The Rise and Fall of Commodities' Hedge Funds

Pump and Dump

Oil, Silver, Gold, Food Commodities -

It's All The Same.

COMMODITY EDGE FUNDS ARE DESPERATELY TRYING TO RAISE MONEY NOW.

THEY MUST SELL EVERYTHING.

by William Schmidt, Ph.D.

Author of TigerSoft and Peerless Stock Market Timing:

1915-2008 and Nightly Hotline

Wall Street Is Not Trusted. But Who Has Confidence in Washington?

It is hard to imagine a set of policies that would more

effectively

destroy long-term confidence in financial markets than the

one Bush, anti-regulation ideologues and Wall Street hipsters have

foisted upon the American people since 2000. Speculative excess,

unbridled greed, unchecked de-regulation, rampant cronyism and

greed lay behind the Crash of 1929. We are headed there again,

unless an abrupt U-Turn is made by the nation's policy makers.

The administration's obsessive devotion to the principles of laissez-faire

has now been matched by massive bailouts, totaling a trillion dollars,

for Wall Street bankers. No wonder wealth is more concentrated

than at any time since 1928.

Will an Obama or a McCain Administration bring a U-Turn? Can

A depression be avoided? Despite all their talk about more regulation,

the bailouts for Wall Street have the approval of Democrats Obama,

Nancy Pelosi and Harry Reid and Robert Rubin of CitiGroup.

An ugly truth is emerging: a class war against Main Street,

the middle class and the working class is now being waged by both

political parties' elites. With real wages declining for workers for

30 years, credit supremely tight, and the costs of health insurance and

education rocketing up, how can a long recession that amounts to an

economic depression be avoided?

Bush has robbed the US Treasury dry. He has given billions,

even trillions, to the Wall Street bankers, private military contractors

and oil company executives who put him in office. Incredibly,

one

twelth of the nation's entire annual GDP (all the nation's goods and services),

has now been ear-marked to save American bankers from the

consequences of their own mistakes and greed. Small wonder

confidence has been so badly shaken.

For his final insult, Bush has now turned the job of fixing the economy

to the very Goldman Sachs thief (Treasury Secretary Paulson - with

a personal net worth of $700 million) who lobbied from 2000 to 2004 for

banking and financial markets' de-regulation and authority for hedge funds

to use much greater leverage. This is EXACTLY what caused the very mess

we are now in. How can confidence be restored by Paulson?

Hedge funds are not regulated. Hedge fund managers are allowed

to take huge chunks of hedge fund profits, but never be liable in any

way for the losses they might create for their clients. In this situation,

of course, they took dangerous risks and used too much leverage.

But that's just part of the story. Commercial banks were

allowed

to sell home mortgages to others once they were allowed to become

investment bankers in 2000. They hyped, obfuscated, packaged and

sold the home mortgages they made and used the proceeds to permit

still more unsafe loans. Lending standards became a joke. They were

nearly unimportant. Someone else could always be counted on to

buy the neatly packaged mortgages.

Another element in the picture was the freedom of hedge funds to

sell short without bothering to even borrow stock, do so on down-ticks

and to not have to report their positions, as they would have been obliged

to if they were buying shares. In this unregulated environment, they

were seldom accountable. They could mercilessly try to drive a

company's stock down, down, down. They could spread false rumors

about the company they were shorting with very little chance that they

would be caught and prosecuted. The SEC still refused to ban short

sales on down-ticks. All in the name of a "free market". The truth

is probably much more sinister. SEC Chairman Cox has probably

received some special considerations from the hedge funds he refuses

to limit. This we cannot know. The SEC does not investigate itself..

In all these way, the anti-regulation zealots have created an

investment climate that could not have been better designed to

create a financial disaster, had that been their intention all along.

Paulson has long been dead-set against trying to cool the bubble in

commodities, just as Greenspan had steadily opposed trying to

contain the housing bubble. "Wall Street profits should not be

contained." Like Greenspan, an earlier backer of the bank

deregulation,

Paulson consistently maintained that commodity and stock prices

should be left to themselves. "There was no need for the government

to intervene in financial markets", he stated time after time. The

economic outlook was rosy as ever. There would be no recession.

As a result, he did not lift a finger to prevent the bankruptcy of

Lehman Brothers in September 2008. When Freddie Mac and

Fannie Mae failed, the US government nationalized them, because

these two entities owned $5.5 trillion in home mortgages and

the US Government has long implicitly guaranteed them. Paulson

changed his laissez-faire approach with the collapse of AIG. This

insurance giant was closely linked to hedge funds. If they started

selling their assets, even more hedge funds might fail. So, he stated

"AIG was too big to fail" and the US bought an 80% interest in it.

The financial debacle among hedge funds we are seeing now

has had far-reaching ripple effects. While hedge funds were set

up exclusively for very wealthy and experienced investors, it is

average investors who typically are now suffering the bulk of the

financial distress caused by the failures of so many hedge funds.

Financial stocks and commodities' stocks make up a heavy

percentage of the SP-500 and DJI-30, which so many mutual funds and

ETFs have endeavored to match. For years, small investors have been

told to simply "buy and hold" these investments. "Never

sell until, you

retire." "The market cannot be timed". This they were told by the

"experts", who it turns out were only the unthinking salesmen of the

very firms who pushed for de-regulation and the prime beneficiaries

of the unregulated boom. Conveniently, they swept out of sight

the

rocky, roller-coaster years, 1929-1941 and 1966-1982. Small

investors were no to quickly buy and sell, like the hedge funds

did. What hypocrisy! It seems that each generation forgets the lesson

that markets are highly cyclical.

The Dangers of Excessive Leverage

Billion dollar hedge funds have used their leverage to buy hundreds

of billion dollars' worth of commodities and securities. Even so, the prices of

commodities like Wheat, Corn, Crude Oil, Natural Gas and Silver collapsed

in the Summer of 2008, even as the hedge fund chiefs doubled down their bets,

a tactic they had often used successfully in the past.

The

Dynamics of "De-Leveraging"

A wider financial disaster was now hiding in the shadows. When

the hedge funds' efforts to prop up prices on the decline failed in July

and August, it was mostly because prices were just too high and

beyond the reach of world consumers. When they double-downed in

September,

they were blind-sided by the take-overs of Freddie Mac

and

Fannie Mae, the bankruptcies of Lehman Brothers and Washington

Mutual,

the government takeover of bankrupt AIG and the near-bankruptcies

of

Merrill Lynch and Morgan Stanley.

When

there was no rebound, these hedge funds started to panic.

Prices

fell disastrously. Because of the over-leveraging, margin and

new

collateral calls came quickly. Word leaked out that big funds were

selling

big positions under duress. The polite term was "de-leveraging".

Rumors spread and stock brokers front-ran the hedge funds' Sell orders.

Other

"rogue" hedge funds smelled blood. They used their extra leverage

to sell short the very stocks and commodities that the troubled funds

had

to unload. And now they could sell on down-ticks, thanks to the SEC

and Chairman Cox. As prices dropped, good stocks had to be sold

along with the bad. Nothing could escape. Other over-leveraged

hedge

funds were caught up by the same dynamics. As losses mounted,

articles started appearing. This made investors want out. Redemptions

rose. Expectations of rising redemptions rose. More stocks had to be

sold.

Seeing prices fall much more quickly than normally, regular buyers

withdrew their buy orders and chose to wait for the decline to stop. This

just made matters worse. Such were and are the dynamics of the 2008

financial panic.

Collapsing Hedge Funds and

Falling Commodity Prices

Create Short Term Weakness in Gold

"Many hedge fund managers are under severe

pressure to liquidate positions as

banks request more collateral to back funds' borrowing. Many hedge funds, including

some of the largest, have gone to the wall in recent months and Credit Suisse estimates

that 30% of roughly 8,000 hedge funds will close over the next few years. Wealthy

investors are turning their backs on high risk hedge funds as there is a reevaluation

of the sensibility of massive leverage and banks are no longer willing to fund the hedge

funds' speculations." 10/17/2008 Source.

George

Soros wrote in January 2008 that the "era of

superleverage" had

ended. Ihe was six months' premature. He was right in saying there has been a

"systemic failure" and

there was then no financial sherif on watch.

NYTimes - 1/23/2008 comment to article on Soros:

"The derviatives market, incluing the credit swap

market, is over

$750 Trillion (that’s with a “T”). Global GDP is estimated at $50 Trillion.

It doesn’t take a “systemic failure” to cause a nightmare. A failure of

less

than 7% of derivatives contracts wipes out global GDP. The fact that derivatives

are the most highly leveraged asset class on the planet (up to 100 to 1) means

that the 7% failure could be brought about by only a fraction of real, underlying

asset decline. " Mark S

- 1/23/2008 comment

"We need new words in the English language to

express the unbelievable

corruption of the US government in its allowance of the banking and Wall

Street crowd to take this country to the edge of financial disaster due to greed.

Now how do we justify the government bailing out these greedmeisters with

public tax money? Bush will go down in history as the most corrupt and

incompetent president ever. Ron

A Systemic Failure

In the financial world, you would be hard pressed to design a

system better able to produce an extreme cycle of binge and purge,

boom and bust, pump and dump. This was the system that the Bush

Administration has set up after 2000, all in the name of "free

markets"

and "private enterprise". In light of the bailouts, his hypocrisy would

be humorous, if it were not so tragic. He has destroyed much more

enterprise and labor than he ever created. We are far less safe.

And his markets are anything but "free".

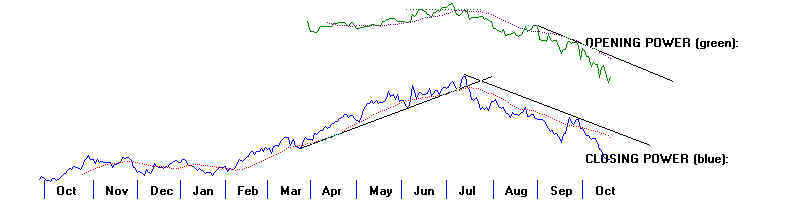

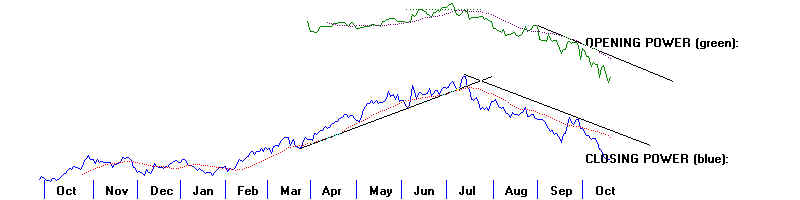

It's easy to see in retrospect what produced the

financial panic

of 2008. But, for me, it was the TigerSoft charts showing heavy insider

selling that was the first alert. When you see such very red

"Distribution"

and a pattern of sell-offs after a string of strong openings, you should

be put on high alert.

I don't pretend to know more than I really do. But elsewhere

I have warned frequently about the housing bubble and how banks

sold bundled mortgages that they knew, but did not care, were not

soundly financed.

8/1/2005 "Housing Bubble Trouble"

http://tigersoft.com/Housing%20Bubble/index.html

6/5/2006 "Home Building Stocks Are Particularly Weak"

http://www.tigersoft.com/What'sNew/index.html

3/10/2007 "Insider Selling in Mortgage Lenders"

http://www.tigersoft.com/Housing%20Bubble/Second%20Leg%20Down.htm

5/14/2007 "Is

Washington Mutual the Next Bear Stearns or Northern Rock?"

http://www.tigersoftware.com/TigerBlogs/May-14-2008/index.html

6/14/2007 "Absolutely, The 1929 Crash Could Happen Again."

http://www.tigersoft.com/Tiger-Blogs/6-19-2007/index.htm

6/4/2008 "Far from Over, The Credit Crunch Is Worsening:"

http://www.tigersoftware.com/TigerBlogs/6-4-2008/index.html

7/16/2008 "Investing in A Perfect Storm"

http://www.tigersoftware.com/TigerBlogs/July-16-2008/index.html

Here I want to talk about billion dollar hedge funds using 200:1

leverage. Their callous, unbridled and selfish greed is

to blame. They

created the commodities' boom, apparently not caring one iota about:

(1) the deleterious effects on poor people around the world that

were starving for rice, wheat and corn;

(See - 4/19/2008 - TigerSoft

News Service - Hoarding, Food Riots, Starvation ...

2/26/2008 - Food Commodities Streak

Upwards.

2/22/2008 - Food Commodities Are

Going Hyperbolic

(2) that they were making consumers pay sky high gas prices,

which were sure to deprive consumers of so much buying power

that a recession would became a foregone conclusion;

4/20/2008 - "Yes",

People Are Bitter.

(3) that they would create an artificial bubble in commodities, not

unlike the Hunt Brothers' effort in 1979 and 1980 to corner the

market in silver, and this ould only end very badly and wipe out

the savings of millions, in its aftermath.

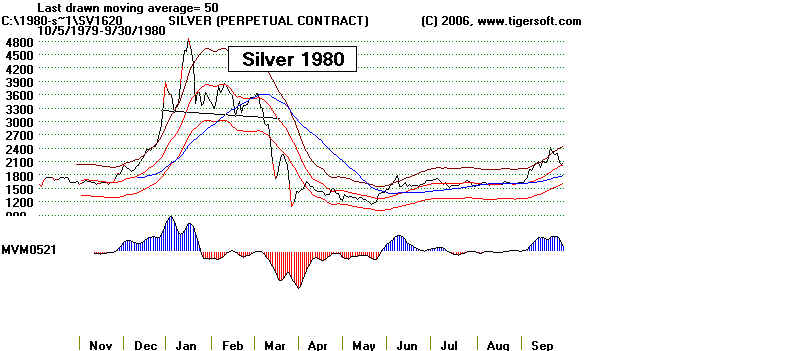

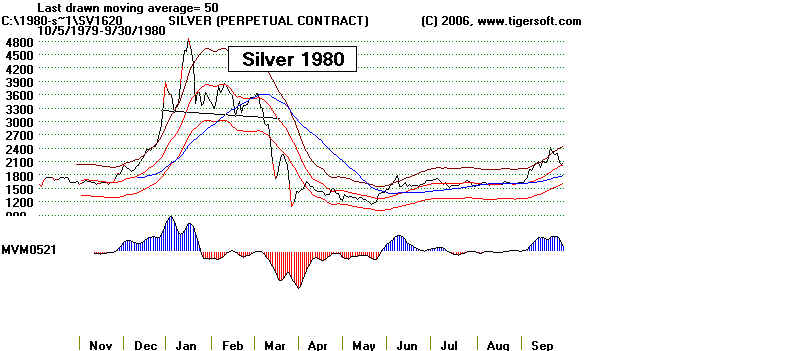

From 1979 to January 1980, the Hunt Brothers from Texas tried to

buy up all silver futures' contracts and corner the market. They would

have succeeded. But the commodities' exchange changed the rules

on them and limited the numbers of contracts that could be held

individually. The result was that they had to sell. Silver collapsed

75% in ten weeks, from $48/ounce in January to $11/ounce. Margin

calls drove prices, down, down, down after prices broke below

the neckline in the head and shoulders at 3100.

BOOM AND BUST

-------------------------------------------- Silver 1980

---------------------------------------------------

A generation later, in 2008, silver like many other

commodities is doing

the same thing, going down, down, down. Will it have to drop 75%

and fall below $5/ounce, as it did in 1980? In many ways, the commodities'

bubble of 2008 is much bigger than in 1980.

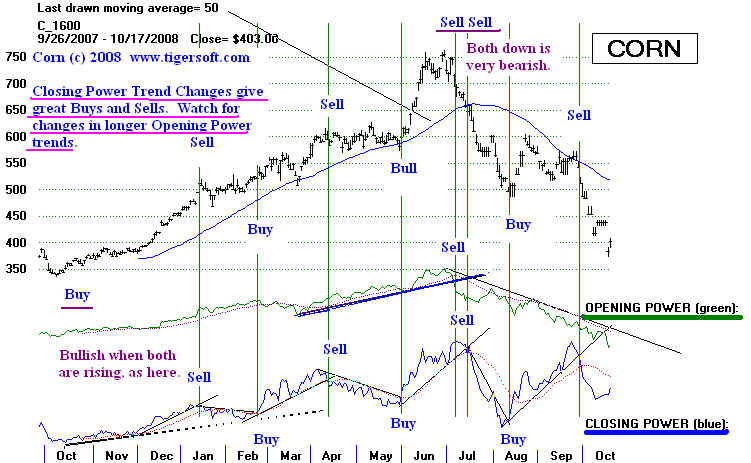

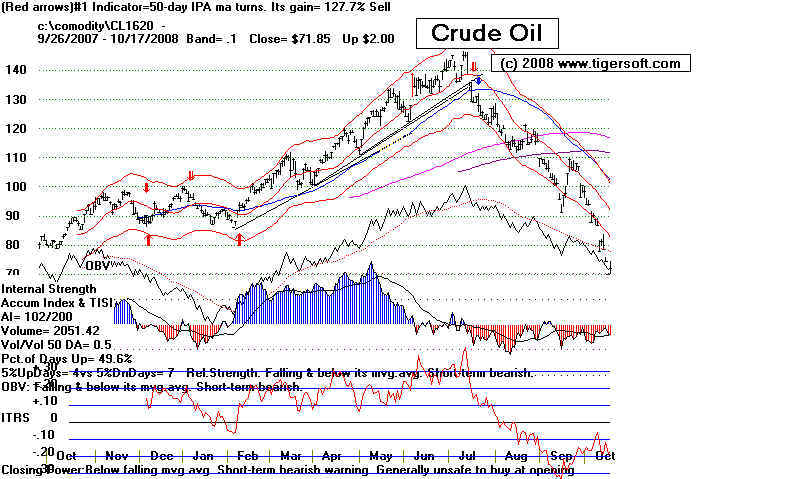

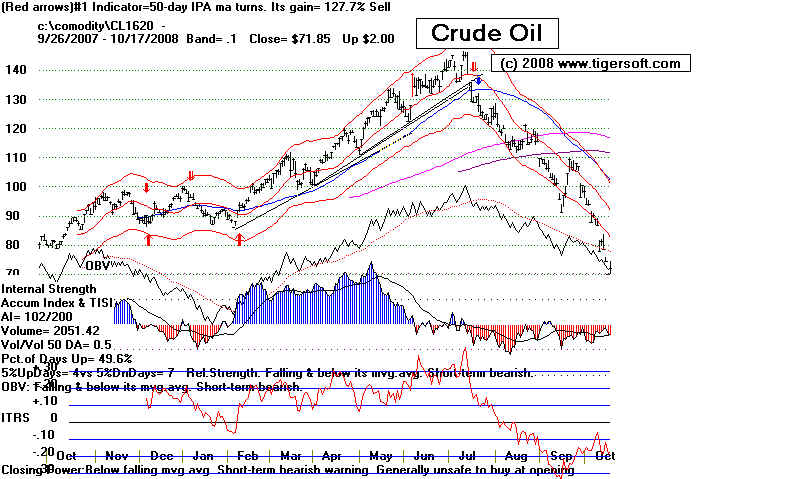

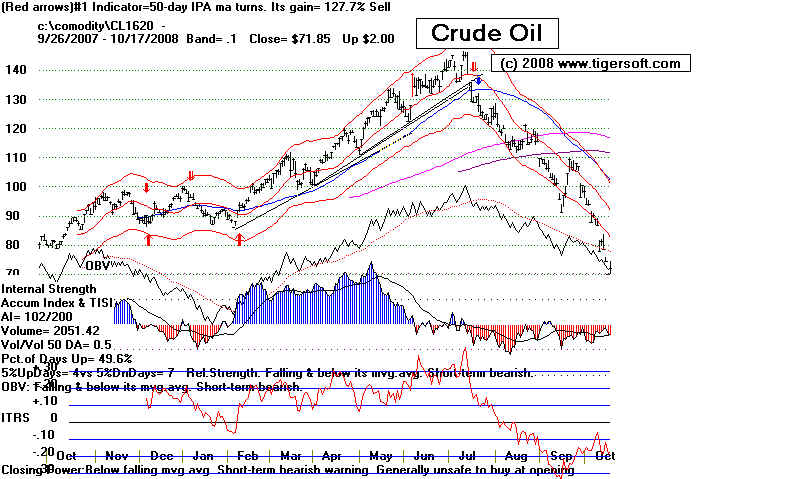

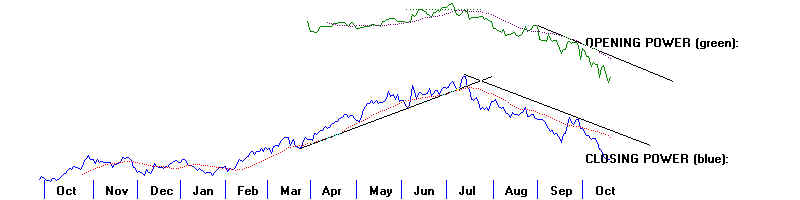

Tiger Crude Oil: Boom and Bust

Crude Oil broke its uptrtendline and its blue 50-day ma. while still above 130,

Red and Blue Sell signals flashed from TigerSoft. TigerSoft's Accumulation Index

was in negative territory. Our Opening and Closing Power Lines were both falling.

This is the bearish of combinations. The black 200-day ma is violated straight away.

Prices do not get back above it and are hit with renewed selling. Technical

conditions

do not get better. A 12-month low is made.

THERE's ALWAYS MORE THAN ONE COCKROACH

The collapse of one big firm endangers others. First, it was Bear Stearns,

then Morgan Stanley and Washington Mutual. Then Fannie Mae, Freddie

Mac and AIG had to be bought out by the US Government. It is not just

a matter of shattered confidence. It is also that these firms' holdings had to

be dumped on the market, making market valuations drop sharply for the

securities that they are selling. And that produces more margin calls and

under-capitalization notices by the FDIC. This produced yet another round

of selling. And so the cycle was self-perpetuating.

Seldom does only a single commodity crash. Others commodities

soon also drop, out of fear and out of necessity. Hedge funds and commodity

funds get margin calls and they must sell out their other positions. This puts

the same pressure on more and more firms investing in commodities. Below

you can see that 10 of the 19 commodities topped out in July 2008.

Commodity Fall 2007 Low

Earlier 2008 Peak Now -

10/17/2008

---------------------------------------------------------------------------------------------------------

Corn (C)

345.

754.75 (6/27/2008)

403.

Coffee (CC1600) 118.90

164.60 (2/29/2008)

115.60

Crude Oil

80

145.10 (7/14/2008)

71.85

Corn

2000

3360 (7/1/2008)

2122.

Copper

287.30

407.75 (7/2/2008)

219.45

Gold

72

99.22

77.21

Heating Oil 220

407.66 (7/11/2008)

213.29

exception Lead

80

98.00 (2/12/2008) hit 62.25 87.48

Live Cattle

94

103.33 (7/1/2008)

91.05

Live Hogs

52

78.60 (7/25/2008)

56.30

Lumber

225

270.10 (8/20/2008) 199.

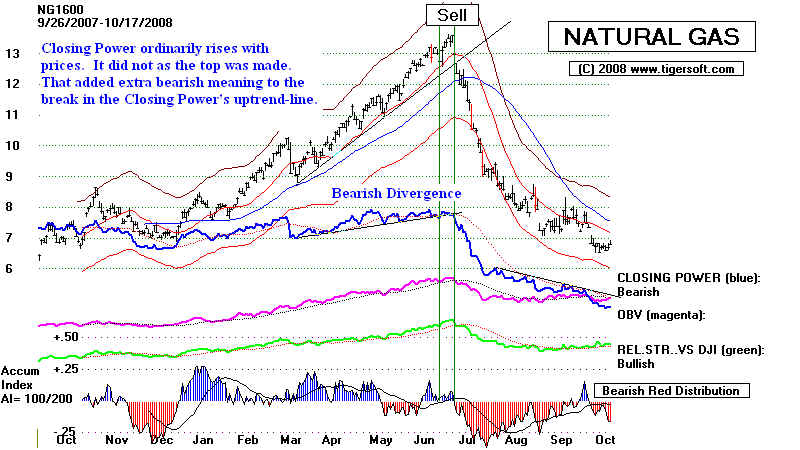

Natural Gas

7

13.39 (7/2/2008)

6.79 example

Oats

261

455 (7/3/2008) 282

exception Orange

Juice 130

128.85 (7/1/2008)

83.55

Platinum

13800

2276.`10 (3/5/2008) 872.50

Silver

1325

2068.50 (3/5/2008) 931

Soybeans

920

1658 (7/3/2008)

894.

Sugar

9.70

14.13 (8/7/2008)

11.58

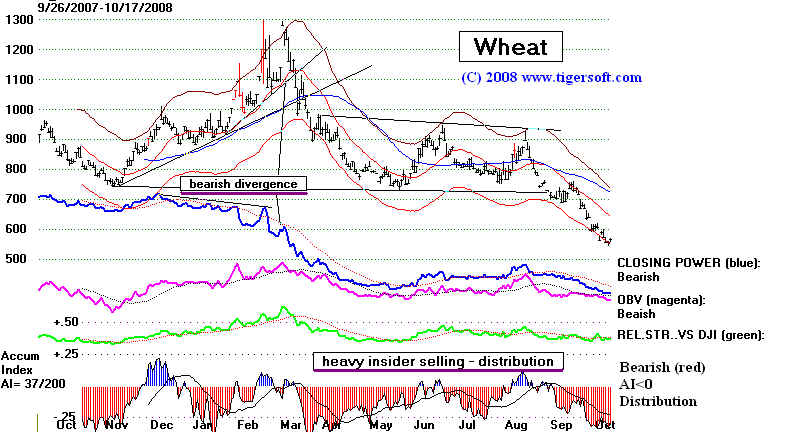

Wheat

752.50

1257 (3/12/2008) 566.25

Tiger Index of 19 Commodities and Metals

FREEDOM FOR THE PIKE IS DEATH FOR THE MINNOWS

By creating stock market bubbles, highly unequal and

unrestrained power

threatens the security, liberty and livelihood of smaller investors and all American

workers. Taliban-like, hypocritical devotion to a free market is a dagger

pointed

at the heart of American democracy. All booms seen to foster an unsavory

assortment of hipsters, promoters, parasites, swindlers and cheaters. They

just be regulated, or the results are tragic for millions that don't even own any

stocks.

WHAT's A HEDGE FUND?

Hedge funds are private and unregulated pools of capital

that invest across all markets. Hedge funds

often do not hedge. They are not more conservative as the word "hedging"

might suggest. Most often, they

use complex, aggressive and risky strategies, in seeking higher returns for their wealthy

backers.

The most important commonality among hedge funds is how managers are compensated.

Typically

this involves management fees of 1-2% on assets and incentive fees of 20% of all profits.

This is in

striking contrast to more traditional investment managers, who do not receive a

percentage of profits.

These compensation structures encourage greedy, risk-taking behavior that normally

involves leverage

to generate sufficient returns to justify the enormous management and incentive fees.

A HEDGE FUND NEARLY CRASHED THE MARKET IN 1998

US Federal Reserve Board chairman Alan Greenspan

acknowledged in 1998 that the collapse of the

hedge fund Long-Term Capital Management last month could have brought a huge crisis on

Wall Street and global financial markets. As it was the DJI merely fell 20%

in 3 months.

Testifying before the US House of Representatives Banking Committee, Greenspan said the

$3.6 billion bailout organized by the Federal Reserve Bank of New York was necessary

because

of the fragility of international markets. :"Had the failure of LTCM triggered the seizing up of

markets, substantial damage could have been inflicted on many market participants,

including

some not directly involved with the firm, and could have potentially impaired the

economies of

many nations, including our own." Greenspan warned that had LTCM been liquidated through

a "fire sale" of its assets this would have resulted in a "severe drying up

of market liquidity"--in other

words, a credit crunch that could have rapidly spread, setting the stage for further

collapses.

WHAT HAPPENS WHEN MARKETS BECOME ABNORMAL?

Greenspan's testimony pointed to the the strong possibility

of future financial collapses. He said

LTCM had based its transactions on mathematical models that sought to profit from

differences

between the current price of financial assets and their historical trend. By

investing vast amounts

of capital, borrowed from the banks and other financial institutions, the fund was able to

make

substantial profits just so long as "normal" conditions applied and the price of

financial assets

returned to levels predicted by their historical models. But markets change

In the case of LTCM, it assumed that short-term interest rates would tend to rise in the

market.

However, in the aftermath of the Russian ruble collapse and default in August 1998, there

was

a rush of capital into US Treasury bonds--the so-called "flight to

quality"--that pushed up prices

and sent short-term interest rates to their lowest levels in almost three decades. As a

consequence

LTCM suffered what Greenspan termed "stunning losses," and was forced to

liquidate the majority

of its capital base.

HEDGE FUND PROLIFERATION AND 100:1 LEVERAGE IN THE 1990s

Hedge finds using predictive models based on normal market behavior have

proliferated. A New

York Times estimated that their number has doubled from 1990 to the end of 1997,

and then

stood at 4500, while investors' capital in them has increased six-fold to $300 billion. As

large as

these sums are, they are only partially indicative of the potential impact of hedge funds

on the

global financial system. In the case of LTCM, for example, the $2.2 billion supplied by

investors

was used as collateral to buy $125 billion in securities that were then used, in turn, as

collateral for

derivatives transactions worth $1.25 trillion.

Commodity hedge funds now oversee about $55 billion in 2008, up from

$30 billion in 2007 and

$14 billion in 2006, according to Cole Partners Asset Management in Chicago, an investor

in these

funds.

California's public employees'

pension fund, the world's largest, made its first investment of $1.1 billion

into oil and other commodities early 2007. Other pension funds

rushed to get in on the action as

the prices of oil, precious metals, corn, uranium and other vital goods rose in early 2008

to record highs. Montgomery County officials shifted 5 percent of their $2.7 billion pension

fund away from stocks and into commodities in 2008.

Commodity markets are not geared to have

big funds sitting on long term positions of thousands

of commodity contracts for long periods for foods and so on. http://www.brownfieldnetwork.com/

EXAMPLES OF FAILED COMMODITY HEDGE FUNDS

Ospraie was the world's biggest commodity-focused hedge fund,

with

$7 billion under management. It

failed in early September. Ospraie sent a letter to

investors saying it was closing its nearly $3 billion flagship fund after a 27% loss in

August

left it down over 37% for 2008. According to SEC filings, Ospraie

had large positions in

Alcoa, Arch Coal, NRG Energy, and XTO Energy, which suffered

disproportionate losses

this week, after the fund's problems were publicized Osparie's collapse settled the fate

of Lehman Brothers, which owned 20% of it.

What

were the main reasons for the failure by a huge hedge fund, like Ospraie

that had $7 billion under

management? When commodities dropped they doubled their bet, hoping for a

recovery as before.

But it didn't. They weren't like individual investors. They were using

leverage of 150-200 to 1. That

means they were committing $450-$600 billion. They suffered from

"front-running" by their agents,

brokers putting in their sell orders. .For example, oil's steep drop on Aug. 22 may have

been related

to Ospraie's efforts to raise capital ahead of Tuesday's letter, where the fund said it

plans to disperse

40% of its assets to investors by Sept. 30. When prices kept falling all that

leverage worked against

them very quickly. And they had to sell even faster. Other commodity hedge funds made a

similar

mistake with the same bad result. They, too, got margin calls because of the falling

prices.

In commodities, speculators can buy silver or oil futures with only 7% down.

Sound familiar?

Highland

Capital Management LP plans to close its flagship Highland Crusader

Fund and the

Highland Credit Strategies Fund after losses on high-yield, high-risk loans, and other

types of debt.

Highland will end up with two funds in the next three years with more than $1.5 billion of

assets.

Citadel

Investment Group LLC, one of the world's largest hedge funds with about $18

billion

of assets, told Reuters that September 2008 was the worst month in its history. Its

main fund,

the $10-billion Kensington Global Strategies, is down approximately 22 percent for the

year.

Rumors are circulating Atticus Capital is liquidating positions, although

executives at the $13 billion

hedge fund deny that's the case, The WSJ reports.

$386 million Merchant Commodity Fund, run out of Singapore.

MotherRock, a $400 million fund run by the former president of the New

York ercantile Exchange,

Robert Collins, said in August that it was closing.

Amaranth Advisors, which collapsed after it took a $6.5 billion loss on

bad natural gas wagers.

Sentinel

Hedge Fund imploded in August 2007. A list of its creditors shows how

wide the

ripple effect is.

Even

c. |

TigerSoft

News Service

10/19/2008

TigerSoft

News Service

10/19/2008