TigerSoft Freedom News Service 12/17/2008 www.tigersoft.com

DON'T ALWAYS TRUST GOLD BUGS' FEAR TACTICS

THE GOLD BUGS ARE NOW SHOUTING

"REMEMBER WEIMAR!"

"REMEMBER ARGENTINA!"

TigerSoft's Charts of Gold, NEM (gold), US Dollar,

Yen, Euro, Crude Oil and Treasuries.

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

|

Tiger

Software Helping Investors since 1981 More Oil

Profits' Cartoons.

|

THE GOLD BUGS ARE SHOUTING

"REMEMBER WEIMAR!"

"REMEMBER ARGENTINA!"

While I have written Blogs about the dangers of a collapsing dollar

and the lessons of the Argentine and Weimar Germany inflation, the circumstances

now appear very different. The biggest risk now is that a galloping, spiraling Deflation

will become a Depression. Deflation is not possible if the Dollar collapses.

And we can readily now see very real signs of deflation, especially in rapidly

falling housing and oil prices, not to mention stock prices. The rising unemployment

and underemployment numbers would seem to make inflation a very low

likelihood.

Gold's rise may now be getting over-done. A 40-day Stochastic shows this.

TigerSoft shows a simple trading system using this tool would have gained an

investor 65% for the past year. That system is very close to giving a new Sell.

NEM's rise (below) from 22 to 42 in the last 3 weeks, almost 100%, would seem to

place it in the over-bought category. A 6-week 120 rally like this in 1998, from 14 to 30

completely evaporated in a few months. You can see all its yearly fluctuations

in a TigerSoft research report -

http://www.tigersoftware.com/NEM-STUDY/index.html

Much of Gold's demand comes from jewelers. But purchasing expensive

jewelry is not high in this year's Christmas shopping list for most hard-pressed

consumers. Mining companies are certainly benefiting from lower fuel costs.

But that may stimulate more production.

When Silver was topping out in early 2008 at $21/ounce and when

Gold was peaking at over $1000/ounce, you could readily find investment

advisors and self-interested coin dealers that were every day readily assuring

anyone who would listen that the Dollar was about to collapse and people

should immediately go out and buy all the silver and gold coins they could find

and afford. Many of these folks are always bullish Gold. But the plain truth

is that markets fluctuate, and so do gold and silver markets. Investors would

do much better not to buy and hold Gold forever, but to use TigerSoft's

charts to spot insider buying and selling and trade their swings. Our TigerSoft

Blogs have offered nearly all the instruction you need if you start using

TigerSoft to catch these price swings.

We have done many, many studies of insider trading. Probably

more than Bush SEC has done, in their non-regulatory, insider-trading-is-OK

mode!

See the warnings we put out this past year as illustrations.

2/21/2008 - TigerSoft on Gold and Newmont Mining's Predictive ...

8/6/2008 - Use TigerSoft's Unique Technical Tools with Gold, Copper and Silver Stocks

9/4/2008 TigerSoftt New Service/Blog - How To Trade Silver (SLV) and SIlver ...

And public comments noting the bottom.

12/10/2008 Tiger Software's Stock of The Day - Newmont ...

See also: Commodity/Futures Trading (1) (2) Commodities Grains

Gold Silver Silver, Gold / Silver Stocks(1) (2) Gold Stocks, Metals Crude Oil (1) (2) (3)

A Look at TigerSoft's Charts of NEM (gold), the Dollar, Yen, Euro,

Crude Oil and Treasuries Show The Dollar Is Stronger Than The Gold Bugs

Would Want Us To Believe.

Gold Stocks like NEM (Newmont) are rallying strongly. Look at the

TigerSoft chart of NEM below. You can see how sharply it turned upwards

just after a successful test of its low near 22 in November. Our powerful

tool, the TigerSoft Closing Power called the turn nearly perfectly.

Now that the stock has reached 40, the "Gold Bugs", investment

advisors that are perpetually bullish on gold and gold stocks, are shouting

that the US Federal Reserve is risking the destruction of the Dollar's value

by giving trillions to banks to stave off a banking collapse and prevent

a 1930's style Depression. They correctly warn that the amount of money

they have put in potential circulation has risen a "staggering 76% in

just 3 months". But, as we all know, banks are NOT lending this money,

not even to each other. They don't trust one another! They are using

these colossal sums to stay solvent and meet the 8% capital requirements

banks have as home prices keep on falling. So this new money is

not going into circulation. "Velocity", like interest rates, is approaching zero!

Will that change? Not until housing prices stop falling is my guess.

Or Obama public works programs change the picture enough to get consumers

to start buying again.

I see a number of problems with their reasoning, when they say that

hyper-inflation lies just ahead.

Gold has a strongly bullish seasonality from mid-November to

mid-January. See Gold''s Seasonal Chart I presented in my Blog on the

Dollar, Gold and Crude Oil back in September 13, 2007. So, some of

the advance we are seeing owes to that seasonal tendency.

It's certainly true that the US Dollar, against a basket of other currencies,

has formed a head and shoulders top in the last two weeks and broken its

recent uptrendlines. See how the TigerSoft Closing Power broke its

uptrend recently BEFORE the top pattern was completed. The Dollar's

downtrend is clearly in effect now.

The US Dollar remains well above its lows of the Summer of 2008.

There is no run on the Dollar, yet!

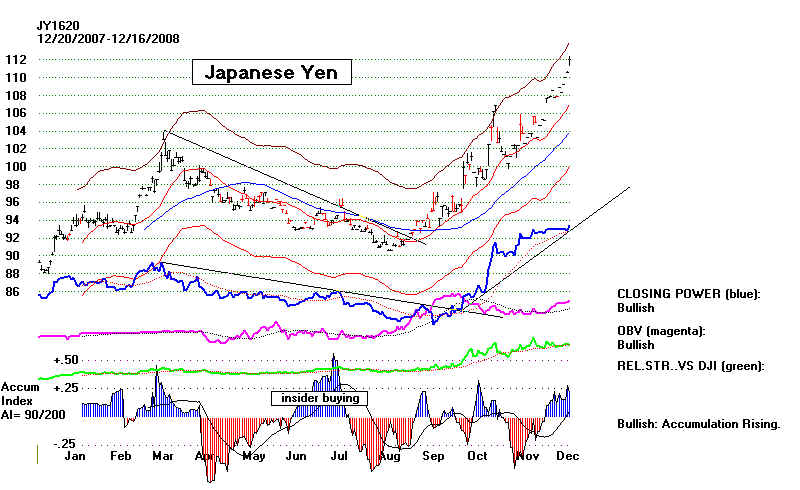

I must say that the Japanese Yen is rising powerfully. It is now

at an all-time high versus the Dollar. It showed bullish Accumulation

and Insider Buying at the bottom and is in a powerful uptrend.

Japanese policy makers may use its strength to cut interest rates

there. That would tend to weaken the Yen against the US Dollar

and prop the Dollar back up.

The EURO has also reversed upwards versus the Dollar. The Tiger

Indicators show that it should go still higher. So, this chart suggests

more weakness is ahead for the Dollar.

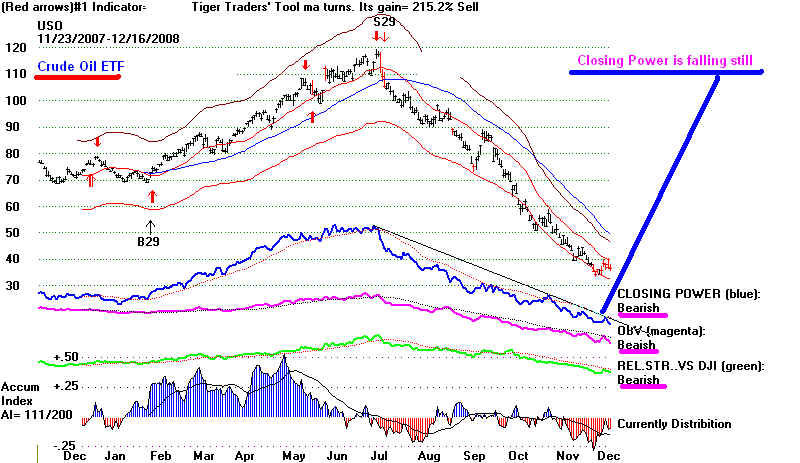

Inflation and a weak Dollar usually take place with rising Crude Oil

prices. That is not true now, or at least yet. Crude Oil, here measured by

the Oil ETF, has fallen by nearly 2/3 from its highs and the Tiger Closing

Power is still declining. So are the other key indicators we watch.

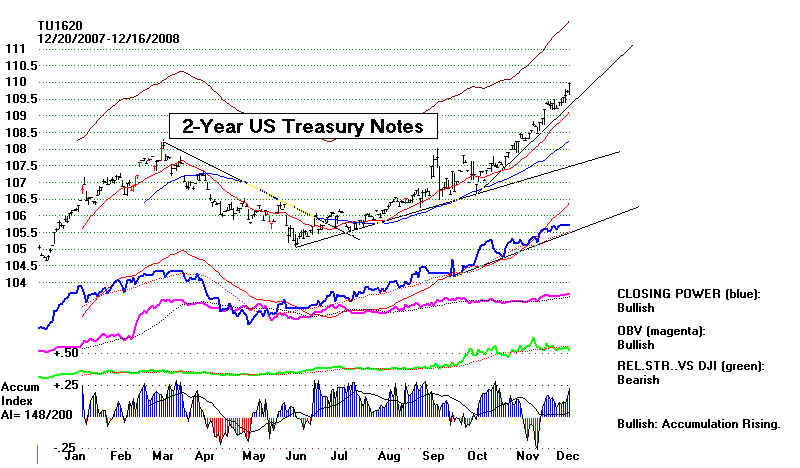

Another factor working against a run on the Dollar is the strength

show in US Treasuries and debt instruments. If the Dollar were really

so weak, we would expect the Federal Reserve to have to raise not

lower interest rates to attract buyers. The fear that is in the stock

market has caused many investors simply to run for cover by buying

US Treasury notes. The Treasury is not wanting for borrowers.

This strength gives the Federal Reserve a lot more room to maneuver.

| Gold

Bugs - Wikopedia says: " The term was popularized in the 1896 US Presidential Election, when William McKinley supporters took to wearing gold lapel pins, gold neckties, and gold headbands in a demonstration of support for gold against the "silver menace",[1] though the term's original use may have been in Edgar Allan Poe's 1843 story "The Gold-Bug,"[2] about a cryptographic treasure map.[3] " http://en.wikipedia.org/wiki/Gold_bug http://www.mineweb.co.za/mineweb/view/mineweb/en/page34?oid=75294&sn=Detail Here is a summary of the document I just received from GLOBALRESEARCH.CA by William Engdahl The Federal Reserve has refused to recently disclose which banks were the recipients of more than $2 trillion in emergency loans from US taxpayers and to reveal the assets the central bank is accepting as collateral. The Federal Reserve is trying to keep "secret that the US financial system is de facto bankrupt" This suggests they are afraid of causing a Dollar panic which could cause "a future Weimar-style hyperinflation perhaps before 2010."

"The total of such emergency Fed lending exceeded $2 trillion on Nov. 6. It had risen

by an astonishing

"Despite this, banks do not lend further, meaning the US economy is in a depression

free-fall of a scale

|