TigerSoft Freedom News Service 7/13/2008 www.tigersoft.com

Investing In A Perfect Storm (1)

with The DJI Down More Than 20%

The Secrets of Successful Bear Market Trading

... The Decline of The American Empire

... The Military Industrial Complex's Threat To The US.

... The Complete Failure of National Leadership

... A Perfect Financial Cyclone

... The History of 29 US Bear Market Years: 1915-2008

... How To Call Bottoms and Trade The DJI In Bear Markets

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981 More Oil

Profits' Cartoons.

|

Investing In A Perfect Storm

with The DJI Down More Than 20%

by William Schmidt, Ph.D

A Chinese sage warned of the curse of living in exciting times. Surely that applies now.

The moral, financial, economic, political, military and diplomatic problems facing the US

are each worsening. They form an interlocking set of dynamics. As each intensifies,

the others worsen and confidence gives way to fear. The world bull market has propped up

US multi-nationals. But now the US stock market has become so weak, it may drag

the world market down with it.

The Headlines Are Grim:

HOME FORECLOSURES REACH RECORD LEVELS

DECLINE IN HOME PRICES ACCELERATES

GOVERNMENT DECEPTION AND CORRUPTION,

ANOTHER MID-EAST WAR LOOMS,

BAILOUT AFTER BAILOUT OF BANKERS

HYPER-INFLATION,

$10 TRILLION IN DEBT,

RISING UNEMPLOYMENT,

REAL WAGES ARE BACK TO THE LEVELS OF 1950,

5% OWN 95% OF AMERICA.. UNDER-CONSUMPTION

TIGHT, TIGHT CREDIT

COSTLY BANK FAILURES

GLOBAL WARMING

DYING OCEANS

RISING FOOD PRICES

WORLD HUNGER

Change is long overdue. The dominant politicians have a perverted sense

of priorities. Americans feel woefully ignored, neglected and scorned. Wholly different

priorities are needed. Everything this Administration has done has been either wrong

or done badly. Small wonder the stock market is in a bear market. One has to

go back to 1930 to see a stock market declining as fast as it has so far in June and July.

(See the bear market charts below).

THE US CAN NO LONG AFFORD ITS MILITARY BUDGET

AND A FOREIGN POLICY DOMINATED BY BIG OIL AND PRIVATE WAR-MAKERS.

The words of George Washington in his farewell address to "beware of entangling alliances".

have long been dismissed. Today reports from Israel say that "President Bush has

authorized Israel to attack Iran if other options fail." (Arutz Sheva (news@israelnationalnews.com )

See my Blog - 6/8/2008 - http://www.tigersoftware.com/TigerBlogs/June-8-2008/index.html

Now 17 years after the Soviet Union disappeared, it might be high

time for the US to recall what Dwight Eisenhower said in his farewell address in

1960.

"We annually spend on military security more than the net income of all

United States corporations. This conjunction of an immense

military establishment

and a large arms industry is new in the American experience. The total

influence --

economic, political, even spiritual -- is felt in every city, every State house, every

office

of the Federal government. We recognize the imperative need for this development. Yet

we must not fail to comprehend its grave implications.

Our toil, resources and livelihood

are all involved; so is the very structure of our society. In the councils of government, we must

guard against the acquisition of unwarranted influence, whether sought or unsought, by the

military industrial complex. The potential for the disastrous rise of misplaced power

exists

and will persist. We must never let the weight of this combination endanger our liberties

or democratic processes. "

The US support and

installation of dictatorships that terrorize

The US support and

installation of dictatorships that terrorize

their own people are a recipe for eventual retaliation and US foreign policy nightmares.

The US is an Empire in significant decline. It cannot afford its military budget and

system of global bases. Using the CIA to covertly overthrow democratically elected

governments, like Mossaegh in

Iran in 1953, Arbenz

in Guatemala in 1954, and

Allende in

Chile in 1970 reveals how deeply our Presidents have been guided by promoting

narrow commercial interests rather respecting human rights and refuse to take care that

the

long-term interests of the US come first. Fear of Communism was always the excuse

used.

Just as now we are told to fear Islamo-Fascist terrorists. But Iran's

Mossadegh was

anti-Communist. So was Chile's Allende. A million Indonesians died as a result of the

CIA's

overthrowing of the

nationalist Sukarno government, again in the name of fighting Communism.

This disregard for human rights and the contempt shown for the sanctity of other

countries' sovereign rights appear over and over in the pages of the Pentagon

Papers. In 1949, Ho Chih Minh appealed to President Truman. He wanted

Vietnam's independence

movement against French colonialism to be recognized in the spirit of the American war

of Independence. Truman preferred to side with the French colonialists. In November

1963, Kennedy

sought the overthrow of the President Diem. The corrupt General Diem

had been propped up as long as he seemed the best defense against the insurgents who

mainly wanted to unify their entire country. As a result, Ambassador Lodge gave the

US Ambassador HC Lodge OKs assassination of

Vietnamese President.

US Ambassador HC Lodge OKs assassination of

Vietnamese President.

"green light" to have South Vietnamese generals remove General Diem. He

was coldly

assassinated the next day. George Bush's lies about the reasons for starting

his war

with Iraq should be seen in the light of long history American Presidential arrogance

and the massive influence exerted by private military contractors, which Eisenhower

had warned against, through their ties with Bush and Cheney. Even 9/11 might not

happened but for the extensive American military bases in Saudi Arabia.

Patriotism is Not about Empire.

Why Is It Not Defined as Caring for ALL Those Who Are Americans?

Like the Roman Emperors, American leaders choose to

not to admit the limits

of America's power or its treasury. They start wars of plunder and debase the

currency

to pay for their military operations. They wear lapel pins, as though that alone

makes

them patriotic. The result is the destruction of the middle class and the deepening

poverty

of those who must hold two jobs to provide for their family. The US military budget

now

equals in cost the military budgets of all the other nations on earth.

No wonder, moral

decay has set in. Contractors steal as much as they can from the US Treasury and the

Administration punishes those who report these crimes. The President has lied

America

into a war of aggression and Congress lacks the moral courage to stop the killing.

The cost

of a war, which 70% of Americans want a quick end to, is estimated now to be between

$3 and $4 trillion. It grinds on and on, just as the war in Vietnam did.

Corruption in Rome is often given as a cause for that

Empire's collapse. US CEO's get paid

five, ten, even fifty million a year, even though their company's stock plunges 90%. Greed

is rampant. Loan officers did whatever was necessary to make commissions. The

banks

and financial institutions bundled mortgages and sold them as secure debt, without giving

any thought to what would happen if housing prices fell. Make the money now and let

someone

else worry about the consequences was their only ethic. There was no regulation!

Bush's

Republicans, in their core, believe in the magic of pure greed. They don't believe

business

should be regulated and they are richly rewarded for protecting their business

clients.

So, no one in the Bush Administration looked ahead to see

what might happen

if housing prices fell or Crude Oil prices rose and rose and rose. Their philosophy

was

the same as a miner in the West. Get all the gold ore you can as quickly as possible

and leave the mess to someone else to worry about. Small wonder that Bush and

Cheney

treated alternative energy development, conservation and public transportation with the

same

contempt and hostility that they showed regulations and research to promote clean, healthy

air

or to protect wilderness areas.

With the same criminal neglect and incompetence shown by

FEMA, and

with the same perverted under-spending on the system of levees guarding New Orleans,

because it did not benefit the military industrial complex, Bush's appointees at the US

Treasury

and the Federal Reserve did not bother considering what would happen when

housing prices started falling. How hard was it to see that allowing

"zero-down" speculative

purchases of houses were just as dangerous as allowing speculative buying of stock

"on margin

with 10% down" in 1928 and 1929. They should have been fired long ago.

Instead, they

party, play golf, take month-long vacations and "double-dip" big-time. "Yes",

people

are bitter.

It is time for a big change.

A

Perfect Financial Cyclone

Former Republican Kevin Philips on the Book Channel talked

this week

about what ails America. In 1969, he wrote a book, "The Republican

Majority"

that became the basis for the Republican Southern strategy. So, this is an astute

observer. He depicts a very grim economic future.

What we are now seeing, he

says is train wreck in slow motion as a perfect storm descends. Small wonder the

stock market has gone straight down so much since the (April 21, 2008) New York

Times review. He covers mainly topics that I have already discussed in my

Blogs.

Unfortunately, he leaves out from his perfect storm three additional elements that should

also be factored in:

1) Chalmers Johnson's

concept of Blowback .

2) The degree to which

maldistribution of wealth in the US has reached levels

not seen until just

before the Great Depression.

3) Protectionist sentiments are growing. The US Smoot Hawley Tariff of 1930

led to widespread world trade restrictions.

"By 2007 total indebtedness was three times the size of the gross domestic

product, a ratio that surpassed the record set in the years of the Great Depression.

From 2001 to 2007 alone, domestic financial debt grew to $14.5 trillion from $8.5

trillion,

and home mortgage debt ballooned to almost $10 trillion from $4.9 trillion, an increase

of 102 percent. A crisis in the mortgage market in August 2007 brought the party to an

end...

"The second component of the perfect storm is the upheaval in the oil industry.

Domestic production peaked in 1971, and there are signs that production worldwide

is also peaking. And with the emergence of new economic powers like China and India,

demand has risen dramatically and prices have been climbing steadily; by 2004 a rapidly

growing China had become the second largest oil consumer, after the United States.

Despite the bad news at the gas pump, however, America has actually been getting a

cost break, because the major suppliers price their oil in dollars. But with the dollar

falling, OPEC

has been talking about moving into other currencies. Were that to happen,

“the effects,” Mr. Phillips says tersely, “could be painful.”

"Finally, Mr. Phillips turns to what he terms America’s “calcified”

political system.

We may need new regulations to deal with the debt mess, along with an energy policy

to address the changing world of oil, but Washington, he says, has become dedicated to

“the politics of evasion,” reluctant to pass dramatic reforms or to call for

sacrifice from

the public. Democrats and Republicans alike are so entrenched, so dependent on campaign

money and special interests, that “the notion of a breath of fresh air has become

almost

a contradiction in terms.” Instead of a “vital center” in Washington, we

now have a

“venal center.” Mr. Phillips holds out little hope of improvement from a new

president.."

Fannie Mae and Freddie Mac Are

"Insolvent"

The Biggest Bank Failure in US History on Friday

We have said for months the credit crisis was going to get much worse.

It has and it will. I take no pleasure in chronicalling the Bush

Administration's

destruction of so many Americans

dreams. But they must be reported to be

changed. The mainstream media has the backbone of a sick jellyfish. It falls

on independents on the internet to break the silence. Our ability to see

what insiders are doing helps enormously in the task of getting past the

smoke and mirrors. See "The Shame of Insider

Selling" in financial stocks.

This was posted a year ago. Now we see clearly why they were selling.

This Friday afternoon IndyMac

Bank was shut down by regulators Friday

as the mortgage crisis claimed one of its largest victims. The Pasadena thrift,

with $32 billion in assets, was a prolific lender during the housing boom,

specializing in so-called Alt-A loans that allowed buyers to borrow with little

documentation

of their finances. Losses are expected to mount among Alt-A mortgages as more

borrowers decide to walk away from residential investment property plunging in value.

Pasadena-based IndyMac's failure is expected to cost the FDIC

between $4 billion

and $8 billion, based on the regulator's preliminary estimates. The bank will

reopen

Monday as IndyMac Federal Bank, run by the Federal

Deposit Insurance Corp.

(Source: http://www.bizjournals.com/pacific/stories/2008/07/07/daily61.html

) This is

the second largest bank failure in US history.

Four billion may seem large. But what happens if housing prices continue

to fall, as seems very likely. Almost 9% of Mortgages are either Delinquent

or in the process of Foreclosure. According to Federal Reserve data on

consumer net worth, real estate net worth fell last quarter for the first time in over

25 years. "Not surprisingly, the combination of falling housing prices

and rising

unemployment is causing consumers to pull back. Auto sales are falling sharply,

and consumers have had to make tough choices, leading to less spending on

non-discretionary purchases. While retail sales at discounters have slowed modestly,

consumers have materially slowed their spending at department stores. Weaker

employment, declining housing prices and tighter consumer credit virtually ensure

subpar U.S. economic growth for the foreseeable future. Making maters still worse

for consumers, the US Dollar is falling and Oil Prices are rising steeply.

These are

realties of a perfect Economic Cyclone. They are imaginary fears, as McCain's

chief economics adviser, Phil Graham said this week. See Mark Kiesel, "

"US

Credit Perspectives", July 2008.

Another Bailout? Nationalization?

The US Government is now $9 trillion in debt. Treasury

Secretary Paulson

is "planning

a $15 billion capital injection" and the use of the Fed's Discount Window,

where

they can put up questionable bundles of mortgages for loans. Paulson

wants the government to receive in return special shares in beleaguered FRE

and NM, which now

provide 70% of the newer mortgages. He would let the

companies continue. He maintains that letting the market place destroy these

companies would mean allowing the mortgage market to grind to a halt and

further weaken confidence in US securities.

The Best Government A Banker's Money Can Buy

Fannie Mae chief executive Daniel H. Mudd, left,

and Chairman Stephen B. Ashley testify before

the Senate Banking Committee. The hearing was

convened to review accounting fraud at the FNM.

In a settlement with the SEC and OFHEO, FNM

agreed to pay penalties of $400 million.

( http://www.washingtonpost.com/wp-dyn/content/article/2006/06/15/AR2006061500677.html )

Despite FNM's past accounting frauds, Treasury Secretary

Paulson has decided today to bail out these companies and let these

two companies' CEOs keep their huge salaries and perks. Daniel H Mudd's

$7.1 million in compensation at Fannie Mae is now safe. Mudd gave $15,500

to the Republican Party in 2006. This was the best investment he ever made!

Richard Syron's $1.35 million salary and bonuses are also now secure as CEO

of FRE. He and the PAC has organized has given $31,000 to Democratic

Senator Christopher Dodd and Senatorial Democrats in the last four years.

Dodd is leading the Democrats in the area of subsidizing homeowners in the

their mortgages. If the government took over these two companies and

kicked out the CEOs, it would save millions. But Paulsen and Dodd won't do this.

Other plans include nationalization, simply having the government take over

the $12 trillion in mortgages of the nation's two top mortgage lenders Fannie Mae

and Freddie Mac. It would place them in a "conservatorship", making the

shares

next to worthless, which is what the President of the St. Louis Fed says they are

now worth, if all their loans are marked to the current housing market's prices.

The high paid executives for these companies would presumably disappear.

But since the US Government already supposedly stands behind these loans,

such action would, in effect, "take these national". The taxpayer might

have to

come up with as much as $5 trillion, if all mortgages failed. They are

as highly

leveraged as any bank... These companies have guaranteed trillions and trillions

of dollars of mortgage loans.

( Fannie

Mae, Freddie Losses Make Them `Insolvent,'

Pres. of St.Louis

Federal Reserve Says

July, 10th http://www.bloomberg.com/apps/news?pid=20601087&sid=as4DEc5UFopA&refer=home

News - http://www.reuters.com/article/marketsNews/idESBNG18193220080711?rpc=44&pageNumber=2&virtualBrandChannel=0

)

Where Will The DJI Find A Bottom?

DJI Declines of 20% or More since 1915

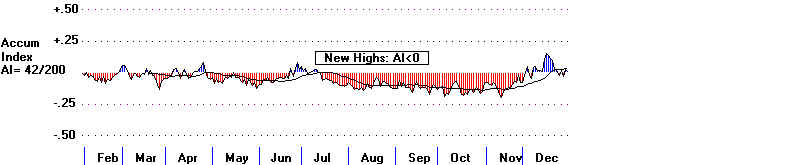

The DJI is now down 22% from its peak in October. The recent Peerless Buy B2s are

not very trustworthy, in that we have no earlier cases of these Buy B2s reversing a

cluster of

major Sell S9s and Sell S4s with the DJI down more than 20% from its peak. The

Tiger OPCT ("aka "OP21) remains negative. For a meaningful rally to be predicted

we will need to see major Buys and the OPCT and its moving average (MA) turn

up and positive. You can see many examples of bear market bottoms further below.

Below you will find the charts of the following bear market years. These are the

deepest declines during a single year.

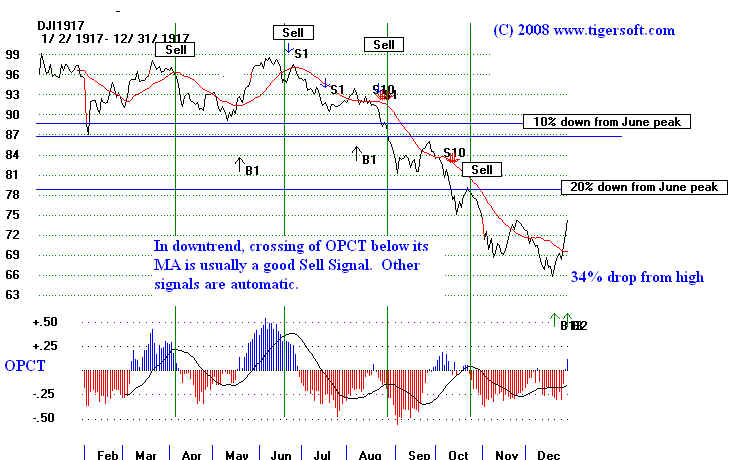

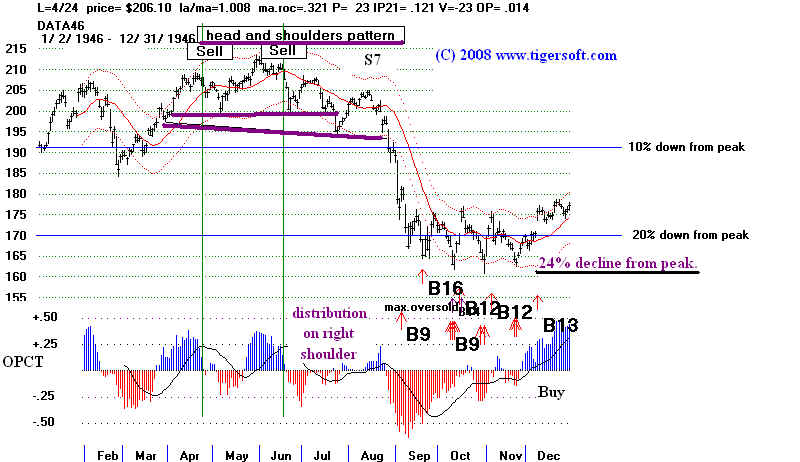

Year Decline for Year Buy Signal

1 1917 -34% - Index Buy B1,

Buy B2

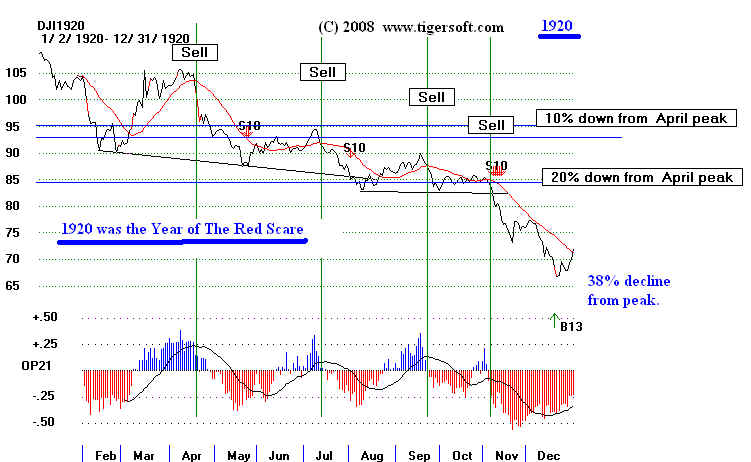

2 1920 -38% - Index Buy B13

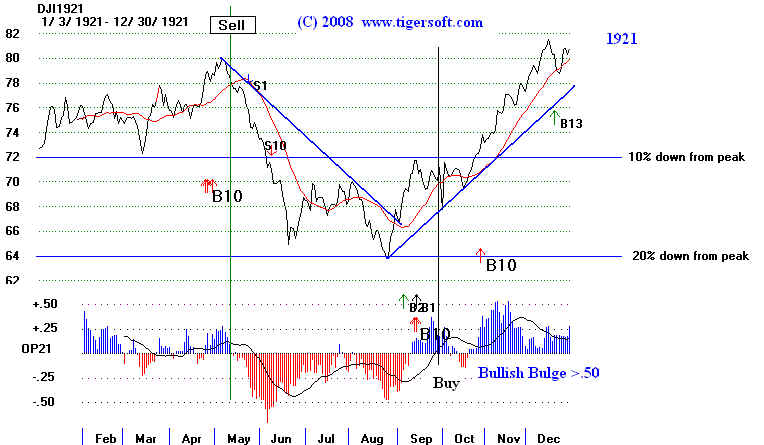

3 1921 -20% - Index Buy B1,

Buy B2

4 1929 -45% - Index Buy B1,

Buy B2

5 1930

-45% - Index Buy B13

6 1931 -60%

- Index Buy B13

7 1932 - 55% - Index

Buy B13

8 1934 - 23% - Index

Buy B1

9 1937 - 38% -

Index Buy B6, Buy B13

10 1938 -

25% - Index Buy B1

11 1939 -

22% - Index Buy B1

12 1940 -

27% - Index Buy B1, Buy B2

13 1941 -

21% - Index Buy B1, Buy B6

14 1946 -

24% - Peerless Buy B9, Buy B16

15 1957 - 20% - Peerless Buy

B1, Buy B8, Buy B17

16 1962 -

27% - Peerless Buy B6, Buy B13

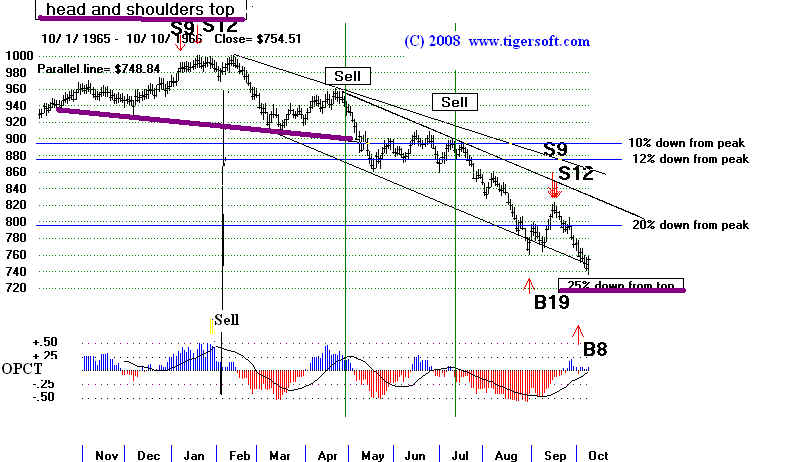

17 1966 -

25% - Peerless Buy B8, Buy B17

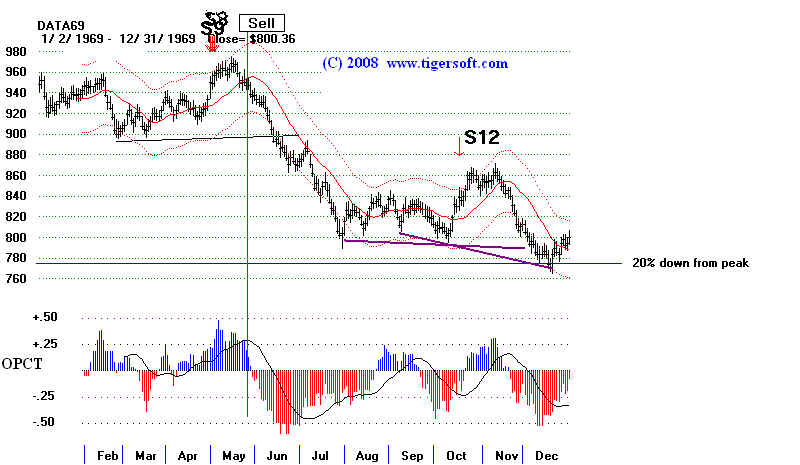

18 1969 -

21% - no Buy ... market goes lower.

19 1970 -

30% - Peerless Buy B12, Buy B16

20 1973 - 25% - Peerless Buy B16

21 1974 - 25% - Peerless Buy B16,

B12, B9, B19

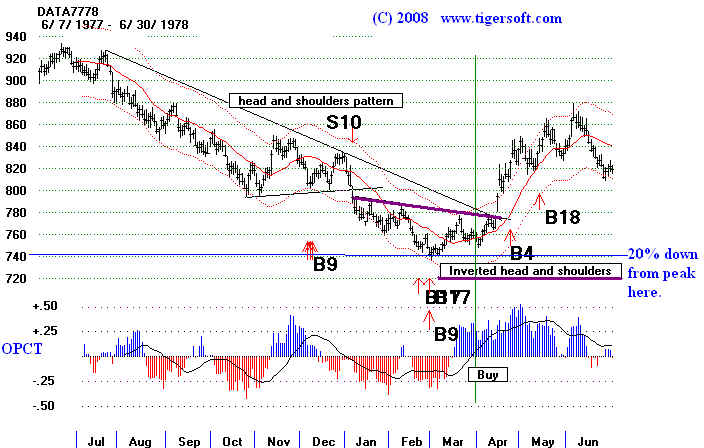

22 1977 - 20% - Peerless Buy B9

23 1978 - 20% -

Peerless Buy B9, Buy B17

24 1981 - 20% -

Peerless B9. B17, B19

25 1987 - 40% -

Peerless B16, B17

26 1990 - 21%

- Peerless B8, B17

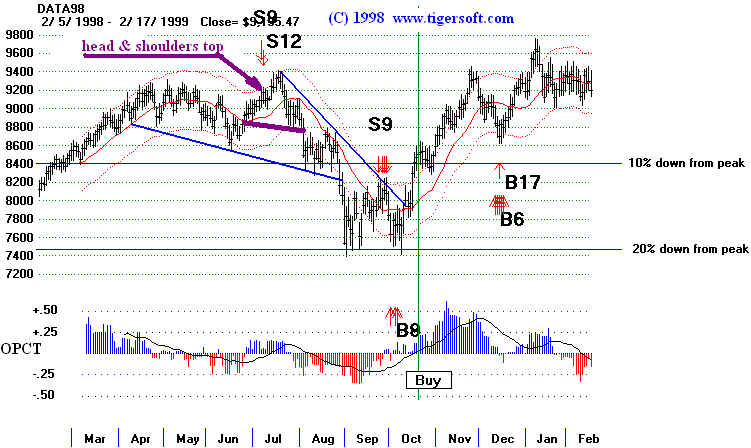

27 1998 -

20% - Peerless Buy B8

28 2001

- 27% - Peerless B8, B17

29 2002

- 30% - Peerless B9, B17, B19

------------------------------------------ DJI - 2007-2008

-----------------------------------------------

BEAR MARKETS SINCE 1915-2008

Officially, a bear market is called when the DJI falls 20% or

more. Here

are the cases since 1915.

------------------------------------------ DJI - 1917

-----------------------------------------------

------------------------------------------ DJI - 1920

-----------------------------------------------

------------------------------------------ DJI - 1921

-----------------------------------------------

------------------------------------------ DJI - 1929

-----------------------------------------------

------------------------------------------ DJI - 1930

-----------------------------------------------

------------------------------------------ DJI - 1931

-----------------------------------------------

------------------------------------------ DJI - 1932

-----------------------------------------------

------------------------------------------ DJI - 1934

-----------------------------------------------

------------------------------------------ DJI - 1937 -----------------------------------------------

----------------------------------------- DJI - 1938

-----------------------------------------------

----------------------------------------- DJI - 1939

-----------------------------------------------

------------------------------------------

DJI - 1940 -----------------------------------------------

------------------------------------------ DJI - 1941

-----------------------------------------------

------------------------------------------

DJI - 1946 -----------------------------------------------

------------------------------------------

DJI - 1957 -----------------------------------------------

------------------------------------------

DJI - 1962 -----------------------------------------------

------------------------------------------ DJI - 1965-1966

-----------------------------------------------

------------------------------------------ DJI - 1969

-----------------------------------------------

------------------------------------------ DJI - 1969-1970

-----------------------------------------------

------------------------------------------

DJI - 1973 -----------------------------------------------

------------------------------------------ DJI - 1974

-----------------------------------------------

------------------------------------------

DJI - 1977 -----------------------------------------------

------------------------------------------ DJI - 1977-1978

-----------------------------------------------

------------------------------------------

DJI - 1981 -----------------------------------------------

------------------------------------------

DJI - 1987 -----------------------------------------------

------------------------------------------ DJI - 1990

-----------------------------------------------

------------------------------------------

DJI - 1998 -----------------------------------------------

------------------------------------------

DJI - 2001 -----------------------------------------------

------------------------------------------ DJI - 2002

-----------------------------------------------

|

|