TigerSoft New Service Tiger Blog- Free Research

TigerSoft New Service Tiger Blog- Free Research 48/2010 12000 or Bust!

WHY TIGERSOFT REMAINS BULLISH.

The Financial Power Elite's Biggest Gamble

with Your Money. It Is A Desperate Last Gambit.

It MUST Work, or Else!

By William Schmidt, Ph.D. - Author of TigerSoft and

Peerless Stock Market Timing: 1915-2010.

www.tigersoft.com

Make Money.in Stocks. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TigerSoft's Thesis about the Power Elite's Purpose and Plan

OBAMA's RHETORIC ASIDE, THERE NOW EXISTS

AN UNHOLY ALLIANCE. Some call it a "Triumvirate",

a "Conspiracy" or a "Power Elite". What matters is

that it includes

1) The Federal Reserve of Greenspan and Bernanke,

2) The Biggest Wall Street Banks - especially Goldman Sachs,

3) The White House

- Pres. Obama,

- Treas. Secty. Geithner,

- Chief Economic Advisor Summers and

- Financial Personnel Advisor - Robert Rubin.

THEY ARE GAMBLING BIG WITH YOUR MONEY that

they can rig stock market prices to go much higher.

This they believe this will trickle down, create buying power,

restart the economy and create full employment again.

This begs many, many questions. They are probably

wrong. But the point is that this is their plan. Given

their Orthodox assumptions, perspectives and priorities,

this is the only plan! So, they have to play it out. And

that means still higher stock prices. They also know

it has to work, or there will be terrible consequences.

If it does not, the Power Elite will have to use brute force

to retain their power in the face of continuing high

unemployment, poverty and social/economic polarization

in America.

This this, the TigerSoft thesis of why the market

continues to advance. For example:

Why is Goldman Sachs' (GS) stock going up just when a Washington blue-ribbon

Pane finally focuses on the causes and culprits behind the financial crash of

2007-2009. Our answer here is that the Power Elite wants to show that they

are still very much in total control.

The CRASH Panel is no real threat to them. The evidence we present below shows

that it continues the cover-up. The Panel is white-washing Wall Street's miserable failure.

They are not following up their interviews with the hard questions about the bankers'

insider trading, for example. They KNEW there would be a COLLAPSE. They created

and then abetted and profited from it. the CRASH Panel is missing most of the real

underlying issues. As a result, it is very dubious that they will make any policy

recommendations that get to the core issues that caused the world-wide economic

collapse.

Goldman's SACHS's (GS) STOCK IS GOING UP JUST WHEN A WASHINGTON

BLUE RIBBON PANEL FINALLY FOCUSES ON THE CAUSES OF THE FINANCIAL

CRASH OF 2007-2009 AND POINTS THE BLAME FINGER AT THE BIGGEST BANKERS?

BECAUSE THE POWER ELITE WANTS TO SHOW THAT THEY ARE STILL IN TOTAL

CONTROL. IN FACT, THEY STILL SEEM TO BE, AS WE SHOW BELOW.

----------------------------------------------------------------------------------------------------------------------------------------------------

THE US POWER ELITE STILL WANTS MUCH HIGHER STOCK PRICES. THEY HAVE ALL

THE CARDS. THE BLOG HERE SHOWS THAT THEY ARE FIRMLY IN CONTROL FOR NOW.

THEY CANNOT AFFORD TO FAIL. THEY ALL KNOW THIS.

----------------------------------------------------------------------------------------------------------------------------------------------------

WHY BET AGAINST THEM. ESPECIALLY IF YOU HAVE TIGERSOFT TO TELL YOU

WHAT INSIDERS ARE BUYING. THEY KNOW THAT THIS GAMBIT NOW MUST WORK,

OR THERE BIG TROUBLE! IF THEY FAIL, TO CONTINUE TO RULE, THEY WILL PROBABLY

HAVE TO RESORT TO BRUTE FORCE.

LET'S HOPE THIS LATEST VERSION OF "TRICKLE DOWN" WORKS BETTER THAN

THE PESSIMISTS THINK FOR STOCKS PRICES AND FOR WAGE EARNERS, AS WELL.

---------------------------------------------------------------------------------------------------------------------------------------

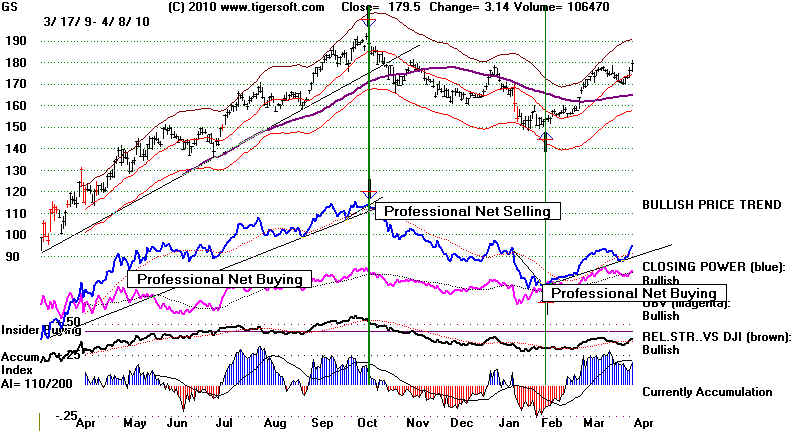

Professionals control Goldman Sachs (GS) See below How Tiger Tracks the Swings of Their

Net Buying and Selling. Right now Professionals want it to rise.

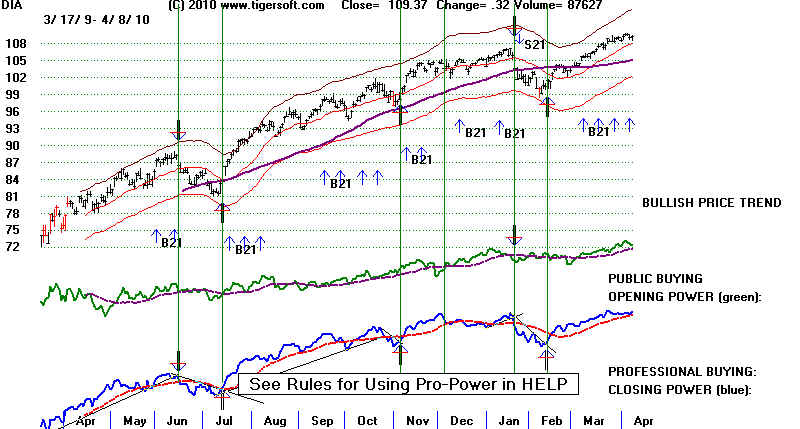

Professionals are also still buying DIA, the ETF fo r the DJIA. This bodes well for the market

even though the DJI has reached the 11000 resistance. The ETF for the DIA (below) now

shows both new Professional and Public buying. That is usually short-term very bullish.

Also TigerSoft Blog - March 23, 2009 - Obama's Monopoly Finance Capitalism (Part 1)

TigerSoft Blog - 9/21/2008 - Monopoly Finance Obama.(Part 2)

Just when Goldman Sachs and other banks are finally getting

some heat. some well-deserved blame for causing the housing

bubble and stock market crash, the GS stock turns up. Why is that?

Millions of Americans see perfectly well what has been going on between

Wall Street and Washington for years and years. The rushed Paulson $800 billion bailout

for Wall Street, their bonuses under Obama and the reckless speculation now, while

10%-18% of all Americans look around desperately for jobs) can only be interpreted

to mean that Wall Street comes first and Main Street pays the bills. Million of Americans

have exhausted their savings, been bankrupted, lost their homes and their jobs because

of the unholy alliance, the triumvirate of Wall Street, the Federal Reserve and two

White Houses, each run by ;leaders of a different political party.

Millions of Americans who are not highly trained economists still clearly

understand that the American taxpayer has been put in hock for trillions of dollars by

the Federal Reserve to bail out the very perpetrators of the biggest financial collapse

and fraud since the early 1930s. Why should they pay for the misdeeds of the very

people who put them pout of work and their home? The magnitude of the heist is

not lost on them. It far exceeds what Halliburton got away with as Cheney's favorite

prime contractor. He arranged that Halliburton would get billions in no-competition

contracts purportedly to support the wars in Iraq and Afghanistan.

Millions of Americans who are not Marxists sense that normal competitive

capitalism has now morphed into a dangerously anti-democratic conspiracy of

cronies, a Power Elite of bankers and politicians who now are totally interdependent.

The big banks are now too big to fail, even though the dangers of allowing them to serve

simultaneously brokerages and commercial banks has been clear since the early 1930s.

Meanwhile, the Fed and the White House have encouraged Wall Street's extremes of

pay and bonuses. They applauded the biggest banks' high growth rates. They even

arranged the monopolistic banking consolidations, in the wake of weaker bank failures.

In all this, nearly all the regulators were in bed with the banks.

How can else can one explain banks being allowed to use leverage of 30:1 and

even 50:1? How else can one explain why they were so readily allowed to sell short

stocks starting just before the market top in July 2007, without need to borrow any shares

and to sell on down-ticks? The lessons of Bear Raid" market manipulators of 1929-1933

were completely ignored, despite their grim consequences. There was no regulation

of Wall Street under George Bush. The SEC was then a wholly captive agency. How else

can you explain that Bernie Madoff's Ponzi Scheme could 17 years, despite the

many warnings federal regulators received. And how else can you explain why

federal regulators allowed banks to speculate madly on each others' demises with

credit default swaps? This would have been an egregious violation of most states'

insurance laws. But Bob Rubin and Larry Summers, both Wall Street Democrats,

condemned such restrictions as forcefully any "free-market" Republican.

So with this background, a blue ribbon panel has taken up the Causes of the Crash..

See the "Financial Crisis Inquiry Commission" http://www.fcic.gov/hearings/

Its chairman is Phil Angelides, a former California State Treasurer. He interviewed

Greenspan and Rubin on the first day. http://www.fcic.gov/reports/

Greenspan says "I was wrong 30% of the time"?

Ex-Citi exec says he warned Rubin on mortgage risk

Ex-Citi executives face questions on mortgages

To date, the questions and testimony in the government's hearings about the Causes

of the 2008 Crash have shed little new light, though for many they have helped connect

the grim events and the key players. A powerful, yet succinct summary was offered by

(4/7/2010) Dylan Ratigan. How the Federal Reserve is boosting stocks by risking

a bigger bubble than in 2000 for stocks, 2004 for housing and 2008 for oil... The Fed's

power grab now seems total and it's all a secret.

Greenspan and Bernanke as successive Crime-Family Godfathers.

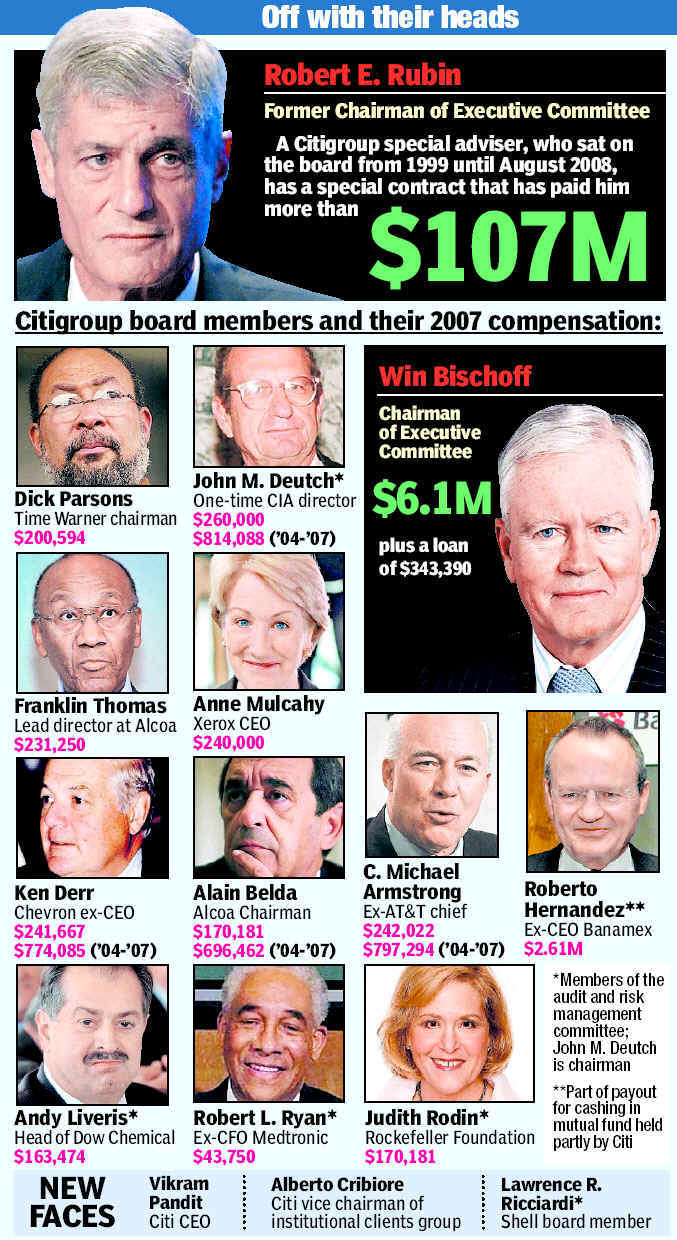

It's frustrating for me to hear the excuses offered by Rubin. He received $107 million from

1999 to August 2008 from CitiGroup . He still says he was not kept informed about

CitiGroup's exposure to a break in the housing bubble. This is a ridiculous lie. He is the one

that pushed hardest for CitiGroup to use massive leverage. Then from June 2006

to January 2007, he sold $13 million dollars worth of CitiGroup stock right at its top,

above $50, precisely because he did know how dangerous the bubble had become.

Two years late the stock could be bought at a dollar a share!

See - http://www.tigersoftware.com/TigerBlogs/Nov-25-2008/index.html CitiGroup

got $45 billion from the taxpayer for it to survive the collapse after Rubin's bubble.

He continues to be respected by Democrat leaders. He was Obama's chief advisor

in hiring his White House financial assistants. Before being Clinton's Treasury

Secretary, he had been Goldman's CEO.

Source:

http://www.nypost.com/seven/11252008/postopinion/editorials/bounce_these_bozo_bankers_140652.htm

100% COSMETICS?

The more I ponder this, the more I see this new panel as yet another way for the

Power Elite to mislead and manipulate the public. The insider selling by these bankers

at the 2006-2007 top proves they knew they were creating a bubble. In addition, Goldman

set up a $10 billion hedge fund to short the market in late 2007, after successfully lobbying

the SEC to let them sell short on down-ticks in July. Their merciless purchase of credit default

swaps on their investment banking competitors and then finally on AIG shows that

they could see the market was very dangerous because of the home mortgages they continued

to sell to unwary investors who thought they were getting good returns on AAA graded

securities. How can these big banks feign ignorance of the dangers? Look at the evidence,

blue ribbon commission. Don't just take the bankers at their own words. They had plenty

of warnings. Early-on respected economists Roubini (NYU) and Schilling (Yale)

warned high powered audiences that there would be a CRASH. Even TigerSoft could

discussed the dangers of the housing bubble and warned of a 1929-like crash in the

period just before the bear market began. See TigerSoft Predictions and

http://tigersoftware.com/tigerBlogs/October-10-2008/index.html

Is this panel then another Power Elite effort to paper over the real problems?

There is no mention of the ever widening gap between the very rich and the poor

and the diminishing "middle class". "The rich get richer but it's the poor that go to jail".

Working people need to have consumer buying power. The rich spend proportionately

less. Investing in stocks takes money away from direct investments in job creation

enterprises. Income inequality in 2007 had just reached the same level it was in 1928.

Should not the unchecked political power of the greediest in our society frighten all of us.

How can we have a democracy when power and wealth are so concentrated and used

so selfishly? Worse, these biggest Wall Street firms would never be to do what they have done

but for the willingness of the President and most of Congress to dance like puppets to

their Wall Street masters' tune. Our government seems almost totally bought and paid for,

does it not?

Is this too harsh? The anger out there is red hot. For me, what is especially frustrating is

how completely Obama has caved in, rhetoric aside, to Wall Street. But it it not a surprise.

His biggest corporate campaign contributors were from Wall Street. Congressmen and

the White House are defined more and more completely by one thing: who gave them the largest

"campaign contributions".

But take heart if you're an investor. The stock market would have crashed wide open,

if this panel were really about to do its job. The DJIA would have fallen 500 points if the

panel was moving to recommend:

1) a separation of investing and commercial banks functions into different

institutions.

2) the break-up of the too-big-to-fail banks,

3) the imposition of a stiff windfall tax on Wall Street's big bonus executives

in the bail-out firms,

4) to stop massive computerized trading, unlimited short sales and NYSE and

CTRB secrecy about members' large short positions.

5) to end the Fed's secrecy in the matter of the trillions in bank bailouts and

6) to stop the efforts in the Power Elite to give the Fed even more powers

vis-a-vis banks.

I think we can safely bet that there will be no expose of the secret arrangement between

the Administration, the Fed and Wall Street Banks, in providing these banks TRILLIONS from

taxpayers in return for worthless toxic debt collateral. There is also very little chance that

anyone will challenge the Federal Reserve, Greenspan or Bernanke for being far too

chummy with the very bankers that caused the Crash.

What is more, I think I can safely guarantee that no one on this panel will attack

the widespread central bankers' ORTHODOXY, their belief and perspective that economic

growth depends first and foremost on Wall Street handouts and on a Wall Street bull market,

not jobs or a Main Street recovery. For them, government jobs are illegitimate! Jobs

also seem to be a lower priority by Obama. The government, he says, cannot

put people to work. Work must be provided by private employers, however long workers

must wait. Obama did not even have a Public Works plan ready to submit when he entered office.

He had to call town meetings to get ideas, a year after becoming President. (Obama is

certainly no FDR bringing a "new deal" for all Americans and frontally attacking Wall Street.

Too bad, because FDR brought a huge increase in stock prices, despite all the new regulations,

the public works programs and the much higher income taxes on the wealthy.)

. I would also bet that no one on the Panel will attack the central bankers' ORTHODOXY that

conveniently forgets how dangerously undemocratic the highly massive and monopolistic

Wall Street banks are as they push around politicians of both parties with millions and

millions of dollars of what are politely called "campaign contributions". Any takers?.