TigerSoft News Service 5/4/2009 www.tigersoft.com

WHY ARE BANK STOCKS RALLYING

IF THEY NEED SO MUCH MORE MONEY

AND THE ECONOMY IS SO WEAK?

BANKERS PLAN TO SELL

SUPER-INFLATED BANK SHARES TO US TREASURY

WHAT IS THE FEDERAL RESERVE COVERING UP.

THE BANKS HAVE GAMED THE TAXPAYER FOR A TRILLION DOLLARS, SO FAR!

HAS THERE EVER BEEN SUCH MASSIVE FRAUD AND CORRUPTION.

TAXPAYERS MAY BE ASKED TO GIVE A TRILLION DOLLARS

TO BAUL OUT THE FEDERAL RESERVE TO MAKE UP FOR

THE FED'S GIVEWAY TO BANKS!

THE FED HAS MADE $2 TRILLION IN LOANS TO BANKS.

THE COLLATERAL THESE BANKS PUT UP MAY BE WORTHLESS.

SMALL WONDER BANK STOCKS ARE RISING.

by William Schmidt, Ph.D. (Columbia University)

(C) 2009All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981

|

WHY ARE BANK STOCKS RALLYING

IF THEY NEED SO MUCH MORE MONEY

AND THE ECONOMY IS SO WEAK?

BANKERS PLAN TO SELL

SUPER-INFLATED BANK SHARES TO US TREASURY

by William Schmidt, Ph.D

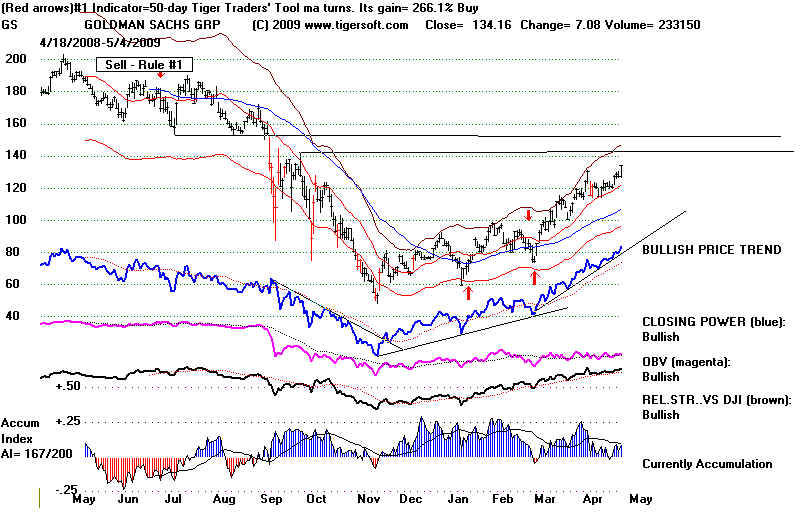

First, consider how well banks stocks are doing now. A trillion dollars

from the taxpayer, certainly should make bank stocks go up! And that's

what we see now. They have cried like babies for Federal funds. Their man

at the Treasury, Paulson, successfully scared Congress last Fall, so

that these big banks could extort trillions from the taxpayer via the

TARP program and fromt he Federal Reserve. Now that they have all

these billions, they let the market go up, even buying stocks for the rally

with the bailout billions they received, rather than making loans to

Main Street. Goldman Sachs trading for its own account now make

up almost 50% of all NYSE trades and 70% of all NASDAQ trades. Only

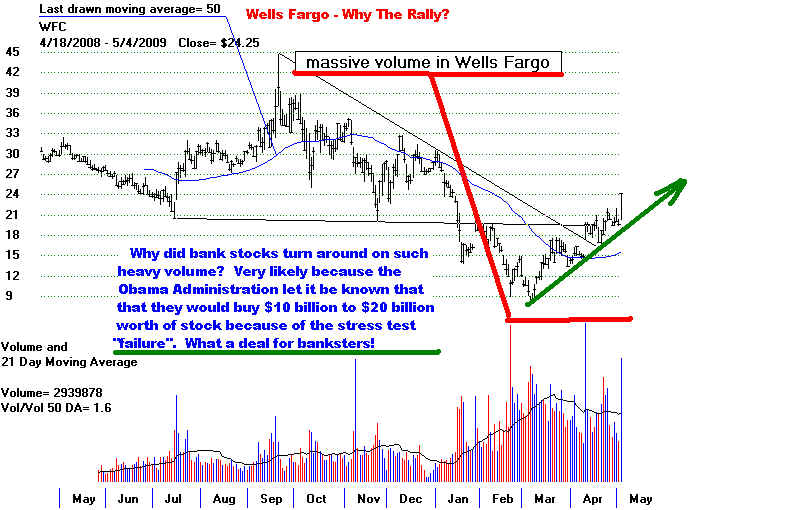

when bank shares are much higher will the Obama Administration buy

more shares in Bank of America and Wells Fargo, supposedly to provide

"needed liquidity" as a result of the "stress testing".

.

Goldman Sachs

Wells Fargo

Bank of America - Why The High Volume Rally?

TAXPAYERS MAY BE ASKED TO GIVE A TRILLION DOLLARS

TO FEDERAL RESERVE TO MAKE UP FOR

THEIR GIVEWAY TO BANKS!

FEDERAL RESERVE COVERS UP ITS OWN

MASSIVE FRAUD AND CORRUPTION.

| Why Gold Is Rallying.. China is aggressively buying Gold. It does not trust the Dollar. It has chosen to double its gold reserves. China now holds double the amount of Gold it last disclosed in 2003, according to Hu Xiaolian, head of the State Administration of Foreign Exchange (Safe), which manages the country’s $1,954bn in foreign exchange reserves. China's statement comes on the heels of several rumors that China is reassessing its faith in the US Federal Reserve Bank and the fiat currency that it prints. Recent news of Paulson and Bernanke's insistence that the Merrill Lynch takeover be done in a secret fashion to preserve the biggest US private banks has spurred the Chinese toward even further abandonment of USD assets. It has recently been said by the Chinese Foreign Secretary that China has passed on all recent US treasury auctions and is letting the Treasuries securities they have now expire without replacement. The move comes as European central banks continue to sell $USD assets and the International Monetary Fund has discussed selling some of its $USD reserves. “This is probably the most significant central bank announcement since the Central Bank of Russia announced at the LBMA gold conference in that it wanted to hold 10-20 per cent of its foreign exchange reserves in gold,” said John Reade of UBS. . If China is slowing down on their reserve accumulation, then who will be covering all of these loans to bail out insolvent private banks? China now mines and produces very large amounts of Gold domestically. This allows for Gold accumulation without foreign currency swaps. “Without any obvious intervention in the global market China can subtly and quietly diversify its reserves into gold by buying domestic production,”. China National Gold Corporation, the country’s biggest gold producer, is state-owned so the State does not have to go through a private company to make its gold purchases. |

The following quote is from

http://www.michaelmoore.com/words/latestnews/index.php?id=13793

April 24th, 2009 2:56 pm April 24 (Bloomberg) -- The Federal Reserve took on more than $74 billion in subprime mortgages, depreciating commercial leases and other assets after Bear Stearns Cos. and American International Group Inc. collapsed. In its biggest disclosure of the securities accepted to stabilize capital markets, the Fed said yesterday it had unrealized losses of $9.6 billion on the assets as of Dec. 31. The bonds, swaps and notes were taken in from Bear Stearns, once the fifth-biggest Wall Street firm by capitalization, and AIG, which had been the world's largest insurer. The losses on securities backed by assets such as home loans in Florida and California signal that U.S. taxpayers may be forced to reimburse the central bank through the Troubled Asset Relief Program, according to Christopher Whalen, managing director of Torrance, California-based Institutional Risk Analytics. "The numbers basically confirm that Treasury is going to have to take some TARP money and reimburse the Fed," said Whalen, whose financial-services research company analyzes banks for investors. "It is essentially up to the Treasury to get the Fed out of this." The central bank lent $2 trillion to financial institutions and hasn't disclosed information about most of the collateral backing those loans. Treasury spokesman Andrew Williams declined to comment. Pressure to Disclose The Fed report follows requests from lawmakers to identify the collateral and a lawsuit by Bloomberg News. Fed Chairman Ben S. Bernanke pledged to expand disclosure, assigning Vice Chairman Donald Kohn to lead the effort. The central bank has refused to name the borrowers, the amounts of loans or the assets banks put up as collateral under most of its programs, arguing that doing so might set off a run by depositors and unsettle shareholders. That would be less of a concern for New York-based AIG, now 80 percent owned by the federal government, and Bear Stearns, taken over by New York- based JPMorgan Chase & Co. a year ago. Bloomberg, the New York-based company majority-owned by New York Mayor Michael Bloomberg, sued Nov. 7 under the Freedom of Information Act on behalf of its Bloomberg News unit. The public is an "involuntary investor" in the nation's banks, according to an April 15 court filing by Bloomberg. Maiden Lanes In the report, the Fed detailed its assets in three limited liability corporations, all called Maiden Lane, after a street in Lower Manhattan that runs past the New York Fed. The $9.6 billion in losses are unrealized because they represent the difference between the fair value of the security under accounting rules and the amount outstanding. The losses become real if the principal isn't returned. Maiden Lane I is a $25.7 billion portfolio of Bear Stearns securities related to commercial and residential mortgages. JPMorgan refused to buy them when it acquired Bear Stearns to avert the firm's bankruptcy. The Fed's losses included writing down the value of commercial-mortgage holdings by 28 percent to $5.6 billion and residential loans by 38 percent to $937 million as of Dec. 31, the central bank said. Properties in California and Florida accounted for 45 percent of outstanding principal of the residential mortgages. AIG Counterparties Maiden Lane II contains almost $11 billion of outstanding subprime mortgage-backed securities from the AIG transaction that the Fed said lost $180 million so far. The fund also contains $6.2 billion of Alt/A adjustable-rate mortgage-backed securities that the report said has $936 million of unrealized losses. The Fed values $11.4 billion of assets in Maiden Lane II with mathematical modeling, the same methods used by banks and AIG itself. About 19 percent of the mortgage-backed securities are rated speculative grade, or BB+ at Standard & Poor's, according to the Fed. About 40 percent are given the top rating of AAA. Maiden Lane III has lost $2.6 billion after being created Oct. 31 to buy collateralized debt obligations from AIG counterparties, according to the Fed. CDOs in this unit include three parts of a high-grade asset-backed security known as TRIAX 2006-2A, totaling about $3.2 billion. Maiden Lane III also has two parts of a commercial mortgage-backed CDO called MAX 2007-1 A-1 with a face value totaling $7.5 billion. The fair value of those two is less than half that much, or $3.3 billion, according to the central bank. A third of the amount outstanding in the Maiden Lane III CDOs are speculative grade, or deemed by ratings companies as having a greater chance of default. Another 27 percent are rated AA+ to AA-, the second-highest tier of S&P's scale, the Fed said in its report. All but $155 million of the $26.8 billion in CDOs are classified as Level 3 assets, or those valued with mathematical models instead of market prices. The case is Bloomberg LP v. Board of Governors of the Federal Reserve System, 08-CV-9595, U.S. District Court, Southern District of New York (Manhattan |

GOLD IS RALLYING.

It needs to surpass its (blue) 50-day ma at 90.

Insiders are not convinced. The Accum. Index is very

negative.

SILVER IS RALLYING.

It needs to surpass its (blue) 50-day ma at 13.

Insiders are not convinced. The Accum. Index is very negative.

|

More reading How banks manage to report positive earnings: http://www.moneyandmarkets.com/big-bank-profits-are-bogus-massive-public-deception-33228 |