TigerSoft Freedom News Service 7/16/2008 www.tigersoft.com

News and Views you won't find in the corporate media.

revised on 7/20/08 to include discussion of "Enron Amendment".

Investing In A Perfect Storm

(Part 3)

DEREGULATION IS AN UTTER DISASTER

Republican Phil Graham ("You're a nation of whiners")

created the Enron Amendment that let Enron Gouge

California Consumers in 2001 and now all US energy

users in 2008.

Spineless Democrat Harry Reid Won't Raise Margin

Requirements on Crude Oil Speculation.

Financial Institutions Gave Him More than $359,000

COX IS A CROOK

SEC and FED Help Wall Street Insiders at The Expense of US Economy

Beware "The Fix" at the Securities & Exchange Commission (SEC).

as Well as at The Federal Reserve Board. (Part 1 and 2)

The Biggest Buildings in Most Cities

Are Owned by Banks and Brokerages.

THERE'S MORE TROUBLE AHEAD.

Financial Institutions Are The Ultimate Insiders. For Them,

It's More Important Who You Know at the FED or the SEC,

Than How Honest, Bright or Far-Sighted You Are. No Wonder

They Couldn't Even Ask The Question: "What Will Happen if

Housing Prices Decline?"

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement

-----------------------------------------------------------------------------------------------------------------------------------------------------

Previous Related studies:

The SEC Is Not Really There To Regulate.

4/3/2008 Wall Street's Dirty Little Secret

1/8/2008 It Does A Poor Job of Stopping Insider Trading

1/3/2008 The SEC Is Slow To Challenge Heart of Wall Street's Power.

6/28/2007 Who's Guarding The Investor Hen House?

It's Real Mission Is To Help Wall Street

Insiders

8/15/2008

SEC Lifts 70-Year Ban

on Short Selling on Down-Ticks

And Lets Hedge Funds

Use Dangerous Bear Raids To Get Rich.

and

Keep The Myth of Fairness Alive,

Giving The Appearance

That Wall Street Is A Level Playing

Field for Investors

-----------------------------------------------------------------------------------------------------------------------------------------------------

Original Research on Individual

Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM

- Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981 More Oil

Profits' Cartoons.

|

Plunging Confidence in Wall Street:

The SEC Is The Biggest Culprit

by William Schmidt, Ph.D

America is being ruined by the SEC and its chairman.

Chris Cox has been a securities' industry lawyer by trade. He is

a laissez-faire de-regulation ideologue by political convenience.

Single handedly, his rulings are destroying trillions of dollars of

investor wealth. By making short selling extremely easy for

professionals in several key ways ( wiping out the up-tick rule.

not requiring stock to be borrowed before a short sale and permitting

the trading in numerous, new ultra short sale ETFs) and by

letting imprudent investment banks more than double the amount

of leverage they use, COX bought the dynamite and the ignition

switch that destroyed the Bull Market and caused the Crash of

2007-2008.

Three weeks before the 2007 top, Cox cancelled the most

important rule on Wall Street, a rule had prevented professional

bear raids since 1934. Now a calamitous bear market has followed.

Still, Cox refuses to meaningfully change his disastrously misguided

policies. We will go from calamity to chaos if Cox'es de-regulation

policies are not reversed.

At the end of June 2007, before the market plunged,

the SEC, without legislative authority, broke the 1934 law

that created it, and cavalierly lifted the 73 year ban on

short selling on down-ticks. The law was designed to

prevent rigged bear markets, created by wealthy insiders

who would create bad news, spread false negative rumors

and mercilessly sell the stock down to create a selling panic.

The 1929-1933 experience had taught that generation

that this practice had to be banned. It was socially too

destructive and dangerous. Bush's SEC did not care

about such concerns. They wanted to make their Wall

Street constituents more money. No matter that the actual

companies and all their employees might suffer. Bankruptcy?

They just didn't care. What's the difference between the SEC

and Bush and Cheney? None/ They just didn't care about the

consequences of what they did. They wanted simply to

repay their sponsors.

So, the SEC caved into the relentless pressure from Wall Street

insiders who could see the top coming and who wanted to be

able to sell short easily and aggressively, without waiting for

an up-tick and without needing to borrow stock. Three weeks

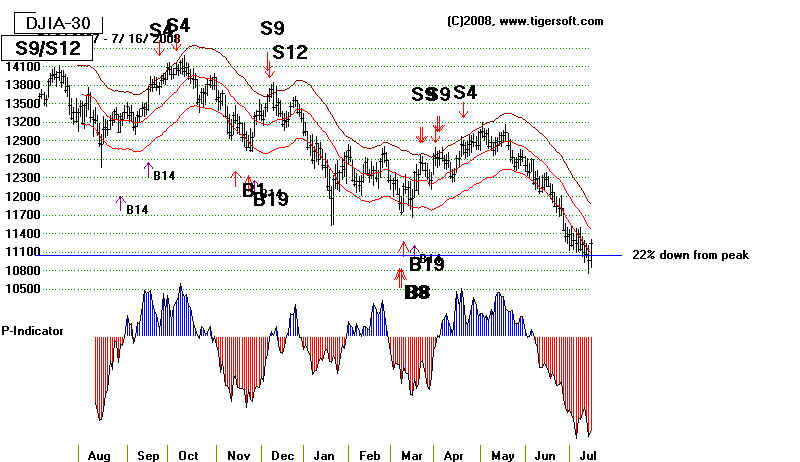

after the SEC allowed short selling on downticks, the

DJI peaked and started down. It had fallenl more than 20%

until yesterday's rally, which the SEC prompted. See the chart below.

Why Has SEC Allowed Naked Short Selling So Long?

Yesterday, July 16, 2008, the SEC decided that

the biggest financial stocks had to be protected from

the merciless selling caused by the banks' poor judgement

in making too many bad mortgage loans and being vastly

over-leveraged. Finance stocks have been ravaged

after the Housing Bubble broke wide open in 2007-2008.

So, the SEC acted to protect their buddies in these banks.

It ruled Wednesday, that for a month 18 of the biggest banks

could no longer have their stocks sold short "naked".

Naked short selling means that the stock is sold short

aggressively without any existing shares having to be

first borrowed. Naked short selling is necessary to

conduct a bear raid. Many existing shareholders do not

keep their shares in margin accounts, where they can be

borrowed. So, stock to borrow to sell short can become

quite limited. To surmount this problem, short sellers break

the rules that require stock to be borrowed before it can

be sold short. Such violations have been growing. The

SEC took a very lax view of the practice. It has refused

to penalize brokerages for breaking the existing rules

against naked short selling. You can understand that

day traders, in particular, who sell short at the opening,

or during the day, using only 25% margin, and then cover

their shorts by the end of the day, need a ready supply of

stock to sell short. Allowing naked short sales does away with

problem and takes brokerage firms off the hook for searching

for shares to borrow.

COX IS A CROOK

The most reckless and dangerous

public official in American history.

The SEC's temporary new ban on naked short sales

should be universal and permanent. It is not, because Cox

is the most crooked SEC chairman since that office was created.

He is in bed with the market makers on Wall Street. He has

permitted the destruction of a whole industry, and soon it

will be the whole stock market, by how easy he has made

short selling for professionals. Until yesterday, they did

not have to borrow stock and they could these phantom shares

on the lower bid and paint the tape red. Significantly, Cox's new

ban very significantly does not apply to market makers

in stocks and options. They can and are still going heavily

short stocks so that they can write lucrative put options.

The market makers control Cox. He does not regulate them.

When the ban goes off, the market makers will drop the

stocks by hitting bids with phantom shares and cash in

on all the shares they are selling short while others cannot

do this. (For more information see this source.)

"(I)f you could jail someone for pure incompetence, Chris Cox would

be the first thrown in the clink. History will be brutal when it comes to Chris Cox.

And to George Bush and the US Congress, who allowed this travesty to continue.

I have no idea what's driving Cox...Maybe he's short he market? Maybe he hates

America? Maybe he's part of al-Qaeda? Whatever it is, it's bewildering.

And it's sick. "

( http://housingpanic.blogspot.com/2008/10/is-sec-chariman-chris-cox-single-most.html )

The SEC Itself Engaged in Insider Trading

Insiders, before the

announcement, got prior word

two days ago that the Securities & Exchange Commission

would announce before the opening the next day that

they would ban "naked" short sales in key finance stocks.

Today many of these stocks jumped 20% or 30%, in just

one day.

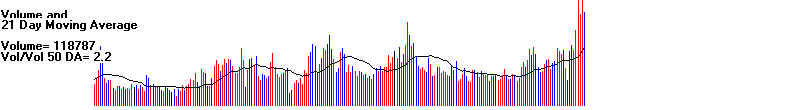

What's the proof? Look at the chart below. The very,

very high volume after the long decline with side-wise price

action was the key to spotting the insider buying, When you

have friends at the SEC who tell you what they are going to

do next, you don't have to be smart, just well connected.

It means that you're earning it the old fashioned way, being

one the boys on the inside. No wonder, wealth is concentrated

in Wall Street not among the brightest, bravest and most

foresighted, but among those who break the insider

laws with impunity. Look at TigerSoft's chart of Financial

Stocks. Note the Buy signal the day before the rally and the

huge jump in trading without additional price weakness.

This was "high volume churning" at a key reversal point.

--------- Tiger Index of Financial Stocks ------------

Clearly naked short selling should be

banned altogether.

It leads to economically destructive bear raids that have the power

to wipe out whole companies and cause great economic

hardship among shareholders and employees whose

jobs are ended. But the Bush SEC has not wanted to

do the right thing, and ban naked short selling altogether.

It has been too afraid to offend the constituents is cares

most about. It has not wanted to reduce or limit the big

brokerage commissions and profits at influential hedge funds

and the big firms' day trading teams.

--------- DJIA - 2007-2008

----------

SEC lifts

ban on short

sales.

Naked Short Selling

DJI falls

22%

Energy

Price Bubble?

Energy prices have tripled in the last

two years.

Initial Margin requirements on energy futures' contracts

are just 5%, even though the margin requirements for

stocks are 50%. The commodities are just as volatile

as stocks. Why are they so low? Because the two

governing units of the Federal Government, the SEC

and the Federal Reserve Board have been much more

protective of the commodity trading firms and funds,

than public welfare. Look at the price of Crude Oil.

Insider were clearly buying it, tightening their control

of it. The Federal Reserve did nothing to stop the upswing.

It had the power to limit the rise by raising margin requirement,

but it chose not to do so,

Energy Price Manipulation and California

Blackouts

Commodities markets have become

increasingly

unregulated. 90 percent of all commodities trades occur

outside of the traditional marketplace exchanges. In these

so-called OTC “Swaps trades”, parties secretly buy and

sell commodities with absolutely no one watching. Speculation

can be intense. Manipulation is much more common. Oil futures

can be "cornered" without anyone knowing. The Enron

Amendment of 2001 effectively hid OTC trades in commodity

futures so that manipulators could escape regulation and

gouge consumers. It was designed by Phil Graham to

help Enron gouge consumers. It worked. Traders for Enron

were artificially able to drive up electrical power futures in

California. Energy prices rose 50% in a few months. Pacific

Gas & Electric went bankrupt.

Traders said that Enron's former president, Jeff Skilling,

pushed them to "trade aggressively" in California and to do

whatever was necessary to take advantage of the state's

wholesale market to boost the price of Enron's stock/ "Skilling

would say, 'if you can't do that then you need to find a job at

another company,'" said one former senior Enron trader...

"He said we should go trade pork bellies if we can't be

aggressive." Manipulation strategies were known to energy

traders under names such as "Fat Boy", "Death Star",

"Forney Perpetual Loop", "Ricochet", "Ping Pong",

"Black Widow", "Big Foot", "Red Congo", "Cong

Catcher"

and "Get Shorty".[6]

Source.

For fuller description, see

http://en.wikipedia.org/wiki/California_electricity_crisis

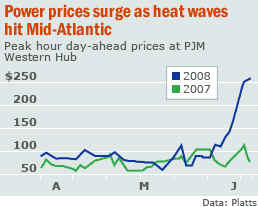

Is the same thing is happening in the Mid-Atlantic

states?

states. ."  As in California,

As in California,

the energy companies blamed heat waves. But the absence of regulating by the

Federal Energy Regulatory Commission is strikingly

similar in both cases.

ider Accumulation is Very Obvious in TigerSoft Crude Oil Charts

Democrats Again Show How

Spineless They Are.

"The Best That Money Can Buy"

Harry Reid, Senate Majority Leader. |

Biggest

Campaign Contributors

|

A timid US Senate is taking up the issue. A month

ago Democrat Byron Durgon introduced legislation that

would compel the commodity regulators at the CFTC to

raise initial margin requirements from 5% to 25% for

speculators, as opposed to commercial hedgers like

airlines. Walter L. Lukken, the CFTC's acting chairman,

drew criticism at the time for not responding more quickly

and wanting to waste time studying the proposal. Since then,

the spineless Democratic leadership and Senator

Harry Reid, in particular, has chosen to leave the

proposal out completely an require the CFTC to study the

problem. "I have seen sick jellyfish with more spine",

said one disgusted observer.

Republican Phil Graham's "Enron Amendment"

Gramm was one of five co-sponsors of the Commodity Futures Modernization

Act of 2000[3].

One provision of the bill was referred to as the "Enron loophole"

because Gramm drafted it in cooperation with lobbyists

for Enron Corporation.

Critics

blame the provision for permitting the Enron scandal

to occur.[4] At the

time, Gramm's

wife was on Enron's board of directors.

The "Enron loophole" exempts most over-the-counter energy trades

and trading on electronic energy commodity markets from government

regulation. The "loophole" is so-called

as it was drafted by Enron

Corporation lobbyists working with U.S. Senator Phil Gramm to

create a deregulated

market for their experimental "Enron On-line" initiative.

It allowed for the creation, for U.S. exchanges, of a new kind of derivative security,

the single-stock future, which had been prohibited since 1982

under the Shad-Johnson Accord,

a jurisdictional pact between John S.R. Shad, then chairman of the U.S. Securities and

Exchange

Commission, and Phil Johnson, then chairman of the Commodity Futures Trading Commission.

It is clear that the Fed

and the SEC have the power

to make and break a bull market and stop a bubble.

It is not only with interest rates that they can change

the outlook for stocks. But special interests rule

Washington.

Want To Predict The Market? Watch The Federal Reserve

and The SEC Closely as They Change Rules for Margining

Stocks and Short Selling. One of

the common causes of the

Stock Market Bubble of the 1920s and the Housing Bubble of

the 2000s was the very low amount of money one had to

put down to buy a stock or a house.

In 1934, the SEC was charged with

preventing short sales

on down-ticks and the Federal Reserve was given power to

change interest rates and margin requirements.

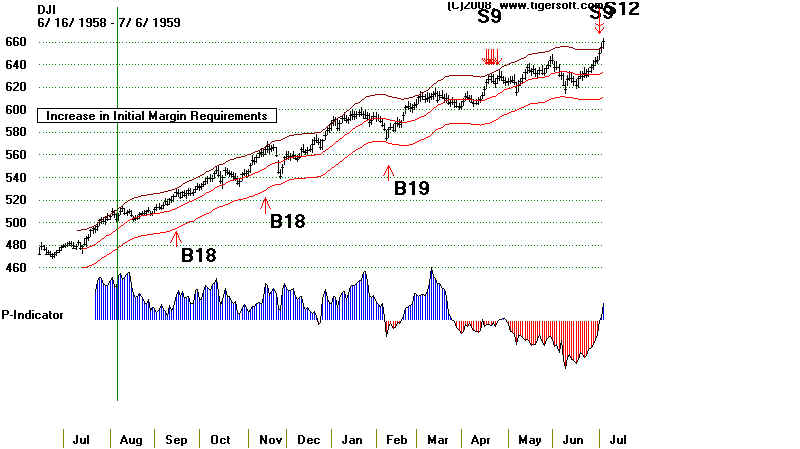

Initial Margin Requirement Changes Have Been Rare Recently

But you can get an idea from some of the examples shown

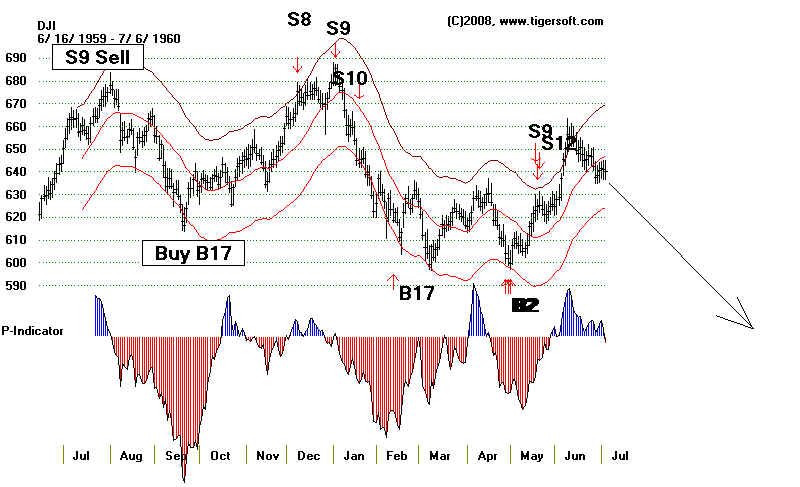

below that this is a powerful tool.

1) Margin Requirements were raised from 50% to 70%

on August 1958. It took more than 10 months for the

DJI to top out after margin requirements were raised.

But the market went down significantly in 1960.

DJI - 1958-1959

DJI - 1959-1960

2) June 1968, the margin

requirements were raised from

40% to 50% to fight excessive speculation in lower priced

stocks. In six months the stock market was falling from

984 to a low of 540 in May 1970.

-------------- DJI 1970 -------------

-------------------------------------------------------------------------------------------------------------------------