TigerSoft News Service 3/21/2008

Visit our www.tigersoft.com

TigerSoft News Service 3/21/2008

Visit our www.tigersoft.com Chart for 2007-2008 added 9/5/2008

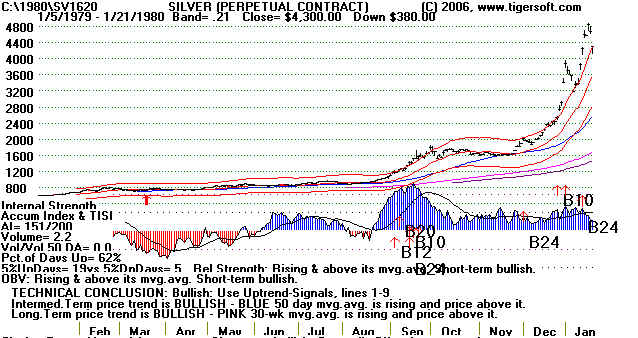

"The Trend Is Your Friend" 27 Years of Silver

Charts Shows You The Proof of This Adage.

"Ruled by The Ruler."

Silver's Trend Is Your Friend. Silver Charts: 1979-2008... Who's Dumping? Does It Matter?

Silver Manipulated? You Didn't Know?

"He Who Sells What Isn't His'n

Will Surely Go To Prison",

unless He Is Short SIlver.

Doubts about SLV, Silver's ETF

A Simple Ruler Can Make You Money

with Silver: Annual Silver Charts: 1979-2008

Weekend Prospecting for Gold and Silver.

. See - http://www.tigersoftware.com/TigerBlogs/Sept-4-2008/index.html

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

|

Tiger

Software Helping Investors

|

HOW CAN SILVER AND GOLD BE FALLING

WHEN US & CANADIAN SILVER DEALERS SUSPEND SALES

BECAUSE OF LACK OF SUPPLY?

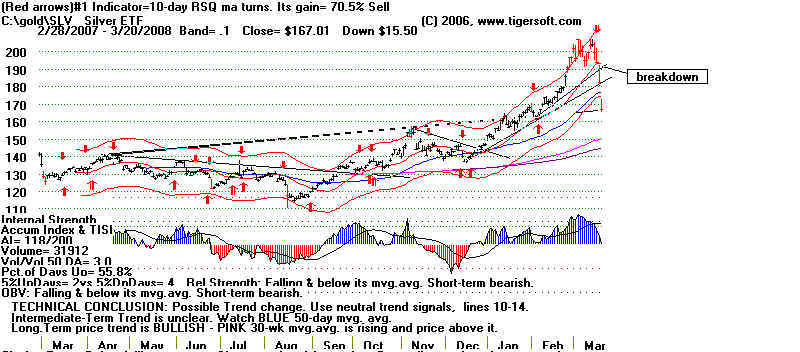

We knew Silver and all the other commodities were over-extended and that they often fall

back quickly once their uptrend-lines were broken. The best clue of the top that I had was

the failure of Gold and Silver to rally this past Monday in the face of the news of the destruction

of Bear Stearns and a further cut in the Discount rate. Usually such news would be bullish for

Gold and Silver. When it failed, we were put on alert and should have used sell stops

just beneath the rising uptrtendlines. The annual charts of Silver since 1990 are shown

at the bottom of this page. You can see from these the importance of using a ruler

(or TigerSoft's "diagonal lines" command) to draw important uptrendlines. The extent

of the decline is very suspicious. That is the subject of this report.

| The Sherlock Holmes Story, The Silver Blaze,

is instructive.It contains the famous episode where Holmes determines the murder because

the dog did NOT bark at him.

"Silver Blaze" focuses on the disappearance of the eponymous race horse, a famous winner, on the eve of an important race and on the apparent murder of its trainer, John Straker. The tale is distinguished by its atmospheric Dartmoor setting, and late Victorian sporting milieu. It also features some of Conan Doyle's most effective plotting, hinging on the famed "curious incident of the dog in the night-time"

( See - http://en.wikipedia.org/wiki/The_Adventure_of_Silver_Blaze

) |

|

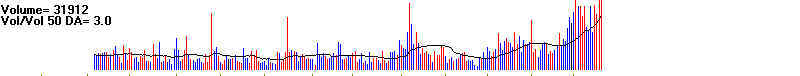

========== Silver

has fallen more than 17% in the

last 4 days ==========

high (red) volume

on the decline.

Why The Big Silver Decline? The Dollar only Got A Techincal Bounce.

Silver dropped by more than 17% this week. Some say this is because the world

economy is slowing down and so world-wide demand for Silver is dropping. China, the

locomotive for the world bull market, has had its banks reserve requirements increased.

Still, since silver coin and bullion dealers can not get there ands on enough silver to

satisfy

demand from investors who want to hedge against the falling dollar, this explanation

though

plausible seems dubious.

Another explanation is that Bear Stearns was long a considerable amount of gold and silver

and that this is now being liquidated quickly and clumsily by the FED which has an

interest

in dampening inflation numbers to strengthen the weak US Dollar. The Federal Reserve

and JP Morgan took control of the bankrupt Bear Stearns for just $2/share on Monday.

This explanation is more plausible because Gold also was down severely this week. It

has its

biggest one-day loss in 28 years.

A more cynical explanation is that a few huge, naked short sellers of Silver are

manipulating

its prices to reduce their rapidly growing losses.

------------------- Rigged, False 33% declines in

Silver Are Not Un-Common -----------------------

-

Physical Silver Is Disappearing.

This week as silver started to decline, dealers

everywhere put essentially the same message

on their Webster and answering machines as this: "Due to

the OVERWHELMING demand for

precious metals, our online ordering system has been unable to keep up with our

customers’ needs.

We have had to disable the (automatic) ordering system to allow us ample time to

upgrade our site

to accommodate the increased demand." See:

http://nationalexpositor.com/News/1113.html,

APEX ,

http://www.golddealer.com/ and http://www.agoracom.com/ir/ECU/messages/768613

http://www.americansilvereagles.com

http://www.coastcoin.com

http://www.nwtmintbullion.com/

"Canadian Maple Leaf Silver Coins Temporarily Out of Stock"

The Royal Canadian Mint has found itself unable to fully meet the

unprecedented demand for silver

Maple Leaf coins with its current supply, and has temporarily suspended shipments. This

situation is

temporary until more of this fine bullion product can be struck and shipped. Because many

of our customers

want to purchase this product at today's prices, Northwest Territorial Mint will accept

orders now for

shipment when the product becomes available, which we expect will exceed 30 days. If the

wait for

product proves too lengthy, we reserve the right to substitute a similar silver

product."

http://www.nwtmintbullion.com/silver_mapleleaf.php

US Government will not wish to aggravate the shortage by continuing to take silver off

the market

Manipulation by A One, Two or Three Shorts

Who Have A Huge Naked Short Position..

Some believe that a few commercial interests are very short silver and are trying to bring

the

prices down. The trading mechanics of how exactly, they would do this is not clear.

But a few very

big players on the short side have every incentive for doing this, especially when chart

players see

a price-trend break and it occurs just before a three day weekend against a backdrop of

fast-breaking

financial news. The four largest traders hold more than 310 million ounces of

silver net short,

while the eight largest traders now hold a record net short position of over 400 million

ounces.

In terms of days of world production, or any objective comparison to any other commodity,

the silver concentrated net short position continues to be "off the charts."

( http://www.investmentrarities.com/weeklycommentary.html

)

A frequent critic of the unregulated Silver shorts is Ted Butler. He follows the

trader

concentration statistics published by the Commodity Futures Trading Commission

(CFTC). They have a

large tax-payer funded budget and are supposed to ferret out manipulation by a conspiracy

of only a few very

big interests. the CFTC monitors the concentrated positions of the largest traders

in every market that it

oversees. It publishes the concentration ratios of the largest 4 and 8 or less traders in

every commodity futures

contract, every week, when it reports these concentration ratios in the long form

Commitment of Traders Report (COT).

Butler asserts that the CFTC does not follow up on the conspiracy-to-manipulate data which

it publishes.

For example., on May 30, 2006, fewer than five large traders in COMEX silver had net

short positions that

amounted to proportionally the biggest short position at any time in history in

Silver.. The degree of "short

concentration" is "far more lopsided" now than for any other major

commodity. "This short position is not

only 3.5 times greater than the concentrated net position of the 4 or less largest long

traders, it is also more

concentrated and larger than any position held by the Hunt Brothers in the great silver

manipulation of 1980"

What makes the present case even more dangerous is that the "total dealer" short

position is much

reduced. :

"The actual numbers state that ... 4 or less largest traders are net short the

equivalent of 181,584,000

ounces, while the 4 or less largest traders are net long 52,506,000 ounces, To put this

short amount into

perspective, it is more than is produced annually on the largest silver producing

continent, North America

(Mexico, US and Canada). It’s larger than the combined total holdings in the COMEX

warehouses and the

silver ETF (SLV). The concentrated net short position is staggering in size."

While

such concentration is a necessary condition for collusion and manipulation, proving that

a conspiracy exists is much harder. That is supposedly why after

the Hunt's tried to corner the Silver

market in 1979-1980, the COMEX strictly limited the size of

individual long positions and regularly

reports them. It does not do this for huge short positions. Accordingly,

silver can be said to rise

without manipulation. But it's falls have often been dramatic. And they are

probably manipulated

by essentially unregulated shorts. Butler claims that this concentrated

short position, which still

persists, is naked short. This runs the risk of a prospective huge default and

failure to deliver.

The CFTC will also not tell us the size of the very biggest short positions. Thus

one entity

may be short much more silver than the Hunts ever bought.

If you think that these huge short positions should be revealed and limited write:

Chairman

Commodity Futures Trading Commission Three Lafayette Centre, 1155 21st

Street, NW.

Washington DC 20581 RJeffery@cftc.gov

Richard Schaeffer Chairman NYMEX/COMEX World Financial Center One North End Avenue

New York, NY 10282-1101 RSchaeffer@nymex.com

Read also - http://www.dollardaze.org/blog/?post_id=00255

| TED BUTLER

COMMENTARY March 18, 2008 Life After Bear Stearns "As previously written, the epic concentrated short position in COMEX silver is a good news/bad news situation. The bad news is that it explains the depressed relative price of silver and accounts for much of the recent price volatility, as the big shorts struggle to create sell-offs with the hope of buying back some of their positions. The good news is two-fold, that it affords the purchase at today’s subsidized low price and will serve as a powerful source of buying on the upside someday. But when? A better question is what may cause the shorts to retreat? "The most logical circumstance that could cause the big shorts to run to cover on the upside is a physical shortage in silver. Remember, the shorts are obligated to deliver real metal, if and when called upon to do so by the longs. This is the shorts’ Achilles’ Heel, that will doom them some day. It is the combination of the extreme concentrated short position and the potential of a physical shortage that portends explosive price action in silver (as distinguished from gold, where no actual industrial shortage appears plausible.) "Of course, by the time we get clear evidence of a pronounced shortage in silver, it is most probable that will already be reflected in the price. In other words, it will probably be too late to buy silver at "reasonable" prices. Therefore, it would seem logical to conclude that we must look for subtle clues that might suggest a physical silver shortage may be upon us. "

|

Silver

Shortage gets Worse, Price Drops Again! (If you don't hold it, you don't own it) by Jason Hommel, March 20, 2008 http://www.silverstockreport.com/2008/shortage.html Three more major silver dealers are reported to be out of silver today: The U.S. Mint, Kitco, and Monex. This, on top of the major dealers yesterday, Amark, Perth Mint, CNI Numismatics, and APMEX, all reported sold out. Further, nearly all of Canada is reported to be out of silver, from Vancouver to Toronto. This is unprecedented, and is a perfect case of market manipulation in the paper market at COMEX and other futures exchanges to see silver prices continue to drop down to below $17/oz. today. Paper promises can be created endlessly, but real silver cannot. This is NOT a case of the dealers getting spooked, and selling out to the refiners just in time, at peak prices. This is a case of the public buying up the stock at coin shops across the world ever since gold hit $1000/oz.. That event finally sparked a little of the public's buying of silver and gold. Thus, the typical coin shop flow of silver to the refiners just stopped in the last few weeks, and especially the last two days. This is NOT a case of the public creating a top with 'everyone' in silver, because nobody's in silver yet. In 2006, only $1 billion was spent on investment silver, which is 0.007% of the $13.5 trillion of money in the banks. As I have long reported, the silver market is so small, there is no room for new investor demand, not even 0.1% of money could be spent on silver, because that would be $13 billion, which would push silver prices to $200/oz., and we are seeing only the tiniest beginnings of that. $13 billion would be almost enough to buy all the silver produced by the mines in one year, which would leave nothing for industry. It would essentially double demand, but supply would remain the same. Furthermore, this is not a top because the public continues to get to the coin shops, and is now getting on waiting lists for silver. The public is not yet in, so how can the price drop? This is a case of price fixing and manipulation...Shortages are evidence of price fixing. Price fixing results in shortages. They are price fixing silver at a below market price over on the paper exchanges in New York and around the world. |

More Reasons for Thinking Silver Is Being

Manipulated

by A Few Big Short Sellers.

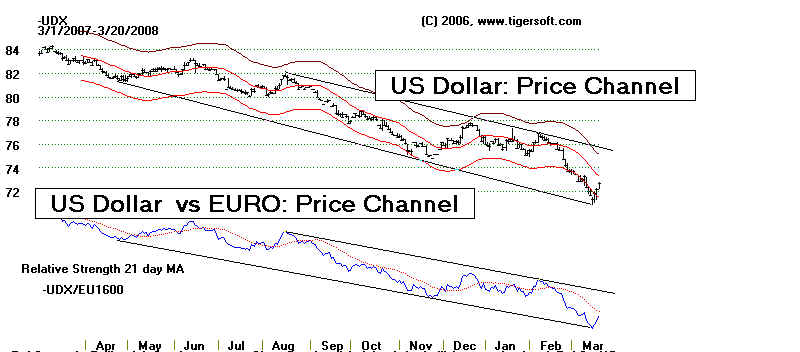

1. The size of Silver's

decline far exceeds what one might expect given

the jump in the US Dollar this week. The Dollar has simply bounced

up from an extremely oversold condition. In the chart below you can

see it hit the bottom of its price channel. It is enjoying a "technical

counter-trend rally".

2. The Asian markets are regularly boosting Silver, but it is declining

when the US markets open.

You can watch this at http://www.kitco.com/charts/livesilver.html

On Monday this week, Silver was up in the overseas markets,

+.51, before the NY market

opened. This was in response to news that Bear Stearns would disappear. In NY

silver

fell to 18.35. The US markets, metals and bank stocks,

seem very manipulated.

Small wonder investors are leaving them in droves.

3. The Silver ETF - SLV - May Not Have The Physical Silver Investors Think

Is This A Scandal That Insiders Are Trying To Prevent.

Cynics have stopped using SLV to own Silver, because they do not believe

the

SLV holds the silver it claims to hold and that they've been supplying the shorts

with silver bullion to suppress the price. SLV is a "fraud", a

"scam". Low

investor confidence in banks only partly accounts for this attitude.

Investors believe there is a

vault in NYC and a vault in London which holds

millions of ounces of Comex Silver Bullion and buying the Silver ETF, SLV, gives

one partial ownership of that silver. This is not the case. Barclay's SLV is backed

to some extent by futures contracts. SLV's newest prospectus, Jan. 20, 2007,

dropped the word "bullion". The new prospectus says: "“The

Trust is designed

to provide a vehicle for investors to own interest in silver." This means

Silver

futures and bangs of silver coins. Is there a difference? Yes. Bullion's

quality is

reliable and easy to track. Silver

coins and Futures are complicated and

un-auditable.

As a result, SLV does not publish a list identifying

its silver bars. It is said

that it has 140,00 or so bars of silver. But there is no transparency for

silver The

gold ETF does publish a daily record of

the gold bars it holds. (Source:

http://www.financialsense.com/fsu/editorials/2007/0919d.html

)

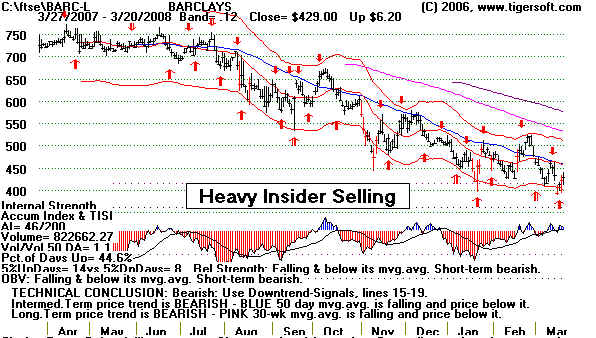

Critics in the UK who have watched the collapse of Northern Rock, voice

concern that SLV is underfunded because Barclay's has had need to sell its

Silver to remain solvent. The Barclay's chart on the London Stock Exchange

does show a steady downtrend and heavy distribution. Defenders of Barclays

answer that the Bank of New York and JP Morgan-Chase Bank are the

custodians of the silver in NY.

Sources: "Can We Trust the Silver ETF?":

By: John Rubino & James Turk

http://news.silverseek.com/SilverSeek/1176161794.php

and

http://www.lemetropolecafe.com/Pfv1.cfm?pfvID=6650&SearchParam=road%20to%20roota

http://www.sharelynx.com/

)

|

SELLING FEAR OF A FALLING DOLLAR

"We face a 75% chance of a financial crisis within five years." "The U.S. does not have more than a 10% chance of avoiding Economic

Armageddon." "We are confronting a day of serious reckoning" "As a nation... we are running on empty." "Gold still represents the ultimate form of payment in the world. Fiat money, in

extremis, is accepted by nobody. Gold is always accepted." "We're facing an unprecedented tsunami... and evacuation is not an option."

"A Category 6 hurricane is threatening our shores - it's the federal budget

deficit - and no one is worried." |

|

GOLD AND SILVER PROSPECTING IN NEVADA AND UTAH.

Gold like this. Would be easy to spot! Most gold is particles too small to see. Want to Go Prospecting? How Do you Find Silver. Gold or Turquoise in America?  "Horn Silver" used to lay on top of

ground in Nevada. "Horn Silver" used to lay on top of

ground in Nevada."In Nevada. Silver there formed strictly on the surface. Over millions of years of desert conditions, silver sulfide minerals weathered out of their volcanic host rocks and slowly turned, under the influence of rainwater, to silver chloride. The climate of Nevada concentrated this silver ore in supergene enrichments. These heavy gray crusts were often polished by dust and wind to the dull luster of a cow horn—horn silver. You could shovel it right off the ground, and you didn't need a Ph.D. to find it. And once it was gone, there was nothing left beneath for the hard-rock miner...The territory of Nevada, along with the states around it, was picked clean in a few decades." ( Soource: http://geology.about.com/library/weekly/aa102598.htm ) Let'e say you have a month and a Winebago and a desire to go prospecting for silver. say in Utah or Nevada, what should you do? Here are some pointers I have found on the internet. 1. Have a working GPS system so that you don't get lost! 2. Small pick, gold pan, metal detector, dry washer amd dredge. http://nevada-outback-gems.com/prospect/Cal_dredge_trip/Cal_dredge_trip.htm 3.. Buy a prospecting book by Richard Pearl.  4.. Do a search for the mines that might be in the area you want to go to. Utah - http://www.mindat.org/lsearch.php?loc=oquirrh Nevada - http://nevada-outback-gems.com/prospecting_info/Nevada_Prospecting.htm 5. Look for hydrothermal sites and baryte. Sedimentary silver. 6.. Find lead. Silver and gold should be near. Gelana (lead) often containes 1% to 2% silver, chiefly as Acanthite. 7. Find Erythrite, which is a distinctively metalic purple.  . . Basic books:    Join a prospecting or metal-detecting meetup in your area: http://metaldetecting.meetup.com/cities/us/ca/san_diego/ |

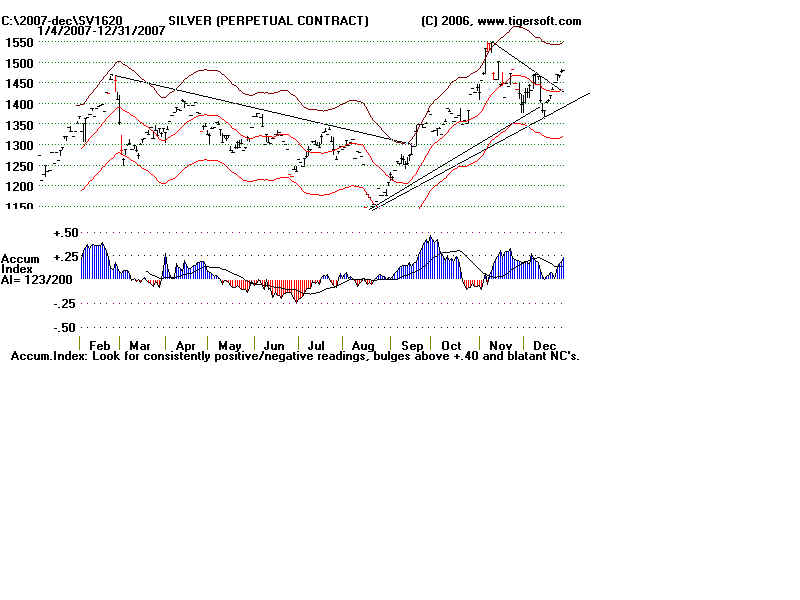

TigerSoft Accumulation Index Charts of Silver:

1979-2008

===========================================================

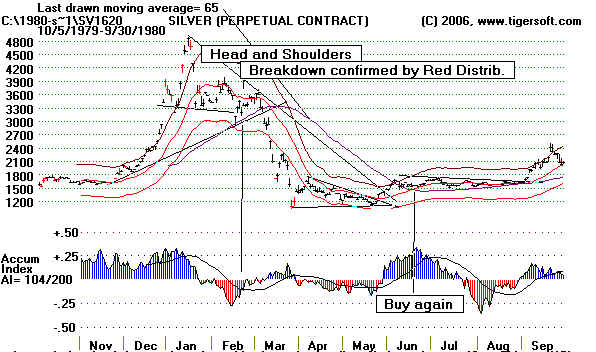

See that huge bulge of Blue Accumulation in August 1979. That is the most bullish

condition we know of having studied TigerSoft charts for 26 years. It set up a

quadrupling

in the price of silver in five months.

1979-1980: The Top in Silver

====================

October 1979 - Sept 1980 Silver ==========================

In the chart below, you can see how TigerSoft used the Tiger Accumulation Index to

confirm breakouts and breakdowns below necklines, support leveles, resistance levels

and key moving averages. Contact us for more information. www.tigersoft.com

======================== 1980-1981 Silver =====================================

The head and shoulders breakdown at 20 was confirmed by red readings from the

Tiger Accumulation Index.

========================

1981-1982 Silver ==================================

Repeated failures to get past diagonal resistance and the key 65-day ma were bearish.

So was the steadily Red Distribution.

========================

1982-1983 Silver ===================================

Swift rises in Silver produce hyperbolic uptrends. Our software lets you draw

hyperbolic

curves to fit the data, so you know when the "hot air" is coming out of the

pumped up stock

dangerously.

========================

1983-1984 Silver ==================================

Another case of valid support breakdowns being confirmed by a negative Accumulation Index.

========================

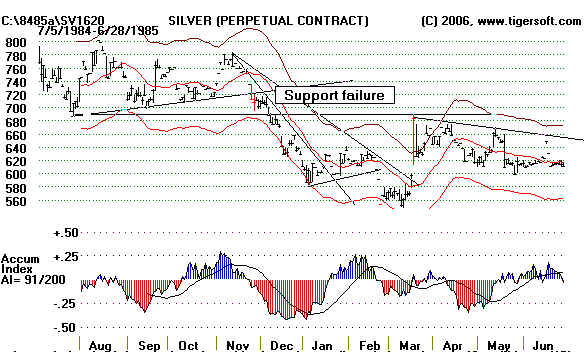

1984-1985 Silver ===================================

Nov. 1985 gives another case of valid support breakdowns being confirmed by a

negative Accumulation Index.

========================

1985-1986 Silver ===================================

Feb. 1986 gives another case of valid support breakdowns being confirmed by a

negative Accumulation Index.

========================

1986-1987 Silver ===================================

The March 1987 breakout was confirmed by a Blue Tiger Accumulation Index.

======================== 1987 Silver ======================================

Get out your ruler when Silver runs up 50% in three months or less. Sell when

the steep uptrendline is violated, even though the Accumulation is blue. This

in May 1987.

========================

1988 Silver ======================================

Look for negative non-confirmations at the upper band. They are bearish.

======================== 1989 Silver ======================================

======================== 1990 Silver ======================================

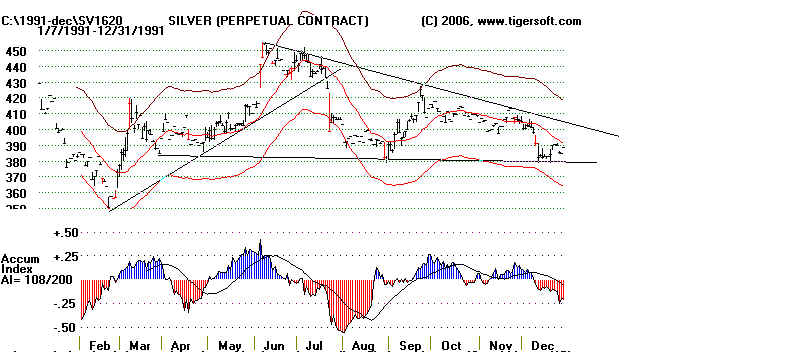

======================== 1991 Silver

======================================

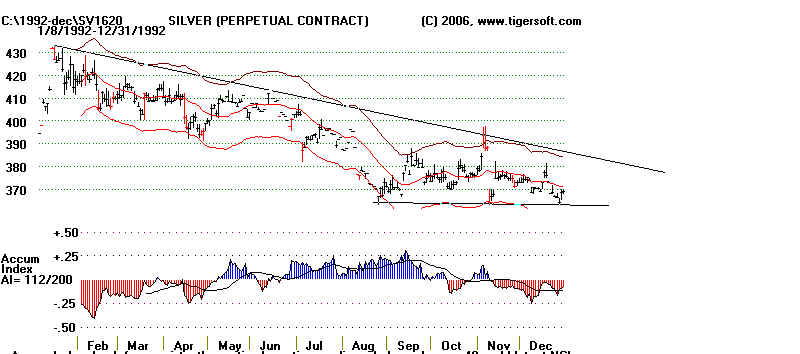

======================== 1992 Silver

======================================

======================== 1993 Silver

======================================

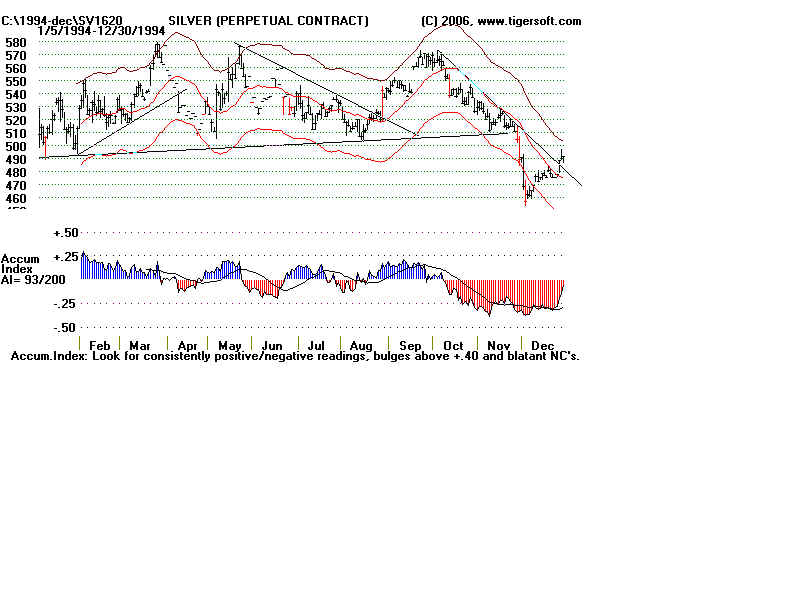

======================== 1994 Silver

======================================

======================== 1995 Silver

======================================

======================== 1996 Silver

======================================

======================== 1997 Silver

======================================

======================== 1998 Silver

======================================

======================== 1999 Silver

======================================

======================== 2000 Silver

======================================

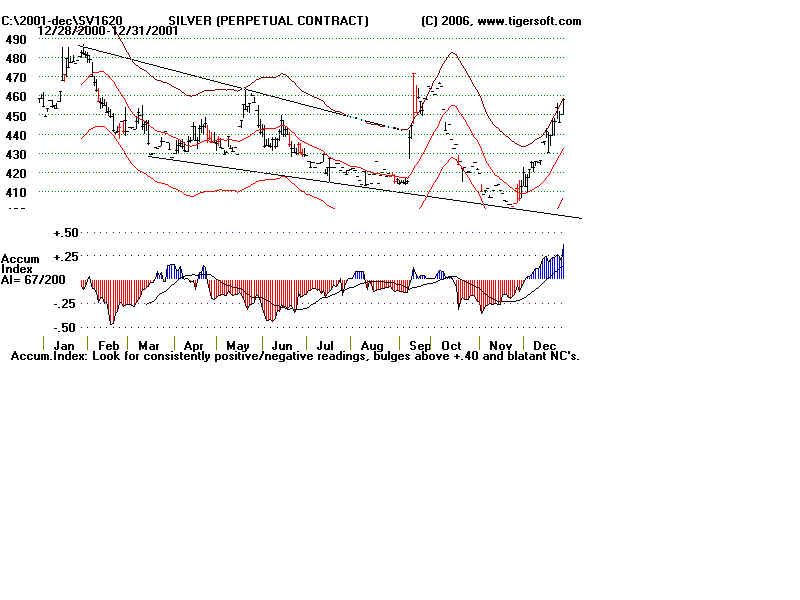

======================== 2001 Silver

======================================

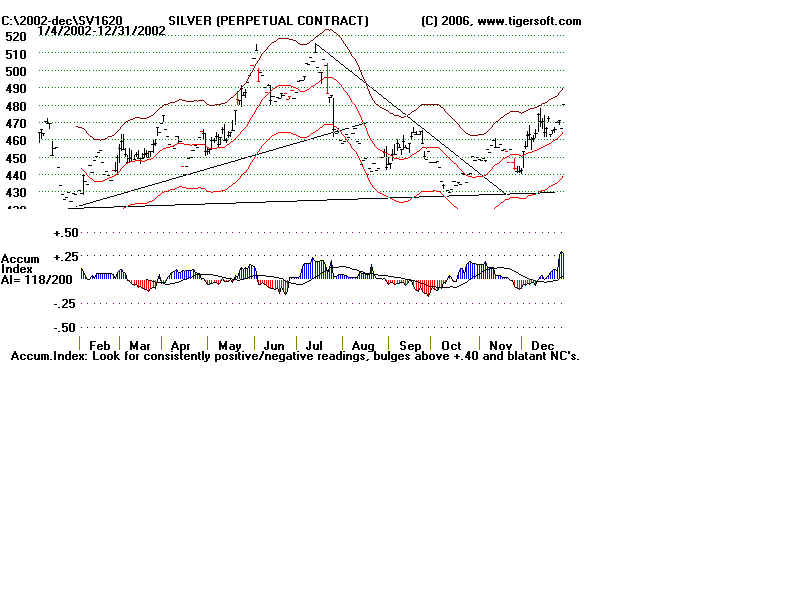

======================== 2002 Silver

======================================

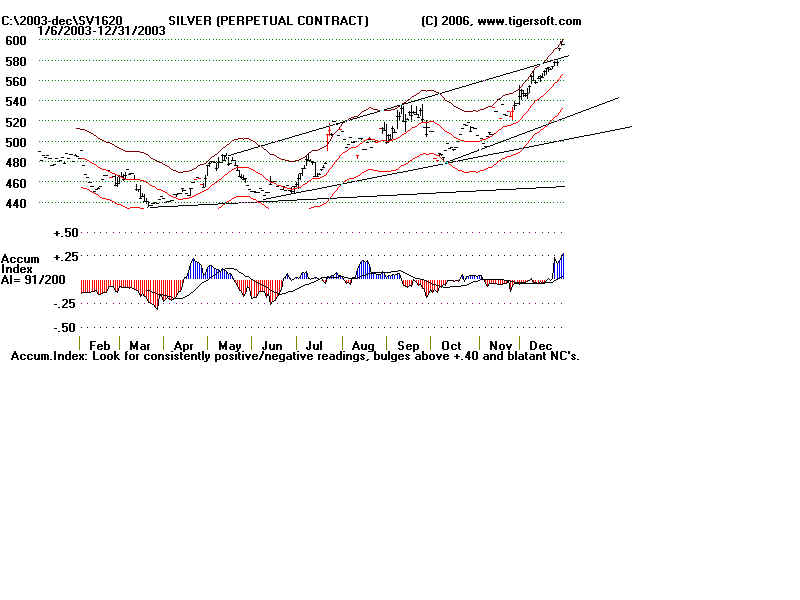

======================== 2003 Silver ======================================

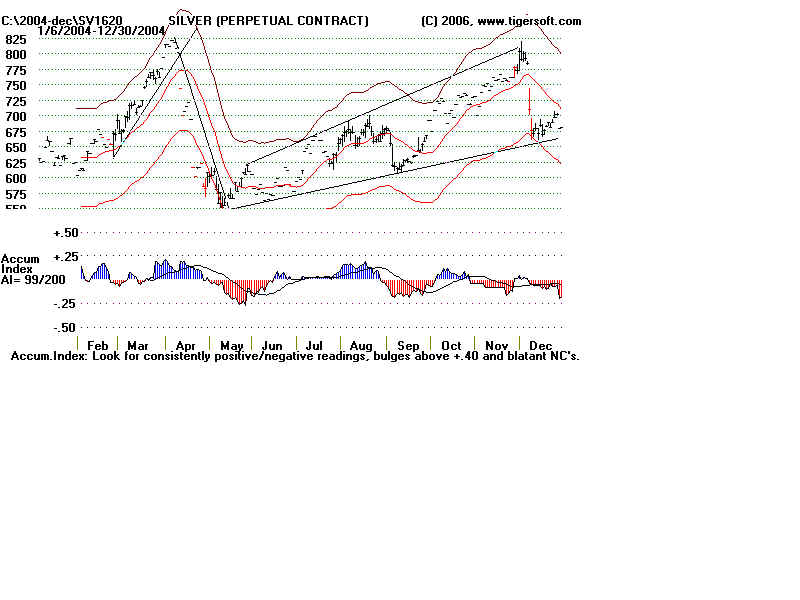

======================== 2004 Silver

======================================

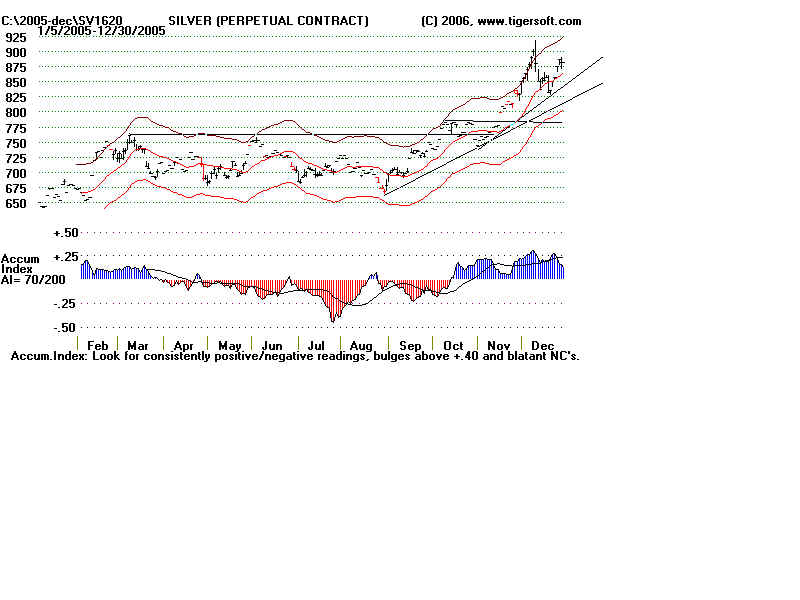

======================== 2005 Silver ======================================

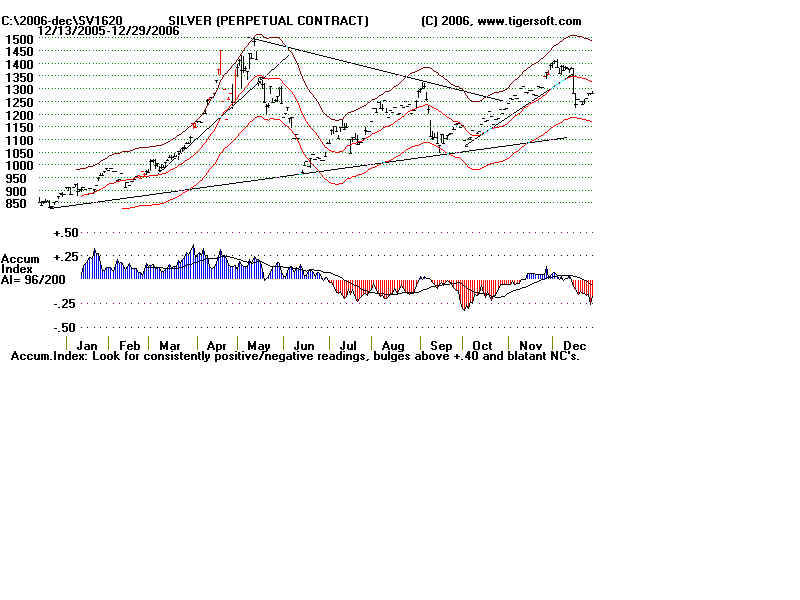

======================== 2006 Silver ======================================

======================== 2007 Silver ======================================