TigerSoft News Service

7/27/2008

www.tigersoft.com

SWEETHEART 2008 HOUSING BILL:

1) IT BAILS OUT MORTGAGE LENDERS,

2) PROPS UP BLOATED HOUSING

PRICES,

3) PREVENTS HOUSING FROM

BECOMING AFFORDABLE,

4) ADDS ANOTHER TRILLION DOLLARS

TO US NATIONAL DEBT, WHICH MAY

REALLY SPOOK STOCK MARKET.

(See Peerless Stock Market Timing

Chart at bottom of this page.)

and

5) HOME MORTGAGES THAT BANKS

DON'T WANT NOW BACK THE

US DOLLAR.

by William Schmidt, Ph.D.

Author of TigerSoft Insider Watch Software

Tiger Software - Helping Investors since 1981

Make Your Retirement Grow

Main Tiger Page

Suggestions:

Peerless Stock Market Timing: 1928-1966

Track Record:

:Major Peerless Signals on DJIA charts

7 Paths To Making 25+%/Yr. Using TigerSoft

Finding Explosive

Super Stocks

Early in Their

Move.

Research: +36%/Year since 1990

Research: Top Performing Stocks of 2006-2007

Killer Short

Selling Techniques

Index Options

FOREX trading

Investing Longer-Term

Mutual Funds

Speculative Stocks

Swing Trading

Big Profits from TigerSoft

Automatic Buys/Sells

Day Trading

Stock Options

Commodity Trading

Despite the decline in the housing market, homes

are still not affordable to millions of Americans. For

most Americans, the new Housing Bill will make them

less affordable. It will artificially prop up home prices

by preventing foreclosures and giving an UNLIMITED

line of credit to mortgage company giants, Fannie Mae

and Freddie Mac. They now handle 75% of new home

mortgages. That percentage will rise sharply, as the

limit on the size of the mortgages guaranteed by

Fannie and Freddie is boosted from $417,000 to

$625,000,

So, if you liked the Federal Reserve's $300 billion

bailout of central banks, you'll love this Housing Bill.

The US Treasury can now buy ALL Fannie Mae and

Freddie Mac home mortgages. Previously, the

Treasury had been allowed to buy only $2.5 billion in

housing mortgage securities. Now there are no limits.

The Dollar is now to be backed up by home

mortgages that banks cannot sell because nobody

wants them.!

More Affordable Housing?

(1) States will get $4 billion in assistance in buying

up boarded-up, foreclosed homes. They may offer

some of these to those who promise to fix them up.

(2) Down payments for FHA loans are dropped

to $3.0% from 3.5%.

(3) New home buyers are thrown a tax credit of

$7,500 in the new housing law.

The changes will help some people. But banks'

lending standards are now much tighter. The 20%

decline in home prices in California, for example,

means little when the median home price is still over

$659,000 in many suburbs of San Francisco, Los

Angeles and California. The central problem is

that housing prices are still way too high for most

working people. |Left to the free market, home prices

would certainly fall much more sharply. Such declines

would make homes more affordable. But Congress

is under too much pressure from banks to allow

a free market. So, risk has been nationalized

and profits have been subsidized.

Real Incomes Drop in US

as Wealth Concentration Accelerates.

Real incomes are dropping every bit as fast as

housing prices in the economic slowdown. With

gas prices now over $4.10 a gallon, someone

driving $12,000 miles a year, and getting 20 miles

per gallon, who is paying $2.00 a gallon more than

even two years ago, has $1200 less a year to spend.

Couple that with a real inflation rate of 6% to 7% a

year, and you can see the problem. Wealth is

just too concentrated to let ordinary working

people buy new houses. The richest 1% own

more than 90% of the wealth in the US. This is

the highest figure since 1928. In 1976, the top

one percent received 8.83% of the national

income. In 2005, it reached nearly 22%. The

average CEO now makes almost 400 times what

an average worker is paid. In 1980 the ratio

was 40:1. More than 45 million people in the

US have no health insurance. One in six children

live in poverty.

Speculative Housing Bubble

Housing inventories are still bloated, the most

"bloated in a generation". In Southern California,

real estate spokesmen talk of a year's inventory.

As in all speculative bubbles, prices zoomed

upwards into fantasy land. They rose for more

than ten years. People began to feel that they

could only go up, never down. Terms were easy.

Rates were low and you could speculate with

zero-down. In this environment, builders built

too much. And anyone who could remotely

afford a house, bought one. Few buyers

were left. Bids disappeared. Speculators

had to dump their condos and second homes.

HOUSING BILL'S DETAILS

The 2008 Housing Bill has now

passed the

House and the Senate. Sen. Dodd defended the

bill on CNN as being designed primarily for

relief of those who were duped into buying a house by

unscrupulous lenders. He insisted that everyone

benefits from preventing foreclosures. He did not

address what will happen if, despite the new Housing Bill

housing prices fall, say, 20% or 30%, as many expect,

or there is no economic recovery and homeowners walk

away from their mortgage, either of necessity or by

prudent choice.

A key provision is

that the banks can get FHA

full insurance on their most troubled mortgages if

they accept a 10% write-off of the original mortgage

and are willing to pay a 3% insurance fee. $300,000,000

is set aside for this new program. But, what if people

still cannot afford the reduced mortgage? It still may

make more economic sense, if equity is below zero,

for the homeowner to walk away from the mortgage.

So, the government's effort to prop up prices may

well fail. In that case, the Federal Government

could lose more than a trillion dollars. Then there

would be nothing left in its coffers to stimulate housing,

rebuild the national infrastructure, offer universal health

care or much of anything else, other than pay for

the US military which now costs $800 billion a year.

Dodd's Sweetheart Deal

The CNN interviewer failed to ask Dodd how much

his support for this bill and the bailout of Freddie

Mae was due to his cozy relationship with the

mortgage industry. Dodd and Senate

Democrats

received got

$31,000 from

Freddie Mac in campaign

contributions.

In 2003, Dodd received preferential

treatment from Countrywide Finance, now Bank

of America, in refinancing two homes, saving him

$15,000 a year. (See bottom of this page and

http://www.portfolio.com/news-markets/top-5/2008/06/12/Countrywide-Loan-Scandal

)

This is a lenders' and homeowners' subsidy bill.

Its real purpose is to prop up home prices long enough

for lenders to find someone new to sell the mortgages

to. It is not designed to make homes more affordable.

The Government is now the "bad-debt buyer of last

resort." Source.

To accommodate the cost of the new

legislation, Congress raised the US National Debt

limit by $800 billion, to $10.6 trillion. Source.

7/25 The President will sign the Housing Bill.

The Senate (72 to 13) got up early and voted

approval. This offers banks full insurance on their

troubled mortgages if they accept a 10% write off

and will pay a 3% insurance fee. At this point, the

most the federal government (FHA) can insure

and lose here is only $300 billion. Source.

Nearly

$4 billion is included for local governments to buy

and refurbish foreclosed properties.

7/25 Freddie Mac and Fannie Mae are guaranteed

not to fail. The Federal Government will either

give

them an unlimited line of credit or buy stock in

them.

There will be no nationalization. No change in

CEOs.

No close inspection of their books. CEOs and

their Directors' entourage will not be stopped from

milking these companies for whatever they can

manage. In

2007, the current Chairman of Freddie

Mac

pocketed nearly $19.8 million. At this point, the

most the federal government can lose is $5.2

trillion!

It is quite possible that the Federal Government

will spend all its resources bailing out mortgage

insurers while housing still is inflated and has

not corrected more than 20% of its bubble from

1995 to 2006. A 50% retracement in prices

might be expected. In Australia, economists are

warning their banks that the $450 billion in US

write-downs for bad housing should be expected to

go to $1.3 trillion in the next two years. Source.

7/25

WS Journal's Critique of New Housing Bill:

(1) Where the mortgages have been bundled and

sold to another party, there is no lender who can

write down the principal. In most cases, the

contracts

prohibit alteration.

(2) Second mortgagers are not protected.

(3) The FHA is not staffed to handle hundreds of

thousands of refinancing. So, there will many

more repossessions.

(4) Lenders let FHA insure their worst loans.The

ones they feel comfortable with, they can adopt

a wait and see approach. Source.

7/25 Washington Mutual exchanged dubious

mortgage collateral for a Federal Reserve loan

of $10 billion last week. Source.

It has reported

losses of $6.6 billion in the last nine months,

$3.3 billion, in the last 3 months, owing to

losses for bad loans and mortgages.

7/25 Second quarter Foreclosures were triple

what they were in 2007. This was a rise of 14%

from the first quarter. This is much worse than

was expected. Source.

Nevada has the highest

percentage, 1 in 43 households. Source.

7/25 Two more banks, one in Nevada and the other

in California have gone bust. The FDIC says none

of their customers would lose a penny, because

the FED has arranged, without saying how, the

takeover of the banks by Mutual of Omaha Bank.

Source.

7/25 "(San Diego) home prices continue to decrease,

by another 4.6 percent in April according

to the Office of Federal Housing Enterprise

Oversight. However, the resulting improvement

in housing affordability may begin to stabilize

the market. There is still a large inventory of

unsold homes, which may take several months to

reduce, but most analysts expect the housing

market to begin recovery in 2009..."

Source.

This same source predicted a housing market

recovery by 2008. Source

7/24

The Fed provided $16.4 billion to commercial

banks based on collateral of dubious value,

compared with $13.9 the previous week. In early

April, the DAILY bank borrowings were as high as

$38.1 billion. Yahoo Source

McCain Votes for Bill, but

Criticizes It.

7/24 On July 24th, McCain backed the bailout

of FRE and FNM. Source.

On 7/24 the

headline

reads: McCain: Get Rid of Fannie Mae and

Freddie

Mac. McCain wrote "Americans should

be outraged at the latest sweetheart deal in

Washington. Congress will put U.S. taxpayers on

the hook for potentially hundreds of billions of dollars

to bail out Fannie Mae and Freddie Mac...Let us not

forget that the threat that Fannie Mae and Freddie

Mac pose to financial markets is a tribute to crony

capitalism that reflects the power of the Washington

establishment...Fannie and Freddie are the poster

children for a lack of transparency and accountability.

Fannie Mae employees deliberately manipulated

financial reports to trigger bonuses for senior

executives. Freddie Mac manipulated its earnings

by $5-billion....Fannie and Freddie's lobbyists

succeeded; Congress failed to act. They've stayed in

business, grown, and profited mightily by showering

money on lobbyists and favors on the Washington

establishment....We are stuck with the reality that they

have grown so large that we must support Fannie Mae

and Freddie Mac through the current rough spell.

But if a dime of taxpayer money ends up being directly

invested, the management and the board should

immediately be replaced, multimillion dollar salaries

should be cut, and bonuses and other compensation

should be eliminated. They should cease all lobbying

activities and drop all payments to outside lobbyists.

And taxpayers should be first in line for any

repayments."

Very good. But let's not forget how indebted

Sen.McCain was to the savings and loan super

star of crooks, Keating. Source.

He probably

sees that he will be hit with reminders of this in the

coming campaign and wants to head off the criticism.

What We Offer Investors: Personal Support and Monthly San Diego User Group Meetings.

The

Confidence That Comes from Knowing that Tiger Has Many Hundreds of Happy Customers. TestimonialsFull Package Special

On-Going Research and All Software, including Power

Stock Ranker and All 3 Books. Research is included with Full Tiger Software order and Elite Stock Professional Service for a year. $995/year.

===> Order here. Nightly Hotline

Dr. Schmidt's comments on market with key charts

of DJIA, SP-500 and NASDAQ and their signals.

Leading stocks, commodities, foreign markets, metals and currencies are discussed and their charts shown

with Peerless and TigerSoft signals shown. Most bullish and bearish stocks charts, too. $298.

===> Order Here

Elite Stock Professional Service ("ESP")/year

New Research

Software Updates

Nightly Hotline

Bullish Special Situations

Bearish Special Situations

Weekly On-Line Posting of Most Highly Accumulated Stocks $595.

===> Order Here Tiger Stock Automatic Buys and Sells on Any Stock, Index, Currency or Commodity. Includes TigerSoft Introductory manual and 3 months of data from us for 1250 stocks, metals, ETFS, commodities and Fidelity Sector funds.. $295.

===> Order Here

Peerless Stock Market Timing

:Book and Software

25%+ On DJIA per Year since 1965. Included 3 months of data from us. . $495.

===> Order here

Charles Keating was convicted of racketeering and fraud in both state and federal court after his Lincoln Savings & Loan collapsed, costing the taxpayers $3.4 billion. His convictions were overturned on technicalities; for example, the federal conviction was overturned because jurors had heard about his state conviction, and his state charges because Judge Lance Ito (yes, that judge) screwed up jury instructions. Neither court cleared him, and he faces new trials in both courts.)

Though he was not convicted of anything, McCain intervened on behalf of Charles Keating after Keating gave McCain at least $112,00 in contributions. In the mid-1980s, McCain made at least 9 trips on Keating's airplanes, and 3 of those were to Keating's luxurious retreat in the Bahamas. McCain's wife and father-in-law also were the largest investors (at $350,000) in a Keating shopping center; the Phoenix New Times called it a "sweetheart deal." ( http://www.realchange.org/mccain.htm )

"Countrywide made two loans at special rates to Dodd in 2003 to refinance homes in Washington and East Haddam, Conn.The loans were reportedly part of a "V.I.P." program that gave preferential rates to "friends" of the company's chairman and chief executive, Angelo Mozilo. In 2003 Dodd got a 4.25 percent interest rate on a $506,000 refinancing loan for his Washington town house, and a 4.5 percent rate on the $275,000 loan on his East Haddam home. Most people would have been paying

2% higher. So, Countrywide saved Dodd $15,000 a year.

Dodd claims if he had known he was getting preferential

treatment he would have walked away from the loan. As the leading Democrat on the Senate Banking Committee, it is

almost certain he knew what mortgages were going for.

(Source: http://www.huffingtonpost.com/2008/06/23/dodd-repeats-denial-of-mo_n_108725.html )

House Republican Leader, Boehner, charges that Dodd and Barney Franks have refused to let Congress investigate VIP loans from mortgage lenders and banks to members of Congress. He charges that Bank of America wrote much of the legislation.

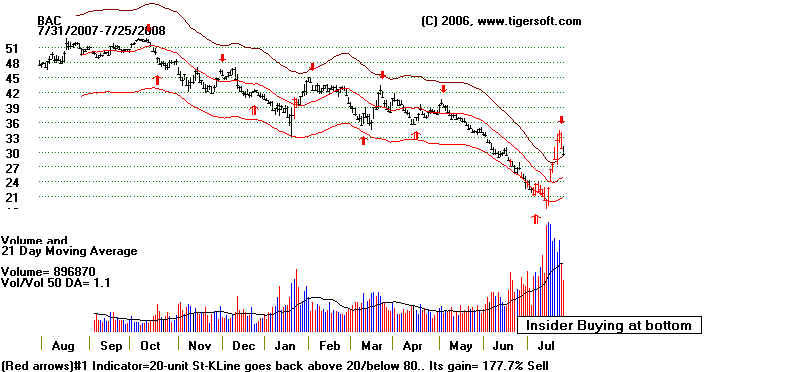

Source. The stock jumped more than 50% as news of the

bill's provisions got publicity.

Bush and McCain Share A Moment Together.

http://www.brillig.com/debt_clock/

The Bush Administration today estimated that the 2009 federal

deficit will be nearly a half a trillion dollars. This is $83 billion

more than what they estimated in February. Source.

The amount of money involved in saving the banks, homeowners

and housing industry may soon exhaust the country's ability to

borrow money, except at much higher rates. It's either that

or print billions and billions of more paper dollars. This will surely

weaken the US Dollar much further. Add in the $3 trillion

cost of the unnecessary and foolish war on Iraq, and you

see how rapidly the US is becoming a nation that is hopelessly

in debt. Wastefully, the US spends nearly a trillion a year on

its military budget, much more than all the other countries on

earth. Meanwhile bridges collapse and its working class must

hold two jobs to support a family. There is no solution because

the US constitution forbids taxing wealth as opposed to income,

and because sizeable wealth is often put overseas in secret

bank accounts so that income cannot be taxed.

If you like what Bush has done to the US, McCain is

certainly who you will vote for in November.

Don't They Make A Couple To Remember.

It's only $35.00 for a Middle-of-page 100 word text ad for a three months on TigerSoft Blog pages. It's $15.00 for a three month 10 word text ad with your link on the sides of the Blog. Please email your listing, with up to 100 words.

william_schmidt@hotmail.com