TigerSoft Freedom News Service 2/25/2009 www.tigersoft.com

updated 3/2/2009

Obama's Pro- "Zombie Banks' Policies"

Will Waste Trillions and Reward Reckless Greed...

In Japan, Similar Policies Brought A Decade of Stagnation.

Main Street Thinks Obama Is On Their Side.

The Real Obama Will Protect Wall Street

Obama's policies will keep in financial power those who

made the worst financial decisions in US history and cost

a hundred million people around the world their jobs and

income. Wall Street Bankers Are Very Safe with Obama.

by William Schmidt, Ph.D. - Creator of TigerSoft

(C) 2009 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

|

Tiger Software Helping

|

Obama Promotes Zombie Bankers.

Japan's 1990s' Experience Was Lost on Him.

Throwing Billions and Billions Down A Rotting Bank Rat Hole...

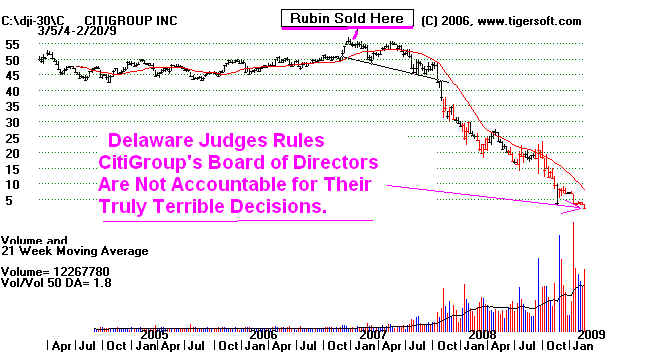

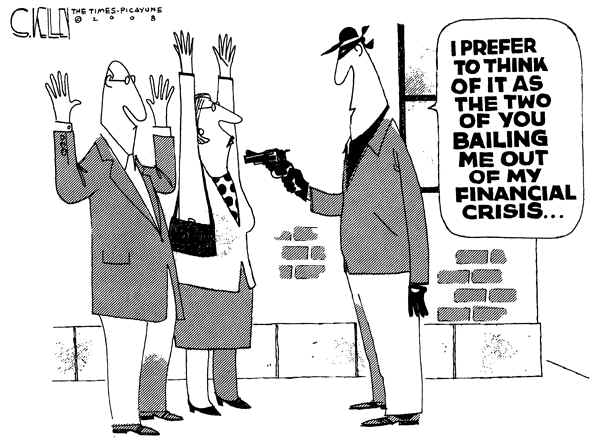

The financial decisions made by the directors and CEOs of CitiGroup and Bank of America are among

the worst in world history, if we consider the economic consequences globally. Should Obama be

giving these companies hundreds of billions, so that they can survive as presently constituted and run?

Ken Lewis has taken in close to a hundred million dollars over the last decade from the pockets of

Bank of America shareholders. In return, he has all but destroyed the company he ran. Obama

and Bernanke would give his company billions and billions more of your money and still let him

continue to run the vast empire that is Bank of America. Never has rule by plutocracy been clearer

in the US. And it isn't just Obama, it's Congress and the Judicial system. Americans should be

"mad as hell". Shareholders certainly should be, too. But corporations in the US are usually run like

Middle Age fiefdoms of the CEO and his over-paid cronies. Shareholders are often quite powerless,

even when a stock falls 95%! Ken Lewis at Bank of America is living proof. How can anyone really

believe he is the best person to head Bank of America after all the reckless mistakes he has made?

How can anyone seriously justify his $22 million/year pay?

Obama Trusts The Banks. Why?

Obama's people and Bernanke insist that there will be no nationalization. Instead, there

will be a 6-week, not very rigorous, "stress test" of the biggest banks so that TARP-II money

only goes to those banks that are realistically solvent and have not been carrying toxic assets

at excessive prices. If it were only so simple! This plan, developed by an entrenched clique

of Wall Street insiders who make Obama's financial decisions, delays the distribution of

the TARP-II money, and gives some hope that the worry about "toxic" debts is exaggerated. Only

the banks know the truth. The opposite is more likely, that the banks are carrying bad loans

at a much inflated value, in order to stay in business.

Can the banks be trusted? Banks won't lend to each other now for lack of trust. But

Obama thinks he can rely on a "stress test" which depends on bank honesty about their

bad loans. And now. March 2nd, it is being revealed that is the banks themselves that

will condict the test. This is a situation that is "ripe for abuse".

"Investors expected the government to be a bit more intense in tests of the nation’s biggest banks.

After all, if nightmare scenarios were appropriate in urging passage of a $787 billion stimulus package,

they should be appropriate now to gauge a bank’s ability to withstand losses. Sadly, that’s not the case,

at least according to the stress-test criteria laid out by the Treasury Department and bank regulators

Wednesday. That is bad news for investors, taxpayers and the economy. The longer we keep trying

to avoid the reality of banks’ dire straits, the longer the financial crisis will stretch. The lack

of sufficient stress in the tests is especially surprising since a big lesson of the past two years

is that the worst can happen,

and then some. In times like these, the government and investors need to play “What If?” even when it

involves some outlandish possibilities. The failure to do such worst-case planning, even after plenty of

red flags, probably made the after-shocks to the financial system from the collapse of

Lehman Brothers Holdings Inc. far worse than they should have been. Perhaps the biggest lesson, though,

is that banks, like plenty of other companies, will get drunk on their own Kool-Aid. And regulators are

supposed to be the ones who abstain.

“We really don’t know how stringent the capital test will be,” Paul Miller, bank analyst

at FBR Capital Markets Corp., wrote in a research note yesterday. “We do know that the test

will be based on institutions’ own forecasts for losses, which may be overly optimistic.” ...

(F)ew specifics are actually known about the testing. The Treasury didn’t give details on the

methodology behind the tests, how the banks will determine capital or what would lead to a

passing or failing grade...This is especially troubling for investors because they are having trouble

understanding how regulators are applying existing oversight rules. .." Source.

Reuters reports that Bank of America is carrying "its loans in its balance sheet marked

at more than $44 billion above their fair value." Naturally, their insiders have been selling

heavily until very recently. With home prices falling at a rate of more than 20% per year,

exactly how far out the Treasury will look into the future in doing its evaluating will be a key

element. My guess is that Obama's crew have already decided whom to give the money to

and the "stress test" is to make palatable somethng that the public would otherwise gag at for

being just another scandalous bailout of the most underserving of the rich, those who ruined the

whole world's economy by their reckless greed and obfuscations...

So, I can see why some of the wilder speculators are betting that Bank of America will be kept

operating and not be nationalized. Obama may talk a tough game, but Wall Street's very

large campaign contributions to him will likely prove to be a very good investment for

Wall Street. Unfortunately, what is good for these bankers will not be good for the US

as a whole, if Japan's economic history between 1990 and 2003 offers any instruction.

A more basic question is why is the Obama Administration intruding at all until the

banks go into receivership. It would be a lot cheaper for the US taxpayer to take responsibility

for CitiGroup and Bank of America AFTER the shareholders' equity and the bond holders'

interest is wiped out. Why should the taxpayer protect shareholders and bondholders in these

banks? Bond holders take risks just like shareholders. Why should they get special treatment,

apart from the fact that Obama got a lot of campaign contributions from Wall Street?

After these banks go into receivership, the government can step in, break the

banks up and sell off the more solid and profitable divisions and deal, as it needs to with

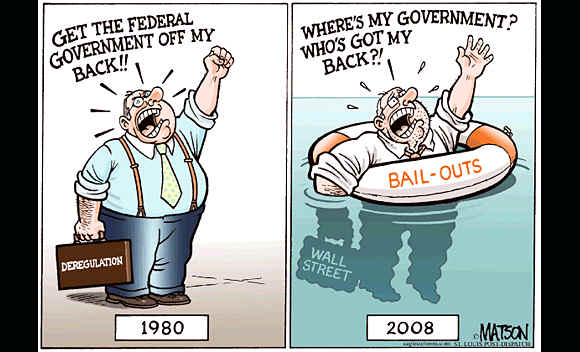

the toxic debts. Republicans claim Obama is waging "class war"! It looks to me that this

charge is a red herring. In fact, he is unduly protecting rich speculators and bond holders.

What would really help this market would be a return to the 1934 short sale rules and a

curbing of leveraged "ultra-short" ETFs. But because Obama's financial advisors are all so

tied into the Clinton era deregulation of banks, financial markets and derivatives, I would not

expect a quick change in short sale rules or a return anytime soon to the 1933 Glass-Steagall

separation of commercial and investment banks. Don't hold your breath for greater enforcement

of anti-trust laws or the rules against pools of insiders. Needed as they are, there will not

higher margin requirements for commodity speculators or even tighter regulation of dervivatives

and Credit Default Swops.... See How Credit Default Swaps Became a Timebomb | Newsweek.

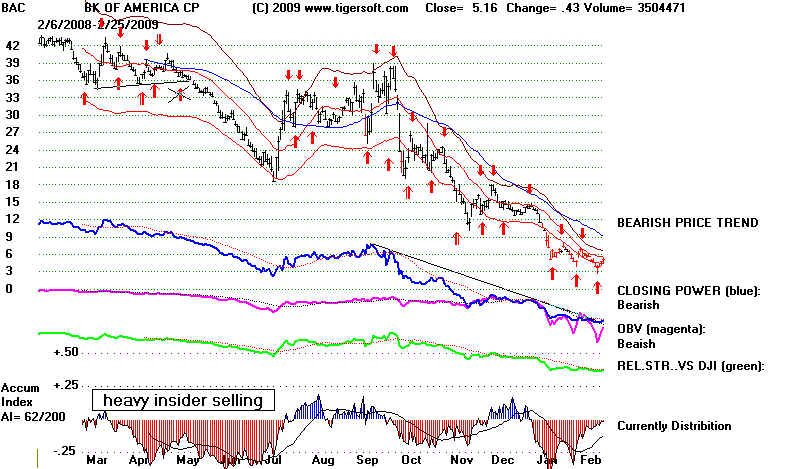

============================ BANK OF AMERICA ===================

There are signs the extreme downward pressure is coming off. The Blue Closing Power Line

is breaking its very steep downtrend and the TigerSoft "Accumulation Index" is not so negative.

But BAC is back on a Sell from a system that would have gained TigerSoft users 400% for the last year,

simply taking hte automatic red Buys and Sells. Before you go out and buy BAC, consider

how gravely weak housing prices still are. The red TuigerSoft Buys and Sells have powerfully profitable.

with BAC, C and most other financial stocks. Much of this is because of how much insider trading

is going on with these stocks. If you know what the insiders are doing, making money in the

the stock market becomes quite easy. Get and use TigerSoft. See for yourself.

========================

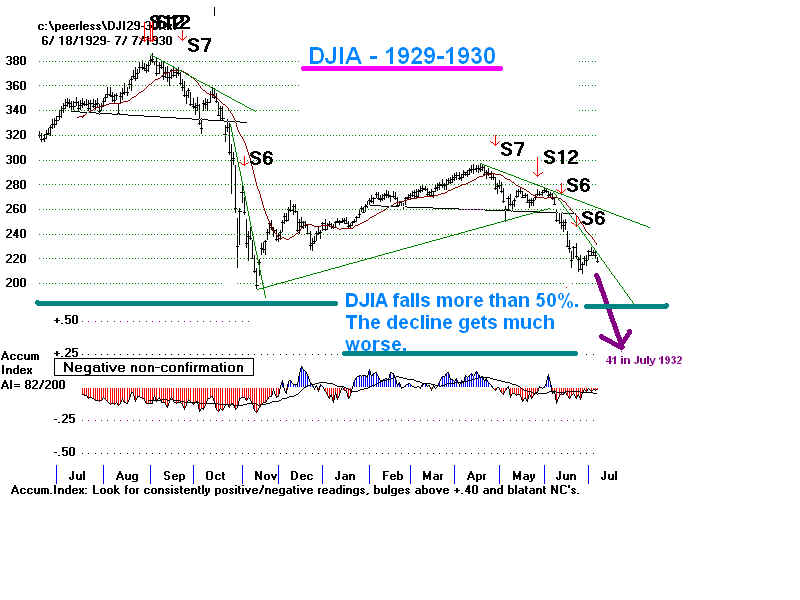

JAPANESE STOCK MARKET ===================

Japanese Stock Market

Peak - Dec. 29, 1989

See also Nikkei

225 - http://en.wikipedia.org/wiki/File:Nikkei_225(1970-).svg

See also Nikkei

225 - http://en.wikipedia.org/wiki/File:Nikkei_225(1970-).svg

On 12/29/1989 the Japanese Nikkei 225 hit a peak of

38915.87. The Japanese bubble then

broke.and eight months later, it was down by

two thirds. The bubble was brought on by

wide-open property speculation,

especially in Tokyo, where a penthouse in Tokyo might rent for

$10 Million a month. Wages had long

stagnated by 1990; so, workers were commonly

puting in 12 hour days to try to make ends

meet. Besides the parallels with the US in excessive

real estate specualtion and the long decline in

real wages, what is significant here is that

the Japanese Government's response to the

decline failed to bring much of a recovery for

more than a decade. Just as in in the US,

Japanese bankers concealed for years just how

bad their loans were and how insolvent they

really were..

Why did the Japanese Government fail to bring about a recovery? What did

they

do wrong? The Bank of Japan bought shares of

public companies using a $500 billion bank bailout

fund.. They promoted very, very low interest

rates (like Bernanke) and gave their banks

colossal sums, 12%

of their entire GNP. At the time, Obama's economic advisor, Larry

Summers, urged the Japanese to stop try to prop up

these bloated, all-but-dead big banks.

He warned them that the banks were eating up the rest

of the Japanese economy. It would be better

to let them fail, use these sums to promote

productivity and clear the decks for a healthy recovery

with newer, healthier banks.

Now that the US is in the same position as Japan was, with more and

more retiring "baby

boomers". Obama seems to be choosing to continue

to follow Japan's prescription for decade-long

stagnation and economic malaise. Larry Summers'

advise to the Japanese in the 1990s to put

their zombie banks out of their misery and stop

pouring good money after bad is forgotten.

The value of the banks' toxic mortgages keeps dropping. The most recent report on

housing prices showed a record decline. The

rate of decline is more than 20% per year.

From their mid-2006 peak, housing prices are down

27%-28.3%. It will take trillions to

keep the banks solvent if the trend continues another

year. The banks have been posting the

value of their mortgage loans at

"unrealistic" levels, to be polite. There is no market for

many of them because they are considered worthless in

this climate. Why should the government

loan them any money based on something which is

worthless!

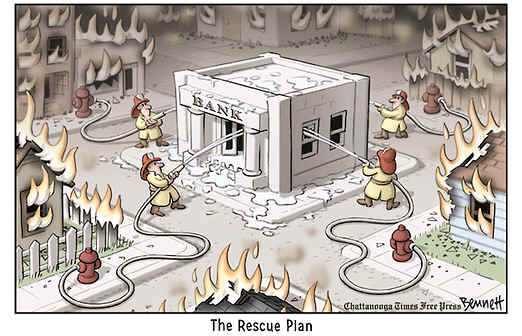

Obama verbally refuses to accept the necessity of nationalization of the biggest, failing

banks.

He refuses to see that the decline in jobs and

housing prices will hopelessly devastate these banks.

The toxicity of their loans grows each day. The

banks are rotting away. Their debtors cannot pay them

what they are owed. Just guaranteeing bank

deposits is going to be hugely expensive. Guaranteeing

the big banks themselves is probably futile.

Most economists are warning that shoring up these

private banks will cost US taxpayers several trillion

dollars MORE. The worst banks banks

are the biggest, CitiGroup and Bank of America.

They need to fail, be nationalized and then

broken up.

This weekend, the US Treasury said it will convert its $45

billion in preferred stock, which

pays 5%/year, in CitiGroup into common shares.

By becoming a shareholder before CitiGroup

is declared insolvent, the US Government

and Obama will be put into a position to have to keep

protecting its investment by giving CitiGroup more

and more money. Already, just by this conversion,

CitiGroup will not have to pay the yearly dividend of $2

billion on its preferred. So, the US Government

is in effect giving this money to the bank to save it.

This is another bailout, a hidden one, by a

different name. The US taxpayers are out $2

billion! And CitiGroup will be kept on life support.

Obama may see that it is only a matter of time before the

US Treasury will own 51%. He can still

claim to be for a private banking system. But he

prolongs the Zombie bank. His lack of honesty

has just cost the US taxpayer $3 billion.

Wait and see. Will the de facto nationalization be

acknowledged? Will the Government change the

bank's loan practices? Will the CitiGroup be

broken up? Obama is not straight forward.

He follows the lead of his Wall Street linked advisors.

His lack of backbone shows clearly. So does his

loyalty to his biggest camapign contributors, Wall Street.

|

Wall Street Backed Obama At The Critical

Beginning of His Campaign to Be President. As of Feb., 1, 2008, "seven of the Obama campaign’s top 14 donors consist of officers and employees of the biggest Wall Street firms, those charged with mainuplating stock prices, consorted short selling and bundling unsound mortgages and selling them as Grade A investments. "Goldman Sachs, UBS AG, Lehman Brothers, JP Morgan Chase, Citigroup, Morgan Stanley and Credit Suisse. There is also a large hedge fund, Citadel Investment Group, which is a major source of fee income to Wall Street. There are five large corporate law firms that are also registered lobbyists; and one is a corporate law firm that is no longer a registered lobbyist but does legal work for Wall Street. The cumulative total of these 14 contributors through February 1, 2008, was $2,872,128, and we’re still in the primary season." ( http://www.infowars.com/obama%E2%80%99s-money-cartel/ ) "Obama promised change, but his economic team is slavishly loyal to the interests of the financial elite who steered the financial system onto the shoals and now expect all of us to patch the hull and somehow get it back into navigable water. Yes, we have some gestures to appease the downtrodden, like restrictions on private jets and largely meaningless promises of salary caps (Lucien Bebchuk, a Harvard Law professor and expert on corporate governance, described how they do little to restrict total comp). Summers and Geithner are proteges of Robert Rubin, former Goldman co-CEO, and they are proving true to form, promoting even more borrowing in a doomed-to-fail-or-be-counterproductive effort to achieve status quo ante, the very conditions that lead to this shipwreck."

Obama's Advisors Have Sworn A Loyalty Oath, To Wall Street  Robert Rubin. "Not only did Rubin himself serve on the Obama economic transition team, but two of the transition’s headhunters were Michael Froman, Rubin’s chief of staff at Treasury and later a Citigroup executive, and James S. Rubin, an investor who is Robert Rubin’s son. Source. Rubin denied anyone could have foreseen the consequences of the housing bubble and the writing of billions of sub-prime loans. Baldersash! He sold a huge stash of shares right at the top. And other economists, like Roubini, did predict the disaster that unfolded. See TigerSoft Blog and News Service - One Million Shares Sold by CitiGroup Insiders ...

A promoter of reckless, highly leveraged lending and CDOs at CitGroup. He denied know there was a bubble, but unloaded 77,500 shares of CitGroup stock right at the top. Glass-Steagall's Repeal Undid Much of What Had Been Learned about Banking's Misdeeds That Led To The Great Depression. Rubin was Clinton's Sectretary of the Treasury. He talked Clinton into backing Republican Phil Gramm's legislation to repeal FDR's Glass-Steagall Act that prevented commercial banks from entering the realm of investment banks to bundle and sell their mortgages. He sold Clinton on the globalization and letting commercial banks sell their mortgages as investment banks. Under Rubin’s guidance, the US heavy industry and manufacturing evaporated and went overseas. Wall Street and Goldman Sachs profited from this by being the "indispensable intermediary". Median income in the US started falling in 1998. Confronted with hard times on Wall Street, Paulsom and now Geithner are providing hundreds of billions to the very people who caused the current calamity. Source. See also http://www.slate.com/id/2208371/ See his opposition to any regulation of derivatives, as initiated by the head of the Commodity Futures Trading Commission. http://www.washingtonpost.com/wp-dyn/content/story/2008/10/14/ST2008101403344.html Rubin, as chairman of Citigroup's executive committee, urged executives there to plunge the bank much more deeply into the market for CDOs. "According to current and former colleagues, [Rubin] believed that Citigroup was falling behind rivals like Morgan Stanley and Goldman Sachs, and he pushed to bulk up the bank's high-growth fixed-income [bond] trading, including the CDO business," the New York Times reported. "The political dynamics in 1932 have similarities with that of the upcoming 2008 presidential election in the aftermath of the credit market crisis that broke out in August 2007. The main difference between 1932 and 2008 is that, unlike in 1932, when Democrats could disclaim policy responsibility for the 1929 crash, they cannot deny in 2008 the responsibility of the two-term Bill Clinton administration (1993-2001) for the credit bubble that burst in 2007... It was Robert Rubin, special economic assistant to Clinton and later Treasury secretary, who worked out what has come to be known as Rubinomics, the strategy of dollar hegemony through the promotion of unregulated globalization of financial markets based on a fiat dollar that also forced deregulation on the US financial market. Source.  Obama's Treasury Secretary Geithner and Fed Chairman Bernanke Rubin Proteges, All Geithner (Treasury Secretary) As president of the New York Federal Reserve Bank, Geithner allowed the key New York Fed to loosen the controls on banks like CitiGroup, as they loaded up on subprime mortgage loans, using extensive leveraging. "Because the Fed conducts much of its work in secret, details about Geithner's role in the Citigroup debacle remain hidden. But a review of publicly available records shows that the New York Fed, in a key period, relaxed oversight as Citigroup went on a risky spree. Geithner, following practice common among Cabinet nominees with pending confirmation hearings, declined an interview for this story. Neither the New York Fed nor Rubin responded to written questions about Citigroup. The New York Fed's supervisory unit reports directly to the bank president, Geithner. The unit's job is to ensure that firms manage risk and have enough capital to cushion against losses. Large companies tend to be held to more stringent capital standards. Yet poor risk management and weak capital levels were central to Citigroup's undoing. One enforcement agreement in place before Geithner took office in 2003 – an order requiring quarterly risk reports – was lifted during his watch. A ban on major acquisitions also was eliminated a year after it had been imposed in 2005. Afterward, in 2006 and 2007, Citigroup aggressively expanded into the subprime mortgage business and bought a hedge fund and Japanese brokerage, among other assets... Compared with its peers, Citigroup had a thinner capital cushion and relied more heavily on less-desirable types of capital, records show. The New York Fed knew – in 2007 it allowed Citigroup to count as capital securities that some regulators and credit agencies frown upon or discount." Geithner won't make waves for bankers... "Rubin, his former boss at Treasury, described Geithner to The New York Times in 2007 as someone with a "calm way" no matter the circumstance. Rubin, a senior counselor and director at Citigroup after leaving Treasury, called Geithner "elbow-less." ( http://www.propublica.org/article/how-citigroup-unraveled-under-geithners-watch )  Larry Summers (Presidential Economic Advisor) Summers teamed up with Rubin to block regulation of derivatves, including those based on mortgages. He was Clinton's Treasury Secretary in 2000 when Clinton agreed to abandon bank regulation under Glass-Steagall. He had served as Rubin's closest aid previously a the Treasury. Summer has a reputation for being loudly arrogant when he is wrong, in an effort to intimidate. Brooksley Born was the chairwoman of the Commodity Futures Trading Commission under Clinton.In March 1998 she got a in her office in downtown Washington. "On the other end was Deputy Treasury Secretary Summers. According to witnesses at the CFTC, Summers proceeded to dress her down, loudly and rudely. "She was ashen," recalls Born's deputy Michael Greenberger, who walked in as the call was ending. "She said, 'That was Larry Summers. He was shouting at me'." A few weeks before, Born had put out a proposal suggesting that U.S. authorities begin exploring how to regulate the vast global market in derivatives." Source.  Gary Gensler (nominee to be head of Commodity Futures Trading Commission) He worked at Goldman Sachs, one of the biggest brokers of commodities, for nine years. He joined the Treasury Department. Gensler served under two Clinton Treasury secretaries. From 1997 to 1999, Gensler worked as assistant secretary of the Treasury under Robert Rubin until Rubin stepped down in 1999. Lawrence Summers then became the Treasury head, and Gensler was promoted to Treasury undersecretary. There in 2000 "he oversaw the drafting of legislation that exempted derivatives from oversight by the federal commodity regulator, including the viral credit default swaps that have amplified the current crisis." (Quote: NY Times. ) As the head of the Commodity Futures Trading Commission (CFTC), Gensler will oversee a troubled organization that has come under fire since oil prices fluctuated wildly throughout 2008. Many industry experts have blamed speculation by investors as the main cause of soaring oil prices in early 2008. Allowing speculators to buy crude oil futures putting only 7% down certainly needs regulation. He has so far been silent on that. Summers and Gensler joined hands with Phil Gramm to ward off regulation of the derivative markets and deregulate banking.  http://bigpicture.typepad.com/comments/2008/10/deregulaterereg.html |

Rhetoric Asside, Wall Street Has A Friend in Obama

A protégé of both Summers and Rubin... Under Rubin’s illuminated guidance, the US

heavy industry fell

behind, evaporated, or left for China. Wall

Street and Goldman Sachs profited from this by being the indispensable

intermediary, worldwide. Median income in

the US started falling in 1998. Confronted with hard times on

Wall Street, Paulsom and now Geithner are

providing hundreds of billions to the very people who caused

the current calamity.

How Plutocracies Self-Destruct

The

conflict between Wall Street and Main Street stands out clearly now. Societies that treat

working

people and Main Street this badly

do not survive. Professor Jared Diamond gave an interview to the US Public

Broadcasting Service, Friday,

February 12, 2009. He was asked point blank if he could tell of a particular

characteristic that made some

societies survive, whereas others collapse. That was the central question Diamond

tried to address in his book

"Collapse. How societies choose to fail, or to succeed". Diamond’s

answer

"It seems to me that one of

the predictors of a happy versus an unhappy outcome, has to do with the role

of the elite or the decision makers

or the politicians, or the rich people within the society. If the society is

structured so that the decision

makers themselves suffer from the consequences of their decisions, then they are

motivated to make decisions that

are good for the whole of society. If the decision makers can make decisions

that insulate themselves from the

rest of society then they are likely to make decisions that are bad for the rest of

society." A case in

point, according to Jared Diamond: "the place that they call the City of New

Orleans".

One can ask "why over ten

years, people in New Orleans did not spend a few hundred millions building

appropriate dikes".

Diamond’s answer: "Rich people are living on high ground In New Orleans. Compare

with the Netherlands, where

"the system of dikes has been called one the Seven Wonders of the World".

"Rich people are not allowed

to have mansions on top of the dikes, everybody is down in the polders.

Politicians and rich people

know that if the dikes failed, they would die".

( See - http://patriceayme.wordpress.com/2009/02/15/stop-humoring-the-plutocracy/

)

Nouriel Roubini in his February 10

commentary, the choice is clear - the former, not the latter option

that will be a "royal

(taxpayer) rip-off" if assets are bought at above market valuations. He sees

losses so

large that the US banking

system "is effectively insolvent in the aggregate." Jim Rogers never

holds back,

and, on February 11, was true

to form on Bloomberg: Interviewed on Geithner's plan he said:

"Mr. Geithner has been bombing for 15 years.

(He) caused the problem. He was head of the

New York Fed that was supposed to

be supervising banks. (Instead), all last year he came up with TARP.

He came up with all these absurd

bailouts. Geithner's has never known what he's doing. He doesn't know

what he's doing now, and pretty

soon everyone will know it, including Mr. Obama."

Rogers opined the best way to

proceed now was following the advise Summers gave Japan in the 1990s.

"You let (bad banks)

go bankrupt. You clean out the system. You wipe out insolvent ones and let (good

banks) take over.

America is making the same mistake (as Japan), and the politicians are making it

worse. You want to know

why they're making it worse? They want to support their friends on Wall Street."

"The idea of the

government buying up bad assets is not going to work." Either the price will be too

high

(at taxpayer expense) or it

will be too low....it's not going to work. It's never worked....Pouring in new money will

only weaken the whole system.

Go back in history and see what worked. Countries that took their pain (solved

their crisis). It was

horrible going through it, but they came out of it and became rapidly growing."

What we need are healthy banks with clean balance sheets

and enlightened risk assessment to provide consumer

and business loans that will generate returns to

shareholders." Let them sell their own toxic debt. They won't

because they "don't like the price." As for

TARP, it failed and so will TARP 2.0 or what's now called a Financial

Stability Plan. The idea is to get "private capital to

buy bad loans and derivatives," but banks won't price them low

enough to sell. Moreover, who'll buy risky assets unless

they're practically given away or Washington guarantees

them.

The Real Causes of The Crashes in 1929 and

2008:

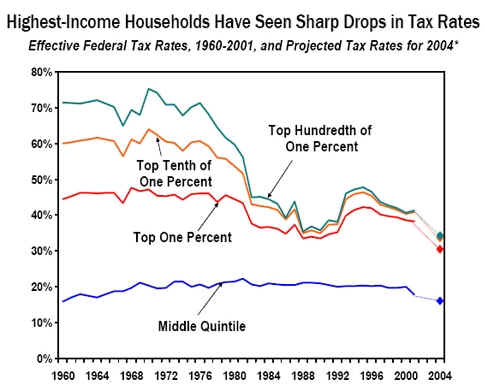

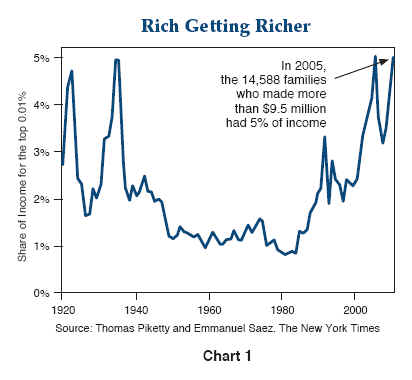

| The Real Causes 1. Lack of Regulation of Wall Street 1930 - "The new Democratic chairman of the Senate Banking and Currency Committee, Senator Duncan U Fletcher of Florida, immediately dismissed the Republican general counsel of the commission on the 1929 crash and appointed as replacement Ferdinand Pecora, an assistant district attorney for New York. Known thereafter as the Pecora Commission, its new investigation after 1930 revealed a host of conflicts of interest in the financial sector in the years leading up to the 1929 crash, such as bank underwriting of unsound securities to save near non-performing bank loans, rampant insider trading and "pool operations" by speculators banding together to move a stock and to close out the pool at a peak price for profit, leaving the manipulated public with subsequent losses. "More shocking still, the Pecora Commission uncovered the embarrassing fact that JP Morgan and his fellow banking titans not only continued to reap huge profit from rescuing firms they helped put in distress while the economy fell into severe depression, but they were also able to avoid paying any income tax in 1931 and 1932 through tax loopholes on paper losses of distressed companies they acquired. These bankers were in fact buying up a country in economic distress with their tax deductions. " Source: 2. Extreme Maldistribution of Wealth 1920, 1929 and 2007 were the years when income was most concentrated in the fewest people. They were also years of market tops.  (Source: http://www.pimco.com/NR/rdonlyres/C61EF99E-6083-469B-B9B2-21EB055A1B76/4273/Chart1.gif ) See TigerSoft Blog 6/24/2007 - The 1929 Stock Market Crash: Could It Happen Again? Yes - Absolutely - June 24, 2007.

|

| See also: http://www.huffingtonpost.com/arianna-huffington/why-is-obama-reluctant-to_b_166572.html http://www.csmonitor.com/2009/0212/p08s01-comv.html Patrice Ayme - Stop Humoring The Plutocracy.

|

newsformormons.com

|

|

|

|