TigerSoft News Service 2/22/2008 www.tigersoft.com

See Blog 10/7/2007 Trading Food Commodities

Food Commodities Viewed by TigerSoft

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981

|

Food Commodities Viewed by TigerSoft

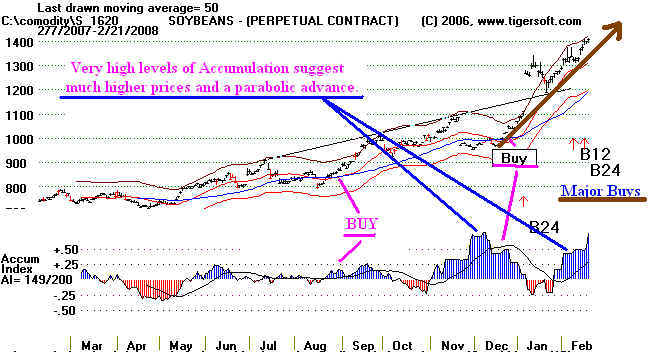

We are long DBA. The chart shows why. Prices surpass the 50-day ma with the Tiger

Accumulation Index being positive. The bulge of intense accumulation showed that the advance

was heating up and could go "hyperbolic". The commodity charts here are based on "perpetual

contracts". The longer term charts show that these commodities' prices often spike and fall

back very quickly. Using protective stops just below their 5-day or 10-day ma is probably

reasonable.

This page shows how strong, lot of Accumulation and high relative strength, Food

Commodities are now.

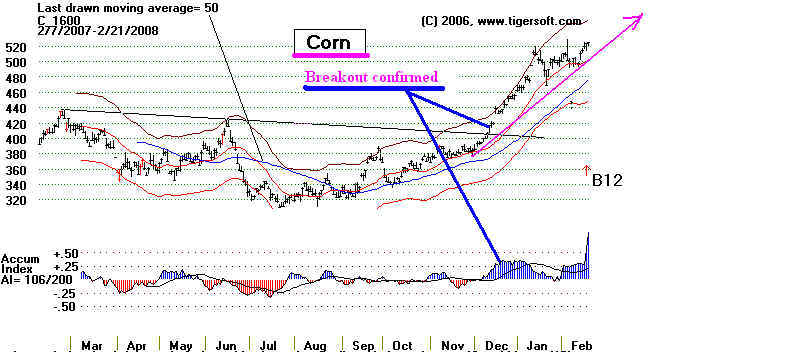

======================== Corn ================================

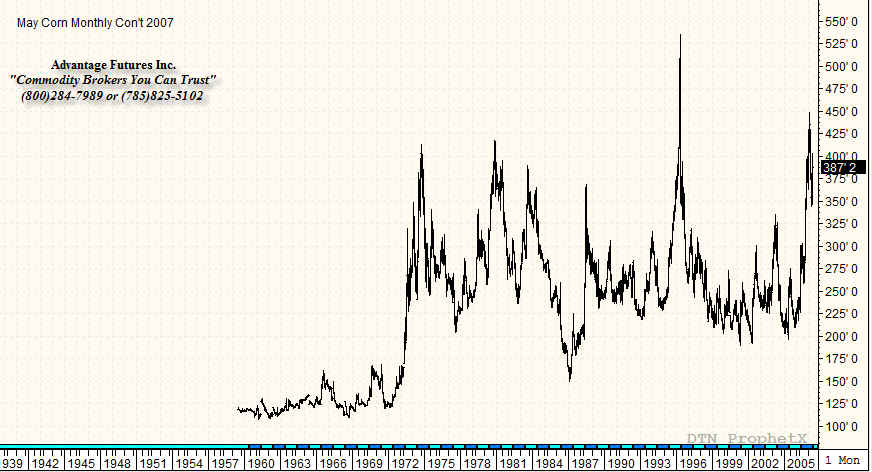

CORN is on a Buy. Positive Accumulation confirmed the breakout. The all-time high

was seen at 525 very briefly in 1993 or 1994. (See the monthly chart below). The last time

it reached this level it reversed and quickly lost all its gains. This calls for caution.

Monthly Corn

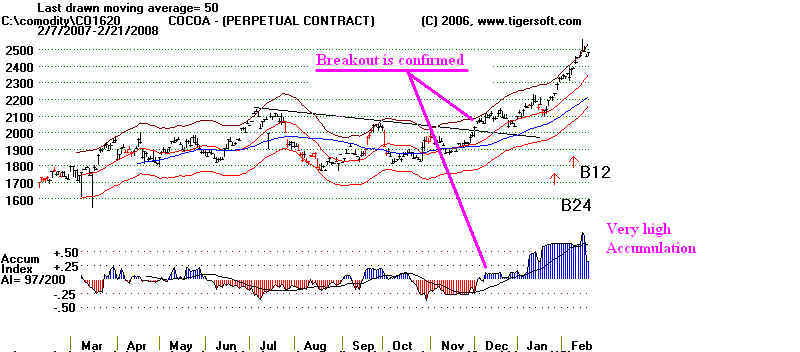

======================== Cocoa ================================

COCOA - Break was confirmed by positive Tiger Accumulation.

Note how high the levels of recent Accumulation are. Higher prices must

be expected. It previously peaked at 2400 in 2002. A double top was needed

to bring about a reversal.

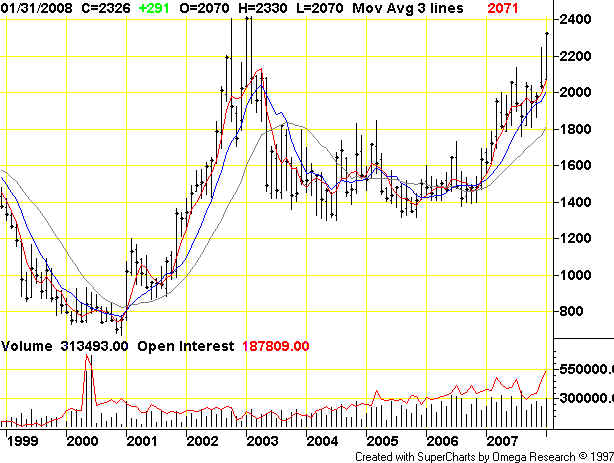

Cocoa Weekly

======================== Soybeans ================================

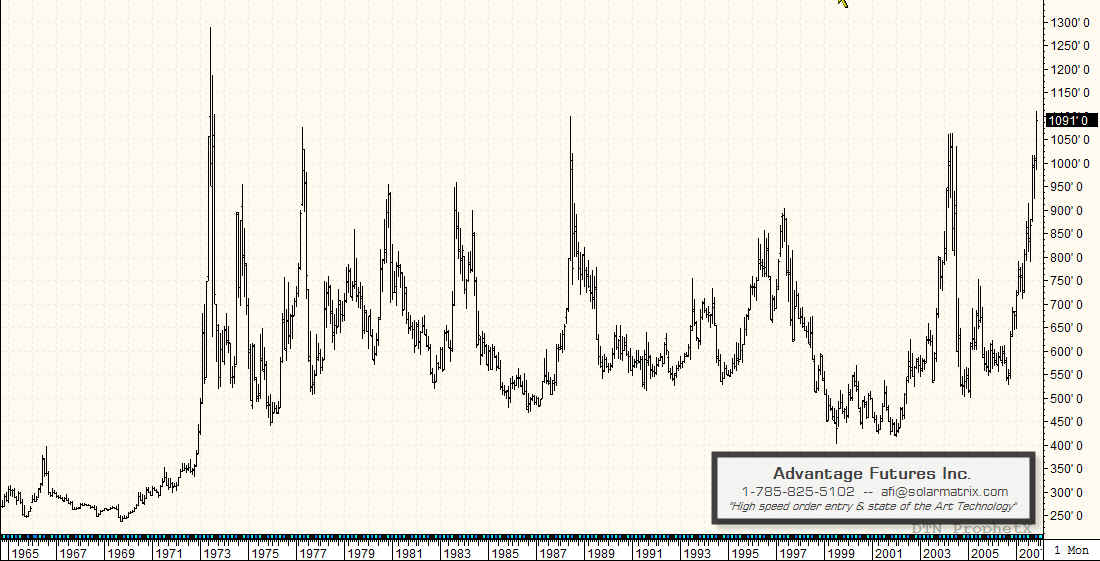

Soybeans are at an all-time high. Their history shows numerous spikes up

followed by equally steep declines. This means that a 5-day or 10-day ma should

probably be used to protect profits.

Monthly Soybeans

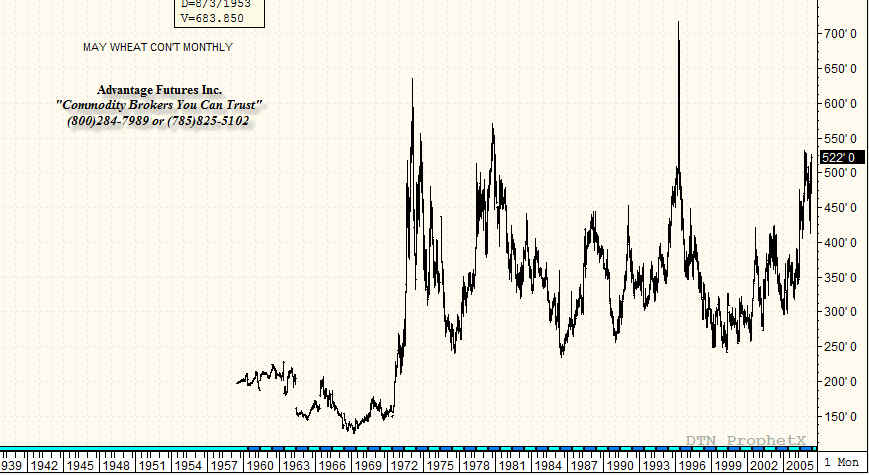

======================== Wheat ================================

Wheat is at an all-time high. Its peaks are often spikes. This means that a 5-day or 10-day

ma should probably be used to protect profits.

============================= Sugar =========================================

Sugar looks bearish because the new highs show red Distribution.