TigerSoft Freedom News Service 9/8/2008 www.tigersoft.com

Revised 9/9/2008 to show charts of Lehman Brothers and General Motors.

See also - 12/7/2008

How Much Money Is Needed To Bribe A Congressman?

How Bribes Stopped Earlier Congressional Oversight of Fannie Mae

Why Does Treasury Secretary Paulsen

Look So Frightened?

What Will The Nationalization

of Fannie Mae's and Freddie Mac's

Mortgages Cost?

Will This Turn Housing, Stocks

and The Economy Around?

Why Is Bank of America So Happy?

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

See the TigerSoft techniques for find Explosive Super Stocks: Oil Coal

|

Tiger

Software Helping Investors since 1981

|

Limited Time Special Offer Introductory Stock Software |

Why Does Treasury Secretary Paulsen

Look So Frightened?

by William Schmidt, Ph.D.

(Columbia University)

(C) 2008 All rights

reserved. Reproducing any part of this page without

giving full acknowledgement

is a copyright infringement.

Will the nationalization of $5.5 trillion dollar worth

of home mortgages stop the decline in the stock market

and shore up the weakening housing market? So much

liability without safeguards! Dangerous. Given the spending

imprudence of this Administration, one should be very

skeptical. Economic and financial conditions must be

very bad for the Republican Treasury Secretary to take such

a gamble.

Most talking-heads saw that something had to be done.

It looks like electioneering to me. But the policy makers

would have been attacked more for doing nothing. The

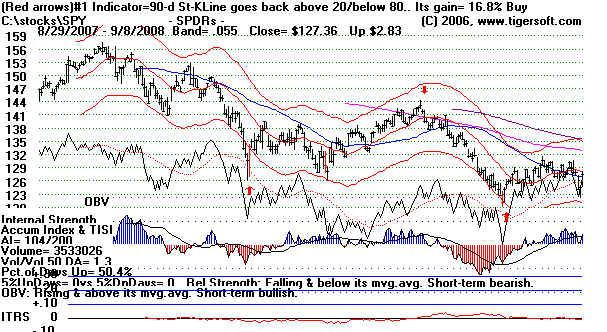

TigerSoft charts of the SP-500, Home-Building and

Finance Stocks should be watched closely now. The

government has made a very big gamble with the money

in the US Treasury that, in theory, belongs to all of us.

Finance Stocks

Finance Stocks broke their 12 month downtrend today.

They did not

make 2 month highs. They closed off well their highs. Blue positive

Accumulation is shown.

Home-Building Stocks

Home-building broke its downtrend line. But it did not close at it

daily high. It still shows bearish red Distribution.

SP-500

...

What Will It All Cost?

Three hours before the market's opening, the US

Treasury Secty was on TV explaining this nationalization

of Freddie Mac and Fannie Mae. The interviewer first asked

what it would cost the US Treasury and the tax payer.

Paulsen would not or could not answer this obvious question.

That IS scary.

If housing prices continue to decline, because people

are tapped out and unemployment is rising sharply, the

US Treasury will be down that percentage times $5.5 trillion.

With an 11 months' housing inventory now existing,

and wealth the most concentrated it has been since 1915,

except 1928(!), it is very likely that housing prices will fall

another 10%, as the Yale economist Schiller predicts.

Listen

and judge for yourself.

The US Government

- led by Bush who has never

felt a need to ask who will pay for his $3 trillion war

in Iraq or the endless use of zero-competition government

contracting to his campaign contributors

- will now save

the bankers from half their bad mortgage debt, The US

government will, if necessary, buy back upon request one

half of all of home mortgages in the US, about $5.5 trillion

dollars worth of mortgages. It will do this as because

it now owns Fannie Mae and Fredde Mac, who are expected

to stand behind the mortgages they guarantee. In effect,

the American taxpayer will now guarantee all these loans,

some $5.5 trillion worth of them. This takes Fannie Mae

and Freddie Mac back to their status before they went private

back in the 1960s.

If housing prices fall another 10%, the

US taxpayer

could easily have to come up with $550 billion. Another

10% as Yale economist Shiller thinks is likely by 2012,

the US taxpayer will down $1.1 TRILLION dollars.

" An influential economist who long predicted the housing market bubble

cautioned ... that the slump in the U.S. housing market could cause prices

to fall more than they did in the Great Depression and bailouts will be needed

so millions don't lose their homes. Yale University economist Robert Shiller,

pioneer of the widely watched Standard & Poor's/Case-Shiller home price index,

said there's a good chance housing prices will fall further than the 30 percent

drop in the historic depression of the 1930s. Home prices nationwide already

have dropped 15 percent since their peak in 2006, he said.

http://www.boston.com/news/local/connecticut/articles/2008/04/22/yale_economist_gives_talk_on_economy/

http://cowles.econ.yale.edu/news/shiller/rjs_06-03-26_prophet.htm

CNBC asked Paulsen about this.

(CNBC) How much will it cost taxpayers?

(Paulsen) "We obviously don"t know that yet".

"Utlimately"

It depends on how long before housing prices to

stabalize...."It may not take too long."

(CNBC) But, there must be some analysis of the amount it

will cost. "$10s billion? $100s of billion? How much

are you prepared to pay?"

(Paulsen) "Ah. I don't. Ah (stammer) There is no

specific analysis. This was not...(stammer) This was....

(stammer) We didn't sit there and figure this with a

calculator. This was about our financial markets.

This was about confidence in our financial markets.

Confidence in our economy and the availability of

mortgage financing."

(CNBC) Did Foregn central banks

threaten to stop buying

US debt?

(Paulsen) Yeah. Ah (Stammer) I ... (Stammer) Nothing like

that. (Stammer) Some had stopped buying. There

was some selling. What is... This was just obvious.

There was grave concern...Not the major driver.

There was concern. Housing is at heart of the

problems. These companies are so big and

ubiquitous.

Compare Paulsen's befuddled answer here with his befuddled answer

back in April when

asked what would have happened if he had not provided JPMorgan $30 billion

to buy out Bear Stearns.

(Paulson:) “I’m not going to speculate and go through

hypotheticals. What

I am going to say is we always when you go through a period like this that

policy makers need to balance various consequences and the right decision

here I’m convinced was the decision that the Fed made which was to ah to to

do things, to work with market participants to minimize the disruptions”

The fact is that these “hypotheticals” were the

heart of the problem. He refused to

comment on the central problems in the matter. As someone properly said in the

New

York Times, "Just once, I’d like a reporter when faced with the “we

don’t speculate

on hypotheticals” phrasing ask… “You say you won’t speculate on the

hypothetical

consequences of your actions. Is that because you haven’t thought through the

consequences of your actions? Or is it because the consequences are likely to be so

bad that you don’t want to get blamed when what you expect to happen, does happen?”

Not that the Democrats can be

trusted. Three months ago,

Dem.

Senator Dodd said there was no problem at Freddie Mac

and

Fannie Mae. They had ample resources. He also knew these

two

companies do their best to avoid timely reporting of their

foreclosures, sometimes waiting two years. He knew these

companies cooked their books and that they had run afoul of

regulators a few years ago and their CEOs had to be fired.

Paulsen says the "The Housing Down-Turn is at

the heart of the problems of our economy." Should

we trust those in the Administration and at the

Federal Reserve that caused the housing

bubble to fix it? These are the

same ones who

allowed banks to get into non-banking businesses

and package mortgage loans so there could be no

transparency or accountability? The FED who

allowed housing to be bought zero-down and

on a "stated income" basis?

Should we now trust Paulsen?

Back in April 2007, he declared

that the housing crisis

had reached "bottom" and that the subprime problem

was largely contained. He was wrong. A year later, he refused

to let the chips fall where they may with Bear Stearns. $30 billion

of taxpayer money was given to JPMorgan as a prod to buy

out Bear Stearns. It stemmed the tide

for 2 months.

Key Banks, he mused, were too big to be

allowed

fail. No matter that giving them this kind of support

would encourage them to take more imprudent

risks and more dangerous loans to one another.

Paulsen sees his job to be saving the stock market, at

all costs. For Main Street this looks a lot like socialism for

the rich.

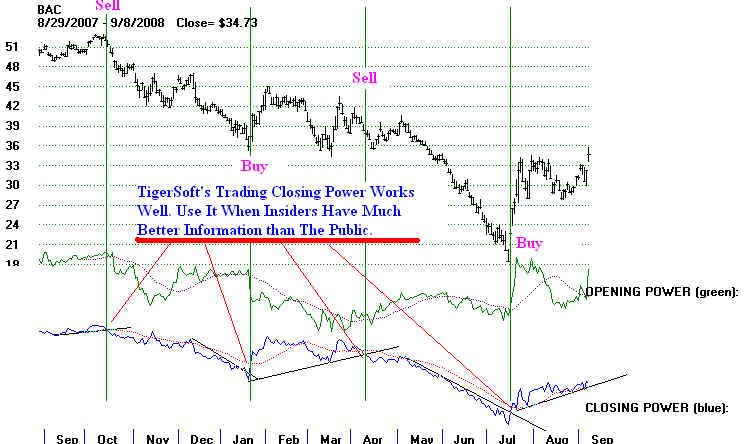

Banks like Bank of America and Wells Fargo are the

biggest beneficiaries. Suddenly the home loans that used

Fannie Mae and Freddie Mac are safe and risk-free! It is said that

Bank of America wrote a draft that became the new Housing

Bill. Their stock shows how much political clout they have.

See - http://www.tigersoftware.com/TigerBlogs/5-7-08/index.html

http://www.tigersoftware.com/TigerBlogs/July-27-2008/index.html

QUESTIONS...

Will mortgage rates go down if profit

is

not a consideration? Will these loans be more

available? Will loan savings to banks be passed

along to home buyers? Will the new US-FNM-FRE

help the depressed housing markets? Without

a better job market, who will be able to buy a house?

Will the terms of mortgages be changed ot help

temporarily distressed homeowners? Will it only be

the rich who want to rent it out? Will it be consortiums

of home-buying investors? Will only insiders benefit?

The devil will be in the details.

And most important... With this bailout, will not

each industry demand equal treatment?

After This Rally, Things Can Get Much

Worse

Will it now be much harder, to bail out

a General

Motors or a Lehman Brothers? We're going to find out.

Below is the chart for LEH. It is on a Sell, shows

heavy (red) distriubution and a falling Closing Power.

Professionals do not trust it.

On 9/9/2008 Lehman fell 40% in one day. Its talks with a Korean bank

On 9/9/2008 Lehman fell 40% in one day. Its talks with a Korean bank

to raise capital has fallen through. This is the fourth largest investment bank.

This wipes out $4 billion of market value.

====================== GM =====================================

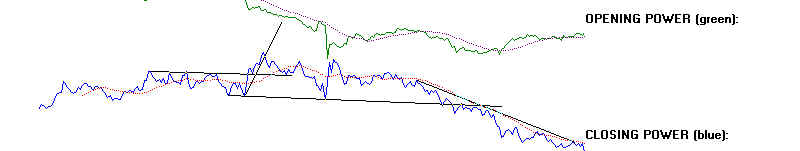

GM is on the edge of making a serious break below its support line.

The Public, as measured by TigerSoft's rising Opening Power is bearish.

Professionals

are bearish, as seen in the declining Closing Power. Usually professionals prove

to be right. The steady red Distribution in Tiger's Accumulation Index is also

a big warning. I fear what would happen if GM should fail. Democrats in the US

House of Representatives are discussing an emmergency $25 billion government

backed loan to automakers to make more efficient cars.

Now McCain is now ahead in the poles. Obama has no

backbone.

His supporters are having doubts, big ones. If McCain wins

in November, there will probably be political grid-lock. There will be

little change in the policies that brought us into this mess.

Phil ("You're all a bunch of whiners!" ) Graham is McCain's closest

financial advisor. He brought us unregulated energy speculation.

See http://www.tigersoftware.com/TigerBlogs/July-16-2008/index.html

http://www.tigersoftware.com/TigerBlogs/July-12-2008/index.html

I fear for us. McCain has

admitted he does not understand

the economy. ‘The Issue Of Economics Is Not Something I’ve

Understood

As Well As I Should’ but, “I’ve got

Greenspan’s book,”

he assured the audience. Early in 2008, McCain said:

“I don’t believe we’re

headed into a recession,” he said,

“I believe the fundamentals of

this economy are strong."

(Source: http://thinkprogress.org/2008/01/18/mccain-economy/

and http://www.boston.com/news/nation/articles/2008/01/26/mccain_tested_on_economy/

"A nation of

whiners". That's what McCain's ex-chief economic

advisor called the millions of unemployed, underpaid,

and home-owners about to lose their mortgage.

So out of touch!

McCain, with his 7 houses, will not allow his rich buds to be taxed.

50% of the increase in the US budget deficit under Bush owes to his

tax cuts for the rich. 35%of the increase int he US Debt owes to Bush's

war in Iraq. See Jared Bernstein:

Why McCain's Wealth Matters and

Video I saw recently. Jared Bernstein -

CRUNCH - Why Do I Feel So Squeezed?

McCain will not cut back his beloved military. He may even start

a war with Iran. ("Bomb, bomb, bom, bom, bom"). WIth McCain

there will be no big public works program paid for by ending the

war and taxing the rich. Without that, the economy will continue to worsen.

There will be no trickle down. Unemployment will worsen. The jobless

will just have to wait and wait! Cities and states will run out of money.

A recession deeper than 1973-1974 becomes a grim possibility.

Batten down the hatches. Gold will probably rise as the dollar declines.

Typically news like this delays the eventual decline, rather than preventing

it. All Paulsen wants to do is delay the big decline until after the

November Presidential Election. .

Compare the Market Now with 1971

after Nixon announced his new Economic Policy To Control Prices.

After a rally, we should expect more new lows. Perhaps, October will

produce a selling climax. It has that reputation. In 1971 the decline

continued until November.

Peerless Chart of 1971 Peerless Stock Market Timing: 1915-2008