-

Source:

http://www.nypost.com/seven/11252008/postopinion/editorials/bounce_these_bozo_bankers_140652.htm

Insider

Selling by Robert Rubin at CitiGroup

| 22-Jan-08 |

RUBIN ROBERT E

Officer |

9,010 |

Direct |

Disposition (Non Open Market) at $24.20 per share. |

$218,042 |

| 22-Jan-07 |

RUBIN ROBERT E

Officer |

77,500 |

Direct |

Sale at $55.05 - $55.05 per share. |

$4,266,0002

|

| 19-Jun-06 |

RUBIN ROBERT E

Officer |

196,624 |

Direct |

Disposition (Non Open Market) at $48.36 - $48.36 per

share. |

$9,509,0002 |

|

|

|

|

|

|

--------------------------------

Total 274,124

shares sold

Rubin was not the only insider selling large

numbers of

shares of

Citgroup in 2007, more than a year before the stock

fell under

$4 and had to be rescued by a second $20 billion

taxpayer

bailiout.

MASSIVE INSIDER SELLING AT CITIGROUP

| 19-Jan-07 |

RHODES WILLIAM R

Officer |

56,000 |

Direct |

Disposition (Non Open Market) at $0 per share. |

N/A

|

| 22-Jan-07 |

KADEN LEWIS B

Officer |

11,200 |

Direct |

Disposition (Non Open Market) at $54.55 per share. |

$610,960 |

| 22-Jan-07 |

BISCHOFF WINFRIED F W

SIR

Officer |

17,708 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$966,0002 |

| 22-Jan-07 |

VOLK STEPHEN R

Officer |

16,348 |

Direct |

Disposition (Non Open Market) at $54.55 per share. |

$891,783 |

| Jan-07 |

MEDINA-MORA MANUEL

Officer |

10,523 |

Direct |

Disposition (Non Open Market) at $54.55 per share. |

$574,029 |

| 22-Jan-07 |

FREIBERG STEVEN J

Officer |

21,162 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$1,154,0002 |

| 22-Jan-07 |

BANGA AJAY

Officer |

18,374 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$1,002,0002 |

| 22-Jan-07 |

GERSPACH JOHN C

Officer |

4,535 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$247,0002 |

| 22-Jan-07 |

KRAWCHECK SALLIE

Officer |

50,339 |

Direct |

Disposition (Non Open Market) at $54.55 per share. |

$2,745,992 |

| 22-Jan-07 |

HELFER MICHAEL S

Officer |

19,590 |

Direct |

Disposition (Non Open Market) at $54.55 per share. |

$1,068,634 |

| 22-Jan-07 |

BUSHNELL DAVID C

Officer |

25,293 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$1,380,0002 |

| 22-Jan-07 |

PRINCE CHARLES

Officer |

81,088 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$4,423,0002 |

| 22-Jan-07 |

RUBIN ROBERT E

Officer |

77,500 |

Direct |

Sale at $55.05 per share. |

$4,266,375 |

| 22-Jan-07 |

DRUSKIN ROBERT

Officer |

43,640 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$2,381,0002 |

| 22-Jan-07 |

RHODES WILLIAM R

Officer |

24,712 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$1,348,0002 |

| 22-Jan-07 |

BISCHOFF WINFRIED F W

SIR

Officer |

17,708 |

Direct |

Disposition (Non Open Market) at $54.55 - $54.55 per

share. |

$966,0002 |

| 22-Jan-07 |

VOLK STEPHEN R

Officer |

16,348 |

Direct |

Disposition (Non Open Market) at $54.55 per share. |

$891,783 |

| 22-Jan-07 |

KADEN LEWIS B

Officer |

11,200 |

Direct |

Disposition (Non Open Market) at $54.55 per share. |

$610,960 |

| 17-Apr-07 |

PRINCE CHARLES

Officer |

13,419 |

Direct |

Disposition (Non Open Market) at $52.93 - $52.93 per

share. |

$710,0002 |

| 17-Apr-07 |

GERSPACH JOHN C

Officer |

19,128 |

Direct |

Disposition (Non Open Market) at $52.93 - $52.93 per

share. |

$1,012,000 |

| 18-Apr-07 |

DRUSKIN ROBERT

Officer |

10,000 |

Direct |

Sale at $53.07 - $53.07 per share. |

$531,0002 |

| 17-May-07 |

PRINCE CHARLES

Officer |

13,395 |

Direct |

Disposition (Non Open Market) at $54.91 - $54.91 per

share. |

$736,0002 |

| 16-May-07 |

RHODES WILLIAM R

Officer |

20,000 |

Direct |

Disposition (Non Open Market) at $0 per share. |

N/A |

| 25-May-07 |

BANGA AJAY

Officer |

26,079 |

Direct |

Disposition (Non Open Market) at $54.93 per share. |

$1,432,519 |

| 3-Jul-07 |

DRUSKIN ROBERT

Officer |

23,885 |

Direct |

Disposition (Non Open Market) at $52.84 - $52.84 per

share. |

$1,262,0002 |

| 20-Jul-07 |

FREIBERG STEVEN J

Officer |

11,591 |

Direct |

Disposition (Non Open Market) at $51.13 per share. |

$592,647 |

7 |

MAHERAS THOMAS G

Officer |

23,964 |

Direct |

Disposition (Non Open Market) at $52.84 - $52.84 per

share. |

$1,266,000 |

| 13-Jul-07 |

RHODES WILLIAM R

Officer |

47,928 |

Direct |

Disposition (Non Open Market) at $52.84 per share. |

$2,532, |

| 13-Jul-07 |

PRINCE CHARLES

Officer |

38,342 |

Direct |

Disposition (Non Open Market) at $52.84 - $52.84 per

share. |

$2,026,00 |

| 17-Jul-07 |

KLEIN MICHAEL STUART

Officer |

19,282 |

Direct |

Disposition (Non Open Market) at $52.19 per share. |

$1,006,327 |

| 23-Jul-07 |

BUSHNELL DAVID C

Officer |

11,809 |

Direct |

Disposition (Non Open Market) at $50.73 - $50.73 per

share. |

$599,0002 |

(Source - http://finance.yahoo.com/q/it?s=c )

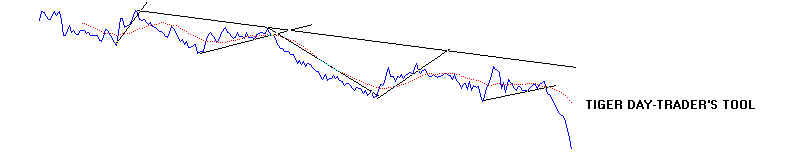

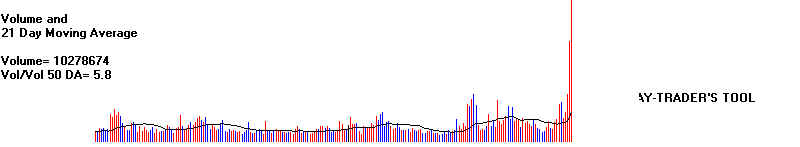

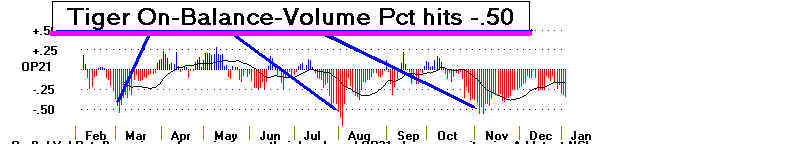

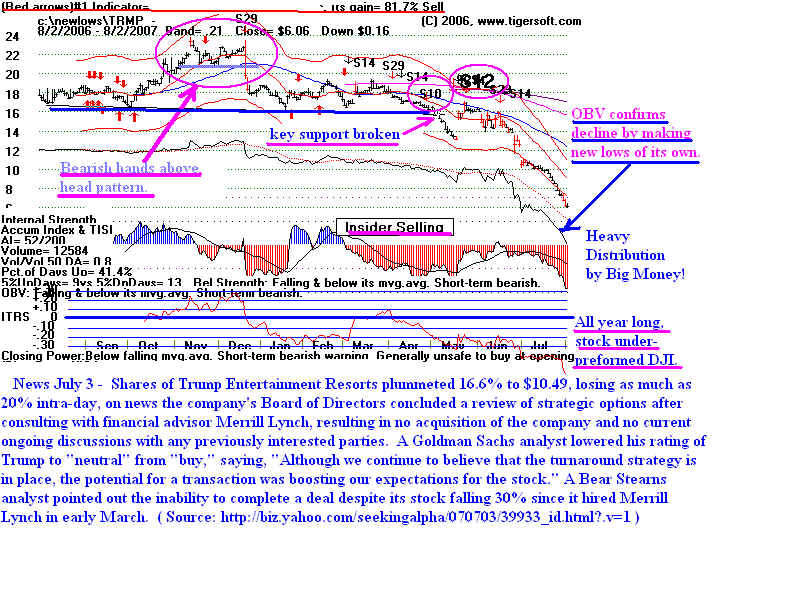

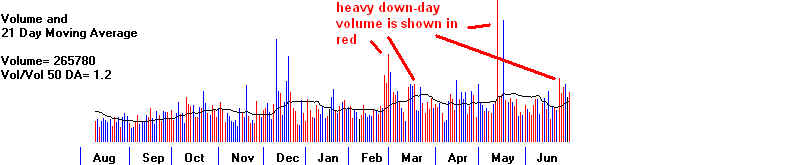

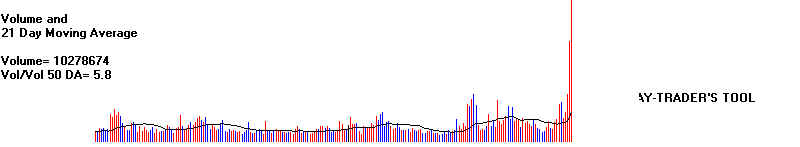

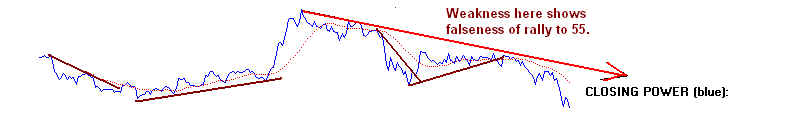

TigerSoft Unique Measures of Internal

Strength

on its

2007-2008 Charts of Citygroup Were Shouting "SELL".

TigerSoft's unique tools made it very clear to anyone looking at a

Citigroup

chart in 2007 that insiders were dumping the stock. And when

insiders do this, big troubles follow. The clear message is always the same

when

our Accumulation Index, Closing Power, ITRS and Day Traders'

Tool

indicators look as bearish as they did from early 2007 to the present,

in

2008. The mesage is that bankruptcy looms as a real possibility.

If you are using TigerSoft, this is what you have to watch for to

find a

stock that could go to zero, either to avoid to sell short. We note in

blue the readings that are only available to TigerSoft.

The bearish signs

to

look for are:

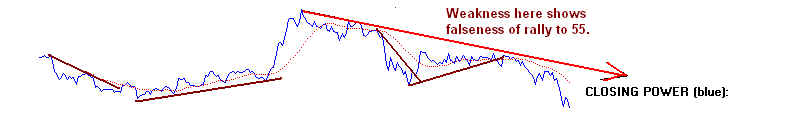

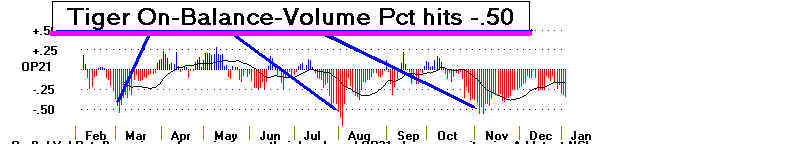

1) TigerSoft's unique Accumulation

Index turns from positive (blue) to negative

(red) and

stays there for months at a time, often going below -.25.

2) TigerSoft's

unique Closing Power indicator

goes into a steady decline

for six

months and makes a new low ahead of price making a new low.

3) TigerSoft's

unique ITRS (Relative Strength) indicator goes below 0

and stays there

for six months.

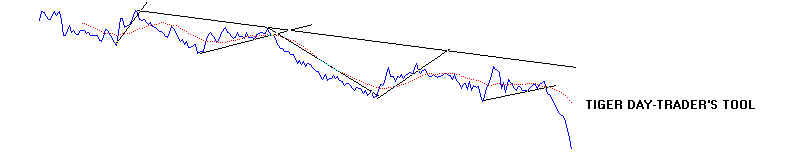

4. TigerSoft's unique Day Traders' Tool goes into a steady decline

for six

months and makes a new low ahead of price making a new low.

See 165 Page Book

"Killer Short

Sale Techniques in Any Stock Market Environment"

When the TigerSoft indicators become this bearish, you will also see

classic head

and shoulders tops and a very weak On-Balance-Volume Line,

where its

rate of descent is much more rapid than the early price decline.

This is

because the stock is often being held up articially.

These are the signs of insider distribution and hasty insider dumping. Word

of

their selling has gotten out and a growing number of institutions are selling

their

huge positons. TigerSoft's key indicator, the Accumulation Index,

was

invented by me, William Schmidt in 1981. Over the years, attempts have

been

made to copy it and pass it off as someone else's by intellectual property

thieves. Mark this. Checking this. They deserve

notoriety, not celebrity status.

But

there they are pontificating on television. The Accumulation Index was

invented it to let me rank and compare a key and powerfully predictive element

of a stock's

behavior. This is a powerful tool. When the Accumulation Index

turns very

positive (blue), it let's us see when insiders are buying a stock in a

way that predicts

a big advance. And as you can see below, steady and deeply

red readings

from this indicator tell us the stock is being distributed by insiders

to less well informed investors.

Massive Insider Selling at Citigroup - 2007-2008

---------------

CitiGroup's Chart Turned Very Bearish Early in 2007 -----------

C - 2006-2007

TigerSoft's Closing Power

TigerSoft's Day Traders' Tool

====================================================================

---------------

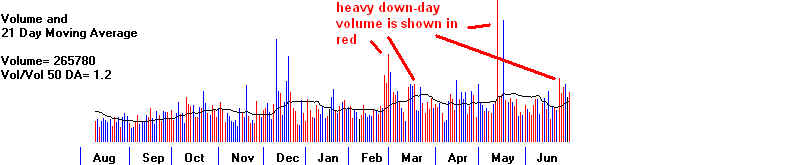

CitiGroup Showed Massive insider

selling in 2007 -----------

Shareholders should be "mad as hell."

--------------- CitiGroup Showed Massive Insider Selling

in 2008 -----------

Note bearish down-trending Day Traders' Tool

Note bearish down-trending Day Traders' Tool

Heavy Red Down-Day Volume is bearish.

The Famous

Insider behind The Bearish TigerSoft Charts

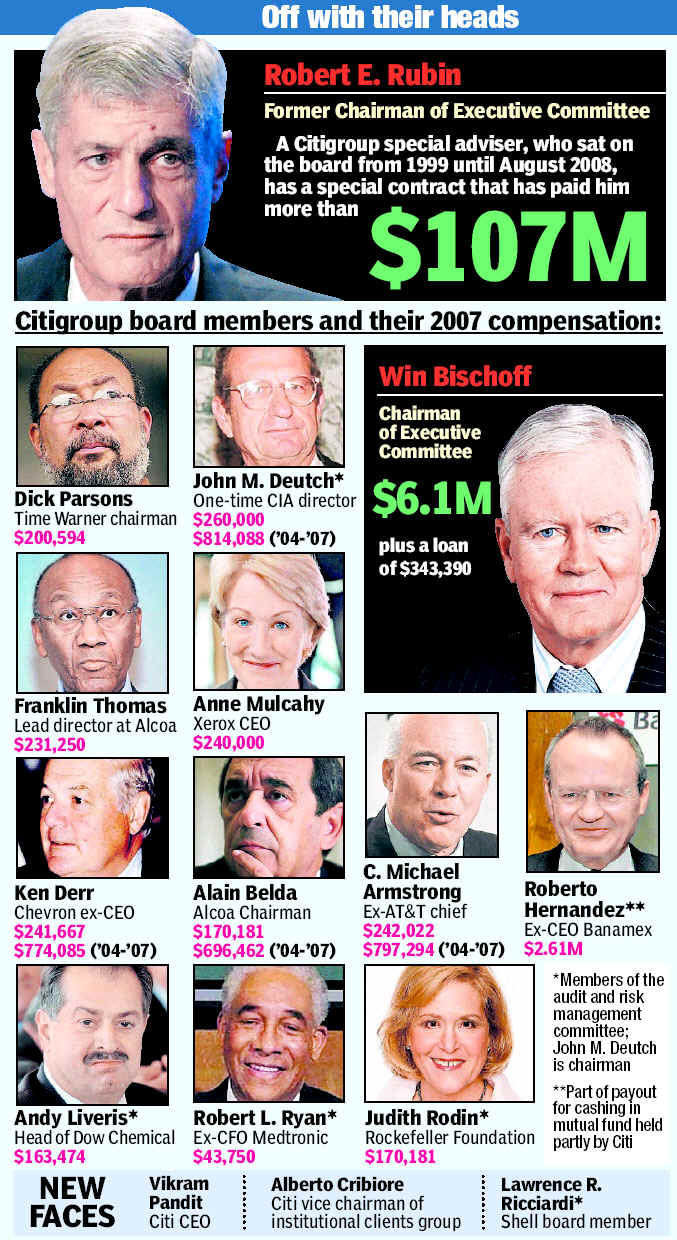

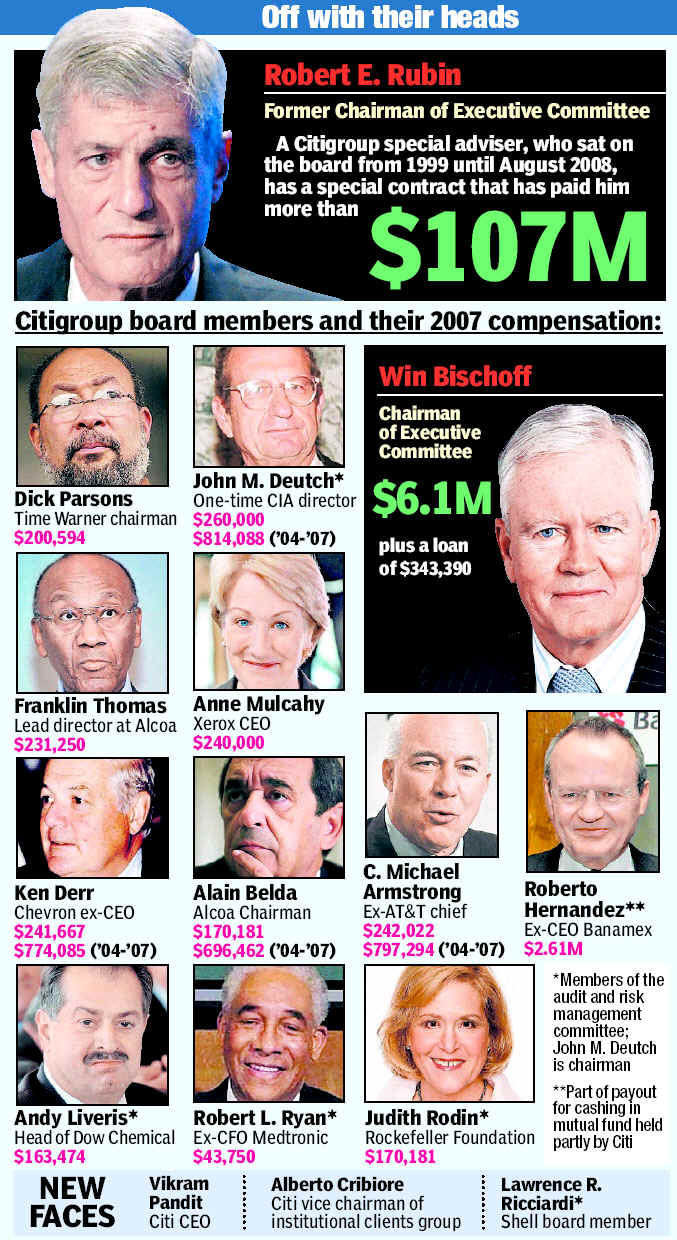

Robert Rubin, The Bubble and The Crash of 2007-2008

Robert Rubin - The Architect and Main Advocate

for Using More Leverage at Citigroup

Citigroup insiders and analysts say that its

former CEO until 2007 and Rubin played

pivotal by drafting and implementing a "strategy that involved taking greater trading

risks

to expand its business and reap higher profits." In fact, it was Rubin who

explained the

benefits of being more aggressive to the new CEO, Charles Prince, in 2002 and how

best to do so. ""Chuck was totally new to the job.

He didn't know a C.D.O. from a grocery

list, so he looked for someone for advice and support. That person was Rubin. And

Rubin

had always been an advocate of being more aggressive in the capital markets arena. He

would say, 'You have to take more risk if you want to earn more.' " (Source. )

Besides, Bush ("Bankruptcy - Mission

Accomplished")

and Paulson -

Pimp for His Wall Street Cronies,

Shown above Are The People Who Caused the 2007-2008 Collapse:

Democrat Rubin and Republicans Greenspan, COX (SEC) and Phil Graham

Clinton's Ex-Treasury Secretary, Robert Rubin, is now dancing

quickly away from

controversial Citigroup. But the fact remains that "(h)e

has collected more than $150

million in cash and stock over eight years to serve as the bank’s elder statesman,

meeting

with important clients and building relationships with government and business leaders

around the world, though his contract states that he is to have no daily operational

responsibilities." (Source.)

RUBIN KNEW THE RISKS AND TRAGEDY HE WAS CREATING.

The proof is that he himself sold out at the top.

Insider

Selling by Robert Rubin at CitiGroup

As much as anyone in Citigroup, Rubin advocated using more leverage to make

more loans to make more money. A year ago I noted that he must have known dire

trouble

was going to engulf CitiGroup as a result of its use of levevage and its lack of controls

on the quality of their loans. So, Rubin sold more than 600,000 shares when the

stock was

between 33 and 55 and he turned down the CEO job. He

denies this. He claimed that

"Few if anyone" anticipated the financial meltdown. Not remotely

true. See NYU Professor

Nouriel

Rubini's dire warnings to International Monetary Fund in late 2006 and ever since.

NY POST ARTICLE

NY POST ARTICLE and Robert Rubin

"Rubin, the Clinton administration treasury secretary who successfully

engineered the bank deregulation that made so much of the current mess possible, was

appointed to the Citi board in 1999.

Then, it seems, things began to happen.

That is, Rubin apparently undertook to test the limits of his new banking rules.

In a 4,076-word autopsy of Citigroup's "rush to risk," The New York Times on

Sunday labeled Rubin "an architect of the bank's strategy."

It describes him as having "pushed to bulk up the bank's high-growth fixed-income

trading," including risky debt instruments.

Risky is hardly the word for it - though in mid-2007, according to the newspaper, Citi

brass claimed that the likelihood of subprime mortgages actually defaulting "was so

tiny that they [were] excluded from their risk analysis."

And this was after Bear Stearns imploded, telegraphing the full scope of the

crisis.

Citi's CEO at the time, Charles Prince, never questioned the preposterously rosy

assessment.

Nor did then-board Chairman Winifred Bischoff, who was paid $6.1 million and got a

low-interest loan of $343,390 in 2007.

What were they thinking?

Did the prospect of ballooning profits totally blind them all to the risk?

Rubin left the board in August 2007, having stuffed his pockets with $107 million from

Citi since '99.

The following November, Prince was fired - walking off with company stock then worth

$68 million, according to the Times, and a bonus for 2007 of $12.5 million.

In the end, federal regulators had no choice but to structure yet another

corporate bailout - this time to rescue a bank with $2 trillion in assets, more

than 300,000 employees and operations in more than 100 countries.

Just letting it collapse would wreak global financial havoc.

But to rescue it without calling out those who engineered the disaster would be an

affront to justice.

There should be no mistake about where the responsibility resides.

That would be with the Citigroup board of directors - and Robert Rubin in particular.

( http://www.nypost.com/seven/11252008/postopinion/editorials/bounce_these_bozo_bankers_140652.htm

)

|

THESE BANKERS KNEW THAT THEY WERE COMMITING FRAUD

All these bankers knew they were making poor quality loans. They knew it. They

did it anyway, because someone else, they calculated would own the bundled mortgages

they way selling as AAA quality to investors around the world. "There's really no profit in

remaining ethical. Perhaps we should teach our children to incorporate, then rip off every

single sucker they can and retire at 40. Join a a gang and commit crimes under mob rule -

that's the ticket to success in the good old U.S. of A. it seems to me. I don't think any of

them are even the least bit ashamed. " (Source.)

"Whistle blowers (people who complained

that 'this ain't right') were fired, excluded, demoted, transferred away from Realty

Agencies,

Mortgage Brokers, Banks and Appraisers offices across the country - The reason I call them

whistle blowers because it's become apparent that the people calling foul in the mortgage

lending industry were correct, while they were punished by their peers both financially

and

emotionally for pointing out the moral hazards of their occupation."

( Source.

) "Honest

appraisers and loan officers were penalized, blacklisted, not payed and fired.

"Recently while

talking to a senior underwriter for a major Wall Street bank, she shared with me that she

had witnessed the sinister inner workings of the lending industry first hand. The

underwriter’s

job is to provide an unbiased assessment of the risk level of a particular loan."

(

Source. )

Robert Rubin's Role in Making The National Housing Bubble

As Treasury Secretary for Clinton, Robert Rubin lobbied hard to get the President to

allow banks to get into the securities' business, thereby giving them new reason to make

unsafe loans and exaggerate their safety as they package them to others to invest in.

(See TigerSoft Blog and

News Service - 9/21/2008 - Monopoly Finance)

WHY DOES RUBIN STILL HAVE A JOB AT CITIGROUP?

Citigroup's risk models never accounted for the possibility of a national housing

downturn, this person said, and the prospect that millions of homeowners could default on

their mortgages. Such a downturn did come, of course, with disastrous consequences for

Citigroup and its rivals on Wall Street.

They never factored that housing prices would drop? Really?

[W]hile Mr. Rubin certainly did not have direct responsibility for a Citigroup unit, he

was an architect of the bank's strategy.

In 2005, as Citigroup began its effort to expand from within, Mr. Rubin peppered his

colleagues with questions as they formulated the plan. According to current and former

colleagues, he believed that Citigroup was falling behind rivals like Morgan Stanley and Goldman, and he

pushed to bulk up the bank's high-growth fixed-income trading, including the C.D.O.

business.

Former colleagues said Mr. Rubin also encouraged Mr. Prince to broaden the bank's

appetite for risk, provided that it also upgraded oversight -- though the Federal Reserve

later would conclude that the bank's oversight remained inadequate.

Once the strategy was outlined, Mr. Rubin helped Mr. Prince gain the board's confidence

that it would work.

After that, the bank moved even more aggressively into C.D.O.'s. It added to its

trading operations and snagged crucial people from competitors.

No wonder Wall Street media is standing there with pitchforks and torches calling for

Rubin's head this morning. A WSJ op-ed wonders

"Why are Robert Rubin and other directors still employed?" New York

Post says "Citi of Fools: Negligent bank board must quit."

Yes, it's incredible that nobody required Rubin and the board to resign as a condition

of the Citibank bailout. But I tend to look at these final days as the BushCo crooks

holding their final heist, taking advantage of the fact that something must be done

immediately to keep the economy from hurling into a ditch. They have the ability to

impede anything from happening, and they're holding us all hostage and demanding the right

to steal as the price of their acquiescence. What's Obama supposed to do? If

he calls bullshit, the fragile markets could tumble. He's in a position where he

really has to just do what he can.

What I'm more concerned about is the key place Rubin still occupies in Team Obama:

Geithner, Summers and Orszag have all been followers of the economic formula that came

to be called Rubinomics: balanced budgets, free trade and financial deregulation.

There are many who are arguing that ideology is not important, and that Obama is

prizing competence over philosophical perspective. Glenn

Greenwald does a nice job of arguing that competence is largely a function of ideology

-- and from a pragmatic perspective, progressives (who are almost entirely left out of

Obama's key administration appointments) got a lot of things right.

Source: http://www.huffingtonpost.com/jane-hamsher/is-robert-rubin-competent_b_146372.html

|

Compare Citigroups' Charts with Other Stocks

That

Went or Are Appraching Bankruptcy.

General Motors

BEAR STEARNS

FANNIE MAE

FREDDIE MAC

LEHMAN BROTHERS

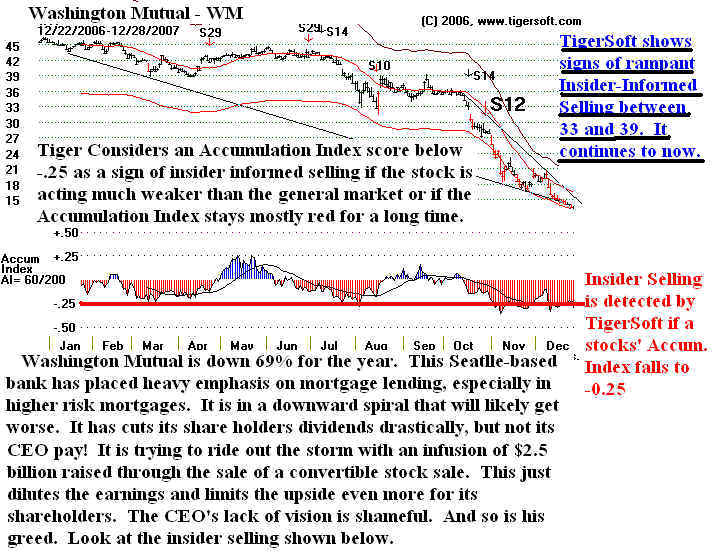

WASHINGTON MUTUAL

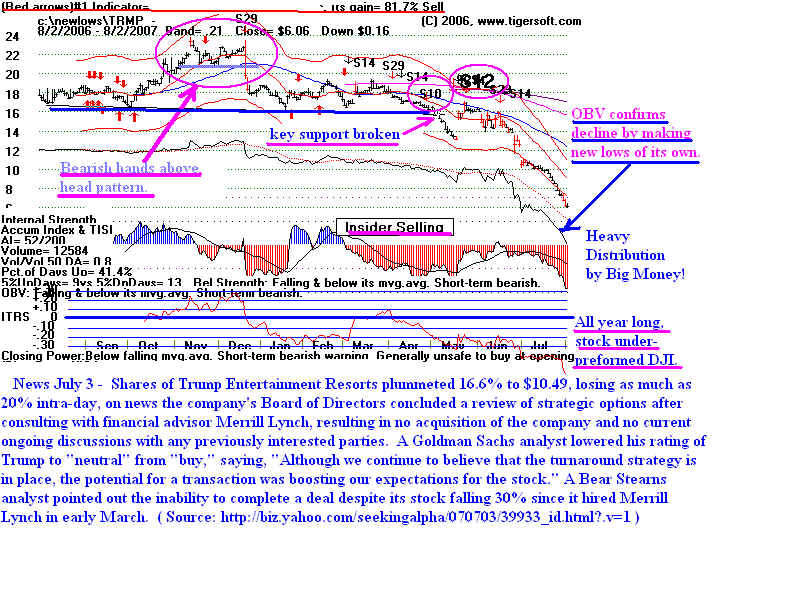

TRUMP

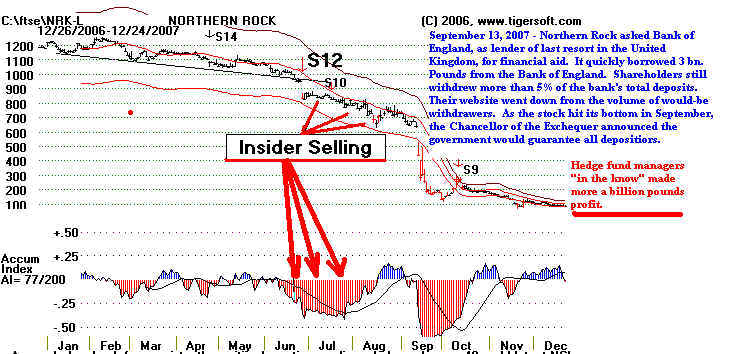

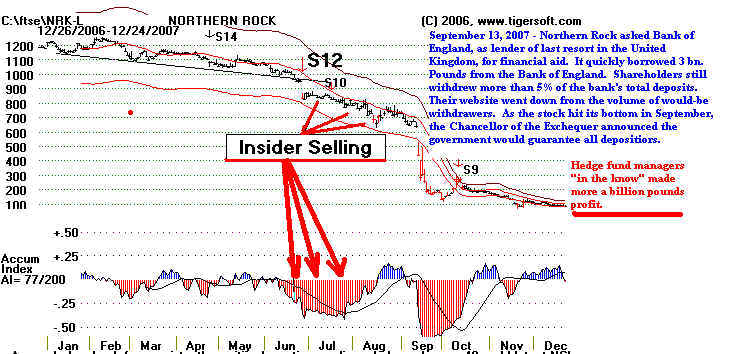

Northern Rock

|

TigerSoft

News Service 11/25/2008 www.tigersoft.com

TigerSoft

News Service 11/25/2008 www.tigersoft.com

Note bearish down-trending Day Traders' Tool

Note bearish down-trending Day Traders' Tool