BERNANKE's BILLIONS FOR BIG BANKS:

It's Scary What He's Willing To Do for His Banking Buddies.

It's A Sign of Desperate Times

"Give me your tired, your poor bankers,

Your huddled mortage lenders yearning to breathe free,

The wretched refuse of your teeming loans.

Send these and the tempest-tossed, to the US Treasury".

by William Schmidt, Ph.D. - Creator of Tiger Software.

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

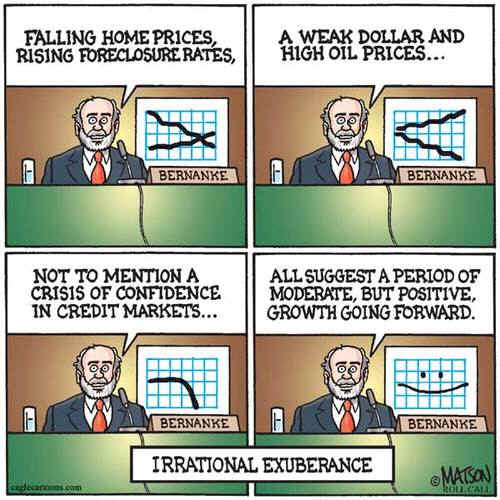

( http://politicalhumor.about.com/od/politicalcartoons/ig/Political-Cartoons/Greenspan-Bernanke.htm ) What's Another $500 Million after $250 Billion among Friends? Today the FED and Bernanke told Congress that they want to pay interest to Commercial Banks, starting this year, for reserves which these banks are required to place with the Federal Reserve. Reserves have long been required to assure the safety of the banking system. Two years ago the Republican Congress quietly voted to start paying the banks an interest rate equal to the Federal Funds rate, but this was not supposed to start until 2011. With interest rates low, this is estimated to be $150 million a year. But if interest rates were to jump to 20%, as they were in 1980, we're talking about a billion and a half dollars. Over a five year period, this could easily amount to $2 billion more dolllars taken out of the US Treasury to subsidize banks. This is one more example of Bernanke being the agent of big elite banks, rather than taxpayers or the rest of America. In March, the Fed financed the JPM buy out of Bear Stearns even though the Fed could be left holding a bag of collateralized assets worth far less than the $30 billion it gave JPM. Exactly how much has been provided commercial and investment banks in return for very questionable mortage collateral? Larry Kutlow said on a TV show it amounted to $650 billion. The Wall Street Journal gives supports this estimate: "the Fed is starting to run low on unconventional ammunition; it started with only (SIC!) about $800 billion in Treasury and repo assets and had already sold, rolled off or pledged about half before Friday’s facility to Bear Stearns was announced... (T)he Fed announced the Term Securities Lending Facility... Under that facility, dealers could borrow up to $200 billion of Treasurys from the Fed in return for agency and private-label MBS.. ." ( http://blogs.wsj.com/economics/2008/03/17/lower-fed-funds-rate-the-fate-of-the-tslf-and-other-fed-notes/ ) This is part of a pattern wherein the Fed gives banks lots of US Treasury money at very low interest rates without requiring much of anything in return. It shows that the FED is hopelessly corrupt and a willing captive of the wealthiest elite banks. It proves that the FED will do anything to stretch its authority to bale out failing financial institutions. That the FED must now openly go to such lengths shows outsiders several things: (1) that the current Federal Reserve System is hopelessly corrupt and chose not to regulate the mortgage business as the bubble of home prices grew and grew. (2) that Banks are desperate and the banking system is in real danger, because of so many mortgage owners just walking away from their home loans. (3) that good paying jobs are declining and wealth in the US is becoming so concentrated in the US there is a real possibility of far-reaching credit failures that will bring down a number of major banks. (4) that the Fed must print so more and more Dollars. (5) inflation will become such a severe problem and interest rates will have to be raised very steeply as they were from 1977 to 1980. The Credit Crisis Is Not Getting Better Banks loans are much harder to get, just when more and more people need them. The lowered interest rates are not being passed along to consumers. Look at your credit cards's rate of interest. Banks are scared. They have themselves borrow billions form the Federal Home Loan Bank. In fact, the "Fed’s discount window lending is vastly outweighed by that of the FHLBs, which have lent $99 billion to Citibank, $51 billion to Countrywide, and $44 billion to Washington Mutual, to name three pressed borrowers." ( http://www.american.com/archive/2008/march-03-08/grading-bernanke-a-symposium ) The evidence keeps building that the losses and delinquencies are rapidly spreading now to prime mortgages. If home prices keep sliding, and they have corrected only 20% of the gains between 1996 and 2006, as many as 10 million households will be in negative territory as far as their equity in their home goes. This creates a very big incentive for a vastly more mortage defailts and "walk-aways". A 30% drop in home prices - now likely - would wipe out $6 trillion in household wealth". The lay-offs created by the banks' de facto tightening of credit, couppled with inflation and much higher gas prices, are extending and increasing the rate of the defaults on credit cards, auto and student loans. Moreover, if there is a recession, which seems likely, 10+% of US corporations may default on their loans.  ( http://politicalhumor.about.com/od/politicalcartoons/ig/Political-Cartoons/Irrational-Exuberance.htm ) Paulson Is Also Not To Be Trusted Secretary of the Treasury tells us that "the credit crisis over". Sure, if you run a central bank and the FED guarantees you can't fail.. He also said that the subprime crisis "came about because of some bad lending practices." Why, after decades of years of experience evaluating borrowers and making loans, did lenders suddenly make so many bad loans, all across the country? . Damnable Adjustible Rates Suck Them in at Low Rates, 0% Down. And Then Sock It To Them "An example of the spreading credit crisis is seen in Don Doyle, a computer engineer at Lockheed Martin who makes a six-figure income and had a stellar credit score in 2004, when he refinanced his home in Northern California to take cash out to pay for his daughter’s college tuition. Mr. Doyle, 52, is now worried that he will have to file for bankruptcy, because he cannot afford to make the higher variable payments on his mortgage, and he cannot sell his home for more than his $740,000 mortgage. “The whole plan was to get out” before his rate reset, he said. “Now I am caught. I can’t sell my house. I’m having a hard time refinancing. I’ve avoided bankruptcy for months trying to pull this out of my savings.” ( See http://www.nytimes.com/2008/02/12/business/12credit.html?_r=1&oref=slogin )

Elliot's Mess

"Do

I believe the banks called Justice and said, “Take him down today!”

Naw, that’s not how

MANY AMERICANS ARE MUCH WORSE OFF

When

George W. Bush took office in 2000, oil was $28 per barrel, the euro was $.87

|

|

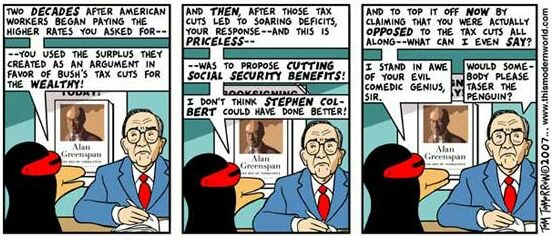

Which Bank Will Get The Next Bailout? Below, see how steady TigerSoft red distribution shows significant insider selling. For more discussion about these stocks, please see: http://www.tigersoftware.com/Insider-Trading-News-Reviews/12-30-2007/index.html http://www.tigersoft.com/Insiders/index.html Great Southern Bancorp Inc. (GSBC)

|

CITIGROUP INC

|

WASHINGTON

MUTUAL

|