The

Greenspan "De-Regulation" of Banking,

by Abolishing The

Glass-Steagall Act of 1933

Directly Led to The

2007-2008 Bear Market.

by William Schmidt,

Ph.D.

Greenspan more than anyone else in Wall Street set the stage

for the terrible state

of finance

and business in September 2008. He did this by permitting a reckless housing

bubble and

avoiding review and regulation of banks and the housing market. Without

any

challenge or investigation, he sat back and permitted the heavily over-leveraged use

of all

manner of esoteric and opaque housing market instruments and mortgage derivatives.

These were

created by the commercial and investment banks to get rich quick. Instead,

it

has severely threatened the health of the American economy. These were the

institutions

the

Federal Reserve was supposed to regulate. Instead, the FED permitted zero-down

housing

loans! Greenspan's FED created a housing boom and bubble but walked away from

regulating it. He wore ideological blinders and simply wanted to make money for his

cronies on Wall Street. At first, he dogmatically espoused a highly ideological

stance of

de-regulation. Without legal authority, he created massive loopholes in the

Glass-Steagall

Act

which was enacted specifically to prevent commercial banks from getting into the business

of

buying and selling stocks or offering mortgage derivatives to investors. When

that was

accomplished, and then ratified ex post facto by Congress, he set forth on a course of

complete

non-regulation.

Greenspan Admits He Was Terribly Wrong

After the Crash of 2008, Greenspan finally admitted he had been wrong to favor

de-regulation

of

banks. On October 23, 2008, he admitted to Congress that he was wrong to have

trusted the

most

powerful bankers to act in their long run self-interest and that of their share

holders. He

explained:

"I made a mistake in presuming that the

self-interests of organizations,

specifically banks and others, were such as that they were best capable of protecting

their own shareholders and their equity in the firms."

What he should have said was

that multi-million dollar bonuses determined the

self-interests of Banking CEOs and Hedge Fund Managers. To make big short-term

profits,

they lied, obfuscated and hid the truth from investors and shareholders. They

recklessly used

leverage. They knowingly gave shareholders and creditors misleading financial

information

and

credit reports to exaggerate short-term profits and procure obscene bonuses for

themselves.

They

cared little about the consequences to millions whose life-savings and jobs were destroyed

in the process.

"What’s

remarkable about this is

that

same erroneous belief is THE key pillar of all free market ideology. Without it,

the

entire edifice supporting the market worship fetish of the Libertarians, the Austrian

School, and most economists collapses into rubble, just as our financial system has

collapsed. It’s

hard to accept that economists could really believe such nonsense;

I suspect that much of their religious attitude toward markets stemmed from their

regular

paychecks from corporations benefiting from such dumb, unsupported beliefs."

(Blue and Red colors in the original for emphasis.

Stephen Zarlenga, American Monetary Insitute - http://www.monetary.org. )

SEC Chairman Cox Must Have Been in Cahoots with Bearish Hedge Funds

All Greenspan's surrendering to big banks was exactly matched by SEC Chariman Cox's

surrendering to big brokerages, hedge funds and mutual funds. Like Greenspan,

Cox

was driven by a mean mix of right-wing ideology and old-boys' cronyism. As a result,

Cox largely repudiated his charge, the regulation of the securities business. The

hen house

was always full of foxes with farmer Cox in charge. Under Cox, insider trading has

became rampant and common place. TigerSoft has documented many cases of this.

Under Cox.

all the New Deal restrictions on short selling and bear raiders were lifted with the same

dire

consequences for the stock market, business and jobs in America. TigerSoft has

documented

and decried this.

Ideological de-regulation and cronyism has made insiders rich, but impoverished

millions who were not in the loop and still don;t understand what happened to their money

or homes. Shame on Greenpan. Shame on Phil Graham. Shame on Robert Rubin.

And

shame on McCain and Obama for not talking about the need for the restoration of

Glass-Steagall.

Bank of America's September 2008 buy out of Merrill Lynch is

in complete

defiance of all that was learned by those who crafted Glass Steagall. It bodes

ill

for America. It is said that Bank of America drafted this Summer's

Emergency Housing Bill. BoA is now the nexus of American political, financial

and

economic power. Watch its stock. Its rise means democracy in America

is

declining. Predictably neither McCain nor Obama is saying a word to question

this

step back to the 1890s.

Federal Deposit Insurance Corporation (FDIC).

The arguments

for the

separation of commercial banking from brokerage and investment

banking can

be summarized:

1.The

granting of credit (lending) must be separated from the use of credit (investing).because

it

creates conflicts of interests and abuses.

2. Depository institutions possess enormous financial power, by virtue of their control of

other

people’s money. Those powers must be limited to ensure banking soundness and

competition

in the market for funds, whether loans or investments.

3. Securities activities are inherently risky and can and do sometimes lead to enormous

losses.

Such losses will surely threaten the integrity of deposits. In turn, the Government

insures deposits

and could be required to pay large sums if depository institutions were to collapse as the

result of

securities losses.

4. Depository institutions are supposed to be managed to limit risk. Their managers are

not

conditioned to operate prudently in more speculative securities businesses.

In the 1950s, Congress again put limits on commercial

banks and

prohibited them from owning insurance companies. They were not allowed

to

buy banks in another state. But then the tide started receding. In the

1960s

banks were allowed to enter the municipal bond field. And in the

1970s

some brokerages began to offer credit cards and check-writing.

Reagan, De-Regulation and One-Stop Banking

Starting in 1986, Reagan's Federal Reserve started picking apart the

Glass-Steagall Act. They re-interpreted Glass-Steagall as baring commercial

banks from being "principally engaged" in securities business, deciding that

banks can have up to 3% of their gross revenues from investment banking.

Previously, banks were not allowed to trade any equities.

In the Spring of 1987, Citigroup, JP Morgan and Bankers Trust pressure

the Federal Reserve to allow banks to handle several underwriting

businesses, including commercial paper, municipal revenue bonds, and

mortgage-backed securities. Chairman Volcker, who was

out-voted, was

not moved, and expressed "fear that lenders will recklessly lower loan

standards in pursuit of lucrative securities offerings and market bad loans

to the public". The Fed then said it would raise the limit on banks'

securities

revenue from 5% to 10 percent of gross revenues. In August 1987, Alan

Greenspan -- formerly a director of J.P. Morgan and a proponent of

banking deregulation -- became chairman of the Federal Reserve Board.

In January 1989, the Fed Board approves an application by J.P. Morgan,

Chase Manhattan, Bankers Trust, and Citicorp "to expand the Glass-Steagall

loophole to include dealing in debt and equity securities in addition to

municipal securities and commercial paper. This marks a large expansion of

the activities considered permissible under Glass-Steagall.

(Source: http://www.pbs.org/wgbh/pages/frontline/shows/wallstreet/weill/demise.html )

Greenspan De-Regulates without Congressional Action

In December 1996, with the support of Chairman Alan Greenspan, the

Federal Reserve Board issues a precedent-shattering decision permitting

bank holding companies to own investment bank affiliates with up to 25

percent of their business in securities underwriting (up from 10 percent).

This expansion of the loophole created by the Fed's 1987

reinterpretation of

Section 20 of Glass-Steagall effectively renders Glass-Steagall obsolete.

Virtually any bank holding company wanting to engage in securities business

would be able to stay under the 25 percent limit on revenue. Further, it

states that the risks of underwriting had proven to be "manageable," and

says banks would have the right to acquire securities firms outright.

"In 1997, Bankers Trust (now owned by Deutsche Bank) buys the

investment bank Alex. Brown & Co., becoming the first U.S. bank to

acquire a securities firm." The Fed allows it.

The Role of Citibank in the Demise of

Glass-Steagall

Quoted from PBS' Frontline.

| On April 6, 1998, Weill and Reed announce a $70 billion stock swap

merging Travelers (which owned the investment house Salomon Smith Barney) and Citicorp

(the parent of Citibank), to create Citigroup Inc., the world's largest financial services

company, in what was the biggest corporate merger in history. The transaction would have

to work around regulations in the Glass-Steagall and Bank Holding Company acts governing

the industry, which were implemented precisely to prevent this type of company: a

combination of insurance underwriting, securities underwriting, and commercial banking.

The merger effectively gives regulators and lawmakers three options: end these

restrictions, scuttle the deal, or force the merged company to cut back on its consumer

offerings by divesting any business that fails to comply with the law.

Weill meets with Alan Greenspan and other Federal Reserve officials before the

announcement to sound them out on the merger, and later tells the Washington Post

that Greenspan had indicated a "positive response." In their proposal, Weill and

Reed are careful to structure the merger so that it conforms to the precedents set by the

Fed in its interpretations of Glass-Steagall and the Bank Holding Company Act.

Unless Congress changed the laws and relaxed the restrictions, Citigroup would have two

years to divest itself of the Travelers insurance business (with the possibility of three

one-year extensions granted by the Fed) and any other part of the business that did not

conform with the regulations. Citigroup is prepared to make that promise on the assumption

that Congress would finally change the law -- something it had been trying to do for 20

years -- before the company would have to divest itself of anything.

Citicorp and Travelers quietly lobby banking regulators and government officials for

their support. In late March and early April, Weill makes three heads-up calls to

Washington: to Fed Chairman Greenspan, Treasury Secretary Robert Rubin, and President

Clinton. On April 5, the day before the announcement, Weill and Reed make a ceremonial

call on Clinton to brief him on the upcoming announcement.

The Fed gives its approval to the Citicorp-Travelers merger on Sept. 23. The Fed's

press release indicates that "the Board's approval is subject to the conditions that

Travelers and the combined organization, Citigroup, Inc., take all actions necessary to

conform the activities and investments of Travelers and all its subsidiaries to the

requirements of the Bank Holding Company Act in a manner acceptable to the Board,

including divestiture as necessary, within two years of consummation of the proposal. ...

The Board's approval also is subject to the condition that Travelers and Citigroup conform

the activities of its companies to the requirements of the Glass-Steagall Act."

Following the merger announcement on April 6, 1998, Weill immediately plunges into a

public-relations and lobbying campaign for the repeal of Glass-Steagall and passage of new

financial services legislation (what becomes the Financial Services Modernization Act of

1999). One week before the Citibank-Travelers deal was announced, Congress had shelved its

latest effort to repeal Glass-Steagall. Weill cranks up a new effort to revive bill.

Weill and Reed have to act quickly for both business and political reasons. Fears that

the necessary regulatory changes would not happen in time had caused the share prices of

both companies to fall. The House Republican leadership indicates that it wants to enact

the measure in the current session of Congress. While the Clinton administration generally

supported Glass-Steagall "modernization," but there are concerns that mid-term

elections in the fall could bring in Democrats less sympathetic to changing the laws.

In May 1998, the House passes legislation by a vote of 214 to 213 that allows for the

merging of banks, securities firms, and insurance companies into huge financial

conglomerates. And in September, the Senate Banking Committee votes 16-2 to approve a

compromise bank overhaul bill. Despite this new momentum, Congress is yet again unable to

pass final legislation before the end of its session.

As the push for new legislation heats up, lobbyists quip that raising the issue of

financial modernization really signals the start of a fresh round of political

fund-raising. Indeed, in the 1997-98 election cycle, the finance, insurance, and real

estate industries (known as the FIRE sector), spends more than $200 million on lobbying

and makes more than $150 million in political donations. Campaign contributions are

targeted to members of Congressional banking committees and other committees with direct

jurisdiction over financial services legislation.

After 12 attempts in 25 years, Congress finally repeals Glass-Steagall, rewarding

financial companies for more than 20 years and $300 million worth of lobbying efforts.

Supporters hail the change as the long-overdue demise of a Depression-era relic.

On Oct. 21, with the House-Senate conference committee deadlocked after marathon

negotiations, the main sticking point is partisan bickering over the bill's effect on the

Community Reinvestment Act, which sets rules for lending to poor communities. Sandy Weill

calls President Clinton in the evening to try to break the deadlock after Senator Phil

Grham, chairman of the Banking Committee, warned Citigroup lobbyist Roger Levy that Weill

has to get White House moving on the bill or he would shut down the House-Senate

conference. Serious negotiations resume, and a deal is announced at 2:45 a.m. on Oct. 22.

Whether Weill made any difference in precipitating a deal is unclear.

On Oct. 22, Weill and John Reed issue a statement congratulating Congress and President

Clinton, including 19 administration officials and lawmakers by name. The House and Senate

approve a final version of the bill on Nov. 4, and Clinton signs it into law later that

month.

Just days after the administration (including the Treasury Department) agrees to

support the repeal, Treasury Secretary Robert Rubin, the former co-chairman of a major

Wall Street investment bank, Goldman Sachs, raises eyebrows by accepting a top job at

Citigroup as Weill's chief lieutenant. The previous year, Weill had called Secretary Rubin

to give him advance notice of the upcoming merger announcement. When Weill told Rubin he

had some important news, the secretary reportedly quipped, "You're buying the

government?"

(Source: http://www.pbs.org/wgbh/pages/frontline/shows/wallstreet/weill/demise.html

) |

|

|

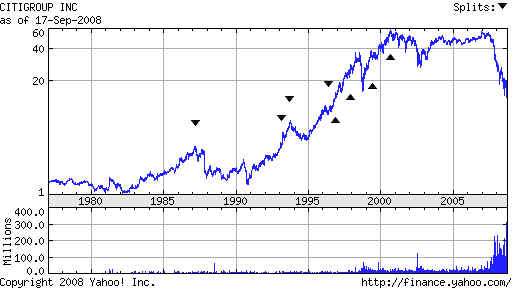

In 1998, banking giant Citicorp was allowed to merge with Travelers

Insurance, which was also an investment giant. At the merger announcement,

Travelers CEO Sanford Weill appealed to Congress to undo the

Depression-era restrictions on banking in order to help American

financial companies compete overseas. (Source:

http://www.pbs.org/newshour/bb/business/july-dec99/bankreform_11-3.html )

On November 12, 1999, the key provision that prohibited banks from

owning financial companies was repealed by the Republican Party led by

Lindsay Graham. Gramm-Leach-Bliley Act President Clinton

signed the

bill

as part of his 1999 Budget Compromise with the de-regulatory Republican

Congress. He was heavily influenced by the self-serving advise of

his

Treasury Secretary, Robert Rubin.

See

The Media Moguls, the Bankers, and the CFR Rubin, it should be noted, went

back

to work for Citibank in 2001 and was marked as a key insider seller

by

TigerSoft in December 2007. Clinton would do what earlier Democrats

would

not: give bankers all but unlimited power, until their house of

cards

fell apart. Note that it cannot be said that Clinton's signature here made

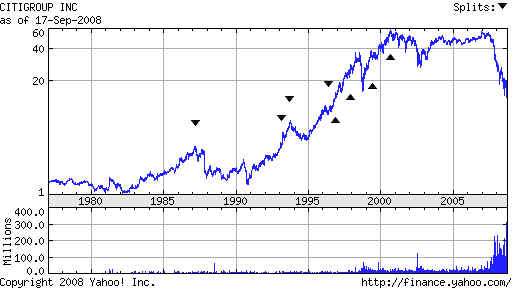

Citibank. As you can see from the chart below, the 1990s' made that

bank.

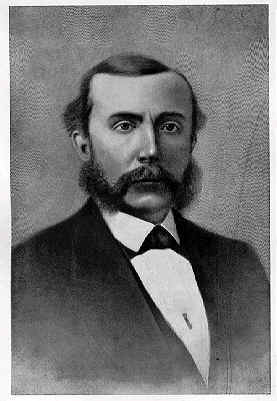

Republicans after Lincoln have always worked for bankers. Read

about how much money Mark Hannah raised in 1896 to promote

trusts, combinations between bankers and industries like steel,

coal, copper and railroads.

| |

Mark Hannah, Republicans and Monopoly Trusts "The first class

of multimillionaires had made their fortunes in the Civil War, and during subsequent

decades they began to consolidate holdings in a number of industries with national and

international reach. Among the most famous were Carnegie Steel and John D. Rockefeller's

Standard Oil Company.

"The Sherman Anti-Trust Act, passed in 1890, was the first

important federal measure to limit the power of companies that controlled a high

percentage of market share. Ironically, in the 1890s the Act was used primarily to block

strikes, since it prevented any 'conspiracy to restrict trade,' and businesses like the

Pullman Railcar Company argued that labor unions were such conspiracies. They won the

support of state and federal militia to enforce this anti-labor view. At the same time,

the Supreme Court ruled in

1895 that many forms of business combination did not constitute "trusts" that

restrained interstate trade, and thus could not be prosecuted under federal law. The

Interstate Commerce Commission had been created, but it did not yet have the powers it

obtained in a later era, and critics considered it ineffectual.

"Antagonism toward "trusts" and

"monopolies" was wide-ranging. Critics of "The Trusts" often targeted

silver and gold mines in the West and other large companies whose employees faced

hazardous conditions and low wages. Others attacked "The Trusts" and "Wall

Street" in the same breath, identifying J. P. Morgan and other

financiers as the agents of industrial consolidation. In rural areas, the most dangerous

monopolies appeared to be the railroads, which controlled shipping rates along their

lines. Railroad magnates like Jay Gould and C. P. Huntington were among the targets of

free-silverites ire. Farmers also denounced grain elevators and speculators: the rise of

agricultural futures markets, accompanying mechanization of harvesting and processing,

caused many farmers to feel increasingly helpless in the face of large institutions beyond

their control. In short, denunciation of "The Trusts" symbolized broad fears

about the size and power of big business in America.

"Trusts also became a central issue in the

1896 campaign because of the fundraising activities of Mark Hanna and the Republican

National Committee. Hanna collected large sums from leading industrialists, most of whom

were terrified at the prospect of a Bryan victory. While such men opposed free silver, their fear of

pro-labor and anti-trust legislation probably played a greater role in inspiring their

donations. In calling attention to the connections between Republicans and industrialists,

Silver Democrats and other anti-McKinleyites were not exaggerating. The Republican

National Committee raised and spent (by its own accounting) at least $4,000,000 during the

campaign--a staggering sum for the day, assembled largely from major gifts by

industrialists and financiers. In addition, some of McKinley's allies, notably Whitelaw

Reid of New York, solicited J. P. Morgan's advice in drafting the financial planks of the

Republican platform."

Quoted from http://projects.vassar.edu/1896/trusts.html

|

The Republican-Banker alliance continues with full force with

Lindsay Graham, a long-time close economic advisor to Sen. McCain,

one

of the Senate's biggest bankers of convicted banker-swindler

Charles Keating. That's what makes such a joke McCain's 2008 campaign

promise that he is a maverick who will correct what ails the banking and

securities' industries.

The banking industry had been seeking the repeal of Glass-Steagall

since

at least the 1980's. Lindsay Graham was also responsible for the

de-regulation of energy futures in what has become known as the Enron

Amendment. This permitted Enron to artificially drive up energy prices

charged Californians in 2001 and allowed hedge fund speculators in 2007

and

2008 to drive up crude oil prices from 50 to 145.

The repeal of Glass-Steagall was "the keystone, that

provided non

transparent financial manipulation and use of leverage to revolutionize the

activities of investment beginning in 1999". It led to the amassing

of

"huge fortunes for the investment bankers who designed, marketed and

oversaw the use of leveraged investments". "The repeal enabled leverage

to be "conceived, deployed and expand, not only in the residential mortgage

sector, but (in) a host of other sectors as well, such as, municipal bonds, and

derivatives such as credit default swaps."

It naturally generated the

growth of highly speculative and unregulated hedge funds that often

whip prices of stocks up and down without any consideration being given

to the deleterious social costs caused, for example when energy prices

rapidly double or American business must lay off their workers and

close because of unscrupulous bear raiders who spread false and

negative rumors.

(Source: http://my.opera.com/richardinbellingham/blog/show.dml/1796860 )

Banks in this environment made mortgage loans en masse. Packaged

them as investment bankers and sold them as Grade AAA, even though

this was not true. With what they were paid for the mortgage packages,

they went out an made still more, lesser quality loans. In this way, they

built up their capital and very highly leveraged their net worth. The

Bush backed Carlye bond fund used 33 to 1 leverage. Its underlying

assets represented only 3% of its portfolio value. Even a small break in

housing prices and a small rise in delinquencies were thus able to bring it

down. Without regulation and transparency, there was every incentive for

an investment banker to espouse the view that the mortgages were

all sound. Now, we see the bundled mortgages are not safe. And without

transparency, private buyers avoid them. The Federal Government

is put in the position, by virtue of the dynamics of de-regulation, to be

last back-stop. This will easily cost it a trillion dollars over the next few

years. It will surely have to print much of this money, thus bringing all

the dire and attendant consequences runaway inflation brings.

"Robert Kutter (Stanford

University) testified before Barney Frank's

Committee on Banking and Financial Services in Oct 2007 " Since repeal

of Glass Stegall (FDR Banking Act) in 1999, after more than a decade of

de facto inroads, super banks have been able to re-enact the same kinds

of structural conflicts of interest that were endemic in the 1920s - tending

to speculators, packaging and securitizing credits and then selling them

off, wholesale or retail, and extracting fees at every step along the way.

And, much of this paper is even more opaque to bank examiners than its

counterparts were in the 1920s. Much of it isn't paper at all, and the whole

process is supercharged and automated formulas."

(Source: http://my.opera.com/richardinbellingham/blog/show.dml/1796860

)

How The Deal Was Made

Source: Judith Moriarty

writes in Foreclosures -

The Untold Story )

|

TigerSoft

News Service 9/18/2008

www.tigersoft.com

TigerSoft

News Service 9/18/2008

www.tigersoft.com