TigerSoft News Service 6/5/2008 www.tigersoft.com

PEERLESS WAS VERY PROFITABLE IN 2008-2009

FOR ALL TRADING VEHICLES:

STOCKS, ETFS, MUTUAL FUNDS - ANYWHERE!

PEERLESS STOCK MARKET TIMING'S

AUTOMATIC BUYS AND SELLS

Here we apply the Peerless Buys and Sells to

hundreds of Exchange Traded Funds, Fidelity Funds and a

sample of important stocks. Peerless works superbly in almost

all these areas because Peerless calls the tops and bottoms

of the DJIA consistently well and because the gravitational

pull of the DJI-30 is so great for all trading vehicles. Buying

and holding is very expensive. By comparion, Peerless is

very cheap. You will especially want to use Peerless for

Brazil, Russian, Mexican, brokerage and gold stocks, as well

as for the general market ETFs for the DJIA, SP-500, NASDAQ

and Russell-2000.

Trading Results:

Superimposing Peerless Signals on

Different Investments. Trading Gains, Buying, Selling

(and Selling Short) at Next Day's Opening and

Allowing $40/Trade for Commissions

and Starting with $10,000.

Translate percentages into Dollars. A 20% Gain

Using Peerless versus a 20% Decline Buying and Holding

Starting with $100,000 is a +$40,000 Difference using

Peerless would have meant to you.

/

1. GENERAL MARKET ETFs - DIA, SPY, QQQQ, IWM

2. FOREIGN ETFs - Examples - UK, Brazil, Mexico, Russia

3. 42 FIDELITY SECTOR FUNDs

4. MOST STOCKs -

Examples - AAPL, ADBE, CSCO, EBAY, GOOG, HD, IBM, QCOM

by William Schmidt, Ph.D. (Columbia University)

(C) 2009 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

Software Helping Investors since 1981

|

PEERLESS STOCK MARKET TIMING'S

AUTOMATIC BUYS AND SELLS

Trading Results: Superimposing

Peerless Signals on Different Investments

Quickly Shows Trading Gains, Buying and Selling at

Next Day's Opening and Allowing $40/Trade

Introduction to Peerless

PEERLESS RECENT REVERSING BUY/SELL SIGNALS ON DJIA

Action Date DJIA Gain

SELL 3/24/2007 12549 13.0%

BUY 9/15/2008 10918 0.9%

SELL 9/22/2008 11016 16.0%

BUY 10/8/2008 9258 0.1%

SELL 10/14/2008 9311 2.6%

BUY 10/28/2008 9065 0.8%

SELL 11/5/2008 9139 12.0%

BUY 11/21/2008 8046 1.3%

SELL 1/29/2009 8149

Cover 3/9/2009 6547 19.7%

BUY 3/10/2009 6926 12.3%

SELL 3/27/2009 7776 -3.1%

BUY 4/3/2009 8018 9.3%

Now 6/5/2009 8763

Peerless users, enter these commands to produce the DJI chart below with all signals.

PEERCOMM

+ PEERLESS

+Peerless Daily DJI

+ DATA

+ Superimpose DJI Saved Signals

(or DJI Major Buys and Sells when not in Extreme Bearish Mode.)

Buying and Selling Gain is shown first, +27.1%

Buying, Selling and Selling Short Gain is shown second, +99.6%

Buying and Holding Loss from 7/30/2008 to 6/5/2009 = -24.3%

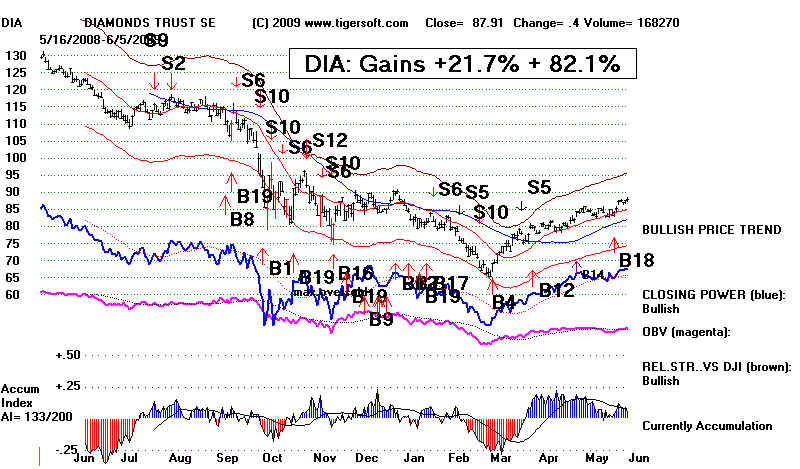

1. GENERAL

MARKET ETFs:

DIA

Buying and Selling Gain is shown first, +21.7%

Buying, Selling and Selling Short Gain is shown

second, +82.1%

Buying and Holding Loss from

7/30/2008 to 6/5/2009 = -23.3%

SPY

Buying and Selling Gain is

shown first, +30.7%

Buying, Selling and Selling Short Gain is shown

second, +112.6%

Buying and Holding Loss from

7/30/2008 to 6/5/2009 = -19.3%

QQQQ Buying

and Selling Gain is shown first, +35.8%

Buying, Selling and Selling Short Gain is shown

second, +110.0%

Buying and Holding Loss from

7/30/2008 to 6/5/2009 = -18.5%

IWM (Russell-2000) Buying and

Selling Gain is shown first, +61.3%

Buying, Selling and Selling Short Gain is shown

second, +198.8%

Buying and Holding Loss from

7/30/2008 to 6/5/2009 = -24.9%

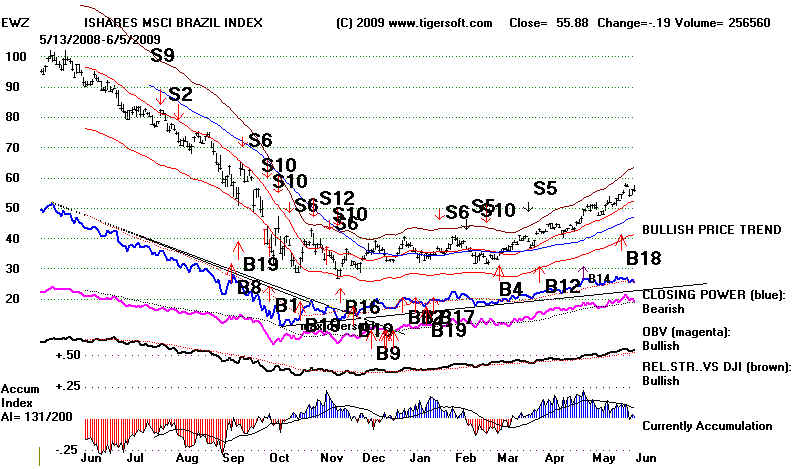

2. FOREIGN ETFs:

Russia, Brazil and India apprear to be excellent ETFs to be

traded with Peerless.

TRADING GAINS

Examples -

Peerless

Peerless

Buys/Sells

Buys/Sells/Shorts

UK

EWU ISHARES MSCI UK

+33.9%

+135.6%

Brazil

EWZ ISHARES MSCI BRAZIL +114.3%

+381.0%

India

INP - INDIA

+104.9%

+276.0%

Mexico

EWW -I MEXICO

+73.3%

+259.8%

Russia TRF TEMPLETON RUSSIA

+301.8%

+729.0%

BRAZIL

Buying and Selling Gain is shown first,

+114.3%

Buying, Selling and Selling Short Gain is shown

second, +381.0%

Buying and Holding Loss from

7/30/2008 to 6/5/2009 = 31.8%

RUSSIA

Buying and Selling Gain is shown first,

+301.8%

Buying, Selling and Selling Short Gain is shown

second, +729%

Buying

and Holding Gain from 7/30/2008 to 6/5/2009 = 5.0%

FOREIGN ETFS and TRADING RESULTS USING PEERLESS BUY AND SELLS Percent Change from 63 Trading Days Back. 3/6/2009 - 6/5/2009 Rank Symbol Name =Peerless Signals== Price Pct.Change Buys Buy and 63 days SHort Sales ------------------------------------------------------------------------------ 1 TRF TEMPLETON RUSSIA FUND +301.8% +729.0% 24.68 242% 2 IFN INDIA FUND +84.8% +237.1% 31.53 129% 3 IIF MS INDIA INV FUND +114.2% +312.0% 23.15 118% 4 INP MSCI INDIA +104.9% +276.0% 52.68 112% 5 CEE CENTRAL EUROPEAN EQUITY FUND +136.5% +584.1% 25.71 110% 6 RSX MKT VCTR RUSSIA +90.2% +300.0% 24.13 103% 7 IF INDONESIA FUND +204.6% +864.2% 8.11 97% 8 PGJ PowerShares USX China +86.3% +227.0% 22.3 79% 9 GCH GREATER CHINA FUND +112.2% +282.5% 12.15 75% 10 EWO ISHARES MSCI AUSTRIA +88.7% +388.2% 16.79 74% 11 EWS ISHARES MSCI SINGAPORE+74.3% +240.3% 9.48 73% 12 GRR ASIA TIGERS FUND +112.0% +385.1% 15.59 71% 13 SGF SINGAPORE FUND +88.5% +284.2% 10.42 71% 14 EWI ISHARES MSCI ITALY +65.9% +253.6% 17.02 69% 15 EWW ISHARES MSCI MEXICO +73.3% +259.8% 37.37 66% 16 EWZ ISHARES MSCI BRAZIL +114.3% +381.0% 55.88 66% 17 KEF KOREA EQUITY FUND +112.3% +390.0% 7.03 63% 18 VWO Vanguard Emerging +75.7% +243.3% 32.9 63% 19 EWC ISHARES MSCI CANADA +90.9% +317.4% 22.78 62% 20 EWY ISHARES SOUTH KOREA +124.3% +421.6% 35.71 62% 21 FXI Xinhua China 25 +76.5% +200.0% 39.04 62% 22 JFC JARDINE FLEMING CHINA +62.2% +241.2% 12.01 62% 23 EWH HONG KONG INDEX +57.6% +159.6% 14.6 61% 24 EZA SOUTH AFRICA +64.4% +186.9% 47.67 61% 25 TFC TAIWAN GRR CHINA +79.8% +213.9% 5.17 61% 26 EEM EMERGING MARKETS +78.4% +237.4% 33.61 59% 27 EPP PACIFIC EX-JAPAN +61.7% +200.2% 32.68 59% 28 ILF LATIN AMERICA 40 +91.7% +304.3% 36.09 59% 29 MXF MEXICO FUND +60.7% +281.6% 17.11 57% 30 EWA AUSTRALIA INDEX +33.0% +126.4% 16.85 56% 31 CH CHILE FUND +82.5% +228.7% 15.5 55% 32 EWD SWEDEN INDEX +36.1% +118.7% 18.17 54% 33 FEZ DOW JONES EURO 50 +50.9% +189.5% 35.19 54% 34 EWP SPAIN INDEX +49.7% +168.5% 39.16 53% 35 EZU ISHARES MSCI EMU INDEX +43.6% +170.0% 31.85 53% 36 EWK ISHARES MSCI BELGIUM +58.6% +247.4% 10.27 52% 37 EWG ISHARES MSCI GERMANY +41.0% +388.2% 19.39 51% 38 VGK Vanguard European +35.5% +150.7% 41.07 50% 39 CHN CHINA FUND +30.8% +107.2% 21.94 49% 40 EWT ISHARES MSCI TAIWAN +41.6% +117.5% 10.72 49% 41 EWN ISHARES MSCI NETHERL. +39.5% +157.0% 15.91 48% 42 IEV ISHARES S&P EUROPE 350 +39.1% +150.7% 32.54 48% 43 EWQ IShares MSCI France +36.4% +139.5% 21.92 47% 44 EWU ISHARES MSCI UK +33.9% +135.6% 13.48 45% 45 MF MALAYSIA FUND +219.9% +189.8% 6.13 45% 46 IXN S&P GLOBAL TECHN. +44.6% +137.9% 45.23 43% 47 TF THAI CAPITAL FUND +80.2% +235.3% 8.53 43% 48 EKH HOLDRS EUROPE +64.8% +218.6% 50.8 41% 49 TWN TAIWAN FUND +67.8% +190.9% 12.44 40% 50 VPL Vanguard Pacific +47.1% +157.9% 46 39% 51 EWL ISHARES MSCI SWITZ. +30.2% +108.8% 17.94 35% 52 EWM ISHARES MSCI MALAYSIA +41.6% +110.4% 9.04 32% 53 ITF ISHARES S&P-TOPIX 150 +38.5% +135.1% 40.21 32% 54 EWJ ISHARES MSCI JAPAN +39.5% +133.7% 9.28 30% 55 JOF JAPAN OTC EQUITY FUND +28.1% +97.5% 7.07 24% 56 PWJ PS DYN MIDCAP GR +39.1% +156.5% 14.42 24% 57 IXP S&P GLOBAL TELEC. +22.1% +86.2% 47.23 16%

FIDELITY INDUSTRY SECTOR FUNDS

PROFITABILITY OF TRADING THEM WITH PEERLESS SIGNALS

Brokerage stocks were particularly well traded

with Peerless BUYs and Sells from 2008-2009.

This accords with earlier published research here.

TRADING GAINS

Peerless Peerless

Buys/Sells Buys/Sells/Shorts

FSLBX BROKERAGE-INV MGT +72.7% +209.6%

Percentage Gain since DJI bottom on 3/9/2009

Buys, Sell and Short Sales

FUNDS RANKED BY GAINS OVER THE LAST 63 DAYS

3/9/2009 - 6/5/2009 Rank

Symbol Name USING PEERLESS SIGNALS Price 63-Day

FIDELITY SELECT FUND BUYS ONLY With SHORTS Pct Gain

---- ------------------------ ---------- -------- ------ --------

1 FSAVX AUTOMOTIVE +54.9% +138.0% 22.17 159%

2 FSPFX PAPER-FOREST +49.2% +140.6% 21.33 104%

3 FSLBX BROKERAGE-INV MGT +72.7% +209.6% 41.2 77%

4 FIDSX FINANCIAL SERVICES +47.0% +153.6% 51.44 76%

5 FSRBX BANKING +12.2% +60.1% 12.83 71%

6 FNINX NETWORKING +40.4% +92.3% 1.91 67%

7 FSDPX IND. MATERIALS +41.1% +135.8% 41.98 65%

8 FDVLX Invest. Values +29.5% +110.9% 45.44 64%

9 FSAIX AIR TRANSPORTATION +41.7% +84.5% 23.81 63%

10 FSCGX INDUSTRIAL EQUIP. +23.1% +97.8% 20.76 63%

11 FSESX ENERGY SERVICES +27.3% +145.2% 51.49 63%

12 FCYIX CYCLICAL +26.6% +97.4% 14.68 62%

13 FSNGX NATURAL GAS +50.2% +155.0% 28.63 62%

14 FSPTX TECHNOLOGY +36.8% +97.2% 56.16 61%

15 FSPCX INSURANCE +57.9% +169.3% 32.72 55%

16 FSDAX MILITARY/AEROSPACE +32.3% +90.6% 53.92 54%

17 FBMPX MULTI MEDIA +22.8% +70.3% 25.41 53%

18 FSHOX CONSTRUCT.& HOUSING +23.9% +67.7% 24.71 52%

19 FNARX NATURAL RESOURCES +38.1% +129.5% 24.7 51%

20 FSRPX RETAILING +22.7% +39.4% 36.28 51%

21 FDCPX COMPUTER +22.6% +72.6% 32.72 50%

22 FSCHX CHEMICALS +20.3% +80.0% 60.55 50%

23 FSENX ENERGY +32.3% +113.1% 38.62 50%

24 FSELX ELECTRONICS +15.4% +50.2% 29.83 45%

25 FSRFX TRANSPORTATION +6.9% +49.3 30.32 45%

26 FSCPX CONSUMER INDUSTRIES +17.3% +48.6 15.4 44%

27 FWRLX WIRELESS +21.4% +53.3% 6.12 44%

28 FSHCX MEDICAL DELIVERY +77.1% +228.6% 32.65 41%

29 FSTCX TELECOMMUNICATIONS +30.8% +80.1% 34.54 41%

30 FSCSX SOFTWARE +18.4% +52.8% 57.48 40%

31 FDLSX LEISURE +22.3% +48.2% 58.94 37%

32 FSLEX ENVIRONMENTAL +25.2% +87.6% 13.57 37%

33 FBSOX BUS.SRVCS-OUTSOURC. +21.8% +37.6% 13.24 35%

34 FSCBX SMALL CAPS +17.5% +61.4% 16.88 32%

35 FSAGX GOLD +93.8% +219.6 38.23 29%

36 FDFAX FOOD & AGRICULTURE +7.7% +28.7% 52.61 27%

37 FSVLX HOME FINANCE +4.7% +88.4% 9.35 27%

38 FSMEX MEDICAL EQUIP +36.8% +116.7% 20.15 25%

39 FSPHX HEALTH CARE +30.2% +95.9% 86.11 21%

40 FSUTX UTILITIES GROWTH +7.3% +51.6% 38.28 21%

41 FPHAX PHARMACEUTICALS +15.9% +51.1% 8.72 15%

42 FBIOX BIOTECHNOLOGY +19.1% +70.6% 58.57 11%

|

4. PEERLESS BUYS AND SELLS with Key Stocks

Some

Randomly Chosen Examples

The

Peerless signals are easily superimposed on any chart.

The software

generates the trading gains of these signals, assuming

that

positions are taken at the next day's openimg, following a

Buy or

Sell.

TRADING GAINS

Peerless

Peerless

Buy

&

Buys/Sells

Buys/Sells/Shorts Hold

AAPL

74.9%

187.4%

-8.3%

ADBE

31.4%

110.2%

-26.8%

CSCO

25.2%

65.2%

-9.9%

EBAY

30.9%

114.7%

-28.9%

GOLDMAN SACHS

105.7%

281.8%

-19.0%

GOOGLE

67.0%

166.4%

-6.6%

HOME DEPOT

22.3%

32.4%

2.6%

IBM

35.3%

101.6%

-16.1%

NEM (gold stock)

92.2%

255.7%

-9.0%

QCOM

12.7%

47.2%

-17.6%

RIMM

110.2%

304.9%

-30.9%

3

|

|

|

|