TigerSoft

News Service 10/23/2008 www.tigersoft.com

TigerSoft

News Service 10/23/2008 www.tigersoft.com A DEFLATIONARY SPIRAL

IS THE BIGGEST RISK NOW

Dynamics of The 2008 Deflationary Spiral

ANOTHER DEPRESSION?

NOT IF WE LEARN THE LESSONS OF PAST DEFLATIONS.

SHOULD YOU SELL NOW?

TIGERSOFT GIVES YOU ANSWERS!

by William Schmidt, Ph.D.

Author of TigerSoft, Peerless Stock Market Timing.

Nightly Hotline, TigerSoft Blogs and www,tigersoft.com

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

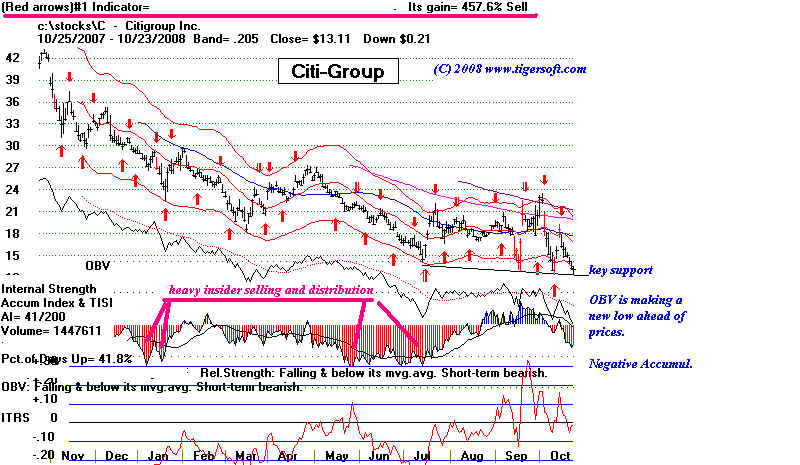

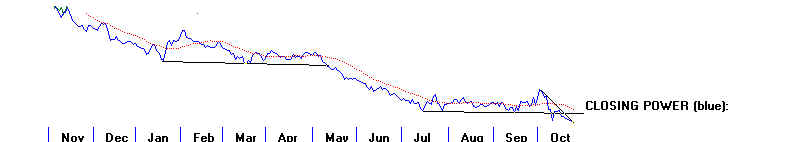

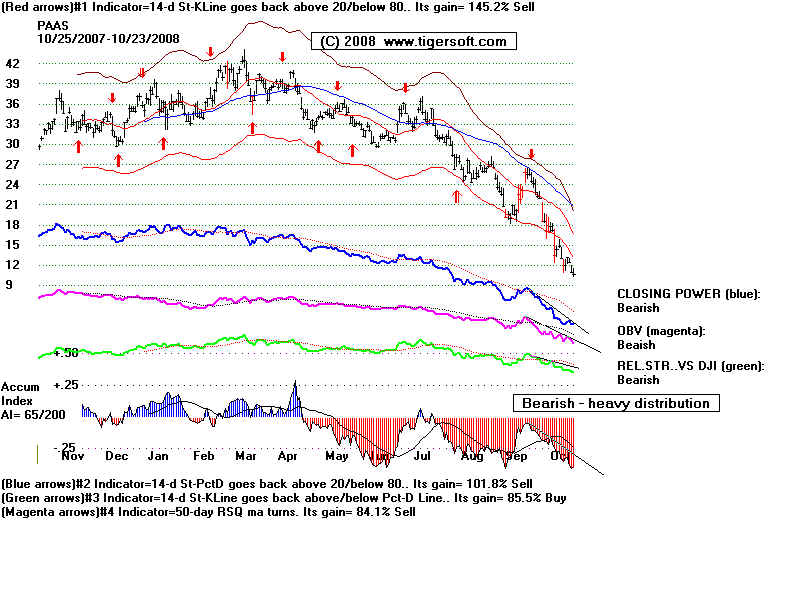

A DEFLATIONARY SPIRAL IS THE RISK NOW ANOTHER DEPRESSION? NOT IF WE LEARN THE LESSONS OF PAST DEFLATIONS. by William Schmidt, Ph.D. (C) 2008 www.tigersoft.com Allan Greenspan says we are experiencing a once in a century financial tsunami, the causes of which he says he does not fully understand. The Federal Reserve and the US treasury are supplying truly massive amounts of NEW credit to banks, almost a trillion dollars since September 3rd. Most of that money is not yet being used by businesses. New hiring is at a stand still. The Fed is pushing on a string. Business confidence cannot be created with liquidity, though it ought to stop a banking panic. I say "ought to". Look at the chart of Citi-Group. The stock shows massive insider selling, distribution and professional selling from t he Opening to the Close. A breakdown below the support level at 12.6 seems highly likely. The measure of aggressive selling (OBV) is making new lows. So does TigerSoft's powerful Closing Power line.   World-Wide Recession TigerSoft's Index of 57 foreign ETFs is now down more than 55% since its May peak. The breakdown in prices in August showed that a world-wide recession had probably started. That sent commodities of all types reeling downward.  All industries and all markets everywhere in the world are in steep declines now. We often here, there's always a bullish trend somewhere. That is not true now. There is no leadership or sanctuary, except CASH. That is a pretty good working definition of DEFLATION. Lessons from Economic History The Bush Administration has very little credibility anymore. Just having a new President will give a big boost to investor and world confidence. Obama will probably win. As soon as his victory is clear, he will do well to tell Americans what his first 100 days will look like. That will remove uncertainty. And it would offer hope, which is badly needed. The biggest problem now is that Obama will not come to power until January 23rd. What he plans to do should reflect the lessons drawn from economics' history.  JM Keynes John Maynard Keynes closely observed the Depression in England from 1929-1933. He had come to his views from within the British Treasury as a key UK representative at the Treaty of Versailles after World War I. He correctly foresaw the economic disaster that lay ahead if war debts and reparations were extracted. He was against trying to extract crippling war reparations from Germany and for the forgiveness of Allied war debts by the US. He was not listened to. England did not fully recover in the intra-war years and Germany was humiliated and impoverished, with the result that Hitler came to power.  Sir Alfred Mond As Keynes watched, the Depression unfold, he dusted off the views of a Liberal politician and creator of ICI, the huge British chemical firm. My own dissertation's research of UK Cabinet Papers shows that Alfred Mond, as First Commissioner of Works from 1916-1921 in the Lloyd George Coalition government ardently advocated for massive public works' expenditure, saying that the soldiers coming home from World War I should be given dignifying work to repair the infrastructure of Britain after its long neglect, because of World War I. He wanted private investment to become more productive. He was from Swansea, Wales. He wanted a jobs creation program in places where it would be most needed. Mond was very prescient. His views were squelched in the Cabinet by Conservative Austen Chamberlain, the Chancellor of the Exchequer and brother of Neville Chamberlain. My dissertation showed that Chancellors in the intra-war period always pursued policies of retrenchment, short-term balancing the budget and protecting the Pound, no matter the level of unemployment and economic suffering. Keynes, the economist, in the 1930s, contended that left to themselves (laissez-faire) economic conditions would worsen in a recession, when there was deflation. This was his central proposition. The economy would not be self-righting as classical economists had maintained. In his General Theory of Employment, History and Money (1935) he made a number of points which have transformed economic theory. In a deflation era, wages and prices are falling; confidence wanes and so money is hoarded and not invested. The expectation of falling wages and falling prices becomes self-fulfilling as businesses postpone or cancel new projects. Because deflation favors creditors, wealth is re-distributed towards the rich. But they spend a smaller proportion of their income than those of modest means, so there is under-consumption, in general. And that makes for over-production, lay-offs and falling wages and prices. A deflationary spiral develops. To break the deflationary spiral requires the government to give tax breaks to working people or launch public works' job creation programs, even though, in the short-run, this causes a budget deficit to grow. Since workers will spend nearly all of any extra money they get through tax breaks or new jobs, that will have positive reverberations through out the economy. A single dollar in tax breaks for a worker or a single dollar paid that worker in a new government created job will add $3 or $4 dollars to GNP. In this way, fuller employment can be regained and the surplus of unsold goods will get absorbed. Businesses will start to make profits again. Confidence can be regained. And, as economic prosperity is restored, more taxes start coming in and the federal budget will become more balanced. Historic Examples UK 1926-1939 Britain went back on Gold Standard. Unemployment remained high. Public works programs were not pursued. Instead, there was one round after another of belt-tightening budget cuts. Protecting the Pound became the orthodoxy of the British financial establishment. In the 1930s, Neville Chamberlain, as Chancellor of the Exchequer and then as Prime Minister, fought Churchill in British Cabinet meetings, and opposed increased defense spending, even as Nazi military power grew. JM Keynes, the famous economist, witnessed first hand this deflation and advocated public works programs, since deflation, he said, was not self-correcting.  Herbert Hoover - President - 1929-1933 US 1929-1933 By 1929 wealth had become very highly concentrated. But the rise in stock prices in the 1920s has produced an abundance of confidence and credit. so jobs were plentiful and working people could bottom to buy what they needed. The market's steep advance was fueled by margin rates of 5%, not unlike the US Housing bubble from 2003-2006. In 1928, the Federal Reserve hiked interest rates. In Europe, financial empires started to topple. In the Fall of 1929, the stock market crashed 49% in only 3 months. As now, the stock market CRASH caused credit to shrink, confidence to disappear and unemployment to rise. Commodity prices fell, as did the prices for producer goods, though commodity prices fell more because commodity production was more inelastic. (In 2008, we see the same phenomenon. - See the TigerSoft charts at the bottom of the page and elsewhere. Financial institutions failed left and right. Personal and business bankruptcies were commonplace. (My grandfather built and sold houses. When the Depression came, he could not sell them and went bankrupt.) Foreclosures on homes and farms soared. People could barter for what they needed in rural areas. But in the city, 25% of the people were unemployed by 1933. Hoover, his band of classical economists and financiers believed that the best medicine for the economy was for the government to tighten its belt. Workers should take smaller wages, so that businesses would be able to hire them. The decline in the stock market was beneficial because it would wring out dangerous speculators. and wealthy. The economy should be left to itself to recover. Balancing the budget was seen as necessary to get rid of wasteful spending. The Federal Reserve did not loosen credit. The Dollar was strong. Banking circles liked the international business that a strong Dollar created. They liked being paid back with Dollars that bought more than when they made their loans. And, so, Hoover, and his friends among classical economists and bankers waited for the recovery that they thought would come naturally. They waited in vain. The Stock Market fell from 383 to 43 shortly before he left office. Without investment confidence and with investors a lot poorer, businesses contracted, consumption shrunk, as did wages and unemployment reached 25% in early 1933. This further dropped US government revenue. Deflation spiraled out of control and turned into a Depression. Monetarists claimed that if the Fed had been more accommodating, the worst of the Depression might have been avoided. Keynesians say that demand for goods and services needed direct stimulation through fiscal policies, reduced taxation and public works and government spending. Japan 1990s-2000 After Japan's stock market crashed in 1990-1992, the Bank of Japan tried to remedy the debacle by lowering interest rates. Though interest rates there approached 0%, the Japanese economy remained sluggish. Only the Global Bull Market of 2003-2007 ended the long stagnation. Interest rates reductions by themselves did not overcome a spiraling lack of confidence and deflation. The collapse of real estate prices in Japan was similar to what has happened in the US. "Banks lent to companies and individuals that invested in real estate. When real estate values dropped, these loans could not be paid. The banks could try to collect on the collateral (land), but this wouldn't pay off the loan. Banks have delayed that decision, hoping asset prices would improve. These delays were allowed by national banking regulators. Some banks make even more loans to these companies that are used to service the debt they already have" Japanese Banks had a higher percentage of loans which were "non-performing". That limited their ability to lend more money and shrunk their cash reserves. In this situation, Japanese people became afraid of bank failures and preferred to buy Gold or Treasury Bonds (especially American). The deflationary spiral in Japan was intensified by the availability of inexpensive Chinese manufactured goods. China Chinese productive capacity keeps expanding. The pricing of exports from China are a key. Low priced imports make for deflation. As the US Dollar strengthens, imports from China will accelerate, hurting US production and jobs. (Source: http://en.wikipedia.org/wiki/Deflation ) Readings http://www.voxeu.org/index.php?q=node/2384 SHOULD YOU SELL NOW? The DJI is down 35% just since its May 2nd peak this year and 26% from its August 11th peak. How much worse could it get historically? In the 1987 Crash it fell 36.5%, from a zenith of 2722.42 on August 25th to a low of 1738.74 on October 19th. Such a decline from the August peak in 2008 to a bottom 36.5% down would bring a DJI decline to 7471. The DJI is already down more that it was at its bottom in the 1962 or 1974 bear markets, after 9/11/2001 or in the 2002 bear market. The 1929 Crash saw a 49% decline. If such a drop occurred today from the August peak, we would see 6100. I like the 7440 level because that would mean a 50% retracement of what the DJi gained from its August 1982 low to its July 2007 peak. 50% retracements are very common. COMMODITIES' DECLINE AND DEFLATION What is happening to commodities is awful. At the top of page you see the last year's prices for Crude Oil. It has had a surge of buying (a bubble) and then a surge of selling (the bubble burst). Commodities often go through these cycles. Hedge fund over-speculation using very high leverage and precious little regulation has brought us to where we are now. Look at the DJI chart of 19 commodities (foods, fuels, lumber and metals.) It is down about 30% from its July peak. Commodity prices are very volatile. They usually are weaker than the prices of producer goods or wages in a Deflation. Supplies are inelastic. Even a prices fall, a farmer will still harvest all the wheat he can.  Dynamics of The 2008 Deflationary Spiral These bearish tendencies were made much worse by the removal of limitations on short selling and the failure to regulate credit default swaps. 2006 Housing Bubble Break ---> Lower Housing Prices ----> Consumer buying power declines sharply. ----> Foreclosures and housing prices fall more. ---> Bank Insolvency and Financial Crisis ---> Extreme commodities speculation driven by trend-following investing seeking performance and lack of alternatives. ---> Rising commodity prices further exhaust consumers' buying power. ---> Heightened bank panic. ----> Commodity bubble breaks .... Hedge Fund De-Leveraging ---> Commodity Panic ---> US White House Scares Country by Demanding $700 Billion to save banking and financial system. ---> Steep and Broader Stock Market Decline ---> Investor Buying Power Drops ---> Further Drop in Consumer Spending ---> Weakness in Commodity Exporting Economies around the world. ---> Wage Deflation and Increased Unemployment ---> Foreign Currency Weakness ---> Producer Country Inflation and Economic Suffering ---> Overseas Markets' demand, except for China, drop sharply. ---> Political Instability ---> Pressures to nationalize mineral production ---> Further decline in stock markets. How TIGERSOFT Trades Commodities and Commodity Stocks TigerSoft gives automatic buys and sells on commodities and stocks. We teach traders and investors to watch for the tell-tale signs of insider buying and selling. Learn to see what professionals expect by watching TigerSoft's unique Closing Power. The Closing Power trends are still down for Gold, Silver and and stocks like NEM, SSRI and PAAS. People using these charts would have almost certainly saved many thousands of dollars But prices never only fall. Even in 1929, there was a 48% recovery of what was lost in the first big decline, known as the October Crash. A 50% retracement in a stock Newmont from say a low of 20 back to its high of 55, would bring back to 37.5. -------------------------------------------- NEM ----------------------------------------------------- Newmont Gold  --------------------------------------------- PAAS --------------------------------------------------- Pan American Silver  ---------------------------------------------- SSRI --------------------------------------------------- Silver Standard  See also: October 18. 2008 The Rise and Fall of Commodities' Hedge Funds Pump and Dump - Oil, Silver, Gold, Corn, Wheat - It's All The Same. Systemic Failures: The "Free Market" Is Too Expensive. Causes of the Crash of 2008. October 11, 2008 The Causes of The Stock Market Crash of 2008. Nouriel Roubini's Prescient Warnings Two Years Ago And Recommendations Now. How Close Are We To A Bottom. Bush and His Crew Are Wrecking Retirement Accounts.

|

| |