TigerSoft Freedom News Service 5/20/2008 www.tigersoft.com

THERE'S VERY BIG MONEY IN

SUPER OIL STOCKS.

YOU MUST USE TIGERSOFT'S

ACCUMULATION INDEX.

Watch what the Insiders Are Buying.

Buy Using TigerSoft's Buys.

A Double or A Triple in 3 Months Is Not UnCommon.

Get our Explosive Super Stocks for more details

and see how to calculate when it is best to sell.

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981 More Oil

Profits' Cartoons.

|

THERE'S VERY BIG MONEY IN SUPER STOCKS,

BUT YOU MUST USE TIGERSOFT'S

ACCUMULATION INDEX

(OR BE FRIENDS WITH ONE OF THE OIL COMPANY CEOS!)

by William Schmidt, Ph.D

(Source: http://www.cartoonstock.com/newscartoons/directory/o/oil_company_profits.asp)

Crude Awakening: How High Can Oil Go?

Bush's visit to Saudi Arabia brought no promise of increased production.

Washington's animosity towards Venezuela has not toppled Chavez, as the CIA

has tried, but it has made Chavez send its oil to China, not the US. The price of

oil goes up, not as the Democrats say, because of speculation, but because of

world demand, made more intense by the growth in developing markets, especially

China and India.

I recall oil reached over $50/barrel. in late 1979. Oil stocks

did not top out until the end of 1980. Prices have generally tripled since 1980.

So, in 1980 terms, crude could spike at over $150/b. In 1972 crude oil was about

$3./bar. The Yom Kipperin October 1973 brought an OPEC embargo on

nations supporting Israel. That lifted oil prices to $13./b. The November 1979

Iranian

revolution and the Iraq-Iran war dropped production by 10% and by 1981 crude oil

prices averaged $34 in 1981. Any supply interruption, as Venezuela's

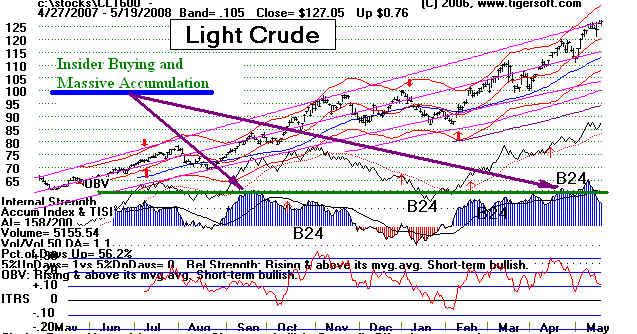

or Iran's, would send up prices even more. The high level of Accumulation on

our Light Crude chart shows that insiders and big money are buying oil and oil

stocks in a big way. They do not think a top is near. A world-wide recession

is probably the only thing that will change the up-trend in oil. Meanwhile, Bush

may be inclined to start a new war with Iran. That would make oil prices rise to

$200.

Fears that Bush and Cheney  will start another war lie

will start another war lie

behind the latest rise. Yahoo reports: "A story in the Jerusalem

Post quoted a

"senior official" there as saying that Bush plans to attack Iran in the coming

months. (An) unidentified official claimed that a "senior

member" of Bush's

traveling entourage made the statement about attacking Iran in a closed meeting.

Bush was in Israel last week... (and that ) Bush ... Cheney "were of the

opinion

that military action were called for."

The White House denied this today. But Oil is over $128 and the stock market

down nearly 200. This is more than a rumor. John Conyers has warned

Bush that Democrats would not be happy about another Bush war and has said

that if he starts such a war, then he should be impeached. There have been

many reputable reports

that Bush and Cheney would like to start another war,

this one with Iran. If oil men are happy now with oil prices, think how happy

they will be with oil at $150 or $200 oer barrel.

I remember the 1973-1974 bear market quite vividly. Steeply escalating oil prices

are big trouble for the stock market. In 1969, 1973, 1977 and 1981 were all bear

market years, during the era of "stagflation"

- rising unemployment and high inflation..

(Source: http://cagle.msnbc.com/ _ )

WINDFALL TAXES ON OIL PROFITS?

It is possible that because it is a Presidential Election year that Democratic

candidates and Congressmen will call for increased taxes on oil profits.

Congressional

hearings are due to start tomorrow. But I recall the period of 1973-1976, when

Republicans were weakened by Nixon's Watergate scandal and his resignation in

disgrace. The Democrats could not bring themselves to raise taxes significantly

on oil and gas companies then. They could not get motivated to raise the royalties

on Federal leases. They were too hooked on the mother's milk of politics, money

and campaign contributions.

So, while there may be TALK

about taxing windfall profits, it is not likely to

happen. The profits received by the major oil producers will be stupendous.

Tens of BILLIONS of Dollars. Exxon reported $40.6 billions

in profits in 2007.

Chevron's were about $14.1 billion.

The CEOs's salaries are probably more likely

to be effectively targetted. The Democrats will seek to rescind the tax

subsidies (!) on

energy companies. Typical tokenism. And they will try to get these

companies

to invest more in alternative energies. But the oil companies will, in the end,

fight

off most of this. Since the 1930s, significant taxation of the rich has been on the

decline. It would take another Depressin to get the Democrats to actually work

to achieve a society that is economically democratic.

One thing is different. Back in the 1970s, oil companies could claim that

they need ot make more money to do more exporation and wild-cat drilling.

That argument won't fly this time. New oil discoveries have been unimpressive

while oil executive salaries define "obscene". Ray Irani of

Occidental will

get $80.73 million this year for a total five year salary worth $198.44 million.

Investors'

Daily claims that a 25% tax on windfall oil profits would decrease

production. They claim that is what happened from 1982 to 1986. What IBD

leaves out is that oil prices sharply fell then, too. That is what caused the

smaller

production. Showing their typical right-wing extremeism, IBD labels such

Democrats

socialists. A democratic socialist would advocate public ownership of oil,

for example,

that comes from Federal Land leases, or, at least, a scaled system of royalties.

Unfortunately, no Democrat in Washington DC is advocating this reasonable

position.

|

OIL CEO COMPENSATION (Source: http://www.forbes.com/lists/2006/12/Oil_Gas_Operations_Rank_1.html )

|

OIL STOCKS AREN'T GOING TO DECLINE BECAUSE OF

TAXATION.

Watch how this debate plays out. I would bet the Democrats will not raise taxes on

oil companies, even if they win the White House. Until then, nothing will happen

because Bush will veto anything that would hurt his oil buddies. A President

Obama will be like a President Carter. He will seek consensus with the oil

companies.

He will put on a sweater and talk conservation. And he will go nuclear.

America is run by

corporate money. And the oil companies may have as much as 25% of all US

corporate profits in another year, if prices surpass $150, as seems likely, given

the level of insider buying we can see in Crude Oil and Oil stocks.

TIGERSOFT MEANS BIG PROFITS

So, it would seem that we have entered a lasting mark-up

phase for oil stocks. Each dollar

rise in the price of crude is pure profits. Those that are highly leverage, will do

extraordinarily well.

I recall the rush into oil stocks in 1975-1977 and 1979-1980. These moves are

very flashy.

They do not end quickly. All the lessons from my Explosive Super Stocks apply here.

Many

pf the ideas were honed on the behavior of oil stocks in this earlier boom.

We provide customers the data on all traded oil and gas

stocks in one directory.

Customers can easily run our flagging and ranking program on this universe of oil

stocks to reach investing conclusions.

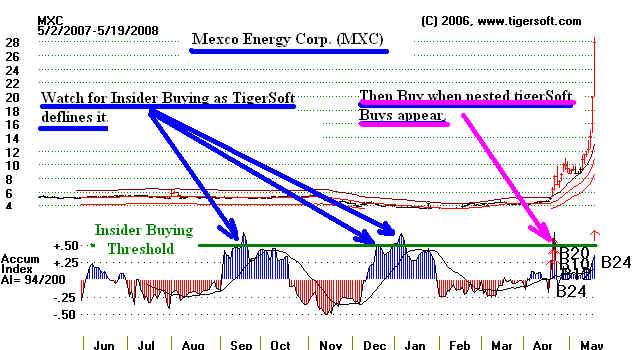

Use TigerSoft its Power-Ranker to find nested Buy Buy

B10/B12/B30 and B24 signals.

It's not much harder than that to find the stocks to buy. And, if you don't want to

find them

yourselves. We will find them for you on our Hotline.

The gains can be spectacularly quick. MXC was a good pick. Our charts of Light

Crude also showed massive insider Buying. See the chart of Light Crude below MXC's.

CRUDE OIL SUPER STOCK +600% in 2 months.

5/21/08 - hit 55.

Update - this stock hit 55 today - 5/21/2008

http://www.mexcoenergy.com/

http://www.mexcoenergy.com/documents/sec_filings/form_8k_2_19_08.pdf

Mexco

Energy Corporation, together with its subsidiaries, engages in the exploration,

development, and

production of oil and gas properties in the United States. It explores for and develops

natural gas, crude

oil,

and condensate and natural gas liquids primarily in west Texas. It has acquires

wells for

secondary production. These wells are now very profitable again. But be

wary. This stock is

traded on the American Stock Exchange. "That's where the biggest crooks

are" still rings in my

ears

from when I worked on Wall Street.

Mexco

Energy Corp. 214 West Texas Avenue Suite 1101 Midland, TX 79701

Phone: 432-682-1119

The

AMEX halted trading of MXC around 11:05 EST on Monday, May 19th, and suspended

trading

for

the rest of the day. This did not dicourage investors. The rose nearly another fifty

percent for the

third

day in a row after trading resumed. Mexco Energy

Corp. now is valued at nearly $75 million

despite the

fact that it turned only $221,000 in profit last quarter has just two full-time

employees

Light Crude Still Shows Massive Accumulation

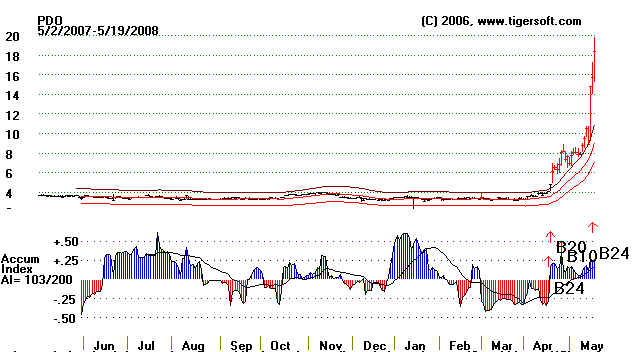

PDO - Pyramid Oil Co.

Update: After Hours: 27.85 ![]() 0.75 (2.77%) as of 4:52PM ET on 05/21/08

0.75 (2.77%) as of 4:52PM ET on 05/21/08

Pyramid Oil Company engages in the exploration, development, and

production of crude oil and

natural gas. It holds oil and gas property interests primarily in California, as well as

in New York,

Wyoming, and Texas.

Pyramid Oil Co. 2008-21st Street Bakersfield, CA 93301 Phone:

661-325-1000

Web Site: http://www.pyramidoil.com

Only 13 employees

ROYAL ENERGY, Inc - ROYL

After Hours: 5.74

0.14 (2.50%) as of 4:19PM

ET on 05/21/08

0.14 (2.50%) as of 4:19PM

ET on 05/21/08

|

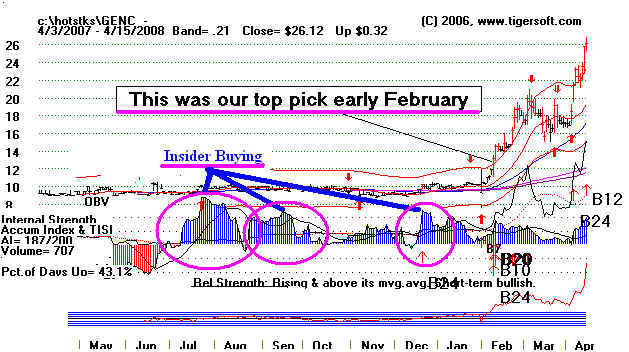

What Goes Up, Can Also Go Down. I posted this stock on our site about a month ago. It was our pick at a Tiger User group meeting in February at 10. It rose to over 30 in 10 weeks. But it was imperative to also know when to sell. It has fallen back to 15. These are thin stocks. It does not take much to derail them. Our Explosive Super Stocks book's system would have gotten you out near the top.  |

5/20/2008

---------- HERE ARE INTERESTING OILSTOCKS'

CHARTS

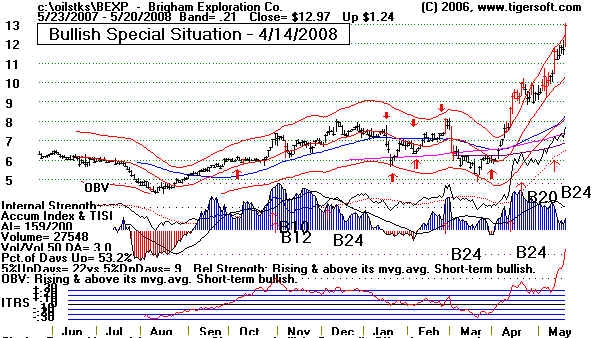

After Hours: 12.95 ![]() 0.08 (0.61%) as of 4:51PM ET on 05/21/08

0.08 (0.61%) as of 4:51PM ET on 05/21/08

Note how our TigerSoft Accumulation Index tells you what to expect. The bulges show

ery bullish insider buying. .

BEXP - we bought on 4/14/2008

Brigham Exploration Company engages in the exploration, development, and production

of oil and natural

gas in the United States. It owns property interests in the Onshore Gulf Coast consisting

of the Vicksburg

trend in Brooks County, Texas; the Frio trend in and around Matagorda County, Texas; and

joint venture

interests in the Miocene and Upper Oligocene trends in Southern Louisiana.

Canadian Natural Resources Limited, together with its subsidiaries, engages in the

acquisition, exploration,

development, production, marketing, and sale of crude oil, natural gas liquids, natural

gas, and bitumen. It also

provides midstream activities that include pipeline operations and an electricity

co-generation system.

CVX - Chevron - in the DJI-30 made a powerful looking

breakout

Old cats and dogs come out to play in a market like this.

This low-priced stock has been around for more than 40 years.

--------------------- MPET

------------------------

Magellan Petroleum Corporation, together with its subsidiaries, engages in the sale of oil

and gas, and

exploration and development of oil and gas reserves. It owns 35% interest in Mereenie oil

and gas field,

52.023% interest in Palm Valley Gas Field, and 34.3365% interest in Dingo gas field,

located in the

Amadeus Basin of the Northern Territory.

Ultra Petroleum Corp. engages in the acquisition, exploration, development, production,

and operation

of oil and natural gas properties. It focuses on developing and expanding a tight gas sand

trend

located in the Green River Basin in southwest Wyoming.

W&T Offshore, Inc., together with its

subsidiaries, engages in the acquisition, exploitation, exploration,

production, and development of oil and natural gas properties in the Gulf of Mexico area.

It has interests in

approximately 155 producing fields in federal and state waters; leases covering

approximately 1.7 million

acres in the outer continental shelf off the coasts of Louisiana, Texas, Mississippi, and

Alabama; and

approximately 539 offshore structures.