WHY IS THE STOCK MARKET

RALLYING?

Goldman Sachs Gave Obama More Than A Million in Campaign

Contributions..

It Was A Very Good Investment. Under

Treasury Secretary Paulson, the ex-Goldman CEO

gave Goldman Sachs $10B in bailout funds.

Goldman paid $6.5B in bonuses to their executives in 2008.

Obama continues the incestuous

relationship at the taxpayer expense.

OBAMA PLANS TO GIVE HUNDREDS OF BILLIONS MORE TO

BANKS.

HIS

ADVISORS ARE ALL TO CLOSE TO THESE BANKS

Obama's

solution to the failure of the American Banking system - keep all the banksters

in

office and give them hundreds of billions. This will not fix what ails America

or the world.

The

problem is not that banks aren't lending. It's that too many people are broke.

Wealth

(and

political power) is too concentrated. One percent of Americans own 50% of the

wealth.

Obama,

his Treatsury Secretary (Geithner) and his Chief Economic Advisor (Summers) all

believe

banks aren't lending because their banance sheets are loaded with "bad assets"

that

the market has temporarily grossly underpriced. The truth is the banks and

businesses

won't

make loans because they realize too many people are too broke to trust that they

will

be

able to pay back their loans.

Obama

believes that "once the banks start lending, the economy will recover.

The

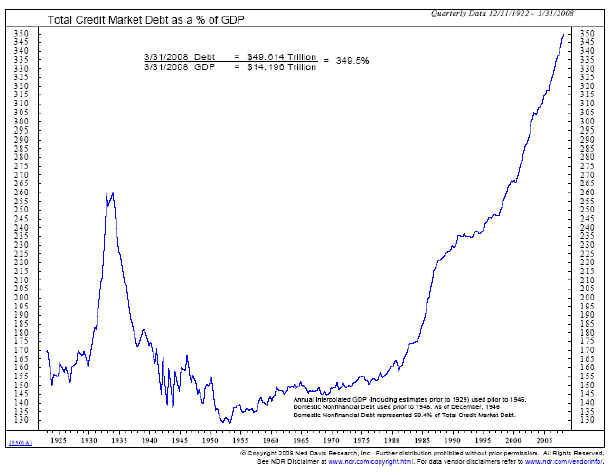

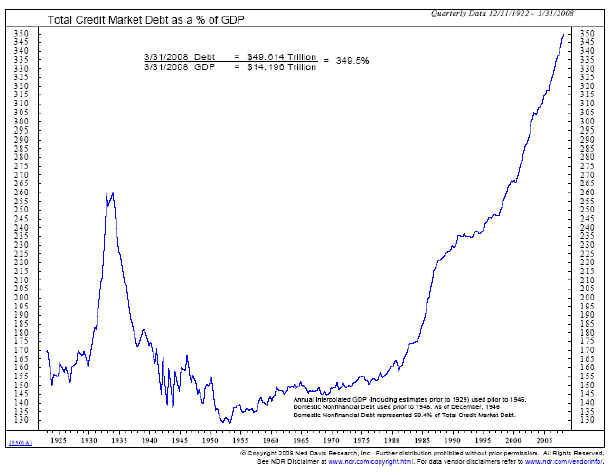

reality: American consumers still have debt coming out of

their ears, and they'll be working it

off

for years. House prices are still falling. Retirement savings have been

crushed. Americans need

to

increase their savings rate from today's 5% (a vast improvement from the 0% rate of two

years ago)

to

the 10% long-term average. Consumers don't have room to take on more debt, even if

the

banks

are willing to give it to them."

DEBT AS A PERCENT OF GROSS NATIONAL PRODUCT

(

http://www.businessinsider.com/henry-blodget-geithners-three-big-misconceptions-2009-3

)

A

Personal Note

Wall Street insider tips and excessive pay offend my Mid-Western values. When I worked

on Wall Street 40 years

ago, I saw first hand how partners in a major brokerage got inside information

which they did not

share with their public clients. (An obscure shipping company named Natomas had

an interest in a major

new oil discovery in Indonesia. This I learned from a telegram that came into

the Research Department

of Harris, Upham at 120 Broadway, New York - later bought out my Smith

Barney. I was a

trainee stock broker at the headquarters of this stock brokerage. Naively, I

thought

I would see how

important information would be disseminated in the firm. That did not take place

for several months.

First, the partners, I was told, bought the stock between 22 and 25. Only

after

it had doubled, did I

see a public report on the stock for customers of Harris Upham. The partners

then sold some of their

shares and helped provide the stock to meet the newly created demand.

It was a very

speculative market. The stock had tripled by the time the broader public heard

about Natomas in

Time magazine on 8/29/1969. This is the experience that made me see how

insiders buy long

before the full story is released to the public.

When I worked at Harris, Upham & Co I saw a lot of other things that made me distrust

Wall Street. I

saw the filing cabinets, one after another, of numbered Swiss Bank bank accounts

in the margin

department. The margin clerk laughed about how little the wealthy owners of

stocks had to pay in

taxes if they used Swiss Bank accounts. I also watched the Mafia rig

and manipulate a series

of low priced stocks. A customer worked for the Mafia (he was a pimp

for homosexual

celebrities) and bought 7 straight stocks through me that tripled or quadrupled.

I also saw the good-old

boys' trade stock tips. They got rich because of who they knew not what

they created or

accomplished professionally. They had every reason to obsequiously ingratiate

themselves with the

well-connected. They had no reason to think independently or critically

about the workings of

Wall Street.

I say these things so, you will understand how it offends me when I see that Obama's

Treasury Secretary

kow-tow to big Wall Street interests all the while Obama pretends to

represent Main Street.

Last night on C-Span I saw Geithner refuse to promise to publish the

number (not the names)

of employees receiving more than a million dollars a year in pay

and bonuses from banks

getting public TARP funds. House Rep. Sherman had asked him to

provide Congress this

information in House Banking and Finance Committee hearings.

Geithner, Obama's

Treasury Secretary, demurred and refused to say "Yes". He said he would

have to think about

the request. (Who says Congress runs the the show even though it

appropriates the money

for these bailouts? So much for responsible government under Obama!)

Readers may be interested in my take on what has gone so terribly

wrong.

September 21, 2008 Monopolistic

Finance Capitalism and Wall Street Are Dangerously Out of Control.

September 19, 2008 Bush Corruption

and Cronyism Reach Dizzying Heights in Paulson's Plan

for US Tax

Payers To Spend A Trillion Dollars Buying Worthless

Mortgages from

Private US Banks. Someone Must Say "NO"!

September 18, 2008 The Greenspan

"De-Regulation" of Banking, by Abolishing the

Glass-Steagall

Act of

1933, Has Led Directly to the 2007-2008 Bear

Market.

Both Political Parties Are To Blame.

Neither Admits This To

Be The

Central Malady.

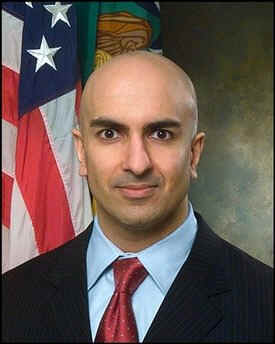

Geithner Defended The Bank

Executives within The Administration.

Last month the NY

Times reported that it was Geithner who "resisted those (in Obama's

new Administration) who

wanted to dictate how banks would spend their rescue money. And he

prevailed over top

administration aides who wanted to replace bank executives and wipe out

shareholders at institutions

receiving aid... Abandoning any pretense about limiting the moral

hazards at companies that

made foolhardy investments, (Geithner's new TARP-II) plan ...

will not require shareholders

of companies receiving significant assistance to lose most or all

of their investment."

TARP II - Taxpayers Get The Downside Again

and Hedge Funds Get The Upside

Geithner's

proposed public-private buying of the banks' toxic assets and bad loans with an

FDIC guarantees of 80% of the loan

is actually a plan that Goldman Sachs developed. They

have convinced Geithner that the

bad loans and mortgages are actually worth something.

That is not what banks who have have

conducted some detailed investigations of a sampling

of these debts. At most, they may

be worth only 5 cents on the dollar. If this is true and such

assets are sold to public-private

consortiums for more than that, the taxpayer will stand to lose

a lot of money. In effect,

Geithner is betting the farm, our farm, on an idea that Goldman Sachs

is promoting, so that it can get still

more management fees from the Government. ( Source. )

Geithner and Goldman Sachs

Goldman Sachs not only received TARP payments directly from the Government, it

received

100% of the money AIG owed it

when the government took AIG over. Goldman was AIG's biggest

creditor. AIG had

insured the packaged mortgages that Goldman distributed and sold against

failure. These

were the infamous Credit Default Swops. Andrew Cuomo, NY Attorney General,

on March 26th subpoened AIG

credit default swap data to see whether Goldman Sachs and others

were being improperly

compensated by the taxpayers. These CDS were at the "heart of the

AIG meltdown"

"The question is whether the contracts are

being wound down properly and

efficiently or whether they have

become a vehicle for funneling billions in taxpayer dollars to

capitalize banks all over the

world.” . Nobel Prize-winning economist Joseph Stiglitz also has said

AIG’s settlement of

credit-default swaps following its bailout by the U.S. government looks

like “grand larceny.” It is highly significant that it is

Andrew Cuomo who is looking after

the American public's

interests in this, because Geithner and Obama have aided and abbetted

the theft of taxpayer

billions. Source.

(The Federal

Reserve had previously refused to provide

Congress with the banks

who benefitted from the bailout of AIG. Many of these are foreign

banks. Additional

source. )

The second bailout of AIG in February also sent large amounts indirectly to Goldman

Sachs.

Goldman received 100% of what

it was owed. No one asked it to take a smaller amount considering

AIG's bankruptcy. How

was this arranged? The NY Times reported that Lloyd Blankfein, now the

chief executive of Goldman,

was the only Wall Street executive at a meeting at the New York

Federal Reserve on Sept. 15

to discuss the A.I.G. bailout. A Goldman spokesman said Mr. Blankfein

was not there to represent

his firm's interests, but rather that Goldman "engaged" the issue

because of the implications

to the entire system. The fallout from the AIG bankruptcy was never

publicly explained or

detailed. ( Source.

and http://airamerica.com/content/jon-elliott-former-goldman-sachs-exec-nomi-prins-geithner

)

Treasury Secretary Geithner's chief of

staff is Mark Patterson, a

former lobbyist for Goldman Sachs.

At Goldman Sachs, he worked against a

bill that would have let shareholders voice symbolic disapproval

for excessive executive pay and bonuses.

The bill was pushed by Obama. It had another provision.

It would have been non-binding. Source. Still Goldman

Sachs opposed it. Its CEO, Lloyd Blankfein,

who got $90 million in 2007, argued that

shareholders were not "sophisticated" enough to understand

the complex issue of why such high

compensation was necessary.

There has been a revolving door between

government and Goldman Sachs. Henry Paulson, ex-CEO

at Goldman Sachs was Bush's Treasury

Secretary as the stock market crashed. He had been assistant

to John Erlichman, who was convicted of

conspiracy, obstruction of justice and perjury. Gerald Corrigan,

former vice chairman of the FOMC, was

hired by Goldman. The firm has encouraged senior staffers

to seek government posts. Bring

home the bacon. The foxes will run the hen-house under Obama.

Chris

Whalen:

Geithner mishandled Bear Stearns and let Lehman (a competitor to Goldman) Fail.

Goldman Sachs was primary beneficiary of Bailout.

Goldman controls the NY Fed. The charirman works for Goldman. There is no

public interest representation.

"Goldman Sachs is the most powerful investment bank in the

world. It owns the US Treasury...

Rubin, Paulson and now Geithner. GS also

has its own "inside man" in the White House watching

and advising Obama in the form of

Lawrence Summers. Goldman Sachs is like an octopus. Don't be

surprised when BB leaves the Fed, someone

from GS will take over the helm of the Fed.GS already

owns the Canadian and Italian central

banks (all are headed by former GS employees).GS also owns

a signiciant shareholding in the NYSE

(via backdoor listing prior to its listing).I suspect John Thain

will be returning to GS in one form or

another."

(Source: http://www.nakedcapitalism.com/2009/01/another-geithner-ethics-compromise-let.html?showComment=1233129420000

)

Goldman Sachs' derivatives trader Gary

Gensler was Obama's choice to head the Commodity

Futures Trading Commission.

According to Senator Sanders, "Gensler worked with

Sen. Phil Gramm

and Alan Greenspan to exempt credit

default swaps from regulation, which led to the collapse of A.I.G.

and has resulted in the largest taxpayer

bailout in U.S. history. He supported Gramm-Leach-Bliley,

which allowed banks like Citigroup to

become “too big to fail.” He worked to deregulate electronic

energy trading, which led to the downfall

of Enron and the spike in energy prices. Why would Obama

pick someone who was "part of the greed, recklessness and ilegal behavior" to run

our economy?

Total

Bailout Cost Heads Towards $5 TRILLION

Fox

Guarding The Henhouse: Ex-Goldman Sachs Exec To Oversee Bailout

Rep. Maxine Waters (DEM-CA) asked

Treasury Secretary Timothy Geithner about his connections

to Goldman Sachs at a House banking

hearing Tuesday morning. Goldman Sachs is known to have

received bailout money given to A.I.G.

Source.

She

complained that Goldman Sachs is going to

be

one of the five firms managing the public-private program to buy toxic bank assets.

OBAMA'S FIRST PRIORITY EMERGING CLEARLY:

PROTECT HIS WALL STREET CAMPAIGN CONTRIBUTORS

At What Cost Has Obama Boosted The Stock Market?

In the last two weeks, as the market has rallied, Obama has stopped criticizing banks

and Wall Street.

He denies that they have committed economic crimes. His Administration

is now signaling Wall

Street that they will protect its executives. That Obama, Geithner and

Summers would not

legally challenge the AIG bonuses was another signal. This week's TARP-II

bank bailout proposal

(which could easily cost taxpayers a trillion more dollars) would have the

taxpayer generously

guarantee the private investment into the "toxic debts" of the big banks.

This was another clear

signal that Obama was Wall Street's friend. Obama said on Leno's

show that nothing

illegal was done by bankers or brokers to cause the Crash of 2008. He did

not even choose to say

he favored a thorough investigation of what caused the Crash of 2007-2008.

So, I think it's fair

to say that Wall Street is rising now because it considers its $3 million

in campaign

contributions to Obama will, in fact, be honored by Obama and turn out to be a

superb investment.

We saw this coming. I have written many articles that discussed Obama's true

loyalties.

I have repeatedly said

that he was no populist. He favored the Zombie bank approach.

Regretfully, I reported

that "No Drama Obama" had little backbone, that he picked the

very people Wall Street

liked the most and got much more money (campaign contributions) from

Wall Street than John

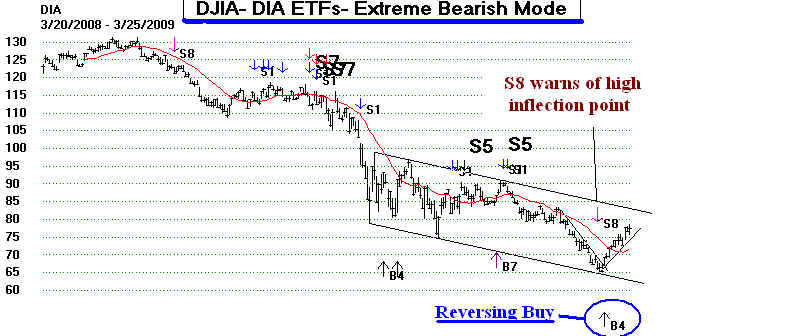

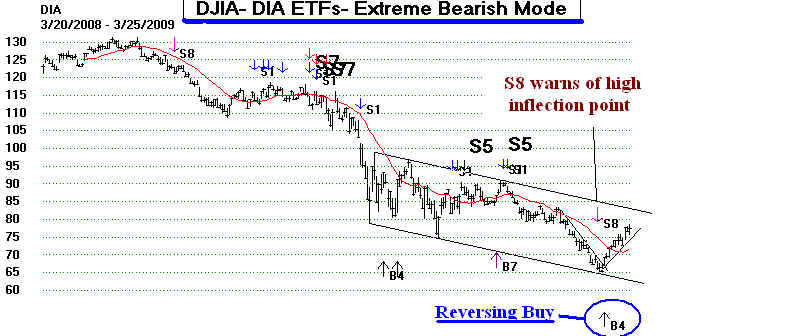

McCain. So, when the Peerless chart gave a buy signal one day off

the the 6600 low, I

advocated buying. A day earlier at the bottom I recommended covering

out short sales.

The market is now knocking on 7800 at this time without a reversing sell from

the applicable Peerless

software. Meanwhile professionals are still pushing the market higher.

I say this because of

the still rising trend in TigerSoft's copyrighted "Closing Power". As one

market timing

professional wrote me, Peerless/Tiger is a "game changer".

Watch Tomorrow To See if Geithner

Asks To Restore The Glass-Steagall Act of 1933

Geithner

to outline extensive overhaul of financial regulations

Geithner could stop the rally tomorrow by calling for aggressive regulation of Wall

Street.

But I suspect he

will not. I would bet that he has been ordered by Obama to do nothing to

offend

Wall Street.

Tomorrow Geithner will be explaining before Congress his proposals to

"regulate"

banking and Wall

Street. I take it as very significant that Obama has not called for a blue ribbon

investigation of

what really caused the 2008 Crash. Instead, recommendations are quickly being

made without an

investigation. A

thorough investigation was done in 1933 by the Senate. It is known

for Senate's lead

counsel, Ferdinand Pecora. A similar Congressional investigation looked

into the

steep 1946

decline. I remember reading it in the Business School Library at Columbia University

in 1969. It

investigated manipulation by short sellers of stock prices at particular brokerages.

The 1946 chart shows an

easily recognized head and shoulders pattern. Obama's silence on

the need for such an

investigation speaks loudly where his true loyalties lie.

I have criticized Obama for picking as his closest advisors those who helped create the

financial mess we are

in: Robert

Rubin - who helped him select his leading officials, Geithner,

Summers...

Instead of picking the very people that helped make the financial mess, he might

have chosen some of

those who saw the Crash coming and tried to warn regulators to take

action.:

Nouriel Roubini - TigerSoft News

11/1/2008

Senator Byron Dorgan - see below

| |

|

The most significant change that seems

necessary is to restore the Glass-Steagall Act of 1933 that prevented banks from becoming

brokerages and insurance companies. In November 1999, Senator Byron Dorgan of North

Dakota warned his colleagues and the public that the de-regulation banks would be

disastrous. With amazing prescience he said: "I

think we will look back in 10 years' time and say we should not have done this but we did

because we forgot the lessons of the past, and that that which is true in the 1930's is

true in 2010... I wasn't around during the 1930's or the debate over Glass-Steagall.

But I was here in the early 1980's when it was decided to allow the expansion of savings

and loans. We have now decided in the name of modernization to forget the lessons of the

past, of safety and of soundness.'

Source: http://www.boingboing.net/2009/03/24/democratic-north-dak.html

At the time, Senator Bob Kerrey, a Democrat from Nebraska poo-pooed

Dorgan's warnings. ''The concerns that we will have a meltdown

like 1929 are dramatically overblown,'' said Senator Bob Kerrey, Democrat of Nebraska."

Here is a great link: "The Long

Demise of Glass-Steagall"

|

|

Geithner's

Regulatory Proposals: 3/26/2009

•

Imposing tougher standards on financial institutions judged to be so big that their

failure would

represent a risk

to the entire system.

==> Nothing about Glass Steagall - the breaking up the

big banks. It is the concentration

of banks that led to the disastrous decline.

• Extending

federal regulations for the first time to all trading in financial derivatives, exotic financial

instruments

such as credit default swaps that

were blamed for much of the damage in the meltdown.

==> Why are these not made illegal? Why is there

nothing about abolishing negative

tick short sales. These led directly to the disastrous decline in 2007-2009..

•Requiring hedge funds and other private pools of capital, including private equity

funds and venture

capital

funds, to register with the Securities and

Exchange Commission if their assets exceed a certain size.

The

threshold amount has yet to be determined.

==> What will registration by itself accomplish? They must be treated as a mutual fund

and

regulated as such.

• Creating a systemic risk

regulator to monitor the biggest institutions. Geithner did not designate

where

such authority should reside, but the administration is expected to support awarding this

power

to

the Federal Reserve.

==> Nothing about Glass Steagall - the breaking up the

big banks. It is the concentration

of banks that led to the disastrous decline.

|