Tiger

Software 2/21/2008 www.tigersoft.com See 2/4/2008 NEM technical study.

Tiger

Software 2/21/2008 www.tigersoft.com See 2/4/2008 NEM technical study.Spot General Market Tops

by Noting Newmont Mine's Run-ups

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringment.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981

|

Calling General Market Tops

by Spotting Run-Ups in

Newmont Mines and Gold.

Newmont rose from 24 to 54 in the three months before the DJI's major top in August 1987.

The DJI then declined 36% in the next two months.

Sharp rises in Gold or NEM since 1987 are

usually quite bearish for the market.

You can see from the data farther

below that a quick advance by NEM of more than 27% in 2 to 5

months is normally reliably bearish

for the general market, as represented by the DJI-30...

When NEM finally does turn down,

the general market is already beginning a big drop.

Sharp advances by Gold were very

bearish for the market up until 2003 when very low interest

rates over-rode the close link

between a rise in gold and a steep decline in the stock market

soon afterwards. Below you

will see all the key Gold or NEM charts from 1971. The biggest market

Crash of all, 1929-1932, is also a

notable exception, too. Gold was then fixed at $32/ounce.

Gold as A Threat To The Economy.

But

speaking of the 1930s, did you know that speculation in Gold against the US Dollar was

considered so dangerous to the

stock market and a national recovery from the Depression

that Franklin Roosevelt issued

Presidential Executive Order #6102 which made it illegal for most

Americans to own gold, except in

jewelry? See http://www.the-privateer.com/1933-gold-confiscation.html

.

NEM as The "Angel of Death" for The Stock Market.

For many Gold Mining is dangerous, even deadly. NEM is accused of placing miners

and local peoples living at far greater

risk than would be allowed to in the US. See my Blog

or http://dte.gn.apc.org/cstd1.htm But

NEM is the angel of death in another way. When its

stock goes upl, the stock market often

suffers a severe decline.

Here are 14 DJI declines of 10% or more since 1987 and NEM's price behavior just before

the decline.

1. - in the 5 months before

the 1987 Crash, NEM rose 120%. (See chart above.)

2, - in the 3 months before

the January 1990 Plunge, NEM rose 40%.

3. - in the 2 months before

the July 1990 - October 1990 bear market, NEM rose 33%

4. - in the 3 months

Feb-March 1994 DJI drop of 11%, NEM rose from 38 to 48, 27%.

5. - in the 2 months

before the October-Novermber DJI 1994 drop of 10%, NEM rose from 38 to 46.

6. - in the 3

months before the September-October DJI 1997 drop of 15%, NEM rose from 36 to 46.

7. - not so before the 20% DJI decline of 1998.

8. - in the month

before the August-September 1999 DJI drop of 12%,, NEM rose from 17 to 22.

9. - in the four months

before the DJI plunged 20% in Jan-March 2000, NEM rose from 17 to 25.

10. - not so before the 12% DJI decline of late 2000.

11 - in the two months

before the early 2001 bear market began, NEM rose from 13 to 18.

12 - in the three

months before the May to September 2001 30% DJI decline, NEM rose from 16 to 24.

13. - in the three months

before the Feb.to October 2002 30% DJI decline, NEM rose from 20 to 26

14. - in the five months

before the Jan.to March 2003 16% DJI decline, NEM rose from 23 to 30

Newmont Mining is

not quite a surrogate for Gold. Its movements are related to, but also

independent of Gold. That

might give us some hope, as NEM has been moving mostly sidewise

as Gold rises steeply this year.

But NEM's relative weakness may be out of the ordinary

right now. NEM's weakness

vis-a-vis Gold stems from concerns about its rising costs

and the growing risks of

nationalization in Indonesia and Peru. NEM is now awaiting

Indonesia's decision about

withdrawing its rights to mine gold there. See NEM's website -

http://finance.yahoo.com/q/pr?s=NEM

So, it is unclear if NEM will work this time as our early warning

system. The very long

rise of Gold must be seen as a warning for the market even if NEM

is treading water.

Today's earning report for NEM shows how costly its approach to gold

mining is. We warned

about this: http://www.tigersoftware.com/TigerBlogs/02142008/index.html

2/21/08 Newmont Reports Fourth Quarter and 2007 Financial and Operating Results

(RTTNews) - reported a fourth

quarter net loss of $289 million or $0.63 per share, compared

to a profit

of $223 million or $0.50 per share in the same quarter last year. Loss from continuing

operations came in at $933

million or $2.06 per share, compared to a profit of $171 million or $0.38

per share in the

corresponding quarter prior year. Quarterly revenues dropped to $1.41 billion

from $1.42 billion in the

year-ago period. NEM included a $1.12 billion exploration "goodwill

impairment charge".

Newmont is currently going sidewise with heavy distrubution..

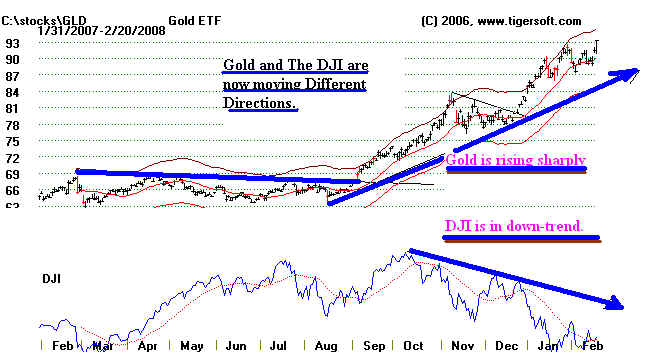

Gold is rising steeply. The DJI is in a downtrend.

Actually, Gold can rise for some time before the general market turns down. NEM

seems

to follow gold's advance, but may

lag for some time. That's what makes it such a good predictor.

We see this in 1985-1987 when Gold

advanced from $200 to $500. Only when NEM doubled in

mid-2007, was the DJI set up for a

big decline. In the chart below, you can see that Gold has risen

steeply since December 2000.

Its advance in 2001 and 2002 did warn of a bear market. But its

rise from December 2004 to now,

from 450 to 950, has seen only one decline DJI decline of more

than 12%. Gold has been able

to rise this long, from 2004 to 2008, without a big general market decline

because the FED has kept interest

rates low. Unlike now, in the 1970's, the FED responded to inflation

by raising interest rates sharply

and that created a number of sharp sell-offs, which also

may have set the stage for the big

bull market after August 1982.

------------------------------------ 28-Year Chart of Gold:

1980-2008 -----------------------------------------------------

(source: http://www.the-privateer.com/chart/gold-pf.html

)

Gold Is A Commodity. Gold and The DJI - 1970s.

Usually Golds rise means

commodites rally, too. After the US Dollar stopped being convertible

into gold in the early 1970s, non-oil commodities tripled.

Then from 1980 to 1985, commodities fell

and the stock market rallied very strongly. In the

chart below, you can see how the bear markets

of 1973 and 1974 were preceded by sharp advances in Gold

prices. The last rally in Gold in 1975

did not bring a bear market, only a 10% dip in the DJI in

the second half of 1975.

Gold and The DJI: 1971-1975

Gold 1976 - The rally in gold from 105 to 135 after September 1976, set the stage

for the bear

market of 1977 in the DJI. The DJI fell from 1000 in January to 800 in

October.

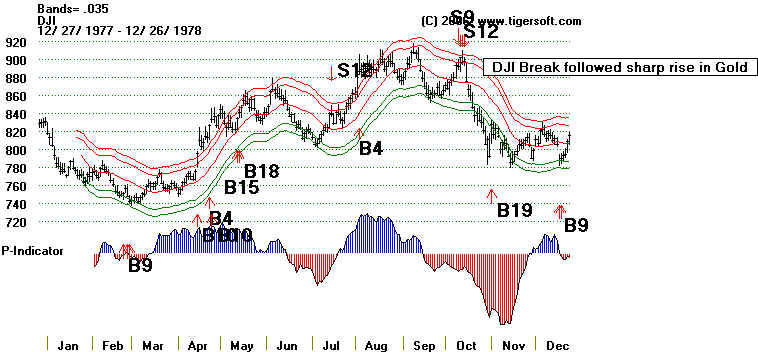

DJI - 1977

============================================================================

Gold had two big advances in 1977. They were soon followed by

the biggest

DJI declines: July to October and November to March 1978.

===========================================================================

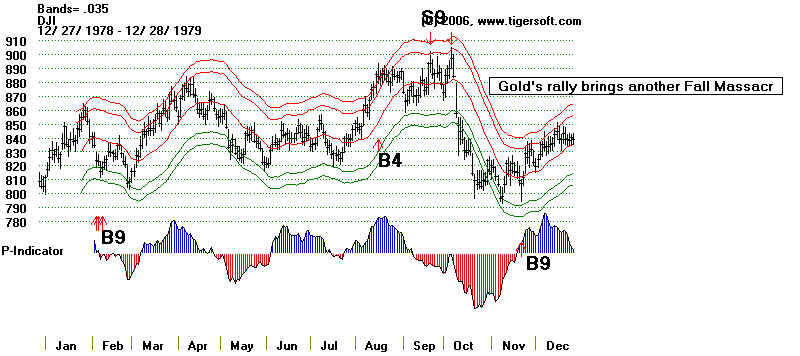

Gold's steep advance after July 1978 led directly to the October 1987 market

massacre when the

Fed boosted the Discount Rate.

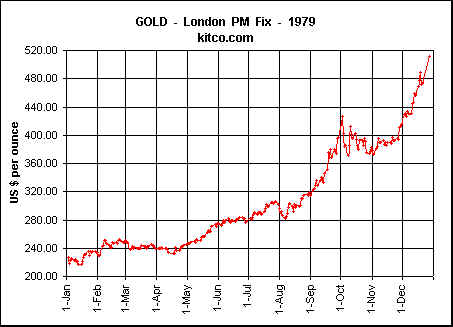

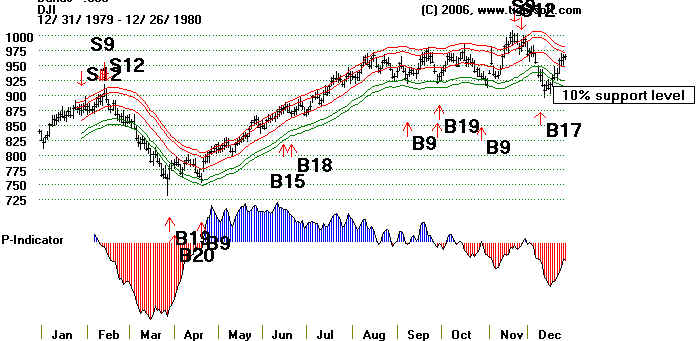

The steep rise in Gold after June 1979 served as warnings for the market sell-offs

in the Fall of

1979 and in March 1980.

DJI - 1979

DJI -1980

Why Does Gold Often Move against The General Market.

A sharp rise in gold may be a sign

of rising international tensions, rocketing oil prices, a

falling Dollar and rapidly

advancing commodity prices. The Federal Reserve usually raises interest

rates when inflationary signs

appear and that sends the market reeling. Many economists

feel that inflation is better

defined by the falling purchasing power of the Dollar than the US

government's distortion of

inflation, the CPI. See my Blog of November 19,

2007.

Since Gold moves opposite to the

Dollar very often, it predicts inflation better than the

Government's closely watched CPI.

http://www.financialpost.com/scripts/story.html?id=2f254b6d-c441-48ad-b283-8de41c0a4251&k=98415

Newmont rises of more than 25% in five months or less are distinctly

bearish for the general market.

Stay Tuned

Note - I wish to thank James Dines for getting me to think about the

relationship

between gold and stock prices.

I have to say I have found most of his political views

startlingly retrograde and his advocacy of

nuclear power a direct insult to what I had

learned about the dangers of

low-level ioninzing radiation from doing research in

the 1970's in New Mexico.

The Federal Government, for example, and Tbe Bureau

of Mines would not release

epidemological data showing how deadly uranium minimg

was to uranium miners in

Grants, New Mexico and those down-wind, as far away

as Albuquerque. This

will make a good topic for a later Blog. Now the truth is coming

out. See http://www.ratical.org/radiation/CNR/RIC/NEJM.html

.

http://www.mindfully.org/Nucs/About-Low-Level-Radiation.htm

http://www.ccnr.org/nfb_uranium_biblio.html

http://web.uccs.edu/amilton/student/waste.html

http://www.berkeley.edu/news/media/releases/2007/09/04_GofmanObit.shtml