TigerSoft Freedom News Service 3/26/2010 www.tigersoft.com

Key Characteristics

of Year-Long Bull Markets

by William Schmidt, Ph.D. (Columbia University)

(C) 2010 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

See the TigerSoft techniques for find Explosive Super Stocks: Oil Coal

|

Tiger

Software Helping Investors since 1981

|

|

Key Technical Characteristics

of Year-Long Bull Markets

Not Interrupted by a Decline

of More than 8%

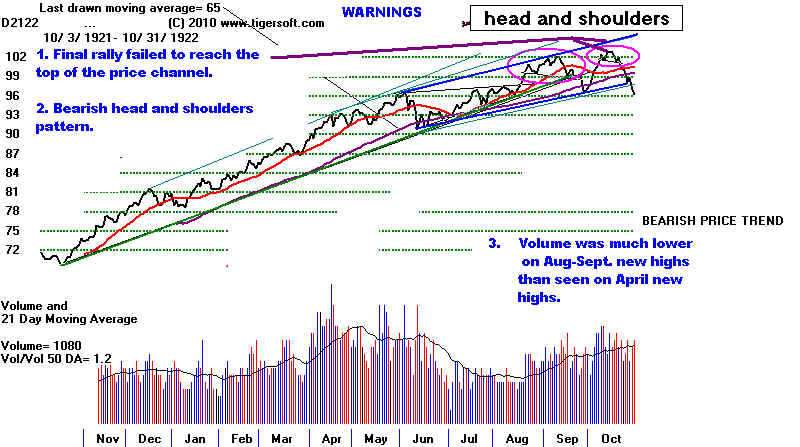

Note the warnings in each of the 19 earlier cases.

1 Failure to reach top of price channel

1922

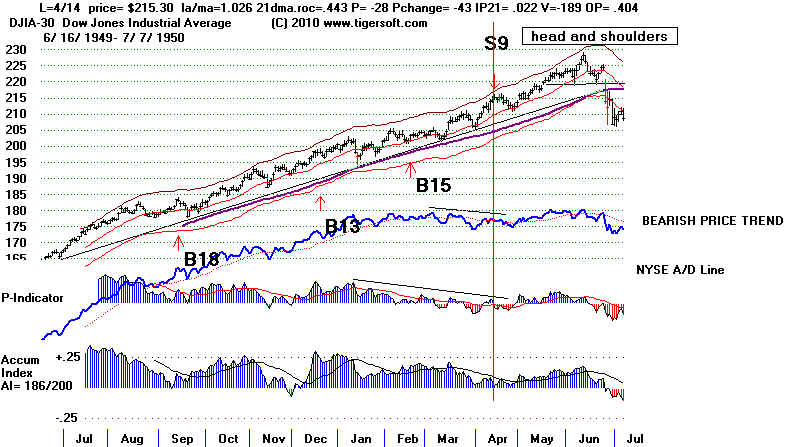

2 Head and Shoulders pattern

1922, 1926, 1943

3 False Horizontal Breakout 1926, 1936

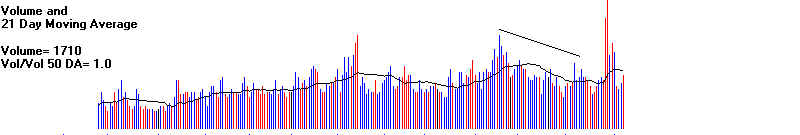

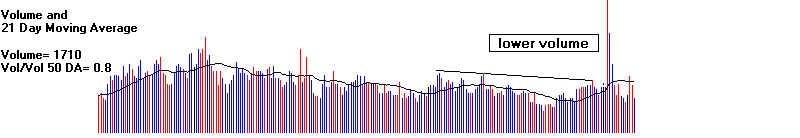

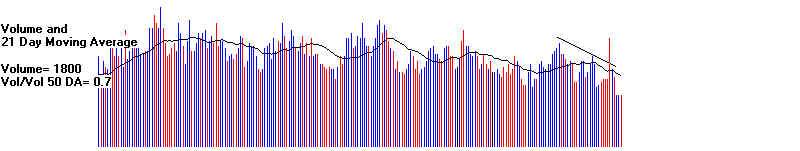

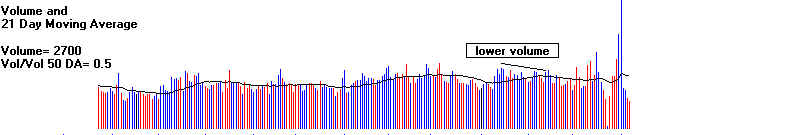

4 Volume was much lower on final rally:

1922, 1926.

1936, 1943

5 Breakdown below 4x or more well-tested

uptrendline:

1922, 1926, 1936,

1943

6 Mutiple Peerless Sells 1936

7 Sell S9-S12 1936

8 Sell S9-S8 1946

9 S9 - 1936, 1943 (six months earlier)

10 S12 - 1936

11 S15 - 1936

1. August 25, 1921 (63.90) to October 17, 1922

(102.60) - Double-Top and 10% decline

Then

marginal new high on March 20, 1923 (105.40) and decline to 88.50 on October 31, 1923.

------------------------------------------------------------------------------------------------------------------------------------------------------

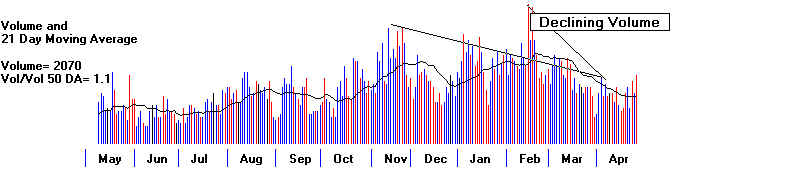

2. May 20, 1924 (88.30) to February

2, 1926 (158.30) - New high failed to bring sustained move

in

and DJI broke support at 153 in February 1926 and fell to its low, down 16% from peak.

October 20, 1926 (146.70) - October 3, 1927 (199.80) under a year...

-----------------------------------------------------------------------------------------------------------------------------------------------------

3. March 15, 1935 (98.20) - April 6, 1936 (161.90) . 12% decline

followed S9/S12.

Chart

with indicators and Peerless Signals

-----------------------------------------------------------------------------------------------------------------------------------------------------

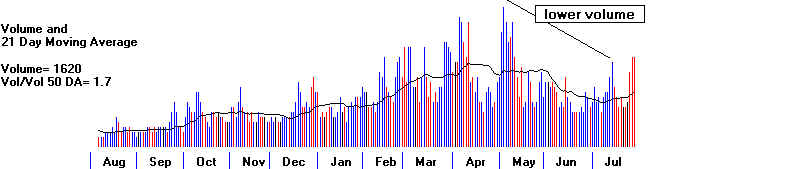

4. April 28, 1942 (92.90) - July

14, 1943 (145.80) - There was no sell signal at

this top.

However,

there was an Sell S9 weeks earlier.

DJI fell 11% to 129.60 on November 30, 1943.

-----------------------------------------------------------------------------------------------------------------------------------------------------

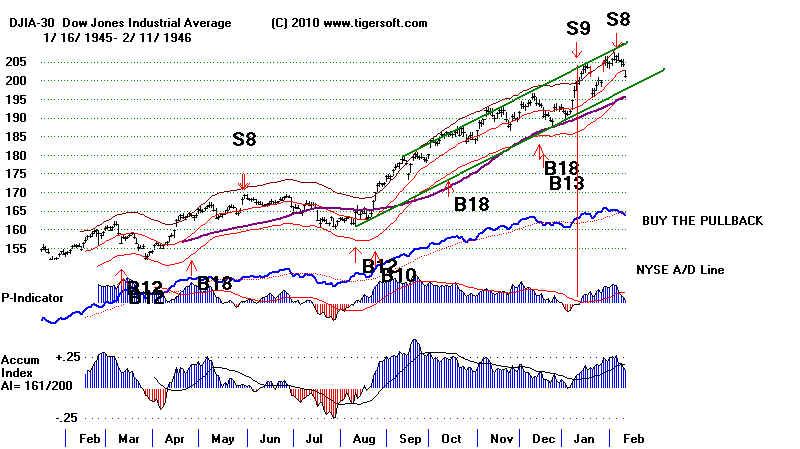

5. April 25. 1944 (135.10) - February 2,

1946 (205.80) - Sell S9 and S8.

DJI fell 10% to 186.00 on February 26, 1946 and recovered to 212.30 before falling

sharply..

-----------------------------------------------------------------------------------------------------------------------------------------------------

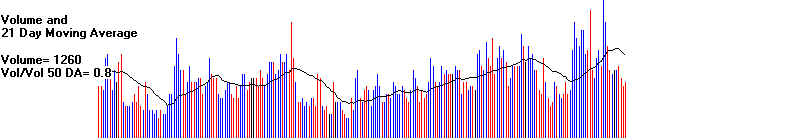

June 14, 1949 (161.90) - June 12, 1950 under a year..

North Korean invasion of South Korea.

Earlier

S9, head and shoulders, break in price uptrend, declining volume on last rally/.

-----------------------------------------------------------------------------------------------------------------------------------------------------

6. September 14,

1953 (255.50) - September 23, 1955 (487.50) - No Sell signal at this top.

Eisenhower heart attack dropped market down 10% to October 11, 1955 (438.60)

-----------------------------------------------------------------------------------------------------------------------------------------------------

7. October 21, 1957 (423.10) - August 8.

1959 (678.10) There were Sell Signals before at

at the top. DJI fell 9% to 616.50 on September 22, 1959

This was a 22-month rally.

----------------------------------------------------------------------------------------------------------------------------------------------------

8. October 25, 1960 (566.00) -

November 15, 1961 (734.30). In 1962 a massive head and

shoulders pattern appeared with multiple Sell S10s. The DJI declined 27%

to 535 on June 26, 1962.

Earlier trend-break,

Sell S9 and A/D NC.

----------------------------------------------------------------------------------------------------------------------------------------------------

. 9. October 23, 1962 (558.00) - May 14, 1965

(939.60) Sell S8 signal occurred at top

and DJI fell 10%.

Chart with indicators and Peerless Signals of last year.

========================= See online Peerless manual for remaining charts

===================

The

Peerless on-line manual with all the charts from 1915-2010

and

full discussion for each year is offered for $95.

October 7,

1967 (744.32) - September 26, 1967 (937.18) Sell S12 signal

occurred at top

and DJI fell 10%. Under a year...

11. November 24, 1972

(798.63) - January 11, 1973 (1051.70) Sell S9/S12 signal occurred at top

and began deep bear market for 13 months.

Chart with indicators and Peerless Signals

12. August 12, 1982 (776.92) - January 6, 1984

(1286.64) Sell S12 signal occurred at top

and DJI fell 15% to 1086.90 on June 15, 1984.

Chart with indicators and Peerless Signals

13. July 24, 1985 (1086.57) - July 2, 1986

(1909.03)/ Month earlier S2 marked topping area.

DJI fell 9% and formed sidewise trading range.

Chart with indicators and Peerless Signals.

14. January 21, 1988 (1879.31) - October 9, 1989

(2791.41) Sell S9 signal occurred at top

and DJI fell 10% to 2569.26 on October 13, 1989.

15. January 9,

1991 (2470.30) - June 1, 1992 (3413.21) Sell S9 signal occurred a month before

DJI fell slightly more than 8% to 3136.58 on October 9, 1992.

16. October 9, 1992

(3136.58) - January 31, 1994 (3978.36) Sell S4 signal occurred a few days

after top and before DJI fell 10% to 3593.35 on April 4, 1994.

17. November 11, 1994 (3674.63) - March 11, 1997

(7085.16) No signal occurred at this

top. The DJI fell 10% to 6391.69

(April 11, 1997).

18. September 1, 1998 (7827.42) - August 25,

1999 (11326.03) Sell S12 signal occurred at this

top. The DJI fell 12% to 10019.71 (October 15, 1999)

March 11, 2003 (7524.06) - February 11, 2004 (10737.70) Sell S9

signal occurred at this

top. The DJI fell 9% to 10783.08 (October 22, 2004) Under a year...

19. April 20, 2005

(10012.36) - May 10, 2006 (11642.65) Sell S9 signal occurred at this

top. The DJI fell 8% to 10706.14 (June 13, 2007).

20. March 9, 2009 (6547.05) - open (

)

| 1921-1922 |

| 1924-1926 |

| 1935-1936 |

| 1942-1943 |

| 1944-1946 |

| 1953-1955 |

| 1957-1959 |

| 1960-1961 |

| 1962-1965 |

| 1972-1975 |

| 1982-1984 |

| 1985-1986 |

| 1988-1989 |