PEERLESS DJIA SIGNALS

SUPERIMPOSED ON SPY: 1993-2010

30% Annualized Rate of Return

for new version of Peerless.

This is an important study. It shows that our Peerless gives great automatic

intermediate-term Buys and Sells on anything, by superimposing its signals

from the DJI on most any charts you pick. Since the SP-500 and the DJIA are so

closely related, the Peerless Signals work very well. ETF traders should also

consider trading the QQQQ or DIA, depending which is showing greater

technical strength. Our Hotline emphasizes this.

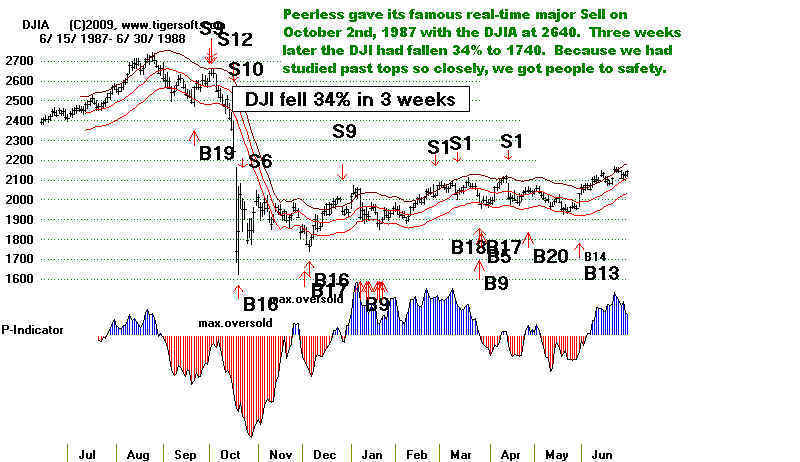

A History of Peerless: 1981-2009

These Peerless numbered signals, Buy B1-B19 and Sell

S1-S19, are fully automatic.

The

basics behind the signals Buy B1-B12 and Sell S1-S12 were researched and

described in books written by the author between 1981 and 1993. In

1981, Peerless

was

based on a study of DJI and NYSE histrorical data from 1970-1981. In 1991, the

advent of Windows offered us to rewrite Peerless after a careful study of the larger

period 1966-1991. A few more Buys and Sells were added, Buy B13-B18 and Sell

S13-S18,

between 1995 and 2002. Peerless served us well for this period. Since

Dr. Schmidt

recorded and wrote a hotline each night, when a question arose about what seemed

to be

a significant technical pattern or development, we back-tested it and where needed

added

it to the Peerless arsenal.

In

2007 we began a study of the Peerless system for the entire period since 1928, even

back

to 1915. Looking at so much data, seasonal patterns became evident that had not

been

noted in the earlier versions of Peerless. We don't want to give any more

information here, as our work has often been copied without credit. Suffice it to

say,

if someone offers you a trading system that has not been back-tested to 1928,

be

very careful. Historical patterns do repeat, but there's no reason now for a system

developer of a general market timing program not to study all the data back to 1928.

That

was when daily highs and lows began to be recorded for the DJIA.

As

our research back into the 1930s was being conducted, we noted how

different the extreme bear markets of 1929-1932 and 1937-1938 were from anything

seen

from 1966 to 2007. That was highly significant. Bottoms in this earlier period

were

formed differently. This discovery allowed our real-time Peerless Hotline

not

only to duck the extreme bear market of 2008-2009, it also allowed us to encourage

sell

short during the declines. And amazingly, it allowed us to cover the short sales

on

the day of the bottom in March 2009 and then go long the next day.

The great

rally since March 2009 has made followers of now and older versions

of Peerless

a lot of money. Those who used the Tiger-Power-Ranker made even

more buying

high Accumulation individual stocks. (Our Hotlines since March 2009

are

available day by day for Peerless purchasers to study,)

Unsolicited

Testimonials

Here are some recent comments from Peerless users.

"I purchased your "Peerless Program" years ago (maybe it was

about 1994).

I love this program of yours and

have updated it faithfully every day...

I want to so thank you

for this program. It has been wonderful over these many years."

VF - Laguna Beach, CA

"I'm following your hotline

every night but wanted a functional version too....

Thanks for your help.

You are making me money and I'm very happy with your service

and the signals are

nothing short of amazing. Everyone, including Art Cashin on CNBC

every morning, was

looking for a pullback, but your software said stay long."

DM - Missouri

"Bill, Thank you very much for all your

detailed analysis and all the hard work

you put into last night's hot line.

You really went beyond the call of duty to answer

all my questions regarding S9s and

S12s in December! I know it really took you

quite a long time... really

appreciate all the effort you put into the hot line and the software."

AW - Hawaii

REAL-TIME PEERLESS RETURNS ARE SUPERB

All but a few of the Peerless signals are those we got real-time. The testimonials

we get from long-time users of Peerless show how well even the originals system

has worked. Most of the changes are minor, but seasonality as a factor, is important

and that was introduced in 2007. Sticking with the same sysyem that we

devised

in 1981 might satify a few purists, but not incorporating new discoveries along the

way seems foolish. Emerson wrote in his 19th century essay "On

Self-Reliance"

that a "Foolish consistency is the hobgoblin of little minds". I have

remembered

this quote since high school. See

review of Peerless signals since 1981.

By going back to 1915, and studying past parallels we do keep learning

new things. So, the program in 2007 was just changed to reflect new

back-testing going back much further than was available to us back

as late as in 1999. Our Hotline keeps doing new research and back-testing

of the historical significance outstanding technical features of the current market.

Subscribers like that. A simple example, would be to study all the cases where

the DJI does not move up or down by more than .5% for 6 days in a row after

a big advance. Is this a pivot point? Only a study of market history answers

the question. If it turns out that this or something was, indeed, a pivot

point

downwards in, say, 85% of its cases and there are 10 or more cases of this

since

1915 case, I would think a computerized rule, a new Sell would make

a

valuable addition to our Peerless arsenal, especially if we add some other

qualifiers.

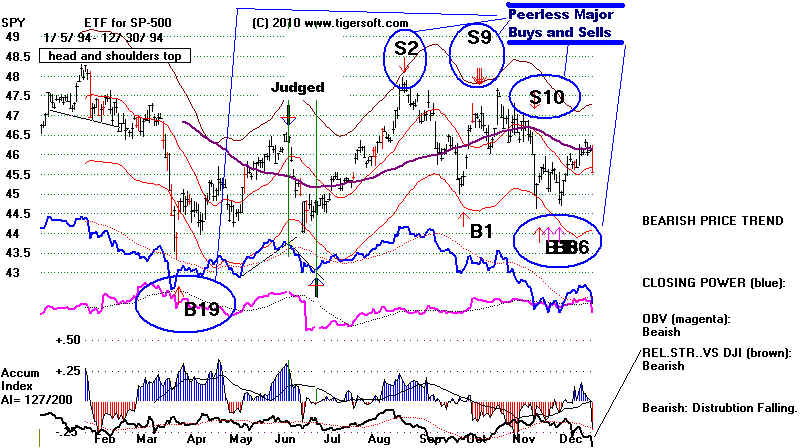

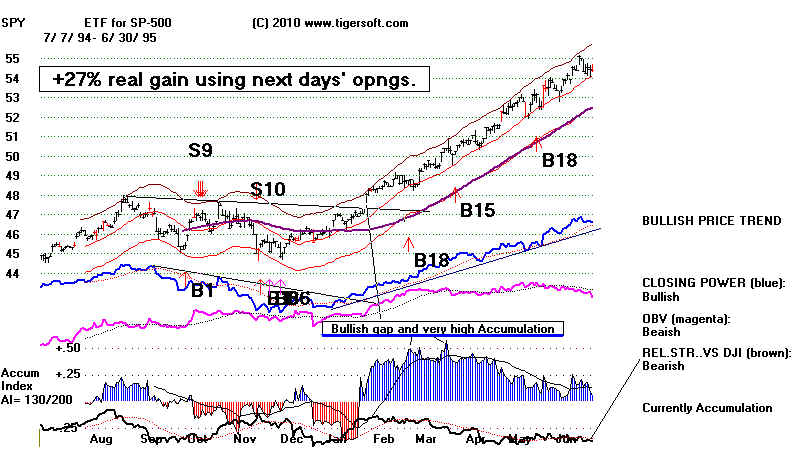

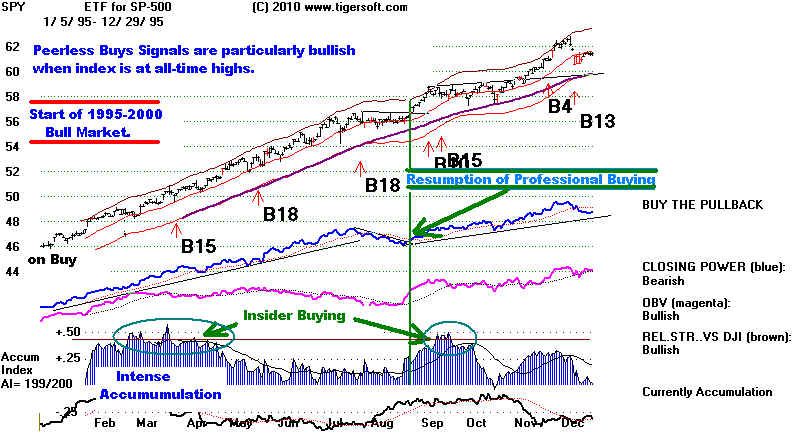

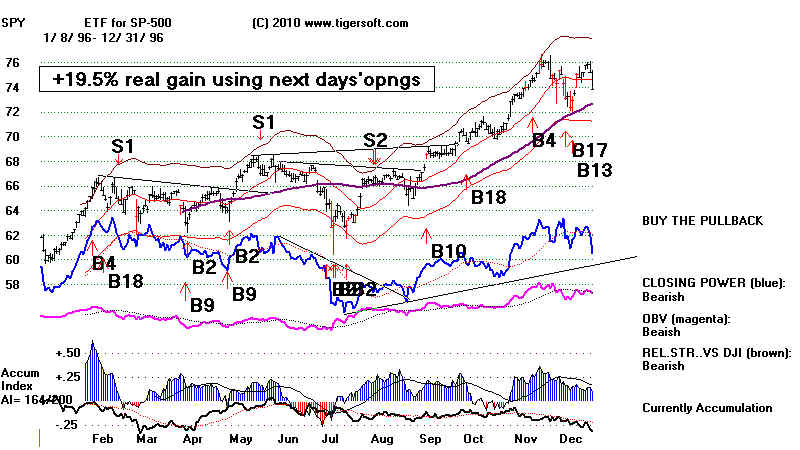

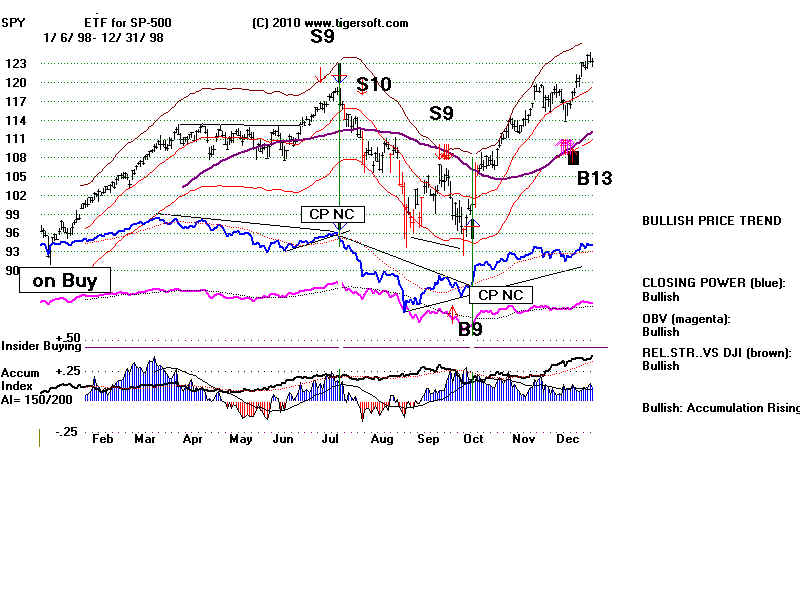

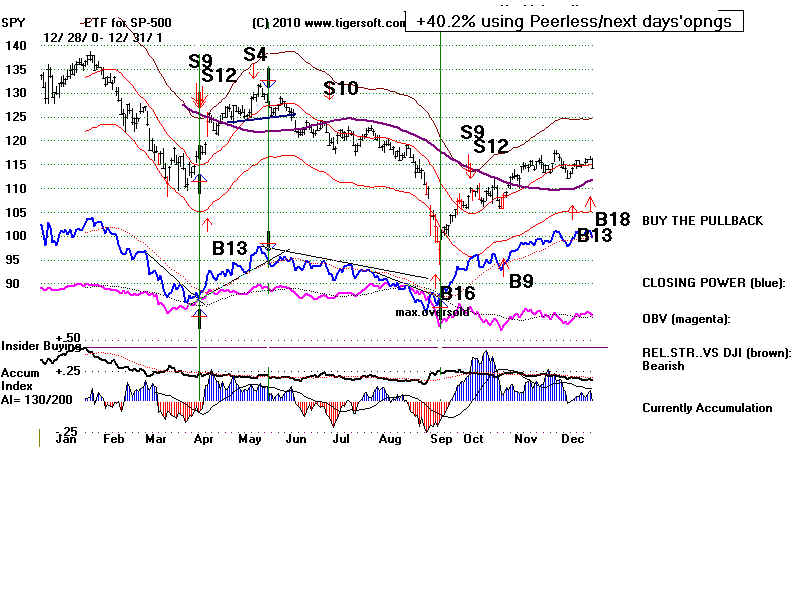

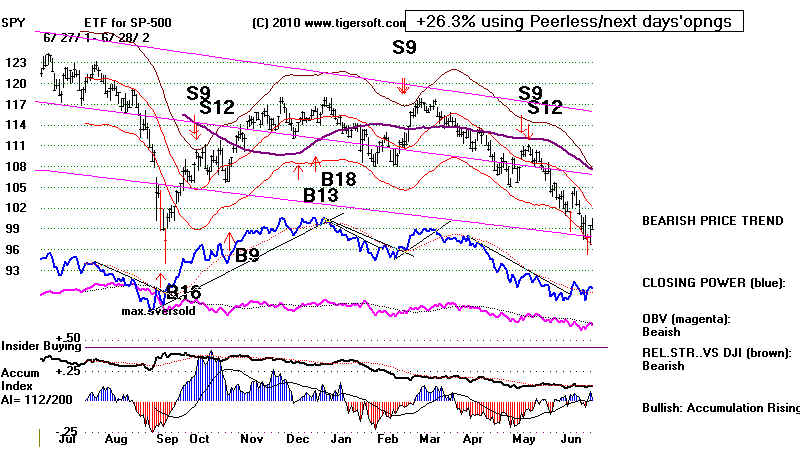

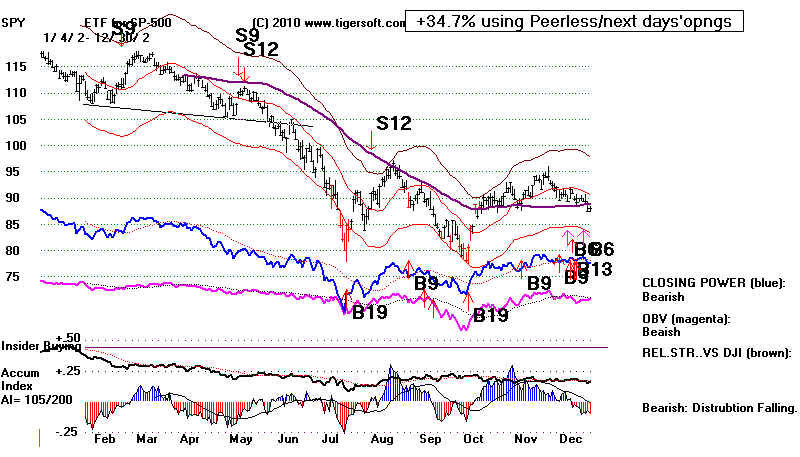

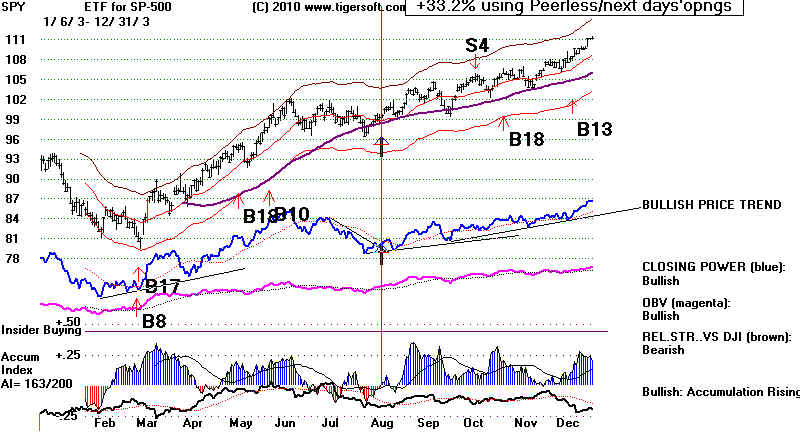

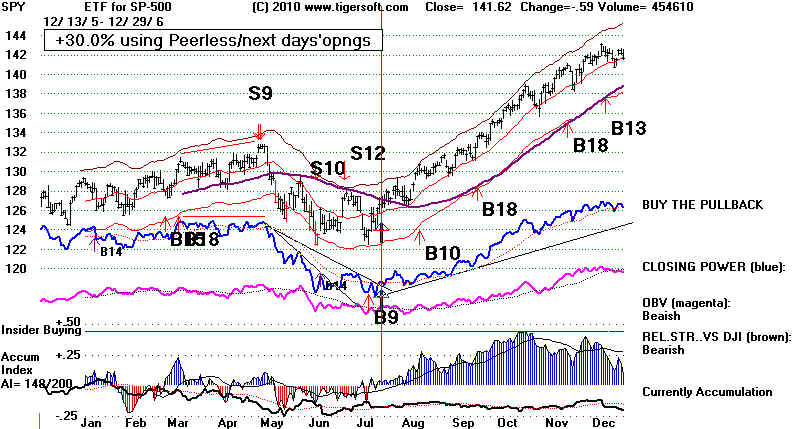

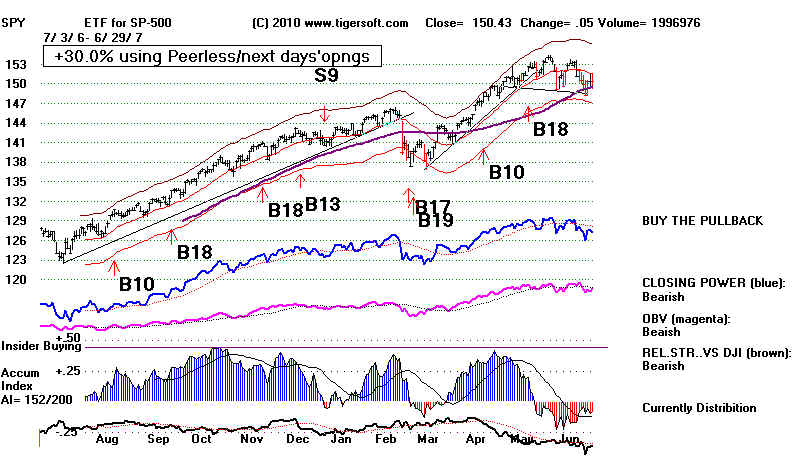

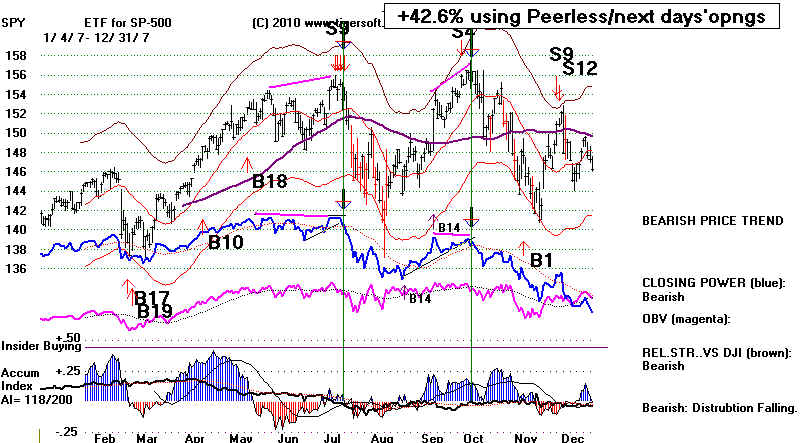

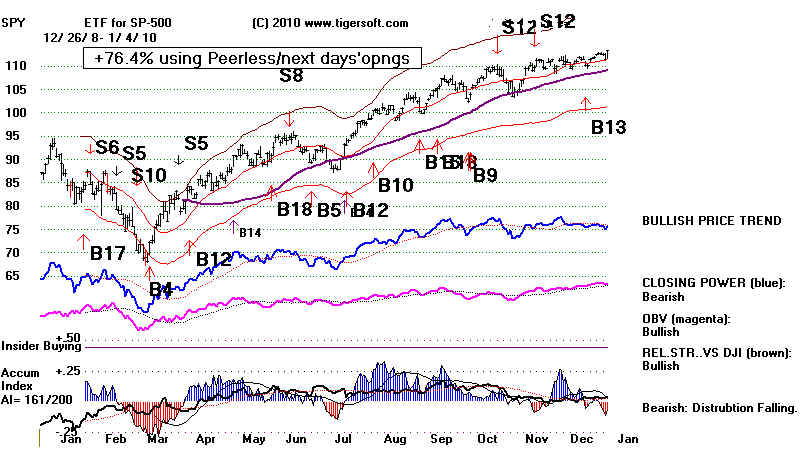

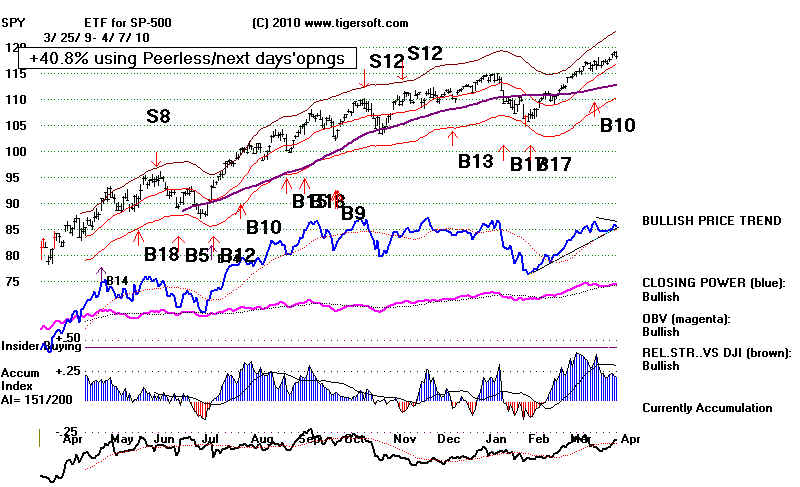

The Buy and Sell Peerless signals are shown below. A "B10" or a

B12" is

a Buy while an "S9" or "S12" is a sell. The gains are shown here

for SPY

using the next days' openings after a reversing Peerless Buy or Sell. Each new

signal closes out a Long or Short position and then takes a Short or Long position,

respectively. Note that using the Openings is much more realistic. In

practice.

we usually do not know that a new signal has occurred until after the close.

There are some exceptions, but it is better to assume that the user will

need to run the Peerless Software to get the signals.

Gains and Losses. We assume in computing the trading a commission of

.2%

for each day's trading. As the account's value grows, "slippage" becomes

more and more a factor. If a higher amount is needed, tell us, we will

recompute

the results. This is fairly easy. And we will provide you the software

to do this,

if you request it, when you purchase Peerless.

As, they say, past returns are not a perfect guarantee of success in the future.

But how else is the value of a trading system to be judged at any point in time?

Our real-time experience shows that all our back-testing is immensely valuable,

and worth far more than what we presently charge. A Peerless manual

explaining and showing all the signals back to 1915 may be purchased

for $95 in additon to the software or hotline.

Reading The Tables Here.

Take as an example, the second trade. On 2/3/1994 Peerless reversed to a Sell,

based in its signals on the DJIA. Here this meant closing out the long position

taken on 2/1/1993 in SPY and also taking a new short position in it at the next day's

opening. The long position that was closed out achieved a gain of 8.2%.

We see this in the table just below. In the second table, we note that the original

$10,000 grew because of this trade to $10,798. This is less than an 8.2%

increase because we allow .2% for commissions and slippage.

The rate of return is great. If we took $10,000 and it grew by 26% each year,

it would effectively double every 3 years. Peerless has done better than that.

The annualized rate of growth for the 18 years from 1993 to 2010 is more than 30%.

The formula is 10000 X (1.30 ^ 18) where the multiplier 1.30 is raised to the 18th

power.

Table 1 shows the reversing trades since the SPY was created in 1999. As

you

can

see from the table 4, further below, there were many reinforcing Buy and

Sell

signals. A reversing signal is the next Buy signal on an on-going Sell or

the

next Sell on an on-going on an on-going Buy. The reinforcing Buys on

the

Peerless charts are very useful. They tell you to stick with the long trade.

They

also give new points to add addition funds. And, from a heuristic standpoint,

we

can test the reliability of each signal better, because there are so many more

signals of both types, reversing and reinforcing. Peerless averages 4.5

reversing trades a year, but in 1995 there were no trades to be made at all,

unless one added to the long position that should have been held the entire year.

Paper

losses are computed and shown here, too. Example: if we take a Short

position at 100 at the opening, but SPY goes up to 104 before declining to a

profitable point to cover on a new Buy or when we cover at a loss, a paper loss

of

.04 or 4.0% in shown.

Table 2 shows how an of investment of $10,000 would have grown using

SPY

openings the next day to trade reversign Peerless Buys and Sells.

Table 3 shows the gains made by the DJI using Peerless.

The

DIA ETF will be offered here in the future, too. That tracks the DJI very

closely. The gains with the DIA (and the next days' openings) are expected

to be

similar to, or better than, the results trading with SPY.

Table 4 shows all the automatic Peerless Buys and Sells since 1993.

Table 1

PEERLESS REVERSING SIGNALS and SPY (ETF for SP-500)

TRADES Use SPY's OPENING THE DAY AFTER THE PEERLESS SIGNAL

1993-2010:

DJI, SPY-OPENINGS' NEXT DAY, GAINS, Maximum PAPER LOSS

77 Trades - 67 Were Profitable. Biggest Loss =

6.8%.

Only 1 buy had a loss while 9 of the 38 sells were closed out

with losses.

Average Annualized Return = >+30%

$10,000 Grew to more than 1,477,180.Trades Dates Buy(B) DJI Close SPY at Gain Maximum

Sell(S) next day's (Loss) Paper

opening Loss

----------------------------------------------------------------------------------

1993

1 19930201 B18 3332.18 44.4 .082 .023

1994

2 19940203 S4 3967.66 48.06 .066 0

3 19940405 B19 3675.41 44.88 .063 .019

4 19940830 S2 3917.3 47.7 .043 0

5 19941007 B1 3797.43 45.66 .027 .005

6 19941017 S9 3923.93 46.91 .031 .016

7 19941125 B1 3708.27 45.45 .437 .013

1995 - no trades

1996

8 19960227 S1 5549.21 65.31 .033 0

9 19960410 B9 5485.98 63.16 .06 .003

10 19960529 S1 5673.83 66.94 .035 .018

11 19960711 B2 5520.54 64.62 .025 .031

12 19960809 S2 5681.31 66.25 (-.036 ) .036

13 19960913 B10 5838.52 68.66 .131 .001

1997

14 19970422 S9 6833.59 77.66 (-.068 ) .068

15 19970509 B4 7169.53 82.94 .141 .004

16 19970918 S12 7922.72 94.66 .023 .037

17 19971028 B1 7498.32 92.5 .045 .003

18 19971120 S17 7826.61 96.62 (-.003 ) .024

19 19971217 B13 7957.41 96.94 .164 .038

1998

20 19980421 S15 9184.94 112.87 .124 .05

21 19981001 B9 7632.53 98.87 .36 .024

1999

22 19990618 S12 10855.55 134.47 .028 .055

23 19991004 B1 10401.23 130.72 .119 .047

24 19991228 S9 11476.71 146.31 .026 .004

2000

25 20000204 B17 10963.8 142.56 .063 .069

26 20000406 S1 11114.27 151.56 .073 0

27 20000417 B2 10582.51 140.56 .072 .002

28 20000717 S12 10804.27 150.63 .04 .011

29 20001002 B2 10700.13 144.53 (-.049 ) .094

30 20001208 S12 10712.91 137.38 .158 .009

2001

31 20010323 B17 9504.78 115.7 .027 .048

32 20010410 S12 10102.74 118.78 (-.046 ) .046

33 20010418 B13 10615.83 124.25 .039 .002

34 20010517 S4 11248.58 129.09 .222 .019

35 20010919 B16 8759.13 100.4 .085 .032

36 20011010 S9 9240.86 108.95 .005 .013

37 20011101 B9 9263.9 108.44 .032 0

2002

38 20020226 S9 10115.26 111.96 .247 .047

39 20020724 B19 8191.29 84.27 .069 0

40 20020808 S12 8712.02 90.1 .017 .073

41 20020903 B17 8308.05 88.61 .048 .135

2003

42 20030106 S12 8773.57 92.9 .045 .005

43 20030122 B9 8318.73 88.75 .179 .102

44 20031015 S4 9803.05 104.68 (-.013 ) .013

45 20031103 B18 9858.46 105.99 .094 0

2004

46 20040211 S15 10737.7 115.97 .047 .002

47 20040518 B2 9968.51 110.5 .096 0

48 20041228 S8 10854.54 121.08 .044 .014

2005

49 20050421 B19 10218.6 115.74 .144 .013

2006

50 20060508 S9 11584.54 132.42 .054 .002

51 20060615 B14 11015.19 125.29 .017 .013

52 20060630 S12 11150.22 127.43 .026 .003

53 20060718 B9 10799.23 124.18 .134 0

2007

54 20070105 S9 12398.01 140.82 .021 .037

55 20070302 B17 12114.1 137.93 .118 0

56 20070717 S9 13971.55 154.23 .057 .005

57 20070829 B14 13289.29 145.45 .068 0

58 20071005 S4 14066.01 155.39 .057 .007

59 20071114 B1 13223 146.57 .033 .04

60 20071206 S12 13619.89 151.42 .143 .004

2008

61 20080307 B8 11899.69 129.84 .039 .014

62 20080324 S9 12548.64 134.86 .131 .061

63 20080915 B8 10917.51 117.2 .031 .005

64 20080922 S6 11015.69 120.85 .175 0

65 20081008 B1 9258.1 99.66 (-.065 ) .126

66 20081021 S6 9033.66 93.2 (-.006 ) 0

67 20081028 B19 9065.12 93.77 .007 0

68 20081105 S12 9139.27 94.46 .133 0

69 20081121 B16 8046.42 81.92 .037 0

2009

70 20090129 S6 8149.01 84.98 .141 .024

71 20090310 B4 6926.49 73 .093 0

72 20090327 S5 7776.18 79.8 (-.044 ) .056

73 20090403 B12 8017.59 83.34 .146 .021

74 20090609 S8 8763.06 95.48 .056 0

75 20090623 B5 8322.91 90.16 .2 .025

76 20091021 S12 9949.36 108.19 (-.019 ) .034

77 20091217 B13 10308.26 110.2 .085 .041

2010

78 20100409 open 10997.35 119.55

------------------------------------------------------------------------------------

|

Table 2

WHAT HAPPENS

TO $10,000 INVESTED IN SPY AT OPENING

THE DAYS AFTER A REVERSING PEERLESS BUY OR SELL

Average Annualized Return = >+30%

$10,000 Grew to more than 1,477,180.Trades Dates Buy(B) SPY at Gain Investment

Sell(S) next day's (Loss) $10000 (Assumed $20

opening commission per trade

and all trades entered

at next day's opening.

---------------------------------------------------------------------------------

1993

1 19930201 B18 44.4 .082 10000

1994

2 19940203 S4 48.06 .066 10798.

3 19940405 B19 44.88 .063 11488.

4 19940830 S2 47.7 .043 12187.

5 19941007 B1 45.66 .027 12686.

6 19941017 S9 46.91 .031 13002.

7 19941125 B1 45.45 .437 13379.

1995 no trades

1996

8 19960227 S1 65.31 .033 19187.

9 19960410 B9 63.16 .06 19780.

10 19960529 S1 66.94 .035 20925.

11 19960711 B2 64.62 .025 21614.

12 19960809 S2 66.25 (-.036 ) 22110.

13 19960913 B10 68.66 .131 21272.

1997

14 19970422 S9 77.66 (-.068 ) 24010.

15 19970509 B4 82.94 .141 22333.

16 19970918 S12 94.66 .023 25431.

17 19971028 B1 92.5 .045 25964.

18 19971120 S17 96.62 (-.003 ) 27078.

19 19971217 B13 96.94 .164 26942.

1998

20 19980421 S15 112.87 .124 31298.

21 19981001 B9 98.87 .36 35109.

1999

22 19990618 S12 134.47 .028 47653.

23 19991004 B1 130.72 .119 48888.

24 19991228 S9 146.31 .026 54597.

2000

25 20000204 B17 142.56 .063 55905.

26 20000406 S1 151.56 .073 59308.

27 20000417 B2 140.56 .072 63510.

28 20000717 S12 150.63 .04 67947.

29 20001002 B2 144.53 ( -.049 ) 70523.

30 20001208 S12 137.38 .158 66933.

2001

31 20010323 B17 115.7 .027 77354.

32 20010410 S12 118.78 ( -.046 ) 79283.

33 20010418 B13 124.25 .039 75485.

34 20010517 S4 129.09 .222 78272.

35 20010919 B16 100.4 .085 95457.

36 20011010 S9 108.95 .005 103364.

37 20011101 B9 108.44 .032 103673.

2002

38 20020226 S9 111.96 .247 106777.

39 20020724 B19 84.27 .069 132884.

40 20020808 S12 90.1 .017 141769.

41 20020903 B17 88.61 .048 143891.

2003

42 20030106 S12 92.9 .045 150496.

43 20030122 B9 88.75 .179 156954.

44 20031015 S4 104.68 (-.013 ) 184679.

45 20031103 B18 105.99 .094 181913.

2004

46 20040211 S15 115.97 .047 198615.

47 20040518 B2 110.5 .096 207536.

48 20041228 S8 121.08 .044 227002.

2005

49 20050421 B19 115.74 .144 236516.

2006

50 20060508 S9 132.42 .054 270034.

51 20060615 B14 125.29 .017 284046.

52 20060630 S12 127.43 .026 288297.

53 20060718 B9 124.18 .134 295201.

2007

54 20070105 S9 140.82 .021 334089.

55 20070302 B17 137.93 .118 340423.

56 20070717 S9 154.23 .057 379831.

57 20070829 B14 145.45 .068 400679.

58 20071005 S4 155.39 .057 427069.

59 20071114 B1 146.57 .033 450509.

60 20071206 S12 151.42 .143 464445.

2008

61 20080307 B8 129.84 .039 529799.

62 20080324 S9 134.86 .131 549360.

63 20080915 B8 117.2 .031 620084.

64 20080922 S6 120.85 .175 638028.

65 20081008 B1 99.66 (-.065 ) 748183.

66 20081021 S6 93.2 (-.006 ) 698152.

67 20081028 B19 93.77 .007 692575.

68 20081105 S12 94.46 .133 696028.

69 20081121 B16 81.92 .037 787023.

2009

70 20090129 S6 84.98 .141 814511.

71 20090310 B4 73 .093 927498.

72 20090327 S5 79.8 (-.044 ) 1011728.

73 20090403 B12 83.34 .146 965277.

74 20090609 S8 95.48 .056 1103995.

75 20090623 B5 90.16 .2 1163488.

76 20091021 S12 108.19 (-.019 ) 1393393.

77 20091217 B13 110.2 .085 1364184.

2010

78 20100409 open 119.55 ---- 1,477,180.

=====================================================================

|

|

Table 3.

PEERLESS

REVERSING SIGNALS and DJIA

1993-2010:

77 Trades - 67 Were Profitable. Biggest Losses were

4.9% and 5.1%.

1 of 39 Buys were losers. 9 of 38 Sells lost money. %

Average Annualized Return = >+32%

$10,000 Grew to more than $1,727,130 Trades Date Buy(B) DJIA Gain Investment

Sell(S) at close (Loss) $10000 (Assuming $20

on day of commission and

signal Slippage.

=============================================================================

1993

1 19930201 B18 3332.18 .191 10000

1994

2 19940203 S4 3967.66 .074 11886.18

3 19940405 B19 3675.41 .066 12740.22

4 19940830 S2 3917.3 .031 13553.91

5 19941007 B1 3797.43 .033 13946.14

6 19941017 S9 3923.93 .055 14377.55

7 19941125 B1 3708.27 .496 15137.98

1995 no trades

1996

8 19960227 S1 5549.21 .011 22601.12

9 19960410 B9 5485.98 .034 22804.03

10 19960529 S1 5673.83 .027 23532.21

11 19960711 B2 5520.54 .029 24119.25

12 19960809 S2 5681.31 ( -.028 ) 24769.07

13 19960913 B10 5838.52 .17 24027.38

1997

14 19970422 S9 6833.59 ( -.049 ) 28055.82

15 19970509 B4 7169.53 .105 26627.72

16 19970918 S12 7922.72 .054 29364.78

17 19971028 B1 7498.32 .044 30888.58

18 19971120 S17 7826.61 ( -.017 ) 32183.18

19 19971217 B13 7957.41 .154 31572.80

1998

20 19980421 S15 9184.94 .169 36362.14

21 19981001 B9 7632.53 .422 42422.38

1999

22 19990618 S12 10855.55 .042 60203.90

23 19991004 B1 10401.23 .103 62607.00

24 19991228 S9 11476.71 .045 68917.41

2000

25 20000204 B17 10963.8 .014 71874.66

26 20000406 S1 11114.27 .048 72735.14

27 20000417 B2 10582.51 .021 76073.97

28 20000717 S12 10804.27 .01 77516.18

29 20001002 B2 10700.13 .001 78134.76

30 20001208 S12 10712.91 .113 78056.47

2001

31 20010323 B17 9504.78 .063 86703.10

32 20010410 S12 10102.74 ( -.051 ) 91981.06

33 20010418 B13 10615.83 .06 87115.45

34 20010517 S4 11248.58 .221 92157.69

35 20010919 B16 8759.13 .055 112299.49

36 20011010 S9 9240.86 ( -.002 ) 118239.01

37 20011101 B9 9263.9 .092 117766.53

2002

38 20020226 S9 10115.26 .19 128343.85

39 20020724 B19 8191.29 .064 152423.72

40 20020808 S12 8712.02 .046 161854.48

41 20020903 B17 8308.05 .056 168961.19

2003

42 20030106 S12 8773.57 .052 178066.17

43 20030122 B9 8318.73 .178 186950.96

44 20031015 S4 9803.05 ( -.006 ) 219787.77

45 20031103 B18 9858.46 .089 218032.11

2004

46 20040211 S15 10737.7 .072 236962.09

47 20040518 B2 9968.51 .089 253515.31

48 20041228 S8 10854.54 .059 275526.02

2005

49 20050421 B19 10218.6 .134 291198.49

2006

50 20060508 S9 11584.54 .049 329558.65

51 20060615 B14 11015.19 .012 345015.61

52 20060630 S12 11150.22 .031 348457.49

53 20060718 B9 10799.23 .148 358541.15

2007

54 20070105 S9 12398.01 .023 410782.03

55 20070302 B17 12114.1 .153 419389.56

56 20070717 S9 13971.55 .049 482589.05

57 20070829 B14 13289.29 .058 505223.44

58 20071005 S4 14066.01 .06 533457.34

59 20071114 B1 13223 .03 564333.86

60 20071206 S12 13619.89 .126 580101.34

2008

61 20080307 B8 11899.69 .055 651887.72

62 20080324 S9 12548.64 .13 686366.07

63 20080915 B8 10917.51 .009 774042.47

64 20080922 S6 11015.69 .16 779446.83

65 20081008 B1 9258.1 ( -.024 ) 902350.01

66 20081021 S6 9033.66 ( -.003 ) 878932.22

67 20081028 B19 9065.12 .008 874542.83

68 20081105 S12 9139.27 .12 879776.10

69 20081121 B16 8046.42 .013 983378.53

2009

70 0090129 S6 8149.01 .15 994170.13

71 20090310 B4 6926.49 .123 1141009.05

72 20090327 S5 7776.18 ( -.031 ) 1278790.46

73 20090403 B12 8017.59 .093 1236669.66

74 20090609 S8 8763.06 .05 1348976.58

75 20090623 B5 8322.91 .195 1413592.56

76 20091021 S12 9949.36 ( -.036 ) 1685864.62

77 20091217 B13 10308.26 .067 1621923.15

2010

78 20100409 open 10997.35 1727130.82

|

Table 4

ALL Peerless

Buys and Sells on DJIA and SP-500: 1993-2010

Date

Peerless

DJIA

SPY

B=Buy S=Sell

Close Opening Next Day

----------------------------------------------------------------------------------------------------------------

19930114 B15 3267.88 not yet traded

19930201 B18 3332.18 44.81 44.4 gain 3.66/44.4

19930302 B15 3400.53 44.93 45.0

19930323 B18 3461.86 44.87 44.81

19930326 B15 3439.98 44.9 44.93

19930526 B10 3540.16 45.59 45.65

19930826 B18 3648.17 46.28 46.15

19930901 B15 3645.1 46.50 46.53

19930922 B17 3547.02 45.65 45.78

19931217 B13 3751.57 46.56 46.53

19940203 S4 3967.66 48.06 48.06 gain 3.18/48.06

19940405 B19 3675.41 44.81 44.88 gain 2.82/44.88

19940830 S2 3917.3 47.78 47.70 gain 2.04/47.70

19941007 B1 3797.43 45.45 45.66 gain 1.25/45.66

19941017 S9 3923.93 46.95 46.91 gain 1.42/45.66

19941018 S9 3917.54 46.84 46.67

19941019 S9 3936.04 47.06 47.06

19941122 S10 3677.99 45.00 45.03

19941125 B1 3708.27 45.47 45.45 gain 9.86/45.66

19941201 B6 3700.87 45.14 45.05

19941208 B6 3685.73 44.87 44.88

19950303 B18 3989.61 48.78 48.45

19950403 B15 4168.41 50.23 50.25

19950525 B18 4412.23 53.17 52.97

19950801 B18 4700.37 56.06 56.39

19950914 B10 4801.8 58.77 58.41

19950922 B15 4764.15 58.31 58.38

19951130 B4 5074.49 60.91 60.98

19951218 B13 5075.21 60.63 60.66

19960207 B15 5492.12 65.14 65.05

19960208 B4 5539.45 65.84 65.81

19960215 B18 5551.37 65.20 65.08

19960227 S1 5549.21 64.80 65.31 gain 2.15/65.31

19960410 B9 5485.98 63.00 63.16 gain 3.09/63.16

19960411 B2 5487.07 62.92 63.36

19960507 B9 5420.95 63.98 63.67

19960508 B2 5474.06 64.78 64.56

19960529 S1 5673.83 67.03 66.94

19960711 B2 5520.54 64.52 64.62

19960716 B2 5358.76 62.81 63.75

19960717 B17 5376.88 63.56 63.75

19960717 B2 5376.88 63.56 63.75

19960724 B2 5354.69 62.81 63.44

19960809 S2 5681.31 66.22 66.25 loss 2.61/66.25

19960812 S2 5704.98 66.70 66.58

19960913 B10 5838.52 68.56 68.66 gain 9.00/68.66

19961009 B18 5930.62 69.59 69.59

19961120 B4 6430.02 74.79 74.59

19961212 B17 6303.71 73.12 73.06

19961217 B13 6308.71 73.12 73.37

19970122 B4 6850.03 78.84

19970221 B15 6931.62 80.37

19970307 B18 7000.89 80.84

19970401 B17 6611.05 75.85

19970422 S9 6833.59 77.73 77.66 loss /77.73

19970423 S9 6812.72 77.81

19970424 S9 6792.25 77.42

19970428 S9 6783.02 77.28

19970509 B4 7169.53 82.62 82.94 gain /82.62

19970617 B4 7760.78 89.62

19970801 B18 8194.04 94.93

19970911 B9 7660.98 91.18

19970918 S12 7922.72 95.22 94.66

19970929 S12 7991.43 95.37

19971007 S12 8178.31 98.18

19971028 B1 7498.32 92.21 92.50

19971028 B17 7498.32 92.21

19971028 B19 7498.32 92.21

19971120 S17 7826.61 96.09 96.62

19971217 B13 7957.41 96.81 96.94

19971219 B9 7756.29 94.78

19971224 B9 7660.13 93.40

19980210 B4 8295.61 102.25

19980317 B18 8749.99 108.56

19980326 B15 8846.89 110.89

19980327 B15 8796.08 109.62

19980421 S15 9184.94 112.78 112.87

19980707 S12 9085.04 115.78

19980708 S9 9174.97 116.62

19980804 S10 8487.31 107.00

19980923 S9 8154.41 107.00

19980925 S9 8028.76 104.25

19980928 S9 8108.83 105.18

19980929 S9 8080.51 104.93

19981001 B9 7632.53 98.81 98.87

19981210 B6 8841.57 116.89 116.44

19981211 B6 8821.76 117.12 116.16

19981214 B6 8695.6 113.75 114.69

19981214 B17 8695.6 113.75 114.69

19981215 B6 8823.3 116.68 117.12

19981216 B6 8790.6 116.53 117.22

19981217 B13 8875.82 118.39 118.31

19990524 B9 10654.67 131.12

19990527 B17 10466.92 128.56

19990618 S12 10855.55 134.31 134.47

19990817 S12 11117.07 134.62

19990823 S2 11299.76 136.46

19991004 B1 10401.23 130.75 130.72

19991018 B17 10116.28 125.78

19991228 S9 11476.71 146.18 146.31

20000107 S15 11522.56 145.75

20000111 S4 11511.08 144.50

20000204 B17 10963.8 142.59 142.56

20000406 S1 11114.27 150.48 151.56

20000417 B2 10582.51 140.75 140.56

20000424 B2 10906.1 142.25

20000503 B2 10480.13 140.75

20000510 B2 10367.78 138.12

20000522 B2 10542.55 140.06

20000622 B2 10376.12 145.62

20000630 B2 10447.89 145.28

20000717 S12 10804.27 151.00 150.63

20000719 S12 10696.08 148.56

20001002 B2 10700.13 143.84 144.53

20001010 B2 10524.4 137.68

20001017 B2 10089.71 134.75

20001113 B9 10517.25 135.56

20001208 S12 10712.91 133.96 137.38

20001228 S8 10868.76 133.71

20010323 B17 9504.78 114.48 115.70

20010410 S12 10102.74 116.65 118.78

20010411 S9 10013.46 116.73

20010412 S9 10126.94 118.85

20010416 S9 10158.56 117.60

20010418 B13 10615.83 124.00 124.25

20010517 S4 11248.58 129.15 129.09

20010706 S10 10252.68 120.71

20010919 B16 8759.13 101.95 100.40

20011010 S9 9240.86 108.32 108.95

20011010 S12 9240.86 108.32

20011011 S9 9410.45 110.00

20011101 B9 9263.9 108.51 108.44

20011217 B13 9891.96 114.30

20011228 B18 10136.99 116.00

20020226 S9 10115.26 111.22 111.96

20020227 S9 10127.58 111.65

20020514 S12 10298.14 110.22

20020517 S9 10353.08 110.90

20020724 B19 8191.29 84.72 84.27

20020808 S12 8712.02 90.85 90.10

20020903 B17 8308.05 88.28 88.61

20020903 B9 8308.05 88.28

20020912 B9 8379.41 89.45

20020918 B9 8172.45 86.95

20021010 B19 7533.95 80.63

20021113 B9 8398.49 89.05

20021209 B9 8473.41 89.50

20021213 B6 8433.71 89.34

20021216 B9 8627.4 91.65

20021217 B13 8535.39 90.85

20021218 B6 8447.35 90.80

20021218 B9 8447.35 90.80

20021219 B6 8364.8 89.16

20021219 B9 8364.8 89.16

20021224 B6 8448.11 89.35

20021231 B6 8341.63 88.23

20030106 S12 8773.57 92.96 92.90

20030122 B9 8318.73 88.17 88.75

20030129 B9 8110.71 86.48

20030310 B8 7568.18 81.32

20030311 B17 7524.06 80.52

20030514 B18 8647.82 94.51

20030604 B10 9038.98 99.16

20031015 S4 9803.05 104.99 104.68

20031103 B18 9858.46 105.99 105.99

20031217 B13 10145.26 108.50

20040102 B18 10409.85 111.23

20040211 S15 10737.70 116.07 115.97

20040220 S9 10619.03 114.88

20040405 S12 10558.37 115.27

20040518 B2 9968.51 109.65 110.50

20040719 B2 10094.06 110.24

20040806 B2 9815.33 106.85

20041014 B9 9894.45 110.64

20041021 B9 9865.76 111.24

20041022 B2 9757.81 109.99

20041116 B18 10487.65 117.88

20041217 B13 10649.92 119.44

20041228 S8 10854.54 121.18 121.08

20050124 S10 10368.61 116.55

20050304 S15 10940.85 122.73

20050421 B19 10218.6 116.01 115.74

20050801 B18 10623.15 123.65

20051014 B1 10287.34 118.67

20051121 B10 10820.28 125.76

20060111 B18 11043.44 129.31

20060119 B14 10880.71 128.31

20060307 B15 10980.69 127.97

20060315 B18 11209.77 130.76

20060508 S9 11584.54 132.36 132.42

20060613 S10 10706.22 122.55

20060615 B14 11015.19 126.12 125.29

20060630 S12 11150.22 127.23 127.43

20060718 B9 10799.23 123.97 124.18

20060818 B10 11381.47 130.69

20060926 B18 11669.39 133.58

20061122 B18 12326.95 140.92

20061218 B13 12441.27 141.95

20070105 S9 12398.01 140.54 140.82

20070302 B17 12114.1 138.67 137.93

20070306 B19 12207.59 139.70

20070420 B10 12961.98 148.62

20070518 B18 13556.53 152.62

20070717 S9 13971.55 154.75 154.23

20070718 S9 13918.22 154.47

20070719 S9 14000.41 155.07

20070723 S9 13943.42 153.97

20070829 B14 13289.29 146.54 145.45

20070918 B14 13739.39 152.46

20071005 S4 14066.01 155.85 155.39

20071114 B1 13223 147.67 146.57

20071206 S12 13619.89 150.94 151.42

20071207 S9 13625.58 150.91

20080307 B8 11899.69 129.71 129.84

20080311 B19 12156.81 132.60

20080318 B14 12392.66 129.63

20080324 S9 12548.64 134.72 134.86

20080325 S9 12532.6 134.85

20080402 S9 12608.92 136.70

20080403 S4 12626.03 137.04

20080404 S9 12609.42 136.89

20080501 S15 13040 141.12

20080723 S9 11632.38 128.17

20080730 S9 11583.69 128.53

20080811 S2 11782.35 130.71

20080915 B8 10917.51 120.09 117.20

20080918 B19 11019.69 120.07

20080922 S6 11015.69 121.31 120.85

20081007 S10 9447.11 100.03

20081008 B1 9258.10 97.51 99.66

20081021 S6 9033.66 95.86 93.20

20081028 B19 9065.12 93.76 93.77

20081105 S12 9139.27 96.19 94.46

20081114 S6 8497.31 86.62

20081120 S5 7552.29 75.45

20081120 S10 7552.29 75.45

20081121 B16 8046.42 79.52 81.92

20081202 B19 8419.09 85.27

20081212 B9 8629.68 88.99

20081217 B13 8824.34 90.99

20081222 B9 8519.69 87.06

20081223 B9 8419.49 86.16

20081229 B9 8483.93 86.91

20090121 B19 8228.10 84.05

20090126 B17 8116.03 83.68

20090129 S6 8149.01 84.55 84.98

20090217 S5 7552.6 79.22

20090302 S10 6763.29 70.60

20090310 B4 6926.49 72.17 73.00

20090327 S5 7776.18 81.61 79.80

20090403 B12 8017.59 84.26 83.34

20090504 B14 8426.74 90.88

20090528 B18 8403.08 90.92

20090609 S8 8763.06 94.65 95.48

20090623 B5 8322.91 89.35 90.16

20090715 B14 8616.21 93.26

20090716 B12 8711.82 93.11

20090803 B10 8286.56 100.44

20090901 B15 9310.6 100.20

20090914 B18 9626.80 105.28

20091002 B9 9487.67 102.49

20091005 B9 9599.75 104.02

20091021 S12 9949.36 108.24 108.19

20091113 S12 10270.47 109.62

20091217 B13 10308.26 110.18 110.20

20100122 B17 10172.98 109.21

20100209 B17 10058.64 107.22

20100409 open 10997.35 119.55

|

|

TigerSoft

News Service 4/9/2010 www.tigersoft.com

TigerSoft

News Service 4/9/2010 www.tigersoft.com