TigerSoft and Peerless Daily Hotlines

TigerSoft and Peerless Daily Hotlines

Samples - 3/24/2010

- 4/12/2010

Earlier Hotlines

-

Links

removed for these older hotlines. They are available to subscribers...

2010 2/12/2010 - 3/22/2010

1/15/2010 - 2/11/2010

2009

10/21/2009-1/14/2010

8/30/2009-10/20/2009

7/31/2009-8/28/2009

7/1/2009-7/31/2009

6/14/2009-6/30/2009

5/1/2009 - 6/11/2009

3/30/2009-4/30/2009

----------------------------------------------------------------------------------------------------------------------------------------------------

4/12/2010 Peerless Remains on A Buy.

If there is a retreat, it should be shallow

4/12/2010 10006 la/21-dma= 1.015

21dma-roc = .433

P= +316 Pch= -8 IP21= .077

V = 20 Opct = .426

21dma-roc >.70 shows unusual momentum. A reversal down is

more unusual.

More information on back-testing this soon.

IP21 (Current Accum.) >.25 make it harder for a downwards reversal.

Important Notice: Redistribution of any text

or concepts here is a violation of copyright laws. This is valuable intellectual

property.

All violators will be subject to legal action. Please visit www.tigersoft.com Goggle TigerSoft and a technical subject, to get

additional examples and a further discussion of concepts and terms used here.

See also our Books for sale. .

(C) 2010 William Schmidt, Ph.D.

===> Order form to Renew

On-Line, "Nightly Peerless/TigerSoft Hotline " ($298)

3/30/2010 When Selling A High

Accumulation "Bubble" Stock on Weakness Is A Good Strategy.

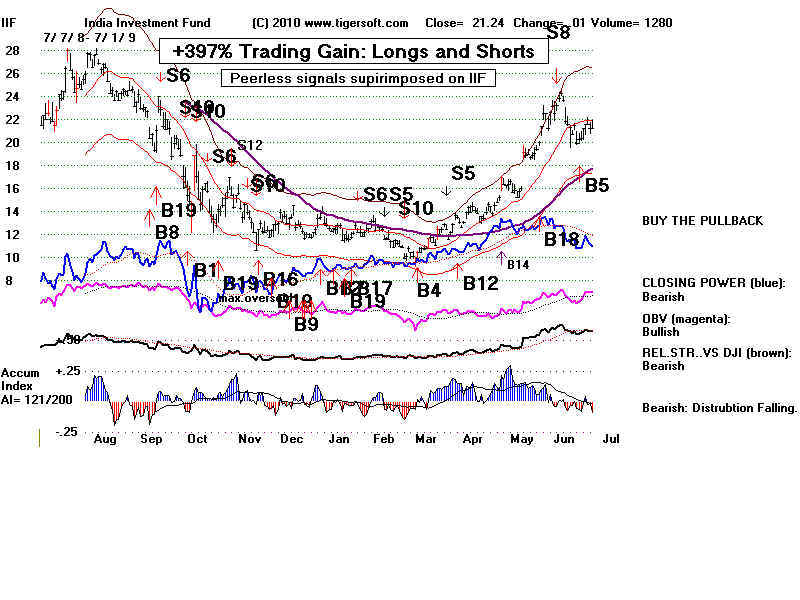

3/27/2010 - Indian ETFS Using Peerless Buy and Sell: So Very Profitable since 1998

3/11/2010

Tiger Weekly Buy B12s on All Stocks, ETFs, Commodities.

3/1/2010 - Many Bubble Stocks Are Going Higher.

2/20/2010 - Watch The Pros To Catch The Tops in "Bubble" Stocks.

Market Tops Seem To Follow Their Break-Downs

-------------------------------------------------------------------------------------------------------------------------------------------------------

HOTLINE - 4/12/2010

-------------------------------------------------------------------------------------------------------------------------------------------------------

Overnight Market Action:

Bloomberg

Futures around the world before the US Markets open.

24-hour Spot Chart - Gold

24-hour Spot

Chart - Silver Dollar and Currencies

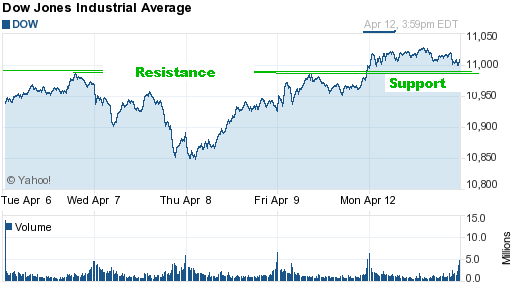

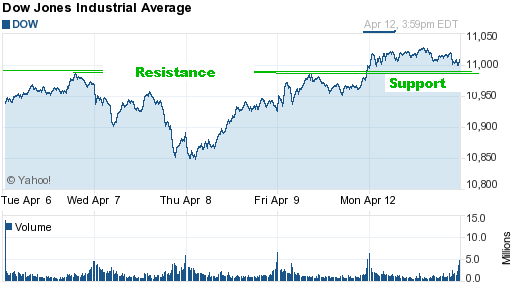

5-day DJI Chart - 4/12/2010 10980-11000 is support

Daily NYSE 224 New Highs - NYSE 3 New Lows

Bullish.

Daily NASDAQ 149 new

highs - NASDAQ 4 new lows. Bullish.

So long as the ratio of new highs to

new lows is 10:1, it's hard to predict a significant

decline. New lows exceeding new highs within 4 days of making a new DJI high,

on the other hand is very bearish.

HOTLINE -

4/12/2010 Peerless Remains on A Buy.

Gold's Internal Strength Is A Warning That The Rally in Stocks Will

Be Limited.

Stay long is our recommendation. Since 1965, the DJI has risen 73% of the time

in the week following April 12th. In fact, the DJI rallied 63% of the time in the

month after April 12th.

Volume was low, as usual. But the move past 11000 showed good breadth and the

internals have not slipped so much down from their previous highs to make a decline back

to

the lower band a high probability. The Closing Power uptrends are still

rising.

I

went through about 250 of the SP-500 stocks to see if there are any head and shoulders

patterns among their charts. There were none, except AA's. Oil, retail and

financial

stocks, particularly, are quite strong.

By my

thesis, the strength in the bank stocks is intentional on the part of the Fed and the

Obama

Administration. Sadly, the Power Elite finds it impossible to help their banker

friends and

also

create Main Street jobs directly. That is a contradiction that only they seem to

still

deny.

They must gamble that the rising stock market will give the rich and the

surviving middle class enough extra money to boost consumer demand. But will what

they

buy really be made in America?

Gold, Bankers and Stocks

The

Power Elite's role now in propping up the Dollar would be nice to get data on.

They

do seem now to prefer a strong Dollar, which especially helps the big US banks

to

keep and attract deposits. My guess is that the Fed-Administration-Banker

triumvirate

are

probably shorting Gold to discourage a run upwards in it. Again no information is

available. A Goldman man runs the Commodities regulatory agency. He will not

permit

big

short sale positions to be disclosed publicly. Only big long positions must be

revealed.

How

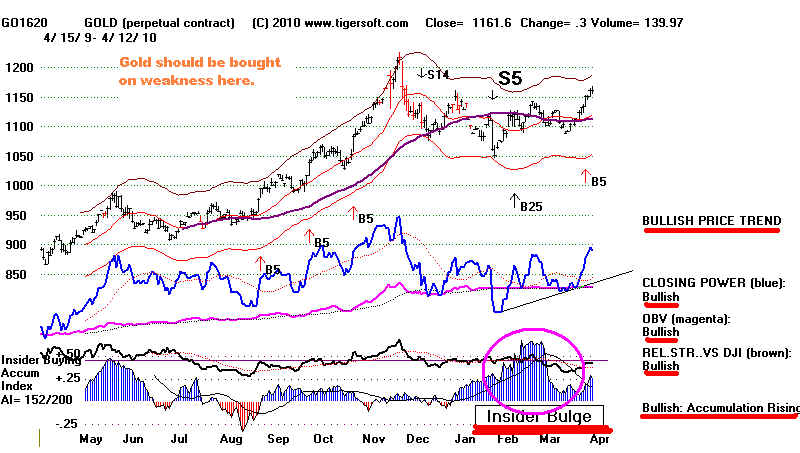

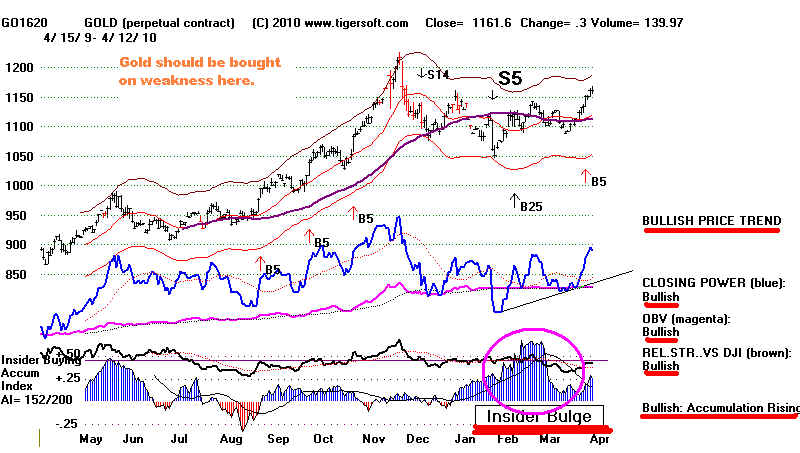

long will the FED-ADM team succeed in holding down Gold? Look at all the

Accumulation in

the

perpetual contract for Gold (GO1620). (I believe the futures market in Gold is more

important and a better predictor than GLD. It seems likely that GLD represents

public

buying or selling, while the trading in Gold futures is done by big profesionals. )

I

keep remembering how from 1977 to 1980 when Democrats took over from Republicans

and

unemployment was very high, Gold quintupled even as the Fed raised rates steeply.

But

there are other President-Democrats. FDR ended all speculation in Gold. But,

Obama is

not

only no FDR, he is also no Carter. I think he is trying to be more like Clinton.

In

financial matters, Clinton took financial marching orders from Greenspan, Rubin and

Summers,

all

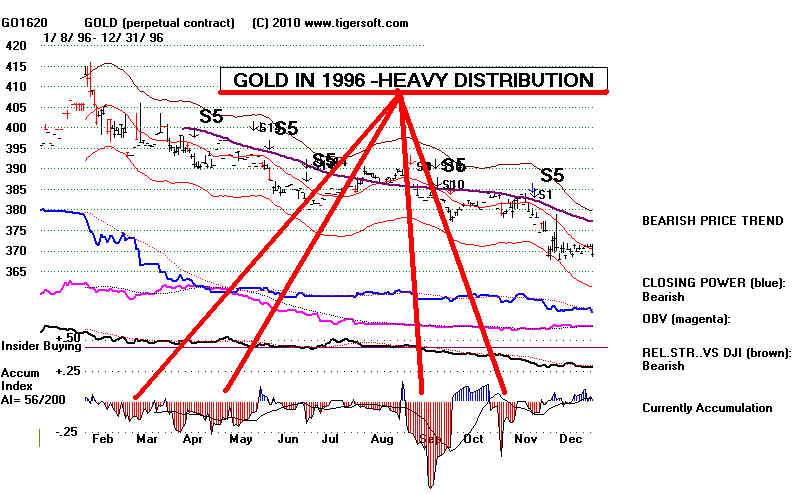

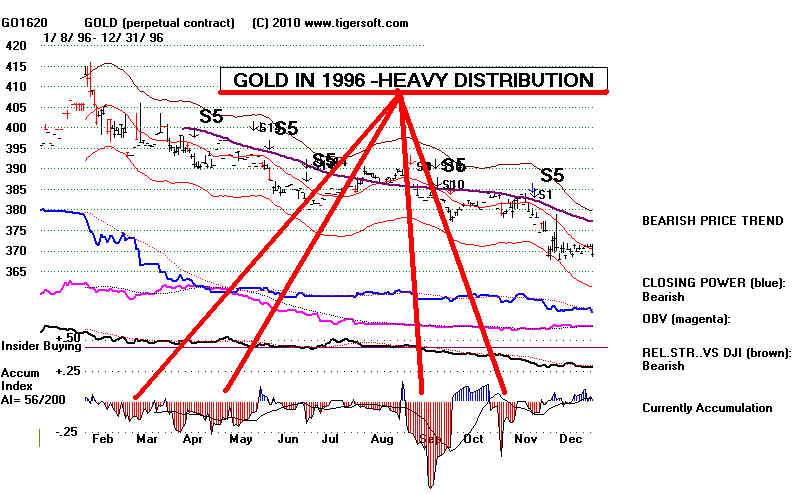

representatives of Wall Street. Under Clinton, Gold first rose from 330 to 420 and

held there

until

1996. Then it began a long slide downward to 250 in late 1999, as stocks became

a

much better investment. If stocks were presently at the start of a 5

year advance,

as in

1995-1999, Gold would be in a decline or showing red Distribution from TigerSoft.

That

it now shows so much Accumulation, suggests that Wall Street's efforts to rekindle

a

long bull market will probably not be successful.

GOLD IS NOW UNDER HEAVY ACCUMULATION

If

Gold were about to go into a long decline -thereby showing stocks would rally much

further - one would think it

would show heavy red distribution, as it did in 1996 when it

was starting a four year

decline.

STOCKS

Generally,

it is best to focus on high AI/200 stocks with the market up nearly 9%

since the

first of the year. Then look for high current Accumulation (IP21) and rising

Cloning

Powers.

Group:

Stocks with Bullish Internals

========

=============================

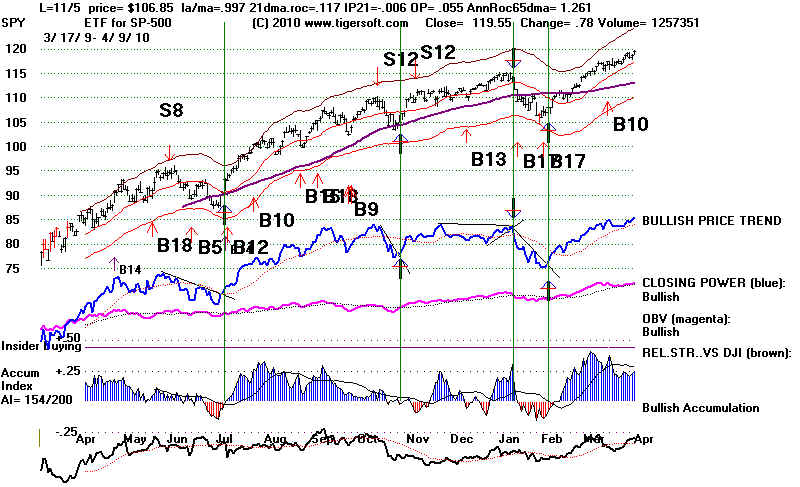

SP-500 - D -

41.18 (AI/200=188, IP21>.25 )

NASD-100 LNCR - 47.18

(AI/200=178, IP21>.25)

FAST - 51.90 (AI/200=140. IP21>.25)

NHCONF LCUT -

13.54 (AI/200=200. IP21>.48)

VOE - 50.23 (AI/200=184, IP21=.43

PHT - 16.44 (AI/200=199, IP21=.26

LNCR - 47.18 (AI/200=178, IP21=.32)

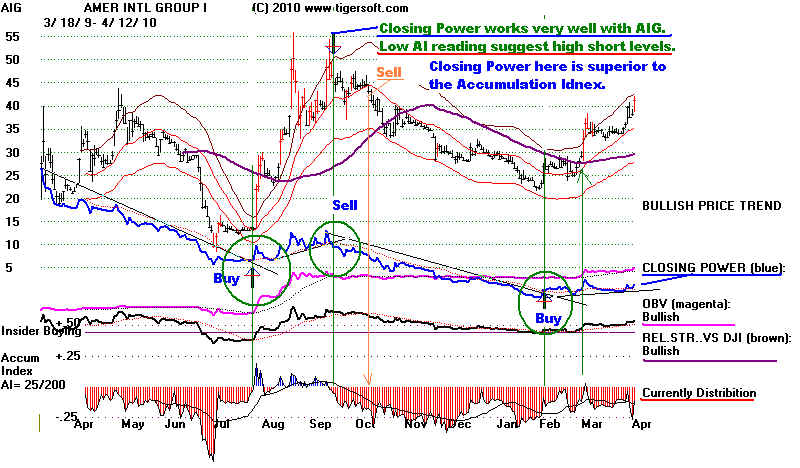

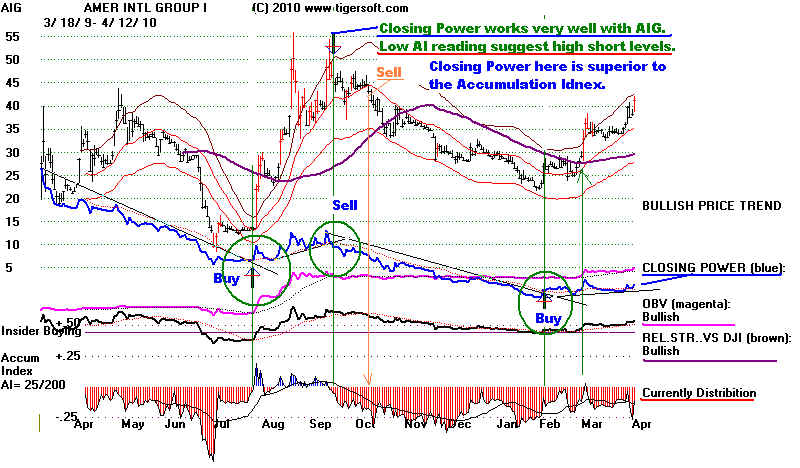

AIG - Turnaround

Look at AIG's chart below. You can see how important the 65-dma was and how the

Closing Power's trendbreaks have timed the stock's turns superbly. The AI/200

has

been very negative for a year. Eventually, the stock will decline. At least,

the

is

usually true with stocks showing so much red Distribution.

==================================================================================

==================================================================================

HOTLINE -

4/9/2010 Peerless Remains on A Buy.

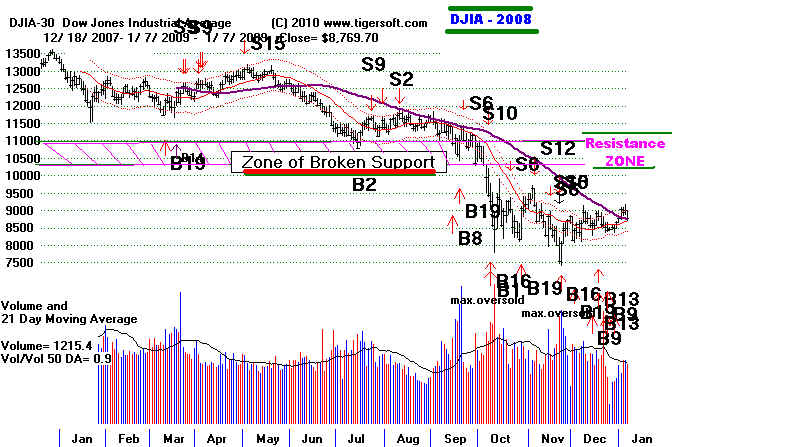

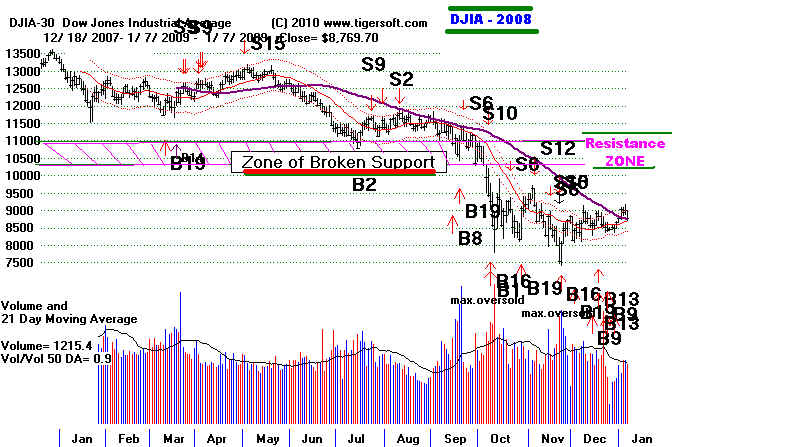

The 10,000 Barrier Almost Overcome

The DJI is

challenging the 11000 psychological resistance. This actually seems to be

the top of

the resistance zone that crumbled in 2008 when Paulson demanded $800,000,000

for his

Wall Street buddies, "or else". The shock of that collapsed the market

below

the

attempted 10600-11000 support. As we all know, broken support becomes resistance.

It is that

resistance which the DJI has been eating up for the last few months. It seems

that now

the resistance may be nearly all eaten up. This is difficult to assess, admittedly,

and volume

has been low. Nevertheless, it now looks like the DJI is close finally to surpass

the

rest of the

10600-11000 resistance. With Peerless on a Buy and the NYSE A/D and CLosing Power

Lines still

uptrending, we have to remain bullish. I think I am correct that the Power Elite

wants,

almost desperately, for the rally to continue. The alternative, with unemployment

still so

high, is too grim. 4/8/2010 12000 or Bust. The

Power Elite's Biggest Gamble of All"

2008: DJIA's -10600-11000 Resistance Has Been A Barrier to DJI's Advance in 2010.

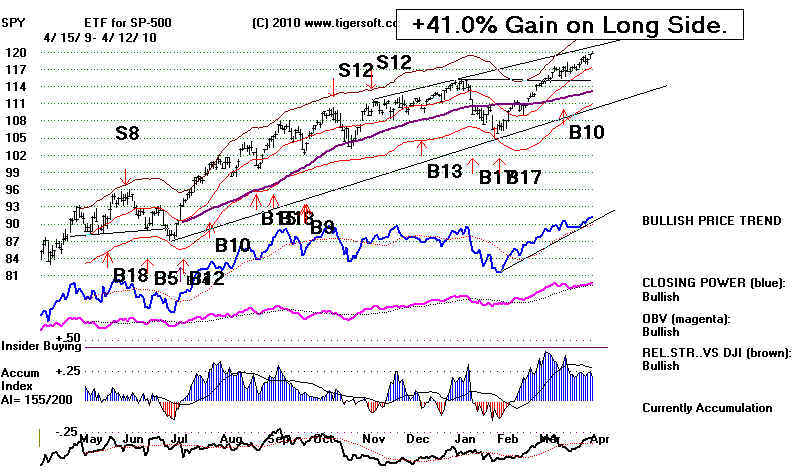

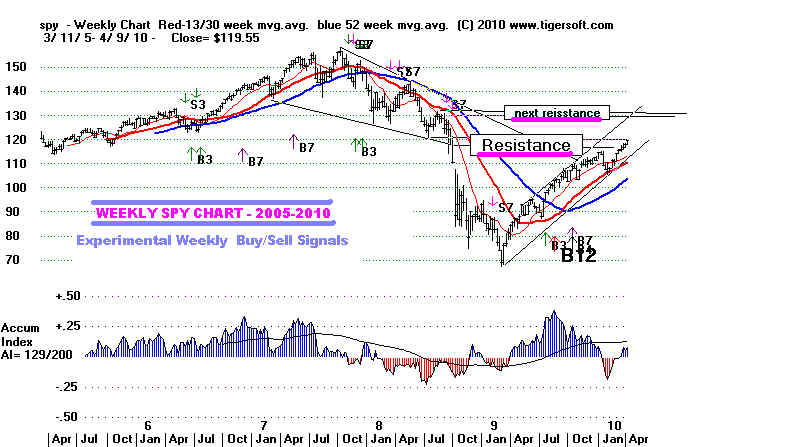

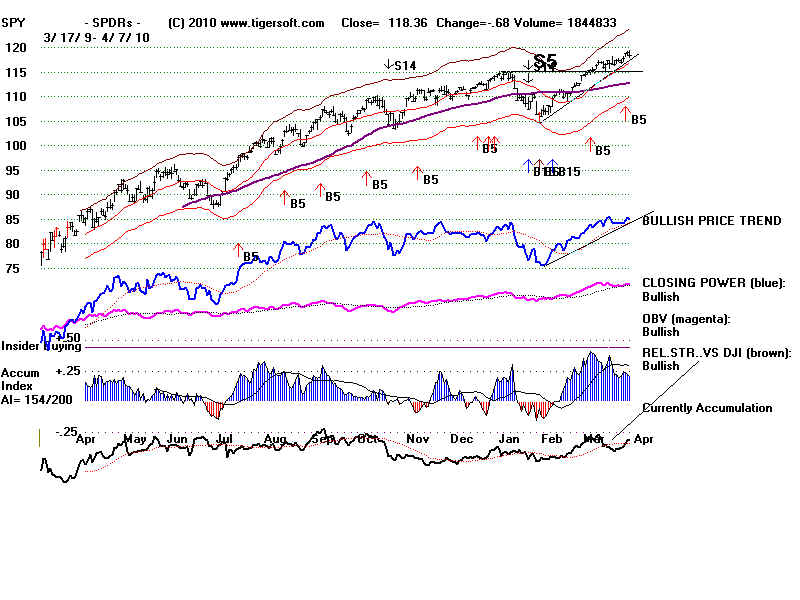

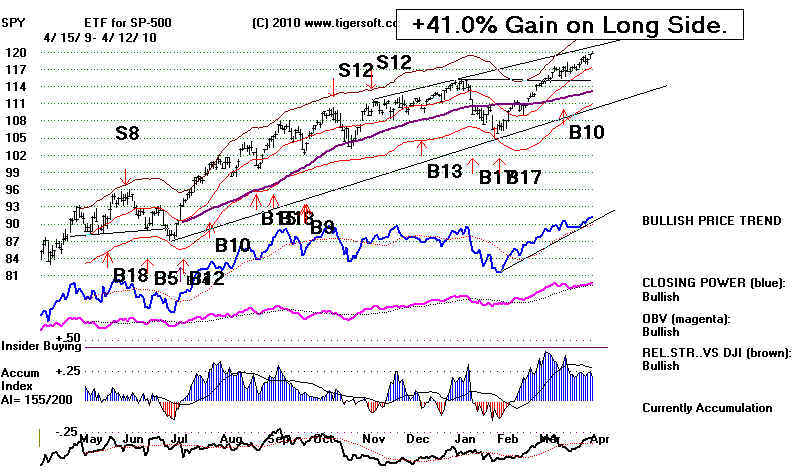

I think that the operative Peerless Buy signal should be respected. Confidence in

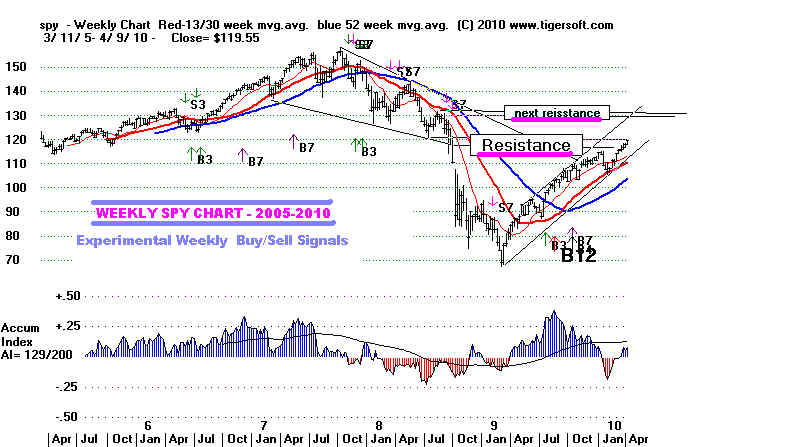

Peerless

grew for me

as I researched this weekend my new study of Peerless and trading SPY.

In

particular, besides great gains on the SPY using Peerless, I noticed that after a

+30% Annualized

Return on SPY since 1993.

big

advance since 1993, when a long trade on the SPY was up more than 8.4%, as now,

the odds

have been good (10 of 16) that SPY will rise still more and achieve a gain of more

than 13%

before the next Sell. In the other 6 cases, the SPY could not rise to a gain

of more

than 11.9%.

That might take the DJI only to 10200. Should this less bullish scenario play

out, it is

still worth noting that only shallow declines followed the next Sell in these 5 cases:

+2.6%,

+0.5%, +4.7%, +4.4%, +5.7%. So, the conclusion I reach is that the odds are

perhaps 60%

that the DJI will keep rising meaningfully. But if there is a Sell signal soon,

only a

shallow decline will follow.

Cases where the SPY Gained more than 8.4% aon a Buy: 1993-2010

2/27/1996 Sell S1 +3.3% decline after earlier +43.7%

rally

4/22/1997 Sell S9 -6.8% rally aftter +13.1% rally

9/18/1997 Sell S12 +2.3% decline after +14.1% rally

4/28/1998 Sell S15 +12.4% decline after +16.4% rally

6/18/1999 Sell S12 +2.8% decline after 36.0% rally.

- 12/28/1999 Sell S9 +2.6% decline after 11.9%

rally - minor additional rally

- 10/10/2001 Sell S9 +0.5% decline after 8.5% rally. - minor additional rally

10/15/2003 Sell S4 -1.3% rally after 17.9% rally.

- 2/11/2004 Sell S15 +4.7% decline after 9.4% rally. - minor additional rally

- 12/28/2004 Sell S8 +4.4% decline after 9.6% rally. -

minor additional rally

5/8/2006 Sell S9 +5.4% decline after +14.4%

rally.

1/5/2007 Sell S4 +2.1% decline after +13.4%

rally.

- 7/17/2007 Sell S9 +5.7% decline after 11.8% rally. - minor additional rally

- 3/27/2009 Sell S5 -4.4% rally decline after a

9.3% rally. - minor additional rally

6/9/2009 Sell S8 +5.6% decline after a +14.6%

rally.

10/21/2009 Sell S12 -1.9% rally after a 20.0% rally.

Current rally is +8.5%/

-------- PEERLESS SIGNALS ON DJIA ---------

HOTLINE -

4/9/2010 10997 la/21-dma= 1.016

21dma-roc = .474 P=

+323 Pch= 1 IP21= .117 V = 26 Opct

= .426

21dma-roc >.70 shows unusual momentum. A reversal down is

more unusual.

More information on back-testing this soon.

IP21 (Current Accum.) >.25 make it harder for a downwards reversal.

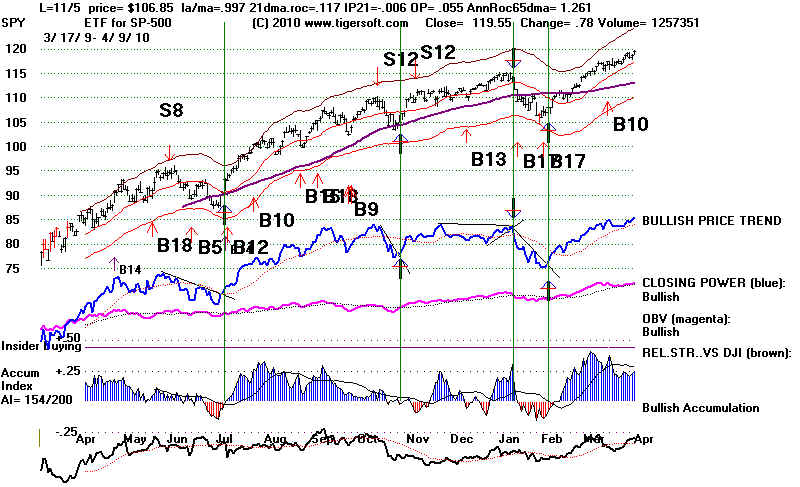

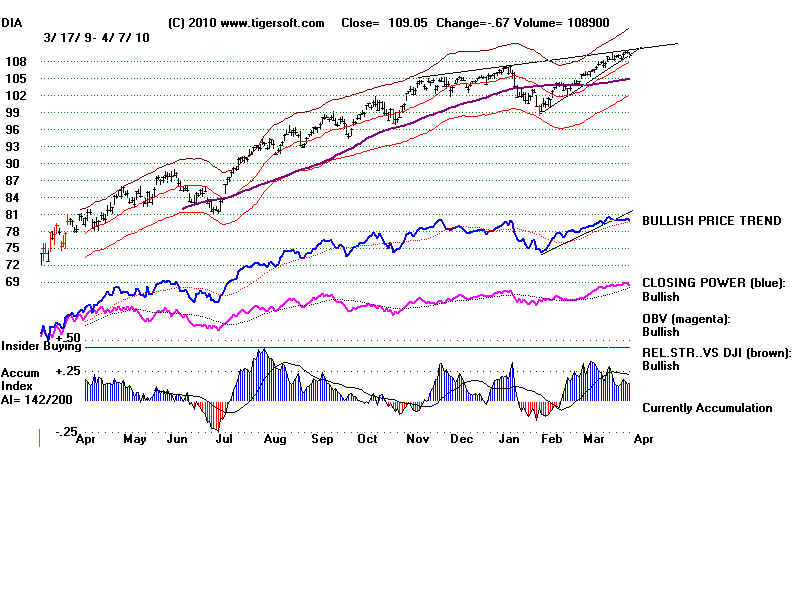

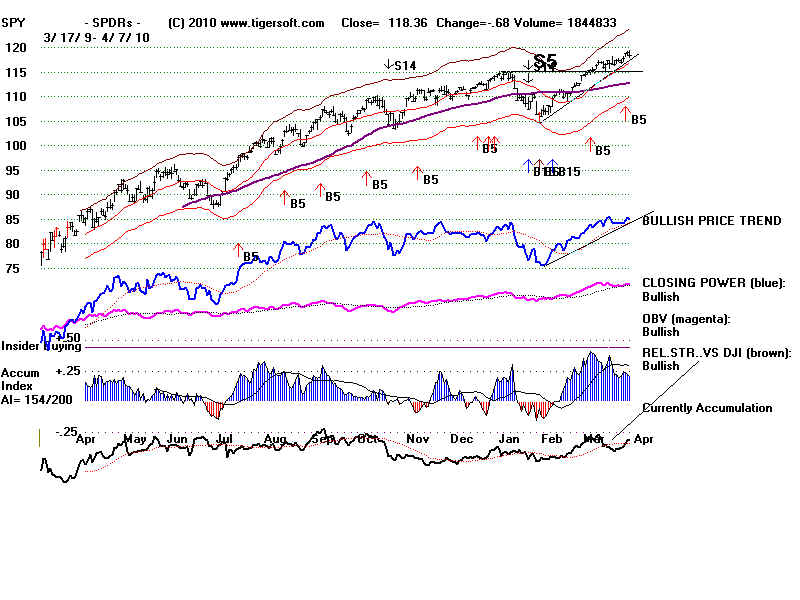

SP-500 - Closing Power is making

a new high.

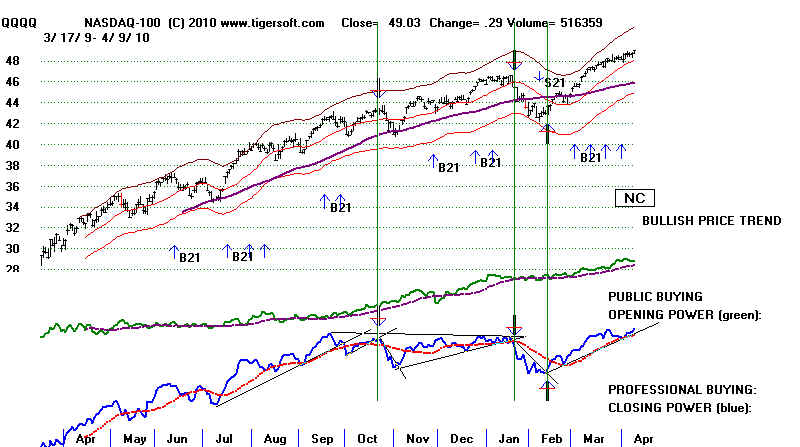

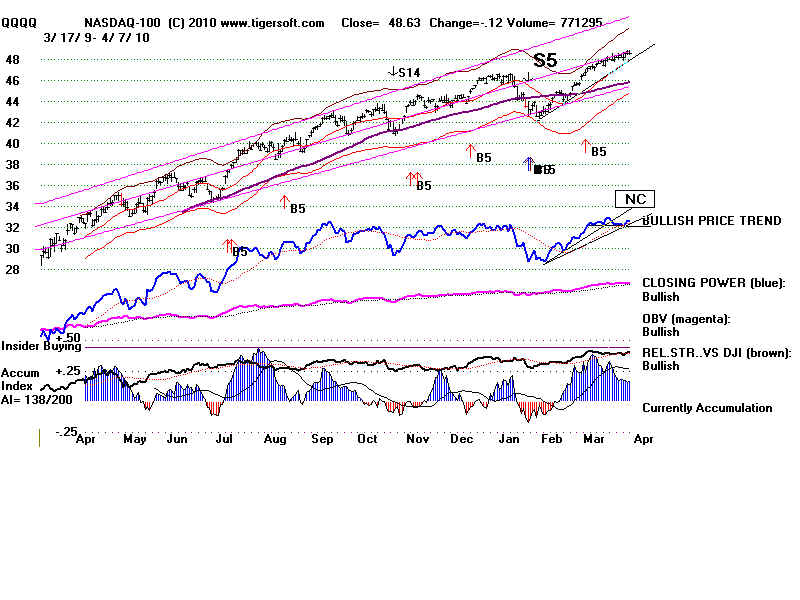

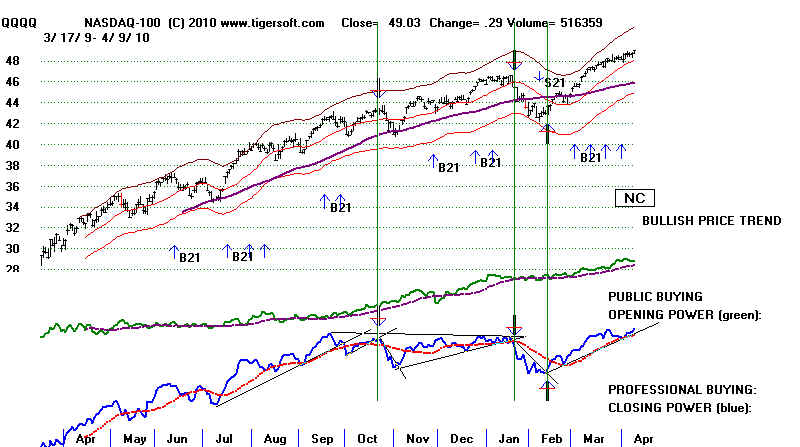

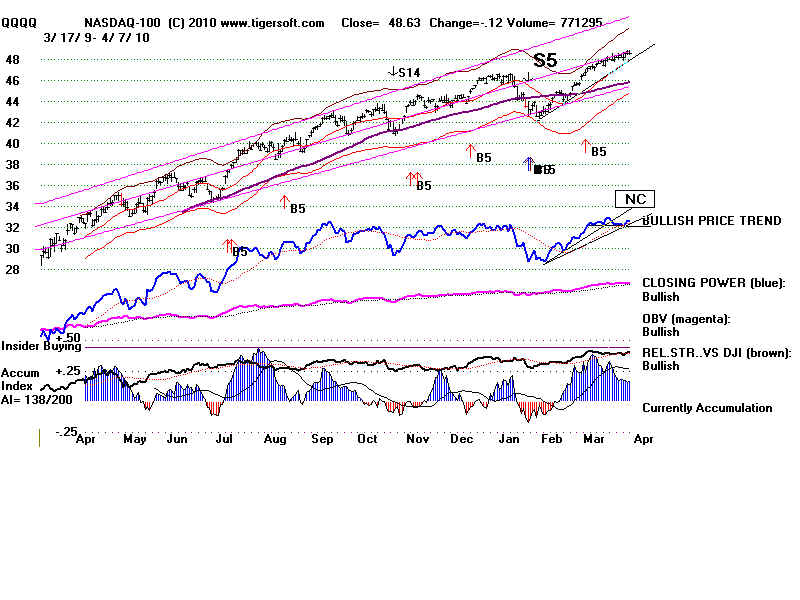

QQQQ - - Closing Power is making a new high.

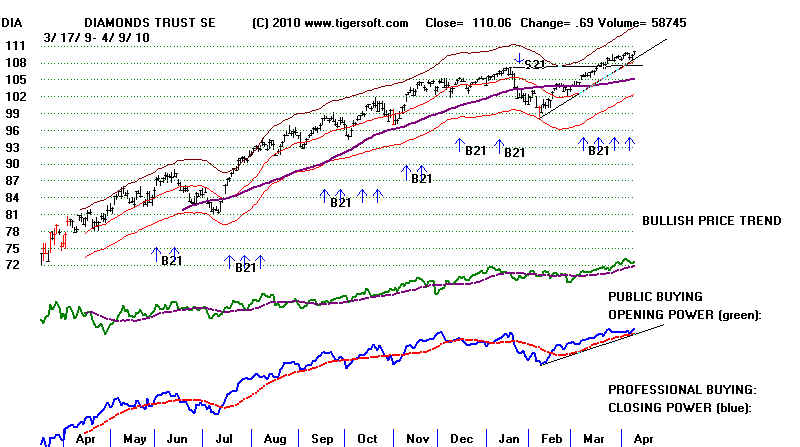

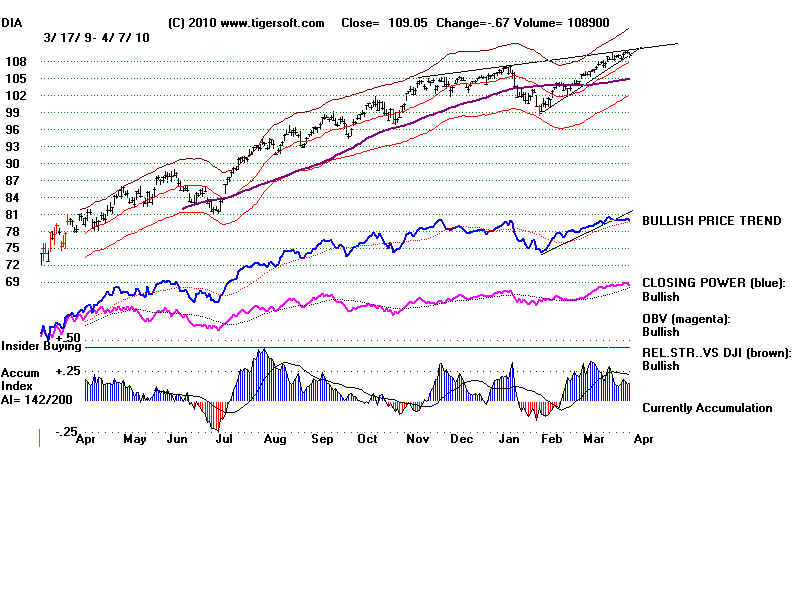

DIA - - Closing Power is making a new

high.

=================================================================================

HOTLINE -

4/8/2010 Peerless Remains on A Buy

The

Triumvirate-Power Elite (the

FED, Obama and Big Wall Street banks) have gambled big

that they can keep the stock market rising. Given

their financial orthodoxy, perspectives

and self interests, they really have no other alternative.

Their control seems unshaken

by the current blue-ribbon panel looking into the causes of

the 2007-2009 Crash and who is

to individually blame. The "Power Elite"

(this is easier to spell!) want to demonstrate that

they are very much in control. One way to do

this was to keep Goldman Sachs rallying.

Another is to turn up the market and move it past the

psychological resistance of 11000.

See - http://www.tigersoftware.com/TigerBlogs/April-9-2010/Index.html

Below are the charts of Goldman,

DIA and QQQQ, No Closing Power sells seem

possible tomorrow, in that it would take a very weak close

after a very strong opening to

break the Closing Power uptrends. 11000 is a good

target to bring in more trading volume.

That is not lost on Wall Street.

.

INDIVIDUAL STOCKS

Looking

at the Tiger data base NHCONF and running the bullish screen, it is clear

that insiders and professionals are

still pushing upwards high Accumulation stocks.

Use TigerSoft and view the charts of G, PHT, CHGY, MRT, HYT, RT, VCBI

=================================================================================

HOTLINE - 4/7/2010 Peerless

Remains on A Buy

We still have no new Peerless Sell.

The A/D Line uptrend is intact. Since the Closing Power

for the QQQQ did not confirm the recent

new highs,. we will consider any break in its

uptrendline to be a short-term sell.

Today, I can still find more stocks

that look like they will

rally than fall. But prudence

probably dictates taking some profits in stocks not showing

high or lengthy blue Accumulation.

After all, 11000 is a logical point for intense resistance.

Bearishly, volume keeps rising on

down-days, too. So, our Stocks' Hotline sold advised

selling a few lower AI/200 stocks.

I have argued that what makes this market so

unusual is the amount of MONEY the Fed is

pumping into it. It is as though all the

big players have been provided trillions in capital, as long

as they use the money to buy, not make cheaper

business, home or personal loans. I don't

think this strategy of the Financial-Politcal

Power Elite will change on its own until the

DJI is even higher. As long as the Dollar

does not collapse, the Fed will probably continue

to keep rates very low. A re-valuation

upwards of the Chinese currency might change

this. But for now, the Dollar's Tiger

chart has all "bullish" notations and its Closing

Power is in an uptrend.

Wall Street's failures and excesses were the

subject today of the "FInancial Crisis Inquiry

Commission" http://www.fcic.gov/hearings/ Its chairman

is Phil Angelides, former

California

State Treasurer interbiewed Greenspan and

Rubin. http://www.fcic.gov/reports/

Greenspan

says "I was wrong 30% of the time"?

Ex-Citi

exec says he warned Rubin on mortgage risk

Ex-Citi

executives face questions on mortgages

Such talk, I think, caused the decline

today.

But take heart, the market would

have crashed wide open, if this panel were really about

to do its job. The DJIA would have fallen

500 points is the panel was moving to recommend:

1) a separation of investing and commerecial banks functions into different

insttitutions'

2) the break-up of the too-big-to-fail banks,

3) the imposition of a stiff windfall tax on Wall Street's big bonus executives

in the bail-out firms,

4) a challenge to the Fed's secrecy in the matter of the trillions in bank bailouts and

5) clear refutation of those who would give the Fed even more powers vis-a-vis banks.

I think we can safely bet that there will

be no expose of the secret arrangement between

the Administration, the Fed and Wall

Street Banks, in providing these banks trillions from

taxpayers in return for worthless

toxic debt collateral. There is also very little chance that

anyone will challenge the Federal

Reserve, Greenspan, Bernanke or Bernanke for being

far too chummy with the very

bankers that caused the Crash. I think that I can guarantee

no one on this panel will attack their

central bankers' perspective as being unable to conceive

of economic growth that does not depend

first on Wall Street handouts and a Wall Street

bull market. Lastly, I would bet

that none will attack the central bankers' perspective that

conveniently forgets how dangerously

undemocratic the highly massive and monopolistic

Wall Street banks are as they push around

politicians of both parties with millions and

millions of dollars in what are politely

called "campaign contributions"

That's why Goldman Sachs rose today and

why such talk as was heard today will NOT much

dampen the spirit of the bulls.

The most

succinct exposition and summation on how Wall Street and the Federal Reserve

are

boosting stocks by risking a bigger bubble than in 2000 for stocks, 2004 for housing and

2008

for oil, is offered today by Dylan Ratigan.

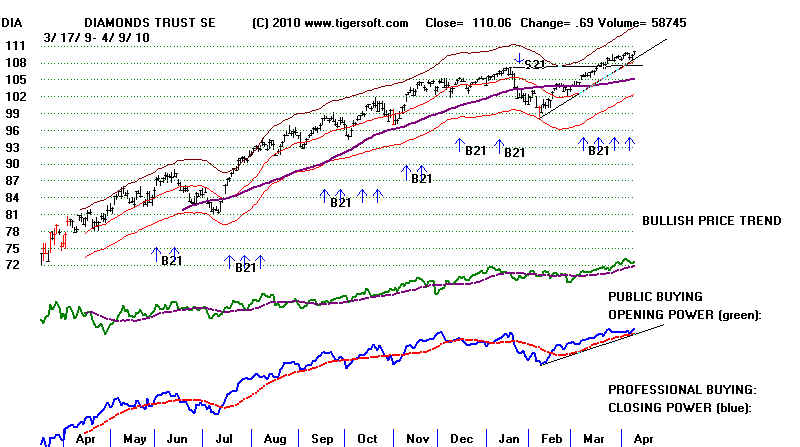

DIA - ETF for DJIA

Closing Power

Uptrend - violated

Bullishly both Opening & CLosing Power are

rising (above their rising 21-dma).

TIGER INDEX OF SP-500 and SPY

Both Opening and Closing

Powers are rising.

This suggests we are in a vertical ascent phase.

Closing Power-Percent - violated its

uptrendline.

The CP

and CPP have not confirmed the recent highs.

87% of the SP-500 stocks are above their 65-dma.

TIGER QQQQ and INDEX OF

NASDAQ-100

QQQQ - All Bullish

Closing Power Percent is not confirming the advance, could easily break its

uptrend-line.

and could be forming a bearish Closing Power head and

shoulders..

86% of the NASDAQ-100 stocks are above their 65-dma.

That uptrend has been slightly violated.

==================================================================================

HOTLINE -

4/6/2010 Peerless Remains Bullish....

11000 on the DJI is the logical place for sellers to concentrate

their sell orders,

if they want to take

profits or get out even. But, we have no signs that there will

be more than a very

shallpw decline, if there is a retreat. In two days, we will have

seen a 13 month rally

from the March 9th, 2009 bottom. Bull markets that last 12 moonths

this long are much more

likely (2:1) to last at least 3 additonal months than suffer

an 8% or more decline.

Breadth remains very bullish. Both Opening and Closing

Power are rising for the

biggest ETFs. Peerless remains on a Buy. There is no indication

that interest rates will be

raised. Interest sensitive stocks are among the best performing

and highest accumulation

groups. Meanwhile, other high accumulation stocks that make new

highs are spectacularly

strong and there are a lot of such stocks. Below is a composite of

more than 200 of them.

"Enjoy the ride". I have to say.

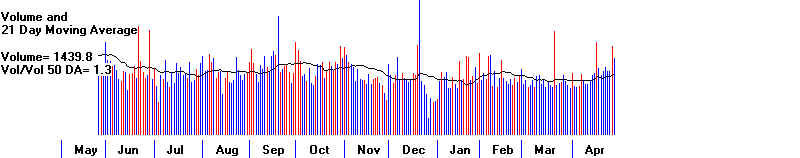

Index of High Accumulation New Highs

=============================================================================

HOTLINE -

4/5/2010 Peerless Remains on A Buy.

Speculative fervor continues to build.

We have no reason to sell. This is one of those times when we want to let our

profits run. Peerless relies

on automatic signals, derived mostly from

breadth indicators and Tiger's

Accumulation Index. The public is pushing up openings

now. Closings are neutral,

not bearish. Both Openings and Closing Powers are

rising. This shows the market is in

verticle ascent. I would, for now disregard other

normally useful tools, like the

MACD, CCI and RSI, whose non-confirmations of

new highs are sometimes very

premature in vertical ascent markets.

The biggest

mistake the Peerless automatic signals have made since 1981 was showing

premature Sell S8 and S12 Sell signals in

first quarter of 1999. In practice, this was easily

overriden by our Hotline because I

allowed for the special strength of the market at all-time

highs and we could see all the stocks

that showed powerful Accumulation on new highs.

I mention this for three reasons.

First, always be careful about

standing in front of a herd of bulls. Expect execess.

The QQQQ's Closing Power was wrong

for 3 months in early 2000. It was a lot easier

to ride some speculative

"bubble" stocks than resist the trend by going short, or

even sitting ont he sidelines.

Second, always be open to new

ideas. We have unprecedented collusion now between

an inexperienced,

semi-figurehead President, the Federal Reserve and the biggest Wall Street

banks. If they want the

market to go up, accept that it probably will.

Why the stock market keeps going up and up?

The Secret Deal Obama, The Fed and Wall Street Seem To Have

Reached.

I still remember reading in high school Emerson's essay "Self Reliance how a

"foolish consistency

is the hobgoblin of little

minds". (A radical idea for a public high school?). So, regarding the

need to keep an open mind, and not

be a victim of a foolish consistency, I keep checking

the worst of the Peerless signals.

It amounted to standing in front of a herd of bulls.

Today, I discovered something new

about this period from February to May 1999. This

period every four years, in the

year before a Presidential Election year have always been

either neutral or strong since

1927. As it turns out, cancelling Sell S9s in 1935, 1959, 1967

and 1999 during these three months

impoves our model quite a bit. Recalling Emerson,

a new Peerless will do this.

A new "SuperImpose DJIA saved signals" file will be provide

these results. The results

gotten trading the DJIA, SPY and QQQQ with this revised

Peerless since 1994 will be posted

in a few days. The on-line-book will show you these

details later this week.

Thirdly, TigerSoft's

Accumulation Index has never worked better. I say this out of pride

but also because there's a

message in this that we should accept or, at least carefully

consider. I take

it to be very bullish today that we see a large number of high Accumulation

breakouts. The 11000

barrier on the DJIA may not hold the general market back. There

were more than 25 new highs

tonight with recent or current Accumulation bulges over

+.45. See ALL the graphs of these high

Accumulation breakouts here.

In recognition of the proven

power of Accumulation Index bulges past +.45, to signify

key insider buying, the

revised Peerless will henceforth for stocks show a horizontal like

at the +.45 level.

You can see this "insider trading threshold: in the sample breakouts

shown just below.

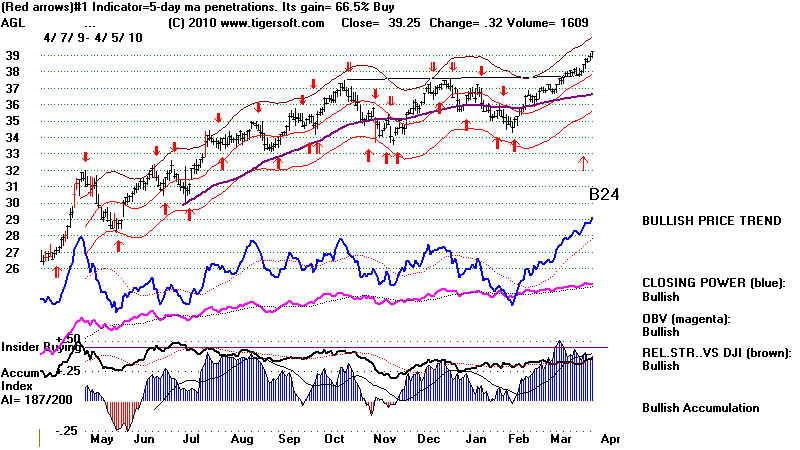

Charts of high Accumulation new highs: PSMT, G, AGL, PXD and VRX

|

===============================================================================================

HOTLINE - 4/1/2010 Another Good

Day for the Rally. Notice the Rotation

The Nasdaq and

low-priced stocks took a day off, as traders noted the breakout by Crude Oil (below)

and bought the best of the oil stocks. Breakouts like this annul red Sell signals

based on

Stochastics and appreciate the value of trading mainly in

the direction of Peerless. Normally,

we recommend breakouts to be in the strongest stocks.

But at some point these are too

far extended and we should consider buying stocks showing

Buys based on their

crossing back above the 65-day ma with positive

Accumulation. (Gold is moved above

at level, too, today, but shows negative Accumulation.

Not surprisingly, the Dollar fell,

though its CLosing Power is still above its uptrend-line

and so may still recover. XOM

and CVX look like good long trades, as mentioned yesterday.

That will help boost the

DJIA. I looked at lots of stocks tonight and

except for PFE in the DJI, I do not see any

ahowing significant danger of a pullback, i.e. head and

shoulders patterns, negative

non-confirmations of new highs or breaks of their 65-dma.

CRUDE OIL NEW HIGH - TODAY.

Of

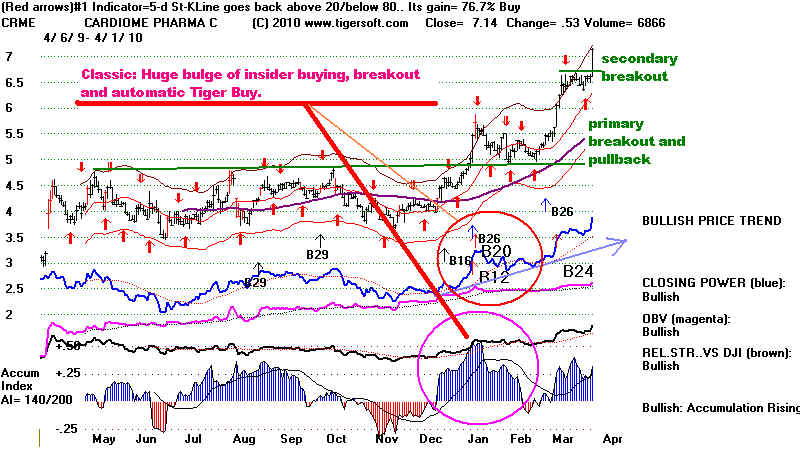

course, in this market traders are still bidding up a number of the high accumulation

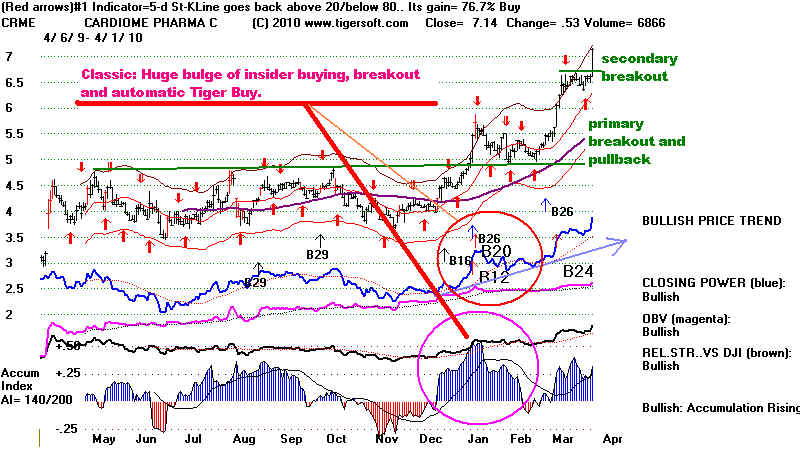

breakouts: HUSA, CRME (shown below) and JEF, JOF, VRX and ZQX which met our

"explosive super stocks" breakout

requirements. The new downloads NHCONF and ACCUMVER

should be a great source for these stocks.

Screen for Bullish, BOTHUP, B12, B10 and B20

using ANALYSIS from PEERCOMM.

JOF, JEQ and

HUSA

===========================================================================================

3/31/2010

Peerless Remains on A Buy. Speculative Low Priced Stocks Remain Hot

The Opening and

Closing Powers are both rising for the QQQQ, SPY, DIA and IWM.

Odds favor a Pull-Back to just below the DJIA's 21-day ma, a

decline of about 2% down from here

and then a recovery to new highs. The specualtive strength

in the market barely cooled down

today on today's mild sell-off. A number of stocks made

confirmed new highs, showing an

IP21 greater than +.25. Here are some of the best of their charts.

What keeps me bullish are a powerful technicals and a powerful

political trimverate:

1) We have no new Peerless Sell in this the 12th month of the

advance without an 8% decline;

2) Breadth remains very good, despite the last two days and the

market is now attracting the public,

judging from the rising A/D Line and surge of interest in thin

low-priced stocks.

3) The market is being pushed up by an unbeatable (in the

short-run) political-financial trimverate,

the President = Treasury Secretary, the Federal Reserve Chairman

and monopoly Wall Street

bankers, like Goldman Sachs.

This triumverate wants the public in the market for different

reasons. They believe business

confidence will be eventually be restored if they can get the

stock market back above

12000, even 14000. They believe that stock market is less a

reflection of corporate earning

expectations than an automatic predictor and precursor/promoter

of furure corporate earnings.

They believe rising stock prices will create new business

ventures and jobs. But where? In the USA?

They neglect that another crash after a bigger bubble is burst

will wipe out many more of the

surviving middle class who are now being enticed into this

market's specualtive phase.

How much will this induced and artificial investment boom address

the profound need for the

rebuilding of the American infrastructure and create and restrore

American manufacturing jobs?

This and the even greater conccentration of wealth and power that

will result GUARANTEES

eventually another financial collapse. The powers that be seem to

have learned nothing from the

last collapse. Want proof? Watch what happens to

financial reform in Congress!

Perhaps, because they know that a new Crash is a real

possibility, they will do all in their

power to keep the market rallying. I have written for a

year that Obama uses rhetoric to

satisfy his progressive base, all the while giving more and more

to boost to Wall Street and

big corporations. His concessions today to the "drill,

baby, drill crowd" are more proof of

how determined, pehaps desperately so, he is to keep this rally

allive. Oil stocks make up a big

part of the DJIA and SP-500: CVX and XOM.

Back to Technicals

The IWM shows a red Sell from a 14-day Stochastic-K Line.

This system (shown by the red signals)

has gained 43.4% for the last year. That should earn it

some respect. IWM/s Closing Power has

broken its uptrend. Its OBV, Relative Strength and

Accumulation Index have lost their "bullish"

status.

What If The Market Weakens Next Much More?

In that case, we will see a big increase in the number of stocks

that form head and shoulders patterns,

that fall below key support levels, break their 65-day ma with

negative IP21 (current Accumulation

Index readings) and then have their 65-day ma turn down.

New Bearish Tiger Data Downloads

See When Selling A High Accumulation "Bubble" Stock on

Weakness Is A Good Strategy.

This offers

TigerSoft's rules to to sell swiftly falling "super" stocks. Beyond this,

I will start to place

on our Tiger Data Page screenings of all stocks for bearish

conditions each night. A good place

to start with be to create directories of stocks to

download each night with all stocks closing

below the 65-day ma with a negative Accumulation Index AND

also for a separate Tiger directory

all stocks below a newly falling-65 say ma, as long as

their Accumulation Index is below +.25.

================================================================================

3/30/2010 Peerless Remains on A Buy. Speculative Low Priced

Stocks Remain Hot

The internal strength indicators are still too strong to predict

anything more than

a decline to the 21-day ma. The DJI is eating up the supply

of stock at 11000. Both

the Opening and Closing Powers remain in uptrends.

The upward power in the stocks showing the highest Accumulation

and highest

momentum is nothing short of amazing now. Momentum like

this draws the

public into the market. The result is that Opening Power is

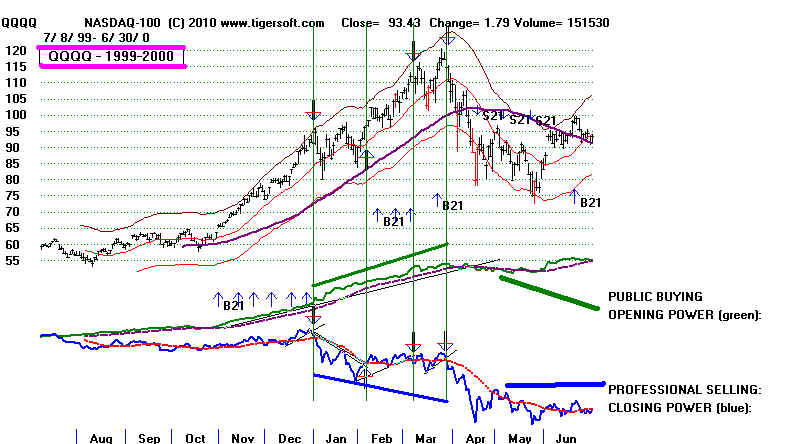

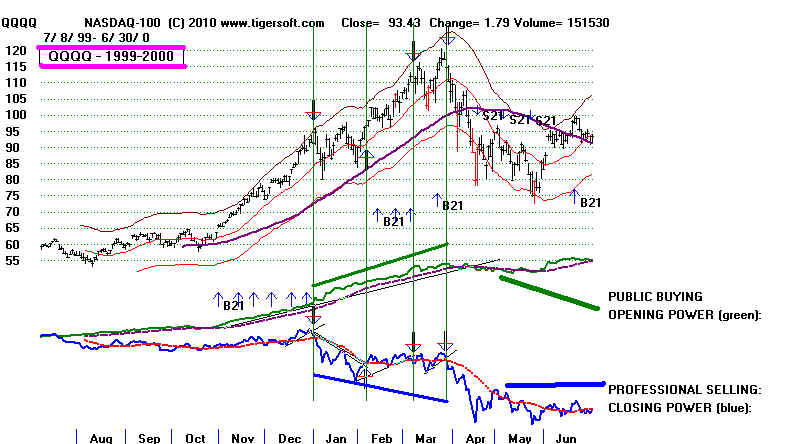

now stronger

than CLosing Power. The period 1999-2000 shows that this

condition can last

for 3 months. A recognizeable top pattern is also likely to

occur, as well as

a Peerless Sell, at the top.

So, instead of telling the market to go

down, because we do not like Fed rigged

markets and we think the economy is still in deep trouble, I

would suggest working

with the trends of the stongest high AI/200 stocks and

trade their Closing Power uptrends

on the long side. The next decline to the 21-day ma will

likely be a good trading

Buy, just as it is with all powerfully uptrending stocks showing

high Accumulation.

The NASDAQ now shows a very high level of positive Accumulation.

Its AI/200

level is 188. Hesitation and more new new highs is what

this strength has historically

shown until there is a Peerless sell.

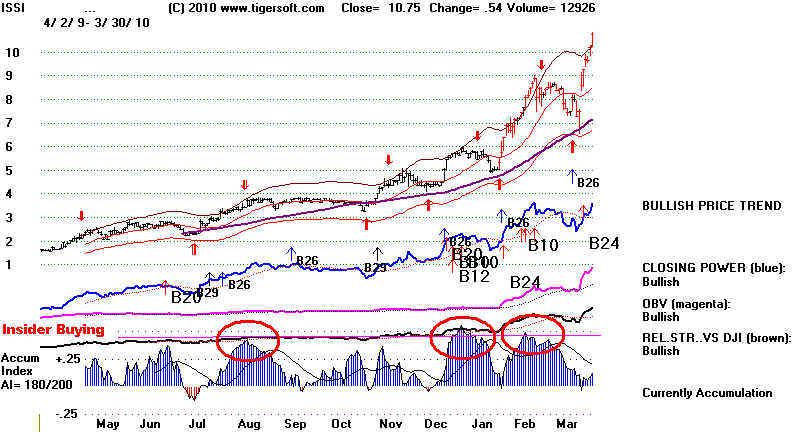

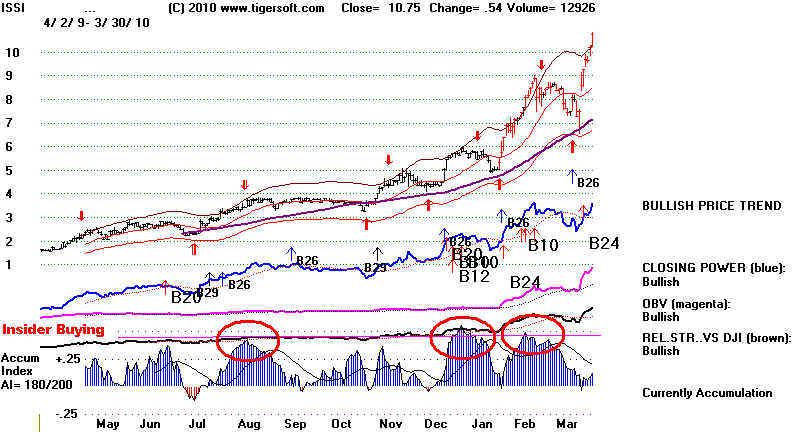

ISSI -

Typical Low-Priced Rocket-Stock - ISSI was 40 back in 2000.

Tahiti Anyone?

Tomorrow will end the first

quarter. Followers of our Tahiti

system, as orginally

set forth, simply buy the highest AI/200 (the count of the number

of days with positive

Accumulation for the last 200 days) stock at the end of the

quarter and hold 21-months.

This system which was meant to be used with the DJIA, but could

and should be used

with other groups of stocks, like the SP-500 (a much larger

universe), the NASDAQ-100,

all medical and all oil stocks. See their charts here. HPQ now shows

the highest AI/200

value in the DJI and just made 5 year high, too.

HPQ

53.26 highest AI/200 stock in DJIA

DTE

45.38 highest AI/200 stock in SP-500

CHKP

34.8 highest AI/200 stock in NASDAQ-100

ARTC

29.84 highest AI/200 healthcare stock

MWE

31.61 highest AI/200 oil stock

=================================================================================

3/29/2010 Hotline Buy B17/ B10 - Give The DJI More

Chance to Reach 11000.

All

the reasons that I posted last week for still being bullish still pertain. It is

true that

the

Closing Power uptrends could be significantly violated on a reversal down

from

a stong opening tomorrow. Given the upwards momentum, I doubt if that would

bring

a DJI decline of much more than 2.2%, slightly below the rising 21-day ma.

More

and more signs show a pattern of higher openings. That suggests overseas and

public buying.

STOCKS

I am

starting to post the data for new yearly highs with an IP21 (current AI) reading

above

.25 at some point in the last month. Below are some of the better ones

tonight. Apply the principles of an augmented B24 to these and you should do well.

Either look at the "bullish", "both up" or "unusual volume"

flags with these stocks

to

find very good candidates to sue the rules in Explosive Super Stocks.

WHEN TO SELL HOT STOCKS -

When Selling A High Accumulation "Bubble" Stock on Weakness Is A

Good Strategy.

Back testing shows that these high Accumulation stocks making new highs

are

often superb BUYS for an aggressive investor who is willing also to:

1) Sell on a Peerless Sell,

2) if the stock breaks below its 65-day ma with negative AI readings or

3) when the 65-dma then turns down.

I am asked why sell such a stock in a strong general market. "The rising

market's tide

will

lift all boats". Sadly, this is not true. Insider can make mistakes.

And so will we

if we

do not have a "Plan B". The reason is that we just have to have some

insurance

against a bigger decline. Moreover, we can usually find a better stock to

replace

the

one we are selling. This new stock is apt to do better. Alternatively,

we can also promise

ourselves when we sell this stock that we will buy it right back if it gets back above

the

rising 65-dma with good internals. If you are still resistant to taking a loss

quickly,

wait

for the stock's 65-dma to turn down to sell. That will save some situations.

But

this

can also increase the loss on a stock that cannot rally. Here is a link showing

some

high Accumulation stocks that last year did decline from their 65-day ma

and

did not turn back up from it even though the general market has been strong.

Please read the unpublished Blog I did tonight.

When Selling A High

Accumulation "Bubble" Stock on Weakness Is A Good Strategy.

====================================================================================

HOTLINE - 3/25/2010

Buy B17/ B10 - Give The Market

More Chance to Advance.

The DJI has now risen 12.5 months without an 8% correction. Since 1929, there

were three other big advances that

lasted nearly exactly as long as the present advance

and then started a decline of more

than 8%. But in 11 cases the DJI continued to move

higher. Based on the behavior of

longduration bull markets, I would have to say

these advances take on a life of

their own. They are self-perpetuating. We are nearing that

stage. Based on the history of

these long-duration advances, if the DJI were to advance

for another month, the odds would

be 8:3 that it can rally for, at least, 3 months after that.

Length of Long Rallies in Time

12-13 months

1936 (12.5). 1961 (12.5), 2006 (12.5)

13-13.5 month

1973 (13.5)

14-14.5 months 1943

(14.5)

15-15.5 months

1994 (15.5)

16-19.5 months

1946 (17.5), 1959 (19.5) 1984 (17). 1992 (17)

20-24 months

1955 (24). 1989 (21.5)

over 24 months

1965 (30.5). 1997 (30)

The only bearish condition we can identify presently are the break in the steep Closing

Power uptrends of the SPY, QQQQ and

DIA and the fact that the DJI is back to the point of

breakdown, 10850-11000 from

September 2008. That may bring a retreat to the rising

21-day ma. But the momentum

is clearly a factor. Until we get one or more of the following

conditions, a major Peerless Sell

signal, it is not consistent with market history to call a top here.

Even then, a decline of about 10%

would be typical in these cases. The bearish conditions

to for are:

1) a completed head and shoulders top,

2) a false breakout from above horizontal resistance,

3) a well-tested price-uptrend break or the V-Indicator is negative with the DJI at least

2%

over the 21-day ma.

Typcially there are much bigger non-confirmations of a new price high by the A/D line,

the P-Indicator and Accumulation

Index than we are presently seeing. The P-Indicator

and the Accumulation Index

typically drop to levels less than 60% of their previous highs

when making new unconfirmed highs.

STOCKS

1. Retail Apparrel

Strength.

For some reason, new health insurance rules or maybe fashion changes, a number

of retail clothing stores are

very much in favor and making new highs. The stronger

Dollar is helping these companies

buy more cheaply overseas. Higher end sales are

clearly picking up as the sotck

market rises.

The stocks I have put in this list are: AEO, ANN, BWS, BEBE, CHS, CWTR, FDO,

FINL,GIII, GES, GPS. JAS, JWN, LTD,

SHLD, SHOO, TGT, TLB, URBN, WEL, WTSLA and ZQK.

2. JOF (Japanese OTC

stocks look good)

3. Peerless has worked

very well with Indian ETFs since 1998, year after year. The world

markets seem totally

integrated now. How that will help American workers looking for

industrial jobs is not clear.

1.

Women's Apparel Stores - New Highs

|

2. Japanese OTC Stocks Strong

While the Japanese Yen has been flat against the Dollar for six months, smaller

Japanese stocks may be starting

their own leg up. When one recalls the size of

the 1980s Japanese bull market,

JOF becomes an attractive specualtion. Their

strength reflects the same investing

emphasis on secondary stocks that exists

in the US.

|

=========================================================================

3/25/2010

Buy B17/ B10 - Give The Market

More Chance to Advance.

There was a late market sell-off today. Only the DJI held a small gain.

The DJIA could not keep advancing into the heavy overhead supply

of stock at 10800-11000

from when Paulson appeared that Sunday night in September 2008

and gave Congress

an ultimatum to give Wall Street $800 billion or else the market

and the US economy would

drop into oblivion. A lot of people wish they had sold that

Monday morning. This 10800-11000

is clearly important resistance. But just reaching it

does not mean the market will go

into a decline. In fact, it is normal for a market moving

higher into overhead resistance

to eat up chucks of that overhead supply of stock, rest and again

move higher. We need to

see more than a failure to hold the highs to become bearish.

True - there were 459 more down than up, however. This is the second Thursday in two

weeks when breadth fell behind the DJIA. Given the momentum of

the 12 1/2 month bull market

that has not seen even a full 8% decline, we have to remain

bullish. Note, we have

no Peerless Sell signal. If we look at all the year-long

advances since 1928, there are only

two or three cases when the DJI dropped more than 8% without a

Peerless Sell. Usually,

tops occur only after the A/D Line clearly stops confirming DJI

highs.

True also - the P-Indicator is not confirming the recent highs by making a new high.

This often brings a small retreat, back to the 21-day ma, but

usually not more. It usually

takes a bigger non-confirmation to bring decline. I will

charts of all the cases of year-long

rallies since 1028 at this location, later tomorrow or this

weekend.

http://www.tigersoftware.com/TigerBlogs/March-25-2010/index.html

That a retreat is becoming more likely can be judged from the failure of the CLosing Power

Percent, which factors in volume, to make new highs on this

year's rally compared to last year.

Clear breaks in the uptrend are usually bearish. But

both the Opening and CLosing

Powers are above their rising 21-day ma. This

"BOTH-UP" condition is associated

with vertical ascents. That should cause us to give the

market more time to advance.

Other bullish factors: the B10 shows that support at 10800 should hold up in the

short-run. Since 1966, the DJI has risen 72.5 of the time

from the close on March 25th to

21 trading days later. The Public is not as Bullish as might be

expected at a top. Usually

we spot a top by a long series of higher openings. Lastly,

we can safely bet the FED is doing

everything it can to hold the market up until April 15th.

====================================================================================

3/24/2010 Buy B17/ B10 - A/D Lines and CLosing Powers Are still rising.

High Accumulation

Stocks still are behaving well. A San Diego medical equipment - VOLC -

company just

broke out to a new all-time high today.

Yesterday's Buy B10 is less important as a signal in itself, than it is to underscore that

the market is

still very strong. The breakout the Buy B10 reports is not from a pattern

showing three

tests of a resistance line relatively equally spaced over the last 3 months.

That is what we

want ideally to see in the price pattern for a Buy B10. The internals do

meet the

requirements for a Buy B10. The internals do not show the exceptionally

high IP21 (above

+.30) and OPct (above +.50) readings that are associated with the most

powerful B10s.

Another negative: Buy B10s in a market already well-advanced as this is

are much more apt

to gain a modest 3% to 5% more than the typical 10% seen for all Buy B10's.

Another factor to

lower our expectations is that March B10s - like our cases

presently - only

bring modest 4.3% gains, unlike Buy B10s in January and February.

whose 5 cases

average+20% gains. But there is still plenty of upwards momentum,

very fine breadth

and one other element. Buy B10s in the second year of a Presidential

cycle are quite

bullish. There have been 8 such automatic Buy B10s since 1928. Their

gains average

15.9%. See the new research

I have posted

about Buy B10s -

Buy B10 - historical research http://www.tigersoft.com/PeerInst/-Buy-B10.htm

Still No Problem Finding High Accum Stocks Making New Highs

VOLC - All time high breakout today and

B12 breakout from short-term flat top.

Yahoo reports corporate insiders are selling mostly. Our indictators suggest their

associates

are buying these shares. This is often a prelude to giving more sponsorship and

publicity to the

stock. Volcano Corporation 3661 Valley Centre Drive

Suite 200 San Diego,

CA 92130

http://www.volcanotherapeutics.com

Volcano Corporation designs, develops, manufactures, and

commercializes a suite of intravascular ultrasound (IVUS) and functional measurement (FM)

products

used in the diagnosis and treatment of vascular and structural heart disease. Its IVUS

products consist

of consoles...digital and rotational IVUS catheters, and imaging tools, including virtual

histology, IVUS tissue

characterization, and ChromaFlo stent apposition analysis; and FM offerings include

consoles and single-use

pressure and flow guide wires used to measure the pressure and flow characteristics of

blood enabling

physicians to gauge the plaque?s physiological impact on blood flow and pressure. The

company?s products

under development comprise IVUS guided therapy products, such as IVUS guided stents and

IVUS

guided coronary and peripheral balloons; forward looking IVUS for minimally invasive

diagnostic and

therapeutic applications in the coronary and peripheral vasculature; and optical coherence

tomography (OCT)

technology that allows imaging of detailed structures in the vasculature. Its ongoing

clinical studies include the

bifurcation lesion analysis and stenting, assessment of dual anti-platelet therapy with

drug-eluting stents,

and Volcano OCT image lesion analysis using intravascular optical coherence tomography. In

addition,

the company develops and manufactures micro-optical spectrometers and optical channel

monitors to

telecommunication companies. Volcano Corporation serves physicians and technicians who

perform PCI

procedures in hospitals, and other personnel who make purchasing decisions on behalf of

hospitals

through its direct sales force and distributors, as well as through supply and

distribution agreements with third

parties. As of December 31, 2009, it had an installed base of approximately 5,000 consoles

worldwide

Also:

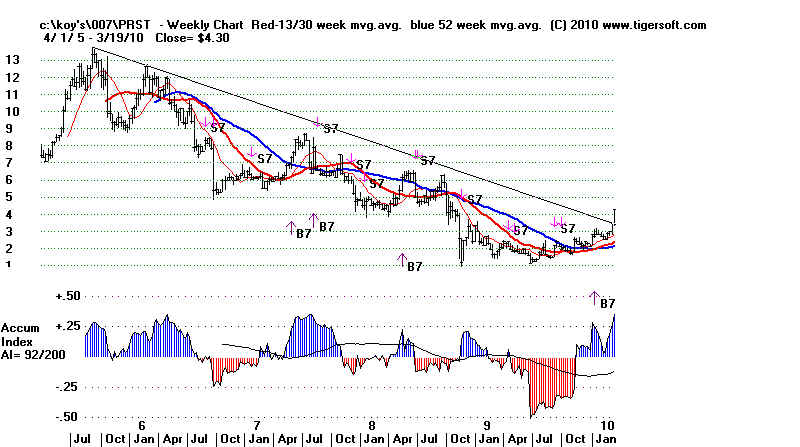

PRST - 4.66 was a $98 stock in 1997

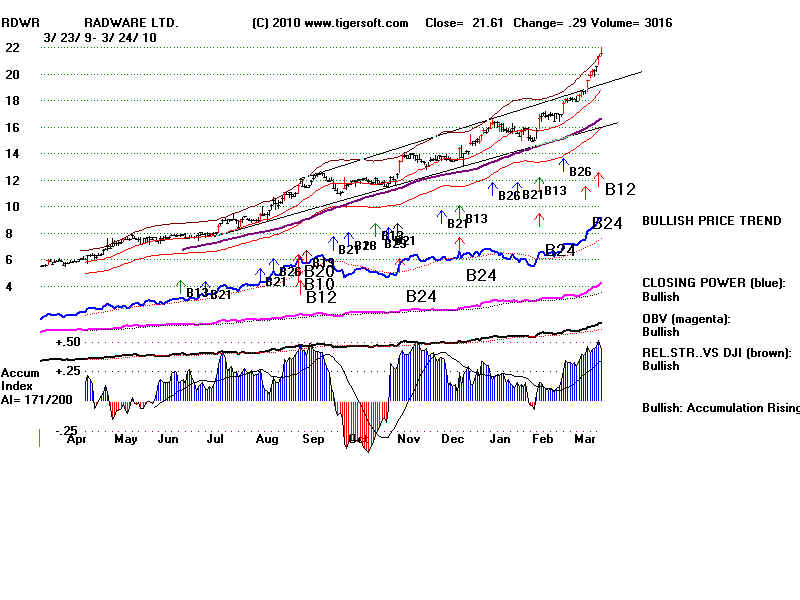

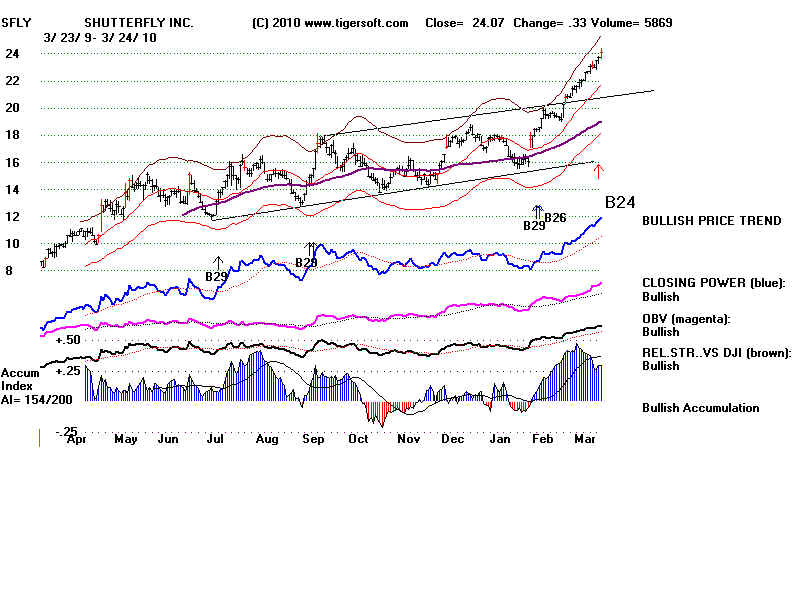

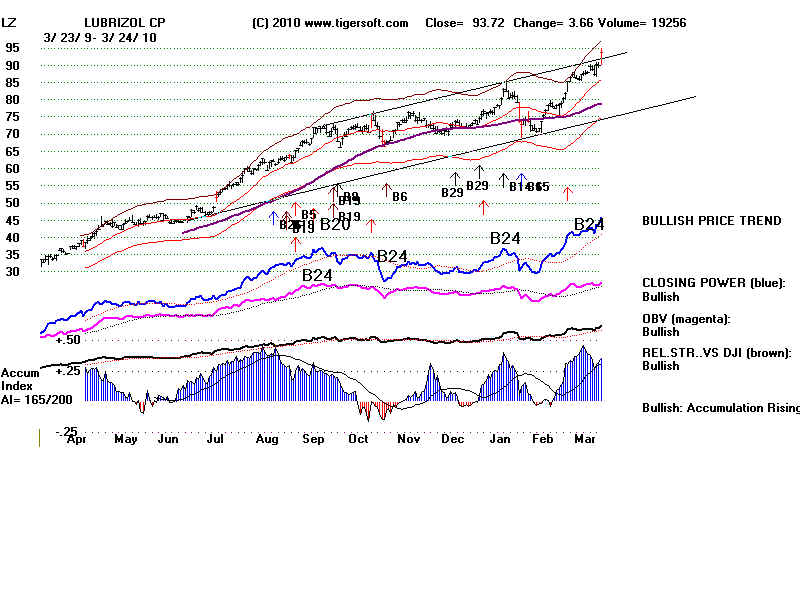

SFLY, RDWR and LZ show that stocks that have exceeded their parallel resistance line

are moving higher. Speculators and Insiders are still optimistically buying

very strong

stocks.

===================================================================================

HOTLINE -

3/23/2010 Buy

B17.

The DJI's upturn

accelerated. Peerless remains on a Buy, The upwards velocity

owed technically to the fact that

both the Opening and CLosing Powers are rising.

This means the market opens higher

and closes still higher. I take this to mean that

both the Public and Professionals

are buying. That the Closing Powers made new highs

today means we should work with

newer, less steep uptrends for them.

Peerless reinforced the bulls with an automatic BUY

B10. The main significance

of this in our case is that

it posits 10750-10800 as new support. Normally, we

should see the flat and

well-tested resistance that the DJI has gone through.

A flat, thrice or more tested

resistance line is not so clear here. The result may

be that the usual immediate

vertical ascent that follows a Buy B10 may not occur

here. In addition,

11,000 is a natural round-number resistance level.

Buy B10 - historical research http://www.tigersoft.com/PeerInst/-Buy-B10.htm

The rally past 10800 will

drive the bears "nuts". The A/D Line has confirmed the

move. That is very

important. Most tops occur only after the A/D Line fails to confirm

a new DJI high. So, we should

see the DJI moving higher and chewing up the

overhead supply of stock with

each rally.

Meanwhile the number of new

highs rose sharply today. Speculative, tech,

restaurant, military and

interest-rate stocks are all doing well. Concentrating

on the highest accumulation

stocks - horizontally and vertically - should

continue to pay off quite

well.

=========== RUSSELL-2000 ===================

IWM: Both Opening and CLosing

Power are rising (above their 21(dma) The Closing Power

uptrend in still rising.

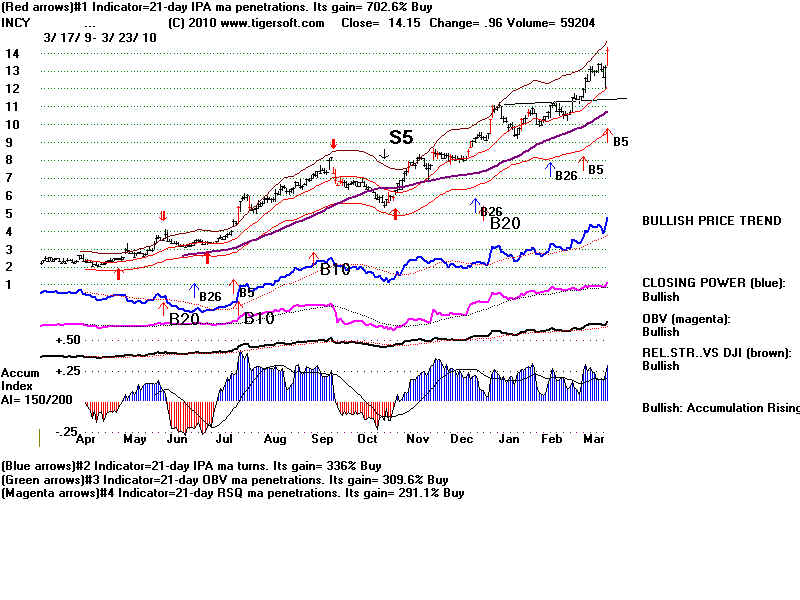

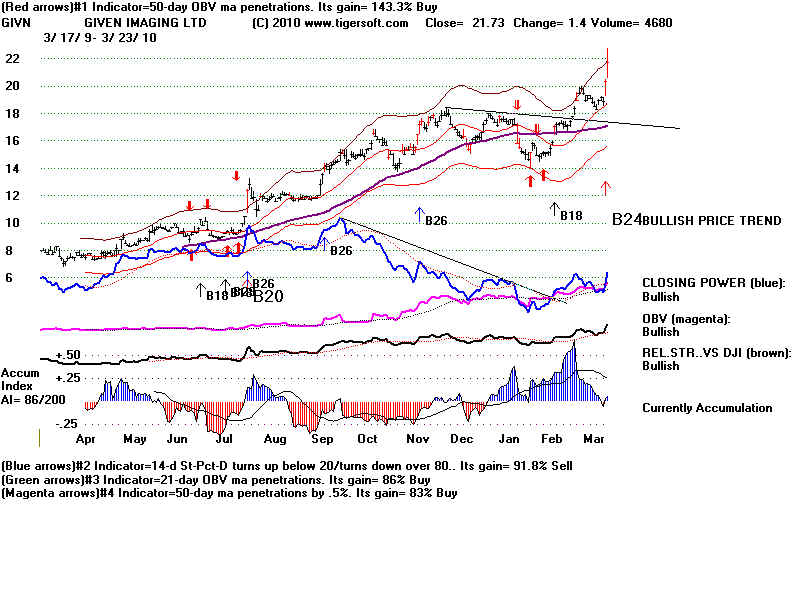

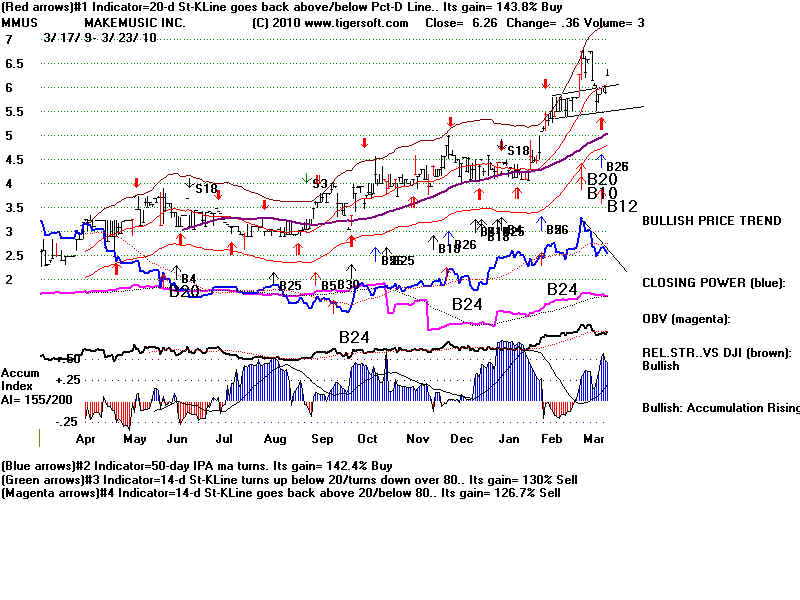

3/23/2010 Buy B17, Stocks continued to soar. It's helpful to look at the

stocks

up the most today that made new highs.

It shows the technical conditions that release

and propel a stock. (Do this with

Tiger using the older Tiger Charting programs +

Ranking Results + User Set Ranking + 1 +

1. ) Here are the top 3 gainers above 3.

INCY

PZZ

GIVN

GNET

MMUS

For earler HOTLINES, click on links at top of page..

======================================================================================

TigerSoft and Peerless Daily Hotlines

TigerSoft and Peerless Daily Hotlines