TigerSoft

News Service 9/26/2008 www.tigersoft.com

TigerSoft

News Service 9/26/2008 www.tigersoft.com

WE

PREDICTED LAST YEAR THAT WASHINGTON MUTUAL

( WAMU ) WOULD FAIL.

WAMU IS THE BIGGEST BANK FAILURE IN US HISTORY.

WHAT WERE THE SIGNS THAT TOLD US

THAT

WAMU WOULD PROBABLY GO BANKRUPT?

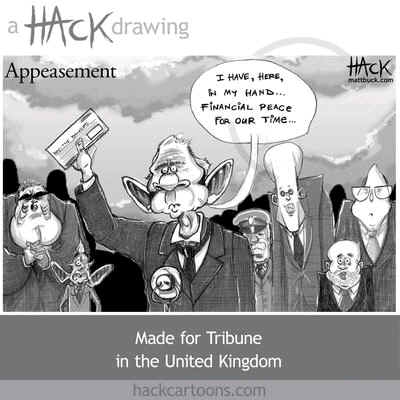

APPEASING THE BANKERS WILL NOT WORK.

Suggestion: Get TIGERSOFT To See Which Banks May Next

Fail.

by William Schmidt, Ph.D.

(Columbia University)

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

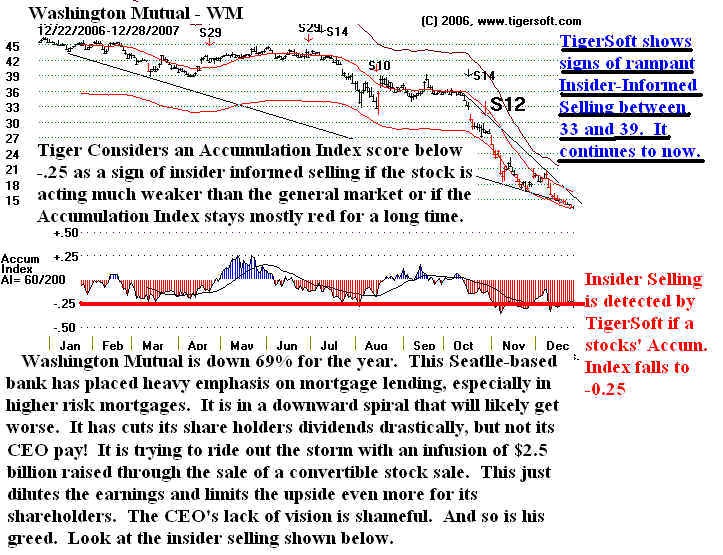

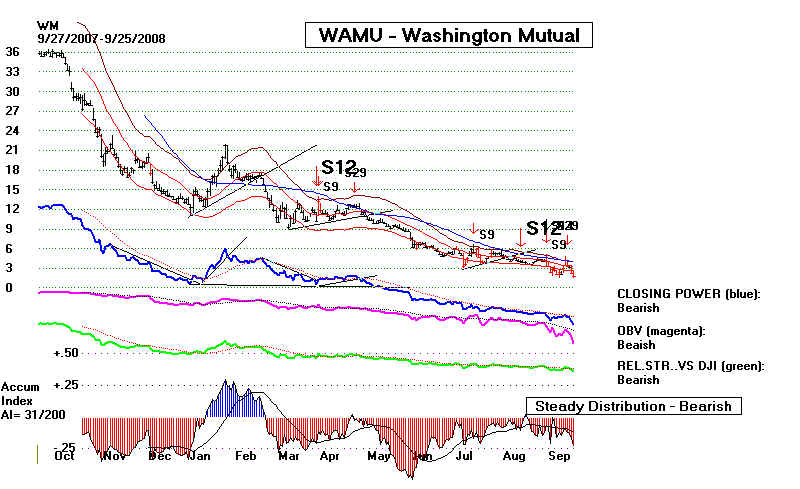

THE BIGGEST BANK FAILURE IN US HISTORY LAST YEAR TIGERSOFT WARNED YOU WAMU WOULD FAIL. WHAT WERE THE SIGNS OF ITS IMPENDING BANKRUPTCY? Suggestion: Get TIGERSOFT To See Which Banks Are Next. by William Schmidt, Ph.D. The lessons of WAMU's crash are clear: Use TigerSoft's studies of Insider Trading. Do not trust over-paid CEOs. They conceal the truth about their companies. They insider trade. Too often, they are unindicted criminals, who have no qualms or guilt at stealing your money. TigerSoft's measures of insider trading made it clear last year that WAMU was being heavily sold by insiders, not just above 40, but all the way down, despite news stories which mislead many traders and investors, who kept trying to call bottoms all the way down from 45 to 35 to 25 to 15 to 10 to 5 to 4 to 3 to 2 and to zero. WAMU's decline and the insider trading and CEO lies are mpre typical, than exceptional. Your best way to learn the truth is to use TigerSoft and read our TigerSoft Blogs regularly. More banks will likely fail. They have used leveraging and obfuscation to sell their toxic, sub-prime mortgages to investors around the world. Housing prices are still falling. The end of the Glass Steagall law in 1999 allowed commercial banks to package their poorer quality mortgages and sell them to others, take the money and loan out still more such loans, all the while concealing the risks if housing prices stopped bubbling upwards. The Republican ethic of de-regulation guaranteed this apolcalyse. The regulators sat idly by as the housing and banking bubble frew and grew. Both Democrats and Republicans Are Responsible. The sinister effect of the Big Banking Lobby with both political parties should frighten all Americans. The Democrats and now Obama are heavily influenced by Robert Rubin of CitiGroup and Larry Summers. Republicans and McCain are heavily influenced by Phil Graham - until recently McCain's most important economics' advisor and the key architect for banking's deregulation in 1999 and Rick Davis - McCain's campaign manager an important lobbyist for Fannie Mae.) Appeasing The Bankers Won't Work, Either.

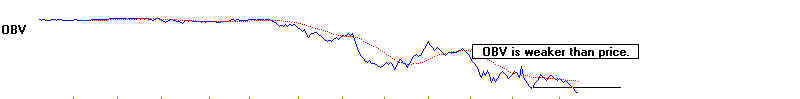

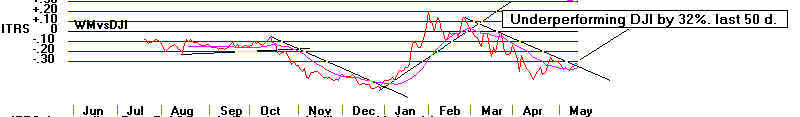

Readers may be interested in my take one what has gone so wrong. September 21, 2008 Monopolistic Finance Capitalism and Wall Street Are Dangerously Out of Control. September 19, 2008 Bush Corruption and Cronyism Reach Dizzying Heights in Paulson's Plan for US Tax Payers To Spend A Trillion Dollars Buying Worthless Mortgages from Private US Banks. Someone Must Say "NO"! September 18, 2008 The Greenspan "De-Regulation" of Banking, by Abolishing the Glass-Steagall Act of 1933, Has Led Directly to the 2007-2008 Bear Market. Both Political Parties Are To Blame. Neither Admits This To Be The Central Malady. The tragedy is that so many investors are going to be wiped out. "All my savings and all I owned in my life does hurt to see it going away. I didn't sleep from last night thinking what to do next and can't help not thinking what happened to me. Is this America? ... I feel ashamed of myself and for the first time feel death is better verses facing this reality." From Yahoo Message board on WAMU. Sometimes, I think these shareholders were blind and trusting sheep being fleeced. They were exploited by the worst people on Wall Street. They could have known better. All they had to do was Google "WAMU" and "Insider trading" and they would come across our dire warnings about this stock. These warnings started last year! May I suggest, readers Google "Tigersoft" and their stock or the subject they are interested in. You don't want what happened to WAMU to happen to your stocks. JP MOrgan will now own WAMU. Deposits are safe. By FDIC order, WAMU was taken over. All WAMU equity was destroyed in the bargain. No long line - but the country's biggest bank failure. Killinger (rhymes with 'Dillinger') was the CEI of Washington Mutual until last month. He got $14.1 million in 2007 and over $54 million from 2002-2007. He milked WAMU for all he could. He took it headlong into the toxic world of leveraged high-risk mortgages. In the process, he lied over and over about the soundness of the company and wiped out the investments of a lot of people who were too trusting and easily mislead. WE PRDICTED WAMU WOULD GO BANKRUPT. On December 30, 2007, I wrote: "WM lost nearly $1.9 billion in the fourth quarter of 2007. Some believe it could lose $7 to $10 billion in 2008. The bank will then be bankrupt." I reported that WAMU's CEO was clearly taking as much as he could, while he could, from the company. He paid himself $14.3 million in 2006. And between January and May 2007, he sold 129,000 shares of WM between 42 and 45.31. In November 2006, he sold an additional 50,000 shares at 42.28. Clearly, he knew there was a high probability his company and its stock were about to crash. It should be noted that Killington and Washington Mutual had been sued before for insider trading. http://securities.stanford.edu/1031/WM04-01/20040720_f01c_SouthFerryLP2.pdf Back in this December Blog, I wrote: "TigerSoft spots insider selling mainly by watching the Tiger Accumulation Index. Its dropping below -.25 when the stock is under-performing the DJI (representing the general market) is the primary way we do this. The reddish-purple lines show these points in this chart. When the Black TISI line (6/6/2007) drops into negative territory and the stock has closed below its now falling 50-day ma, TigerSoft users know to consider the stock bearish, especially if it over-extended on the upside. Additional Tiger Sell signals give more points to sell the stock short. Note how the cumulative On-Balance-Volume (OBV) Line makes confirming new lows." These conditions our Power Ranker flags for. And these technical conditions are described in more detail in my TigerSoft Killer Short Selling Techniques in Any Market. WAMU - through 12/28/2007 ===========================================================

In March 2008, I

wrote: "More Bank Failures

Are Expected."

|

||||||||||||||||||

| |