TigerSoft

News Service 12/8/2008

www.tigersoft.com

TigerSoft

News Service 12/8/2008

www.tigersoft.com Updated 12/11/2008 Sure enough, I was right. Congress turned its back on

blue collar America and saud no to a $14 billion to the Auto Inustry after

giving $700 billion to Wall Street. Now we see cearly who runs the country!

The Senate rejected helping Detroit by 52-35. See new Blog for 12/12/2008

General Motor's Bailout:

(1) See The Stark Difference between

a Healthy Bullish Stock (EBS) and a Very Sick Stock (GM)

(2) GM Bailout vs. Wall Street's Bailout

3 Million Jobs or An Economic Depression.

(3) Trading GM's Stock from 1998-2008 Using:

(1) TigerSoft's Automatic Buys and Sells,

(2) the TigerSoft "Accumulation Index" and

(3) the TigerSoft "Closing Power"

by William Schmidt, Ph.D. - www.tigersoft.comD GR

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

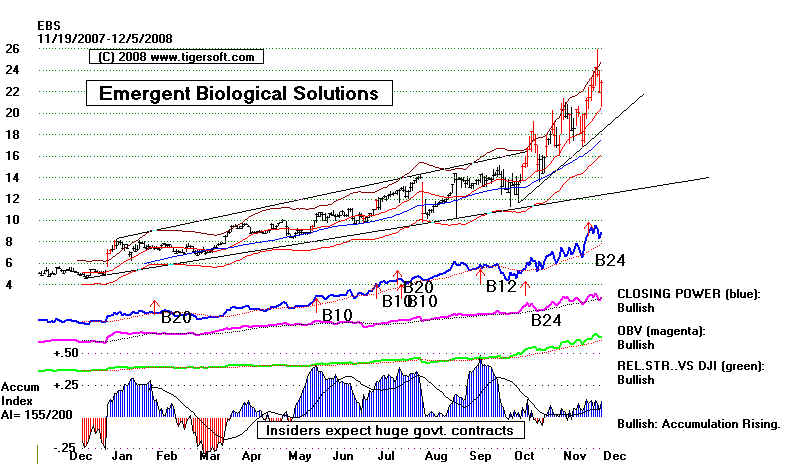

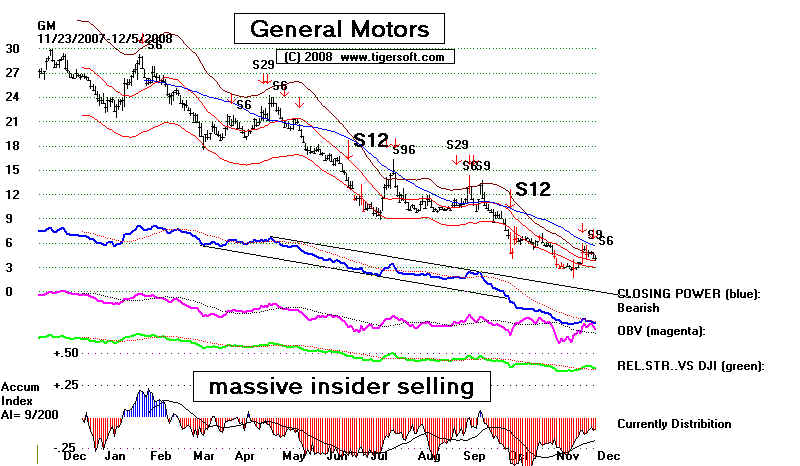

See The Stark Difference between a Healthy Stock (EBS)

being heavily accumulated by insiders and a a Very Sick

Stock (GM), which is being sold by insiders.

A.) EBS Shows Positive (Blue) Tiger Accumulation (Insider buying)

vs

GM Shows Negative (Red) Tiger Distribution (Insider Selling)

B.) EBS Shows a Rising (Blue) Tiger Closing Power (Insider buying)

vs

GM Shows a Falling (Blue) Tiger Closing Power (Insider buying)

C.) EBS Shows a Rising (Blue) 50-day mvg.avg. (uptrending)

vs

GM Shows a Falling (Blue) 50-day mvg.avg. (downtrending)

D.) EBS Shows a Rising (Green) Relative Strength Line (uptrending)

vs

GM Shows a Falling (Green) Relative Strength Line (downtrending)

2007-2008

======== EBS - Emergent BioSytems - Flagrant Insider Buying ================

=========== GM - General Motors - Massive Insider Selling ================

General Motors' Bailout::

3 Million Jobs and A Depression on The Line.

by William Schmidt, Ph.D. (Columbia University)

It is wrong for Wall Street white collar people to be bailed out with more than

a trillion dollars and blue collar workers in the automobile industry making far less

per hour to be refused 1/50th of that amount. An auto industry subsidy could,

with proper guidelines and controls, let that industry continue operations, retool

and contribute mightily to making America energy independent.

The American public was more than 10:1 against the Wall Street bailout, but Congress

and Obama voted for it. They approved $700 billion with no important strings, conditions

or even accountability! Americans, fed with lies that the average auto worker gets

$70,000 per year, are not enthusiastic about this bailout.

Congress pampers Wall Street. They gave them the better part of a trillion

dollars and "deliberated" less than a week. There were no public committee meetings

on the Wall Street bailout. Not a single banker had to appear before Congress to beg

or explain what they would do with all the money! Congress will now again, I fear, show

the degree to which Big Money rules them. I fear that they will not to do enough to

save the US Auto industry. Watch, you'll see. They will probably blame a Republican

filibusterer in the Senate. I fear that they will find some excuse. I hope I am wrong.

Another thing I fear. Obama will make more speeches with perfect syntax and fine principles.

But, I fear that he will not stand firm for the millions of ordinary workers who voted for him.

There's Nothing "Free" about Corporate Monopolies

Estimates are that 3 million jobs would be lost if the automobile industry is allowed

to go bankrupt. Unemployment for long periods of time is tragic, humiliating, alienating,

miserable and de-humanizing. Expect the rates of child abuse, alcoholism, crime and

divorces to rush skyward. Making millions and millions suffer unemployment's stress and

the jarring poverty it causes because of a devotion to an outdated, disproven and destructive

worship of "free enterprise" is heartless and very hypocritical. American capitalism is not

"free enterprise". It is hugely expensive. Its social and environmental costs are

enormous. It must be regulated for the good of the whole society. Monopolies and near

monopolies rule most industries. In many industries, there is little "free competition".

Instead, the norm is informal price-fixing and collusion by that industries' three or four

biggest corporations. As industry giants devour would be competitors, there has been

only a wink, never even a blink of disapproval, by Bush's FTC Commissioners. These huge

corporations and the CEOs who run them are too often above the law. The reason: they

have paid the requisite protection money to Congress. They have lavished bribes on

Congressmen in the form of favors and campaign contributions.

(See Sunday's revelations about Fannie Mae and House| Republicans. These are

more proof of the sad ubiquity and omnipotence of the corporate money in politics.)

We surely have the best Congress money can buy. Campaign contribution laws don't

stop the process. These corporations have to give vast sums of money to politicians

to compete with each other. Their companies are more and more dependent upon

government largesse in the form of contracts, subsidies, abatements, favorable international

trade and guest worker policies, regulations against competition, tax deductions and

tax credits. The stock above, EBS, that is so bullishly rising in a bear market is doing

so precisely because it is the recipent of a set of huge US Government contracts, which

could add up to $600 million in the next five years!

Forget Sub-Prime, Now We Must Pump-Prime.

If we have learned anything from the Great Depression, it is that deflation is

not naturally self-correcting. Deflation is now the name of the game. Continuing to

fight against inflation will do grave harm now. The government must pump-prime

the economy and provide jobs when the private sector is not able. Requiring workers

to "tough it out" "because it is good for their spirit of self-reliance" may have made

some sense when there was a frontier and hard physical work and individualism

was required to survive. But it makes no sense now. American society is now urban,

inter-dependent and complex. What we do to one group or class affects all Americans.

The workers at GM and Ford are consumers, too. And they are as skilled as any

in the world. But if they are not provided decent jobs and a decent middle class existence,

the economy will suffer for a decade. All working people will then have no claim to

protection when the economy falters through no fault of their own. The UAW has

long been in the forefront of getting its members health care and a measure of job

security. Until the US Government provides health care as a universal right and

guarantees everyone who wants to work hard a reasonable job, unions like the

UAW are the workers' main protection. Depending upon corporate-bought Congressmen

does not work. That's why real wages have been declining for working Americans

since the early 1970s.

Accountability? Responsibility? Detroit should fix its own mess? There is

abundant evidence that unbridled greed at the top of Wall Street's biggest banks is

the single biggest cause of the horrible economic situation. we are all in now. Even

now willing buyers of Ford and GM cars cannot get credit from banks, because

banks have decided to sit on their bailout money instead of making loans. If it were

a just matter of personal responsibility and simple justice, the biggest banks would get

no bailout money and their CEOs would be in jail for criminal negligence, corruption

and insider trading. Instead, the US tax payer is now richly subsidizing them because

they are considered vital to the functioning of the economic system.

If consideration of economic consequences to the nation, not personal accountability, is

the right criterion to evaluate the merits of government subsidies, then the 3 million auto

industry jobs are, at least, as important as the CEOs and boards of directors running

Citigroup, Bank of America and JP Morgan. These Wall Street moguls were recklessly

imprudent. Read about Washington Mutual's Killinger or Robert Rubin of CitiGroup.

The consequences of their reckless pursuit of profits have been so dire that millions of

Americans within 15 years of retirement have lost 50% of what they expected to

be able to live on. And elsewhere around the Globe, the consequences are even

worse. These Wall Street executives should never have been allowed to stay in

office. But of course, they have too many well-placed political allies. And they also

know where the political skeletons lie.

On the other hand, if personal accountability is the right criterion, than Congress

should take back the billions given Wall Street; distribute it quickly to all Americans and

put on trial all the board of directors at the key banks, charging them with knowingly

haven conspired to allow this financial disaster to occur, just so that they could make

obscenely high bonuses and salaries while also engaging in the fraudulent selling of

grossly over-valued mortgages and the insider selling of their own banks's shares

at excessively high levels. Never doubt this. They knew what they were doing. That's

why CitiGroup executives were so busy selling one million shares of stock a year

before the collapse.

More reading. How about "Euthanize Wall Street to Save The Economy." By

Tony Wikrent - 4/24/2008.

"The fundamental problem is the big players on Wall Street have misused

the credit mechanism for their own private gains through the bloating of debt

and speculation, at the expense of actually allocating and supplying capital to

the real economy. This is what has caused the 30-year decline of the American

industrial economy...The goal of the next President must be to force the

financial system back into subservience to the real economy. That is the only

way the myriad financial, economic, and environmental problems facing us are

going to be solved. To put it more precisely, that is the only way we as a society

are going to be able to muster and allocate enough financial resources to solving

those problems. Of course, the big players on Wall Street are not going to meekly

accept their new role. A bitter, protracted, and probably bloody period of political

warfare can be expected, as the big investment and commercial banks and hedge

funds are stripped of their financial power and political clout, and forced into

serving the needs of the real economy once again."

Wikrent is absolutely right. Wall Street is all about corporate profits, no matter

the long-term price. Now 0.2% of American shoes are built in America. In the 1960s

a person working in a Massachusetts shoe factory could afford to have a house built.

The American shoe industry created jobs and the jobs meant American buying power

was alive and well.

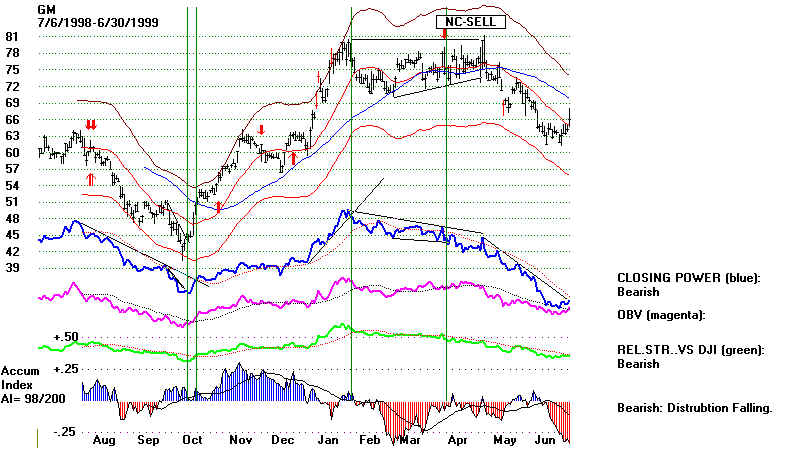

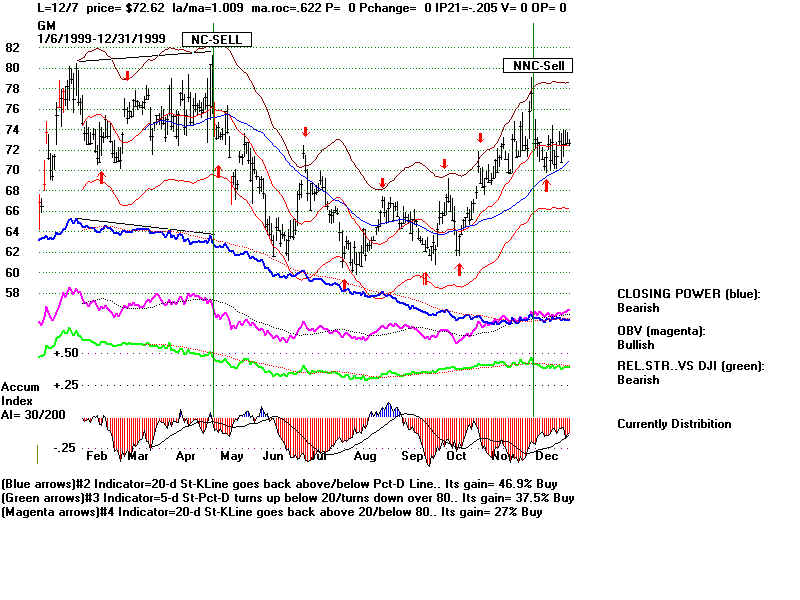

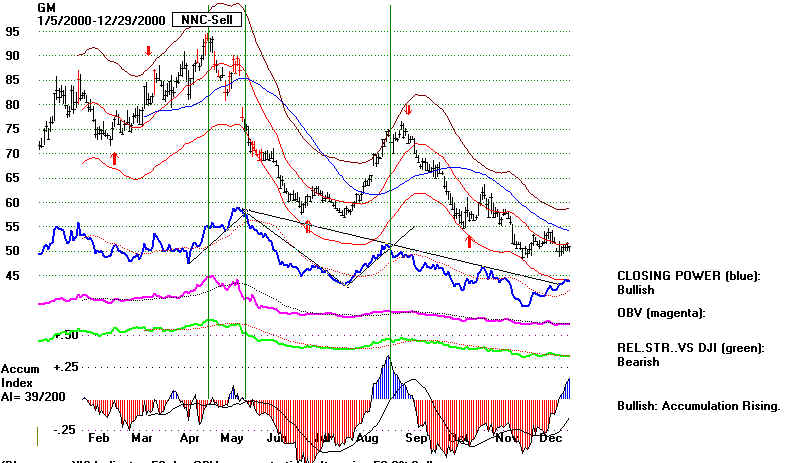

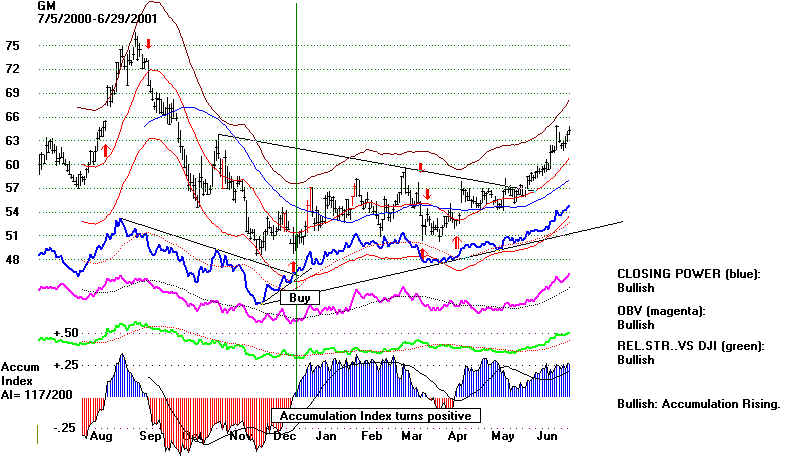

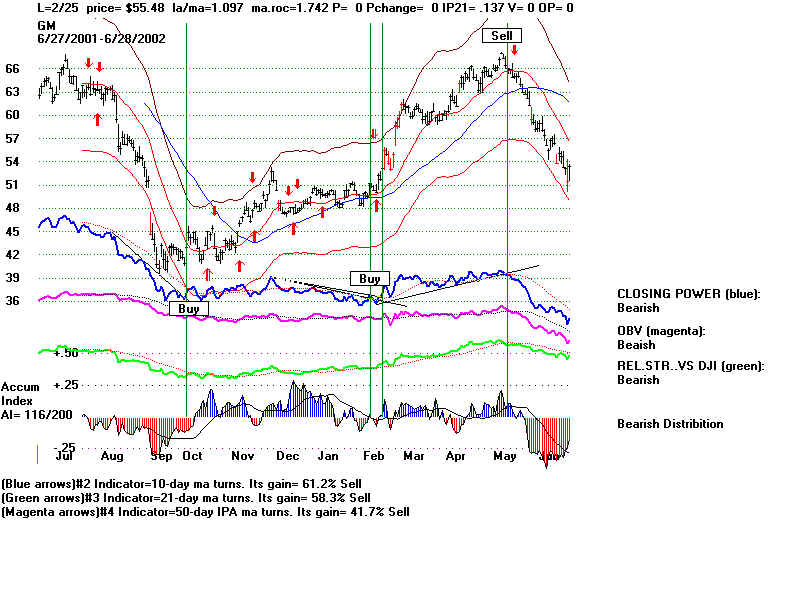

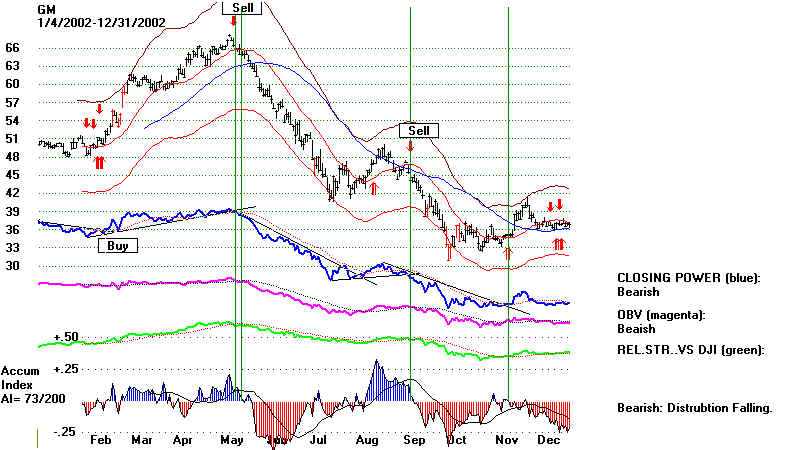

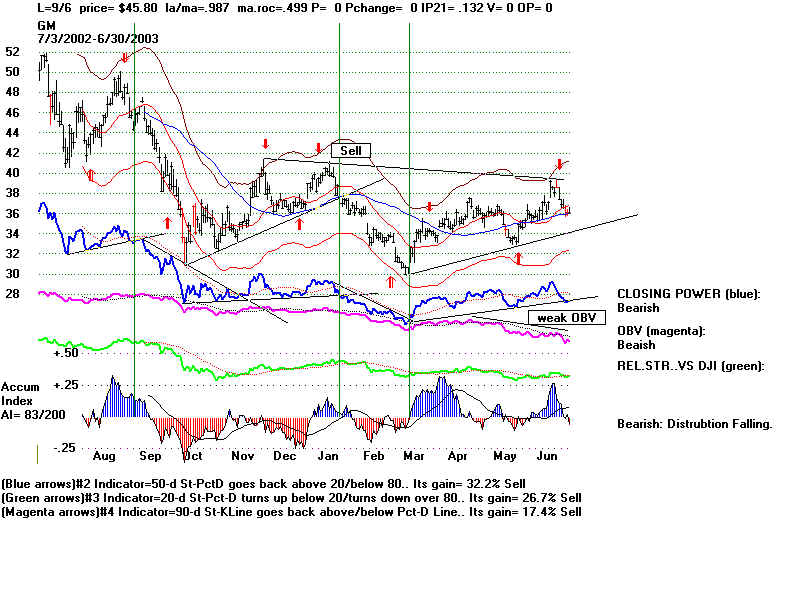

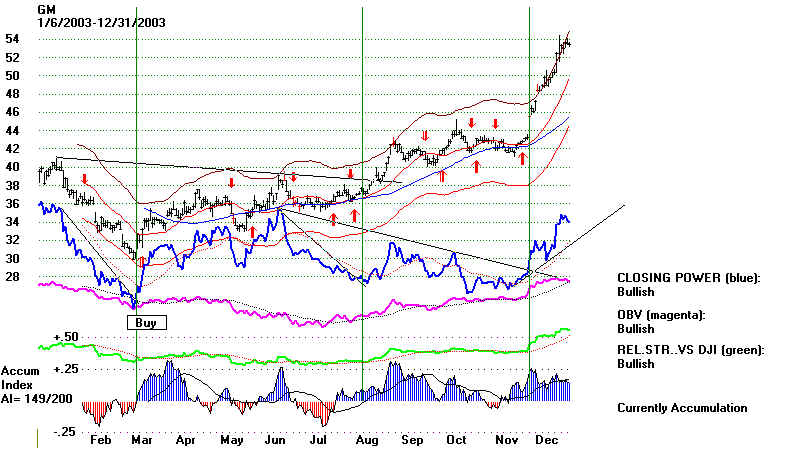

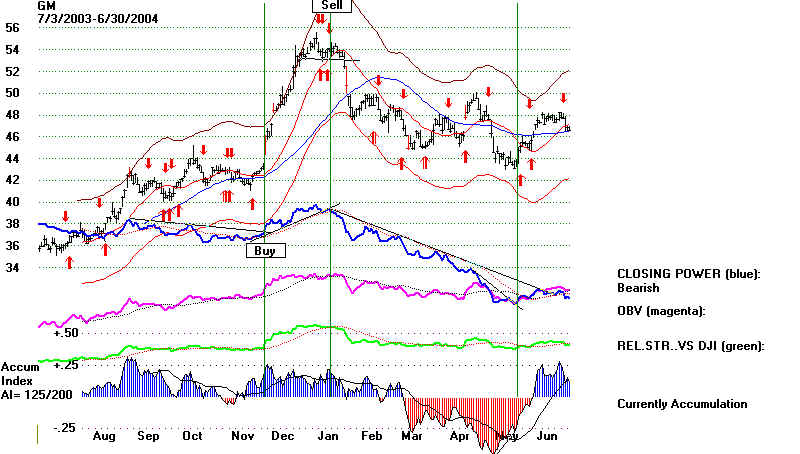

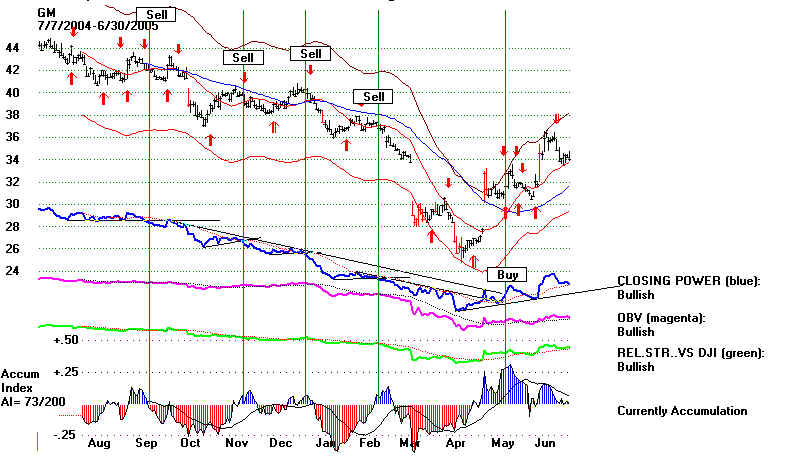

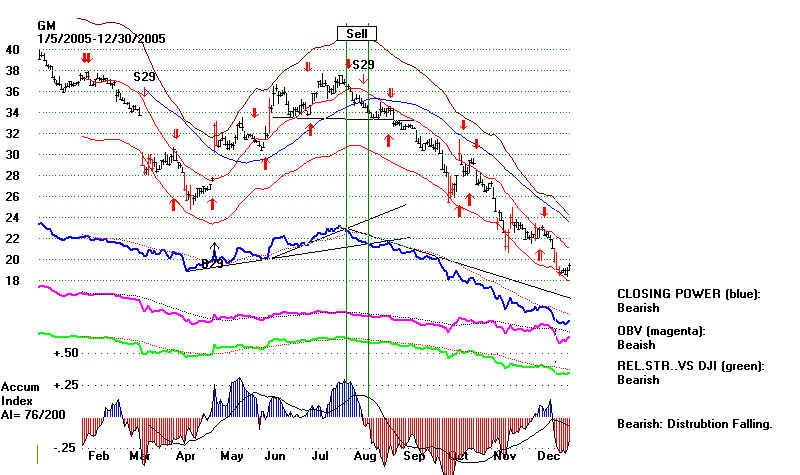

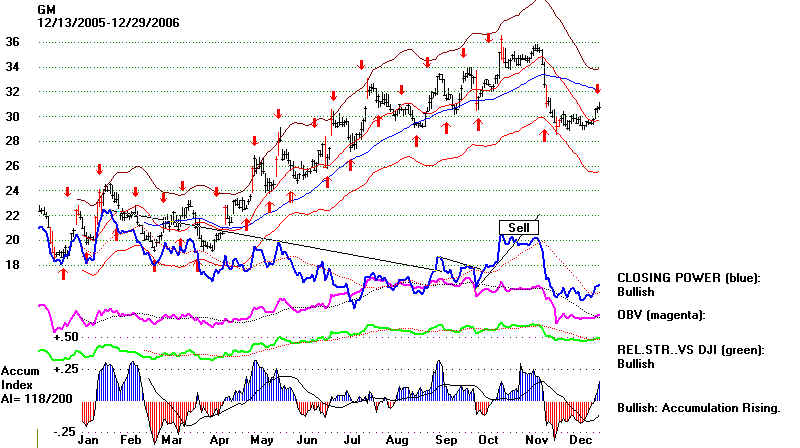

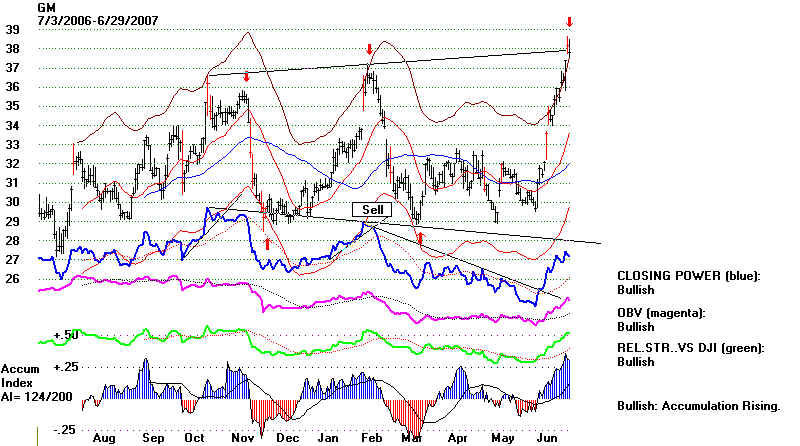

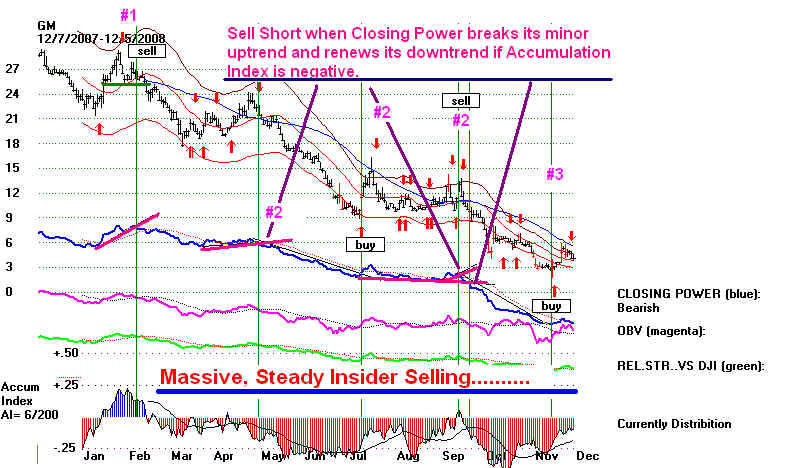

| TigerSoft's Trading Tools and Tactics for GM: 1998-2008 Using TigerSoft, you have a big advantages over other traders. You have the Tiger Accumulation Index and Tiger Closing Power to show you the most likely next trend of the stock. You also have automatic Buys and Sells. Many chartists point to the importance of noting the trend of the blue 50-day price ma. If it is rising, the stock is considered bullish. If it is falling, the stock is considered bearish. We at TigerSoft add something to that. If the 50-day ma is closed below by, say, 1% to the downside with the Tiger Accumulation Index in red and negative territory, we will usually take it as a Sell on the stock, if the stock is over-extended and has risen for three or more months. If the 50-day ma is violated by a percent to the upside with the Tiger Accumulation Index in blue positive territory, we take it as a Buy on the stock, if the stock has been falling for threer more months. Usually, we have other signs of a top or a bottom. In addition, a rising 50-day ma is good support and a falling 50-day ma is reliable resistance when internal strength indicators confirm the move. Another thing, use the TigerSoft automatic Buys and Sells in the direction of the 50-day ma trend if the stock is in a clear uptrend. Don't go short on Red Sells in a strong uptrend or after a price breakout. Don't buy on Red Buys in a powerful decline or after a price breakdown below well-tested support. When prices have been locked in a trading range for more than a month, use the red TigerSoft Buys to go long (buy) and close out short positions and the TigerSoft red Sells to Sell and Sell Short. In such cases, you must be ready to acknowledge the end of the trading range when well-tested support or resistance is exceeded. Whether or not, the stock has not been rising or falling for 2 months, it is a good idea to also require that the Tiger Closing Power has also broken its trendline. You might want to print the charts below out and apply these rules. The TigerSoft program's Help routines and instructions expand on these ideas. For now, we suggest applying these fairly simple rules, as a starter, to show that TigerSoft will be of big help to you. TigerSoft users will want to employ their analysis skills on the 11 years of GM charts below. We emphasize watching the trend-changes of Tiger's Closing Power if you are a trader, giving special weight to those upside trendbreaks supported by coincident positive readings from TigerSoft's Accumulation Index and downside trendbreaks supported by coincident negative readings of the TigerSoft Accumulation Index. Insider Buying and institutional Accumulations are seen by very steady and positive (blue) Accumulation Index readings and rising Closing Power for 5 or more months. See GM chart - (1) December 2000-June 2001, during which stock rose from 51 to 66. (2) August 2003-January 2004, during which stock rose from 38 to 54. Insider Selling and institutional Distribution are seen by very steady and negative (red) Accumulation Index readings and falling Closing Power for 5 or more months. See GM chart - (1) February 1999-November 2000, during which stock fell from 75 to 49. (2) March 2004-April 2005, during which stock fell from 46 to 26. (3) August 2005-January 2006, during which stock fell from 34 to 19. (4) November 2007- December 2008, during which stock fell from 28 to 4. False (professionally manipulated) new highs occur when the stock makes a new high and the Accumulation Index is negative. May 1998 - GM fell from 64 to 42 in 5 months. April 1999 - GM fell from 81 to 61 in 5 months. January 2000 - GM fell from 81 to 41 in 12 months. September 2008 - GM fell from 12 to 4 in 4 months. False (professionally manipulated) new lows occur when the stock makes a new low and the Accumulation Index is positive. October 1998 - GM rose from 42 to 78 in 5 months. 1998 #1 - False new high. New price high, but bearishly Closing Power (blue), OBV (fuchsia) and Relative Strength (green) fail to make a new high. This non-confirmation is made worse by Accumulation Index being in negative (red) territory. Trend-break or breakdown of Closing Power soon afterward or at same time is a SELL. #2 - Close below well-tested price support with blue 50-day ma falling is a SELL. #3 - New price low at lower band with Accumulation Index is (blue) is a Buy. Insiders and professionals are buying on false new low. #4 - Sell after well-tested resistance is tested if the uptrendline of Closing Power (blue) is violated. bearsh head and shoulder top  1998-1999  1999  1999-2000  2000  2000-2001 Note bullish Accumulation in second half of chart.  2001  2001-2002  2002  2002-2003  2003  2003-2004  2004  2004-2005  2005  2005-2006  2006  2006-2007  2007  2007-2008 2008 #1 - Close below well-tested price support with blue 50-day ma falling is a SELL Reinforced by break in Closing Power uptrend. #2 - Trend-break or breakdown of Closing Power when Accumulation Index is negative and blue 50-day ma is falling is a SELL. #3 - After a very big decline, traders may Buy when steep downtrend of Closing Power is broken. provided Accumulation Index is rising. But only so long as Closing Power does not make a new low.  |