TigerSoft Freedom News Service 9/4/2008 www.tigersoft.com

How To Trade Silver and Silver Stocks

Much More Profitably

Case Studies of Silver, PAAS and SSRI

(Pan American Silver and Silver Standards)

Where Is Their Likely Support Now?

Test Your Understanding of These Concepts

with another Silver Stock:

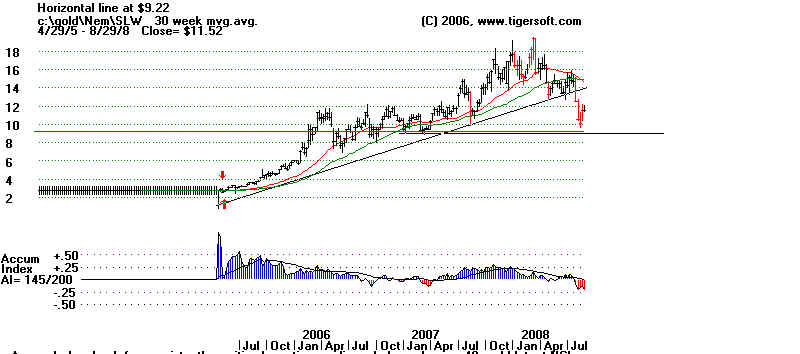

(Silver Wheaton and SLW)

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

See the TigerSoft techniques for find Explosive Super Stocks: Oil Coal

|

Tiger

Software Helping Investors since 1981

|

Limited Time Special Offer Introductory Stock Software |

How To Trade Silver and Silver Stocks

More

Safely and More Profitably

by William Schmidt, Ph.D.

(Columbia University)

(C) 2008 All rights

reserved. Reproducing any part of this page without

giving full acknowledgement

is a copyright infringement.

------------- Tiger Index of 6 Silver

Stocks -----------------

Silver

Stocks include:

Silver Wheaton Corp.

(NYSE: SLW),

Helca Mining Co. (NYSE:

HL),

Coeur d'Alene Mines

Corp. (NYSE: CDE),

Silver Standard

Resources Inc. (Nasdaq: SSRI),

Apex Silver Mines Ltd.

(AMEX: SIL)

Pan American Silver

Corp. (Nasdaq: PAAS).

------------- Silver

and Gold Yearly Charts

-----------------

We are told that SIlver and Gold prices are manipulated.

That's nearly always the case. It begs the question of

which direction do the manipulators want prices to

take. TigerSoft's Accumulation Index and Closing Power

go a long way to answer this question. Only

TigerSoft

offers these tools.

Watch the Trend!

TigerSoft's Closing Power's Trend Is Your Friend

We

are also told that a big Lehman Commodities

fund is now liquidating its

positions, hence the big sell-off.

That helps explain the particular decline we see now.

But it will not help us in the future. It will be better to

understand that precious metals swing violently much

of the time, sometimes up and sometimes down. Our

job is to watch for the tell-tale signs of trend-reversals

that occur in cycle afer cycle.

Lessons We Can Widely Apply To Trading

Silver and Silver Stocks More Profitably.

(1) Silver and Gold Should Regulalry Be Compared with Crude

Oil

and The Dollar

A rising

Dollar hurts Gold and Silver. A falling Dollar helps.

When

crude oil prices rise, it puts pressure on the Dollar because

of how much oil the US

imports. When the Dollar weakens, as it had

for several years until this

Summer, Gold prices rise as investors try

to beat inflation. While

Silver is more a commercial metal, and can

sag like crude oil because of a

recession, it is also widely promoted

as a hedge against a falling Dollar.

(2) Watch the Tiger Index of Foreign ETFs to spot the

type of global

economic weakness which

will hurt the global demand for Oil

and Silver.

It is significant now that foreign ETFs (exchange

traded funds that

represent different

countries' stocks) have broken below their

support and are in a

downtrend. Demand for silver is waning.

Gold usually holds up

better in this environment.

When the DJI cannot rally in the face of sharply falling oil prices,

it is a warning about how eak the overall economy is. As I finish

this Blog this is

alarmingly true.

TigerSoft predicted the

world bull market was ending in November 2007 by seeing

many head and shoulders

patterns in foreign ETFs.

http://www.tigersoft.com/Tiger-Blogs/11-22-2007/index.html

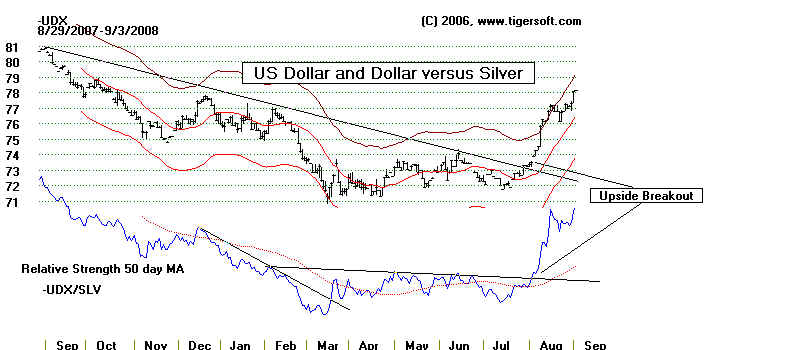

(3) Precious Metals Have Recently

Fallen Sharply.

A decline in metals' spot prices drops

mining companies'

shares to the extent that

they have not hedged their selling prices.

In late July

2008, the Dollar (See below.) reversed its down-trend.

That was matched by gold and silver

falling sharply.

You can see that the quotient of the Dollar divided by Silver

broke its downtrend a few days before the Dollar completed its

reversal pattern and turned

up. Someone watching this chart

closely

would have been given advanced

notice that Silver would become weak.

The fall in Crude Oil prices is a

reasonable explanation for the rise in

the Dollar. But it works in

reverse, too. When the Dollar is worth more,

it buys more Crude Oil. It is

quite probable that the Administration

has orchestrated a rise in the

Dollar and a concurrent fall in the

price of Crude Oil, to make

Republican chances better in November

for the Election. This also

happened in the 3rd quarter of 1976, only

to be followed a super rally in

Silver and Gold when the Democrats

came into office.

----------------------- US Dollar and Dollar/Silver

-------------------------------------

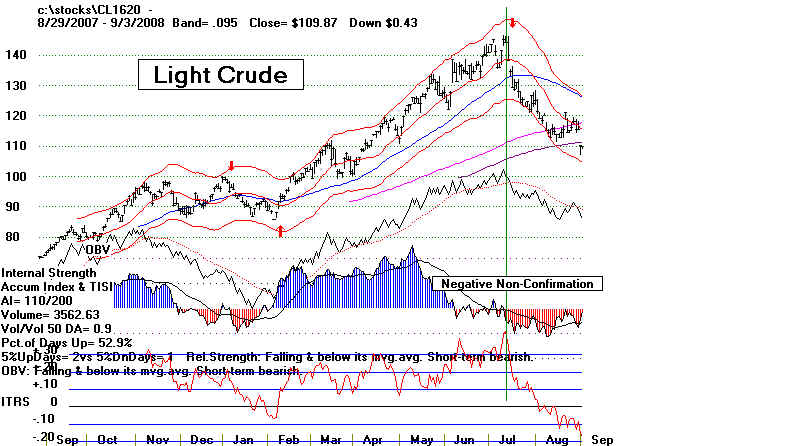

(4) Use

A Ruler To Spot Changes in the Direction of Commodity Swings

Commodities tend to run together.

More and more hedge

funds

and mutual funds are trading commodity ETFs.

That

puts extra pressure on prices. They have always had booms

and

busts historically. Their

advances very often come in

big

spurts. Their uptrendlines are hyperbolic. The chart

of

Crude Oil now shows how simple trendlines would have

helped spot the points in time when prices changed direction.

Since silver prices are historically very volatile, it is important

not

to fight their trend.

I wrote a Blog on 3/21/2008 and talked about how silver is

often manipulated on the short side

with impunity. Displaying

all of Silver's charts since 1979,

I showed that somone using

just a ruler ought to be able to

make money in it regularly.

See these concepts and all the

charts at

http://www.tigersoftware.com/TigerBlogs/3-21-2008/index.html

(5) Use Downside Projections.

Classic technical analysis postulates that a breakdown from

a trading range typically sets up a

minimum downside objective

that can be reckoned by

supbtracting the height of the trading

range from the point of breakdown.

Here the height of the pattern

was "A", about 4.30

points and the point of breakdown was 16.

That sets up a minimum downside objective of 11.70 with Silver now.

----------------------- Silver and Gold Prices

-------------------------------------

----------------------- Crude Oil (Perpetual Contract) -------------------------------------

Crude oil has sliced through its rising 200-day ma with negative

(red) readings from the Accumulation

Index. This is bearish,

though the fact that the (black) 200-day

ma is rising usually means there

will be a rally back to the point of

breakdown of this ma.

(6) Use

TigerSoft's Accumulation Index To Spot Reversals

Crude Oil is in many ways the key now to predicting

Gold and

to a lesser extent silver.

Experienced TigerSoft users know to

watch our Accumulation index

closely. Bulges of Blue Accumulation,

especially on a price breakout from

a base, are very reliably

bullish. But after a long advance, a new price high that occurs

with the Accumulation Index

negative, or nearly so, is often making

a significant top. The July peak in Crude oil (above) showed such a

bearish negative non-confirmation.

Similarly, we want to watch

for new lows being made with the

Tiger Accumulation Index positive,

Newmont, a gold stock, illustrates

this below.

----------------------- Newmont Mines

(Gold Stock) -------------------------------------

(7) Use TigerSoft's Closing Power To Spot

Reversals

There was another bearish aspect to

Oil's advance into July.

It was too quick. It

had "bubble characteristics" in the sense that

both Tiger's Opening Power

(public buying) and Closing Power

(professional buying) were

rising simultaneously. This makes for

an exciting climax in prices.

But when the Closing Power breaks its

uptrend, it is bearish.

Traders will usually make money looking

for these situations and

going short. See the Opening and Closing Power

for Crude Oil in the chart

below.

----------------------- Crude Oil (Perpetual Contract) -------------------------------------

(8) Study individual silver stocks like SSRI and PAAS for signs of red

(bearish) distribution, (bearish)

false breakouts, (bearish) head and

shoulders tops and (bearish)

violations of well-tested support.

For more information on "false breakouts" see:

http://tigersoft.com/Tiger-Blogs/11-15-2007/index.html

and

http://www.tigersoftware.com/Breakouts/index.html

TigerSoft predicted the

world bull market was ending in November 2007 by noting how

many

head and shoulders patterns were appearing in foreign ETFs.

http://www.tigersoft.com/Tiger-Blogs/11-22-2007/index.html

So

long as the Accumulation Index is below its falling moving

average and the Tiger

Closing Power is falling, it would be best not

to try to call a

bottom. Guarding capital should be the #1 rule for

traders and investors.

------------------------------------------- SSRI --------------------------------------------------------------

--------------------------------------------------- PAAS -----------------------------------------------

(9) Study individual

silver stocks like SSRI for important clues about

where professionals think the stock is headed. A falling Closing

Power trend is bearish. That the public is bullish, shown by

a rising Opening Power, is usually not enough to keep the stock

from falling.

======================= SSRI ==============================

======================= PAAS ==============================

(10) Look at Weekly Charts To

Find Support on A Steep Decline.

Below are the 5-year charts of Silver, Pan-American Silver (PAAS)

and Silver Standards (SSRI).

Earlier lows are commonly used to try

to call a bottom. But when

prices fall very, very steeply, it may seem

like calling a bottom in this

environment is like catching a "falling knife".

----------------------- Silver Stock - PAAS -------------------------------------

PAAS formed a head and shoulders top

with a neckline

at 30. The height of its pattern

was 43-30. Taking the height

of the pattern, 12 points from 30, yields a downside price

objective of 18 using classic technical analysis techniques.

A rally back to 30 would then be a distinct possibility technically.

Traders would expect a rally of 33% to 50% of the amount lost

from the high to be recovered.

----------------------- Weekly Silver Stock - SSRI -------------------------------------

It is hard to be constructive about SSRI's technical picture.

It should find support at 20, but how much will it rally?

The weekly chart of SSRI shows a bearish head and shoulder top.

The right shoulder displays negative (red) distribution. The height

of the pattern is about 20 points highs. The breakdown point

was about 25. This too-simple approach warns that it could drop

back below 10. Traders should understand that It is not

safe to buy until is breaks its price downtrendline. And any rally

from 20 back to 25-26 should be used to sell, as a precaution.

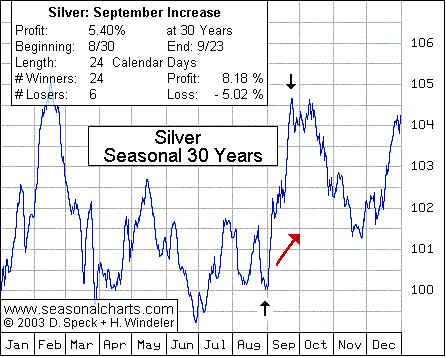

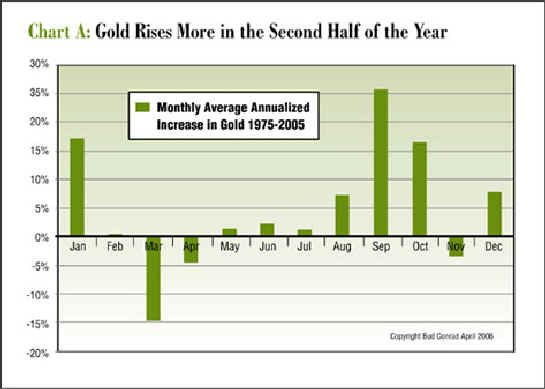

(11) Use Gold Seasonality to Help

You Look for Tops and Bottoms.

When Silver goes opposite to the direction expected by

Seasonality we should certainly be cautious. It should

by

seasonality be rallying this month, instead it is falling.

The chart

and the data below show how Silver did from 1973-2003.

Silver also

rose in September each year, 2004-2007, That means

it advanced

in September in 27 of 33 years.

The 'Silver: September Increase' is

the seasonal rise in silver, starting

on August 30 and ending on September 23. The increase was observed

in 24 of 30 years, resulting in an average profit of +8.2%. But there were

also 6 years, where the price of silver fell during this period of the year.

The average loss then was -5%. The overall rise during all 30 years was

+5.4% p.a.

( http://news.goldseek.com/GoldSeek/1061908537.php

)

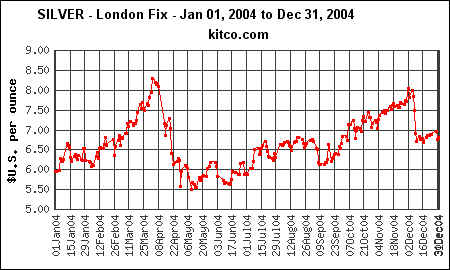

Silver 2004

Silver was up.

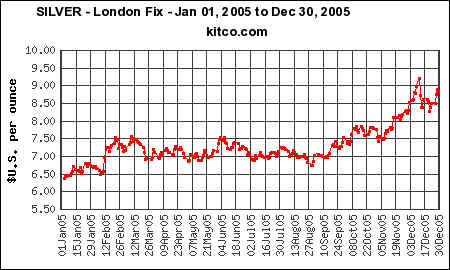

Silver 2005

Silver was up.

Silver 2006

Silver was up.

Silver 2007

Silver was up.

======================================================

Apply These Concepts to Another SIlver Stock,

SLW