A bear raid is a type of stock market strategy, where a trader

(or group of traders) attempts

to force down the price of a stock

to cover a short position. This can be done by spreading negative

rumors about the target

firm, which puts downward pressure on the share price. This may be a form of

securities

fraud. Alternatively, traders could take on large short positions themselves, with the

large

volume of selling causing the price to fall, making the strategy self perpetuating.

SEC ALLOWS MUTUAL FUNDS AND HEDGE FUNDS

TO

SELL SHORT WITHOUT BORROWING ANY STOCK FIRST

"How

bad is the problem? Listen to this story: On Feb. 3, a man named Robert Simpson

filed a

Schedule 13-D with the SEC describing his purchase of 1,158,209 shares of Global

Links

Corp.

(OTCBB: GLKCE), "constituting 100 percent of the issued and outstanding common

stock

of the Issuer." As described in a story that ran on FinancialWire on March 4, Simpson

stuck

every single share of the company in his sock drawer -- and then watched as 60 million

shares

traded hands over the next two days. In other words, every single outstanding share

of

the company somehow changed hands nearly 60 times in the course of two days, despite the

fact

that the company's entire float was located in Simpson's sock drawer. In fact, even as

recently

as last Friday, 930,872 shares of Global Links still traded hands. If Simpson's claim

that

he owns all shares is accurate, that is a staggering number of phantom shares being traded

around

by naked short sellers." (Read more at

http://www.fool.com/investing/high-growth/2005/03/24/the-naked-truth-on-illegal-shorting.aspx

)

Insiders

are allowed by the present SEC policies to sell short a small company mercilessly.

Chairman

Cox has Done away witht he need to borow any stock to go short. All traders have to

do

is to "locate" shares to borrow, not actually borrow them. When a short

sale is undertaken,

broker-dealers

like Merrill Lynch are, under the law, supposed to take appropriate steps to settle

out

the trade in three days. This should mean buying back shares that were not really

borrowed.

Instead

the brokerages make only book entries now. The result is that many a smaller

company's stocks

has

been sold short nakedly with dire effect on the company, its shareholders and employees.

The

SEC

does not care. It is more concerned with protecting the borkerages. Investor

confidence will

take

a long time to restore. Particularly negligent is James Brigagliano. He

heads the SEC committee

that

makes recommendations regarding short saling abuse. The

SEC is headed entirely by Republicans who

are

opposed to regulation, no matter the cost to shareholders.. (Source. ) See also.

"When the trade fails settlement it is the Goldman

Sachs, the Lehman’s, the

Merrill

Lynch’s, the Morgan Stanley’s, and all the other prime

brokerage houses who

hold

these fails on their books indefinitely. Each colludes with each other

to dismiss the

settlement

responsibilities associated with the contract to settle they agreed upon. The

3-day

settlement periods are ignored for trade commissions, liquidity, and the rights

to

future business from those who sold what did not exist".

The

SEC enacted a new Regulation "SHO" in January 2005 regarding naked short

selling. .[Source]

Regulation

SHO also created the "Threshold Security List," which reported any stock where

more than

0.5%

of a company's total outstanding shares failed delivery for five consecutive days. A

number of

companies

have appeared on the list, including Krispy Kreme, Martha Stewart Omnimedia and

Delta Airlines. The Motley Fool, an investment website, observes

that "when a stock appears on this

list,

it is like a red flag waving, stating 'something is wrong here!'"[3]

On its Regulation SHO website ("Does

Naked

Shorting Drive Prices Down?" section), the SEC cites the prevalence of false claims

of naked short

selling

in Pump and Dump fraud. The SEC downplays naked shorting as a factor

in declining stock prices,

stating

that stock values ideally should be determined by "the quality of the company

itself," "supply and

demand"

of the company's shares, and the company's ability to generate positive income.

NASDAQ Regulation SHO

Threshold List.

Selective Enforement for the Elite's Stocks

There is a list of companies that the SEC

will now police naked short selling. This is the WHOs

WHO

list of the Wall Street elite. Small wonder the SEC is considered merely an agent of

these

companies!

BNP

Paribas Securities Corp

Bank

of America Corp - of course.

Barclays

PLC

Citigroup

Inc

Credit

Suisse Group

Daiwa

Securities Group Inc

Deutsche

Bank Group AG

Allianz

SE

Goldman Sachs Group Inc - naturally.

Royal

Bank ADS

HSBC

Holdings Plc ADS

JPMorgan

Chase & Co

Lehman

Brothers Holdings Inc

Merrill

Lynch & Co Inc

Mizuho

Financial Group Inc

Morgan Stanley

UBS

AG

Freddie

Mac

Fannie

Mae

"Who Is Missing? Where is Washington Mutual (WM)? Wachovia

(WB)?

Were

they tossed to the dogs? What about Corus Bank (CORS), Bank United (BKUNA),

National

City Corporation (NCC)? It is beyond all belief that naked short selling

is affecting

Goldman

Sachs (GS) more than Washington Mutual, Wachovia, Corus Bank, Bank United,

and

National City Corporation. One only needs consider all facts above to figure out

what is

going

on. " (Source: http://www.marketoracle.co.uk/Article5505.html

)

The Uptick rule is a former financial

regulations rule, relating to the trading of securities in the

United States. The rule was eliminated by the U.S. Securities and Exchange Commission

(SEC),

effective July 6, 2007.

Within a year after the elimination of the uptick rule a

large number of small and medium size companies experienced declines of even 95% in share

value. Many small companies suffered unexplainable and unusually large declines. A 15%

stock fall taking place in a matter of few minutes and in absence of news was something

usual. Some companies were falling by double digits the same day they were releasing

record earnings beyond all analyst expectations. The stock declines were so severe that

Warren Buffet said was "not seen since 1929".

In the year following the elimination of the rule, for

the ensemble of companies under 18B in market capitalization, 83% declined and 27% lost

more than 50% of their market value . It can be argued that the consequences of the uptick rule's

elimination are difficult to measure since shortly after the elimination of the rule the

financial markets faced the sub-prime crisis. Some have blamed the worsening economy, the

credit crisis and higher energy costs as a cause of the worsening stock markets. Others

have blamed the elimination of the uptick rule.

Data seems to indicate that the lack of uptick rule could

be the cause of the extreme stock price decline of small and medium size companies. A

decline due to the credit or mortgage crises should have affected the financial sector

more significantly. Nevertheless, the decline took effect very homogeneously across all

economy sectors. Most important, the homogeneity was observed only for companies with

small trading volumes (easier targets of orchestrated bear raids). In contrast, within the

set of large companies over 18B in market capitalization (250 in total) only 10 companies

lost more than 50% of their stock value and all were financial institutions. Same

reasoning rules out the increase of oil price as an important factor in stock decline of

small caps. Besides, the oil price increase affected all the economies worldwide but

declines of 50% to 90% in stock prices were observed only in the United States.

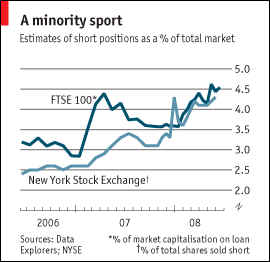

On July 3, 2008 Wachtell, Lipton, Rosen & Katz, an adviser on mergers and

acquisitions, said short-selling was at record levels and ask the SEC to take urgent

action and reinstate the 70-year-old "uptick rule".[2]

On the March 20, 2008 episode of Mad Money, Jim Cramer launched

his campaign to reinstate the Uptick Rule. Citing the wild swings of the market since its

elimination, Cramer said that the SEC eliminated the rule during a bull

market, when liquidity was not a problem. Cramer believes that, without the Uptick

Rule in place, short sellers are devaluing perfectly solid stocks. As a former hedge fund

manager, Cramer admitted to making millions short selling with the Uptick Rule in place.

Without an impediment such as the Uptick Rule to slow down the pace of short sellers,

Cramer believes it puts the market at risk for the very problems he believes led to the Great

Depression.

Complaint letters have been submitted to the SEC for their decision of eliminating the

uptick rule. Examples of complain letters that can be found at the SEC website are:

April 27, 2008

In 2007, the SEC eliminated the "Uptick Rule" stating that there is

sufficient liquidity in the market place to make an "Orderly" market without the

rule. I find it incredible that, at that very time, a huge "Liquidity" crisis

was developing before the eyes of the SEC. Why was it important for the SEC to make the

change at that particular time? Were there hordes of investors pleading with the SEC to

eliminate the "Uptick Rule? I think not. On the other hand: Did the SEC buckle under

to pressure from the hedge funds to eliminate the "Uptick Rule" so they could

cover some of their losses in the impending liquidity crisis and down market which

followed July 2007? I think, probably so. The elimination of the "Uptick Rule"

has cost me many thousands of my retirement dollars. One only need look at the 33% short

interest in SCRX, a strong, viable, profitable company to witness "FRAUD" in

action.

July 9, 2008

It is well past time you dealt with infractions of the fails to deliver rules. This

practice, in far too many cases, seriously dilutes stockholders to the advantage of short

sellers seeking easy gain. I am disappointed in the SEC. It has done far too little to

protect the integrity of our markets. Abolishing the "Uptick Rule" last July was

a particularly damaging decision, one which has left the market and thus small and large

investors alike at serious risk from fear and short sellers capitalizing on the panic

trade. Please correct your mistakes. Reinstitute the "Uptick Rule". Punish

serial naked shorters, and clean up the threshold securities list. There shouldn't be a

single company on that list, and it is to your discredit that so many remain there for

such long periods. Sincerely, Steven O'Hara

June 6, 2008

Dear Commissioners, Please reinstate the 'Uptick Rule' to make it more difficult to

short stocks relentlessly. the small investor, retirees and many other buy and hold

investors lose tremendous amounts of money due to the practice of greedy shorters

attacking a particular stock. These professional shorters know all too well that a rapidly

falling stock price creates panic which causes more selling which in turn makes them

richer and the unsophisticated small investor poorer. Your commission is to prevent

corruption in the marketplace and by reinstating the 'Uptick Rule' you will be doing just

that. Respectfully, A disabled retiree.

April 6, 2008

What brilliant argument or whos influence, convinced law makers to repeal the uptick

rule which has served to mitigate extreme volatility and protect us from market crashes

since it was created after the lessons learned from the forensic reconstruction of the

factors leading to the crash of 29. Since the uptick rule was repealed market volatility

has increased drastically leading to both the fed and the treasury having to take extreme

measures to stabilize the market. Let us learn from our mistakes and reinstate the uptick.

rule. (except form Michael E Kushner, letter)

( http://en.wikipedia.org/wiki/Bear_raid

)

More to be added here about

modern day "Bear Raiders" this

weekend.

See also - http://www.tigersoftware.com/TigerBlogs/July-16-2008/index.html

http://findarticles.com/p/articles/mi_qn4158/is_20050610/ai_n14663414

http://www.efinancialnews.com/homepage/content/2449156285/restricted

http://business.timesonline.co.uk/tol/business/columnists/article4133443.ece

http://www.economist.com/displaystory.cfm?story_id=11591349

|