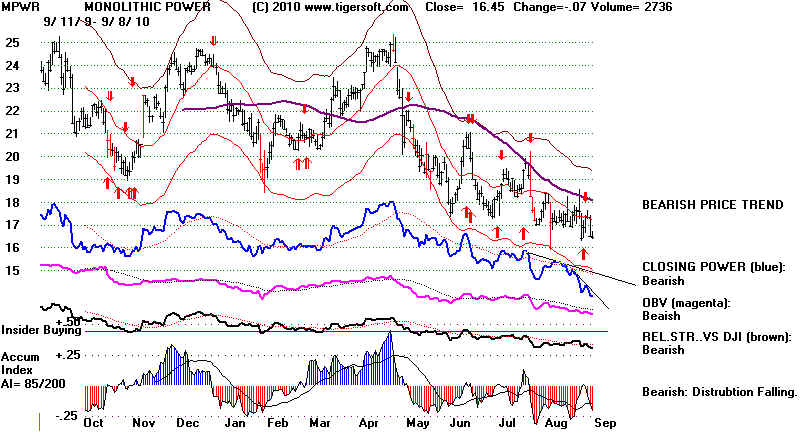

MPWR

SYUT

============================================================

9/7/2010 Peerless Remains on A Buy. CLosing Powers Are Still

Rising. The QQQQ,

SPY and DIA Are on Still on Buys.

The DJI rallies only

43.6% of the time since 1965 over the

next 21 trading days

and in bi-elections years since 1918, the

DJI has risen in 8

Septembers but falled in 23 cases.

It still seems a good

time to be hedged. The IWM (Russell-2000)

has given a Sell.

Sell it short while holding long the DIA, which

remains on a Buy.

The bullish MAXCP stocks that are not dividend

plays should

out-perform the bearish MINCP stocks. A number of

short sale candidates

are shown below from the "bearish" MINCP

stocks

Bullish MAXCP (149)

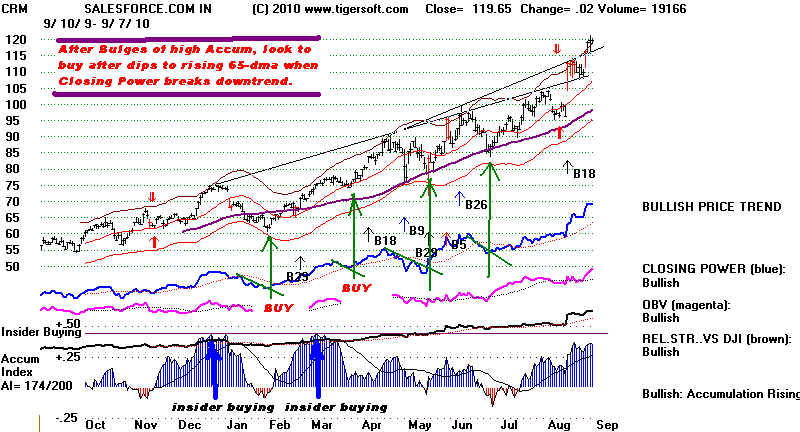

VMW, VOD, VGR, NZ, EZCH, EW, VRX,

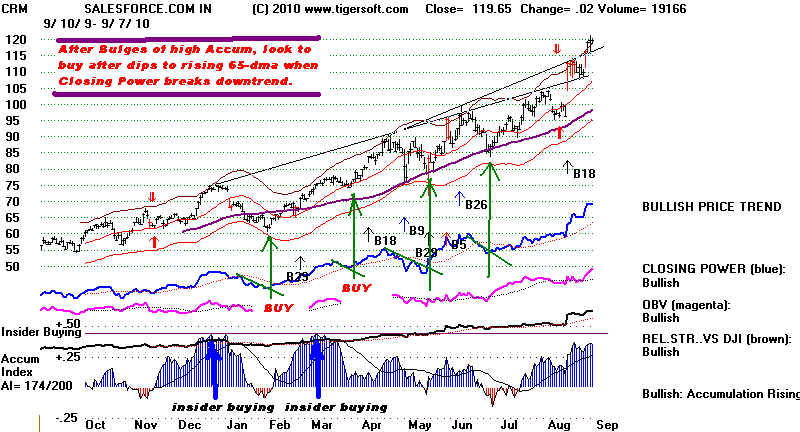

TRE, CRM, FFIV and AZO

Stocks that have not broken their 65-day ma for 7 months have trapped a lot of

shorts and tend to jump with each new high as many are forced to quickly cover.

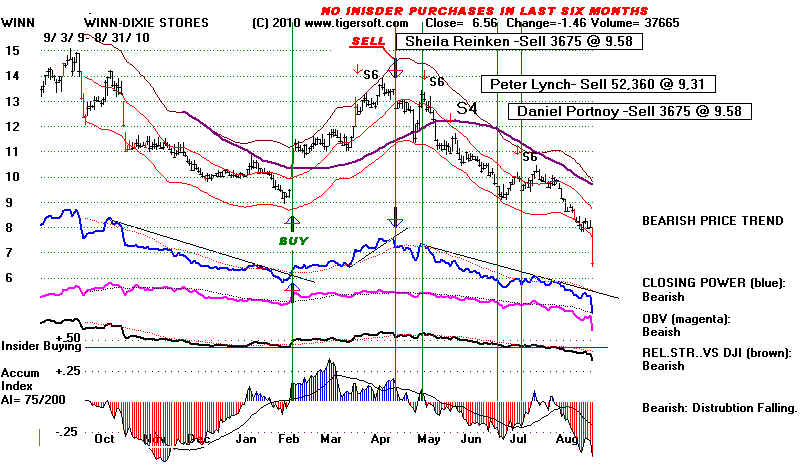

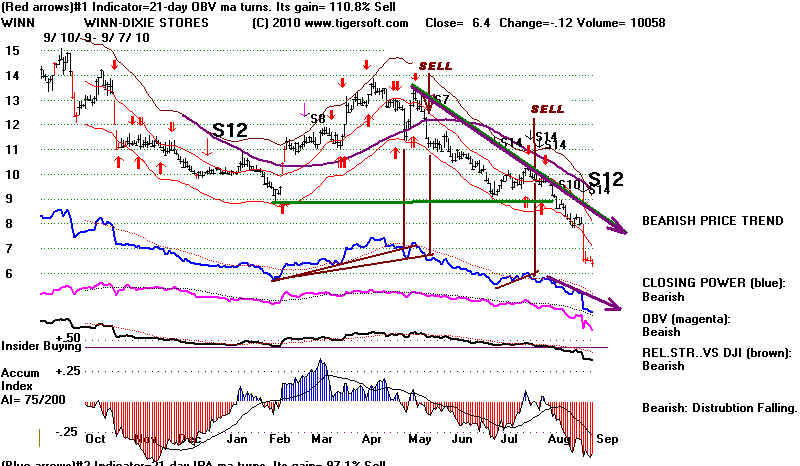

Bearish MINCP

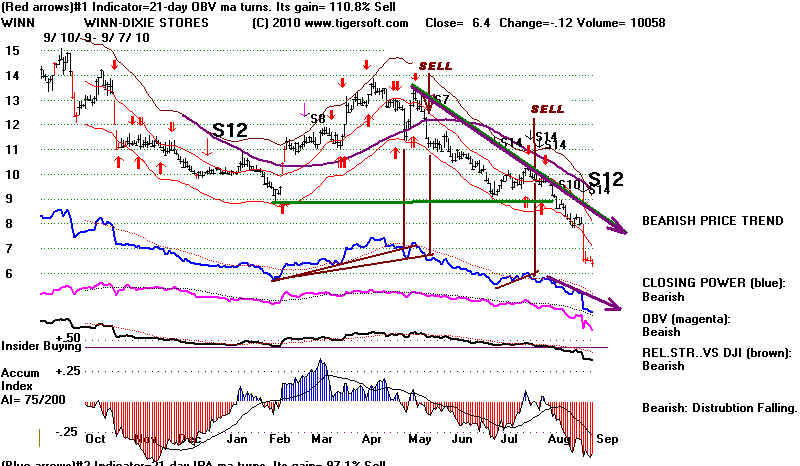

HAWK, BAMM, WINN, CFFN, KNDL, COMV, TKLC,

CSKI, CHBT, ROCM, MPWR, and IVAC

Stochastic Red Sells

among Stochastic-5 Stocks

with Negative

Accumulation and Below 65-dma:

AAON, ATI, ATSG, BCRX, BOOM, CIR, STP. UEPI

and NWPX

===============================================================

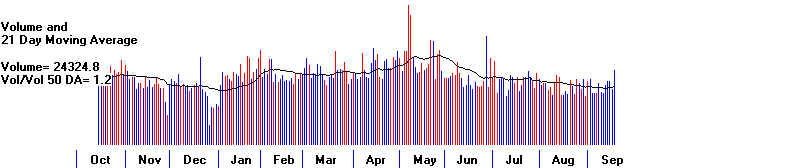

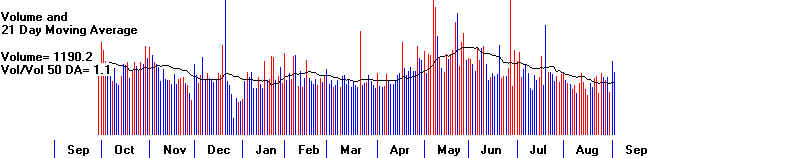

9/3/2010

Rally within Trading Range Towards Resistance

at Upper Band at 10650.

But Volume was pathetic on the rally.

This and Bearishness of

Septembers Are Warnings. Watch

for Breaks in Closing

Powers' Uptrends and A/D Lines' Uptrends.

Hedge with New Short Sales?

Weakness Tuesday Would

Likely Bring Automatic Red Sells

from Many Stocks Traded

Best with 5-Day Stochastics.

New Red Sells in this

group from stocks below their

65-day ma with negative

Accum. Index are: ACOR and HMA.

For potential short

sales, we will be looking at Sell S9s in

individual stocks where

the CLosing Power uptrend is violated.

Rising Rates?

The very good breadth

has again saved the market from

medicore up-day volume

and the bearish head and shoulders

patterns. Since

the good breadth has been based on the

very low interest

rates, we have to ask what would happen if

interest rates start to

rise. Would the Fed do that before

the November Elections?

Volcker raised rates in 1978 and

caused a mini-panic.

Watch rates.

Septembers were bearish in 15 of the 23 years when there

was a Congressional

Election but no Presidential Election.

Octobers are the months

most often to bring a turn-around.

Only 9 of these

Octobers were down. Decembers in these

years bring automatic

Buys on weakness because of the

overwhelming tendency

for a rally from December lows

after mid-term

Elections.

MID-TERM ELECTION YEARS DJIA Performances in September, October, November and December

in Even Numbered Years between Presidential Elections

last day Last day last day last day last day Change in

in Aug in Sept in Oct. in Nov. in Dec. Last 4 Months

---------------------------------------------------------------------------------------------------

1918 82.70 84.70 85.50 80.90 82.20 DOWN

1922 100.80 97.10 96.10 94.70 98.20 DOWN

1926 162.50 158.20 150.80 156.60 157.20 DOWN

1930 240.40 204.90 188.10 180.90 164.60 DOWN

1934 92.90 92.50 93.10 102.90 104.00 UP

1938 138.30 141.50 151.70 146.10 154.49 UP

1942 106.20 109.10 113.10 114.50 119.40 UP

1946 189.20 172.40 169.29 169.80 177.20 DOWN low was on 10/9/1943 at 163

1950 216.90 226.40 225.00 227.60 235.40 UP

1954 335.90 336.50 352.10 386.80 404.40 UP

1958 507.70 532.10 543.20 557.50 583.70 UP

1962 602.90 578.90 589.80 652.60 652.10 UP low was on 10/23/1962 at 558

1966 788.40 774.20 807.10 791.60 785.70 DOWN low was on 10/7/1966 at 744

1970 765.80 760.70 755.60 794.10 838.50 UP low was on 9/22/1970 at 748

1974 656.80 607.90 665.50 618.70 616.20 DOWN low was on 10/3/1974 at 588

1978 876.62 865.82 792.45 799.03 816.10 UP low was on 11/14/1978 at 785

1982 901.31 896.25 990.99 1039 1059 UP

1986 1898 1768 1878 1914 1896 DOWN

1990 2593 2452 2442 2560 2634 UP low was on 10/11/1990 at 2365

1994 3913 3843 3908 3739 3834 DOWN low was on 11/23/1994 at 3675

1998 7539 8081 8495 9117 9181 UP low was on 10/1/1998 at 7633

2002 8737 8664 7592 8397 8896 UP low was on 10/9/2002 at 7286

2006 11381 11679 12081 12222 12463 UP

------------------------------------------------------------------------------------

8 up 14 15 17 14

23 down 9 8 6 9

|

The market will face resistance this coming week

as it rallied towards

its upper band, at 10650 from:

1) now rising interest rates,

2) bearish post Labor Day 21-trading day seasonality (where the

DJIA is up only 43.6%

of the time since 1965),

3) the just barely positive internals (P=+50), IP21=+.066)

and negative volume

readings (V=-119) and (OPct=-.106).

Tagging the upper band

with the present internals would NOT

bring a Peerless Sell,

however. But breadth is likely to weaken

if interest rates

continue to rise. The CLosing Power downtrend

for Interest Rates has

been broken. Of course, interest rates

are still very low.

CDs are under one percent. This forces a lot

of investors to put

money into the market. Bond funds are still

rising, but the long

uptrend is weakening. Utility Stocks, a

beneficiary of low

rates have reached resistance, but 78.5%

of them are above their

65-dma.

B8s, B9s, S8s and

S9s on ETFs Work Well in Trading Ranges.

Use CLosing Power Trends to Clinch These Signals.

Watch Gold's Rising CLosing Power Lines.

I wrote up instructions recently on how

to trade with an emphasis

on the these signals being clinched by

trend-breaks of the Closing

Power. The B8s and S8s occur when a

price move is not confirmed

by OBV, Stochastic-20 and IPA near the

bands. The B9s and S9s

show that there is a positive

non-confirmation or a negative

non-confirmation by the Accumulation

Index. See the write-up

I did at http://tigersoft.com/TigerSoft-Simple-Very-Profitable/Part-2.htm

Look a little

later at these signals on the SPY since 1993 here.

Roaring bull markets with the DJI moving

into new all-time high

territory do not let them work well.

But when multiple head and

shoulders patterns develop as in

2000-2001 and 2007-2008, the

S8s and S9s are very valuable aids to

tell you when uptrends

are over and bigger declines will start.

=============================================================

9/2/2010

Happy Labor Day Weekend.

NYSE A/D Line Downtrend-Break. There were more than

1200 up then down on

the NYSE. With this downtrend-break,

The DJIA should Rally.

There are three levels of resistance:

10400, 10600 and 10800.

My guess is that the upper

3.5% Band at 10661 seem

the best future target. 3.7% is the

optimized upper band.

The Head and Shoulders pattern is

losing its symmetry.

A close above 10400 would destroy

the most recent DJI H/S

pattern. The short-covering that causes

should make the DJI

reach 10600-10750.

Cover

the QQQQ Short sale unless the NASDAQ is very weak at the

opening and hold long DIA.

The QQQQ has broken its downtrend.

That usually means the QQQQ will get past the falling 65-day ma

if the Accumulation Index is positive. The current AI is +.053.

FLASH - The economy lost 54,000 jobs as 114,000

temporary census

positions came to an end. State and local

governments shed

10,000 positions. The jobless rate rose

to 9.6 percent

from 9.5 percent in July. Significance:

There

will most likely

NOT be any change in the FED's very low

interest rates if

they can hold back Gold and the Dollar

does not fall

apart. The Tiger chart of the Dollar, shows it

may weaken.

So, the FED and Treasury may try to make Gold fall.

FLASH - Kabul

Bank run may pose more immediate threat than Afghan Taliban?

(Christian Science Monitor)

"The Kabul Bank is a bedrock for a stable

Afghan society. Its collapse could

spell disaster for the country already battling a resurgent Afghan Taliban."

---> Watch Gold to see if it turns down from here,

which would be

bullish for the market, or breaks above

resistance -

which would be bearish for the market.

Next Week

and Bush Tax Cuts

---> Watch the news on the Bush tax cuts as they

apply to the very wealthy.

After

Labor Day, it will be harder for the DJI to make

gains. The bearish seasonality kicks in then. Tuitions seem to take

a lot of money off the table. The longer days bring less optimism. But

it does look like the Senate and House will back away from their talk

about letting the Bush tax cuts on on the very rich lapse. As the rich

own the vast amount of stock, this would be bullish for the stock market

in the short run. Longer term, it would also mean a more unbalanced budget.

That would probably boost Gold.

The NYSE seems to be back on solid ground. It is

back above its 65-day ma and the ratio of new highs

to new lows today is 97 to 8. On the NASDAQ, the ratio

is a much less robust 37 to 10. The NASDAQ is still below

its falling 65-day ma. The Tiger RELDJI indicator is in

red (bearish) territory.

Work with the rising

Closing Power Lines and Short-Term

Buys now. A much bigger move could be started by a

DJI Advance Past 10800. Close out

Short Sale Hedges

if CLosing Power Downtrend-Lines Are Broken. That means

closing out the QQQQ short now and hold long DIA. I am

impressed that there are 281 MAXCP stocks on Buy and

30 MINCP stocks.

MOST BULLISH MAXCP STOCKS

Dividend Plays: BTZ, LNT, NIO, EDD, EPD, BLW, TEG, MWO, FCFS,

Others: VMW 82.74 +1.17, AAP 56.29 +.81, CRM 119.12 +2.72, ADVS 51.63 +.48