FOR SUBSCRIBERS TO HOTLINE ONLY

Characteristics of Market Tops since 1928

9/11/2010 (C) William Schmidt, Ph.D.

There have been 25 major market tops that led to DJI declines of more than 15%

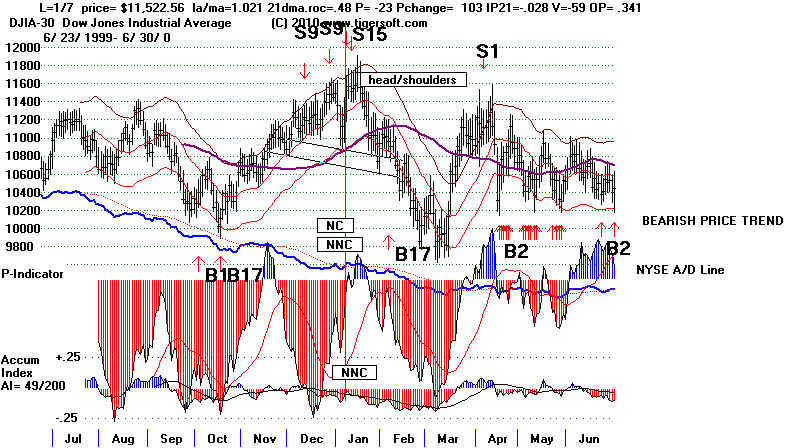

since 1929. What signals and conditions most called them? Most common

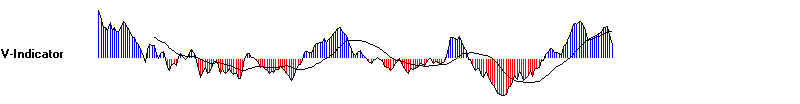

are NYSE A/D Line non-confirmations of a new high, Sell S9s, a DJI at least 2.5%

over the 21-day ma with the V-Indicator negative, the Accumulation Index under

.06 and the P<70. But we still have to watch for other signals: S10 (1946 and 1962),

S1 (1948 and 1969), S8 (1977), S4 (2001 and 2007) and S15(2008).

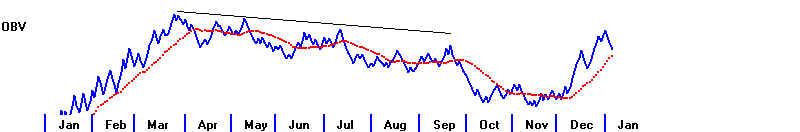

20 A/D Line NC (The NYSE A/D Line did not confirm the high by making a corresponding

high of its own.)

16 P<70

15 S9s + 1 special varierty S9

15 V<0

16 DJI more than 2.5% over 21-dma

15 AI<.06

14 DJI Head/Shoulders

13 S10s

10 P<0 (P-Indicator)

9 S12s

7 S15s

5 Current AI<0

4 S4s

5 S8s

1 S7 Extreme Bearish Mode

1 S5 Extreme Bearish Mode

1 S6

1 S1 (1948)

1 Repeated failure to get past round number resistance. (1976)

The cases where the A/D Line remained strong despite the top were:

5/29/46 Earlier S9 and H&S

12/2/69 S1...later S9

9/21/76 Later S8

5/21/01 Earlier S9 and earlier S12. H&S

Characteristics of Final Market Tops since 1928

8efore A Steep Bear Market

Date S9 S12 A/D-NC V-Ind. Head/Shoulders Other Signals LA/MA P-I IP21 OP21

---------------------------------------------------------------------------------------------------------------------------

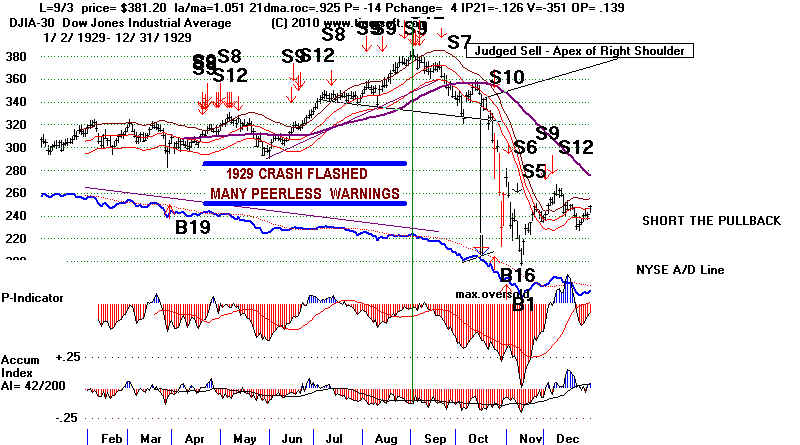

#1

9/3/29 Y Y Y-lengthy -351 Y - 6 wks later S7 and S8 1.051 -14 -.126 .139

There were at least 10 sets of major Sells in the 5 months before the final top

S9/S12/S7

---------------------------------------------------------------------------------------------------------------------------

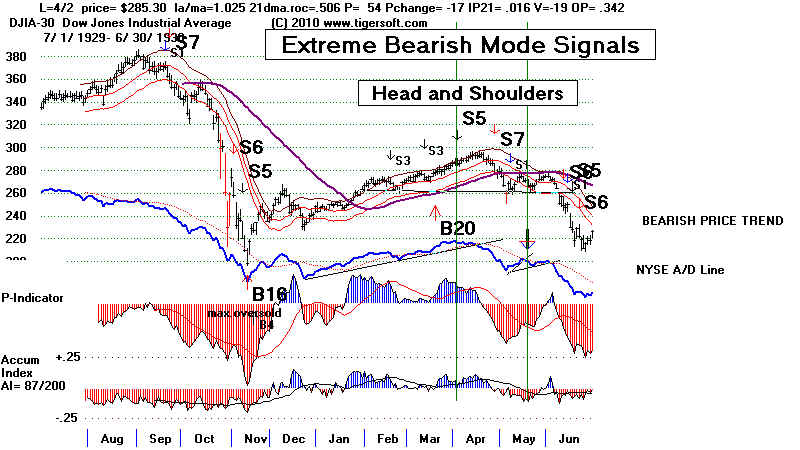

#2

4/17/30

E-Y Y-10day -322 Y - two months later also E-S4 1.024 -2 .084 .524

There were at least 4 sets of major Sells in the 5 months before the final top using normal mode.

Using Extreme Bearish Mode, Peerless gave a Sell S5 (Extreme Mode) on 4/2/1930

Yes -19 1.025 54 .016 .342

---------------------------------------------------------------------------------------------------------------------------

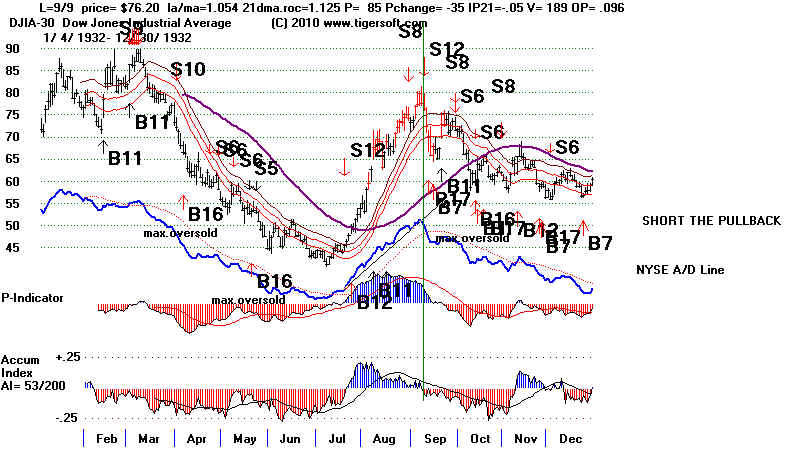

9/7/32 Y 464 Y - month later S8 S6 1.118 129 ,056 .233

The NYSE A/D Line trend-break cliched the S8 and S12 sell signals quite well.

S8/S12/S6

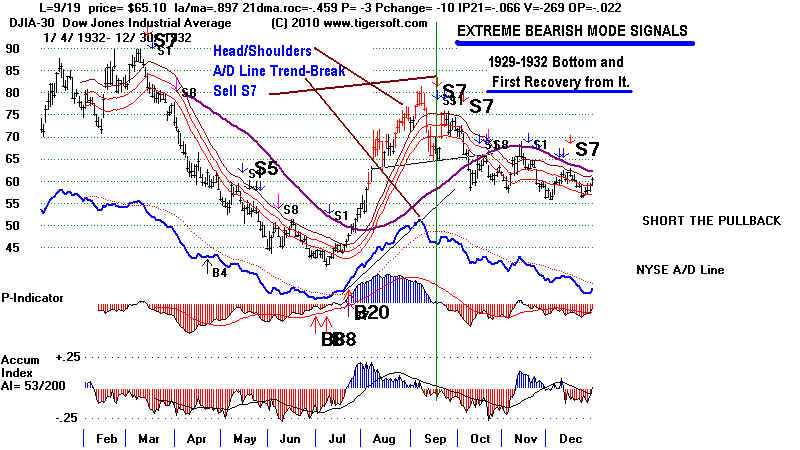

Extreme Bearish Mode shows a Sell S7 on 9/19/1932. S7(EBM) .897

The trend-break of A/D Line, Sell S7 and head and shoulders were clear warnings of this top..

S7(EBM)

---------------------------------------------------------------------------------------------------------------------------

3/5/37 Y Y-30 day -231 Y - month later S15 1.028 -15 .037 .094

There were 3 clusters of major Sells before the final top in March 1937.

S9/S15

---------------------------------------------------------------------------------------------------------------------------

8/13/37 Y Y-15 day -43 1.024 -2 .042 .242

There had been earlier 3 sets of major Sells in the previous 6 months, though they are not shown in this chart.

See the previous chart.

S9

---------------------------------------------------------------------------------------------------------------------------

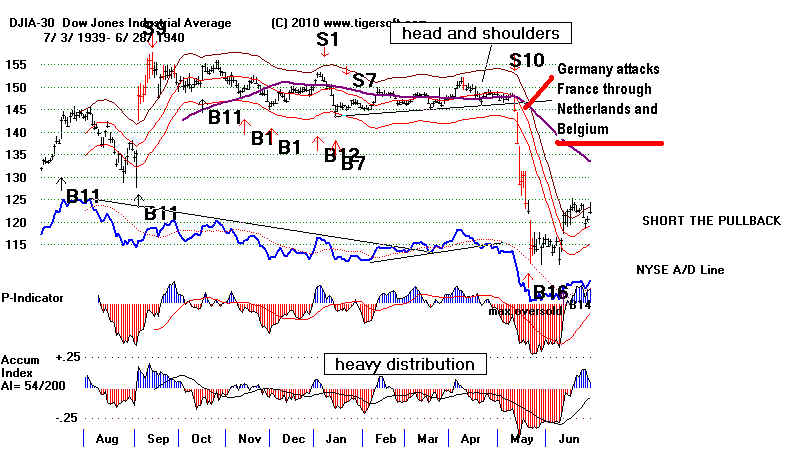

9/13/39 Y Y-6 wks 56 also S8 1.181 -43 .138 .317

The top here did not produce a significant decline here until May 1940.

1939 S9/S8

1939-1940

S9

---------------------------------------------------------------------------------------------------------------------------

5/29/46 E-Y 43 Y - month later S10 1.029 64 .269 .355

Classic Head and Shoulders

When a head and shoulders develops, using the turning down of the A/D Line after

the apex of the right shoulder has been reached works well here and generally.

---------------------------------------------------------------------------------------------------------------------------

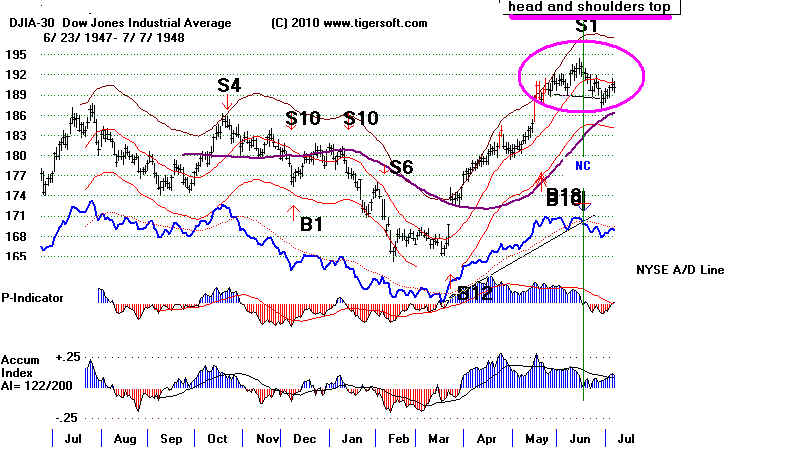

6/14/48 Y-10day 62 Y - 3 weeks later also S1 1.012 55 .106 .143

S1

---------------------------------------------------------------------------------------------------------------------------

7/15/57 Y Y-6 wks -217 1.02 -41 .063 .107

Perfect Sell S9 occurred on 7/8/1957, a week earlier. Note the clear way the A/D Line did not confirm the last highs.

S9

---------------------------------------------------------------------------------------------------------------------------

1/5/60 Y Y-lengthy -186 also S15 1.018 4 -.038 .09

divergence

S9/S15

---------------------------------------------------------------------------------------------------------------------------

Peak on 11/15/1961 showed LA/MA= 1.034 ROC= .522 P=20 OP21=.108 V=53 OP=.408

Selling just after peak of right shoulder when NYSE A/D Line uptrend was broken

would have been advised.

---------------------------------------------------------------------------------------------------------------------------

2/9/66 E-Y Y-15 day 4 Y - 2 months later Also E-S4 1.007 3 -.064 .153

1/18/66 Y 5 Y - 3 months later Also S4 1.02 49 -.028 .481

S4/S12

---------------------------------------------------------------------------------------------------------------------------

12/2/69 12 S1 1.021 114 .068 .169

5/14/69 Y 0 S8 1.028 61 .097 .237

S1 S8/S9

---------------------------------------------------------------------------------------------------------------------------

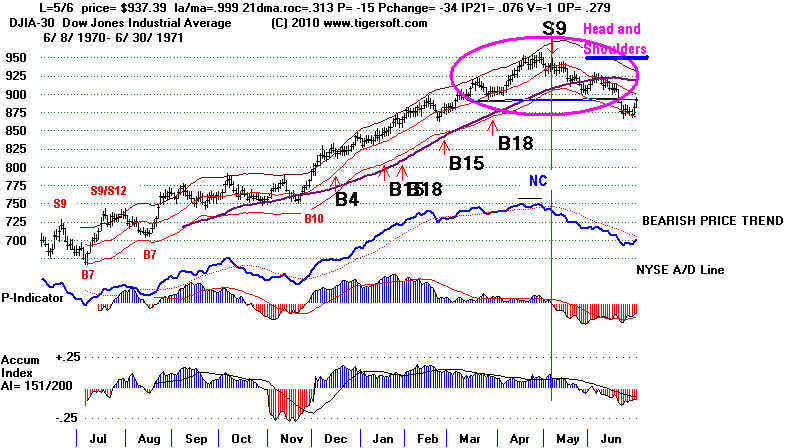

4/28/71 Y-1 wk 1 Y - 6 wks later S9-variation 1.024 82 .095 .405

S9

---------------------------------------------------------------------------------------------------------------------------

1/11/73 Y Y Y-1 month -2 S15 1.024 -96 .002 .059

S9/S12/S15

---------------------------------------------------------------------------------------------------------------------------

9/21/76 2 1.033 178 .181 .173

12/27/77 S8 1.028 224 .107 .362

A/D Line was very strong until June when DJI fell more than 12% from its Sept 1966 highs.

It was impenetrability of the 1000 resistance that contributed mightily to the DJI decline in 1977.

S8

---------------------------------------------------------------------------------------------------------------------------

2/13/80 Y Y Y-2 weeks -1 S15 1.028 -26 -.01 .208

S9/S15

---------------------------------------------------------------------------------------------------------------------------

4/27/81 Y Y-2 weeks 0 S15 1.02 11 .026 .21

3 earlier major Sell-Sets (S9s and S12s) in previous 5 months.|

---------------------------------------------------------------------------------------------------------------------------

8/25/87 Y-1 wk 21 1.034 117 . 224 .319

The August top saw an A/D Line trend-break after a 3 month advance put the DJIA into an oversold

position. The P and AI Indicators dropped quickly below their 21-day ma. The A/D Line trend-break

should have been used to take profits, at least.

10/2/87 Y Y -7 hands above head pattern 1.026 -56 -.017 .068

2 earlier major Sell-Sets (S9s and S12s) in previous 6 months.

S9/S12

---------------------------------------------------------------------------------------------------------------------------

7/16/90 Y Y-6 weeks -3 Y - 3 wks later 1.033 0 .049 .426

S9

---------------------------------------------------------------------------------------------------------------------------

7/17/98 Y Y Y - 4 mo 11 Y - 2 weeks later 1.034 141 .026 .134

S9/S12

---------------------------------------------------------------------------------------------------------------------------

1/14/00 Y Y-lengthy -28 Y - 1 month later S15 1.03 90 -.058 .441

6 earlier major Sell-Sets in previous 6 months

December is normally a bullish month. December S9s can be premature.

S9/S15

---------------------------------------------------------------------------------------------------------------------------

5/21/01 E-Y E-Y 410 Y - 1 month later S4 1.041 410 .151 .08

A/D Line was very strong until August when DJI fell more than 12% from its May 2001 highs.

S4

---------------------------------------------------------------------------------------------------------------------------

10/19/07 Y - 4 mo 140 Y - 1 month later S4 1.027 408 .119 .282

The multiple major Sells in 2007 set up the big decline in 2008-2009.

S4

---------------------------------------------------------------------------------------------------------------------------

5/1/08 Y-2 weeks -28 Y-2 weeks later S15 1.029 178 .048 .076

S15

===============================================================================