TigerSoft Freedom News Service 6/4/2008 www.tigersoft.com

Updated 6/5/2008 - Foreclosures Rate hits record high

Far from Over, The Credit Crunch Is Worsening.

Use TigerSoft Indicators and Signals

To Sell Short The Weakest Banks.

Huge Insider Selling by Washington Mutual's CEO,

Killinger (as Rhymes with Dillinger),

Was How We First Spotted This as A Short Sale.

Also Use Our "OP21" and "Sell S6s" for Shorting

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

See the TigerSoft techniques for find Explosive Super Stocks: Oil Coal

|

Tiger

Software Helping Investors since 1981

|

The Credit Crunch Is Worsening.

Try Borrowing Some Money from A Bank!

(Source: http://caglepost.com/cartoon/John+Trever/49084/Credit+Crunch.html )

There are 11 million American homes now on the market for sale. Even if

no other homes go on the market for the next year, it would take nearly that long to eat

up that supply. Housing prices are soft. Another 10% decline will cause a whole new

wave of foreclosures and write-downs by banks of their loans. With home prices

down and no way to pay a balooned mortgages, it is cheaper for many to just walk

away from their home and let the bank suffer the losses. 8.5 million homeowners had

negative or no equity in their homes at the end of March, representing more than

16 percent of all homeowners with mortgages

"Nearly 1 percent, or roughly 447,723 loans, fell into foreclosure during the

January-to-March period, the Mortgage Bankers Association said Thursday in its

quarterly snapshot of the mortgage market. This exceeded the previous high of 0.83 percent

over the last three months in 2007. Homeowners slipped behind on their monthly payments..

The delinquency rate jumped to 6.35 percent -- or 2.87 million loans -- compared

with 5.82 percent for the previous three months. Payments are considered delinquent

if they are 30 or more days past due. These rates are the highest on record going back to 1979.

(Source: http://biz.yahoo.com/ap/080605/home_foreclosures.html )

This wave will surely make some big banks insolvent unless they can

miraculously raise billions of investment capital. The Fed has signaled that it will not

be lowering rates anymore. But it may soon have to get its checkbook out. More big

bank failures are likely otherwise. The credit derivatives have cluded the issue terribly.

How close a bank is to insolvency cannot be easily determned because of these complex

derivative instruments. But the way financial stocks are declining surely tells us that big

money wants out more than in.

Wealth Distribution Is Dangerously Highly Concentrated

Wealth has become as highly concentrated in the US as it was right before

the Crash of 1929. Wealth inequality was a major factor in the coming of the Depression.

See - http://www.gusmorino.com/pag3/greatdepression/

In 1983, the bottom 40% of the population owed less than 1% of the US. The wealthiest 1% owned 34.3%.

(Source: http://www.faculty.fairfield.edu/faculty/hodgson/Courses/so11/stratification/income&wealth.htm )

This year the NY Times estimates the top 1% own 90% of the wealth in America.

(See - http://query.nytimes.com/gst/abstract.html?res=9503EFD8153EE033A25753C3A9679C946697D6CF )

If the rich don't share more of what they have, a Depression is likely. If working people

have no money and there is no credit, they can't buy things. It's about that simple. The US Government

is so deeply in debt, its ability to stimulate the economy is much more limited. The Democrats

have grown very fond of attacking Bush and the Republicans for imbalancing the budget.

This will put them in a straitjacket fiscally if they should inherit a steep recession in 2009.

Personal bankruptcies are up 40% from a year ago nationwide. Congressional Democrats are

seeking an expansion of the authority of bankruptcy judges to modify loan terms on a mortgage

for a principal residence. Republicans say this would cause banks to stop making mortgage loans.

(See - http://www.washingtonpost.com/wp-dyn/content/article/2008/01/03/AR2008010303617.html )

|

Stripping Houses after Foreclosure People blame the banks for the balloon loans, not themselves. Their anger at having to give up their homes, turns to stripping the house, sometimes beyond repair. They takes "everything including the kitchen sink." They smash walls to rip out the wiring and copper pipes to sell them for scrap in back alleys. They dig up the palm trees. Many bankers are paying occupants thoufands of dollars to leave without stripping the houses. In some places, holes are punched int he wall as retaliation and paint or motor oil is dumped on the floor. Dog poop is also a favorite of the angry ex-homeowners. Look in the newspaper or Craig's List for used double0wall ovens, dishwashers and wall-microwave ovens. See - http://outsideyourmarket.com/2008/04/09/buyers-revenge-trash-the-house-after-foreclosure/ One guy even put pigs in the house when he was foreclosed upon. The banks have to prove who did the vandalism. This not not easy if the trial goes to jury. A lot of people think of banks as the enemy. "Actually, I couldn’t be happier about this. Remember, the ones who will ultimately - and yes, it will take a long time - be hurt most by this are the same moth&rF#cke*s who should have never been let anywhere near this house. So when this dummy strips his house, screws the bank, stiffs the developer and trashes the neignborhood it will make the stark reality of the lesson to be learned all that dramatic. The worst

thing that could happen is for this guy to clean the place, slap on a freash coat of paint

drop off the keys so the bank can show it the next day. No, these bankers must really FEEL

the hassle, and the anger, and the loss that their loose lending stanmdards caused because

ultimately that is the only thing that will restore sanity to this market, and with it

more affordable housing." |

BERNANKE's LATEST WARNINGS

Fed Chairman Bernanke is clearly worried that the Credit Crisis is worsening,

On the one hand, he told Congress to do something, anything, to stave off the growing

wave of foreclosures. On the other hand, his own data shows that banks are

tightening

credit in an unprecedented way. Though, he has given central banks a cheap

supply of money,

through dramatic Fed interest rate cuts and a $30 billion subsidizing of JPM's take-over

of Bear Stearns, banks are tightening credit, thereby reinforcing the business, housing

and

automobile turns-downward. . Monday he provided Fed watchers more pertinent data

on the worsening credit crisis.

1) About 70% of domestic lenders have made it harder for consumers to get home equity

lines of credit, while about 50% have tightened terms for those with existing home equity

loans in the past six months. In some cases, the amount of the loan has been cut. The

tougher standards are a response to falling home prices.

2) About 30% of U.S. banks have ratcheted up standards for credit cards, compared with 10%

in the previous three months. Banks are reducing credit limits and requiring consumers to

have higher credit scores.

3) Banks expect to approve fewer student loans this year than they did in 2007. Of the 29

domestic banks that originated student loans under a federal program last fall, many

expect decreased business.

4) About 55% of banks reported imposing tougher standards on commercial and industrial

business loans to large and middle-market firms, up from about 30% in the previous survey.

5) Nearly 60% of domestic lenders have set tougher standards for safer prime mortgages,

while an even larger slice of banks making riskier loans has tightened up.

More details:

http://www.zimbio.com/mortgage+industry/articles/1151/MortgageNewsClips+Luxury+Foreclosures+Chicago

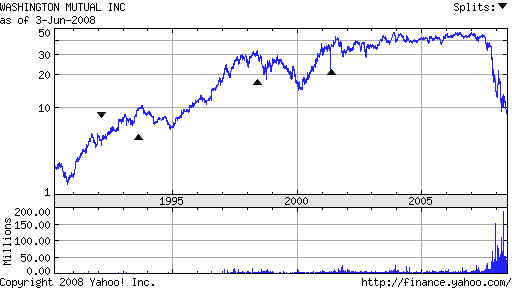

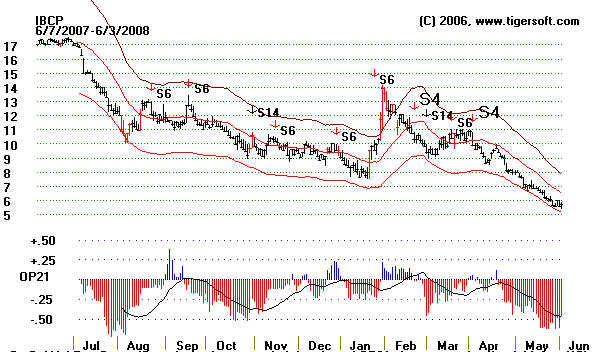

INSIDER TRADING in BANK STOCKS

TigerSoft specializes in watching stocks for signs of

bullish (blue) Accumulation

or bearish (red) Distribution. As a working definition of

"insider selling", we look for dips

by the Accumulation below -.25 and steady underperformance by the stock. Washington

Mutual is a good example of this. And, sure

enough, when you check for insider transactions,

WAMU's CEO Killinger (as rhymes with Dillinger) heads the list of insider sellers.

Needless

|

to say, the shareholders and the SEC treat all this as perfectly legal. Below

is a report of

Killinger's REPORTED insider selling. How many more people has he privately urged to

sell? When you look at a TigerSoft chart of WM (WAMU)

you see massive insider selling.

Look at the TigerSoft

blog of 12/30/2007 about insider selling at WM (then 11.7, now 8.61

and C (then 30, now 21.19). I used WM as an example of a highly vulnerable stock

for the Blog I wrote here on 5/14/08. Lawsuits are prolifferating against WAMU's

executives for concealing the company's problems that they created while quickly selling

their shares. See http://www.allbusiness.com/legal/legal-services-litigation/5328728-1.html

70% of WAMU's loans are in California and Florida. The Attorney General of the

State of

New York can accused WAMU of inflating the values of mortgage apraisals to allow them

to increase the value of their loans. Fir more information:

http://www.businessweek.com/bwdaily/dnflash/content/jan2008/db20080116_577720.htm?chan=search

Shares Price Value

Sold

| 2008-01-18 Sale |

2008-01-23 7:45 pm |

WASHINGTON MUTUAL, INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

140,685 | NA | |||

| 2007-05-01 Sale |

2007-05-03 7:07 pm |

WASHINGTON MUTUAL, INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

50,000 | $42.05 | $2,102,304 | ||

| 2007-02-01 Sale |

2007-02-05 8:22 pm |

WASHINGTON MUTUAL, INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

50,000 | $44.67 | $2,233,298 | ||

| 2006-11-01 Sale |

2006-11-03 7:00 pm |

WASHINGTON MUTUAL, INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

50,000 | $42.36 | $2,118,178 | ||

| 2006-08-01 Sale |

2006-08-03 7:35 pm |

WASHINGTON MUTUAL INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

51,688 | $44.49 | $2,299,449 | ||

| 2006-05-01 Sale |

2006-05-03 6:47 pm |

WASHINGTON MUTUAL INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

50,000 | $44.94 | $2,247,123 |

| 2006-02-01 Sale |

2006-02-03 7:25 pm |

WASHINGTON MUTUAL INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

50,000 | $42.03 | $2,101,675 | ||

| 2005-04-12 Sale |

2005-04-14 7:28 pm |

WASHINGTON MUTUAL INC | WM | KILLINGER KERRY K (Chairman and CEO Director) |

86,842 | $39.3 | $3,412,895 |

Try Getting A Loan from WAMU!

"As a recent previous employee of Wamu, working as a Banking Loan Consultant,

it was almost impossible to get underwriting approval on a re-finance or home purchase.

In the rare occasion that underwriting approval was granted, the processing center in

Downers Grove, Il, would usually find a way to drop the ball and lose the 30 day loan

lock,

effectively killing most deals. Their rates were not competitive and it was just a big

waste

of time trying to help consumers. Most un-professional and mis-managed company I've

ever worked for. Worst thing was having to listen to weekly wamu web-casts of Killinger,

Rotella, and Sstein making up bigger and bigger lies each week."

(Source: http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_W/threadview?m=tm&bn=19978&tid=149042&mid=149045&tof=18&rt=2&frt=2&off=1

)

How Short of Cash is WAMU?

I have said I would move my money elsewhere. $100,000 of deposits

may be insured, but there coud be substantial delays in getting this money back.

Here is an unverified comment posted on WM's Yahoo Message Board on 6/5/2008.

"...Now I can't get my $35,000 withdrawal from my damn

savings

deposit account. No kidding...Seattle-Metro branch of (WAMU)... has me

waiting

for 8 business days for money to arrive to back my withdrawal. Called branch this

morning and received their "apology for the delay" went on to ask "please

call back

before visiting the branch to make sure your money has arrived"...GOOD COVER

(as in please don't make a scene at our local branch, please, please! Please speak in low,

confidential tone when visiting our branch) They failed AGAIN TODAY. U.S. Bancorp

and Wells Fargo is a "can do".... A no can do on customer service

accounts...Yes,

before you ask, I did register the complaint with the State Banking folks and e-mailed

the Senate Banking Committee."

The Bear Market in Finance Stocks

Goes from Bad to Worse.

Study

the TigerSoft Charts of The Weakest Financial

Stocks below.

In doing so, we suggest the following:

1) Find the weakest sector and don't be afraid to sell weak

stocks in that sector short. In a bear market, that is the

safest way to

proceed, unless you resolve absolutely to

go to the

sidelines until the bear market is over.

2) Use our

TigerSoft Power-Ranker Software to find the

weakest stocks in

the weakest sectors.

3) Look at the

TigerSoft OP21 Indicator, as well as the

Tiger

Accumulation Index, which we mention in most cases

on our site.

Note those cases where the OP21 drops below

-.5. Sell

the stock short on rallies that fizzle, as judged by

the OP21 dropping

back below its moving average.

4.) Use the

TigerSoft automatic Sell signals. In the charts

below, I show you

the "Sell S6" signals. They work very well

in downtrending

stocks where the OP21 frequently drops

below -.5.

5.) Many of the best short sales are in

lower priced stocks,

under $10.

Being low priced does not make a stock cheap

or a good buy.

6.) The news gets worse and worse for

these companies.

Solvency and

credibility is everything to a bank. Once

the dynamics set in

that make things spiral downward,

it is very hard to

stop. You can get a sense of this

from the news items

below for each stock.

These stocks' declines are similar to those we have

studied in our book on

Short Selling techniques.

http://www.tigersoft.com/--5--/index.html

1 month - Biggest Decliners

NEXC 0.63

-80%

Law Suits: (1) Brower

Piven Encourages Investors Who Have Losses in Excess of $100,000 From Investment in NexCen

Brands, Inc. to Inquire About the Lead Plaintiff Position in Securities Fraud Class Action

Lawsuit Before the July 28, 2008 Lead Plaintiff Dea. (2) Law Offices of Brian M. Felgoise, P.C.

Announces Class Action Lawsuit Against NexCen Brands, Inc. -- NEXC (3) Holzer Holzer & Fistel, LLC Has

Filed a Shareholder Class Action Against NexCen Brands, Inc. (NASDAQ: NEXC)

Lay Offs and Selling Assets: UPDATE

- NexCen cuts 25 pct of New York workforce, mulls options [$$]

NexCen Cuts Jobs, Explores Asset Sales

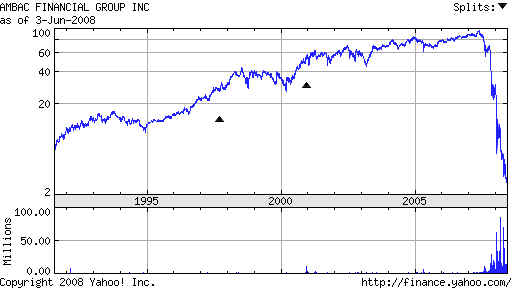

ABK Ambak 3.00 -45%

Rising

Municipal Bond Defaults:

http://seekingalpha.com/article/79980-muni-defaults-triple?source=yahoo

ABK IS BEING DELTETED FORM THE S & P 500:

INDEX FUNDS MUST SELL ALL ABK SHARES

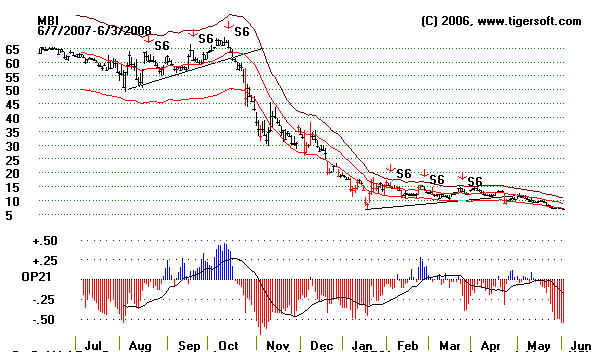

MBI MBIA

6.69

-42%

Downgrades:

Moody's

Investors Service said it is likely to cut its ratings

on MBIA's bond insurance arm. S&P Sell recommendation.

Shunned for

Fear of Bankruptcy:

Florida

Shuns MBIA and Ambac Insurance, Lowering Costs - Housing Tracker

Law Suits: http://www.lawcash.com/attorney/4271/mbia-lawsuit.asp

Personal Bankruptcies: New York

Times - June 4, 2008

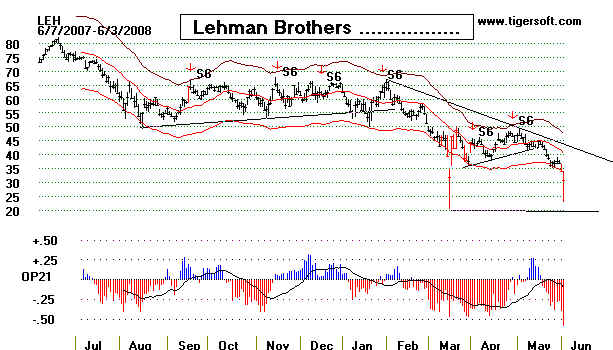

LEH Lehman Brothers

30.61 -42%

Criminal

Fraud: Lehman Brothers was found to have assisted in fraudulent activities

by providing financial backing to an aggressive home equity lender.

Mortgage Defaults:

As one of the largest bond guarantors, MBIA insured many of the

exotic derivatives that are collapsing under the mortgage mess.

Incompetent CEOs:

One NBC guest said CEO Ackman "is a slick salesman who

doesn't know much about insurance."

http://www.nytimes.com/2007/12/01/business/01nocera.html?_r=1&pagewanted=print&oref=slogin

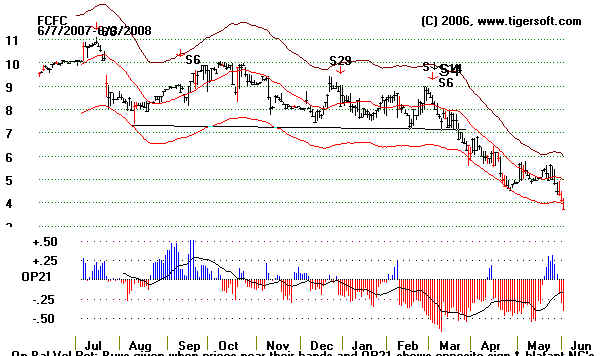

FCFC First City Financial Corp 3.73 -34%

Losses: http://finance.yahoo.com/q/is?s=fcfc

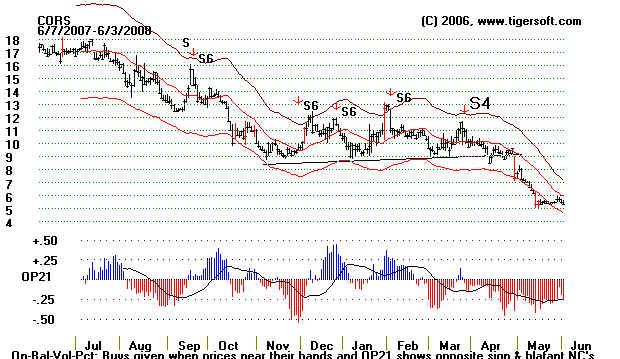

CORS Corus Bankshares

5.34 -34%

Yahoo Scare/Despair:

"THIS IS TRULY

UNPRECEDENTED !! THIS IS A FINANCIAL

ARMAGEDDON, FOLKS !! AMERICA WILL SINK INTO SECOND

GREAT DEPRESSION !! I ESTIMATE CORS NEEDS $1B NEW CAPITAL

QUICKLY TO STAY SOLVENT !! MASSIVE DILUTION COMING SOON !!"

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_C/threadview?m=tm&bn=4208&tid=20326&mid=20326&tof=2&frt=2

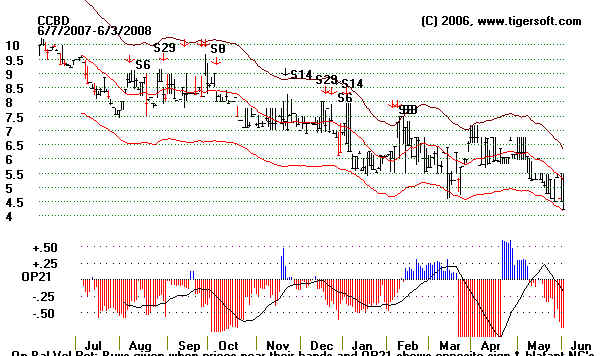

CCBO

4.23 -33%

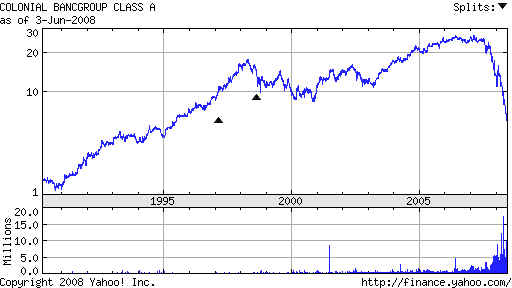

CNB Colonial Vankshares 5.34

-31%

Dilution: Red

Mountain plans $10M private stock sale

Downgrades:

| • | Colnl BancGrp downgraded by Janney

Mntgmy Scott Briefing.com (Thu, May 29) |

| • | UPDATE

- Janney cuts Colonial BancGroup on credit issues at Reuters (Thu, May 29) |

WM WasHington Mutual

8.75

-29%

CEO Greed, Insider Sekking and Managerial Ineptitude:

http://www.tigersoftware.com/TigerBlogs/May-14-2008/index.html

Lack of Capital: Where

will it come from?

Losses: The company reported $3 billion of losses

uring the past two quarters.

IBCP Independent Bank

5.7

-29%

GSBC Great Southern Bancorp 11.08 -28%

Big Losses from

write-downs:

$37,750,000 in the quarter just reported, compared

to total revenues of $48,514.

http://finance.yahoo.com/q/is?s=gsbc

Finding the weakest group and shorting it is

often very profitable, provided you use TigerSoft tools

to confirm the trend and time your trades. The same,

by the way, works in reverse. Look at TigerSoft's

studies of the Oil

and Coal explosive,

super stocks.