TigerSoft and Peerless Daily Hotline

TigerSoft and Peerless Daily HotlineImportant Notice:

1/14/2010 - Our Hotline Address Changes This Sunday.

To Renew for $298/year - click here.

Current subscribers will get new address by Saturday evng.

Tonight's Summary:

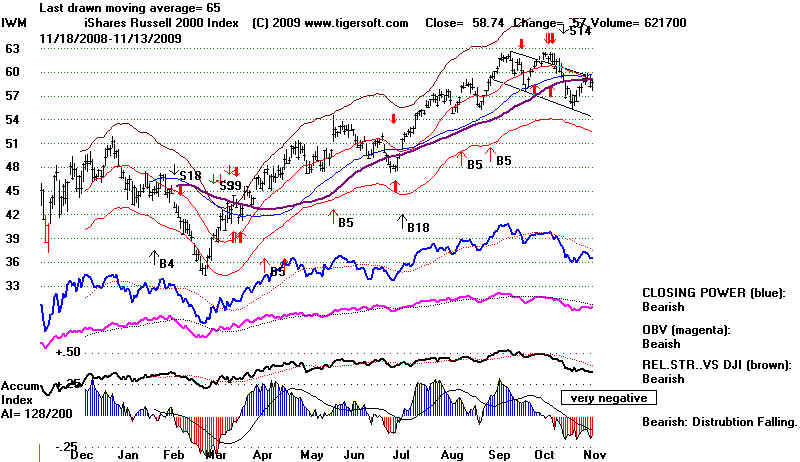

Still on A Peerless Buy. Closing Power and A/D Uptrends Continue

Wall Street is on its "best behavior" after 2008.

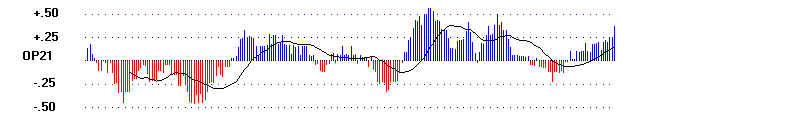

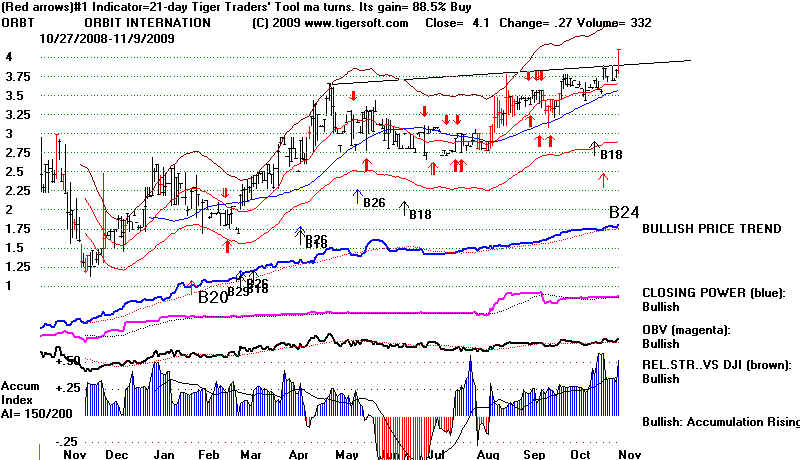

Watch Breakouts' Levels of Current Accumulation (IP21)

and watch for False Breakouts. Enough false breakouts

will bring a retreat. This does not appear the case now.

Next Hotline will be Sunday Evening.

Daily NYSE 186 New Highs - NYSE 1 New Lows

Daily NASDAQ 88 new highs - NASDAQ 1 new lows.

Next San Diego Tiger User Group

Meeting is first Saturday of February

Next San Diego Tiger User Group

Meeting is first Saturday of February ---------------------------------------------------------------------------------------------------------------

1/14/2010 Peerless Book Purchasers - More Updated Materials

1915-1930 Charts/Analysis, List of All Signals: 1929-2010, Buy B13 Santa Claus Rally,

Extreme Bearish Mode Signals, Extreme Bearish Mode Buy B8... Go to link sent.

More is on the way!

Previous Hotlines:

8/30/2009-10/20/2009

7/31/2009-8/28/2009

7/1/2009-7/31/2009

6/14/2009-6/30/2009

5/1/2009 - 6/11/2009

3/30/2009-4/30/2009

(C) 2009, 2010 William Schmidt, Ph.D.

===> Order form to Renew On-Line, "Nightly Peerless/TigerSoft Hotline " ($298)

Important Notice: Redistribution of any text or concepts here is a violation of copyright laws. This is valuable intellectual property.

All violators will be subject to legal action. Please visit www.tigersoft.com Goggle TigerSoft and a technical subject, to get

additional examples and a further discussion of concepts and terms used here. See also our Books for sale. .

Overnight Market Action: Bloomberg Futures around the world before the US Markets open.

24-hour Spot Chart - Gold 24-hour Spot Chart - Silver Dollar and Currencies

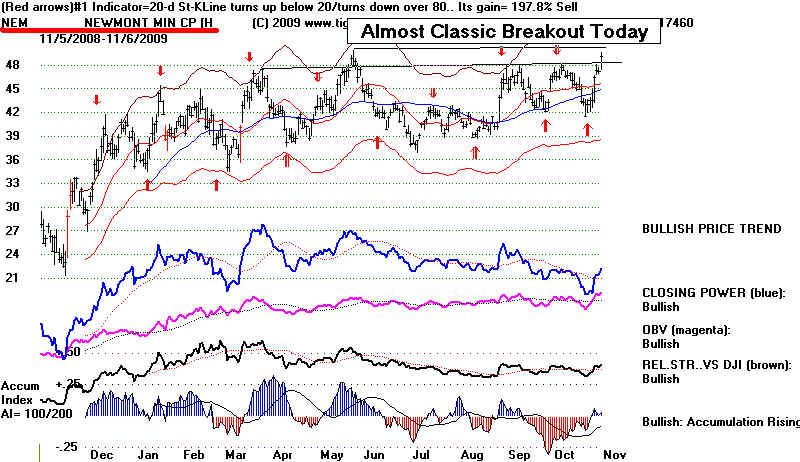

5-day Chart of DJI - 1/14/2010

1/14/2010

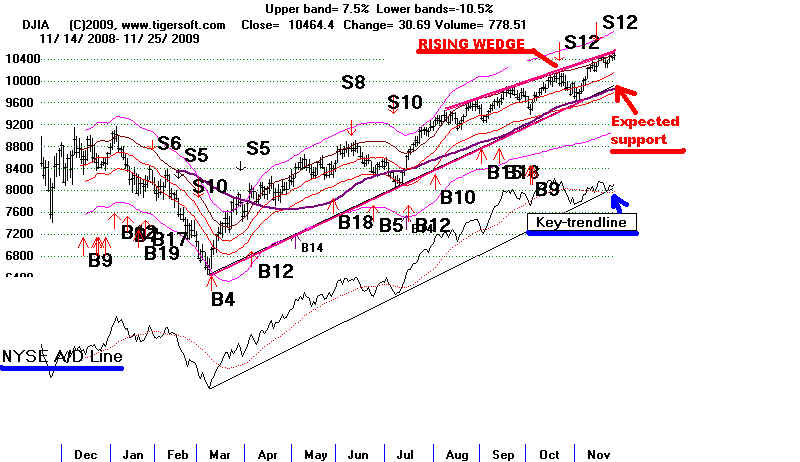

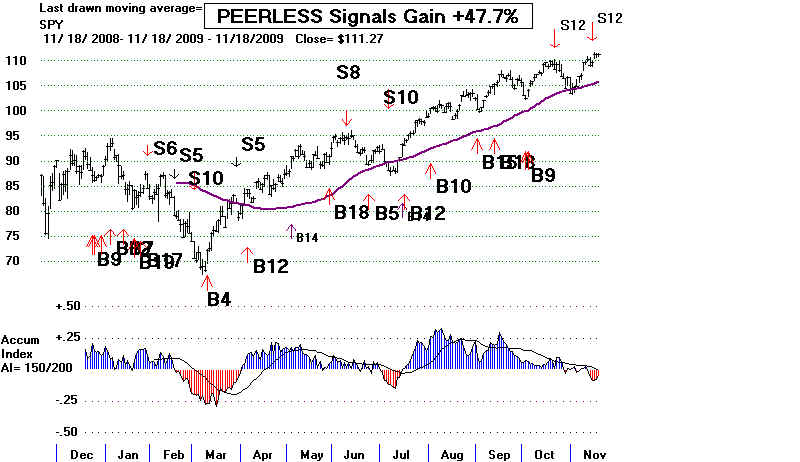

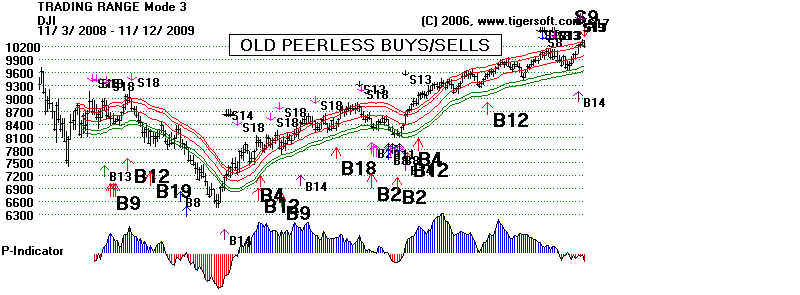

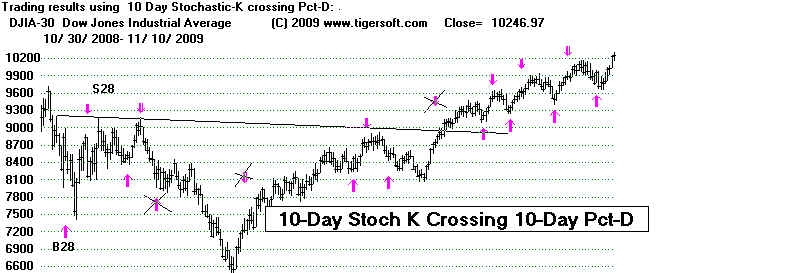

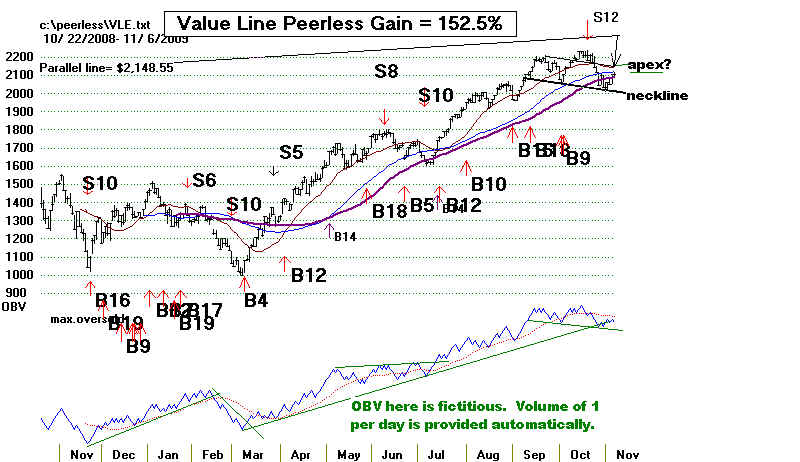

--------- SUPERIMPOSED PEERLESS SIGNALS ON DJIA ---------

1/14/2010 10710.55 la/ma= 1.017

21dma-roc = .237 P= 409 Pch= -50 IP21= .03 V= 12 OPct = .294

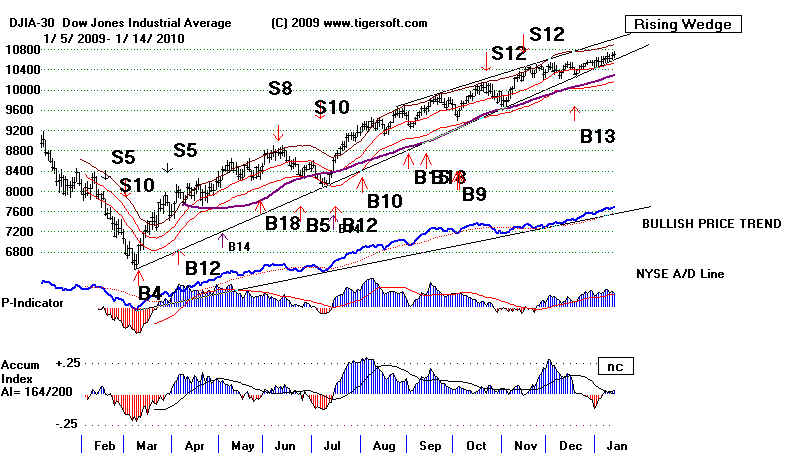

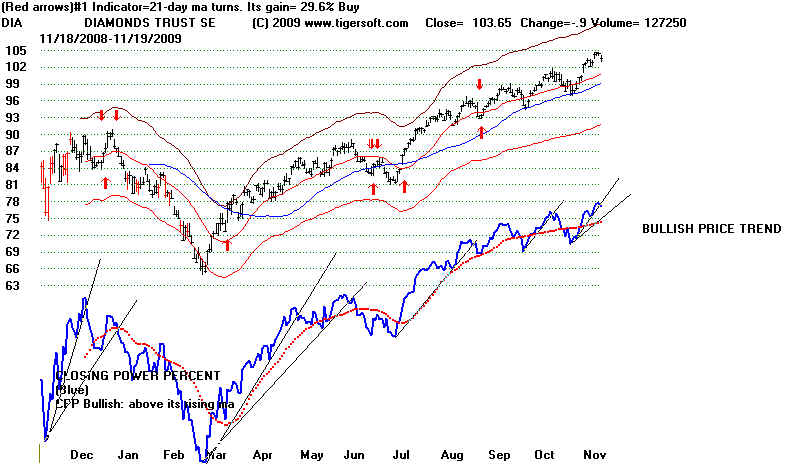

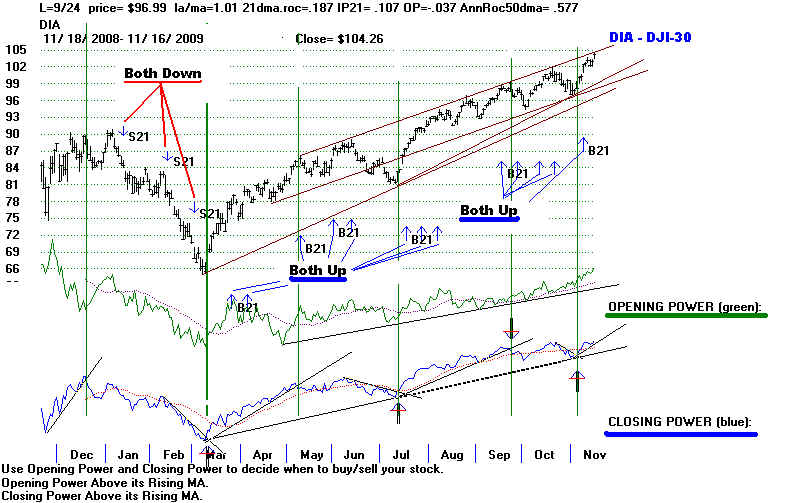

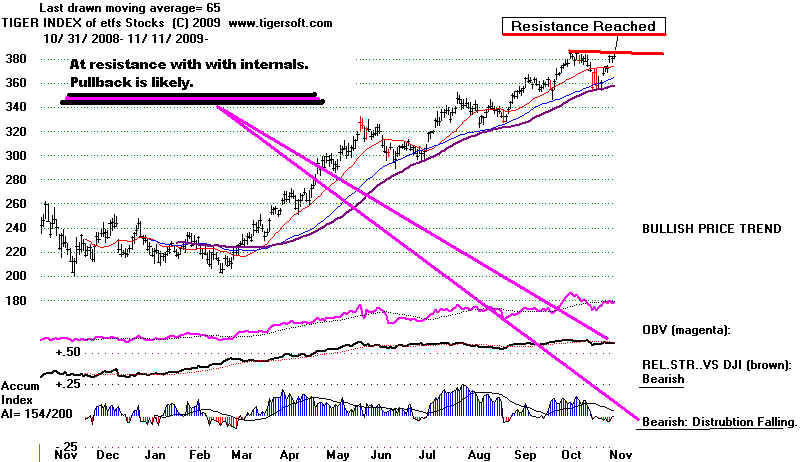

DJI is moving steadily up past the 10660 resistance 10200 is support. A/D Line is very strong.

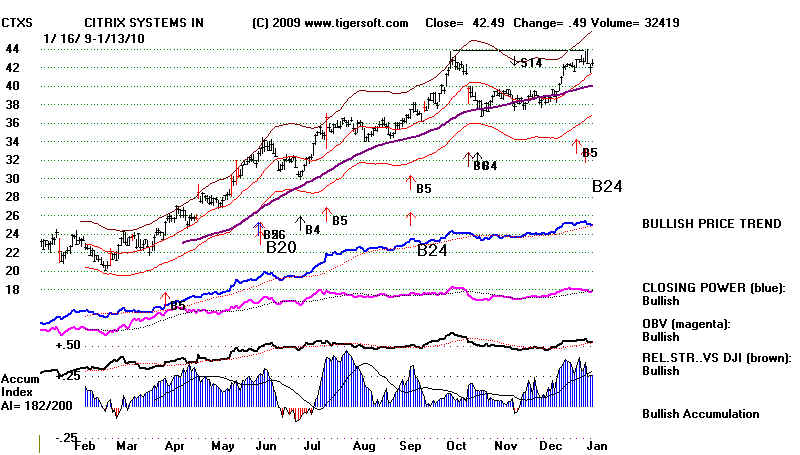

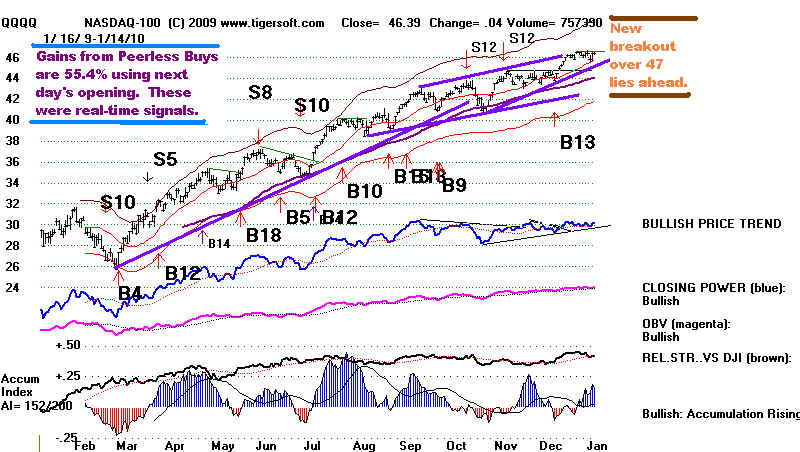

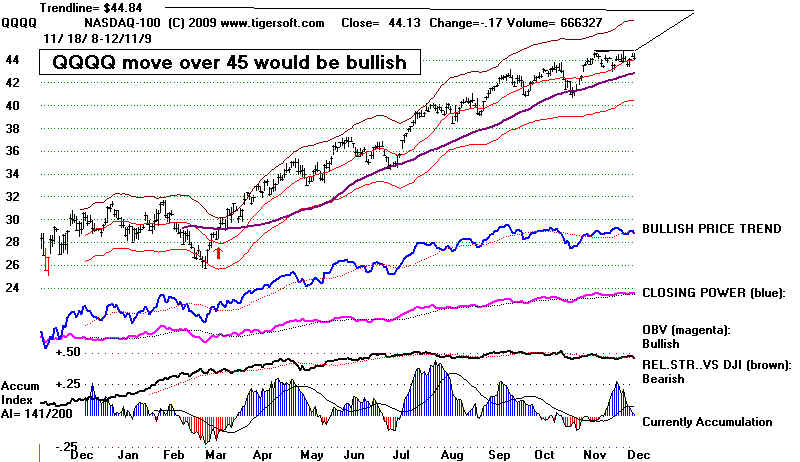

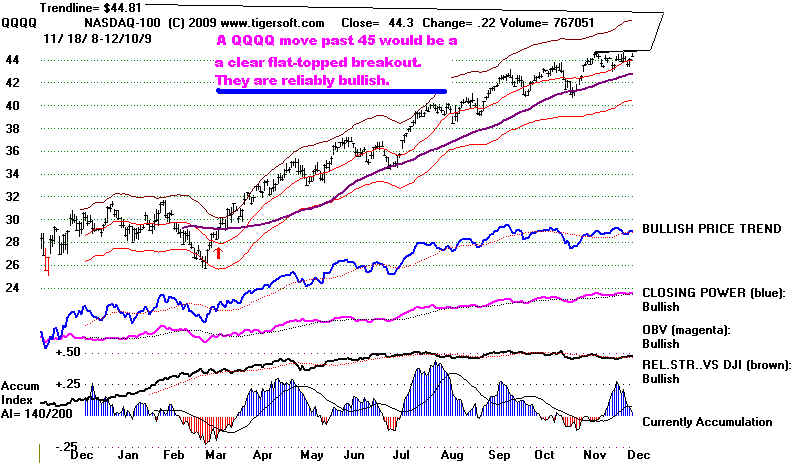

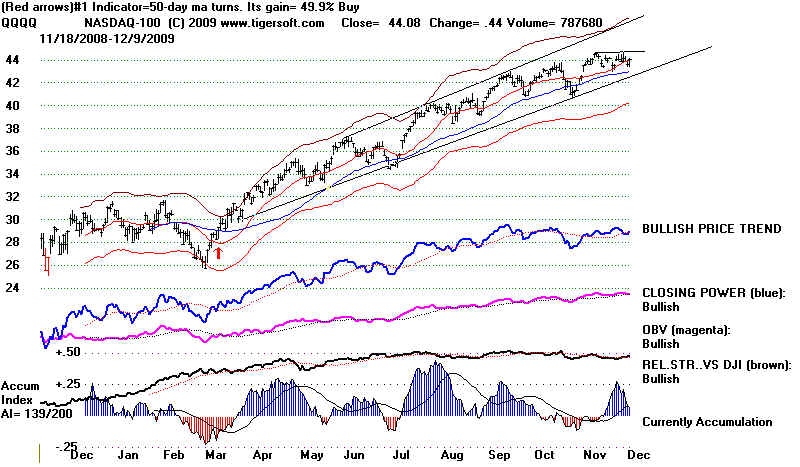

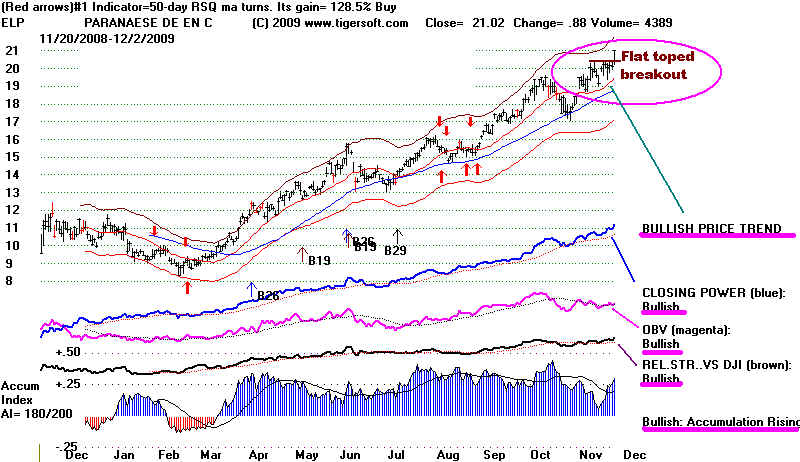

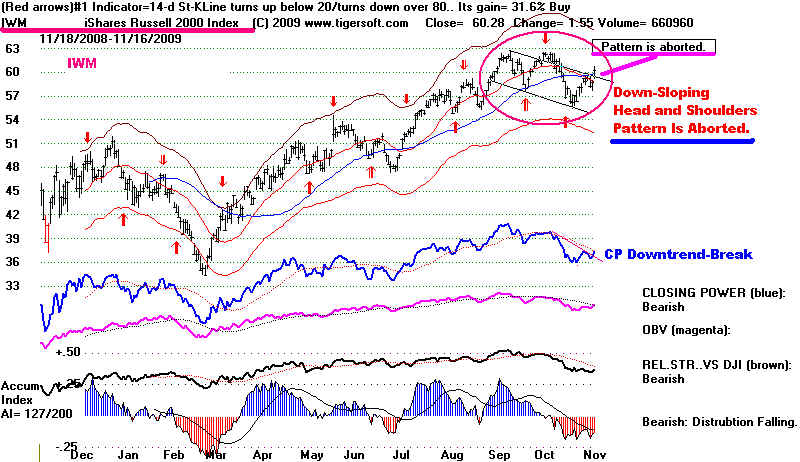

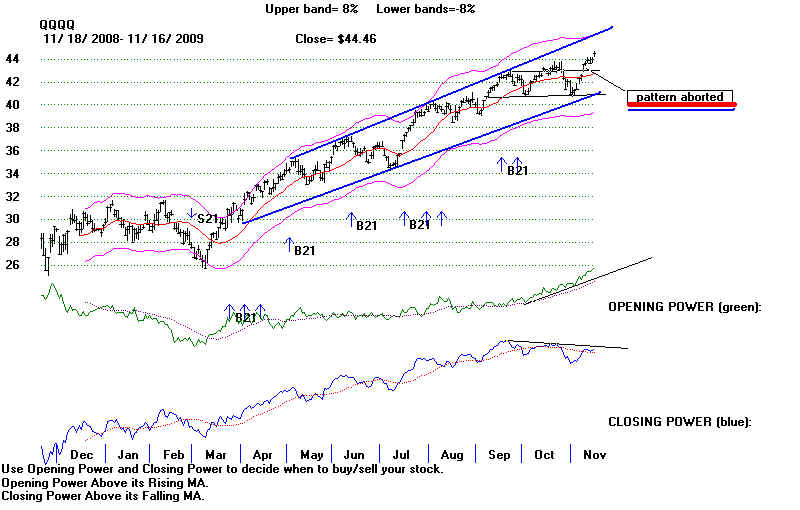

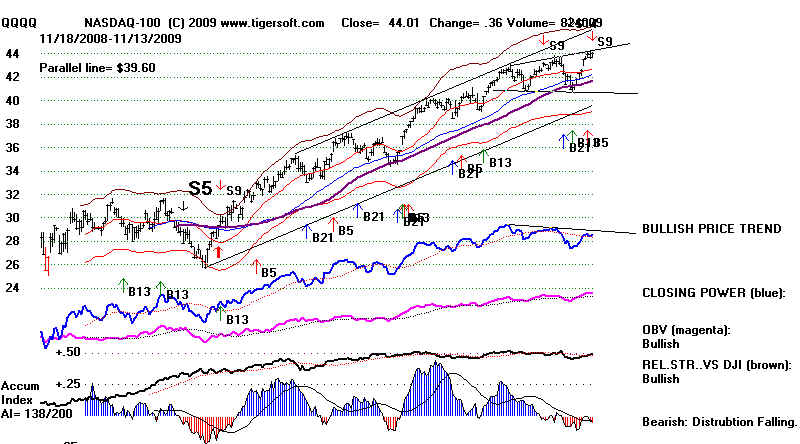

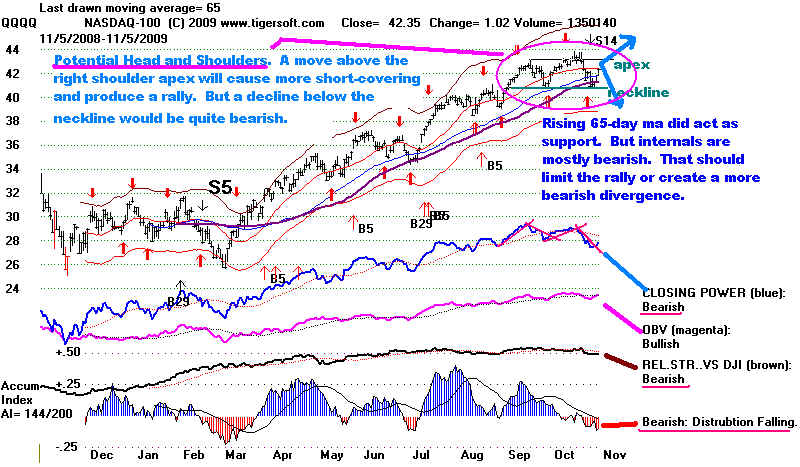

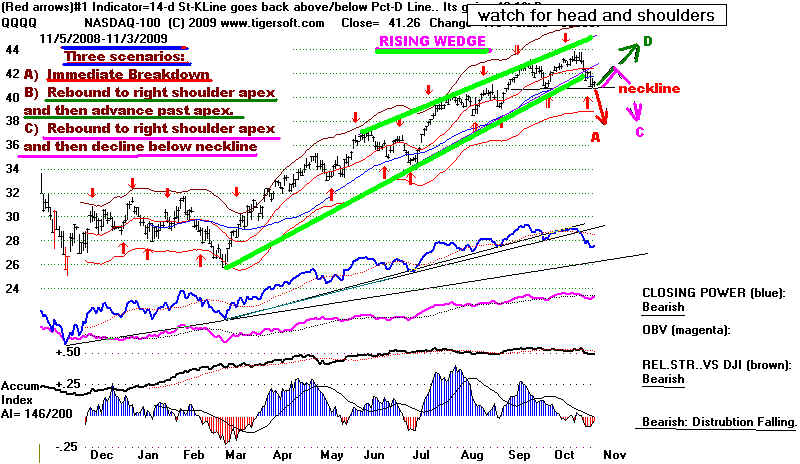

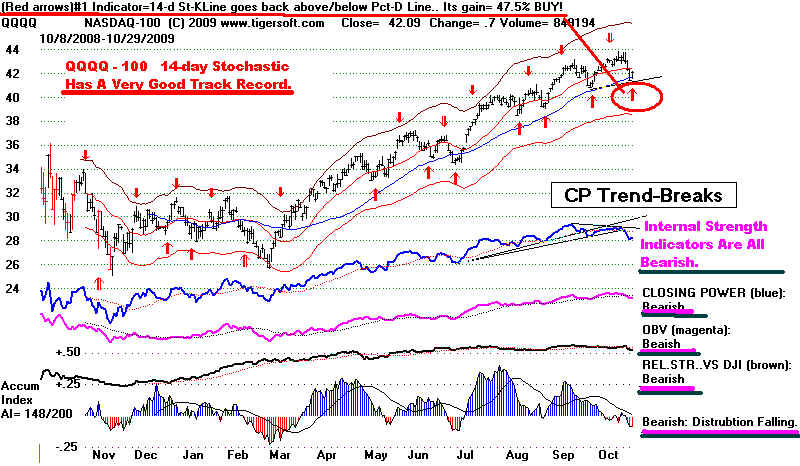

QQQQ may make another flat-topped breakout.

Its Closing Power uptrend is UP. The Accumulation Index is bullishky rising.

---------------------------------------------- HOTLINES -----------------------------------------------------------

Important Notice: Redistribution of any text or concepts here is a violation of copyright laws. This is valuable intellectual property.

All violators will be subject to legal action. Please visit www.tigersoft.com Goggle TigerSoft and a technical subject, to get

additional examples and a further discussion of concepts and terms used here. See also our Books for sale. .

Overnight Market Action: Bloomberg Futures around the world before the US Markets open.

Color Codes blue or green = new to this night's report or considered more important

black = from a previous night's report

Introduction. When reading this HOTLINE, please note the dates that show when the comments in a paragraph or set

materials were written. Always read the first comments at the top with the most recent date. They show the Buy or Sell

which now applies. Older comments are there entirely for background and to teach TigerSoft and Peerless technical analysis.

On a Peerless graph, only the new and latest signal applies. Again, always note the date at the top of a set of paragraphs.

INTRODUCTION.

Readers, our assessment of the stock market's future trends is based on the following.

Google TigerSoft and these subjects to get additional links, besides those shown below.

1) Peerless automatic Buys and Sells for intermediate-term trend.

Details of Peerless Signals are given here as they occur.

2) Price charts and moving averages.

3) Closing Power and Closing Power Percent for 2-4 week trends.

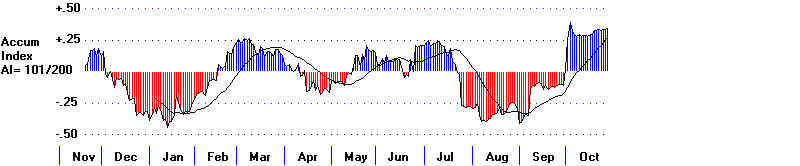

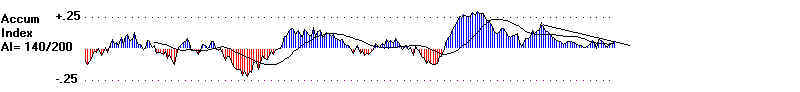

4) Accumulation Index to measure support on weakness or distribution on strength.

5) Volume (and OBV to a small extent).

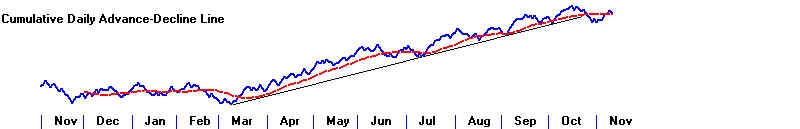

6) Breadth: Advances minus Declines. P-Indicator, A/D Line

Tiger Charts produce this for groups of user specified stocks.

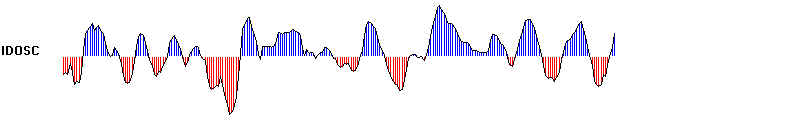

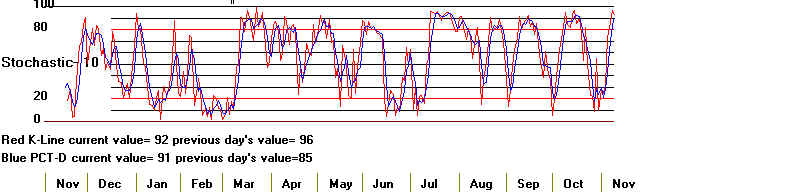

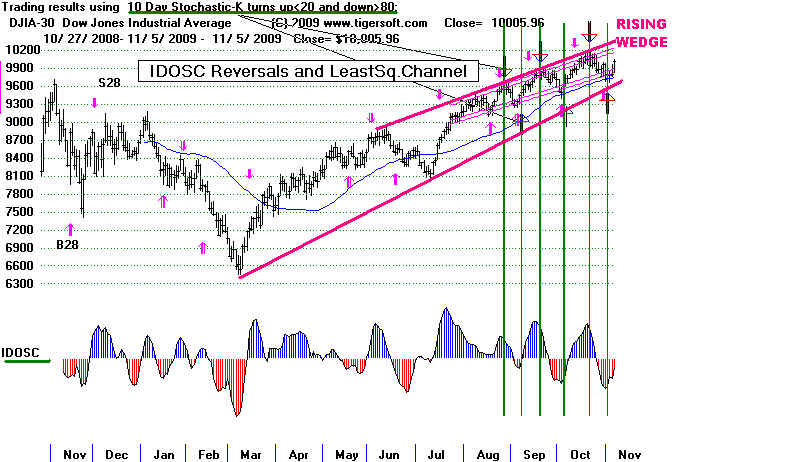

7) Stochastics when they are the best trading system. See QQQQ in 2003.

8) Relative Strength - QQQQ/DJI rising is bullish. Compare QQQQ Chart now, on this page, with 2003..

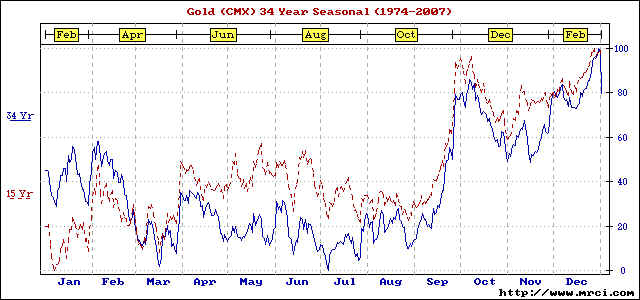

9) CURRENT Seasonality Example 9/1/2009

10.) CURRENT Sector Strength/Weakness Analysis. Example 9/1

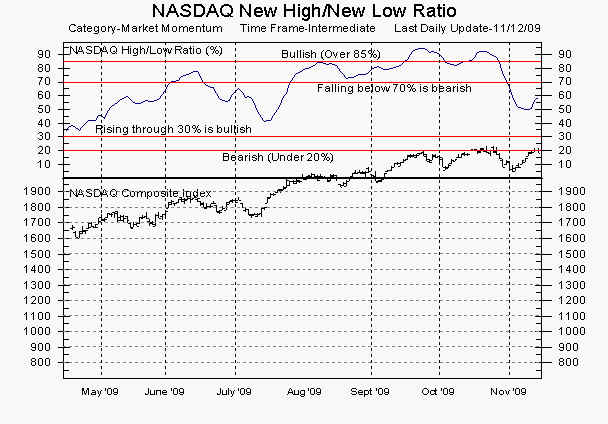

11) CURRENT NASDAQ New Highs/New Lows. Interesting NH/NL Stocks. Example `10/15

12) News and Political Economy. See Tiger Blog

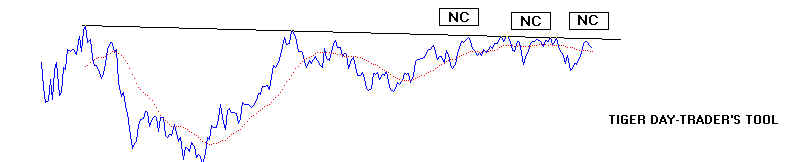

See also Predicting The QQQQ Using TigerSoft's Opening Power,

Closing Power and Tiger's Day Traders' Tool: 1999-2008

=========================================================================================

1/14/2009 Hotline

Study The New Highs/Lows

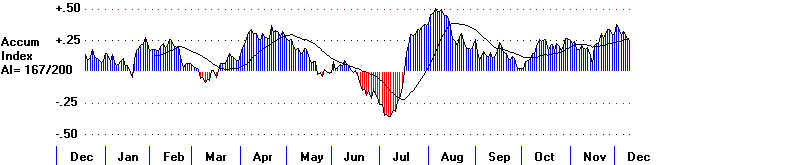

Peerless is still on a Buy. The Accumulation Index for the

DJI could be higher. But breadth remains superb. The A/D Line

is in a powerful and steady uptrend. The ratio of new highs to

new lows is very positive. The DJI is lagging the more speculative

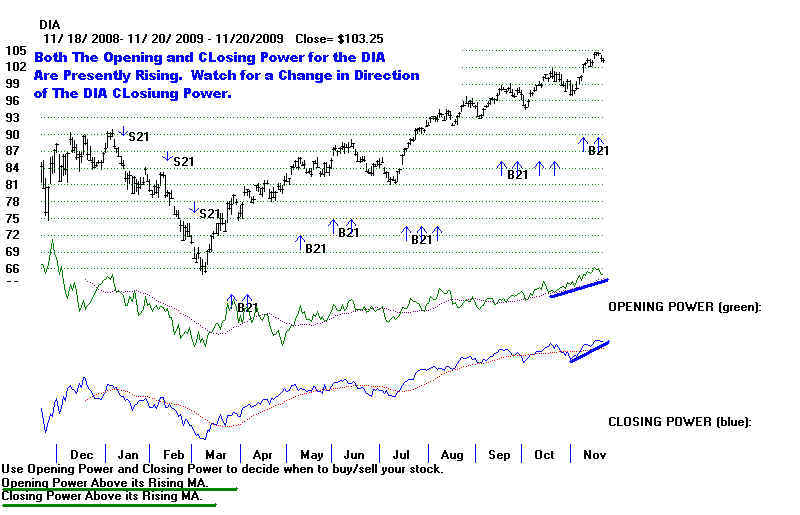

indexes. The key ETFs' Closing Power are rising. Wall Street

is on its "best behavior" after its misconduct and fraud (which

Goldman denies) in 2008.

In the news Treasury Secretary defends the 100% payout to

Goldman and other big banks by the taxpayer when AIG went

bankrupt and its debts were repaid. If he is so proud of the

billions he allowed the big banks be paid by the taxpayer,

then why did his NY Fed office try to cover this up in 2008

and 2009? Stay tuned. Geithner is not going to make it, I

predict. That will hurt Wall Street big banks and possibly

the stock market. Wall Street's special influence in the

Obama Administration will be disclosed if Geithner is challenged.

Let's see if the Republicans can step up to the plate now.

In the 1970s, before I wrote Peerless, I was much influenced

by Nicolas Darvas' system for playing new highs. See the Blog

I wrote in 2007. In particular, I would watch the ratio of NYSE

new highs to new lows. As long as the 10-day ma ratio was 4:1,

the market was safe enough to keep buying breakouts. I

watched the market mainly with weekend charts I subscribed to.

What I noticed was that before a big decline would start, there

would be a number of false flat-topped breakouts. That is

still something to look for. But now, I would look for the key signs

that a breakout is apt to be false. In particular, I count the number

of breakouts that occur with the current Accumulation Index

(termed "IP21" here, after the original name of the Accum. Index)

that are in negative territory.

First, I go to http://dynamic.nasdaq.com/asp/52weekshilow.asp?exchange=NYSE&status=HI

Second, I either download these stocks or build a directory of

just these stocks using the BUILDER.exe program on out data

page.

Third, I run the older TigerSoft program (dated 7/27/2006) and

rank these new highs for Current Accumulation (IP21) using

Ranking Results + User Set Ranking... + 21 + OK + 3 + OK

The seventh column displays the stocks by IP21.

(You can also use our spread sheet program after

running the Analysis. From Peercomm. just click View at the top,

then Tiger Spread Sheet and then click the heading for "IP21".

This ranks the data by IP21. )

Here I compare the number of stocks with a current Accum.

Index (IP21) value greater than +.25 (considered healthy)

with the IP21 number under zero (bearish). Thursday night |

the ratio was 75 to 14. That seems healthy. What we do not

want to see are stocks starting to look like MED.

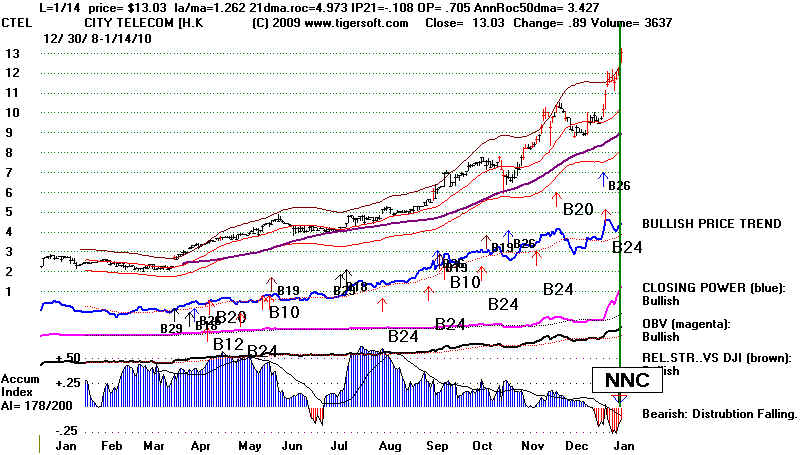

MED - False Breakout Picked Up on by IP21 NNC

(Accum. Index - Negative NC on new high near upper band.)

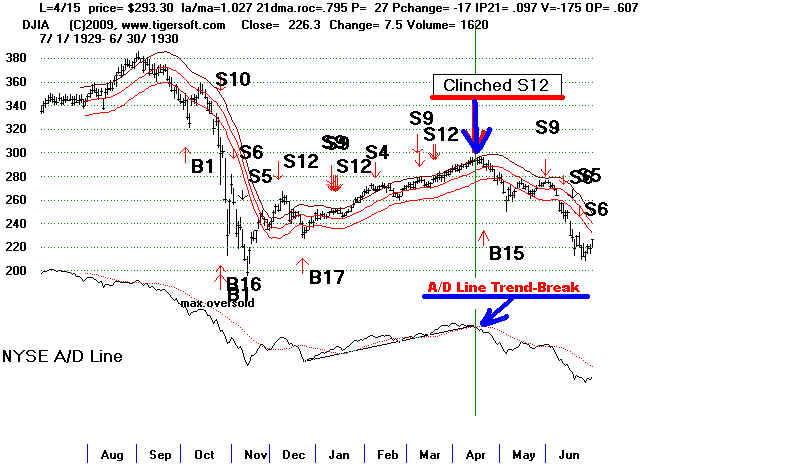

It should be empasized that a negative non-confirmation (NNC)

of a new high by the Accumulation Index, which is often

a Tiger S9, does not always bring a quick reversal and breakdown.

If the Accumulation has been steadily very positive, a brief

dip into negative territory may mean very little at the

time of the NNC and the stock may keep rising. But this

is a sign of dangerous speculation. See the chart of CTEL

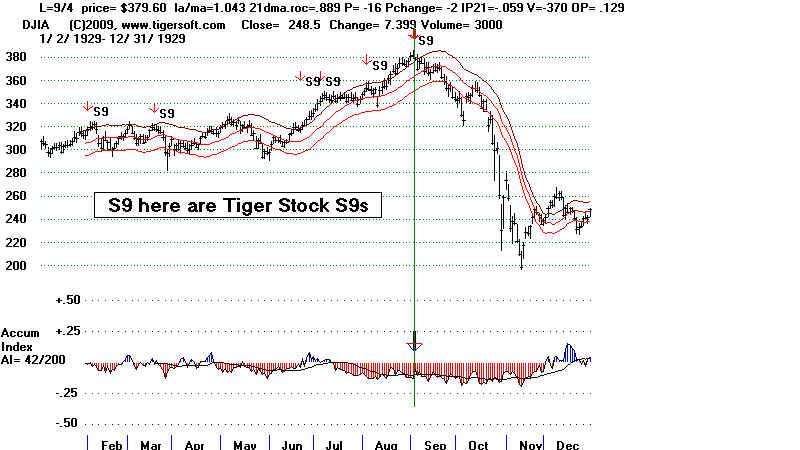

below and then the DJI chart of 1929! (With Peerless

charts of the DJIA, such IP21 NNCs are called Sell S12s.

The Peerless DJIA Sell S9 is actually a NNC by the

P-Indicator. See Peerless Sell S12 Sell S9 )

CTEL's SPECULATIVE ADVANCE FEATURES NNC oF NEW HIGH

TigerSoft IP21 NNCs are bring S9s when the DJIA is

treated like a stock. (If this is confusing, just know that

both types of NNCs (AI and P-Indicator) are bearish.

And they are doubly so, when both indicators are negative

as the DJI reaches the upper band.)

It should be also be said - and emphasized - I looking for

stock breaking above flat tops that show high Accumulation.

I take this to represent insider Buying. CLC (below) seems perfect,

until you ask the question: "Why has it taken the stock so

long to breakout?" We usually do better if we find these

such stocks soon after a fresh and reversing Peerless Buy.

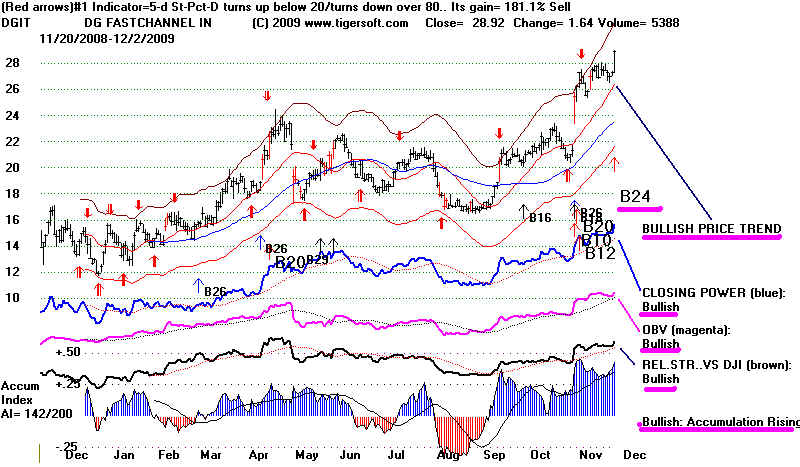

as in our Stock's Hotline's MSPD.

.

=====================================================================================

1/13/2009

Peerless Remains on A Buy B13.

Sticking with The Peerless Signal Usually Pays Off.

Once again the DJI shook off news that might have sunk a technically vulnerable

market. The creme of Wall Street's elite bankers had their integrity challenged

publicly by Congress and the immense biblical JOB-like tragedy of the Haitian

earthquake should and would normally shake our rosy confidence that man can always

prevail over natural calamities. I take these to be signs that the market wants to go higher.

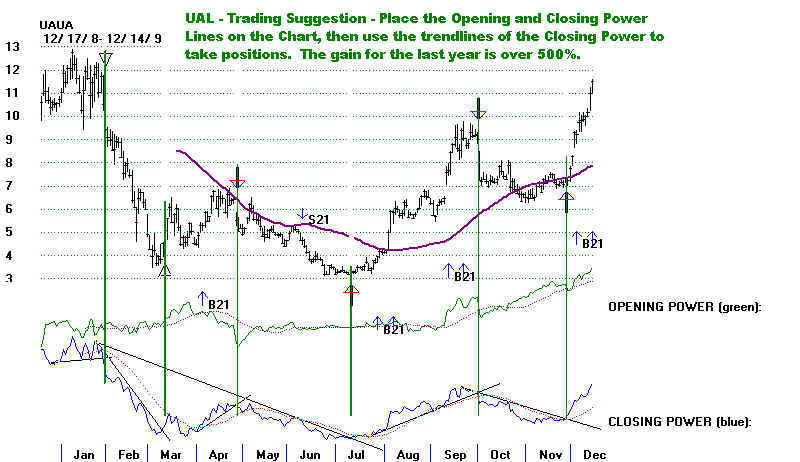

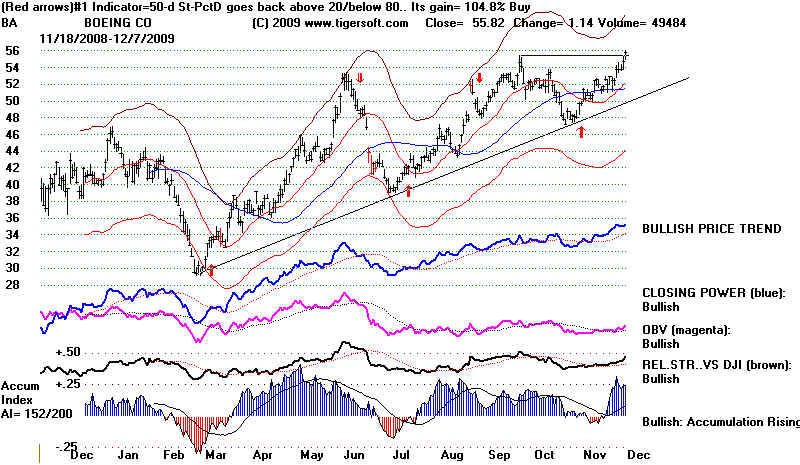

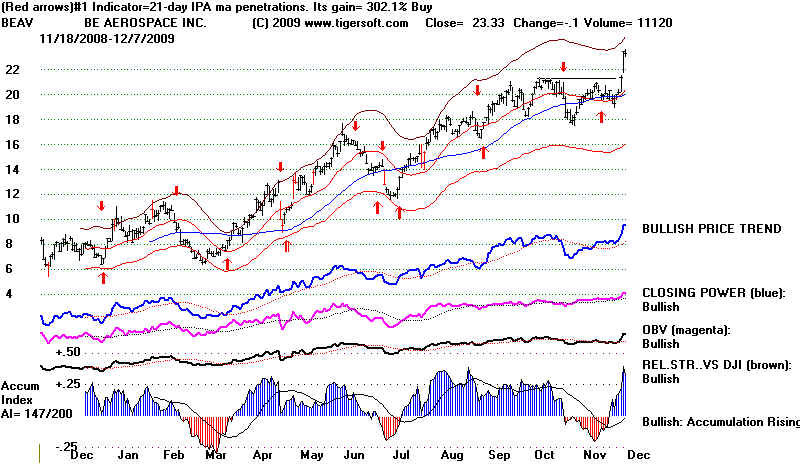

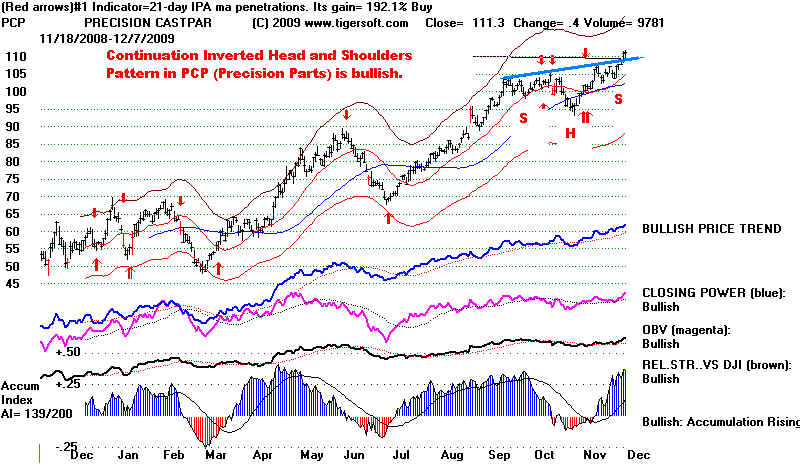

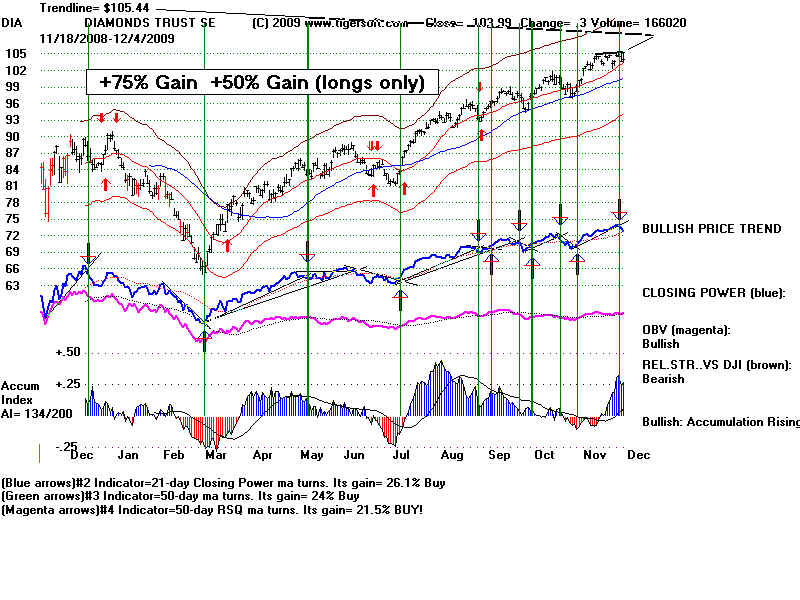

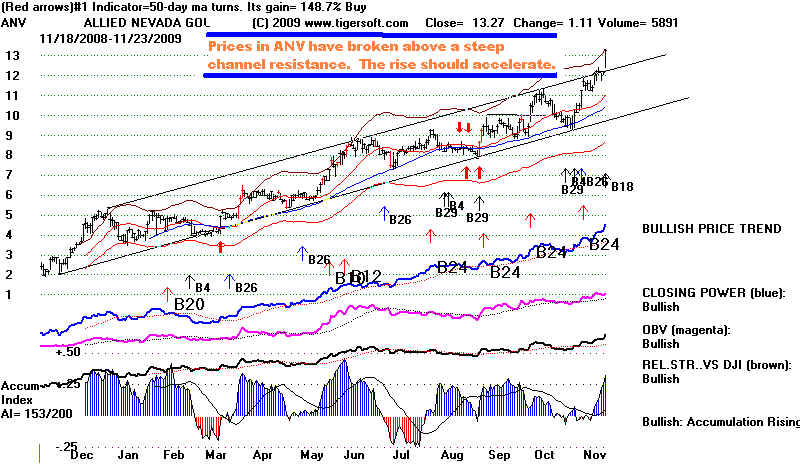

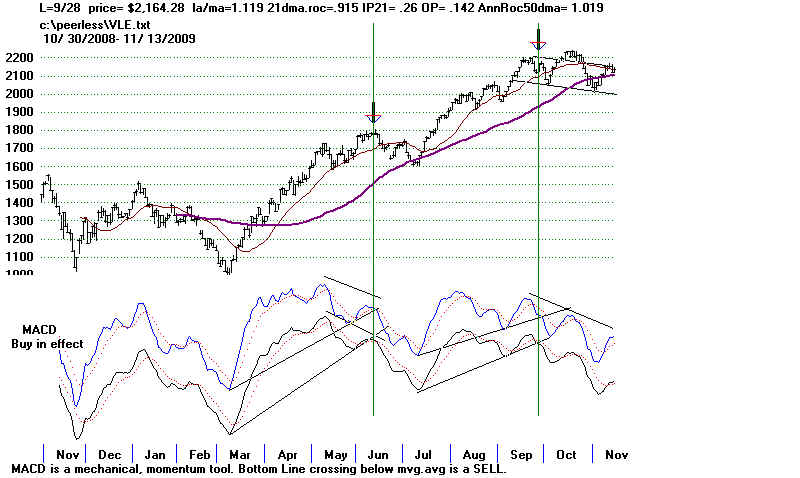

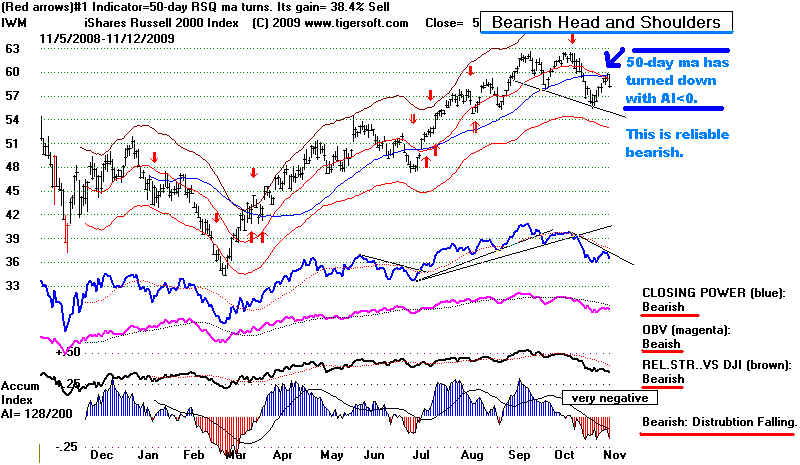

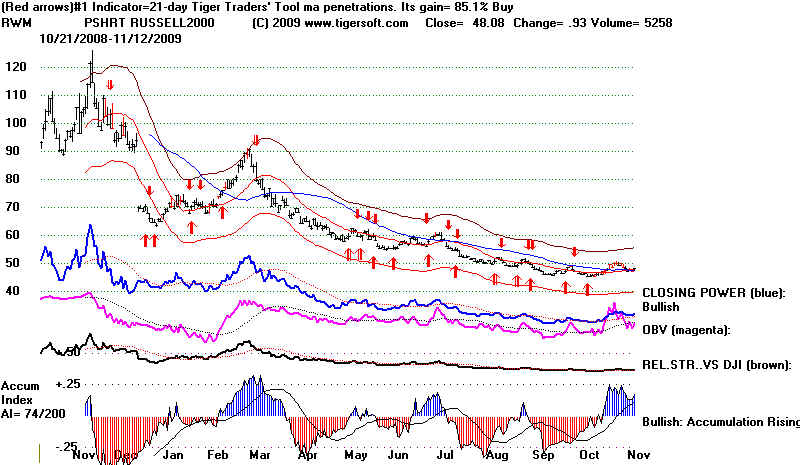

What vehicle should users employ to take advantage of Peerless Buys and Sells.

The answer may be obtained with historical studies using the Peerless software's ability to

let the user super-impose the DJI based Peerless Buys and Sells signals on any chart

the user wishes. Using DIal Data I can get the data back to 1980 on any stock that is

still extant and trading now. (So, could users if they want to pay $40/month and would like

me to set them up with this capability).

To help us decide how best to use Peerless I gathered the data year by year since

1999 when the major ETFs, DIA, QQQQ and SPY, were established. I super-imposed the

DJI signals on the DIA, QQQQ and SPY for each year and let the computer calculate

the trading gains for each year from the first signal of the year. I think this shows that

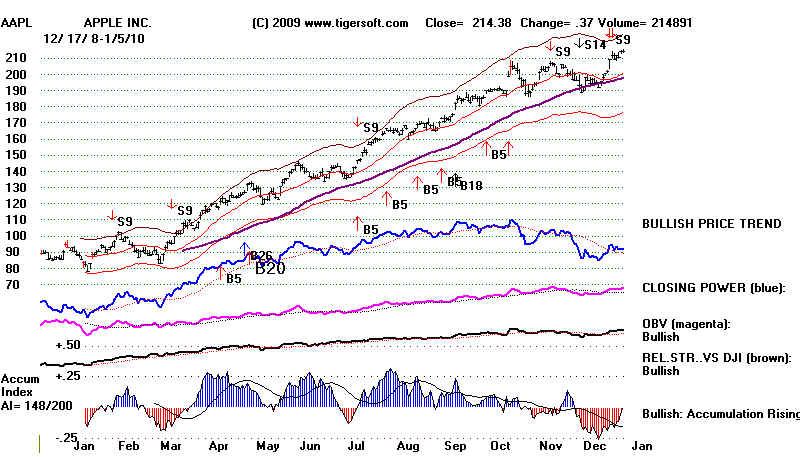

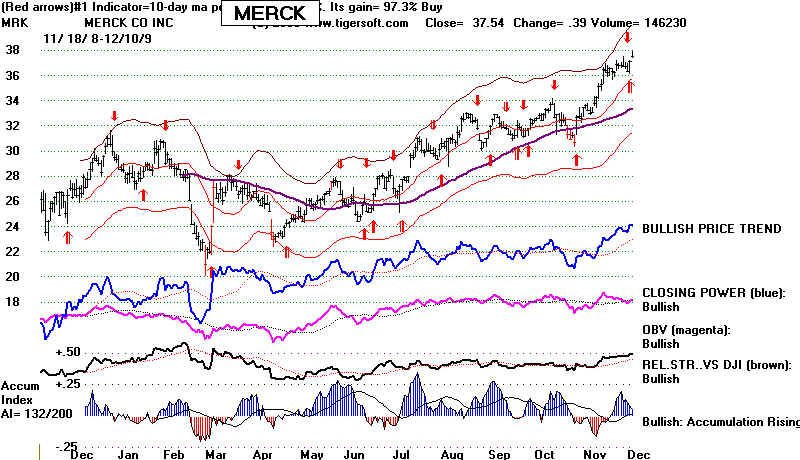

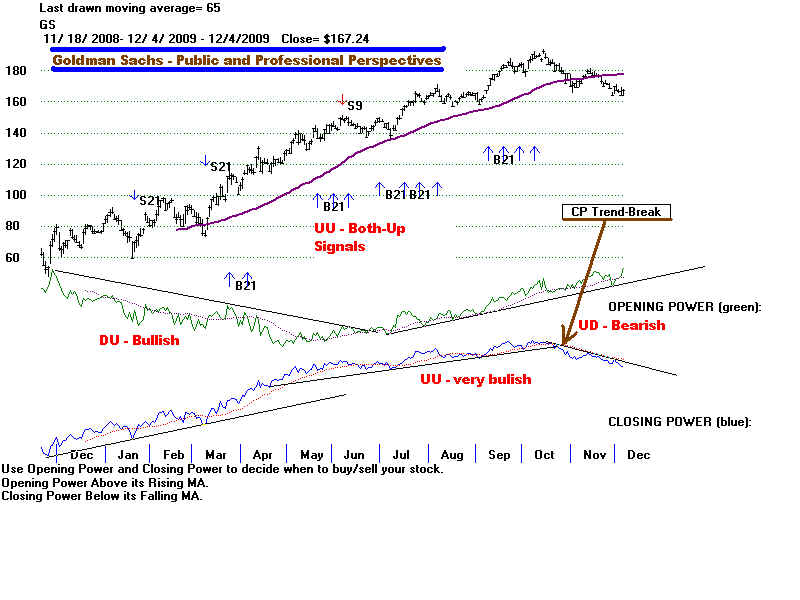

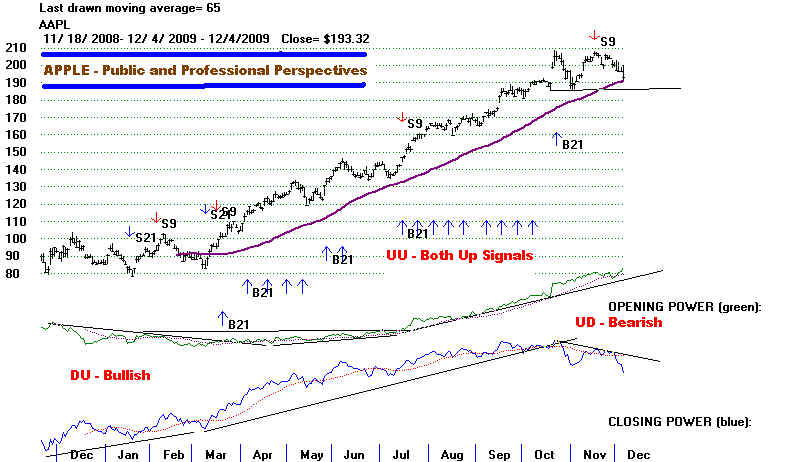

the QQQQ is generally the best instrument to buy using the Peerless signals. AAPL has been

a great stock to trade using the signals. Its current chart is not so bullish looking now.

So, I post below some other QQQQ stocks that now look attractive.

Three sytematic approaches should be mentioned. One could reasonably search the NASDAQ-100

using Tiger's POWER-STOCK-RANKER software:

(1) Buy the highest Power Ranked DJI stock, now ISRG, but it has tripled since March

and shows weakening Accumulation; or

(2) Buy the highest Ai/200 stock, ADBE (see below); or

(3) Buy the highest current Accumulation Index stock with a rising CLosing Power, FISV.

As it turns out, FISV seems ready to score its own breakout past 50 and should be watched closely

for that. (See chart further below.)

|

Trading Results Using Peerless

Buys and Sells on DIA, QQQQ, SPY and AAPL: 1999-2009 June-Dec 1999 March-Dec 2000 Feb-Dec 2001 Feb-Dec 2002 DIA +10.8% +22.6% +5.6% +30.7% QQQQ +38.5% +11.5% +9.3% +9.3% Buy/Hold +77.5% -45.2% -15.6% -28.6% SPY +12.4% +22.4% +6.9% +6.3% AAPL +97.4% -20.1% +12.3% +1.2% ========================================================================= Mar-Dec 2003 Feb-Dec 2004 April-Dec 2005 Jan-Dec 2006 DIA +39.9% +11.4% +4.6% +24.6% QQQQ +54.5% +10.4% +13.5% +19.5% Buy/Hold +51.5% +14.2% +13.9% +1.7% SPY +37.5% +12.0% +7.2% +19.9% AAPL +57.0% +94.4% +94.7% +43.9% ========================================================================= Mar-Dec 2007 Mar-Dec 2008 Jan-Dec 2009

DIA +25.3% +10.0% +42.3%

QQQQ +33.0% +11.4% +61.7%

Buy/Hold +21.5% -30.9% +62.8%

SPY +20.9% +13.7% +51.8%

AAPL +114.5% +21.1% +136.6%

=========================================================================

ADBE (below) is at the support of its rising 50-dmay and 65-dma

and shows steady positive Accumulation.

|

)

-----------------------------------------------------------------------------------------------------------------------------

1/12/2009

The Coming Financial Storm

- Wednesday AM, 1/13/2009

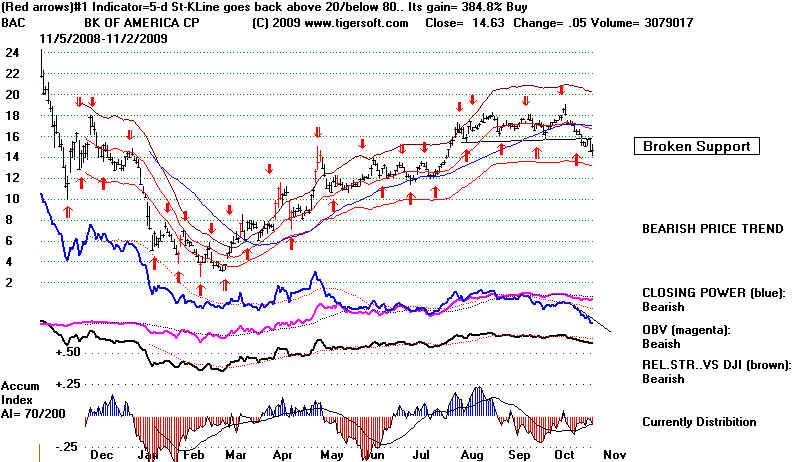

Finance stocks drove the market down

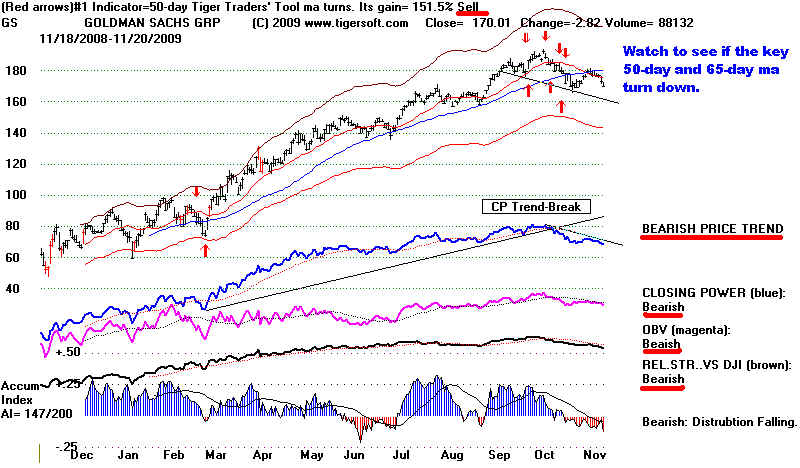

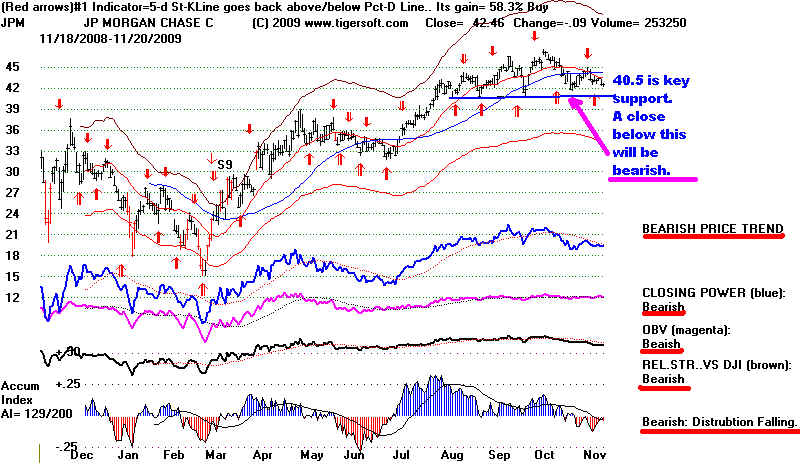

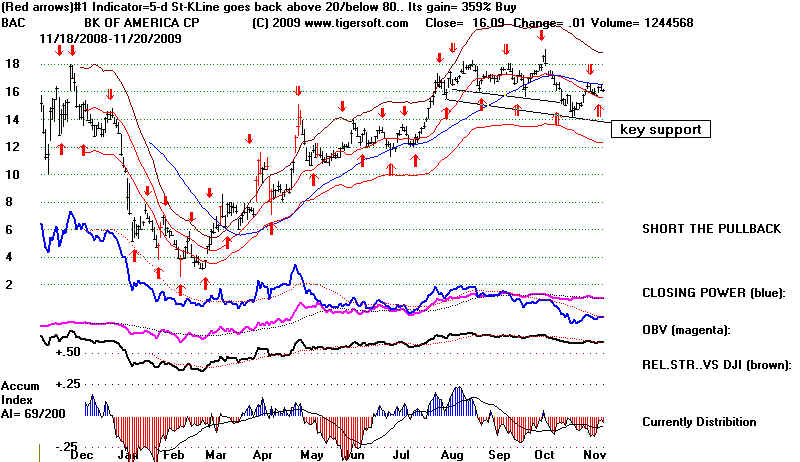

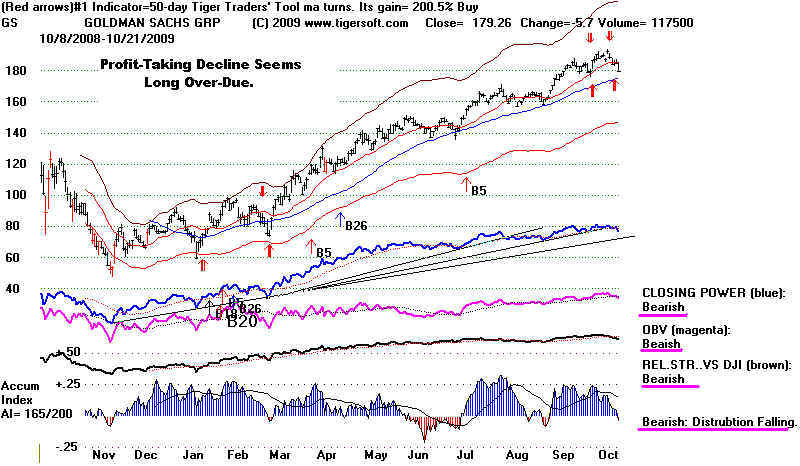

today. BAC lost -.57, JPM -1.04, WFC -.72, GS

fell 3.74 (below its now falling 65-dma and IP21<0 and AIG -1.17. But bullishly

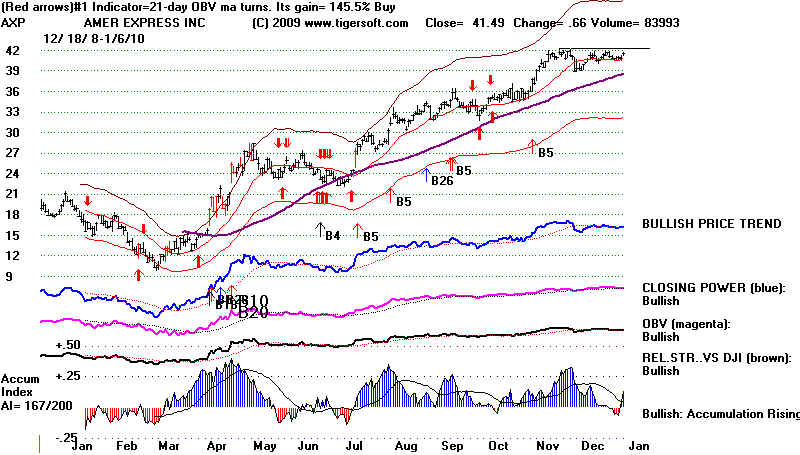

AXP rose +.55 to 42.02 and

looks ready for an upside breakout above a flat top. That the Closing Powers

were rising

for the DIA and SPY and MDY helped keep the losses very limited. Talk

of regulation of

banks

and Obama's

talk of more taxation of bank bonuses and trading profits clearly

frighten them and create new uncertainties. The public may deeply resent their excessive

pay

and believe without deeper regulation of Wall Street another financial bubble and panic

are inevitable,

but these Wall Street bankers also hold the recovery hostage. Who doubts that they

could

quickly dramatically drop the stock market in a few days, even hours, if that was their

wish?

Such is their dangerously excessive power and the problem in a democracy of banks

"too big to fail".

Needless to say, there is a an on-going and gathering movement to much more heavily tax

and regulate

banks. So, we must be careful. All this talk will amount to very little

unless Glass Steagall is restored

amd commercial banks can once again no longer be investment banks. I hear no such

proposals from

the rhetoric-minded White House or the Republicans who rightly see a real political

opportunity

in Geithner's cover-up of his favoring Goldman Sachs with $13 billion from taxpayers in

the AIG bailout.

"The F.D.I.C. board, in a 3-2 vote, approved a preliminary plan to tie the fees that

the

F.D.I.C. charges banks to fill its insurance fund to the banks’ compensation

practices.

Under the plan, banks that use long-term stock to reward employees and adopt provisions

to claw back compensation would pay lower fees."

GS has to be very concerned that unseemly revelations will come out about its special

treatment

by Geithner and the FED in the matter of the AIG bailots. Geithner has to be

concerned that

he has committed criminal perjury if he denies knowledge of illegal Fed instructions last

year to AIG

to conceal its payments to GS from the public and Congress. Obama has to be

concerned that

he could be committing an impeachable offense if he protects Geithner too much and insists

he knew nothing. An independent prosecutor should be called for. Obama will

resist doing

what is right. The degres to which Goldman runs the Administration's financial

policies would

then have to be disclosed.

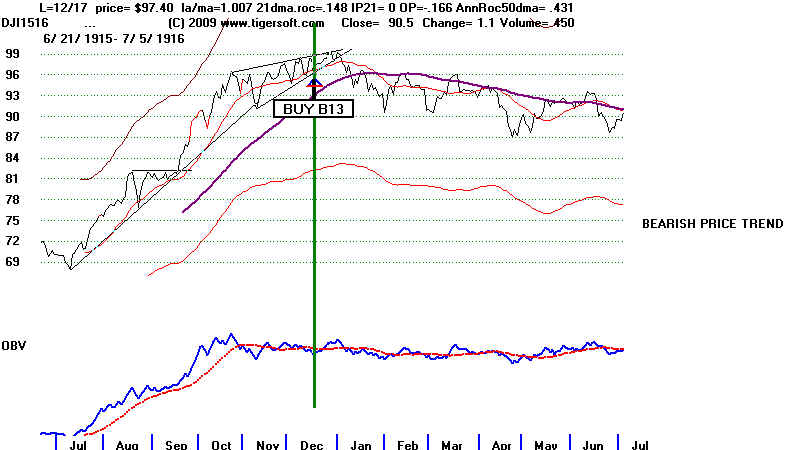

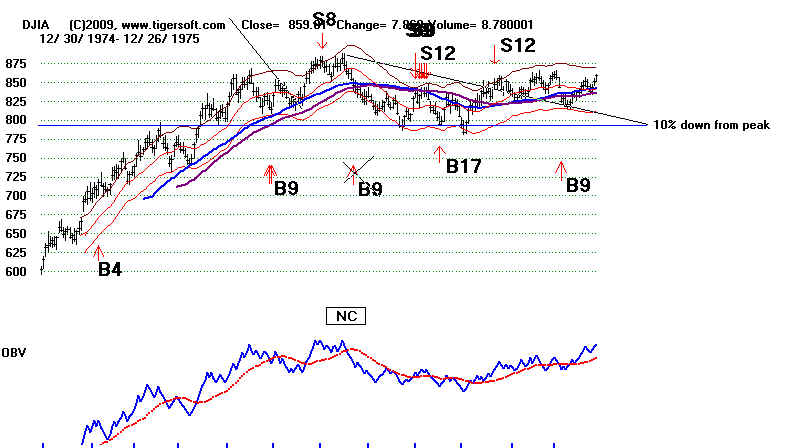

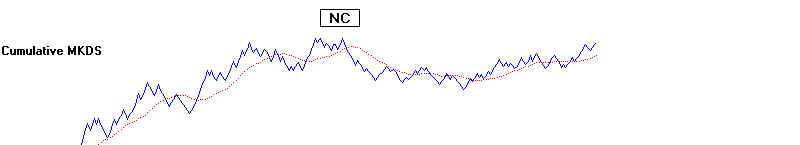

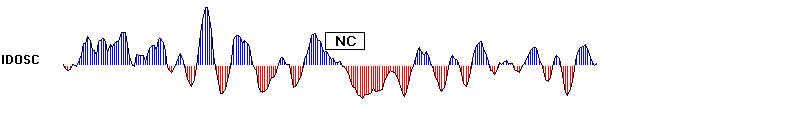

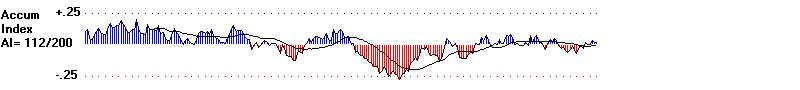

The DJI has been in an unusually narrow range for 10 weeks. There are a few cases

trading is similarly stuck in a narrow range. The closest parallel I can find is

also at the end

of a year and the begining of the next. It is 1915-1916. In this case the DJI

gradually retreated

10% over the next year. An OBV NC of the January 1916 high, a violation of DJI's

uptrend,

and then the 65-dma were the best clues. The DJI's OBV Line now is confirming.

In general,

it pays to believe the evidence of a decisive breakout from the narrow channel. If

it is to the upside,

the market is bullish. But if it breakdown, here below 10200, it will be bearish.

Very likely

such a breakdown would also bring a Sell S10, although breadth would need to deteriorate

more.

Falling 65-Day MA with Negative

Accumulation Is Bearish.

More Upside for AXP? Impending Flat-Topped Breakout.

====================================================================================

1/11/2009

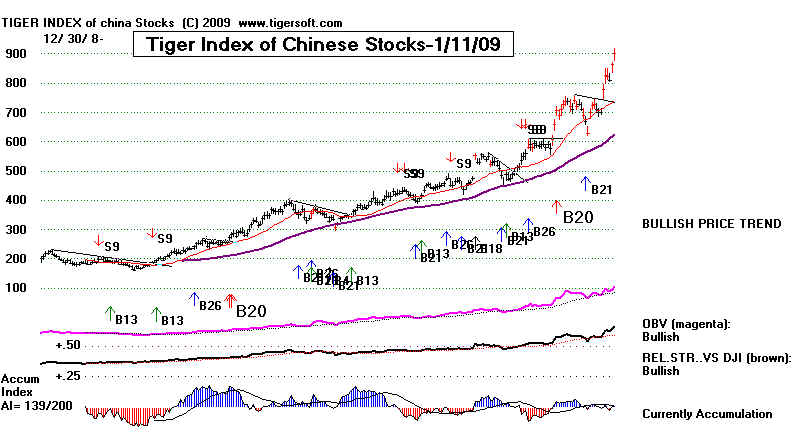

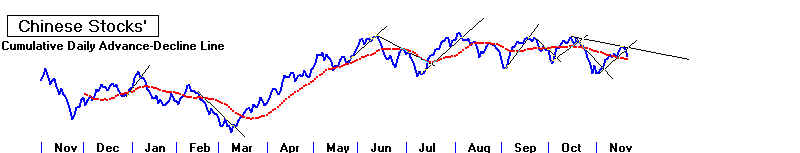

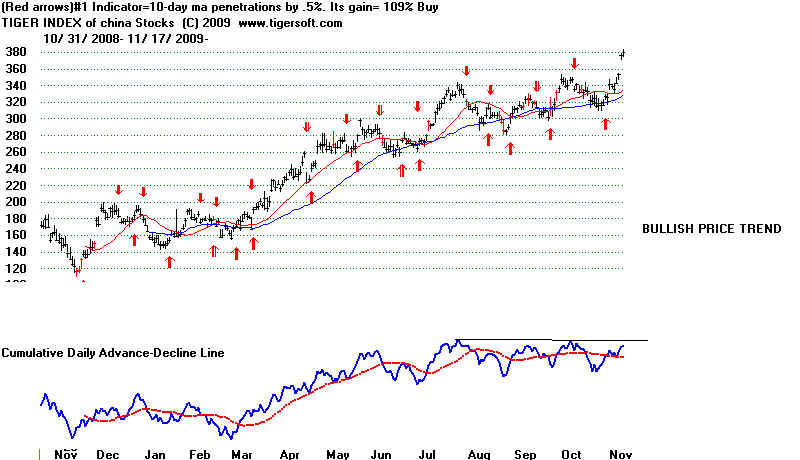

A New Chinese Market Bubble?

While the DJI struggles to decide if it will achieve

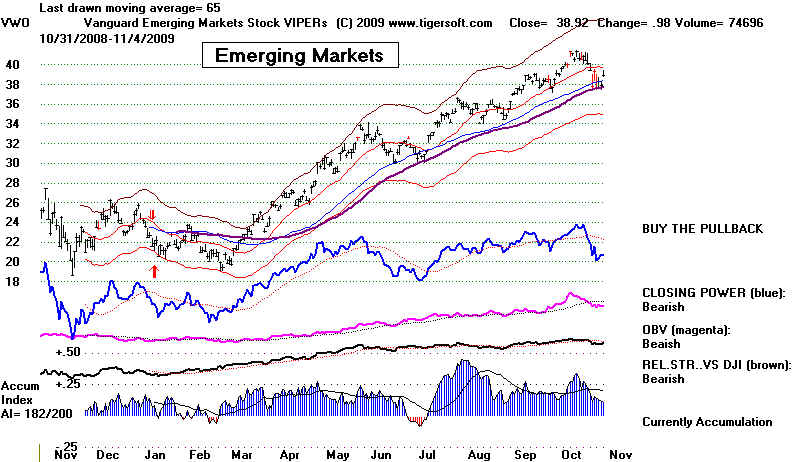

a decisive 2 month new high,

foreign markets, especially Russia, Eastern Europe, Brazil, Indonesia and especially

China are rising with great speed. Many Chinese stocks may be easiy purchased

in the

US. That and the strong

Chinese recovery are creating a speculative bubble in

China. Two dozen, or so,

Chinese stocks up several hundred percent in the past year

are getting most of the play.

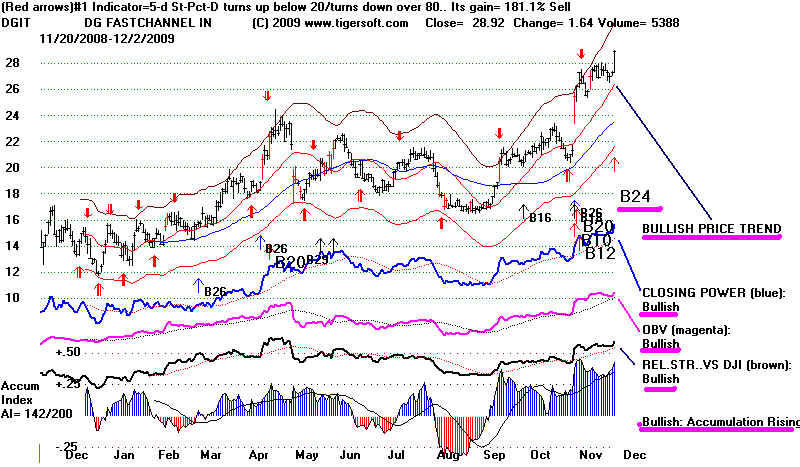

These Chinese super stocks show the same characteristics that explosive US

stocks do: Early bulges of Insider Buying (AI>+.45), Flat Topped Breakouts, Buy B10s,

B12s and especially B20s and B24s. Closing Power is less significant with these

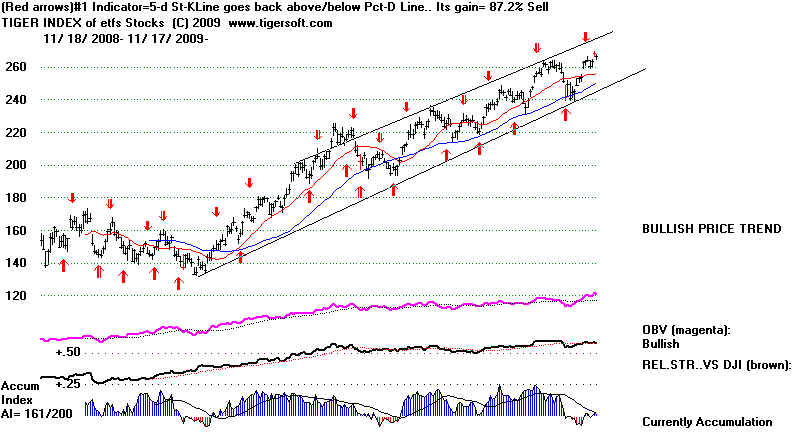

overseas companies. What you may not realize is how much big US investors are

buying in the way of Chinese stocks. One can easily use Yahoo to research the

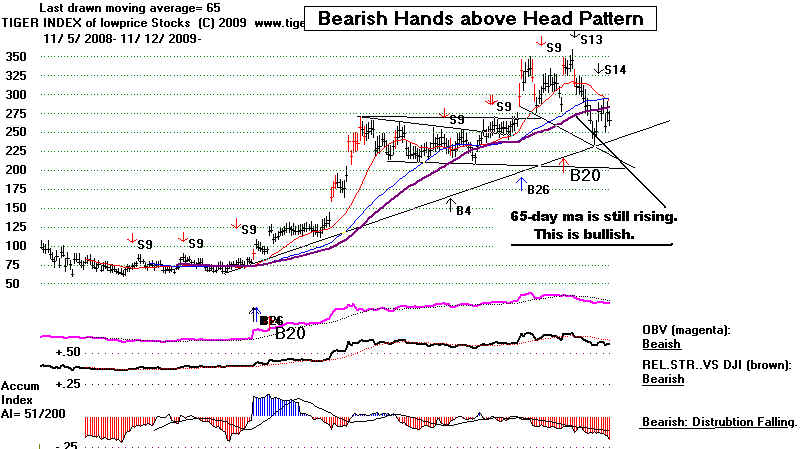

biggest holders. Below is the TigerSoft Index Chart of 158 Chinese Stocks. The

TigerSoft index weight each stock by trading volume times price. Look at the A/D

Line

for the group of 158 Chinese stocks. Notice it is flat. This shows a

narrowness to the rally.

This is a bearish divergence. When this A/D Line actually turns down and starts

making

new lows, we will have to be ready for a severe shakeout. Meanwhile, we are in

the climatic, blow-off phase of this advance. There are stocks now thatr look like

they will make good trades to buy. Seethe table below of the best performing

CHinese stocks.

26 Chinese Stocks Leaders 1/11/2010

Pct Change

Since

1/9/2009

----------------------------------------------------------------------------------

+232% BIDU - S14 S29 IP21<0 and below flat 65-dma Chinese langauge search engine

+668% CAAS - AI Bulges and B10,B20,B24 AUtomotive

+668% CAGC - AI Bulge and B10,B20,B24 Oraganic liquid fertilizers

+445% CGA - AI Bulge and B20,B24 Agritech

+223% CPHI - AI Bulge and B20,B24 Pharm

BUY

+378% CSIQ - B20 Solar Energy

+333% CTEL = AI Bulge and B10,B12, B20,B24 Hong Kong Telecom

Negative AI with stock at upper band.

+266% CTRP - B20 TRAVEL SERVICES

+314% CYD - B10, B20 DIESEL ENG. MFG.

+98% FMCN - AI Bulge and B24 MEDIA

+328% HMIN - AI Bulge and B10,B12, B20,B24 HOTELS +181% HRBN - AI Bulge and B10,B20 ELECTRICITY +176% JOBS - AI Bulge and B24 JOBS +590% KNDI - AI Bulge, Line Formation, B20 TECHNOLOGIES +273% KONG - AI Bulge and B10,B12, B20,B24 WIRELESS PHONE SERVICES +427% NEP - AI Bulge and B12, B20 OIL EXPLORATION +142% PWRD - B20 ON-LINE GAMES +530% SEED - B20, 6-Mo. Trading Range Break-Out AGRIC. +445% SORL - B20 AUTO +484% SPRD - Flat topped Breakout, B20 WIRELESS SERVICES +524% TSL - Flat topped Breakout, B20 SOLAR +920% TSTC - B20, B10 WIRELESS SERVICES +130% VIMC - AI Bulge and B20,B24 SEMI-CONDUCTOR +296% VIT - B20, B10 TECH +306% WATG - AI Bulge and B10,B12, B20,B24 AUTO +141% WX - B20, B10 PHAR +210% YZC - B20, B10 COAL |

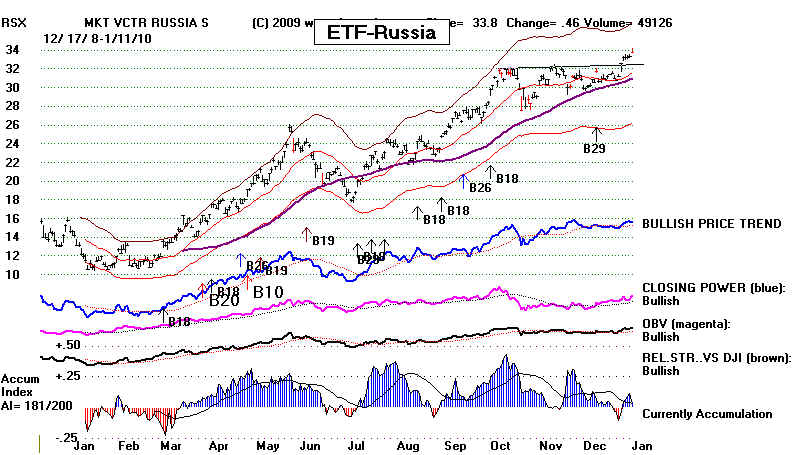

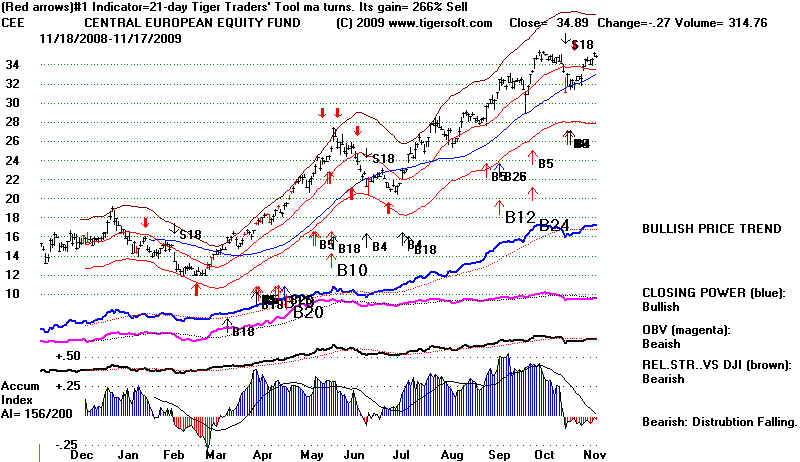

The Russian ETFs. RSX and CEE, look like they are making bery tradeable breakouts now.

This is partly a reflection of the rising

oil and gas prices.

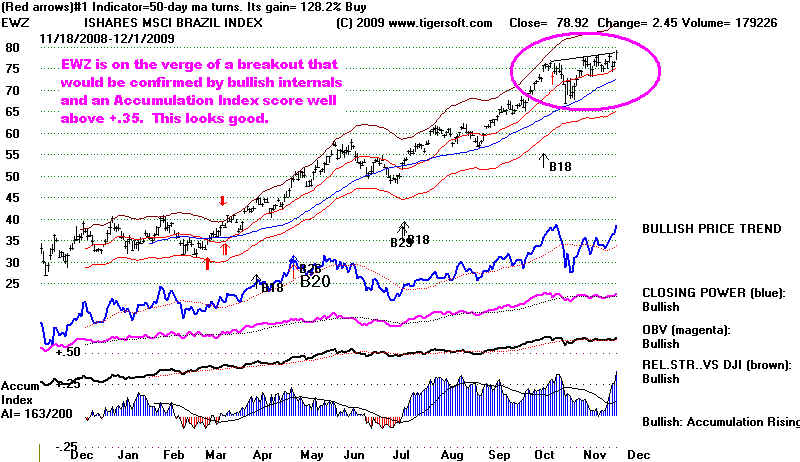

============================== Country ETFS =====================================

Pct Change

Since

Country

Peerless Buys and Sells'

Recommendation

1/9/2009 ETF

Performance - Long Side Only

-------------------------------------------------------------------------------------------------------------------------------------------

158% RSX - Russia

+166%

Breakout BUY

157% MF - Malaysia

+69%

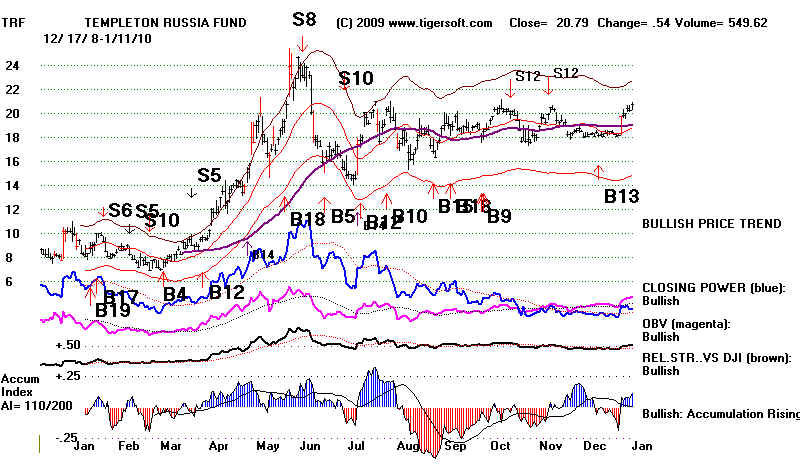

133% TRF - Templeton

Russia +325%

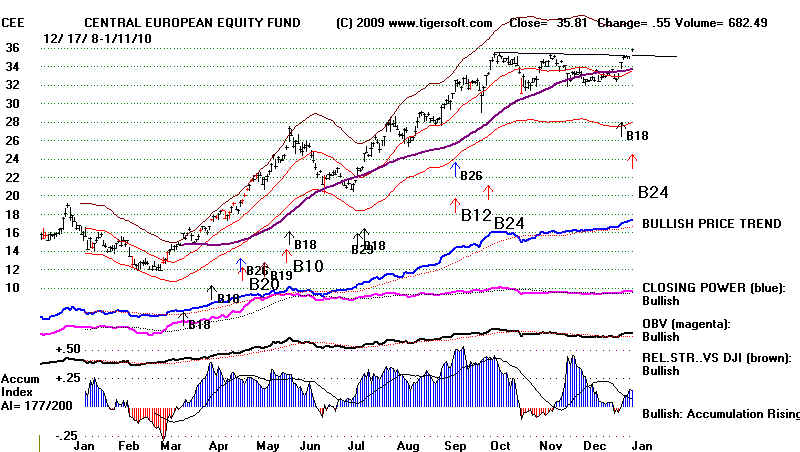

117% CEE - Central

European +202%

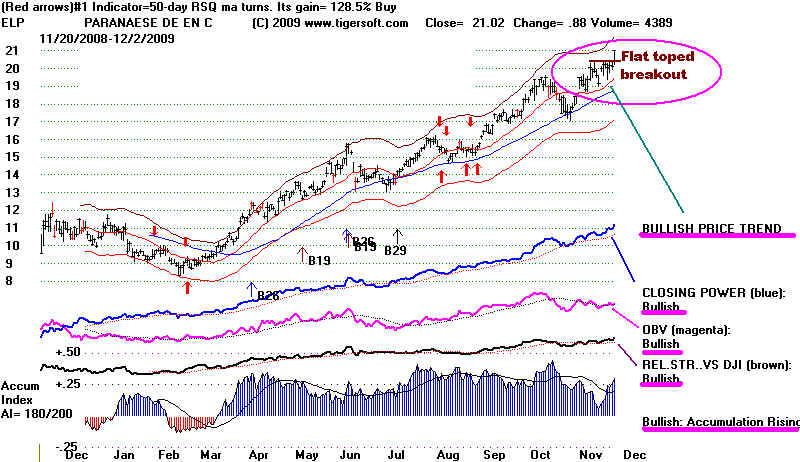

Breakout BUY

115% EWZ - Brazil

+120%

103% IF - Indonesia

+258%

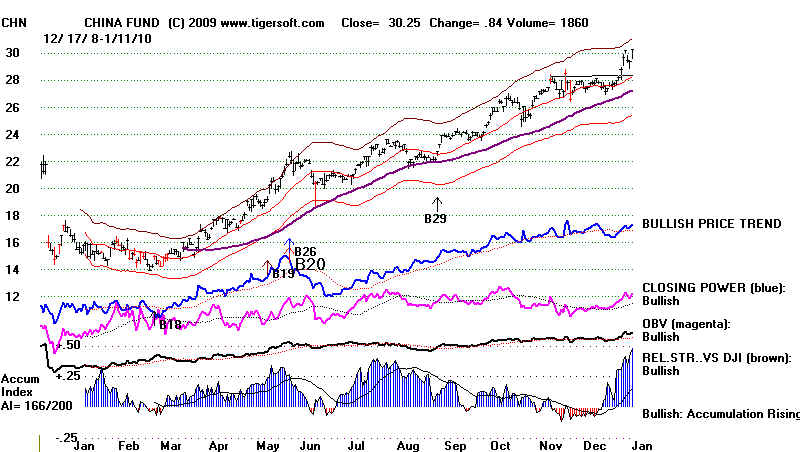

95% CHN - China Fund

+71%

AI Bulge Breakout Buy

94% GRR - Asia Tiger Funds,

+108%

On verge of Breakout

--------------------------------------------------------------------------------------------------------------

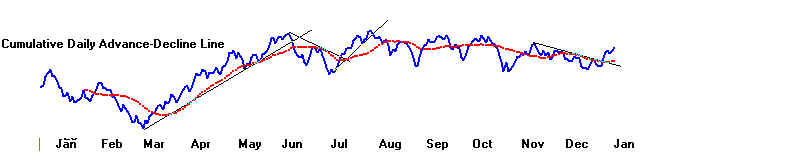

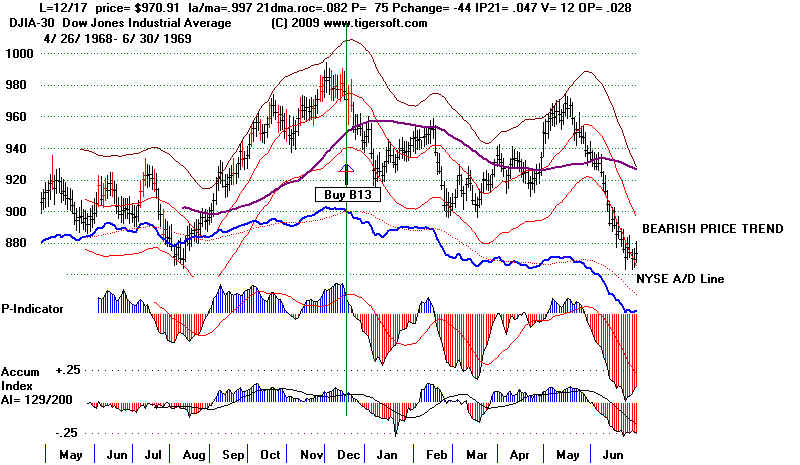

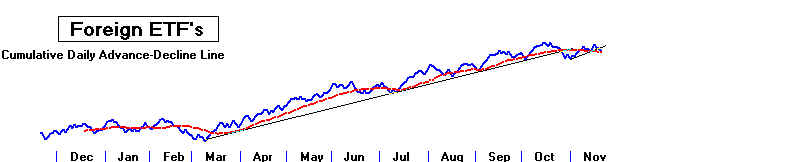

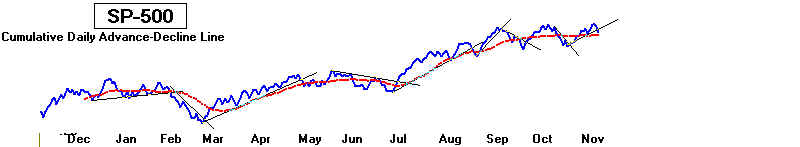

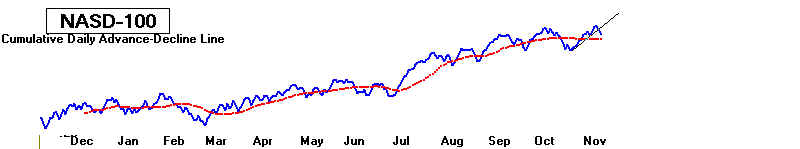

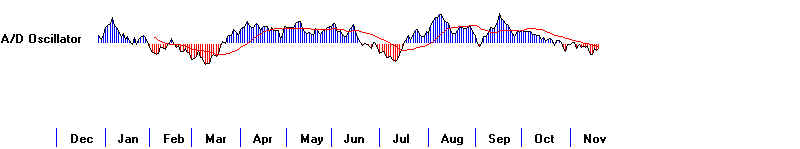

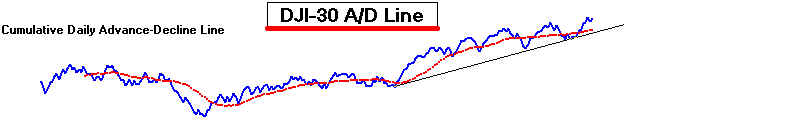

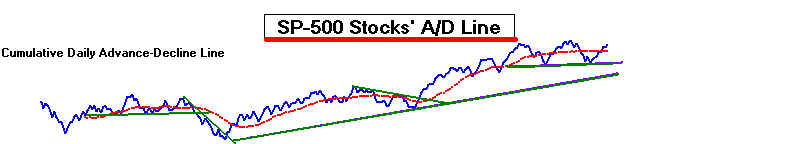

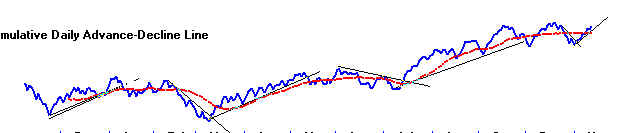

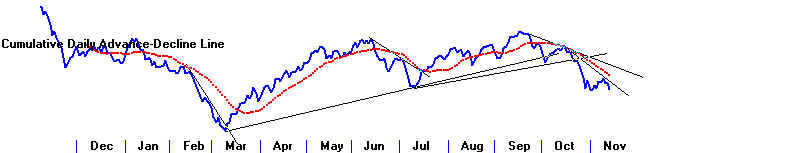

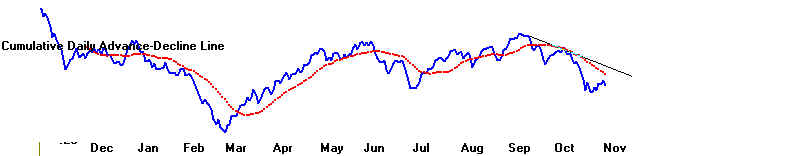

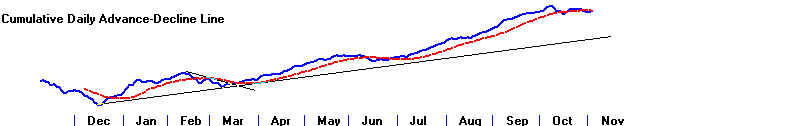

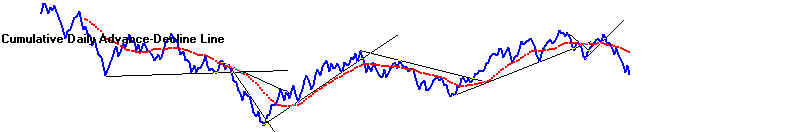

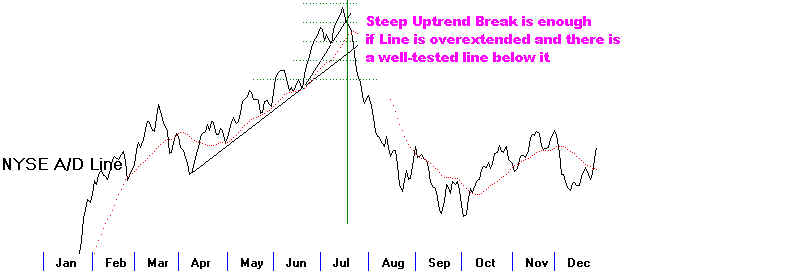

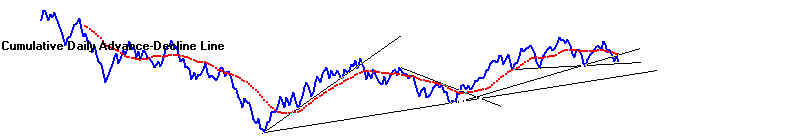

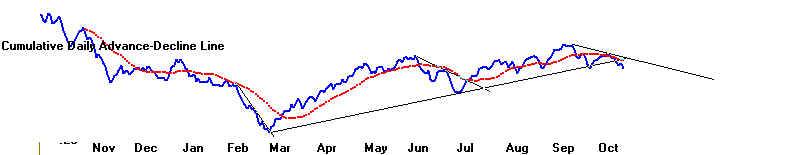

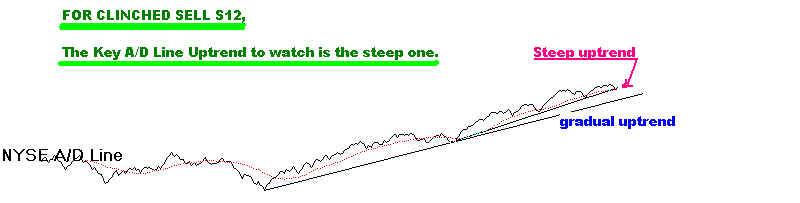

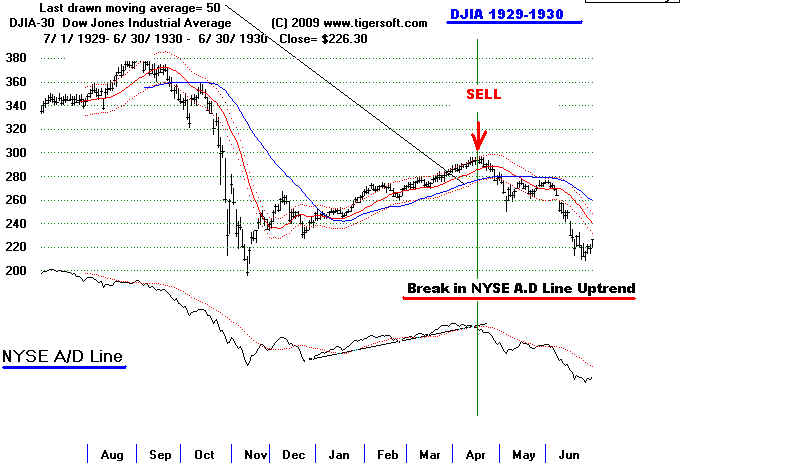

1/8/2009 A/D Line Keeps

Moving Higher.

The DJI-30 is the only major DJI that has not been able to make a clear

breakout to new highs. As you can see above, all the others have. Not only

that, but the NYSE A/D Line keeps bullishly streaking to new ALL-TIME highs on our

weekly chart, way ahead of the DJI. See below. Going back to 1928, I would judge

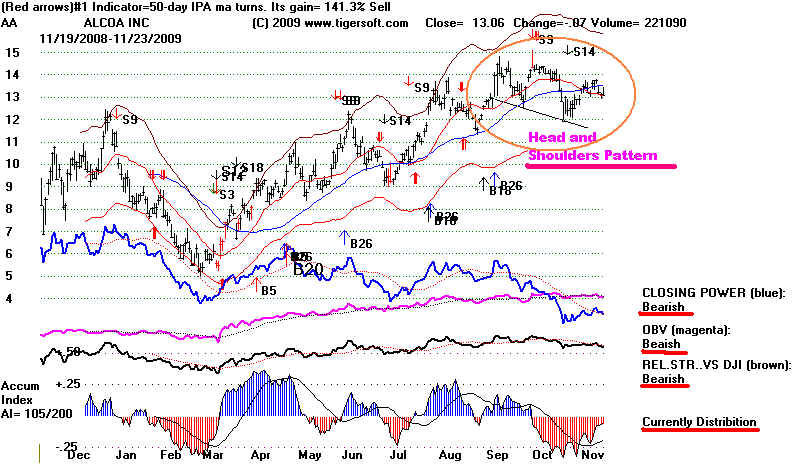

that 70% of the major tops occur with the the A/D Line not confirming a DJI high.

(The others we pick up with Sell S12s, head and shoulder tops and some other rarer

signals.) So, the strong A/D Line is very encouraging.

We should be even more bullish now because in many past cases, especially

in a lengthy bull markets, it often takes a number of such non-confirmations by

the A/D Liine of new highs to bring about a top technically. We have not had even

a first such A/D "NC" of a new high. So, the exceptionally strong A/D Line should

keep us bullish.

Of course, we can always find exceptions or something else to worry about.

We could worry that this is a market like 1977 when a weak Dow Jones wins out

over the A/D Line. But that takes months and months of the DJI hitting its head

on resistance before the bulls give up. In 1977, after 6 months of floundering and

then slipping more than 12% from its high, a "fail-safe" Peerless Sell S10 finally

should have been used, because the DJI then dropped another 15% over the next

nine months anf the A/D Line turned down.

We will want to watch the Accumulation Index on the DJI. It is not very positive.

But an S12 seems unlikely, since I have found that S12s work best when the

P-Indicator is not so positive as now. The P-Indicator measures monthly breadth.

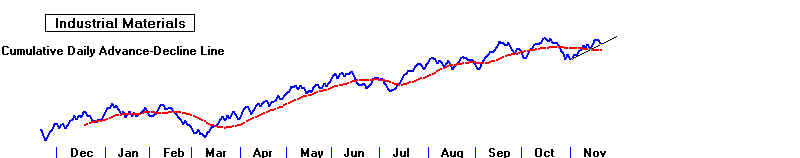

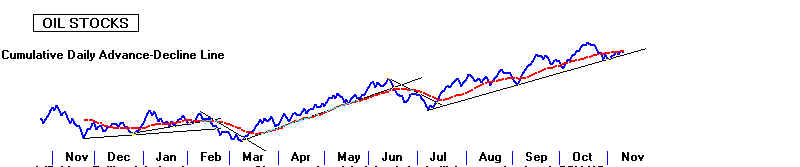

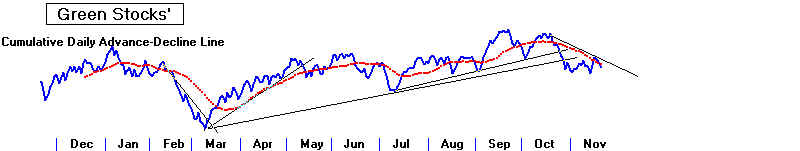

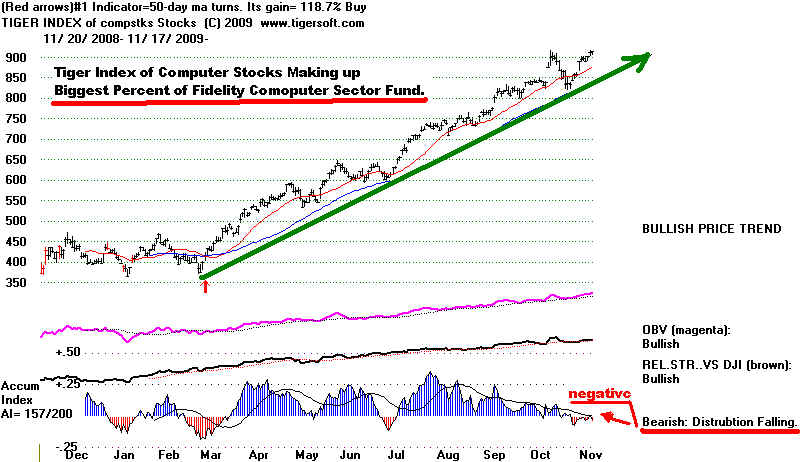

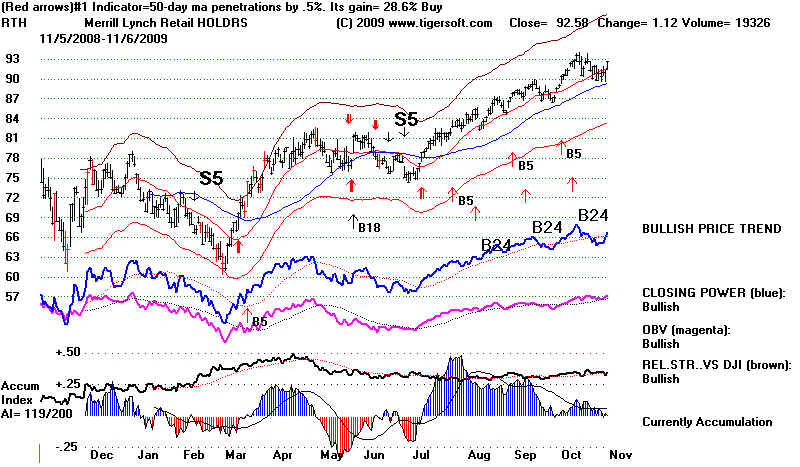

Strong Sectors Abound - That's Bullish, including

Cyclicals, which Suggests Am Improving Economy!

Inspection of the Fidelity Sector fund yearly charts show quite a few

that are making new highs in what I consider to be a sustainable way:

Cyclical FCYIX Multimedia FBMPX Outsourcing, IT FBSOX

Natl Resources FNARX Energy Services FSESX Air Transp FSAIX

Automotive FSAVX Small Caps FSCBX Ind Equipment FSCGX

Chemicals FSCHX Military FSDAX Developing Comm FSDCX

Ind. Materials FSDPX Electronics FSELX Energy Services FSESX

Medical Delivery FSHCX Medical Equipment FSMEX Health Care FSPHX

Environmental FSLEX Transportation FSRFX Wireless FWRLX

I offer the biggest 10 stock-holdings of all the 40 Fidelity Select funds on the

TigerSoft data page each night. So, this a safer, more vetted universe to run

the Power Ranking program against. Presently, the top Power-Ranked stocks

here with an IP21 over +.25 and rising Closing Powers are:

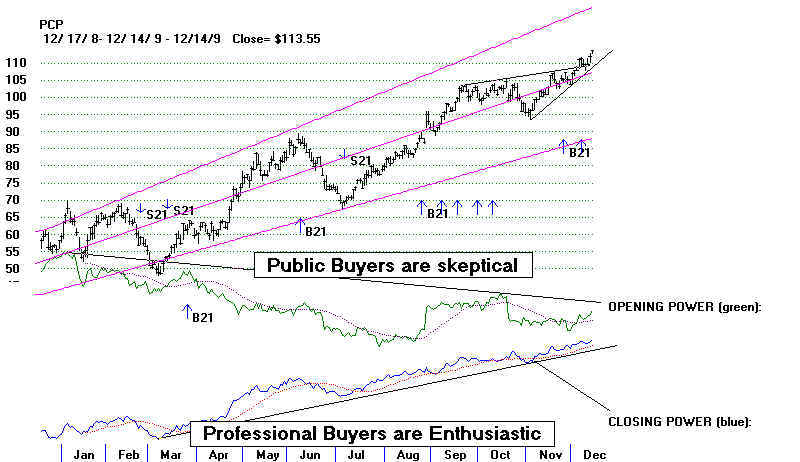

Price AI/200 Curr. AI (IP21) TGR Signal

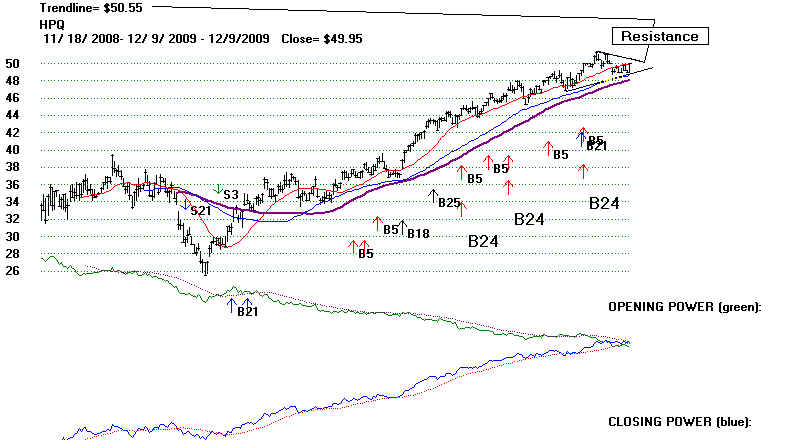

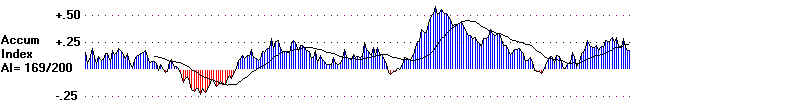

HPQ 52.59 189 +.37 Down (public) Up (professional)

PCP 117.22 160 +.31 ? (public) Up (professional)

MDT 45.99 168 +.35 Up (public) Up (professional)

Oceaneering (OII) among these Fidelity favorites has just made a flat-topped

breakout after consolidating for four months. Its internals are all bullish. Both

Opening and Closing Power are rising. The breakout nullifies the short-term Sell.

A number of energy stocks not owned by Fidelity also look very good, in the sense

that they have very a high power-ranking value, an IP21 above +.40 and and both

their Opening and CLosing Power are rising: NOG, SWM, IOC. But each these are

already up at their upper band. So, I suggest simply looking at the oil stocks

making new highs. This reveals ETE as another attractive trade now.

=== ==========================================================================

1/6/2009 Still A Buy B13.

The DJI failed to breakout past 10600. Having failed to overcome resistance,

it may have to test its support near 10250 again. The NYSE A/ D Line again outperformed

the DJIA. There were 605 more up than down on the NYSE. NYSE New Highs rose,

though NASDAQ New HIghs did not. Breadth, I keep saying trumps volume. And as

long as we have no new Sells from Peerless and the NYSE A/D Line uptrend is not

broken, I think we have to expect higher prices, proably a move to the 11000 broken

support from 2008, which should now be reisstance. NYSE Down Volume keeps

declining. So, downside pressure is limited now. Also, bank stocks like BAC and C

are on the upswing again.

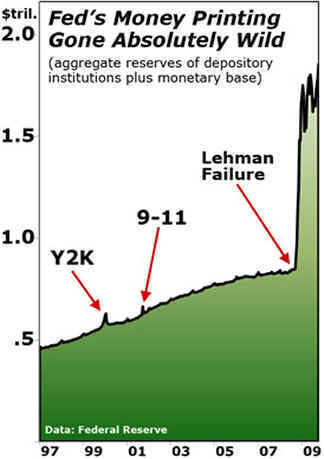

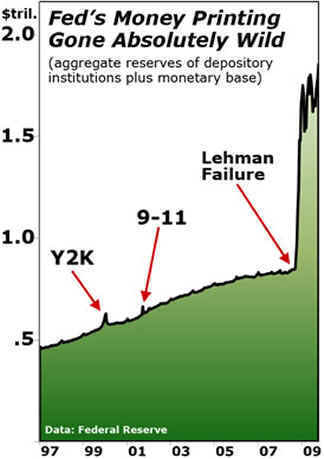

Doubters of the rally point out the artificiality of the recovery. They say the advance

has been fueled artificially by essentially free money that banks have been given by the

Fed, Bernanke refuses to give details, Small wonder! What we do know is that in

return for toxic debt collateral, Goldman, Chase, Bank of America, CityGroup,

Wells Fargo and other very big manks have been able to borrow more than

$2 trillion at the Fed' Discount Window in return for collateral consisting of taxic

debt that has little market value. The banks, it is said, certainly Goldman Sachs,

have run up the market, hoping to sell shares to every-day investors once the

economy picks up. There is no evidence that the FED has restricted speculative

stock purchases or efforts by Goldman and Morghan Stanley to rig the market. There

are those that belive that the Fed has encouraged and even orchestrated these

activities. All this would, of course, have been completely illagal under the laws that

existed from 1935-1999, when Glass-Steagall was in effect. Now there are those who

claim that the FED may be directly causing the market tp rally. Personally, I

believe tthe FED has always tried to move the stock market up and down. And

it has always shared its intents with the biggest banks, so that their intentions

would more easily come to pass. That conclusion is easily reached looking back

at November 1970, Septmber 1978, mid 1982, September 1987, December 1987...

My new Peerless book shows this to be a regular theme in US Stock Market

history: insiders always know first. And the job Peerless is to track them.

The blatancy is greater now, because the insiders, the bankers, are more desperate,

- "The source of approximately $600 billion net

new cash necessary to lift the market's overall

capitalization by $6 trillion last year could not be identified by TrimTabs, Biderman said. The money,

he said, didn't come from traditional players such as companies, retail investors, foreign investors, hedge funds

or pension funds. - "We know that the U.S. government has spent hundreds of billions of dollars

to support the auto

industry, the housing market, and the banks and brokers. Why not support the stock market as well?"

(someone's been reading my blog...) The Federal Reserve or the Treasury, Biderman said, could have easily

manipulated the stock market by purchasing $60 to $70 billion worth of futures of the S&P 500 Index

on a monthly basis. (especially in premarket when the market is thin...recall so much of the rally in the spring

and summer was overnight, rather than during the day )

(Source:

Another reason for still being bullish, it's not hard to find stocks that still look like Buys.

Rank the stocks in the SP-500 and the new highs' list for current Accumulation. If

a stock shows current Accumulation above +40, is making a new high and shows

high past (blue) AI/200 scores, it is considered attractive for purchase. Only when

it becomes difficult to find attractive stocks like htisto buy, we often then have

good reason NOT to buy. That is not true now.

Watch to see if AXP makes a flat topped breakout past 42. That will be bullish.

BAC and GS have just penetrated their 65-dma. With a positive Accumulation

Index, they could move up smartly now like NVOL has done below.

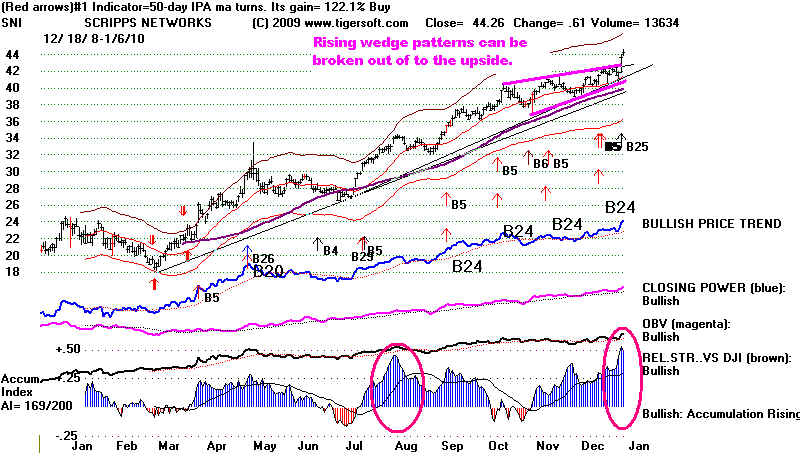

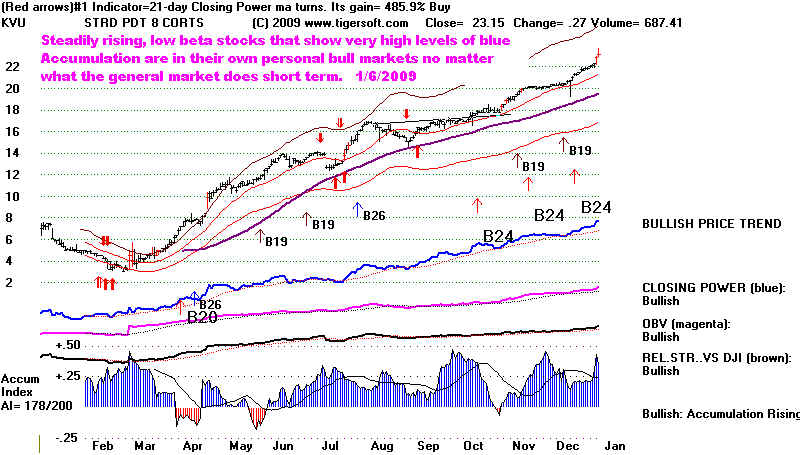

High Accumulation stocks like KVU seem reliably bullish now.

New flat topped breakouts confirm the uptrend. Note red high volume.

Internals are all rated bullish for TKTM.

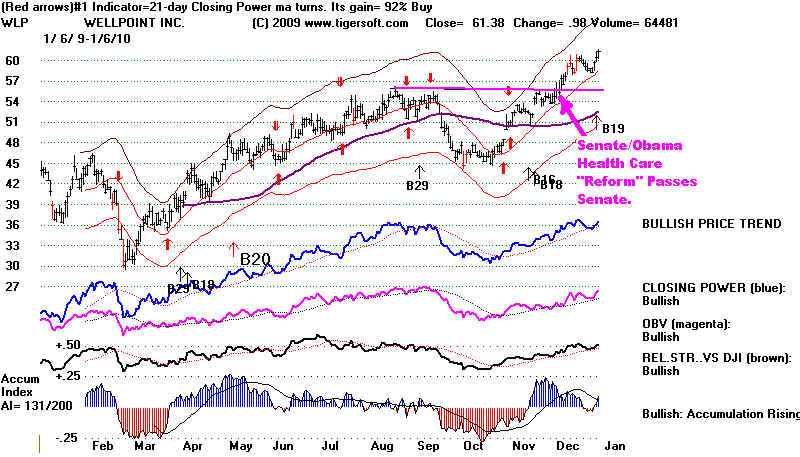

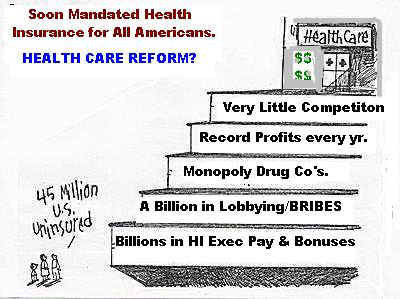

Beneficiaries of public policy are making new highs. Well-Point is a direct

beneficiary of the new health care "reform" which will require all Americans

to buy private health insurance. Blue Cross of Califrnia is owned by

Well Point. Their premiums have gone sky-high in the last five years.

People buy high deductible health "insirance" from them and then have

no money left for preventative tests and care. Small wonder that we

spend 12 to 15 times per person more on health care in the US than

Cuba, but have exactly the same lide expectancy.

=======================================================

1/5/2009 Still A Buy B13.

The DJI nearly closed above the 10660 resistance. (See chart above. )

A clear price breakout above its well-tested, slightly rising resistance line

would suggest a rise to 11000 based on the rising channel. It still might fail.

But that seems unlikely, as breadth remains very positive and January

is when such breakouts often occur. Volume remains low on rallies and

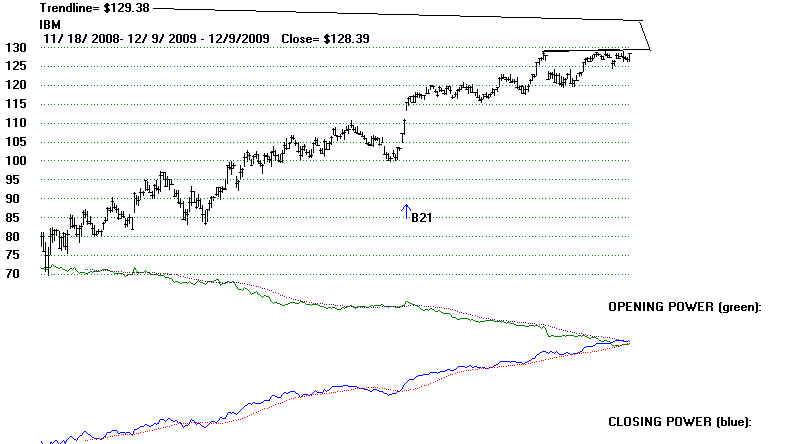

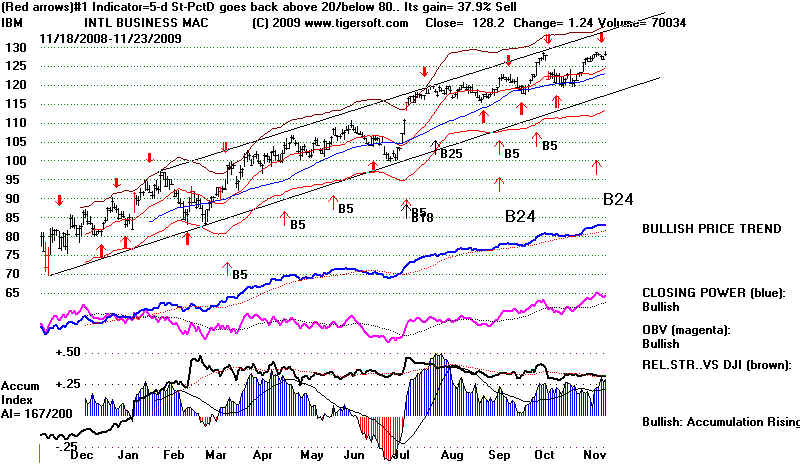

picks up on declines. This has to be of concern. IBM (-1.6) faltered as market

leader today. But its Accumulation Index has been consistently

very positive. Dips will probably be quickly recovered from.

On the positive side, there were 650 more up than down on the NYSE. Money seems

to be shifting around, but not exiting. Goldman is back above its 65-day ma but

APPLE shows red distribution and a Tiger Stock Sell S9. Without a Peerless Sell S9

or Sell S12, this probably only shows short-term re-deployment of funds from

Apple on the announcement of its new Slate and a growing sense that it must

do battle with the formidable Google goliath.

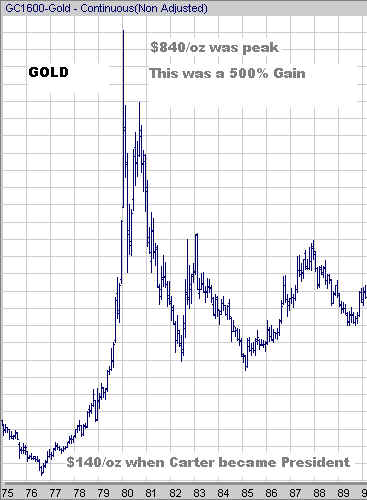

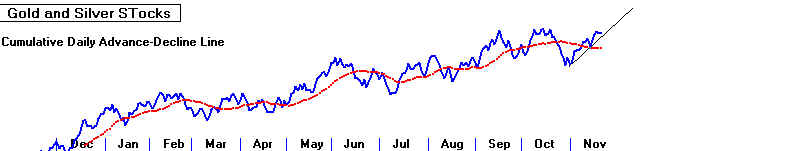

Precious metals (Gold and Silver) are rallying again. Silver seems headed for

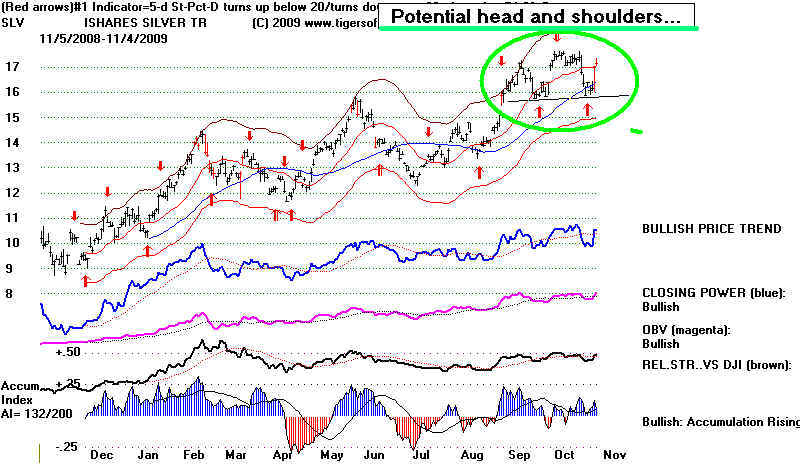

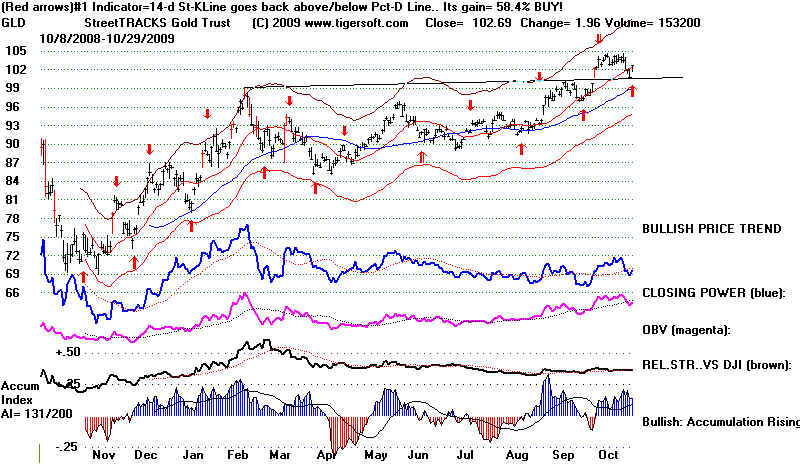

its recent high of 20-21. But their Accumulation Indexes are in red (negative)

territory. While that may put a limit to how far they can advance on their current moves,

see how quickly Gold bounced up off its rising 65-dma. That shows a lot

of patient (usually smart) buying interest, The CLosing Power downtrend-liens have been

broken above.

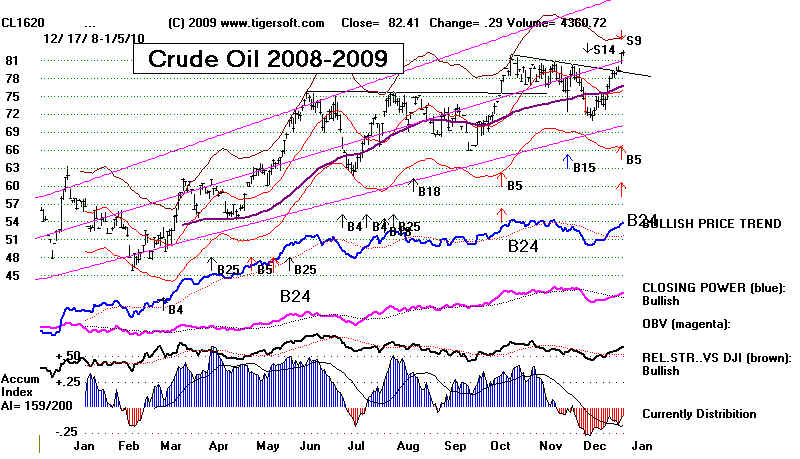

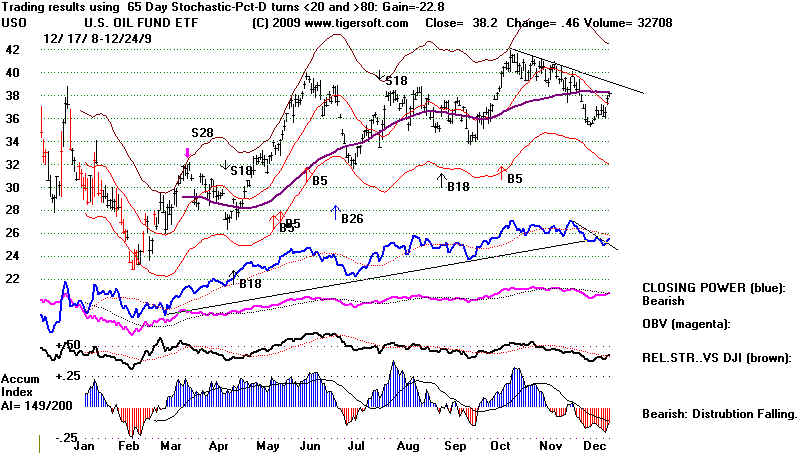

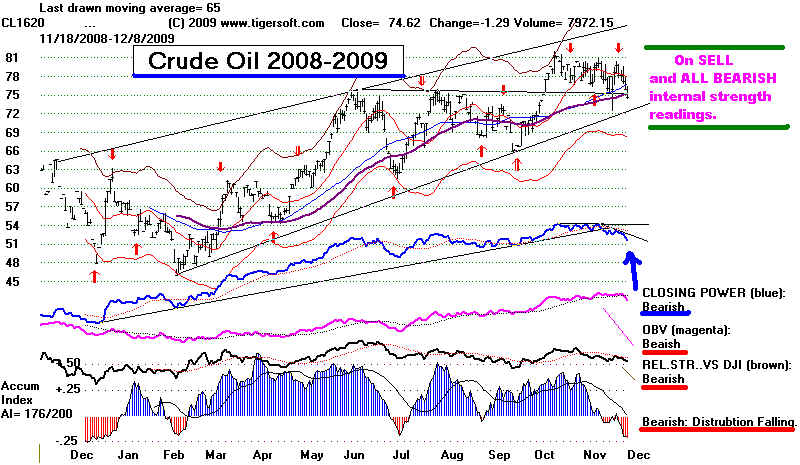

Crude Oil's Accumulation Index is also negative as it makes a run now to new

highs, bringing a Tiger Stock S9. After substantial advances, this can show

extreme vulnerability if the overall market also showed Peerless Sell S9s

and Sell S12s. But that is not so now. In addition, there has previously been

six months of (blue) Accumulation. So, I take this only to be a sign of heavy selling

into strength. Without a Peerless general market sell, it probably means a period

of hesitation and backing and filling is likely after a limited rally. Breakouts like

Crude Oil shows now past a well-tested line of resistance do have a considerble

short-term bullish momentum that usually must be played out.

See how strong the weekly A/D Line is on the 5 Year DJI chart. Accumulation

is weakening, but not negative. My judgement is that NYSE Volume is not high

enough to make a penetration of the 11,000 resistance imminent, but NYSE Down

Volume remains very low. So, the DJI will continue to eat up the overhead supply

while avoiding a significant sell-off that takes the DJI below the rising 65-dma. .

======================================================

1/4/2010

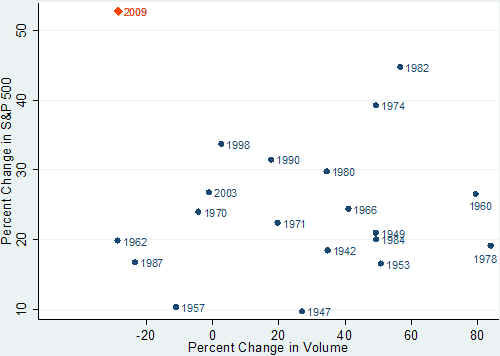

Buy B13 Continues. The rally took most stocks up today. I would favor stocks

making new highs soon after a period of "insider buying", which is signified

by a clear Accum. Index bulge past +.45. See the bulge of Accumulation in the

chart below as an example. Below are some stocks that show that pattern now.

Today many of the best performing stocks rose as a result of short-covering.

BAC was the best performing stock in the DJI and WYNN was the best in the

NASDAQ-100. It is bullish that the shorts are being forced to cover. Their buying

can push up selected stocks 25% over a few weeks time,. But after that, the

best performing stocks are usually those showing lots of Accumulation, flat-top

breakouts, red high volume and good relative strength. Lots of my studies of past

market moves upward in January suggest we want to own the stocks insiders

are buying with the start of the new year. Last year, the DJI started off weakly.

So, the insider buying in March and April was more important. See how

often this insider buying correctly identified the explosive super stocks of 2009.

http://tigersoft.com/2009-Super-Stocks/index.html

I would favor the stocks on the Tiger Data page under ACCUMULA. ACCUM.

Example - China Biologics - CBPO

,

Stocks showing this much Accumulation are still under Accumulation. They may

actually be held back a months, so that insiders can buy more. Give this plenty

of time.

====================================================================================

1/3/2010

Buy B13 Continues. The Buy B13 reminds us that the DJI is likely to

rise in the 10 trading days after December 17th. Tomorrow's trading

will be the tenth day. The next three trading days have seen a gain 61.5%

of the time since 1965. The bullishness wanes after that considerably.

Will Friday's weakness of 1.17% (671 points) spill over? I checked back

over all the past years to 1928. This was the second biggest percent decline

on the last day of the year. In 1996 the DJI fell 101 on December 31st

and then immediatelt rose 9% to early February. In 1998, the DJI lost 1% on the last

day and then also immediately rallied 5% a week later. So, one day does not

stop the rally. Both occurrences were years before the lasting, year or more

length bear market that began in 2000. Remember that flat tops like we now

see usually bring excellent breakout runs early in the new year. Hope the

bullish pattern continues!

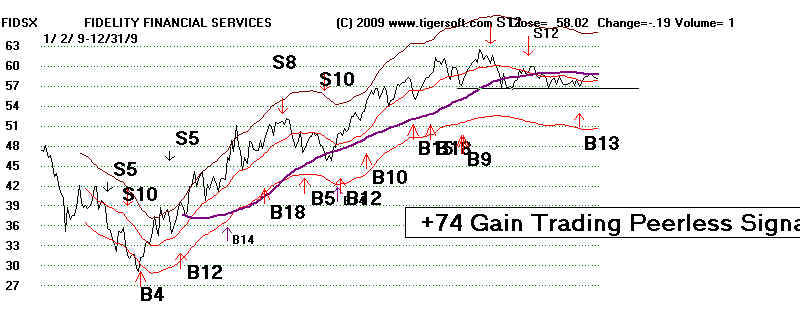

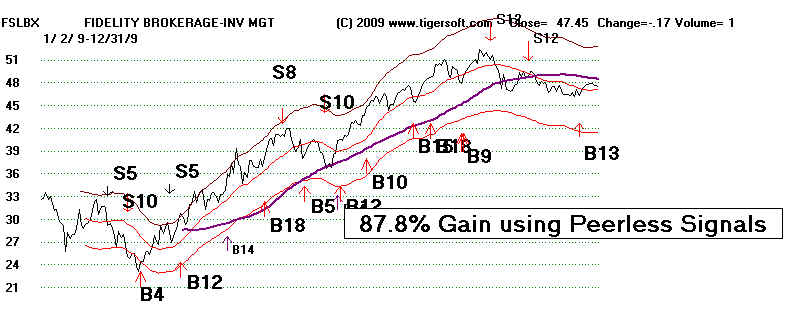

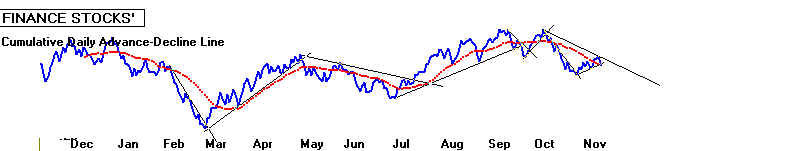

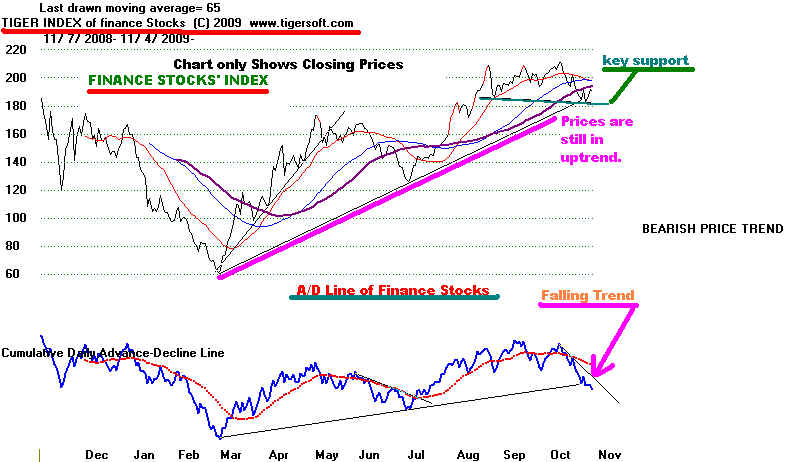

Looking at the 40 individual Fidelity Select funds, that show all the various industries,

one sees weakness right now only in financial, brokerage and insurance stocks.

Most stock groups are in staunch uptrends. Certainly, the Financials' weakness

could be a warning. It could grow. If the government really were to regulate

and go after big banks, financials might sabotage the whole stock market, as a whole.

This is surely a big fear that influences Obama. We just have to keep watching

them. Singificantly, my extensive back-testing shows that since 1987, the Peerless

Buys and Sells can be applied most profitably among all funds to the Fidelity Financials'

Sector Fund, FIDSX. This demonstrates that the fate of the stock market and these

Financial Sector funds seldom uncouple for very long. (I would add that past pro-bank

governmental policies have made this relationship closer than it might need to be

in the future. )

If the DJI violates 10200, there will be a significant break in a well-tested

support. A close below that might, depending on breadth, bring a Sell S10.

The bullish fact remains now that we are not likely to be at a top until

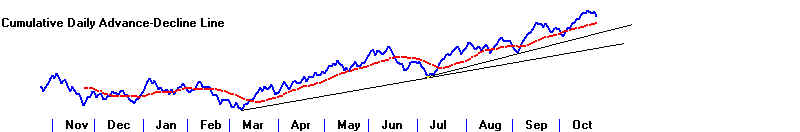

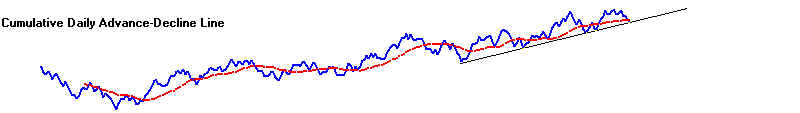

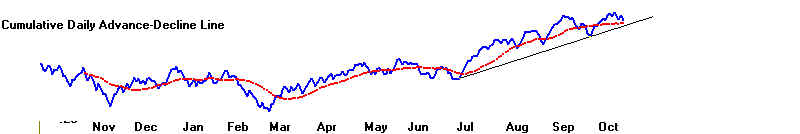

there is a significant deterioration in breadth (the difference between

NYSE advances and declines). A break in the 10 month A/D Line uptrend

would change that. The NYSE AD Line trendline is shown below. Its uptrend

is still continuing. But No Sell S9 is close to occurring. However, a break a

long NYSE uptrendline in May 2002 signified the post 9/11 recovery was over.

Very low interest rates could only take the market up so long.

For now, stay bullish.

Historical odds usually favor higher prices until breadth deteriorates.

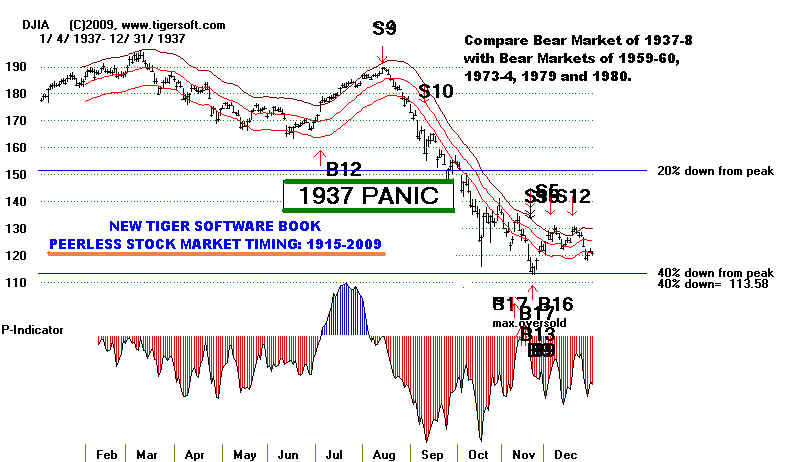

Since 1928 ended because of the NYSE A/D Line deteriotation and Sell S9s.

I count 18 tops made in this way: 1929, 1932, 1937, Sept-1939, 1950, 1957,

1959, 1969, 1973, 1979, 1981, 1987, October 1989, July 1990, July 1998,

January 2000, May 2002, July 2007.

11 other major tops were signalled not by a weak A/D Line or a Sell S9,

which is triggered by weak breadth.uajpp

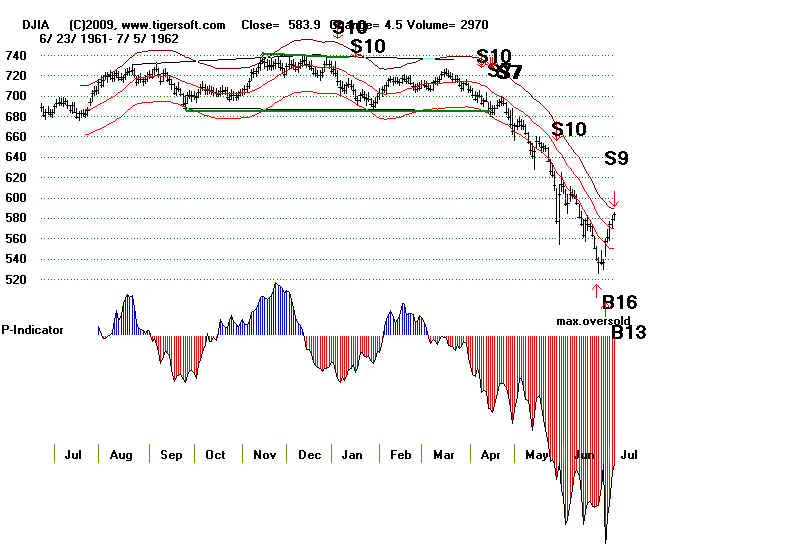

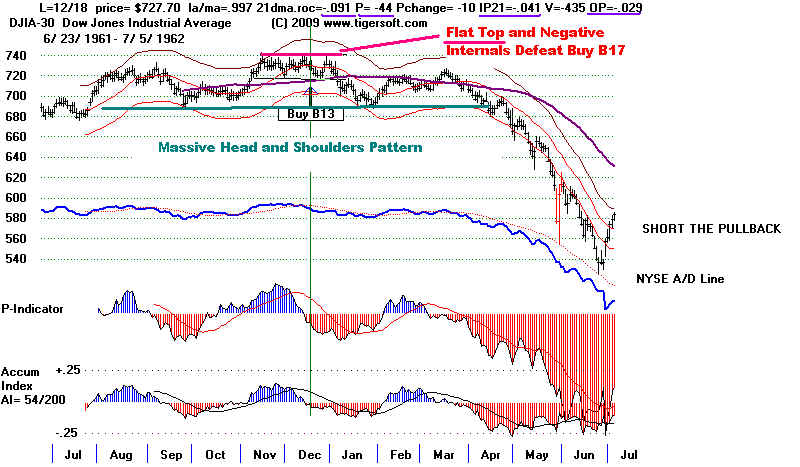

Head and shoulder tops accounted for four additonal tops in August 1941,

1946, 1962, March 1974. The sidewise action of the DJI since late October

is not a head and shoulders pattern. I would note, though, that most of the

DJI's trading has taken place near the top of the pattern. If there is a price

breakdown, that would make the pattern seem to be distribution.

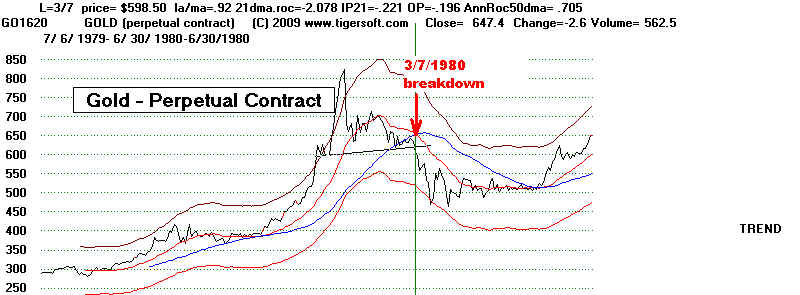

Negative Accumulation on a new high (Sell S12) alone signalled the tops

only in 1966, September 1978, February 1980 and September 1997.

That's only 4 cases. Sell S12s are more important because they reinforce

and add to the bearishness of S9s and bearish A/D Line divergences.

Other signals called the tops in 1968 (S1), 1976 (S8), January 1994 (S4)

=======================================================

12/30/2009

Buy B13 Continues. As long as the NYSE A/D Line uptrend-line in not violated,

we should give the DJI every chance to score a breakout above 10600 and make

a strong advance in 2010. There many examples of such runs at this time of year.

Study the NYSE A/D Line charts for these years showing such breakouts. .

One warning, if the Accum. Index stays negative on the breakout, the advance will be

much smaller. See the case of 1966. If a breakout does take place, we will want

to see a boost in volume. Our Stocks' Hotline is heavily invested in stocks that have

already made flat topped breakouts. I expect more from them, if the DJI achieves

a breakout. This will get publicity and invite more of the cautious public into stocks.

My General Prediction for 2010

Rhetoric aside, this Administration seems committed to getting the economy

out of its slump by helping first, banks, second, insurance and housing stocks, then

the stock market, then GM and lastly the rest of America. What might derail the

current market trend and their plans will be higher American Joblessness and populist

demands on the Administration that the biggest banks be broken up and Glass-

Steagall be reinstated. There should be a small improvement in the Unemployment

numbers for the next few months. If not, I would think the market will stumble. And

as logical as a return to Glass-Steagall (where cannot banks cannot be brokerages

and investment banks) seems to me, given the recent near-fatal collapse of the

financial system, almost no political leaders are demanding this and certainly not the White

House. (After all, it was Summers and Geithner's mentor Rubin that sold Clinton

on ending this Depression era banking reform.) So, American discontent with banks is

likely to be unfocused and will probably be satisfied by token financial reforms. That

Geithner allows big bank bonuses and high CEO pay, shows me that the Administration

does not fear a populist revolt and believes they can manage it using occasional

bursts of feigned indignation expressed solely via unbacked rhetoric.

If this prediction is correct, the uptrend should continue in 2010. Another significant point:

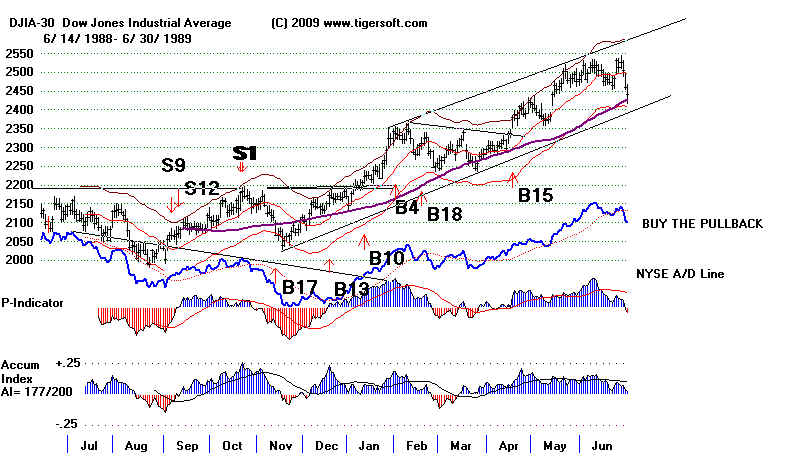

Just as in 1988, after Wall Street computerized trading crashed the market in the previous

October, the stock market is now also on its best behavior! It is clearly in Wall Street's

interest to let prices rise gradually. They may even have reached an agreement to do this in

return for Treasuty and Federal Reserve aid. Notice that after a year of a steady uptrend

in 1988, the Dow Jones Avg. broke out on January 11, 1989 above a very flat top and then

took off, running handily upwards until the Sell S9 of October 1989. See below, also,

how in 1989 the NYSE A/D Line was much weaker than it is now. The overhead resistance

at 11000 will be a problem. But it is surmountable after a lot of backing and filling, such

as we are seeing since October. So, except for fact that 2010 starts a new decade, and

such years, 1890, 1900, 1910, 1920, 1930, 1940, 1950 (less so), 1960, 1970, 1980, 1990 and 2000

have been historically jinxed, I would think that 2010 should start off as a good year.

If I'm wrong, fortunately we have Peerless to tell us when to get out. HAPPY NEW YEAR..

=======================================================

12/29/2009

Buy B13 Continues. Technically, we must require good breadth to compensate

for the low volume. Bullishly, the NYSE A/D Line is still uptrending. Today there

were 83 NYSE stocks making new highs and zero making new lows. On the NASDAQ,

the same numbers are 45 and 7, respectively. That represents a deterioration from

a few days ago. The QQQQ's breakout has not been matched by the DIA or the

SPY. In the DJI, we have seen impressive breakouts by HPQ, IBM and MSFT. But

breakouts are needed by DIS, AXP and JNJ. They have flat topped patterns,

but no breakouts. As I showed last night, the breakout need not be just as the

new yars starts to bring a very good rally. But it should occur in the next three weeks.

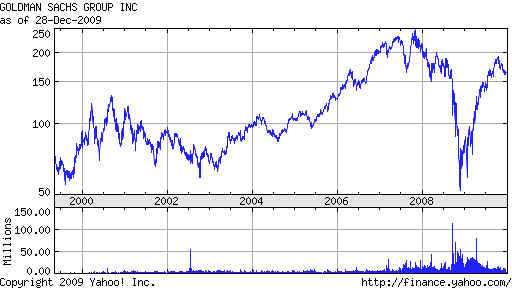

We want to watch Goldman Sachs closely. GS historically starts to fluctuate

violently when it and the market are topping out. That was true in 2000 and also

in 2007. The current decline does not yet look so serious. But the decline

is not over, judging from the Tiger Daily chart.

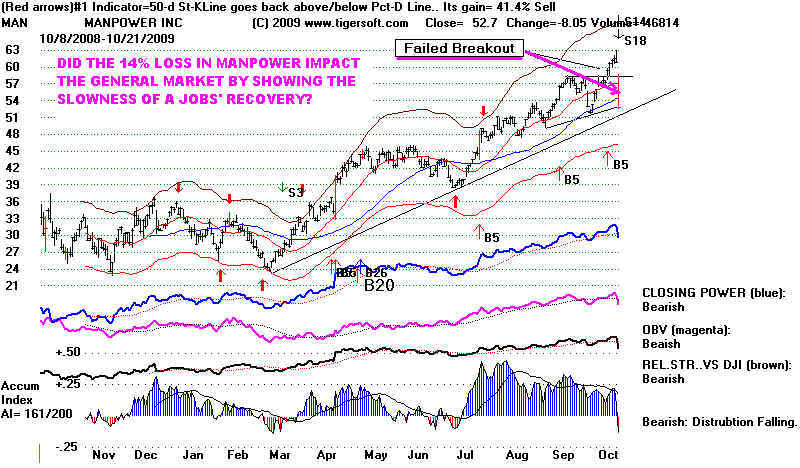

Jobs Will Be Very Important Politically in 2010

Our chart of Staffing stocks is in a rising trend. This is a coincident indicator.

It does not lead the market, but a serious lag in it would be bearish. Let's hope

the uptrend continues.

As Obama starts 2010, he must create more jobs and not just promote

a rising stock market by taking money from tax payers and then helping banks.

A bitter populist backlash is now working against the biggest banks, especially

Goldman Sachs for getting $13 bilion from the taxpayer through AIG with the

total complicity of Paulson and Geitner. Populists advocate closing big bank accounts

putting money in community smaller banks. The politicians understand this. It will be

hard for Congressmen and even Senators to pad their banker friends' wallets so easily.

That has caused bank stocks to languish and even act like they might even breakdown.

See the key support level in the Tiger Financial Stocks' Index above. While it held,

the falling 65-day ma is clearly acting as a barrier. A penetration by Finance stocks of that

support without a further move upwards by the SPY and DIA would be bearish.

Fortunately for the banks, Geithner and Bernanke are like two knights on

a chessboard protecting each other.

17% of Americans who need and want work are still unemployed. There are 38

million Americans on food stamps and another several million without homes

who have difficulty qualifying for them. Mortgage defaults are not going away,

No doubt, the rising the stock market has prevented the big banks from failing and

given some spending cash to those who trade the market while making retirement

accounts still look like a viable long-term option. But job creation will be essential

in 2009. Democrats should appreciate the urgency of this. Obama has done little

to make the most enthusiastic of his supporters still believe in him. So, Congressional

Democrats will have to do something to dramatically reduce the unemployment.

As always, that will create winners and losers on Wall Street. So, stay tuned politically.

Can the stock market rally with a dwindling American middle class? Seems

unlikely. Presently, tech stock stocks are leading the rally. But it's not clear how many jobs

this creates, especially since many of these now go overseas. Worrisome, too,

there is nothing that I know of in the Obama stimulus program, that is designed to

keep exisiting jobs in the US. Notice how well Hewitt is doing. HEW is a leader in the

growing field of consulting companies specializing in helping US employers

export jobs and avoid paying full wages and benefit to American workers.

Here is a recent quote about HEW from their Yahoo message board:

"During difficult economic times, should Hewitt sponsor an all-expense

paid trip to St. Thomas for their executives and sales leadership group...

including family members? It seems that Hewitt continues to struggle financially

with all the layoff that occur, but yet, find enough capital to conduct an all-expense

paid trip to St. Thomas for RF, JR, SF, KS, Sales Mgmt, HRO Mgmt, etc. How does

the rest of Hewitt feel about such a trip paid from our bonus plans? How does

the rest of Hewitt feel about such a trip knowing our fellow coworkers our being

laid off due to economic constraints while the rich enjoy their all inclusive Carribean

vacations? And ALL this while Hewitt lays off American workers and replaces

them with Indian workers. ..."Who says that companies like Hewitt will hire Americans

when there are openings? Customers are upset, the offshoring of their work has

resulted in poor quality. The constant dismissal or talented people in favor of

cheap labor will be the end. Clients will NOT renew."

( Source: http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_H/threadview?m=tm&bn=25345&tid=3504&mid=3504&tof=8&frt=2 )

======================================================

12/28/2009

Buy B13 Continues. A Flat-Topped Breakout Seems Likely

There have been 9 flat-topped, year-end breakouts by the DJI since 1954. Each led to

superb gains in the new year. They all occurred between December 30th

and January 22nd. In the one other case, 1956, although there was no breakout

as the new year started, but it did occur in early March. With such a bullish track-record

for price patterns like we now see in the DJI and the SP-500, we have to be bullish

now. See these charts here. Our weekend studies of all stocks found many

confirmed, bullish chart pattern breakouts among more speculative stocks.

Look at CRM, NOG, WDC, SRQ, HPQ and GDI for example.

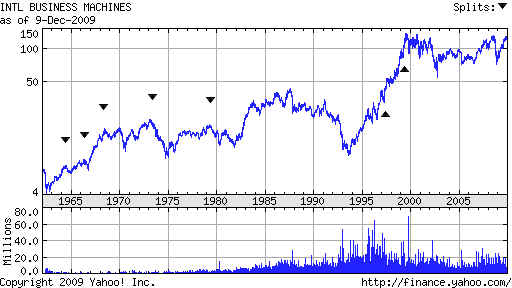

IBM's breakout is typical. But because the DJIA is calculated by simply adding the

components' prices, an advance by IBM will have more than 4.3 times the weight of

a DJI stock trading now at 30. And IBM's strength will boost tech stocks generally.

With IBM leading the DJI, the market now is somewhat reminiscent of the period 1963-1965.

The big difference, of course, is that the DJI is not now, as it was then, making all-time

highs. So, there will be a lot more over-head resistance to eat up for the other DJIA stocks.

But IBM's flat topped breakout into all-time high territory with so much prior positive

Accumulation should be exceedingly helpful to the bulls now.

Year-End Flat Resistance Breakouts:

1/2/1951 cl/ma= 1.044 roc= .639 P= 202 P ch= 18 IP21= .119 V= 354 OP= .278

1/15/1954 cl/ma= 1.017 roc= .313 P= 82 P ch= 37 IP21= .094 V= 354 OP= .278

3/6/1956 cl/ma= 1.027 roc= .349 P= 93 P ch= -11 IP21= -.008 V= 107 OP= .114

1/4/1963 cl/ma= 1.02 roc= .196 P= 30 P ch= 2 IP21= .03 V= -104 OP= .309

1/22/1964 cl/ma= 1.015 roc= .297 P= 66 P ch= 19 IP21= .026 V= -93 OP= .356

1/5/1976 cl/ma= 1.044 roc= .429 P= 201 P ch= 119 IP21= .148 V= 1 OP= .245

1/21/1985 la/ma= 1.041 21-dmaroc= .525 P= 237 Pch= 38 IP21= .097 V=8 OPct = -.097

1/5/1987 la/ma= 1.024 21-dmaroc= .149 P= -88 Pch= 73 IP21= .094 V= -13 OPct = -.115

1/12/1989 la/ma= 1.023 21-dmaroc= .454 P= 188 Pch= 21 IP21= .078 V= 11 OPct = .188

12/30/1992 la/ma= 1.074 21-dmaroc= 1.071 P= 168 Pch=50 IP21= .134 V= 15 OPct = .302

IBM's Flat-Topped Breakout into

All-Time High Territory Is Very Bullish.

--------------------------------------------------------------------------------------------------------------

12/24/2009

Buy B13 Continues

The Santa Claus rally usually lasts until the end of the year. There are

a few exceptions, but heavy profit-taking is often delayed until the

new year for tax reasons. At the same time, the inexorable window-dressing

by institutions helps push up prices for stocks in strong uptrends.

The DJI has risen 2/3 of the time looking out a week and looking out two

week. The odds drop to just a little more than 50% if we look out a month.

Since 1915, a new year has produced a pivoting significantly down

in 20 cases. It produced a strong rally in 22 cases. And in 47 cases, the

DJI did not move much up or down in the first two months. This shows

the potential that January offers. Fortunately, if there is a Peerless Sell

signal between now and the end of January, we should know that 33

of the first such sell signals were profitable when reversed by a Peerless

Buy. Only 3 of the Sell signals produced losses. Here are two new

studies showing this:

Big Market Moves That Start Early in The New Year: 1915-2009

What Happens after the First Peerless Sell Signal of The New Year: 1928-2009

Geithner has announced that Fannie Mae and Freddie Mac will get a

blank government check to guarantee home mortgages for banks. This

was announced the day before Christmas. It should keep the FInancial

stocks' rally alive up from support. That will boost the market. However,

WFC, BAC, GS and JPM are each below their falling 65-day ma and

show red Distribution and falling Closing Powers. Citi-Group has

all-bearish indications.

We will watch retail stocks this coming week to see how their Christmas

sales went. MC, V and AXP are in powerful uptrends. AXP's AI/200 score

is 171. That means it Accumulation Index has been positive 171 of 200

days. In this, it is only 1 less than IBM. HPQ is the highest AI/200 stock

now in the DJI. In these circumstances a few years ago, it rose handily.

Gold and Crude Oil have started moving up. Geithner's announcement

puts the US in the position of backing-up $5-6 Trillion in mortgages.

That must be a big strain on the Dollar, no matter how troubled certain

EEC countries' economies and finances are. The EURO did move

up on the 24th. A renewal of it's strength will put pressure on the Dollar

and boost Gold and Crude Oil.

------------------------------------------------------------------------------------------------------------

12/22/2009

The indexes have not yet broken above their flat resistances. The QQQQ

is the closest. Watch it closely and IBM, which is within a point or two of

making its own breakout into all-time high territory. The seasonal odds

favor the rally continuing. From 1965 to 2008, the DJI rose 77% of the

time over the next two weeks. Lots of stocks are making new highs. A

good number have scored flat top breakouts above well-tested resistance

accompanied by both Opening and CLosing Power rising, confirming OBV

and relative strength, an AI/200 score over 150 and a current Accumulation

Index over +.25. These are the bullish situations we look for. Finding

these, there is no need to wait for an ETF breakout. Look at some:

ASYS ATHR CAVM MRVL PKG PRGS SANM UIS WLP WLT

It is bullish, I think, that the market is rising without the help of Gold and Oil

and a weak Dollar to attract foreign buyers. The bullish periods from

1953-1957 and 1982-1990 saw gold and oil in decline.

See the data - Consumer Price Index Historical Data: 1913-2009

But before too long, we need to see breakouts. If there is no breakout by

the end of the year, the buyers will become discouraged, stop and the

sellers will take over. There are four cases in history that show how a

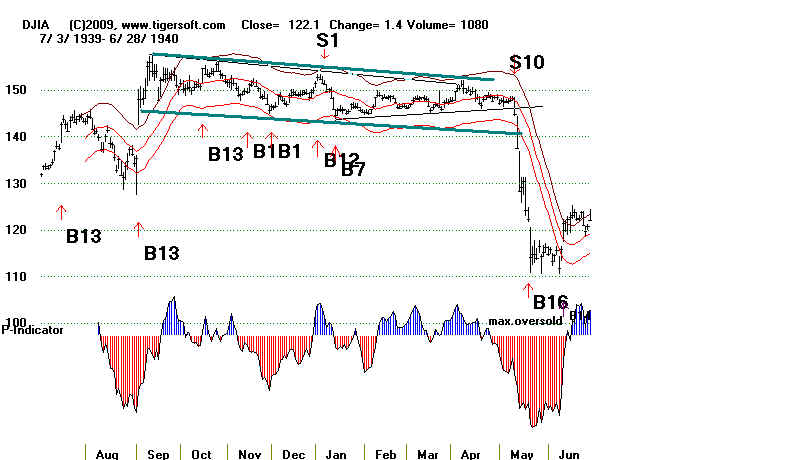

flat top in the DJI eventually becomes quite bearish. 1940, 1962, 1976

and 1980-1981. Six to nine months of sidewise action was common before

the DJI pivoted down. That's why I would guess a broader trading range

we will develop between 10000 and 11000 or, if there is no breakout, a

trading range bounded by 9500 and 10500.

Tops in 1940 1962 1976 1980-1 Are Essentially Flat

They take 6-10 months to form.

======================================================

12/18/2009 Buy B13 - Short Term Buy

We got suspicious data on Friday for the NYSE Up and Down Volume.

But that is less important than simply understanding that until the DJI

and the major ETFs breakout decisively from their flat trading ranges,

price movements for the market as a whole will be random and mostly

inconsequential fidgets. The fact that the Closing Powers are in shallow

declines now tells us to wait for a very strong or very weak close to

bring a breakout or breakdown.

If I was forced now to have to guess which way the stock market will move

next, I would have to say UP, because of the short-term Santa Claus -

Buy B13 (that we have been mentioning recently.) As the P-Indicator

and Accumulation Index are positive, there is no change in the President

in January and we are not in a severe bear market, the probabilities are

more than 90% that the DJI will be higher either at the end of the year

or on the next Peerless Sell.

The Dollar has been helped mostly by the EURO's weakness. We may

have entered a period when the DJI may be able to rise even if the Dollar

is strong. But watch the Financials. They remain the weak link in the chain.

Oppositely, watch the QQQQ. It may breakout first. IBM will probably

need to make an all-time high past 130 to send the DJI up to the top of its

channel, even if 10600 is broken above.

---------------------------------------------------------------------------------------------------------

12/17/2009

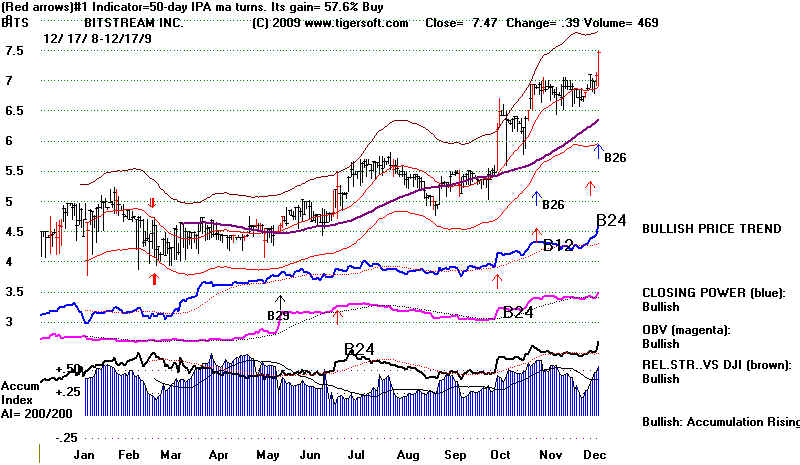

Some stocks look like they will go up, no matter what the market does,

because they show so much Accumulation and because we can guess that

portfolio managers will want to show they own these stocks at the end of

the year. Look at BITS. See its wonderfully high and steadily positive

Accumulation. The AI/200 score is a perfect 200 of 200. Download high

Accumulation stocks from Tiger's data page as ACCUMLA. I would post

this as an example of what we should generally be searching for when

we are seeking little know companies that could well become "explosive

super stocks."

Today's decline brings the DJI back closer to its 65-day ma support at 10100.

The recent lows line up at about 10150. That may have to be tested because

the volume rose substantially today, sending the aggressive buying/selling

oscillator, the Tiger OBVPct into negative territory. Still positive is the P-Indicator

and the Accumulation Index. As such, that makes the probability of a profitable

Santa Claus Buy B13 quite high. This signal is not in the current verson of Peerless.

Some more tweeking is needed, using the data shown in yesterday's Hotline.

It MAY be posted for downloading at the Elite Subscribers' Page this weekend.

At this stage, my view is that the Buy B13-Santa CLaus Rally signal works

most of the time. But it does not have a significant track record in reversing

an existing Sell to a new Buy, as would be true here. But perhaps, a little

more study will show otherwise with a tweaked B13.

Buy B13s in the older Peerless occurred automatically on Decmber 17th or the

next trading day. From 1965 to 2007, buying at the close on December 17th

and selling at the close 10 trading days later would have brought a trade a profit

in 89.7% of the cases and there would have been an average gain of 2.2%.

It should be noted that for the last 3 years the Buy B13 would have brought

a loss. I want to say here that I am concerned about a parallel now with

Dec. 17th, 1961 (where the DJI also could not breakout above a flat resistance)

and Dec. 17th, 1968, when the DJI declined rather than rising as the new year

approached. (1968, like 2009, was period of a great boom and bubble

in low priced stocks.)

The data since 1915 show that B13 signals which have no additional qualifiers

beyond simply buying on December 17th are profitable in about 70 cases

and produce losses in only 12 cases. When a loss occurred, the DJI was more

likely to be in a bear market and/or show negative readings from the

Accumulation Index and P-Indicator. In addition, there are a number of

cases where a bearish head and shoulders pattern developed to destroy the

B13. This last consideration is important now because a break in the 10150

neckline here would make the DJIA look like a distribution top and would

resemble a head and shoulders's pattern.

My conclusion is that we can take the old Buy Buy B13 with today's closing

and consider the S12 reversed, if we understand also that a close below 10150

would introduce much more risk. There is still support at the rising

65-day ma on the DJI at 10100. But a decline below this level, even at this time of

year, would break the DJI's long uptrendline in its rising wedge pattern and

very likely bring a break in the long uptrend of the A/D Line. That could drop

the DJI another 5%. My guess now is that the DJI will be seeking a 10% wide

trading range for the next 3-6 months. That range might be 10000-11000 or

it might be 9500-10500. A bigger move seems unlikely, though historicaly

the new year tends to start a bigger move, which is not necessarily up!

Here are the charts of the failed Buy B13s since 1915.

4 Cases Where The Buy B13 Did Not Work

1940

1961

1968

2007

----------------------------------------------------------------------------------------------------------------

12/16/2009

A breakout seems likely above the flat resistance lines in the DIA, QQQQ

and SPY. The most imprtant reason for thinking so is the very bullish

seasonality of the market from December 17th thru December 31st.

Here are the statistics I am gathering now. It will be refined more in the

course of Thursday. A Peerless Signal, a Buy B13, is in the old Peerless

but needs to be added with refinements to th current version. It would

presumably reverse the Sell S12 in effect. New here is the evidence showing

that this signal is made more reliable by adding the requirements that the

P-Indicator and the Accumulation Index not be under 0 on the date of the

Buy B13. As such, a new Buy B13 tomorrow must be expected to be more

reliably bullish, because the current P-Indicator and Accumulation Index

values are clearly positive.

|

Peerless Santa Claus Rally, Buy

B13: 1928-2009 Also shown below each line are the key values for the date of the signal. They are close/21-day ma, rate of annualized change of 21-day ma P-Indicator P-Indicator daily change Current Accum. Index (IP21) V-Indicator OBV-Pct 1915-1927 Date DJI Gain/Lost if sold at end of year. ------------- ---------- --------------------------------------------------- 12/17/15 97.40 99.2 on 12/31/1915 12/17/16 98.10 95 on 12/29/1916 12/17/17 67.10 74.4 on 12/31/1917 8% gain 12/17/18 83.40 82.2 on 12/31/1918 12/17/19 107.30 107.2 on 12/31/1919 12/17/20 70.30 72 on 12/31/1920 12/17/21 80.30 80.8 on 12/31/1921 12/17/22 97.60 98.2 on 12/31/1922 12/17/23 95.30 95.5 on 12/31/1923 12/17/24 114.40 120.5 on 12/31/1924 5% gain 12/17/25 152.80 156.7 on 12/31/1925 12/17/26 160.70 157.2 on 12/31/1925 12/17/27 200.90 200.7 on 12/31/1925 ========================================== 8 gains 5 losses 1928-2009 X = B13 signal cancelled because of negative internals while DJI is above .992 of the 21-day ma. Do not use B13 is Republican replaces a Democrat and a country is at war,1972. Use as the internals the P-Indicator or Accuulation. Do not use OPct/ A very high IP21 cancels a negative P-Indicator - 1986 Date DJI Profit at time of next Peerless Sell ------------- ---------- --------------------------------------------------- 12/17/28 270.2 +.066 Reverses a lone S12. DJI then reaches 320.

.961 .034 -38 -11 -.027 -518 .044 Negative internals at lower band are OK for a Buy

12/17/29 249.6 +.002 DJI falls to 230.90 before rallying.

1.014 1.572 81 -17 .137 101 .119

12/17/30 165.6 +.031 also B6

.926 -.988 -125 22 .034 -599 -.246 Negative internals at lower band are OK for a Buy

12/17/31 73.8 +.058 B13 is able to reverse a severe decline.

.833 -4.28 -242 027 -.285 -936 -.538 Negative internals at lower band are OK for a Buy

x 12/19/32 60.1 -.136 DJI fell below lower band and then rallied to 63.8 on 1/11/33

1.002 -.554 -62 -1 -.096 -160 -.097

===== ===== ===== ===== =====

la/ma ma-roc P-Ind IP21 V-Ind. Opct

12/18/33 97.2 +.12

.974 -.215 -42 -36 -.226 -158 -.138 Negative internals at lower band are OK for a Buy

x 12/17/34 100.9 +.036

.993 .141 28 16 -.029 -7 .313

12/17/35 140.6 +.071

.98 -.472 -51 0 -.214 -303 -.01 Negative internals at lower band are OK for a Buy

x 12/17/36 180.8 +.048

.997 - .269 -54 -27 -.143 -264 -.202

x 12/17/37 124.9 +.034

1.014 -.251 -128 -7 -.131 -238 .085

x12/19/38 150.4 -.160 reached 154.90 on 1/4/39

1.009 -.191 -63 -21 -.118 -116 .05

X 12/18/39 149.2 +.014

1.005 -.16 -55 -22 -.10 -71 -.344

X 12/17/40 130.5 -.034

.993 -.461 -58 2 -.129 -95 -.158

12/17/41 109.4 +.044

.96 -.709 -76 -18 .004 -234 -.392 Negative internals at lower band are OK for a Buy

12/17/42 118.7 +.195

1.029 .434 23 40 .193 -2 .475

12/17/43 135.4 +.021

1.02 .467 69 26 .074 41 .37

12/18/44 151.5 +.083

1.019 .465 127 -22 .192 129 .477

12/17/45 190.4 +.046

.991 -.043 25 -53 .071 -34 .108

X 12/17/46 174.5 -.045 but on 2/10/47 DJI reached 183.60 and formed small H&S

1.026 .336 P=-42 9 .155 -52 .255

X 12/17/47 179.8 -.013 12/31/48 DJI = 181.20 Head and shoulders then developed.

1.0 -.04 P=-36 8 .072 -96 .088

X 12/17/48 175.9 no proximate Sell. Rally peaked on 1/7/49 with DJI at 181.20

1.004 -.014 P=-63 9 -.102 -137 -.061

12/19/49 198.2 +.086

1.019 .423 98 -26 .247 76 .167

12/18/50 231.0 >13% DJI peaked at 263.10 on 5/3/51 Next Peerless Sell was 8/3/51 @ 262.90

1.01 .109 108 32 .027 114 .156

12/17/51 265.8 +.032

1.013 .222 22 -4 .055 -41 .104

12/17/52 285.7 +.022

1.01 .472 130 -11 .174 120 .311

12/17/53 282.7 +.059

1.01 .375 43 17 .164 -18 .102

12/17/54 394.9 +.037

1.019 .468 114 4 .059 114 .255

X 12/19/55 481.8 +.02 but DJI only rallied to 488.40 on 12/30/55 and then fell back to 462,40on 1/23/56

.997 -.086 22 7 .059 -.148 -.035

X 12/17/56 493.8 > +.05 but DJI only rallied to 499.50 on 12/31/56 and then fell back to 454,80on 2/12/57

1.027 .337 P= -38 3 .059 IP21= -.002 -230 -.142

12/17/57 431.1 +.052 Here was a rare B13 at the lower band. Unusual.

.966 -.369 -27 -75 -.047 -200 .255 At lower band negative internals do not cancel B13

X 12/17/58 569.4 +.096

1.018 .043 17 -7 IP21= - .026 -203 .151

12/17/59 673.9 +.017

1.018 .679 28 -1 0 -142 .501

12/19/60 593.3 +.133

1.018 .264 51 4 .074 -72 .129

X 12/18/61 727.7 -.018 Rallied to well-tested flat resistance and then caved in.

.997 -.091 -44 -10 -.041 -435 -.029

12/17/62 645.5 +.086

1.001 .303 80 -12 .095 127 .293

X 12/17/63 766.4 > +20% Next Peerless Sell S8, 5/13/65 @ 938.9

1.023 .309 -47 11 -.012 -493 .226

12/17/64 863.6 +.087

.989 -.297 -119 5 -.138 -761 -.138 At lower band negative internals do not cancel B13

X 12/17/65 957.85 +.029

1.008 .016 18 11 -.002 6 .019

12/19/66 798.99 +.087

.995 -.252 -24 8 .027 1 -.108 (OPct by itself cannot cancel the B13)

12/18/67 881.65 +.03

1.002 .297 29 -34 .002 3 .231

12/17/68 970.91 -.036 Bear market starting THIS WOULD HAVE BROUGHT A LOSS.

.997 .082 75 -44 .047 12 .028 ELECTION YEAR B13s must be checked?

Other factors? Two years of computer stocks' bubble.

Republican taking over from a Democrat while at war.

12/17/69 769.93 +.052

.961 -1.074 -382 9 -.215 -4 -.402 At lower band, negative internals do not stop B13,

12/17/70 822.15 +.14

1.03 .923 221 13 .172 1 .532

12/17/71 873.8 +.079

1.039 .734 195 21 .07 1 .298

12/18/72 1013.25 +.034

.991 .111 -10 -55 .065 0 .102 At lower band, negative internals do not stop B13,

12/17/73 811.12 +.054

.978 -.907 -329 -5 -.099 -5 -.243 At lower band, negative internals do not stop B13

12/17/74 597.54 >40%. Next Peerless Sell on 7/1/75 @ 877.42

.992 -.986 -274 22 -.182 -3 -.098 Near lower band, negative internals do not stop B13

X 12/17/75 846.27 +.193

1.007 -.147 -111 2 -.027 -3 .074

12/17/76 979.06 +.017 Presidential Election Year - Change of Presidents.

1.019 .509 292 -28 .104 3 .276

12/19/77 807.95 -.018 This was in on-going bear market. Right shoulder in H&S.

Peak was 831.27 on 12/30/77

.981 -.345 -30 -27 -.063 -2 -.032 At lower band, negative internals do not stop B13

12/17/78 787.51 > +12% also Buy B9 - DJI rallied to 880.38 at time of next Sell.

.975 -.098 8 -91 -.007 -2 .038 At lower band, negative internals do not stop B13

12/17/79 844.62 +.024

1.021 .336 178 -14 .028 4 .159

12/17/80 928.5 +.048

.968 -.715 -272 32 -.066 -8 -.061 At lower band, negative internals do not stop B13

X 12/17/81 870.53 -.043

.994 .227 -28 -9 .03 -1 .252

X 12/17/82 928.5 +.059

.991 -.187 -38 -10 -.215 -6 -.177

12/19/83 1244.61 +.034

.985 -.063 -77 -21 -.051 -7 -.158 At lower band, negative internals do not stop B13

12/17/84 1176.79 >+15% next Peerless Sell was on 10/14/85 @ 1354.73

.991 -.294 -69 23 -.073 -5 -.099 At lower band, negative internals do not stop B13

12/17/85 1544.5 +.183

1.042 .882 176 -13 .10 14 .279

12/17/86 1918.13 +.161 Note how very positive the IP21 was. This cancels negative P-Indicator

1.004 .361 P= -99 -7 IP21= .184 -8 .107

X 12/17/87 1924.4 +.01

1.02 .014 -48 22 .085 -12 .197

12/19/88 2172.68 >+27% next Peerless Sell was on 10/4/89 @ 2771.09

1.029 .758 32 55 .234 12 .38

X 12/18/89 2697.53 .042

.995 .272 -36 -44 .073 -9 .096

12/17/90 2593.32 >+25% DJI fell to 2470.30 before rallying

next Peerless Sell was on 4/14/92 @ 3306.13

1.009 .224 56 -11 .117 4 .093

X 12/17/91 2902.28 .139

.998 -.167 -148 28 .014 -.23 -.182

12/17/92 3269.23 .11

.998 .276 121 34 .064 7 .136

12/17/93 3751.57 .058

1.011 .152 0 62 .05 -13 .348

12/19/94 3790.7 >+48% next Peerless Sell was on 2/27/96 @ 5549.21

1.015 .119 -131 18 .067 -33 OPct=-.082 (not significant)

12/18/95 5075.21 .093 next Peerless Sell was on 2/27/96 @ 5549.21

.993 .247 75 -108 .072 -11 .182

X 12/17/96 6308.33 .084

.982 -.074 P= -71 -4 .051 -37 .031

12/17/97 7957.41 .154

1.005 .39 76 -59 .019 -37 .143

12/17/98 8875.82 .075

.982 -.145 -116 22 .055 -45 .001 Near lower band, so B13 was allowed.

X 12/17/99 11257.43 .019 A simultaneous S12. Declined to 9800 3 months later.

1.014 .402 -465 50 -.041 -108 .107

X 12/18/00 10645.42 .021

1.005 -.012 60 58 -.052 -11 .009

12/17/01 9891.96 .023

.991 .024 56 26 .062 -97 - .061 (OPct not significant here,)

12/17/02 8535.39 .028

.985 -.06 142 -62 .006 -113 - .171 (OPct not significant here,)

12/17/03 10145.26 .058

1.028 .525 388 90 .048 9 .286

12/17/04 10649.52 .019

1.009 .113 220 -39 .102 -17 .212

X 12/19/05 10836.53 .068

.999 .128 172 -147 - .103 -16 -.08 If last Peerless signal was a Buy

the B13 is more likely going to be profitable.

12/18/06 12441.27 -.003

1.012 .131 234 -60 .039 234 -9 -.168 (OPct not significant here,)

X 12/17/07 13167.2 -.047 Note head and shoulders. Severe bear market follows.

.993 .051 -139 -11 -.021 -173 .227

x 12/17/08 8824.34 -.077 Peaked at 9034.69 on 1/2/2009. In severe bear market no B13s.

1.038 .773 162 102 .115 44 .237 See 1930, 1931, 1932, 1937

12/17/09 10308.26 Open

.991 -.148 140 -51 .015 -120 -.049 (OPct not significant here,)

--------------------------------------

67 up 12 down

|

===============================================================================

12/15/2009

Tomorrow the Fed makes its announcement about

interest rates. Perhaps

that will generate some interest in buying or selling. The key indexes have

seemingly stalled out. They cannot make a clear breakout or a breakdown

below the narrow range they have been in for a month. Financial stocks

may still drag the entire market down. But the Santa Claus seasonality will

be a boost until the end of the year, The DJI's decline was made worse by

selling in XOM after they announced they would buy out XTO. That Home

Depot made a new high today offers hope hat the FED will keep rates unchanged.

That, in turn, should allow a run to new highs by the key averages.

The charts since 1929 suggest very strongly that as long as the A/D Line

is uptrending,at its present angle and confirms the DJI's steady rise, the

market's rise will continue. Only when we see weakness from the Peerless

P-Indicator and/or the Tiger Accumulation Indexes does a serious decline

unfold. Of course, something unexpected, outside the box and very bearish

cpuld occur to spoil my optimism. But, these unusual developments seem

always to have been anticipated by someone, somehow. Even IKE's heart

attack in September 1966 took place witht he A/D Line failing to confirm

the DJI's high. It then fell 10%. My Peerless book shows that the market

. or its weakening internals somehow anticipated the the

most important events of

the 20th Century. Here are some of these occasions.

1) Wilson's entry into World War I, despite his campigning heavily

using the phrase, "He Kept Us out of War"

2) The Bolshevik Revoution in November 1917."

3) The German attack on Western Europe in April 1940.

4) The North Korean attack on South Korea in June 1950

5) The Cuban Missile Crisis in 1962.

6.) The JFK Assassination. Nov. 1963

7) The Gulf of Tonkin attack that started the War in Viet Nam. August 2, 1964

8) The 9/11 Attack on The Twin Towers and The Pentagon...

-----------------------------------------------------------------------------------------------------------

12/14/2009

The key indexes appear to be waiting for the FED to

keep rates low at this

week's meeting. Bernanke is seeking reappointment. It seems unlikely he

will change his policies, especially with the Dollar showing

some strength

and Commodities weaker, especially Gold and Oil. But the cynic in me

makes me wonder if Gold is falling because the Fed has let the word out that

they will soon be raising rates. My new Peerless history of the DJIA since

since 1915 is replete with examples of FED leaks before big moves by the

market. Let's hope Gold's decline is simply profit-taking. Bulls would not

want the DJI to reverse down from here or just after a breakout. It would

make the market's rally look very stalled out and vulnerable.

As I said last week, tech stocks are moving higher following the leadership

of IBM and HPQ. The drop in

Crude Oil prices has helped the Airlines take off.

See some examples below. Or run the Tiger Analysis again the Transportation

stocks. Buffet's purchase of Burnington-Santa Fe is boosting all the other

train stocks. They also see a brighter future if the government puts new

money into rapid rail transpoirtation.

As predicted, too, Health Insurance stocks have broken further above their nine

month price pattern's resisatnce, because the Democrats with zero leadership

from the timid and

inexperienced Obama are tying themselves up in knots over health

insurance reform, mainly because they lack the courage to take head-on the

ridiculously obstructive voting requirement of having a 2/3 majority in the

Senate.

Volume remains low. But unless the FED surprises everyone right before

the biggest year's retail period, the breakouts in the key ETFs, DIA,

SPY and

QQQQ seems very likely. And a further advance should

come if Santa's Rally

appears this year, as it does 90% of the time.

The Crude Oil price decline has provided opportunities for trading

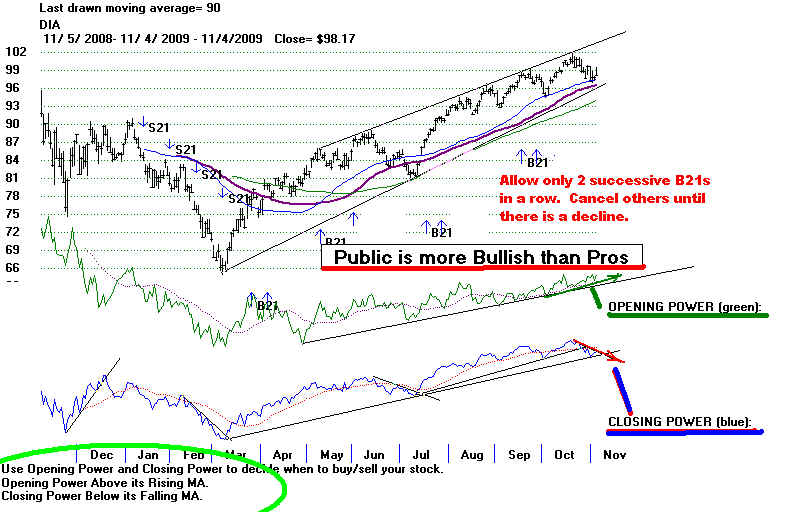

profits in airlines issues. Tiger's Closing Power, high accumulation and bullish

looking charts are a winning combination. The Buy B21 registers the fact that

both Opening and Closing Power are rising.

-------------------------------------------------------------------------------------------------------------

12/11/2009

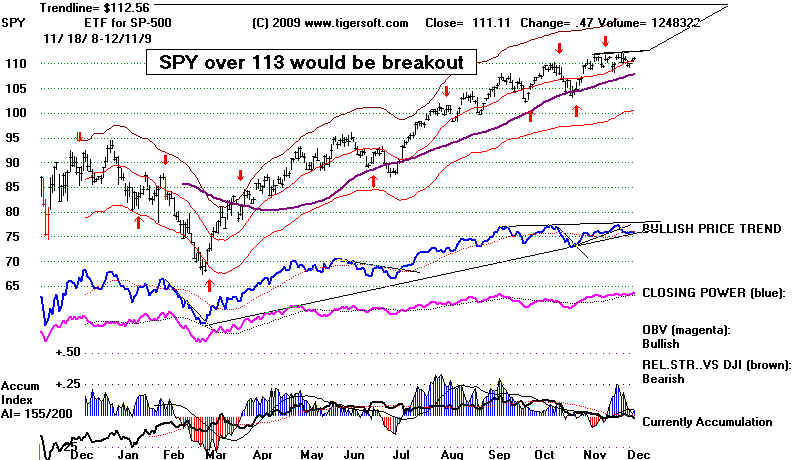

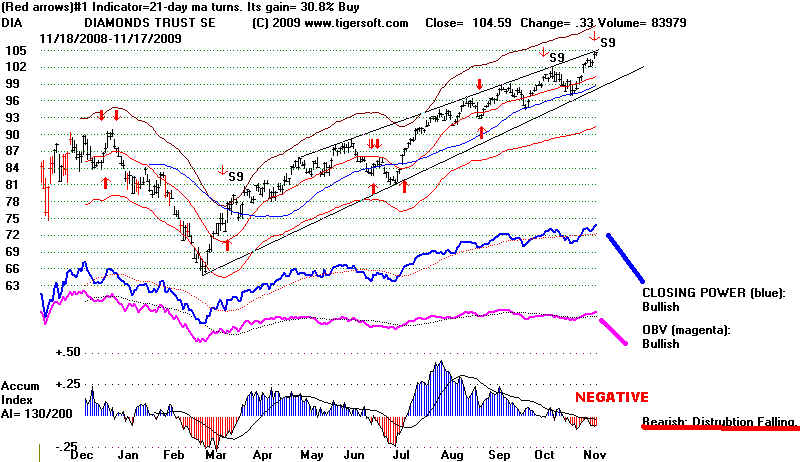

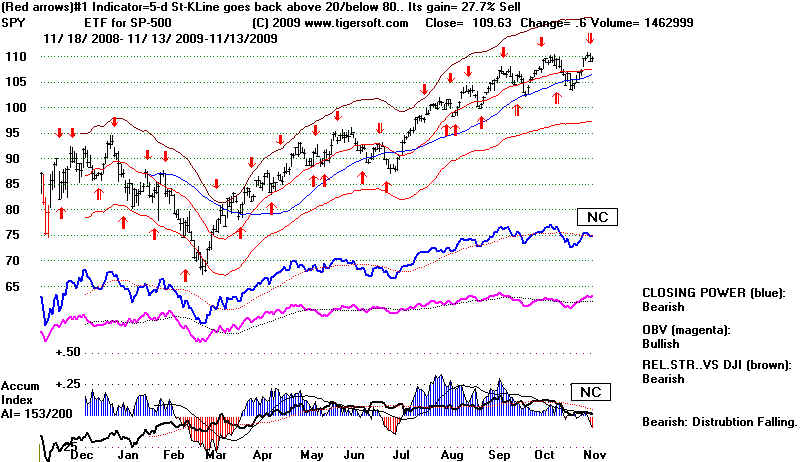

SELL S12 - Right now

the Sell seems to have been an aberration, where the DJI

reached the upper band for one day with the Accumulation Index negative.

The Accumulation Index and the breadth Indicators (A/D Line and P-Indicator)

are positive and rising. They are the indicators that work best year in, year out,

A price breakout is needed soon by the SPY and QQQQ. If they do not breakout

soon, though, the rally up to these levels will look like a ball that has been tossed

high in the air and then hangs there seemingly for a ,moment before turning down

and falling faster and faster. The DJI, SP-500 and QQQQ are the indexes to watch

this

week. The chart of the DIA is displayed above. The SP-500 and QQQQ are

shown here.

Watch these three ETFs.

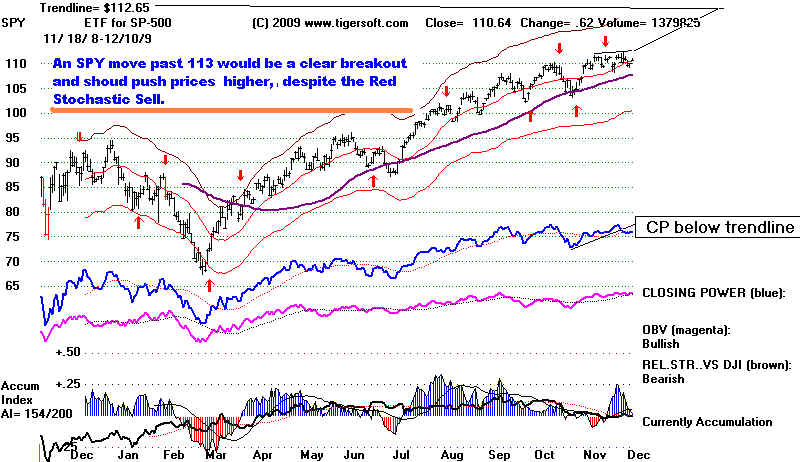

The DIA closed at 104.92 and needs to

get past 106.

The SPY closed at 111.11 and needs to

close above 113.

The QQQQ closed at 44.13. A close

above 45 will achieve a significant breakout.

Gold and Oil declined last week despite the Dollar abd the market's strength.

The 1980s saw this pattern most of the decade. So, we should watch to

see if the pattern of the market rising when the Dollar is weak that

prevailed from March 9th until this week has ended. Or whether Gold

and Oil come roaring back. Or whether the strong Dollar will hurt the

stock market.

------------------------------------------------------------------------------------------------------------

12/10/2009

SELL S12 - But the

high cap averages have their sights set on making breakouts.

I would think they will make breakouts unless the financials weigh down

the DJIA and SP-500 too much. It sure seems as tough most of Congress seems

utterly unwilling to do much of anything to offend Wall Street. So, that may be what

the market needs to make a breakout. I do have to note that tax selling in some of

the strongest stocks before the end of the year may occur, but mostly I would

think it will be postponed to next year, since Congress is not planning to change

the rate of taxation on capital gains.

IBM moved up a point to a marginal new high and seems ready to

move much higher. See its chart in yesterday's Hotline. HPQ in the

second most accumulated stock in the DJI-30 for the past year, after IBM.

This tech strength makes the QQQQ the best index ETF to buy and

trade long. A breakout must be expected, I would say.

hot

hot

Health care and health insurance stocks like MRK, UNH and WPT made new

12 month highs today, as a result of the Senate's killing the Public Option in the

new Health Care legislation.

In the DJI-30, DIS and KO also made 12 month highs. If it were up to the

health

care and tech stocks in the DJI-30, breakouts by the major high cap indexes to

new highs would seem assured, given the bullish seasonality soon ahead.

But finance stocks, other than AXP, V and MA, are generally drooping

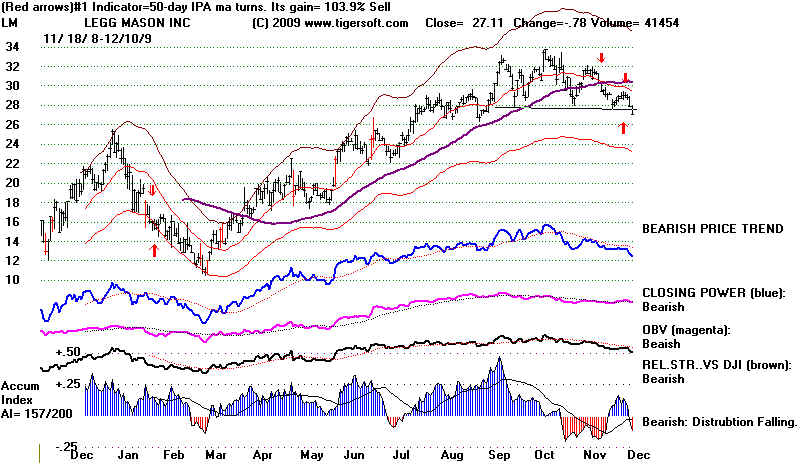

and as a group may break their support levels, as LM and WFC have already.

In the DJI-30, watch JPM and BAC. and,

of course, Goldman Sachs (GS) always.

Congress is considering what legislation is needed to regulate the Financial

Industry after the over-leveraging by banks nearly destroyed the entirety

of the world economy 15 months ago. That there still has not been a thorough