TigerSoft News Service Visit our www.tigersoft.com

TigerSoft News Service Visit our www.tigersoft.com A TIGERSOFT RESEARCH PROJECT 5/10/2009

GOLDMAN SACHS:

The UNBRIDLED GREED CONNECTION

BETWEEN WASHINGTON AND WALL STREET.

Making US Financial Policies Pay Off Big for GS!

OBAMA Is Clearly Goldmans' Tool.

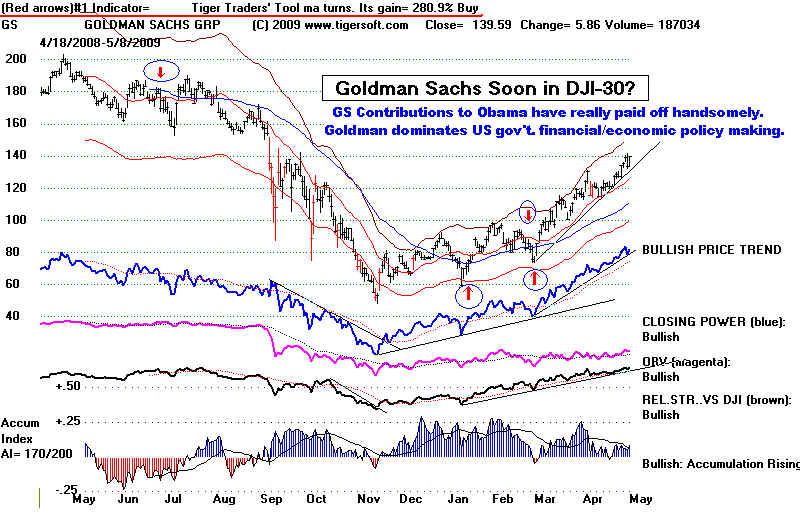

Look at GS Rocket Up.

OBAMA Is Goldmans' Tool.

Obama Has Covered Up Goldman's Criminal Fraud.

By picking Tim Geithner as Treasury Secretary, Obama

gave Goldman a Gift worth Billions and Billions.

in Return for a Mere $1 Million in Campaign Contributions.

This article shows in detail how dangerous is Goldman Sachs'

Political Influence... Sadly, for American Democracy, Obama defends

Goldman. They are "Too Big To Fail" and "No Laws were Broken".

Obama says this, even before there is a thorough investigation.

#1 Goldman committed massive fraud in knowingly peddling vastly

more soon-to-default mortgages as bundles of "AAA" rated debt

than any other Wall Streeet firm.

#2 Obama steadfastly ignores Goldman's "Insider Trading" and

the Very Costly and Corrupt Influence Peddling by Goldman

Operatives in Gov't.

#3 Geithner (the head of NY FED) in September 2008 set up the taxpayer's

payment of $12.9 Billion to Goldman when the Government took

over AIG. This was done in secret. Congress and the American

people were not told. The US was under no obligation to pay

AIG's "criminal" debts, or 100% on the Dollar on them. AIG sold

Credit Default Swaps to Goldman and others, which it knew full

well it might never afford to be able to pay. Such transactions

constitute fraud.

#4 Geithner's Successor as NY Fed Chairman Abruptly Resigned

When It was Disclosed that He Granted Goldman Sachs Status

as A Commercial Bank, Enabling Then to Get $10 Billion in

TARP Payments and Full Access to Fed's Discount Window,

All The while He Was Buying Three Millions in Goldman Stock.

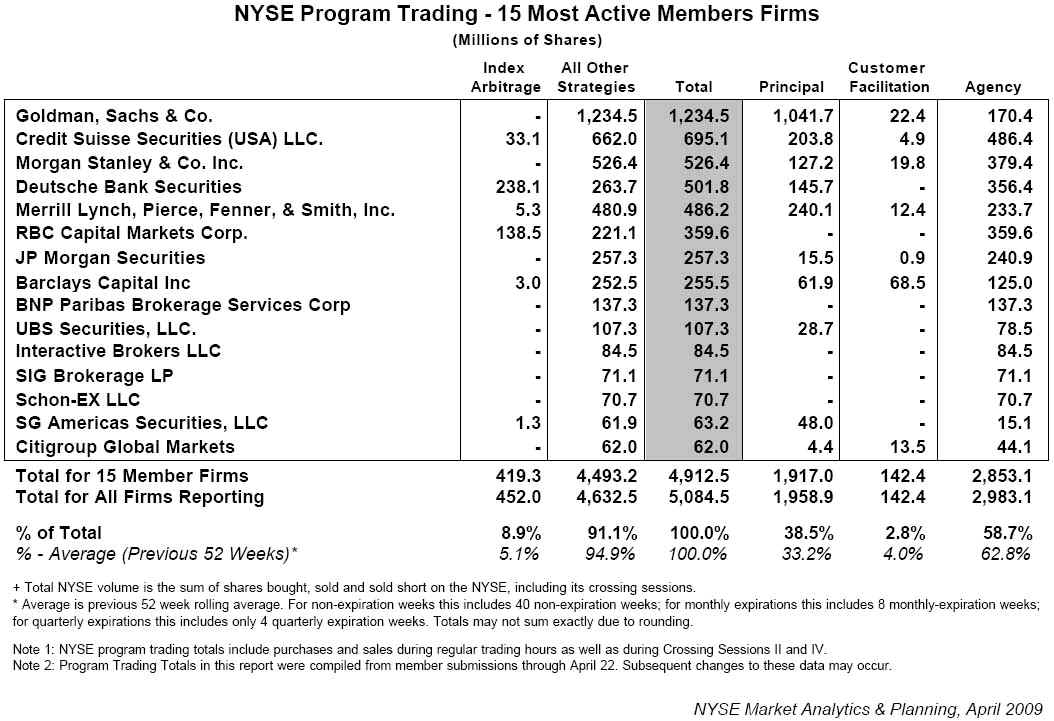

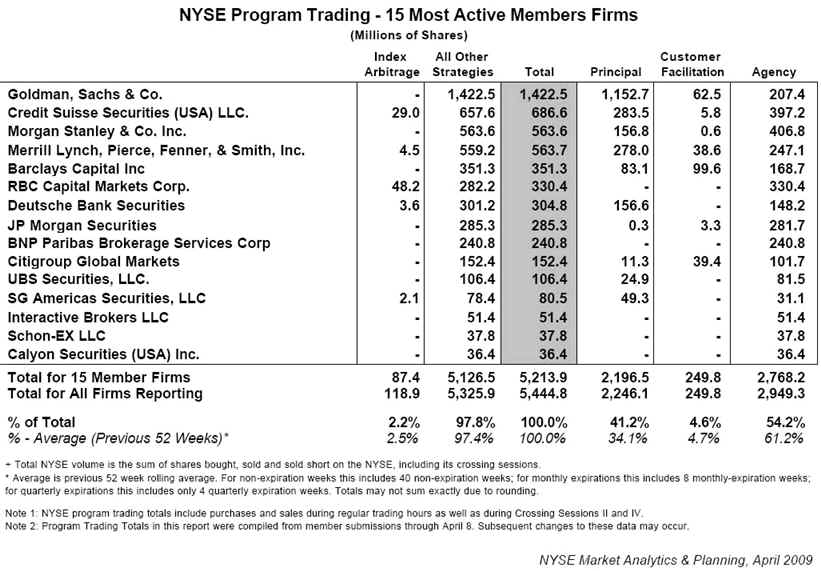

#5 Goldman Is A Giant Hedge Fund. It Dominates Program Trading

And Rampantly Manipulates Markets. It Should Have No

Banking Privileges. It Does So because It Runs The Government.

REAL HATRED FOR GOLDMAN SACHS KEEPS GROWING.

BUT THAT HASN'T HURT THEIR STOCK. THEY RUN THINGS!

Breaking News:

4/19/2009 MORE TAXPAYER BANK BAILOUTS COMING

4/19/2009 FL's Largest Bank Fails While Bush Treasury Scandal Unfolds

"Proof-positive that fraud has been rampant, institutionalized and flat-out

supported by our government throughout our nation's financial services sector

for a very extended period of time....(F)raud is clearly demonstrated."

--------- GS Stock: 2008-2009 courtesy of TigerSoft ---------

4/9/2009 124.33 +9.58

by William Schmidt, Ph.D. (Columbia University)

(C) 2009 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

|

Tiger

Software Helping Investors

|

FINANCIAL CONDITIONS ARE STILL WORSENING

OBAMA'S IS TOADYING DANGEROUSLY TO WALL STREET

Goldman Sachs

THE UNBRIDLED GREED CONNECTION

==================================================================

Noun - toady - a person who tries to please someone in order to gain a personal advantage

ass-kisser, crawler, sycophant, lackey

apple polisher, bootlicker, fawner, groveler, groveller, truckler -

someone who humbles himself as a sign of respect; who behaves as if he had no self-respect.

adulator, flatterer - a person who uses flattery.

Verb - to toady - try to gain favor by cringing or flattering;

bootlick, kotow, kowtow, fawn, truckle, suck up

blandish, flatter - praise somewhat dishonestly

court favor, court favor, curry favor, curry favour -

seek favor by fawning or flattery; "This employee is currying favor with his superordinates"

==================================================================

Wall Street - Goldman Sachs - Washington

The UNBRIDLED GREED CONNECTION

The CEOs who boss the huge Wall Street firms invariably took huge risks with

other people's money in order to get obscenely high bonuses after 2000. It was

their lobbying for de-regulation and then their over-leveraging that caused the

bubble and crash. Investment bankers like Goldman Sachs knew that they were

committing fraud when they sold packages of "liars' loans" as triple "AAA" investments.

Not only did Goldman sell more of these bundles of "toxic assets" than anyone

else, they also bought more credit default swaps from AIG as insurance against

the mortgages and the banks who held them failing. Such large purchases of insurance

from AIG prove that Goldman knew their bundled mortgages were not grade "AAA".

That should prove in a court of law that they were guilty of fraud and misrepresentation.

Why is their no criminal prosecution and no trial? Sources.

Besides, Goldman, many economists also saw this coming. Even TigerSoft

got the essentials exactly right. But among those who ran Wall Street and ran the

country, there was only a complete and reckless disregard about the consequences

of their greed, fraud and corruption as the housing boom developed and peaked.

Despite their responsibilities as leaders of finance and government, bank

CEOs like Paulson at Goldman (for example), US Treasury officials from Goldman,

Geithner at the NY Fed and key Congressmen, all let the boom get bigger and bigger,

pushing home prices higher and higher. Goldman Sachs' CEO Paulson even

successfully lobbied the SEC to further reduce controls on investment bankers

in 2004 and 2005 while permitting them to use even more leverage. With no

real oversight, Bear Stearns, Lehman Brothers, Merrill Lynch, CitiGroup and

dozens of other banks became houses of cards to make their CEOs rich. Criminal

fraud of epic proportions as been committed, but Obama, who is in their pay,

says no crime has been committed without even conducting an investigation

and allows the CEOs at the banks getting billions in bailouts.

The eventual collapse was easily foreseen by cynical Wall Street insiders, like

ex-GS CEO Robert Rubin who sold out at the top. Rubin knew the risks. He and

Larry Summers (who got $7.8 Million from Wall Street and Goldman Sachs in 2008)

had long promoted the de-regulation of banks and the non-regulation of derivatives

like those that bankrupted AIG within the Clinton Administration. At CitiGroup,

it was Rubin after 2002, more than anyone else, who had urged that big bank to

maximize their use of leverage all the way up, making more and more ridiculous

loans to increase short-term profits to get higher and higher bonuses. These

corrupt anti-regulation ideologues just didn't care about the consequences

of their policies. They completely disregarded the lessons of the 1920s-1930s.

How could such smart and learned men do this? Simply put, their loyalty had

been richly bought and paid for by Wall Street..

.

It is significant that Goldman Sachs avoided the worst of the 2008-2009 Crash.

In September 2007, Goldman issued a report predicting a 35% to 40% drop in housing

prices. Most of their profits after 2007 came from buying credit default swaps and selling

stocks short. To that end, because they understood the dynamics of the boom

they had helped create, they set up a huge $10 Billion short selling Hedge Fund

in December 2007. This was done at the perfect time. Goldman thus sold short

all the way down.

But that's only a small part of the story. Goldman Sachs got a TARP- I taxpayer

bailout of $10 billion from their ex-CEO, Henry Paulson as Treasury Secretary,

even though they were in no way a commercial bank, which could extend credit to

Main Street and re-start consumer spending, as Paulson insisted was the purpose

of the bailout. And never ones to lose an opportunity to steal from the taxpayer,

Goldman got $13 billion more when the American taxpayer bailed out AIG. Goldman

was claimed it was owed that much by AIG for the credit default swaps it has bought.

Keep in mind, If the taxpayers had not bailed AIG out, Goldman would have been

shy $23 billion last Fall and probably not have had sufficient capital to survive. To arrange

their getting the $13 billion via AIG from the taxpayer, free and clear, a secret meeting

took place in September 2008 between the current Goldman Sachs CEO, Lloyd Blankfein,

and Henry Paulson, Bush's Treasury Secretary and the previous CEO of Goldman Sachs.

The pay-off was only divulged five months later, as a result of Congressional

investigation into AIG bonuses.

Goldman might have been grateful to get the Paulson bailout and the $13 billion

AIG pass-through. They might, as a result, have made a sincere, good faith effort to

set up a commercial banking business. They might have reduced their executive

pay and bonuses. But that was not their plan. The history of Goldman unbridled greed,

fraud, insider trading and opportunism were too entrenched. They used the bailout

billions to trade the stock market for their own account even more aggressively, Their

CEO vowed to return the bailout money as quickly as possible in order to avoid any

limitations on executive bonuses or oversight. Goldman now trades much more "

aggressively for its own account, as principals, far more than any other brokerage

or investment bank. The current ratio of trading for themselves as opposed for clients

is 5:1, the highest on Wall Street.

( Source: http://4.bp.blogspot.com/_FM71j6-VkNE/SfCdjXYUchI/AAAAAAAACGc/ehB0IWpfeuM/s1600-h/NYSE+Program+trading.jpg )

With this "MO", where they trade almost exclusively as principals, there is no

justification for them being able to borrow from the Federal Reserve's Discount Window

for 0.25%. They are almost exclusively using this public money to trade for their own

account. Their program trading makes the market's swings wider and makes prices

much more subject to their manipulation. They certainly have no compunction about

using TARP money to sell short! These practices must be exposed to the light of day.

One wonders if it was Goldman Sachs, more than any other Wall Street firm, in 2007

that successfully lobbied the SEC to do away the uptick requirement on short sales.

That would seem likely given their influence and their decision at this time to create

a $10 billion short selling hedge fund in December 2007. This decision opened the

door to aggressive short-selling and made the plunge much worse than it would have

been. The lessons of the early 1930s were convenienly forgotten so that gangs of

short sellers could again fleece Main Street for their own selfish purposes.

Investment bankers create nothing! But they are paid everything! Goldman

played the bubble perfectly. Why did they succeed, where others on Wall Street

failed? They controlled Washington. Their people ran the US Treasury. When

they needed more money, their friends in Washington arranged billions for them,

always at the taxpayers' expense.

Washington has been the tool of Wall Street for years and years. But never

more clearly than now, and it is Goldman Sachs that is the epicenter of this

Greed Connection between Wall Street and Washington.

The first quarter of 2009 earnings reports for Wells Fargo, Goldman Sachs

and JP Morgan have now come out. They show that the biggest monopoly

US Banks are certainly making lots of profits from the bailout, but the amount of their

loans to individuals and real people are declining, not rising! Housing starts and

employment are not going to improve by making wealthy bankers even richer.

The stated purpose of Obama's/Paulson's TARPs and the central premise in their

simplistic view of big bankers as salvation is shown to be a nasty FRAUD for scamming

billions from taxpayers. Shame on you, Obama! And shame on you, Mr. Bernanke! We

still cannot see how much of the $2 Trillion that you have loaned individual banks,

has gone to companies like Goldman Sachs and on what terms. What are you

hiding? Why?

Who Are These People?

With an arrogance found only among the super rich, these Goldman Sachs

executives have claimed that they are the "best and the brightest". They work hard

and have earned every penny of their fabulous pay. To keep the most talented

loyal, Wall Street firms like Goldman always say that they must pay very high salaries

and bonuses, very often in the tens of millions of dollars.

What a crock! They pay them excessively to buy loyalty, just as a crime boss would.

They wish to prevent dissent, to keep their frauds and deceptions private, to attract

the greediest who lack compunction and to perpetuate an aristocratic cult.

The truth is very different. Goldman Sachs executives are not so

smart. They cultivate contacts and insider knowledge. Most have

been shown to be cut-throat fraudsters, They are not complex. They

are not conflicted. They are simply massively arrogant, spoiled and

greedy. They are elitists with a gigantic sense of entitlement. They

expect others to clean up after them. Under Obama, they remain

unpunished white collar criminals. They have committed massive

economic crimes in bringing down the entire world economy to

the shame of all Americans. They now fully expect to go unpunished

and be fully bailed out. In this, they are as unworthy as any dull,

selfish, over-indulged child from rich parents. Until they are punished

and their power and wealth taken away, America's claim to be

a Democracy with equal justice for all will sound very hollow to

those that know the truth.

When the public finds all this out, they will be mad as hell. And it will ALL come out.

Help spread the word. Now is the time to break up these monopoly banks that are

"too big to fail" and have a thorough investigation of their criminal fraud. Without

such a public investigation, nothing will have changed. Trust will not return and

America will be victimized by these same scam artists again and again. The US

is already in too much debt. Giving billions and trillions to the banksters who

caused this calamity is immoral and very, very dumb.

( A very good summary: http://www.pbs.org/moyers/journal/04032009/watch.html )

--------------------------------- DJIA -2007-2008 ----------------------------------

2007-2008

|

|

2009

|

Lloyd Blankfein, Goldman's CEO

since June 2006, He received over $60 million in 2008. The Wall Street Journal has disclosed that Lloyd Blankfein was present at the meetings with Tim Geithner and Hank Paulson when the decision was made to bail out AIG, which had sold credit default swaps to Goldman Sachs on which AIG was unable to make good. Goldman’s stock had plummeted to 50-, wiping out vast amounts of wealth amongst the Goldman Sachs top echelons, including Blankfein. The taxpayer bailout of AIG to the tune of more than $150 billion, was said to be necessary to safeguard the entire financial system. The truth is very different. Goldman thereby secretly and quietly received $12.9 billion from the AIG bailout for the debts AIG owed it. GS was the largest beneficiary of such AIG "pass-through." See - Protests against Greed at GS Meeting.. Who's Keeping Burger King Workers Below the Poverty Line? http://www.teachersforceomeritpay.com/profiles/ |

Instead of Challenging

Wall Street, Obama Has Turned The

US Treasury Over To Goldman Sachs Supporters.

This article attacks Obama. He deserves it. I

think he needs to change course.

He pretends to be

a populist in front of large audiences. But his appointments and actions

show he is a tool

of the biggest Wall Street firms and their CEOs.

Wall Street and Goldman Sachs, specifically, were Obama's biggest source of campaign

funds. If

McCain had won, would things be any different with respect to Wall Street running

Washington?

McCain got lots of money from the same people. So, we can't say. But

Obama is way

off-course if he wants an economic recovery. And this needs to be said.

It was the

bankers who were the problem. They are not the solution.

Obama chooses not to start an open investigation of what lay behind the financial collapse

from 2007 to 2008,

because of just how vast the corruption is, the venal connection between

Wall Street and

Washington, at the expense of Main Street.

I know it's hard to believe,

but the economic news is getting worse. Any day now GM may

declare

bankruptcy. The IMF is predicting that toxic bank debts "could

reach" $4 Trillion,

up 80% suddenly

from the $2.4 Trillion they had estimated until recently. Leading Wall Street

firms, especially

Goldman Sachs, have made a lot of money at public expense and now they

have a lot of

enemies and that number is growing exponentially.

HATRED FOR GOLDMAN SACHS IS GROWING FAST

"If Stephen Friedman (for insider trading of

Goldman Sachs while

he was Chairman of the NY Federal Reserve) is allowed to walk

away without tough legal prosecution aimed his way, then it makes a

mockery of prosecutions aimed at Martha Stewart or Sam Waksal

for “insider trading.” In fact, it makes a mockery of the entire USA

capitalist system and it further sows the seeds of mass cynicism and

disgust with the current Establishment. It is becoming very clear to

even the most obtuse that Goldman Sachs and JP Morgan, as constituent

owners of the Federal Reserve, engineered a phony financial crisis last year

in order to allow their government shills to force the hapless US taxpayer

to pay for years of aggressive investment bets that turned sour...

"(B)oth Goldman and JP Morgan created this fake

financial crisis

in order to steal TRILLIONS of dollars from taxpayers and preclude

derivative losses that would have destroyed both companies. In the name

of “protecting” the system, their grand larceny of US taxpayer money

saved their hedgebooks from failure. They socialized their losses even

though, for many years, they always demanded their profits be kept in

private hands, utilizing every scam under the sun to avoid paying the

IRS a significant dime. Goldman and JP Morgan, as counterparties to

the failing AIG (another long-time precious metals short player), saved

themselves from bankruptcy under the guise of “precluding systemic risk,”

when the only natural result of their failure would have been to see some

major regional bank(s) absorb them for pennies on the dollar. As part of

this process, precious metals investors would have been enriched

tremendously, but THAT is how the capitalist system is supposed to

work, money is supposed to flow from those who are wrong to those

who are right! That was not allowed to happen as the market’s normal

function once again was subverted by the Wall Street foxes who control

the chicken coop. (Source)

"Goldman certainly manipulated the

trading in various individual stocks last year.

They wanted a close competitor, Lehman, to go out of business and they used

whispers and rumors to help them go out. In March, a former Goldman

employee with then with the DOJ leaked an internal memo which caused CME

to drop 140 points in one day. That employee is now CEO of Wachovia.

Mission accomplished-and rewarded. "Anonymous on April 13, 2009 12:33 PM

Look at Yahoo's Finance's Messages on

GS. Here a sample.

- "Video that got Dylan Rattigan fired!" http://www.cnbc.com/id/15840232?video=10...

- "I agree... "

- "That video was just the start. Ratigan kept ranting through out the week

calling it the "Greatest

- financial fraud

ever" He was shown the door. So much for how outspoken honest people are

treated."

- I also agree that

was probably a key reason for letting him go. But he did raise many interesting

questions that have gone unanswered by anyone in our corrupt as hell government or Goldman

for that

matter. I truly can not stomach even the mention of the name of that schlock firm. The

only way to

get

any justice is the old fashion way folks. Grab a rope find a nice sturdy oak tree and hang

em

till

they no longer move!! Blankfein would be number one on my list and that list is very

long!!

"GS criminal" - "wear fancy suits, rob millions,

and make more money than 1,000 productive

humans

combined. These are the lowest form of human on earth. They must be destroyed for peace

on earth to

return." shintabou1

"what that F' blankfein and Paulson forgot is that-

" "they still live in the USA W/their families,

Paulson's son owns a baseball team in Utah.They still have to live among us, we might not

want to

talk

to them or even acknowledge them." takemychanc..

- We need them tried for treason and legally executed for treason... get them out

of the US

and onto their next life.

- But the first thing people need to know is just how crooked these two guys are and how

they are at the center of the whole crisis. All of the money trails, influence

peddling, fraud etc.

seems to (not so) mysteriously lead back to Goldamn... Paulson, Blankfein, Cohn!

What is the current method of executing someone for treason?

- YEH! they are liars and thieves

- good info! Keep it up outing these thieves and there families. They can

only walk the streets

so long if everyone knows them and wants to kill them

- Goldman Sucks needs to pay back the AIG money too.

These guys are really evil.

They stole from the taxpayers when the derivatives were trading at less than face value.

This is the problem when you put as the treasury secretary a cronyganger of Goldman Sucks.

It is time that Geithner left in shame, but you can see he has no shame. And neither does

Goldman Sucks.

Can

there be any doubt about Obama

bgamall4

Slate.com's critique of GS is heard

frequently and widely now. For the rally to continue, investor

confidence needs

to grow, not contract. Hatred, real hatred, for Goldman Sachs is growing.

Salon's

Don Rich makes a key point when he notes that Goldman's purchase of huge numbers

of credit default swaps

from AIG, more than anyone else, is strong proof that they knew that they

were fraudulently

marketing"toxic" bundled mortage loans as "AAA" around the world.

"It was Goldman Sachs more than any other entity who was peddling

these now so-called

"toxic assets" on a massive scale as AAA rated safe investments for your

grandmother's CD

account. At the same time that it was saying these now "toxic assets"

were safe, Goldman Sachs

was purchasing and advising clients to purchase insurance protection on these investments

called

credit default swaps from AIG on a scale that was wildly inconsistent with the

presentation of the

original securities being deserving of a AAA rating. In technical terms, their purchase of

default swaps at this level proves that their probability estimates as to risk was not as

stated in the

origination of the security. That constitutes a material, and I believe,

crimnal fraud and breach

of insurance contract in terms of the credit default swap."

CNN

Money has reckoned the US Government (and we taxpayers) have already spent $2.6

Trillion

rescuing banks from their own

mistakes. Obama is clearly continuing down the same path

that Bush and Goldman Sach's

CEO Paulson started. The

Zombie US banks will likely need $4

trillion

to make up for their "toxic" debts says the IMF. Will the American public

allow Obama to

keep giving unlimited amounts

of money to Wall Street as his advisors, Summers and Geitner want.

Scandal after scandal is

emerging for Obama. Even the liberal CNBC is critical. This weekend

the news broke that Obama's

Chief Economic Advisor, Lawrence Summers, got almost $8 million

last years for a few weeks'

"work" and speeches at Wall Street firms. Now the nearly $20 billion

secretly paid to Goldman Sachs

by the taxpayer through the newer AIG bailouts are being investigated.

As a result more and more

critics are emerging of the effectiveness of Obama's economic solutions

and his excessively close ties

to and and control by the biggest Wall Street firms. In former IMF

Chief Economist Simon

Johnson's words, "the finance industry has effectively captured our

government".

Leadership is desperately needed. Obama is not providing that now, despite all the

speeches.

And he will certainly not be able

to provide that leadership if the public realizes how effectively

Wall Street controls him.

Despite his populist rhetoric, Obama has shown no willingness to confront

entrenched interests

anywhere. Muddling through with a vaulted rhetorical style is not going to

"cut it" if the

unemployment keeps rising. Even if there is some recovery, without significant

new

controls and re-regulations on

banks and brokerages, there will little public confidence that

investments are safe. Only

trading rallies will take place. As usual, the broader public will

probably be tempted to buy at the

top and sell at the bottom.

Sadly, the Obama SEC now is postponing a decision on returning back to the short

selling rule

requiring up-ticks.

The delay is very dismaying and more proof that Obama's SEC is run by

pathetic cowards who continue

to want to protect Wall Street hedge funds rather than safeguard

investors and Main Street.

This is the single most important step the SEC can do to protect

everyday investors from

predatory organized short selling bear raids.

Goldman Sachs' Political Influence Is Dangerous and

Very Self-Serving

"Tally up the various forms of

direct and indirect taxpayer

assistance Goldman has

received in the last several months,

and it turns out that

you and I are providing billions of dollars

to bail out the proud

firm." Goldman is now

one of New York's

biggest welfare

recipients. Last Fall, GS redefined itself as a bank

holding company,

instead of being an investment bank. In doing

so, it became eligible

for TARP-I payments.

"On Oct. 28, Goldman sold $10

billion in preferred stock

to the government,

which bears an interest rate of 5 percent

through 2013 (after

which the rate bumps up to 9 percent). Like

other TARP recipients,

Goldman received capital on pretty easy

terms. Just a month

earlier, when Goldman raised $5 billion from

investor Warren

Buffett, it sold preferred shares that carried a

10 percent interest

rate. (At the same time, Goldman also raised

$10 billion in a public

offering of stock.) The difference between

borrowing $10 billion

at 5 percent and borrowing $10 billion at

10 percent—in

other words, the value of the government

subsidy—is $500

million per year..." Interestingly, Art Cashin on CNBC

just said that Obama's

Treasury is considering extending the 5% loan period

for banks by several

more years. There's nothing Obama won't do for Wall Street..

In addition, the Federal

Deposit Insurance Corp. has guaranteed $5 Billion of

Goldman's

unsecured debt sold in November 2008 in three-year notes at

a 3.367 percent

rate. On March 12, 2009 GS sold

another $5 billion. Thanks to

the government's

guarantee, Goldman is saving several hundred million dollars

per year in

interest. Wouldn't you like to be able to borrow with this guarantee

behind you!

Even more of a

subsidy for GS has come from the AIG bailout. Perhaps,

$20 Billion more.

"Goldman, and many other firms, made the mistake

of a) buying

insurance from a company that, it turned out, couldn't make good

on its insurance

contracts, and b) borrowing securities from, and lending

securities to, a

company that essentially went bankrupt. In normal bankruptcies,

firms in these in

situations have to get in line with other creditors and ultimately

settle for a

fraction of the amounts they're owed. As Eliot Spitzer pointed out,

because the

government didn't let AIG formally file for bankruptcy, Goldman,

and so many

others, have instead been made whole."

( Source: http://www.slate.com/id/2214076/

)

|

THE AIG

PASS-THROUGH OF $12.8 BILLION (Maybe much more) TO GOLDMAN SACHS

Last month, Obama's Treasury

Secretary, Geithner, and Chief Economics Advisor,

|

|

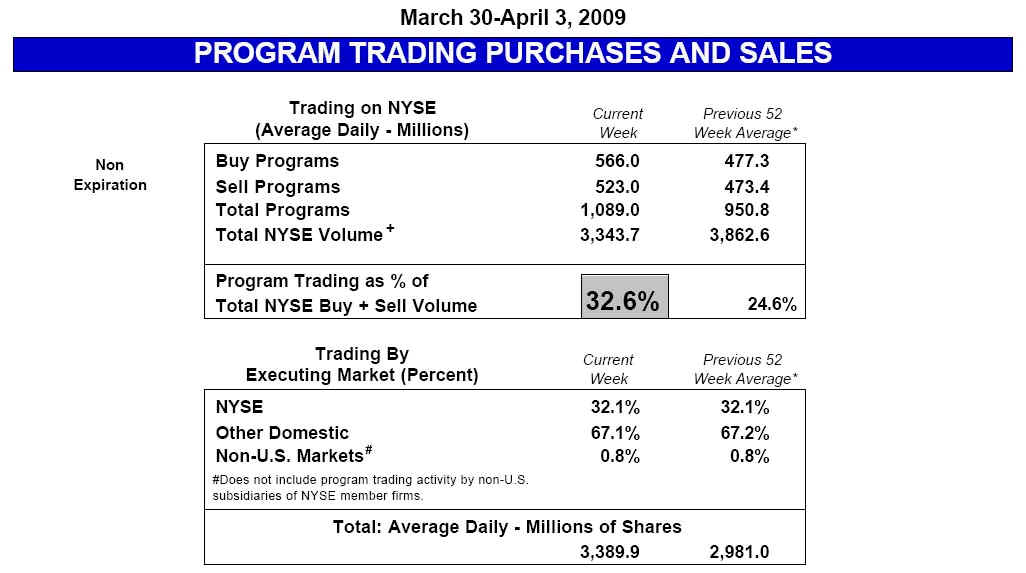

GOLDMAN SACHS TOO BIG TO FAIL. STOCK MARKET MANUPULATION Goldman is so big it can manipulate markets as well as Presidents. The NYSE shows it to be by far the biggest "program trader" for its own account. No other company comes close to Goldman's efforts to manipulate the market. For the NYSE "program trades" are orders worth more than a million dollars than simultaneously buy or sell a large number of different stocks. The period of time is not shown in the table below. But it clearly shows how much bigger Goldman is than any other participant. What is scary is that program trading now accounts for 32.1% of all NYSE trading and 67.1% of NASDAQ and ASE trading. Stock market liquidity is disappearing. We are right to worry about Goldman's front-running and manipulation. We need also to worry about another meltdown occasioned by out-of-control computerized program trading as took place in October 1987. Allowing program traders to go short on down-ticks with no need to borrow the stock in advance has set the stage for the steep stock market decline in 2008 and in January and February 2009. Speaking of Self-Serving Absurdities "After the most volatile percentage day in history, October 19, 1987, “trading collars” were placed on index arbitrage transactions via NYSE Rule 80A. (Index arbitrage was a favorite tactic of big institutions to circumvent other selling restrictions.) On November 2, 2007, however, the NYSE abolished these “circuit breakers,” writing “The Exchange is making this change since it does not appear...that market volatility envisioned by the use of these “collars” is as meaningful today as when the Rule was formalized in the late 1980s. Right .... On October 8, 2008, at 3:58 EDT, I captured a screenshot of the market. It was up 107.60 points. Two minutes later the market closed down 189.96 points. That’s a 300-point swing in two minutes. There was no news of interest to account for such a panic. There is no way enough individual investors or even institutions acting rationally or placing orders up to 10,000 shares could have sent the market into such a tailspin. I was a senior executive with Charles Schwab & Co. (SCHW) on October 19, 1987. I can tell you it was the novelty of computer program trading that was primarily responsible for the 1987 crash – and the current crash, as well. Facilitating instantaneous execution of enormous blocks of stocks, index stocks and futures resulted in blind selling of stocks as the market fell, intensifying the decline in both 1987 and in 2008....If we are to reinstate reasonable trading and the confidence of the backbone of the stock markets, actual investors (rather than program traders,) we must reign in program trading, dark pools and algorithmic trading. It’s all trading. None of it is investing! ". Source. http://www.bearmarketinvestments.com/time-to-breakup-goldman-sachs http://zerohedge.blogspot.com/2009/04/incredibly-shrinking-market-liquidity.html http://2.bp.blogspot.com/_FM71j6-VkNE/Sd-KeUtjJUI/AAAAAAAABzg/NyPbdplXe-k/s1600-h/nyse1.jpg http://seekingalpha.com/article/100159-program-trading-dark-pools-and-gold http://www.goldmansachs666.com/2009/04/does-goldman-sachs-manipulate-stock.html

|

:

| OBAMA CONTINUES THE PAULSON CRIMINAL

FRAUD AND TAXPAYER "RIP-OFF". No wonder Obama Does Not Want A Full Investigatiuon. Loosening "frozen bank" credit was, and still is, the excuse given, to have the taxpayer give banks billions. Never mind, the absurdity of thinking that making taxpayers get deeper in debt will help the economy or that taxpayers should give money to banks so that they can be charged interest on their own money, when they borrow back their own money. The Billions given the banks have not freed up bank credit. Many knew it would not last year. So, that should come as no surprise. The billions-for-bankers federal bailout was never intended to do that. Its real intention, all along, was to let bank executives get their bloated, obscene and undeserved bonuses. 86% of Bailout Money Used for Executive Bonuses by Jason Green ( http://endthebailouts.com/2008/11/07/86-of-bailout-money-used-for-executive-bonuses/ ) "When confronted about these numbers, the executives will always claim that the bonuses are paid out of other funds and company earnings. This completely ignores the fact that without the taxpayers’ bailout money, there would be no earnings! If there was anyone left who still felt like the bailout was a good idea (besides the executives who directly benefit), this should be the final nail in the coffin that we were just robbed blindly while the politicians patted themselves on the back.... It turns out that the nine banks about to be getting a total equity capital injection of $125 billion, courtesy of Phase I of The Bailout Plan, had reserved $108 billion during the first nine months of 2008 in order to pay for compensation and bonuses (PDF). "The country’s top investment bank (which since Sept. 21 calls itself a bank holding company), Goldman Sachs, set aside $11.4 billion during the first nine months of this year — slightly more than the firm’s $10 billion U.S. government gift — to cover bonus payments for its 443 senior partners, who are set to make about $5 million each, and other employees." |

GOLDMAN SACHS IS THE GREED CONNECTION

BETWEEN

WALL STREET AND WASHINGTON

Obama's bank - rescue plan will likely

fail because

it is the product of Wall Street Big Bank "mind set", according

to a Nobel

Prize winning economist, Joseph Stiglitz of Columbia.

Shareholders and bondholders get bailed out, but the taxpayer

is left holding the bag. Obscenely bloated bonuses are par for

the course for this crowd. They protect each other's privileges

as royalty would in Elizabethan

England. With an arrogance typical

of the very rich, they claim that they are the "best and the brightest"

To keep the most talented, Wall Street firms say that they must pay

these high wages.

The truth is very different. They are simply totallly spoiled,

arrogant and greedy elitists and unpunished crooks. They have

committed massive economic crimes in destroying the world economy.

They now fully expect to go unpunished and be fully bailed out.

In this they are as unworthy as any over-indulged child with rich

parents.

Too harsh a judgement? Read what a former chief economist

at the IMF wrote:

"(E)lite business interests—financiers, in the case of the

U.S.—played a central role in

creating the crisis, making ever-larger gambles, with the implicit backing of the

government,

until the inevitable collapse. More alarming, they are now using their influence to

prevent

precisely the sorts of reforms that are needed, and fast, to pull the economy out of its

nosedive..."

( http://www.theatlantic.com/doc/200905/imf-advice

)

1. Robert Rubin - Worked for

26 years with Goldman Sachs.

1. Robert Rubin - Worked for

26 years with Goldman Sachs.

There he specialized in risk

management and arbitrage. In 1990, he became the Co-Chairman

of Goldman Sachs. In

1993, was Clinton's Economic Advisor and the Director of the National

Economic Council.

He pushed for Free Trade and NAFTA, despite the loss of millions of

American jobs overseas.

In 1997, along with Larry Summers (see below), Rubin opposed the

regulation of derivatives,

like those that destroyed AIG and thereby cost the American taxpayer

$175 Billion in 2007-2008.

Rubin convinced President Clinton to sign the law that abolished

Glass-Steagall, thereby

permitting commercial banks to recklessly make mortgages and then

bundle them as products to

unsuspecting investors around the Globe. Rubin played a major role

in advising Obama whom he

should pick for the new President's economic team. Rubin advocated

at CitiGroup where he became

a chief advisor an expansion of their use of leverage in making

riskier and riskier loans.

When the housing bubble broke in 2006 and early 2007, Rubin sold

a huge stock

position in CitiGroup right at the peak, more than $20 million dollar's worth. He

knew that a Crash was coming.

It was he, as much as anyone, who created the financial bubble.

2. Henry Paulson - Worked as Assistant to John

Erlichman,

2. Henry Paulson - Worked as Assistant to John

Erlichman,

until the latter was convicted and jailed

in the Watergate scandal. In 1974, Paulson then joined Goldman

Sachs. In 2004, he lobbied successfully

the SEC to release the major investment banks from limits under

the net capital

rule, the requirement that their brokerages hold reserve

capital that limited their leverage

and risk exposure. Originally,

after this change there was to be set up a Federal Risk Management Office

to ensure undue risks were not taken by

banks. Paulson as CEO of Goldman Sachs convinced the

SEC not to establish such an oversight

office of investment banks. His compensation there

allowed

him to build up a net worth of $700

million. In 2006, Paulson was selected by President

Bush to become

the Secretary of The Treasury.

"Each of Paulson's three immediate predecessors as CEO of Goldman Sachs

— Jon Corzine, Stephen Friedman, and Robert Rubin

— left the company to serve in government: Corzine as a

U.S. Senator (later Governor

of New Jersey), Friedman as chairman of the National Economic Council (later

chairman of the President's

Foreign Intelligence Advisory Board) under President George W. Bush, and Rubin

as both chairman of the NEC and later Treasury

Secretary under President Bill Clinton.[14]"

Source.

Paulson quickly fell behind the curve of the financial

collapse that gripped the world on his watch.

In August 2007, Paulson said that the

sub-prime mortgage collapse was "contained." On July 20th,

He said that the US banking system was

"safe" and "sound" and that regulators were on top of

the situation. The situation

was "very manageable". On September 7th, Freddie Mac and

Fannie Mae, went into receivership.

Two weeks later, he demanded that Congress give him the

colossal sum of $800 million to buy bad

("toxic") bank debts to keep them solvent and prevent

a financial collapse. In

this, Goldman Sachs received a very generous $20 billion loan from the

US Government with a charge of only

5%/year. Goldman Sachs also received nearly $20 billion

more by the taxpayer bailout of AIG,

because of money it was owed by AIG. No Goldman

Sachs "hair-cut" or reduction

in the amount it was paid back by failed AIG was ever asked for

by the Treasury under Paulson or Obama.

See my Blogs:

9/20/2008 - Paulson

Takes Washington Corruption and Cronyism To Dizzying New Highs.

10/20/2008 - Goldman

Sachs Foxes...Gaming The Bailout. $700 Billion Down A Rat Hole.

12/25/2008 - Paulson Is

Nothing More Than A Pimp for America's Greediest CEOs.

3.

Larry Summers Obama's Chief

3.

Larry Summers Obama's Chief

Economic Advisor. Summers

teamed up with Rubin to block regulation of derivatives,

including those based on mortgages. He was

Clinton's Treasury Secretary in 2000 when Clinton

agreed to abandon bank regulation under

Glass-Steagall and allow banks to bundle dubious and

"toxic" mortgages and sell them to

others. . He had served as Rubin's closest aid previously at

the Treasury.

Summers Gets $7.9 Million "Advance Bribe" from Wall Street in 2008

"How would you like to make $7.9 million for a few

weeks' part-time work?

Could

you ever bite the hand that feeds you so well? That's what Obama's Chief

Economic Advisor got from a half dozen Wall Street firms in 2008, according to newly

released financial disclosures from the White House. Example - Goldman Sachs gave

him

$135,000 to make a single speech. Details

: This explains the taxpayer billions for banks

under

the new Geithner-Summers TARP-II Plan where FDIC Public money is used to guarantee

private investors against losses in buying the mostly worthless big bank "Toxic

Debts".

It

certainly explains the billions in bonuses for Merrill Lyuch, Bank of America and

AIG execs.

It

explains why Obama is bailing out AIG, so that Goldman Sachs will get the billions

that

they are owed by the bankrupt AIG. It explains why Obama refuses to order a

high

level criminal investigation of Wall Street and says the economic collapse Wall Street

created as all perfectly legal, even before there is an investigation about economic

crimes

and

political corruption. The subject of excessive Wall Street salaries have

recently

been

declared off limits, with Summers insisting the Obama

Administration can do nothing

about

AIG giving executives bonuses worth more than $200 million from taxpayers

Pay reform on Wall Street has very

low priority. This whole affair shows how superficial

and

cowardly much of the media is. They are infatuated by his eloquence and remain

blind

to how corrupt the Obama Administration looks when closely examined."

Source: http://www.tigersoftware.com/TigerBlogs/April6-2009/index.html

4. Gary Gensler (Obama's

nominee to be head

4. Gary Gensler (Obama's

nominee to be head

of

Commodity Futures Trading Commission) He worked at Goldman Sachs, one of the

biggest brokers of commodities, for nine years. He joined the Treasury

Department. Gensler

served under two Clinton Treasury secretaries. From 1997 to 1999, Gensler worked as

assistant

secretary of the Treasury under Robert Rubin until Rubin stepped down in 1999. Lawrence Summers

then

became the Treasury head, and Gensler was promoted to Treasury undersecretary.

There in

2000 "he oversaw the drafting of legislation that exempted derivatives from oversight

by the

federal

commodity regulator, including the viral credit default swaps that have amplified the

current

crisis." (Quote: NY Times.

) As the head of the Commodity Futures Trading Commission (CFTC),

Gensler

will oversee a troubled organization that has come under fire since oil prices fluctuated

wildly

throughout

2008. Many industry experts have blamed excessive and unregulated speculation by

investors

on 7% margin as the main cause of soaring oil prices in early 2008. Gensler has so

far

been

entirely silent on revising commodity trading margin requirements, the need for more

regulation

of commodity speculation, including publicizing very large short positions. We have

to take

notice that both Summers and Gensler joined hands with Phil Gramm to ward off regulation

of the

derivative markets and to promote the deregulation of banking and mortgage selling.

5. Edward Liddy Liddy served on

the Goldman

5. Edward Liddy Liddy served on

the Goldman

Sachs

Board of Directors from 2003 to 2008. It was Liddy who ex-GS CEO and Treasury

Secretary

Paulson appointed as CEO of AIG. Liddy then gave Goldman Sachs $12.9 of taxpayer

bailout money

to

repay AIG's Credit Default debt to Goldman. There was no haggling. Liddy just

paid them this

amount "to

retire the derivatives." This was not made public until the issue of AIG bonuses

surfaced.

Many

consider this debt highly vague, suspect and criminal in itself. The truth will come out

as a result

of

the NY Attorney General's investigation. No help or thanks is due Obama, who

supported the

payment to GS. Source.

" Liddy has a bundle of stock in Goldman he earned as a Director on the Goldman board

before he took this job and his Goldman stock was down to $47 when he gave his former

company

$13Billion of 100cents on the dollar that Obama is covering up according to William Black!

Goldman stock has more than doubled with the secret $13 Billion payment to Goldman so

Liddy

has more than doubled his Goldman stock worth; far more than this joke he is working for

$1."

Source.

griz99cub

http://www.nytimes.com/2009/04/17/business/17liddy.html?_r=2&ref=business

OTHER GOLDMAN SACHS PEOPLE

RUNNING

THE AMERICAN GOVERNMENT

Timothy

Geithner - US Treasury Secretary under Obama. He mever met a bank he didn't

want to give taxpayer

|

money to. Geithner, was mentored by

Goldman alumni. Mario Draghi, who is leading the crisis response

for

the E.U., is a former Goldman VP.

5. Steve

Friedman - along with Rubin,

Friedman was co-chairman at Goldman.

5. Steve

Friedman - along with Rubin,

Friedman was co-chairman at Goldman.

He was Bush’s economic advisor and became the Chairman of

the NY Federal Reserve on Geithner's placement

in Obama's administration. Friedman abruptly resigned as Chairman in May 2009,

"after questions arose about

his ties to Goldman Sachs. Mr.

Friedman was chairman of the New York Fed at the same time that he was a member

of Goldman’s

board. He also had a substantial stake in the firm as

the Fed was devising a solution to keep Wall Street

banks afloat... Because

the New York Fed approved a request by

Goldman to become

a bank holding company, (thereby

allowing them to get a massive TARP payment of

$10 billion despite the

fact they trade mostly for their own account and so should have

been considered a giant

hedge fund) the chairman’s involvement in Goldman was a

violation of Fed

policy, The Wall Street Journal said in an article earlier this week. The

New York Fed asked for

a waiver, which, after about two and a half months, the Fed

granted, the

newspaper said. During that time, Mr. Friedman bought 37,300 more

Goldman shares in

December, which have since risen $1.7 million in value."

(Source: http://dealbook.blogs.nytimes.com/2009/05/07/friedman-resigns-as-chairman-of-new-york-fed/?hp

)

"Is it an equitable tradeoff for Goldman to be

released from TARP restrictions simply by paying back

the TARP itself while

retaining access to FDIC-backed financing and all the other perks of a bank

holding company?

..It’s hard to really know how secure Goldman is as a bank. We know you can’t

enter one of their

“branches” and make a deposit, let alone receive a free gift for

opening an account ."

(Source.)

Mark

Patterson - Geithner’s chief advisor . He was lobbyist

for Goldman Sachs who fought against limiting

Wall

Street executive pay..

John Thain

- Co-President of Goldman Sachs, its chief operating officer. Merrill Lynch

President when the company

failed. He had received $300 million from Goldman and was finally fired from Bank

of America for his wasteful

spending on his office. It was Obama's criticisms of Thain which scared the stock

market in early February 2009.

Wachovia head Robert Steel was a vice chairman of GS.

.... Paulson's Bailout aids

were mostly from Goldman.

Robert Zoellick -

World Bank president . He was a managing GS director

Neel Kashkari ("CASH_CARRY") Bush TARP head - had been a Goldman

vice-president

Edward Liddy, the CEO of AIG, came to the company from the Board of Directors of Goldman

Sachs.

Steve Shafran - Bush US Teasury TARP Administrator - formerly of Goldman Sachs

Kendric Wilson - Bush US Teasury TARP Administrator - formerly of Goldman Sachs

Edward Forst - Bush US Teasury TARP Administrator - formerly of Goldman Sachs

See

- http://www.tigersoftware.com/TigerBlogs/October20-2008/index.html

Compare JP Morgan to Goldman Sachs' CEOS

"Blankfein

and his ilk continue to function as though it were business as usual, using campaign

contributions

and lobbyists to grease the wheels of access and power. And as soon as they dislike

something, they start

shorting the market, engendering panic until the politicians relent. At least Morgan acted

out of a sense of duty

when he saved the country in 1909 and he wasn’t even that rich. What America has now

is a pack of parasites

like Blankfein, to whom

the country is a bottomless pit they can exploit endlessly. " Source

|

Prosecuted Goldman Sachs'

Criminal Fraud "Goldman Sachs was one of five Wall Street firms to settle a December suit alleging insufficient email records. The suit, headed by the Securities and Exchange Commission (SEC), resulted in two penalties for Goldman Sachs: it was fined $1.65 million to be split between the U.S. Treasury, the New York Stock Exchange (NYSE), and the National Association of Securities Dealers (NASD); and it will have to take measures to make sure that it complies with SEC record-keeping regulations in the future. "Goldman Sachs is one of a dozen defendants in another securities suit that is expected to settle in mid-2003. This suit – also filed by the SEC, but headed by New York Attorney General Eliot Spitzer – alleges collaboration between the investment banking and research/advice branches of each firm. The firms are believed to have issued advice to investors to inflate stock prices, with the goal of luring the patronage of investment banking clients that stood to benefit from these inflations. Goldman Sachs will pay approximately $150 million of the $1.4 billion settlement, the second most among the twelve. Each firm also must agree to regulations designed to separate their research and investment banking arms. "Goldman Sachs, ..(is) currently being sued for fraudulent manipulation of initial public offerings (IPOs) of stocks. Investor suits, which also name as defendants the companies they invested in, allege that the investment firms arranged deals that inflated the stocks’ prices as soon as they hit the market. For example, Goldman is suspected of participating in the notorious broker practice of arranging deals with buyers in which they can buy a stock before it is offered to the public, but must agree to make a purchase at a " higher price during the stock’s IPO stage. The demand for shares that results inflates their price for consumers. Goldman Sachs is also being sued by the companies themselves – Etoys, for example, is alleging that Goldman undervalued its IPO in 1999. "Goldman Sachs is facing charges by investors that it defrauded them in other ways. One of the most prominent cases involves Touch America, the company formerly known as Montana Power. According to investors, they were left in the dark when Goldman Sachs pitched the idea for the energy provider to transform itself into a telecommunications company. The transformation left the company bankrupt, and the stock has plummeted." (http://www.goldmansachsfraudinfocenter.com/information.php ) More Links "Our treasury secretary hopes to circumvent laws enacted to protect the economy by subsidizing a bunch of multimillionaire investors - ostensibly to help regulators fulfill their most basic job description - in a bid to prop up bankers who cooked their books to support a gambling binge and still refuse to admit they lost." -- THE SEC...grossly incompetent, criminally negligent, or just simply corrupt? YES!! ... And for this to happen...the Senate Banking and House Financial committees are corrupted also. READ http://www.motherjones.com/print/22937 Source - fpvsff TARP-II - Barrons says TARP-II is "Sweet Deal for Banks" 4/18/2009 http://online.barrons.com/article/SB124001886675331247.html |