NYU Professor Nouriel Roubini

"Dr. Doom" or Economic Cassandra

by William Schmidt, Ph.D.

See Riubni's daily comments RGE

Monitor.

"This is clearly the worst financial crisis that the US and other advanced

economies

have experienced since the Great Depression..."

A second

stimulus package of $400 billionis needed immediately.. "That's

going to be the only way we're going to make sure that

this recession will be shorter and more

shallow." (This is from his

testimony Congress on October 31st. ) He predicted a sharp drop in

private sector jobs and spending amounting to $450 in 2009 from the weak 2008

numbers.

A new fiscal stimulus between $300 billion and $400 billion must not wait until the new

Congress. The bailout of the banks is not enough by a mile.

"This fiscal stimulus should be voted on and spent as soon as possible as

delay will make the economic contraction even more severe. A stimulus package

legislated only February or March of next year when the new Congress comes

back will be too late as the contraction of private aggregate demand will be

extremely sharp in the next few months. Such policy action should be legislated

right away—in a "lame duck" session right after the election—to ensure

that

the actual spending is undertaken rapidly in the next few months. "

(Source: http://www.usnews.com/blogs/the-home-front/2008/10/30/nouriel-roubini-to-congress-pass-stimulus-asap.html

)

A Perfectly Terrible Prediction in 2006

Previously an obscure economist, his words are

to be taken seriously, since he was one

of the few that foresaw what has come to pass. He laid out a bearish scenario to the

International

Monetary Fund in the fall of 2006 that has proved remarkably prescient. His words

were ominous

while most economists and network "talking heads" offered reassuring but very

false hope.

His blog spoke of "hard landing", "equity market slaighter",

"systemic

financial meltdown"

and the "coming US banking bust". He correctly predicted that the

Fed's easing of interest rates

would not prevent a recession; there will be a consumer burnout, a global recession

(no de-coupling)

and commodity prices will fall sharply. The US current account deficit is

unsustainable.

Foreigners will at some point not finance US deficits. (This prediction has not been

born

out. The Dollar is considered a refuge, as the world markets fall.)

(Source - his

entire speech to the IMF on September 7, 2006 is available on the internet: )

Phase 1 - The burst of the housing bubble

Phase 2 - Rising mortgage defaults, homes prices start

falling, sale volumes falls,

housing starts and permits decline.

Phase 3 - Home-builders’ bankruptcies, housing starts and permits crash,

substantial layoffs in construction and real estate-related fields (mortgage brokers,

mortgage lenders, etc.).

Phase 4: substantial price declines in major metro areas, large rise in defaults of prime

but low-equity mortgages. The stage we are now in, he

thinks.

Phase 5: Large-scale government intervention to help households going bankrupt.

This is a political phenomenon, so the timing and nature of this cannot be reliably

forecast.

(See - http://www.rgemonitor.com/blog/roubini/242290/

)

His Outlook Is Bleak

"I believe we're

going to have two years of negative economic growth. The last two recessions

lasted only eight months each ... This time around this is going to be three times as

long,

three times as deep. This is going to be the worst recession the US has experienced

since the

1980s." He could have said

1930's! But he predicted that hundreds of over-leveraged

hedge funds will be wiped out. A global recession will make matters much

worse.

Bankruptcies

and Plant Closings Rising in China - Nov 1,

2008

As for the stock market, he predicts the worst lies ahead. There will not be a "V" bottom. It

will be "L" shaped. The recession will be long and drawn out, lasting 2 or

3 years.

Offical unemployment will reach 9%. Its now 6.1%.

The government will need to double its

investments. Private investors will be frightened away by more bank failures. The

total credit losses will be 2 or 3 times higher than the $1. trillion estimated by the IMF

(Intenrational Monetary Fund) on October 7. (Source.)

If you can wait until 2012,

it will be descibed optimistially as a "U" bottom, if look out to 2012!

But, he assures us:

a 1930's, decade-long, Depression will be avoided.

Roubini's Prescriptions and Obama's "Economics Brain

Trust"

His presecriptions are worth noting, as he has gained the ear of a powerful Obama

economics advisor, former Clinton Treasury Secretary and Harvard President,

Lawrence Summers. This former exponent of deregulated banker claims:

“I

have in the last few months become more pessimistic than the consensus. Certainly,

Nouriel’s writings have been a contributor to that.”

1) An immediate stimulus package of $300-$400 Billion.

2) It should go to lower income consumers and include much higher unemployment benefits.

3) There should be a moratorium on main-home foreclosures.

4) A massive public works program is badly needed.

"a massive direct government fiscal stimulus

packages that includes public works,

infrastructure spending, unemployment benefits, tax rebates to lower income households

and provision of grants to strapped and crunched state and local government."

5) Banks must be told to forego their dividends.

( Source.

)

"A Total

Rep-Off", says Roubini

The Administration's top-down trillion dollar give-aways - bailing out banks by loaning

them billions and buying their "toxic" mortgages - are vastly too expensive and

will not

prevent a deep recession. He says the obvious: namely, that the

Administration's

policies now are simply a huge subsidy for banks who have made greedily reckless decisions

and want their powerful Republican allies, Paulson and Bernanke, to rescue them.

"Is

Purchasing $700 billion of Toxic Assets the Best Way to Recapitalize the Financial System?

No!

It is Rather a Disgrace and Rip-Off Benefitting only the Shareholders and Unsecured

Creditors

of Banks."

Bad (toxic) debts should not have been purchased Injections of public capital

could have more effectively and less expensively taken the form of the

government

buying common shares. Roubini reports this is the conclusion of an IMF study of

42 similar banking crises around the world. What the US has done is follow the

example of Paraguay, Jamaica, Bolivia, Maylasia and Mexico. (Not a very

encouraging set of parallels.)

"Thus the claim by the Fed and Treasury that

spending $700 billion of public

money is the best way to recapitalize banks has absolutely no factual basis or

justification. This way of recapitalizing financial institutions is a total rip-off that

will mostly benefit – at a huge expense for the US taxpayer - the common and

preferred shareholders and even unsecured creditors of the banks. Even the late

addition of some warrants that the government will get in exchange of this massive

injection of public money is only a cosmetic fig leaf of dubious value as the form and

size of such warrants is totally vague and fuzzy."

Read the Roubini's entire condemnation here:

Source: http://www.rgemonitor.com/roubini-monitor/253783/is_purchasing_700_billion_of_toxic_assets_the_best_way_to_recapitalize_the_financial_system_no_it_is_rather_a_disgrace_and_rip-off_benefitting_only_the_shareholders_and_unsecured_creditors_of_banks

See Riubni's daily comments RGE Monitor.

Financial Panics, Recessions and

Depressions

Severe financial panics do not always produce a recession. The Bunker

Hunt-Silver Bubble Collapse in early 1980 saw a "V" bottom and new

highs were made only 4 months after the March 1980 low. The Ocober 1987

34% drop in the DJI owed to Greenspan's reckless tightening of interest rates

and reckless program trading in derivatives and futures. It did not lead

to a recession and the DJI recovered all it lost in 23 months, by September 1989.

Greenspan reversed course and provided all the liquidity that market makers

needed.

But recklessly laissez-faire financial policies produced a Depression

from 1930 that continued until the start of World War II. The stock market

shows

what lies ahead, I would suggest A second set of new lows by the DJI was a bad sign

in October 1930. By this thinking, it would be extremely bearish, and likely lead

to a sustained recession, for the DJI to make a new set of lows below the

lows of this year.

In addition, "normal" bear markets do last more than 24 months.

The 1973-1974 bear market was 23 months in duration. That marks the

outer boundaries, unless there is an exogenous event, as the 9/11/2001

attack on the US and we are cursed again by having a recklessly aggressive

war-initiating President. (The DJI peaked in January 2000 and under Bush

there was no final bottom until March 2003, 39 months!)

The DJI in 1973-1974 fell from 1250 (January 1973 high) to 580 (December 1974 low),

about 44%. A DJI decline of more than 44% must also be considered very

bearish.

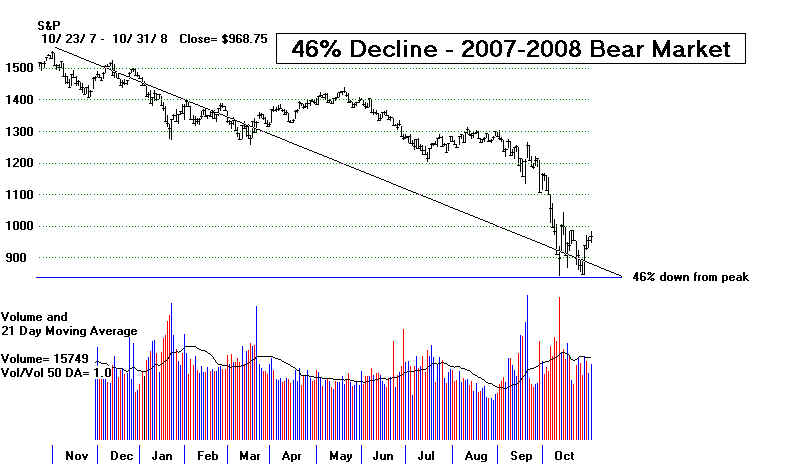

The DJI's 2007-2008 decline is 43%, so far. The SP-500, howver, has fallen 46%

from its highs to its lows.

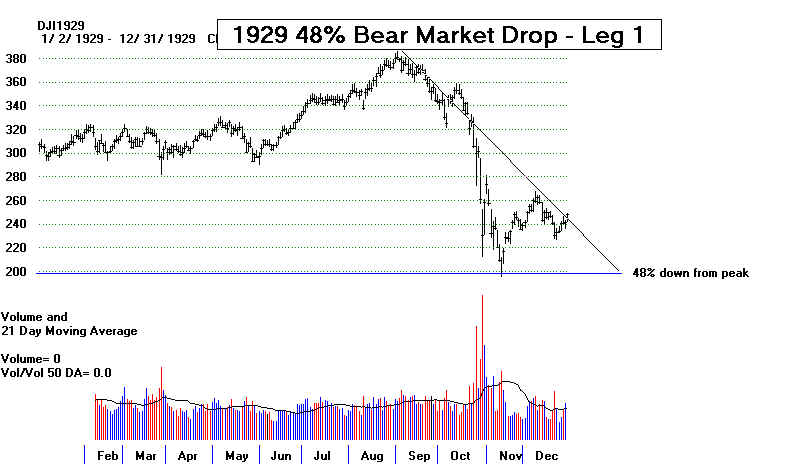

The 1929-1933 bearish experience stands out. In October 1930, the DJI

started making lows below ts lows of 1929. That proved to be very bearish

for stocks and the economy. So, a DJI close much below 8000 would run

that risk. As a warning, that we are not out of the woods yet, I must

note that Paul Volcker has been designated by Obama to be his chief

economic advisor. Volcker was associated with stratosphere-high interest

rates and repeated stock market collapses, October 1978, October 1979,

February 1980 and the 1981-1982 bear market. He is credited with killing

inflation, but the cost to investors in these years was very high. One had

be very agile. Our Peerless Stock Market Timing did

very well in this

period. Investors would, I think, be smart to employ it. You can see how

well it did by studying the charts of bear markets since 1915.

The Biggest U.S.

Stock Market Declines: 1915-2008

ECONOMY, JOB LOSSES, JOBS, EMPLOYMENT, MARKETS

CNBC.com | 10 Nov 2008 | 09:48 AM ET

The economy will worsen in the coming months and caus e the market to fall another 20 to

25 percent in the Un ited States and abroad, said Nouriel Roubini, a New Yor k University

business professor, on CNBC’s “Squawk Box” on Monday.

“There's going to be negative growth all the way to t he end of 2009," he said.

“The surprises from now are g oing to be on the downside, for the economy, for earnin

gs, for the financial system." (See video of Roubini, l eft.)

Job losses will accelerate in the next months, Roubin i said, and he expects a weak

economic recovery in the short and mid-term.

“There's going to be a very slow recovery, because yo u have the financial system

that's impaired; earnings a re not going to grow very fast, and therefore the stock market

will go sideways for quite a while,” he said.

More Economic News on CNBC.com: |

TigerSoft

News Service 11/1/2008 www.tigersoft.com More

information later today.

TigerSoft

News Service 11/1/2008 www.tigersoft.com More

information later today.