TigerSoft

News Service 3/10/2008 www.tigersoft.com

TigerSoft

News Service 3/10/2008 www.tigersoft.com "Bank Failures Are Coming", Says Ben Bernacke

The Most Endangered Banks Are Showing

Very Aggressive Dumping of Their Shares

by William Schmidt, Ph.D.

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

"Bank Failures Are

Coming", Says Ben Bernacke Fed

Chairman Bed Bernanke told the Senators on the Senate Banking, Housing Fed

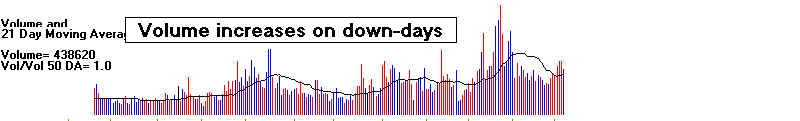

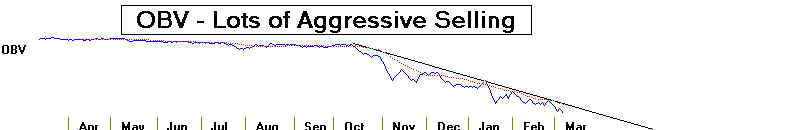

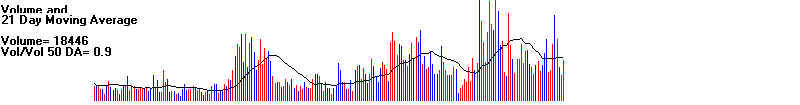

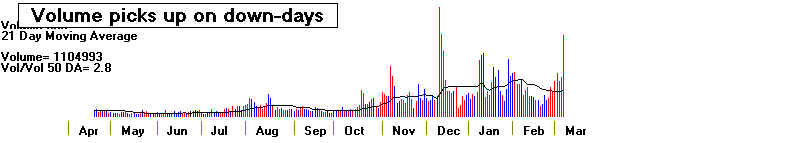

Chairman Bed Bernanke told the Senators on the Senate Banking, Housingand Urban Affairs that he expects some bank failures as a result of the quickly spreading financial gloom. Taking into account the growing population, US economic growth was zero in the last quarter. Bank failures have been rare. You have to go back to the savings and loan failures of 1990 and 1991 to see silimar circumstances. Then the taxpayers had to bail other banks out. It was expensive. But the stock market actually rose in 1991 and 1992. The Washington Post reports that a week before Bernanke said "there will probably be some bank failures" among smaller regional banks", he had said he foresaw no bank failures. Now he is saying "I don't anticipate any serious problems of that sort among the large, internationally active banks that make up a very substantial part of our banking system.". Sadly, the financial storm is fast-moving and we can not be sure what Bernanke will say next week, or the week after. Keep in mind this is the same man who is denying the risks of inflation. "I don't think we are anywhere near the situation that prevailed in the the 1970's." Has he even bothered to look at the steep rises in corn, wheat, coffee, soybeans, sugar, crude oil, gold, silver, platinum.... Look at the charts on TigerSoft. "Am I hearing you correctly that we're in actually - we're in a worse position today to respond to this than we were eight years ago? asked Senator Christopher Dodd a week ago.. "I think that's fair in that both fiscal and monetary policy face some additional restraints", replied Bernanke. Bank failures are already starting. In January, bank regulators closed the small ($58 million-asset) Douglass National Bank of Kansas City. Douglass had made so many bad loans its net asset value less than $1.5 million. "Douglass was closed by the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corp. was named receiver. According to the OCC, "There is no reasonable prospect that the bank will become adequately capitalized without federal assistance." The FDIC said Liberty Bank and Trust Co. in New Orleans would assume all of Douglass' deposits, which totaled $53.8 million. The FDIC said the failed bank's three offices would reopen on Monday as Liberty branches. Liberty agreed to purchase $55.7 million of Douglass' assets at book value, less a discount of $6.1 million. The FDIC said it would retain approximately $2.8 million in assets. (Source: http://www.fourwinds10.com/siterun_data/government/banking_and_taxation_irs/news.php?q=1201320363 ) There were three bank failures in 2007: 1) 15.8 million-asset Metropolitan Savings Bank in Pittsburgh in February 2) $2.5 billion-asset NetBank in Alpharetta, Ga and 3) $86.7 million-asset Miami Valley Bank of Lakeview, Ohio These are smaller sized banks. What would a large bank failure mean for the Federal Deposit Insurance Corp. Presently mostdepositis are insured up to $100,000. Some retirement accounts are insured up to $250,000. The Feds are seeking a rule change that "would place a provisional hold on a fraction - say, 10% or so -- of certain account balances at some 159 of the nation's largest banks." Should you worry? Quite possibly. Depositors without FDIC coverage lost money in at least two of the recent failures. Of the $109 million in uninsured deposits (over the $100,000 maximum) at NetBank, nearly 30% has not yet been reimbursed. Of $14 million in uninsured funds at Miami Valley, only 5.9% of uninsured funds, so far, has been reimbursed.  Which Banks Are at Risk? Six months ago, the Federal Depositors' Insirance Corp (FDIC) estimated there were 65 banks with assets of $18.5 billion or more on its "Problem List". They will not identify them. But Institutional Risk Analytics of Torrance, California has set out the names: BAC - Bank of America (in DJI-30) C - Citigroup (in DJI-30) JPM - JP Morgan (in DJI-30) WB - Wachovia Corp. HBC - HSBC Holding (Source: http://www.marketwatch.com/news/story/how-risky-uninsured-bank-deposits/story.aspx?guid=%7B03FBB3D6-6F11-455A-8730-04DC7082FEEA%7D&siteid=yhoof ) When we look at these bank stocks and many others like WM (Washington Mutual), we see how these sell-offs evolve. Initially. we see insider selling and distribution (red reading below -.25 from the Tiger Accumulation index. Then slow and steady distribution becomes impractical; too much bad news starts coming out. So, we see increasingly heavy trading volume on down days. This is the dumping phase. Until this dumping ends, and that won't stop until investors believe that all the bad news is out, we must expect still lower prices. I say this applies now to the bank stocks in part because I see that the Feds lowering of interest rates has been demonstrated to be insufficient to turn these stocks around. And the negative and reinforcing side-effects of the credit (bank) panic are being reported every day now. Yet the root cause, the war in Iraq goes on, is not blamed. Tragically, the bank stocks' declines remind me more and more of a stock from 38 years ago, Equity Funding, which rapidly fell from $50 to $0. The insurance policies it had on its books just did not exist. It was an empty shell and not that much different from Enron more recently. Could this be happening again with bank stocks? All that's needed are rampant gullibility, greed, fraud and a cowardly mass media. It happens with each new generation. ------------------------------------- Bank of America ------------------------------------------------------

------------------------------------- CitiGroup ------------------------------------------------------   |

------------------------------------- JP Morgan ------------------------------------------------------ |

------------------------------------- HBC

------------------------------------------------------  |

------------------------------------- Washington Mutual ------------------------------------------------------  |