TigerSoft News Service 3/2/2008 www.tigersoft.com

Picking Short Sale Candidates with TigerSoft's Power-Ranker

When The Markets Are Already Down Substantially..

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981

|

TigerSoft's Accumulation Index Makes It Easy

To Spot Stocks That Are Under Distribution

This is a sample of some of the stocks that are very weak now. Even this sample shows

the industries now under pressure: consumer credit, banks, semi-conductors, networking and biotech.

Watch for break-downs below support when there is heavy distribution. These are very vulnerable,

epecially if they start making all-time lows. Short sellers can find stocks like this by using our New Lows

list of stocks and data. Then use the Power-Ranker against them and look at the stocks that our analysis

automatically shows to be most "bearish" on a 3-month basis. Shorting the stocks whose Accumulation Index

drops below the black TISI is recommended among these stocks. I particularly like to short stocks

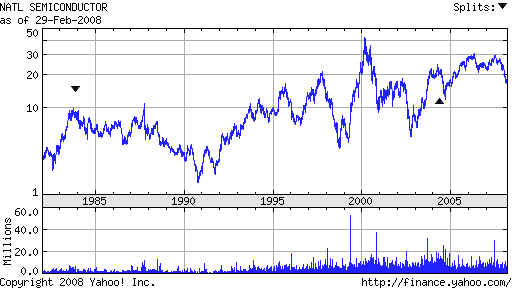

like NSM where the directors pay themselves millions and millions of dollars woth of options. These

stocks are bloated. Their earnings do not reflect the huge dilution. And you can always count on

these jokers to do a lot of tell-tale selling when the stock looks vulnerable to them.

| |

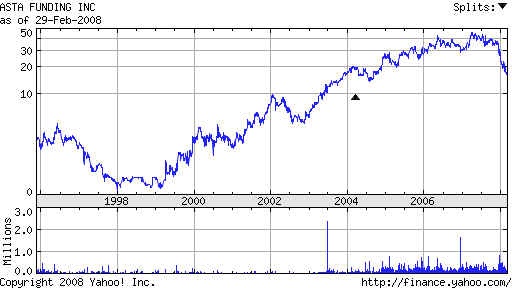

| ASFI Asta Funding, Inc., together with its subsidiaries, engages in purchasing, managing for its own account, and servicing distressed performing and non-performing consumer receivables.   |

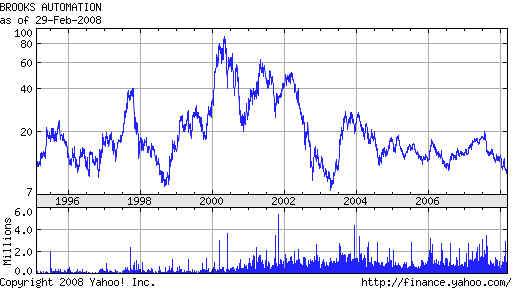

| BRKS Brooks Automation, Inc. supplies a range of technology products and solutions to the semiconductor market.   |

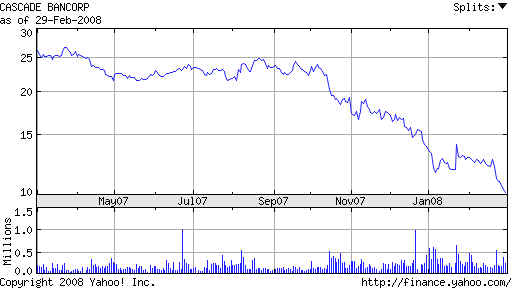

| CACB Cascade Bancorp operates as the holding company for Bank of the Cascades that provides commercial and retail banking services in Oregon and Idaho markets.  |

| MYL Mylan, Inc. and its subsidiaries engage in the development, manufacture, marketing, licensing, and distribution of generic, brand, and branded generic pharmaceutical products, as well as active pharmaceutical ingredients.   NFP National Financial Partners Corp., through its subsidiaries, distributes a range of financial products and services primarily to high net worth individuals and companies in the United States.  |

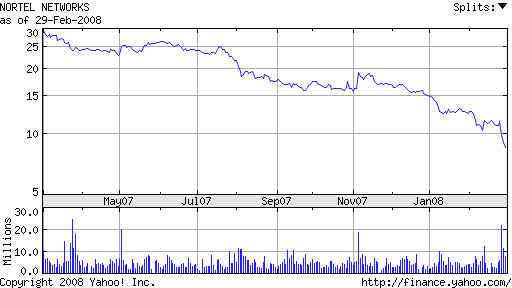

| NT Nortel Networks Corporation engages in the design, development, assembly, marketing, sale, licensing, installation, servicing, and support of networking solutions worldwide.   |

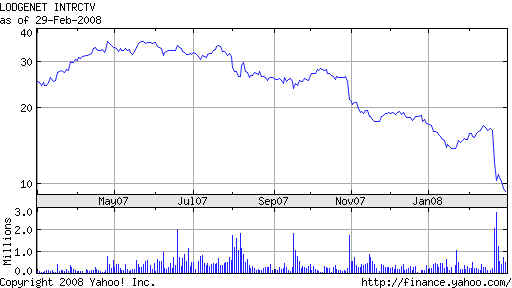

| LNET LodgeNet Entertainment Corporation and its subsidiaries provide interactive television and broadband solutions to hotels in the United States, Canada, and internationally.   |

NSM National Semiconductor Corporation engages in the design, development, manufacture, and marketing of semiconductor products.   Salary Options

|

| 10-Sep-07 | MCCRACKEN EDWARD R Director |

20,000 | Direct | Sale at $25.95 - $25.95 per share. | $519,0002 |

| 23-Jul-07 | SWEENEY EDWARD Officer |

20,000 | Direct | Sale at $27.81 - $27.86 per share. | $557,000 |

| 17-Jul-07 | SEIF ULRICH Officer |

27,450 | Direct | Disposition (Non Open Market) at $28.83 - $28.83 per share. | $791,000 |

| 27-Jun-07 | SEIF ULRICH Officer |

488,858 | Direct | Sale at $28.51 - $28.7 per share. | $13,984,000 |

| 15-Jun-07 | SWEENEY EDWARD Officer |

295,000 | Direct | Sale at $28.41 - $28.67 per share. | $8,419,000 |

| 14-Jun-07 | MACLEOD DONALD Officer |

150,000 | Direct | Sale at $28.25 - $28.45 per share. | $4,253,000 |

| 14-Jun-07 | MAIDIQUE MODESTO A Director |

20,000 | Direct | Sale at $28.25 - $28.25 per share. | $565,000 |