TigerSoft New Service

10/11/2010

TigerSoft New Service

10/11/2010 Make Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

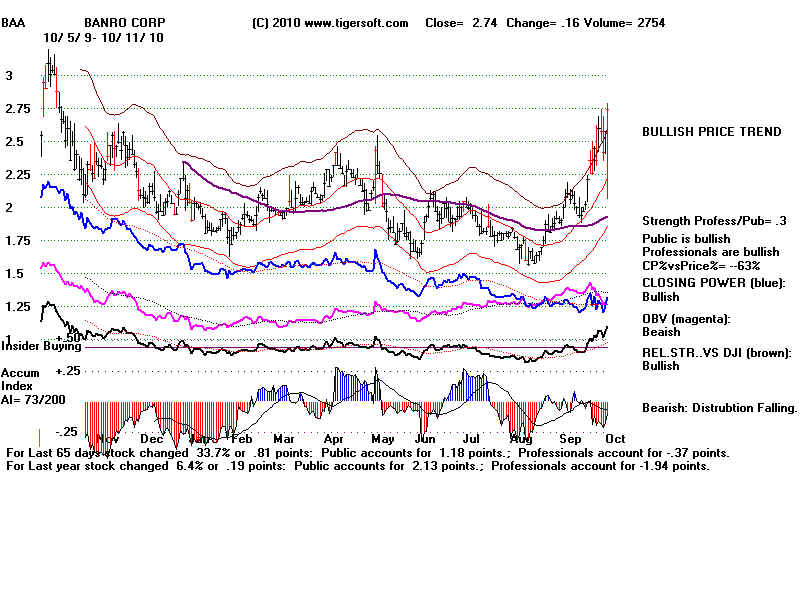

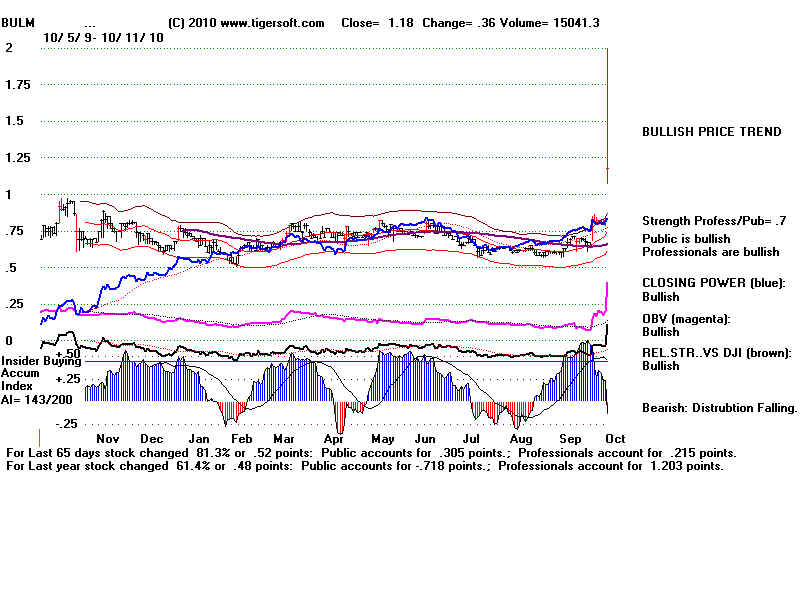

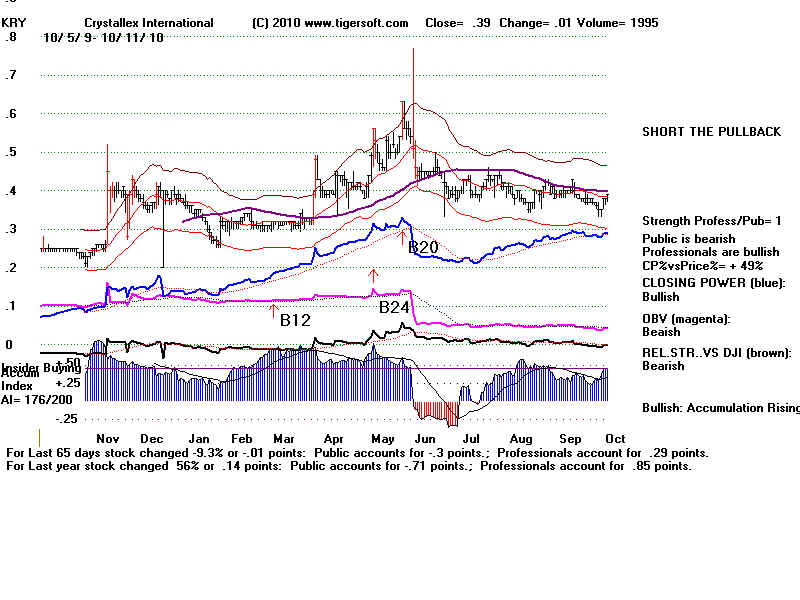

Insider Buying Distinguishes The Best

Gold Stocks from The Worst.

The very best performing Gold stocks all have one unique characteristic. They show insider buying

as TigerSoft measures it. The very worst performing stocks serious insider selling. The best and

worst were easily distinguished. Go to the bottom of this page to see the best and the worst.

What Does It Mean When A Gold Stock

Get Out of Step With Gold Prices?

by William Schmidt, Ph.D. of www.tigersoft.com (C) 2010 All Rights Reserved.

Why is Gold making new highs while some gold stocks are lagging? One might simply

think that because the costs of production are assumed to be fairly constant, a big rise in

prices would almost all go to the bottom line and make for much bigger profits. Things

are more complicated and each mining company is different.

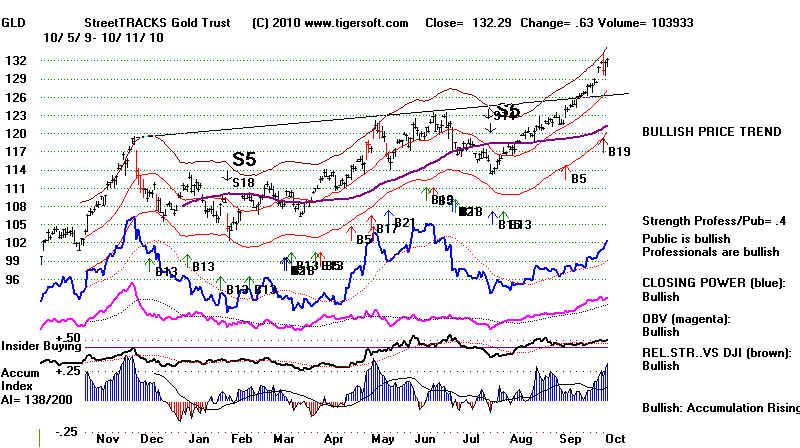

First, here is the chart of GLD, the ETF for Gold. It is above its rising resistance line and

running in all-time high territory. The Public and the Professionals are "Bullish". All the

intenral strength indicators are rated "bullish". Not shown here, the SLV chart looks

just as good, if not more so.

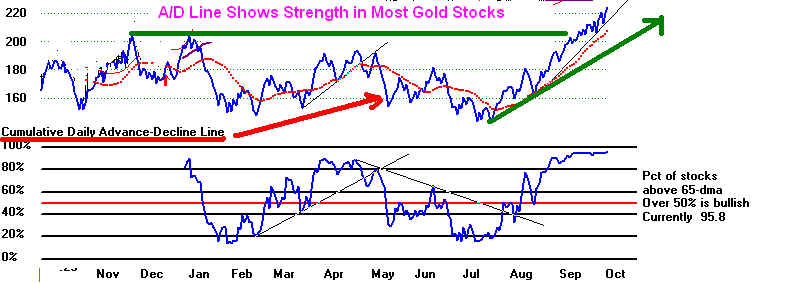

Second, here is the Tiger Index chart for 71 Gold and Silver stocks. It has recently been strong,

but is not making new highs. This index is weighted by volume. Some of the biggest gold

stocks are lagging. Some smaller, more leveraged mining stocks are generally doing very well, judging

from the fact that the Line showing the Gold Stocks' Advances minus Declines is making new highs.

Gold stocks are much more volatile than gold or its ETF, GLD. The smaller the gold stocks,

the more volatility. Even the biggest Gold Stocks like ABX and NEM rise and fall faster than gold.

In part, this is because they must use leverage, as when they launch new mines that take years

to bring on line. If gold prices fall appreciably after they have committed to investing in new operations,

their stocks fall more quickly than Gold, since the mining stocks can lose millions and millions when

the expected break-even price of Gold is broken below. Knowing this, Gold mining companies

hedge by trading Gold futures and locking in what look like favorable prices. If Gold prices rise far

above the prices they have locked in with their hedging, their stocks will lag Gold on the upside.

That may be true for some of the biggest, more conservative Gold stocks.

Gold mining shares have added volatility because each mine has its own problems and potentials.

Underground mines can flood in the Spring (Idaho silver mines) or have electrical power problems

(as in South Africa). Nationalization is a threat in less stable countries. So is labor unrest which

can bring minimg operations to a halt,

Bolivia - 10/9/2010 Weakness recently in NEM may be ascribed more to the fear of increased

labor unrest than nationalization.

"Bolivian President Evo Morales said Saturday the government should expropriate mines

where private owners have not invested sufficiently. “Mining concessions where there has not

been investment must return to the hands of the Bolivian government,”

On Thursday, clashes between rival bands of miners erupted at the state-owned Huanuni mine,

which holds Bolivia's richest tin deposits, when an estimated 4,000 miners from independent

cooperatives demanded access to the mine, confronting workers for the state-owned Mines of Bolivia.

The two sides threw sticks of dynamite at each other and fired guns across mountain passes,

leaving at least 16 dead and injuring more than 60. To restore order, the government sent in

700 police to the Huanuni mine, located high in the Andes and 500 kilometres south of La Paz.

In May, President Evo Morales announced the nationalization of the country’s oil and gas sector,

giving majority control of the industry to state energy company Yacimientos Petroliferos Fiscales

Bolivianos. Although this was suspended in September, Morales has hinted about nationalizing

the mining sector as well." Source.

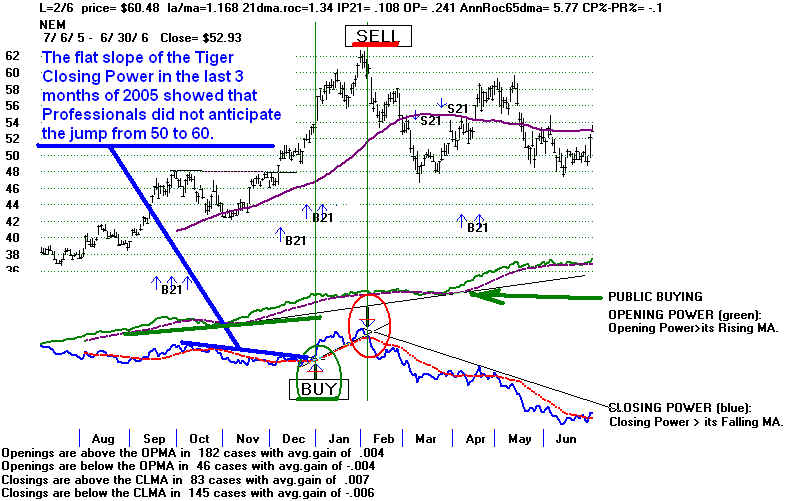

TigerSoft helps here. Example: Insider and Professional selling can be seen in NEM in 2006

before its Central Asian mines were expropriated. As gold prices rise, populist politicians will surely

want a larger share of the revenues, when they see the extraordinary profits that sharply higher gold prices

bring foreign companies. As lesser developed countries see their incomes rise, natives of these

host country start to appreciate the environmental dangers of gold mining. The costs of improving

mine safety and reducing dangerous ground-water and environmental contamination from gold mines

are always rising. So, does the cost of bribing politicians.

See "THE ENVIRONMENTAL COSTS OF GOLD MINING ARE VERY HIGH."

http://www.tigersoftware.com/TigerBlogs/02142008/index.html

The conclusion is that Gold Stocks must always rise and fall at rates different than Gold Prices.

Watch The Insiders and Professionals To See When To Sell

And all this leaves out, the ways in which Gold stocks are manipulated by market makers, specialists

professional touts, as well as big hedge-funds. The Pros have insider information and they take the pulse

of the market every day. NEM's biggest drops have come after steady selling on strength by insiders. We

register this when we see lengthy periods of negative (RED) distribution from our own TigerSoft

Accumulation Index, especially as the stock makes "false" highs. Major Sell S9s from TigerSoft

(not our Peerless S9s) gave ample warning of trouble. See the S9s of October 1987 and 2007.

SELL S9s from TigerSoft Forwarned of 1987 and 2008 Declines.

WATCH THE PROS TO SEE WHEN TO BUY

Insiders know best. Always look at Tiger's invention, the Tiger Accumulation Index.

Lengthy and intense Blue Accumulation shows that insiders expect much higher prices.

Months of Red distribution is a warning that insiders know some reason to sell. Usually

that is what we should do.

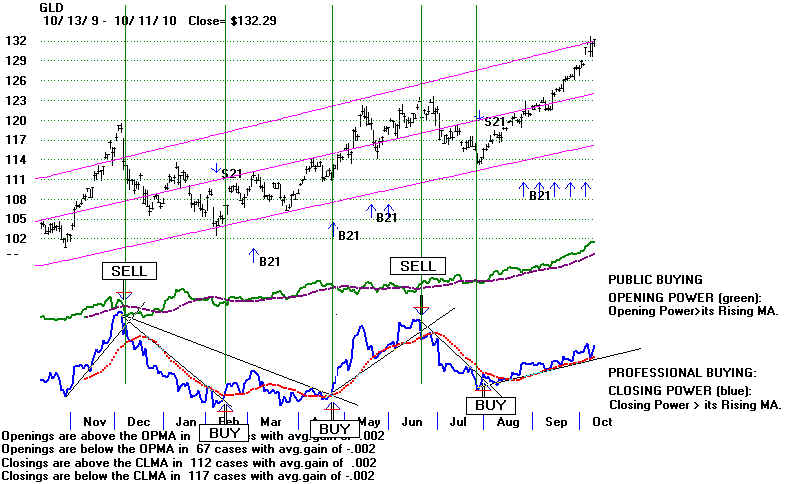

We also watch for times when Professionals turn bullish and when both Opening (Public Buying)

and Closing Power (Professionals) are rising. These two cases bring the best gains, especially

where there is heavy Blue Accumulation. The B21s show when both Professionals and the

Public are bullish. The vertical lines in the chart of GLD below show when there were trend-breaks

in our key Closing Power indicator.

In 2008, a huge general financial market liquidity collapse occurred. Everything declined, even Gold bullion.

NEM fell a relatively small 60% from its 2007 peak. Smaller mining stocks lost 75% or more. Hedge funds

had to raise money any way they could. You can see in the links below how the TigerSoft tools helped spot

the heavy insider and Professional selling that signalled the collapse.

October 18. 2008 The Rise and Fall of Commodities' Hedge Funds

Pump and Dump - Oil, Silver, Gold, Corn, Wheat - It's All The Same.

Systemic Failures: The "Free Market" Is Too Expensive.

Causes of the Crash of 2008.

September 4, 2008

How To Trade Silver (SLV) and Silver Stocks ( PAAS and SSRI ) More ProfitablyOverseas and Public Buying Can Outweigh Professional Selling

The Public is, by no means, always wrong. Public and overseas buying can overcome professional selling

in the short-run. What usually happens in this case is that professionals do not stubbornly demand that prices

fall below their SALE prices. Instead, they buy aggressively. They did this in January 2006 when they

realized that they had been wrong about NEM's next big move. Unlike the Public, as measured by Opening

Power, they became sellers after the stock peaked at 61. That is where the blue Closing Power uptrend

was violated. Whereas the Public kept buying all the dips, Professionals were net sellers. The pros were

proven right this time, as the stock remained soft and later in 2006 broke down to 40.

Our job at TigerSoft is to discern what Professionals are doing with Gold stocks. Their behavior is

very different than overseas buyers or members of the public. They are usually correct, but not if

they fight powerful waves of public speculation. Right now the price moves of ABX (the world's biggest

gold mining company) and NEM (the second biggest) are dominated by PUBLIC buying overnight.

Professionals are much more cautious. We readily see this in the TigerSoft charts for ABX and NEM.

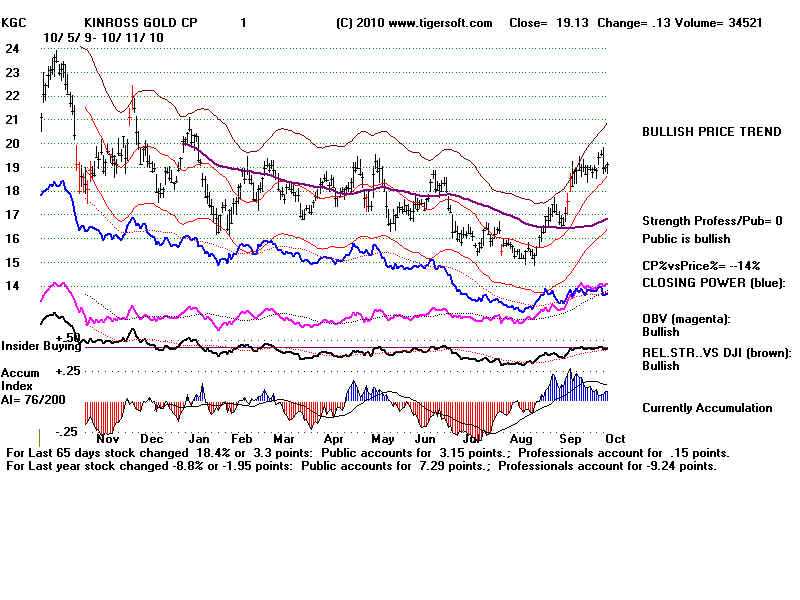

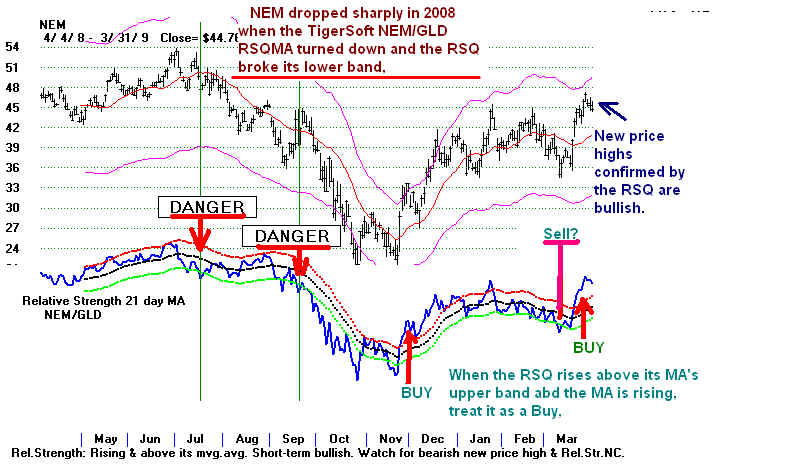

RELATIVE STRENGTH OF NEM versus GLD (See the third chart below)

Is the current weakness of the NEM compared to Gold (GLD) a warning that there may be a bigger

decline? A simple and effective approach is to compare the prices of NEM and GLD with what TigerSoft

calls its Relative Strength Quotient (RSQ). This simply plots the daily price - quotient of NEM/GLD. Moving

averages and percentage bands are used. When the RSQ-MA turns down with the RSQ below its

lower band, we should be very cautious. As long as the RSQ lower band hold and the RSQ-MA does

not turn down, the odds favor a good rally by NEM after the RSQ lower band has been reached. You

can see this in the NEM charts of 2008-2009, 2009 and 2009-2010.

NEM and The TigerSoft NEM/GLD RSQ in 2008-2009

NEM and The TigerSoft NEM/GLD RSQ in 2009

NEM and The TigerSoft NEM/GLD RSQ in 2009-2010

The NEM RSQ is at its lower band and the RSQ MA is still rising. That suggests a rally should

take place unless the RSQMA (moving average) turns down. The most bullish development

will be for Professionals to change their ,ind and start buying. That will take a break in the

downtrend of the recent blue Closing Power downtrend. This is a distinct possibility, given

the strength in Gold in 2010 at this time and NEM's recent all-time high breakout past

the 62-63 resistance.

When TigerSoft's Accumulation Index at the bottom of a chart shows

high and steady Blue Accumulation, it means INSIDER BUYING. The

opposite is INSIDER SELLING.

Compare the levels of Accumulation at the bottom of each chart.