TigerSoft

News Service 11/23/2008 www.tigersoft.com

TigerSoft

News Service 11/23/2008 www.tigersoft.com BANKERS STAGE SOCIALIST COUP D'ETAT IN THE U.S.

A New $20 Billion Bailout for CityGroup.

IS WALL STREET GUILTY OF A GIGANTIC "CRY-BABY"

MANIPULATION OF CONGRESS?

WALL STREET IS NOW HOOKED ON HANDOUTS.

Look at their one-day gains on 11/24/2008 after the latest handout.

Goldman Sachs +26.5%

Citygroup +57.8%

Bank of America +27.2%

JPMorgan +21.4%

PAULSON LEARNS NOTHING FROM

HIS EARLIER MONSTROUS FAILURES

Again No Requirement That The Bank Make Loans

Again The Goverment Does Not Get Even A Seat on Board of Directors.

Again The Government Gets Non-Voting Preferred Stock

Again No Transparency!

Again No Protection That These Bankers Will NOT Make The Same Mistakes again.

Again No Discussion of The Need To Break Up This Unmanageable Giant

Again Unbridled Greed Is Rewarded

The Last Bailout Did Not Help. Why Should This One?

If The Banks Refuse To Make Loans until Government Buys

All Their Toxic, Non-Performing Loans, Then Start A Real

Government Bank To Make Loans!

CitiGroup Needs To Be Broken Up. It's Too Big (period).

by William Schmidt, Ph.D.

Author of Peerless Stock Market Timing: Automatic Buys and Sells: 1915-2008

TigerSoft's Accumution Index, Opening/Closing Power

Finding The Most Bearish Stocks

Studies of Insider Trading Best Ways To Trade Stocks

Spoting Banks in Big Trouble

TigerSoft News Service - 9/26/2008 - TigerSoft Warned Investors ...

http://www.tigersoftware.com/Insider-Trading-News-Reviews/12-30-2007/index.html

http://www.tigersoft.com/Insiders/index.html

http://www.tigersoftware.com/TigerBlogs/5-7-08/index.html

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

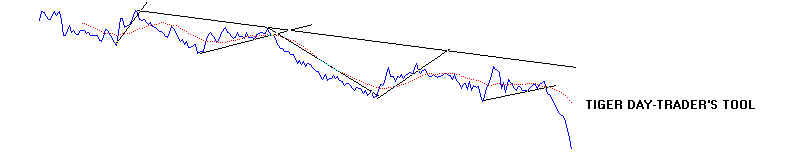

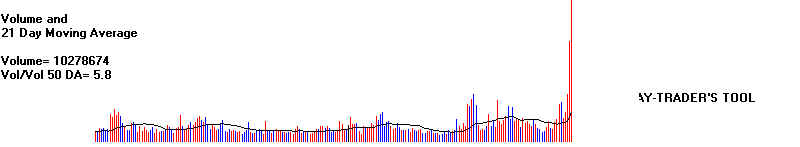

- TigerSoft 2006-2008 Charts of City-Group - See Blog 11/15/2008 See the heavy red distribution and Sells that warned of very significant insider selling. This indicator was invented by TigerSoft in 1981. It is the hallmark of stocks that make good short sales. See 165 Page Book "Killer Short Sale Techniques in Any Stock Market Environment" Massive Insider Selling at Citigroup - 2008 --------------- Citigroup's Chart 2008 -----------  Note bearish down-trending Day Traders' Tool

Note bearish down-trending Day Traders' Tool Heavy Red Down-Day Volume is bearish.  New $20 Billion for CityGroup. by William Schmidt, Ph.D. Has The 2008 Decline Been Rigged To Let Bankers Steal A Trillion Dollars? Wall Street's 30% decline since late September can be seen as part of a giant extortion racket, to get the biggest bankers every penny they can from the US Treasury. By this view, the banks that want taxpayer money are spoiled, undeserving, under-achieveing, overweight cry babies. They seek to get all the money they can before Obama becomes President. By this view, the whole debacle looks and feels like one big fraudulent manipulation, facilitated by how easy the SEC has made short selling. My own view is more complicated. The banks have been very badly managed. They certainly do not deserve to be bailed out. There are much better ways to use $750 billion. It would have been better to just give every American $2500 and start a new government owned and run bank to fill the void and to compete with the biggest banks, if they unwilling to make new loans. The private banks would get the money soon enough. I do not think this is one gigantic bankers' conspiracy to get money. The crisis is now all too real. And the banks really do not want the new regulation and government controls that now seem likely. Most important, the financial outlook is genuinely desperate. One only has to look at the price charts of one stock after another to see how all-encompassing the financial crisis has become, especially since Paulson scared Congress into giving him the $750 billion for bankers. And, finally, a rally now is overdue anyway, though the market will be pleased that some big unknowns are lifted about the Obama Presidency. Wall Street has now gotten what it wants from Obama. Obama's advisors are well known friends of Wall Street bankers: Geithner, Larwrence Summers, and Bob Rubin. And Obama has said he would delay raising the taxes on the very rich until 2011. There is no need for bankers to rush to take all they can from the $750 billion bailout package. Obama will not change the present bailout approach much. PAULSON'S BLUNDER AND PLUNDER Investors have now lost almost 10 trillion dollars since mid 2007 with Paulson as the Secretary of the Treasury. 23 trillion dollars has been wiped out around the world. All last year and until the Spring of 2008, Paulson repeatedly assured Americans that the economic and financial systems were "sound" and no economic stimuli was needed. He was terribly wrong. Then things changed. His own company's stock, Goldman Sachs, started to olunge. Big banks like Lehman Brothers and Washington Mutual failed. Paulson suddenly went into panic mode. He frightened the Congress into giving him $750 billion to give to big banks, that's $750,000,000,000 (or about $2300 for every US citizen). He said there would be disastrous consequences otherwise. In getting the bailout, he succeeded in one thing: he successfully scareed the world's financial markets into a disastrous 30% across-the-board panic that caused hedge funds to fail, commodity prices to plummet and stock markets around the world to go into free-fall. Paulson is not getting enough in return for the billions he is giving the banks. I have said that he has gotten no guarantee that the banks will loan the money and no way once the money is given to prevent the banks from using it to buy other banks, pay deferred executive bonues, waste it on lavish resorts or pay big dividends to shareholders. Without the government getting representation on the companies board of directors, it has no protection against the banks wasting the money. The government would have gotten more for its money, if it simply bought shares in the companies. "Paulson has used the $700 billion in taxpayer funds voted him by a labile Congress in September. Early on, Paulson put $125 billion in the nine largest banks, including $10 billion for his old firm, Goldman Sachs. However, if we compare the value of the equity share that $125 billion bought with the market price of those banks’ stock, US taxpayers have paid $125 billion for bank stock that a private investor could have bought for $62.5 billion, according to a detailed analysis from Ron W. Bloom." This means that half of the public’s money was simply a gift to Paulson’s Wall Street cronies. ( Source.) Warren Buffett would have gotten much more for the taxpayers. When he invested $5 billion in Goldman Sachs and bought the same types of securities–preferred stock and warrants, he received preferred shares that pay a 10 percent dividend, while the public gets only 5 percent. Buffett also “received at least seven and perhaps up to 14 times more warrants than the Treasury did. On a percentage basis, his warrants were also much closer to the current price of the shares. Paulson simply gave away half the money to his cronies. CitiGroup Should Never Have Been Allowed To Get So Big! With 374,000 employees world-wide, CitiGroup is the world's largest bank. We are told by Paulson that it is too big to fail. Like an octypus, its tentacles reach out in all directions, consumer banking, institutional banking, real estate lending, auto loans, Primerica Financial Services and investment advise. Other key banks hold immense positions in it. Barclay's holds nearly 238 millions shares, worth $4.8 billion. Mellon Banks has 79.2 million shares worth $1.6 billion and UBS holds 75.3 million shares, worth $1.5 billion. It may be reasoned that the failure of CitiGroup might well mortally wound these companies, such would be the drop in their assets versus their debts and so much would be the psychological damage to investors' confidence world wide. Clearly, it has been a huge mistake allowing CitiGroup to get so big. The Federal Trade Commission and Federal Reserve have miserably failed to protect the public int his respect, quite apart from the now very evident impossibility of administering efficiently and prudently such a huge monster. These regulatory agencies, under laissez-faire ideologues appointed by Bush. have blantantly disregarded their mandate to protect the public from CituGroup's sheer power, as a vast oligarchy with boards of directors that are interlocking and anti-competitive.  Citigroup - Chief Financial Officer, Gary L Crittende Bad decisions at the top to make loans to home owners, much more aggressively than many other banks did, has laid Citigroup low. The people at the top wanted the big numbers to get their million dollar bonuses, but did not want to hear about how bad many of the loans were. Now it is the taxpayer and all Americans who are being made to pay the still exorbitant salaries at CitiGroup to the very same managers who made this mess. "Citigroup became ensnared in murky financial dealings with the defunct energy company Enron, which drew the attention of federal investigators; it was criticized by law enforcement officials for the role one of its prominent research analysts played during the telecom bubble several years ago; and it found itself in the middle of regulatory violations in Britain and Japan....As it built up that business, it used accounting maneuvers to move billions of dollars of the troubled assets off its books, freeing capital so the bank could grow even larger...." ( http://jessescrossroadscafe.blogspot.com/2008/11/robert-rubins-culpablity-in-bubble-that.html ) Executive pay at CitiGroup is a profanity. It payed its Chief Financial Officer, Gary L Crittenden $19.2 million this past year. He should be fired and sued for malfeasance! He has overseen the company's chief finance officer since March 12, 2007. He is a Harvard MBA, just like George Bush. Robert Rubin Advocated Using More Leverage at Citigroup Citigroup insiders and analysts say that its former CEO until 2007 and Rubin played pivotal by drafting and implementing a "strategy that involved taking greater trading risks to expand its business and reap higher profits." In fact, it was Rubin who explained the benefits of being more aggressive to the new CEO, Charles Prince, in 2002 and how best to do so. ""Chuck was totally new to the job. He didn't know a C.D.O. from a grocery list, so he looked for someone for advice and support. That person was Rubin. And Rubin had always been an advocate of being more aggressive in the capital markets arena. He would say, 'You have to take more risk if you want to earn more.' " (Source. ) Clinton's Ex-Treasury Secretary, Robert Rubin, is now dancing quickly away from controversial Citigroup. But the fact remains that "(h)e has collected more than $150 million in cash and stock over eight years to serve as the bank’s elder statesman, meeting with important clients and building relationships with government and business leaders around the world, though his contract states that he is to have no daily operational responsibilities." (Source.) Insider Selling by Robert Rubin at CitiGroup

As much as anyone in Citigroup, Rubin advocated using more leverage to make

|

|||||||||||||||||||||||||

| See also http://www.insider-monitor.com/trading/cik831001.html

White Collar Crime Prof Blog: Insider Trading Based on Recklessness |

|||||||||||||||||||||||||

| |