TARP IS PART TRAP and

PART CRAP!

Over-hanging the market are fears that CitiGroup or Bank of America

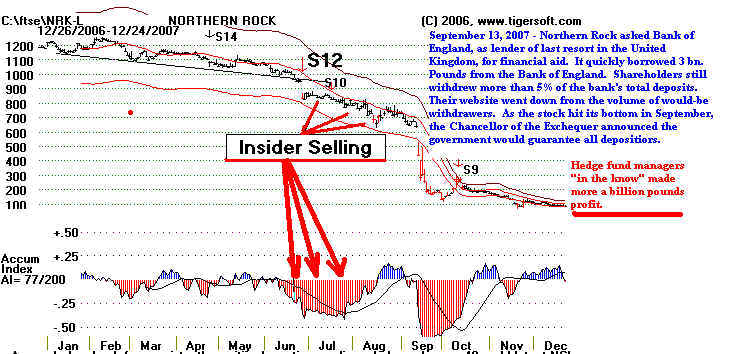

will fail or need to be nationalized, as has happened in the UK to Northern Rock

and Royal

Bank of Scotland. Tonight, 1/27/2009, Bank of America and CitiGroup each

rose more than 9.3% in after-hours trading today. The Obama Administration

seems willing to buy these banks' toxic (worthless) bad debts at above-the-market

prices and resist cheaper and a common sense nationalization. This should send the

market

up quite strongly. Our untouched Peerless Stock Market Timing shows lots of Buys

since mid November.

Blame The Aniquated and Unrepresentative US Senate

for

The Coming of The Depression II.

Update

1/30/2009: the Republican minority have turned down the Democrats's stimulus

package.

This is desperately needed. Layoffs are reaching the 1 million a month

level.

Private spending is dwindling. Banks don't want to make loans. And

Republicans,

true

to Hoover's memory, are repeating his arguments against increasing national debt

to

provide jobs no longer provided by the private sector. Their newly discovered

devotion

to balanced budget is about as hypocritical as you will ever hear from any

band

of rogues anywhere. These Republicans put drunken sailors to shame between

2001

and 2006 with their reckless government spending and cut backs by the hundreds

of

billions on needed taxes on the very wealthy. Now they can conduct their "class

warfare"

raids

with near immunity in the Senate with fillibusters.

Someday,

the US Senate will be abolished, when folks see what a disgrace it is.

Wholy

unrepresentative, inefficient and with no effective rules of closing long-winded

speeches

by the plutocrats from thinly populated states, the will of the majority of

the

people mean nothing. They care not at all about the extreme hardship their

obstructionism

causes

the tens of millions out of work. Minority "class warfare"from the top

down rules

America.

These rogues will do whatever it takes to protect the one percent that own 50%

of

America!

A Botomless

Pit

The buying of "troubled assets" from banks at their pleasure and discretion

ensures that the banks will only sell the worst of their toxic debt to the US. How

will

these valueless assets be priced? By whom? The banks want them priced at their

original faced value. Will their be any transparency about the pricing? No

answers

from the Obama Administration yet.

What they are saying is that these toxic assets will go into into a Government

owned "Bad Bank", the banks will get hundreds of billions and this is somehow

supposed

to promote financial recovery. How? Will it really? Paulson's TARP

succeeded

only in wasting vast public sums on undeserving banks and scaring investors, while

underscoring how blatantly crooked the Bush Administration was and how stupidly and

selfishly banks have been run. What Obama is proposing looks like more of the

same. When

this new TARP II bank bailout fails, and I believe it will, for the reasons discussed

below, Obama's credibility will drop sharply. Then where will the leadership

that

is need to produce a recorvery going to come from?

Incredibly, the Obama administration is developing

plans to pour hundreds

of billions of taxpayer money into banks beyond the $700 billion bailout Congress

already has approved. The International

Monetary Fund just reported that bank losses

in the U.S.and Europe already have topped $1 trillion and could reach well over $2

trillion.

(

Source. )

HOW MUCH OF A RALLY CAN

THERE BE?

In another year, two trillion dollars will be wasted on corrupt private banks. What

a plan!

But that's what Obama wants. So many things need doing. But Obama wants

another trillion

for private banks. Obama says that private industry is the "engine" of

American

job creation. He said this despite the fact that almost 1.2 million jobs were lost

in the private

sector just in November and December 2008. Obama's loyalty to the private banks

seems

very clear. They heavily sponsored his campaign, Clearly Obama is no spokesman

for public employment. But that is what is needed. Millions need jobs now.

The money would

be better spent coming as loans from a national "good" bank. That

would fill the void and

restart the economy. Obama's plan will please the stock market long enough to let

professionals

unload the shares they bought between 7500 and 8000. But Obams's is no lasting

solution. When

the public sees how Obama has wasted a trillion on banks, the stock market will be in very

big

trouble.

Does the chart below of the DJI starting at the end of September 2008

show a calmer or more stable market? Hardly. No clear explanation has

ever been

given about how giving a trillion dollars to banks helps Main Street America, except

that this will enable to make bank loans again. This is absurd reasoning. We

the tax-

payer are giving banks a trillion dollars so that they can make more loans to us when

they chose to, but charge us a high interest rate in the bargain!

US FEDERAL RESERVE AND TREASURY DISGRACED

BY PAULSON, BERNANKE, GREENSPAN and GEITHNER

I have written long and hard criticism of Bush's Treasury Secretary

Hank Paulson and Federal Reserve Chairman Bernanke.

http://www.tigersoftware.com/TigerBlogs/Dec-24-2008/

http://www.tigersoft.com/Tiger-Blogs/September19-2008/index.html

http://www.tigersoftware.com/TigerBlogs/5-7-08/index.html

A few months ago, when you Google "Paulson" "crook"

"corrupt" you found

only my Blog and two or three others. Not so now. He is held in contempt by

even professional investors. from Rogers to Soros. He is a quote that I saw today.

"Famed money manager Jeremy Grantham says that the continuing credit

crisis...

is largely the fault of poor leadership at the Federal Reserve and U.S. Treasury

(and) a small clique of financial policymakers that now includes new Treasury

Secretary Tim Geithner....Reviewing the last two years, of course, it's a misplaced

trust in the competence of our leadership, from the very top...They were cheerleaders,

all of them. And they encouraged reckless leverage and low-quality debt.

"Grantham said that Geithner, who was president of the New York Federal Reserve

Bank, current Fed Chairman Ben Bernanke, and even former Fed Chairman Alan

Greenspan, as well as former Treasury Secretary Hank Paulson, must share the blame.

They made no effort to resist it in any way. Even jawboning would have been a great

advantage over nothing .. And Bernanke couldn't even see the house bubble. On our

data and Robert Shiller’s, it was a three-sigma, one-in-100-year event. After 100

years of being flat, it soared after 2000. You could not miss it. And right at the peak,

October '06, Bernanke said —

quote— 'The U.S. housing market merely

reflects

a strong economy'. What was he looking at? Where were his

statisticians? These

are the guys we picked out of millions to lead us in a crisis. And they can't see a

three-sigma bubble? Every single bubble of that kind has broken."

( http://moneynews.newsmax.com/streettalk/bernanke_disgraceful/2009/01/28/175906.html

)

GEITHNER IS A WALL STREET PUPPET

Obama's Geithner tells us that this time TARP payments will not be wasted

on bonuses, extra lobbying, million dollar offices and private jets. There will be a

new

public transparency he assures us, in order to get the $350 billion released to his

clients,

the big banks. But why should we believe him? Why should we think these

banks

will make any more loans? Why should we think this huge sum will stimulate the

economy any more than the first $350 billion in TARP payments? Even if there

is a short-term rally, the charts for CitiGroup and Bank of America look terrible.

They look like it is only a matter time before they go to zero!

As the head of the NY Federal Reserve, Geithner, acquiesced silently and

ineffectively while CitiGroup increased its bad loan and totally mis-managed their

leverage after 2005. In addition, he did not protest the first round of

non-transparent

and wasteful TARP payments. The notion that he will suddenly be tough on banks

seems very fanciful. Small wonder the bank stocks are now starting to bounce, as

the Treasury prepares to release the second half of the TARP payments. Geithner

has consistently opposed nationalization and been an advocate of making the banks such

a superb bargain for private investors that the government will not need to do more.

Wall Street again wins out over Main Street. No one asks if there are not better

uses

for the $350 billion. We still have NO GUARANTEE that this second round of

payments will free up credit and get banks to make loans. A national bank would do

this immediately and without administration by the same over-paid bank executives

that have made one bad decision after another as the housing bubble emerged.

All

those Goldman Sachs campaign contributions to Obama were not wasted!

Robert Reich's Recommendations for A Good "Bad Bank"

Jan 19, 2009

"It looks increasingly likely that a big chunk of the TARP II funds will be

used to set up

what's being called an "aggregator" -- or "bad" -- bank to buy up the

bad assets that continue

to hobble the balance sheets of private-sector banks. That's what Hank Paulson and Sheila

Bair

suggested Friday. Obama officials-in-waiting seem to view the idea favorably.

"A Bad Bank is surely better than the piecemeal, unpredictable, and opaque approach

of TARP I. But in order that the Bad Bank not turn into another giant taxpayer-financed

boondoggle

for the benefit of shareholders, creditors, executives, traders, and directors of the

banks that got

us into this mess in the first place, any Bad Bank purchase of their toxic assets ought to

carry

conditions similar to the ones I suggested recently for dispensing TARP II funds. Until

the

taxpayer-financed Bad Bank has recouped the costs of these purchases through selling the

toxic assets in the open market, private-sector banks that benefit from this form of

taxpayer

relief must (1) refrain from issuing dividends, purchasing other companies, or paying off

creditors;

(2) compensate their executives, traders, or directors no more than 10 percent of what

they

received in 2007; (3) be reimbursed by their executives, traders, and directors 50 percent

of

whatever amounts they were compensated in 2005, 2006, 2007, and 2008 -- compensation

which was, after all, based on false remises and fraudulent assertions, and on balance

sheets

that hid the true extent of these banks' risks and liabilities; and (4) commit at least 90

percent of

their remaining capital to new bank loans." Source

A NATIONAL BANK IS A MUCH

BETTER SOLUTION

A publicly owned bank would be able to make all the loans needed very quickly.

The public would benefit. It could not be run worse than CituGroup or Bank of

America.

CEOs. The US Government need not be a "barren whore", as those who think

that

private capital is the only legitimate capital and source of jobs. Who do you think

created the Atom Bomb or built all the highways we drive on or the huge hydroelectric

power plants? We'll see how the UK model of nationalized banks fare, while trillions

and trillions will go into the American banks for profit system waiting for the housing

bubble

to play itself out.

Not surprisingly, some say

that CitiGroup originated the verbiage used back in

2007: that they are the "good bank" and a bank taking on their bad, toxic,

valueless will then

be the "bad bank".

Campaign

Contributions To Obama from Wall Street Bankers

Goldman Sachs $955,000

JP Morgan $642,000

CitiGroup $633,000

UBS

$505,000

See also - Thursday, June 26, 2008 Obama's

Accepts Millions From "Subprime" Tied Contributors

"Obama’s

Chief of Staff Pick Took Campaign Contributions from Wall Street"

Friday, November 07, 2008 By Fred Lucas, Staff Writer

"President-elect Barack Obama’s choice for White House chief of staff is

one of the

biggest recipients of Wall Street money in Congress, according to a Washington, D.C.-based

“money-in-politics” watchdog group. The Center for Responsive

Politics has issued a report

highlighting millions of dollars in campaign contributions that Rep. Rahm Emanuel (D-Ill.)

has

raised from individuals working in the hedge fund industry, private equity firms, and

large

investment firms. Emanuel has raised more money from individuals and

political action committees

in securities and investment businesses than from any other industry.

This comes after a presidential campaign that saw Obama frequently criticize Wall Street

and blamed lack of government regulations for the economic crisis that hit the country in

mid-September.

Emanuel, a former Clinton White House aide, is chairman of the Democratic Congressional

Campaign Committee and received much of the credit for the Democrats winning a majority in

the House of Representatives in 2006 – the first time in 12 years.

For his own 2006 re-election campaign, where he faced no serious opposition, Emanuel

raised $1.5 million from the investment industry. His other sources of contributions came

from

lawyers, who gave $682,900, while people working in the entertainment industries gave

$376,100.

(Source: http://www.cnsnews.com/public/Content/article.aspx?RsrcID=38963

)_

More on Geithner

"In March 2008, Mr. Geithner brokered the deal enabling JPMorgan Chase

to acquire Bear Stearns, with the crucial help of a $29 billion loan from the Fed.

At the

time, critics said that the terms of the deal were too generous, and that Mr. Geithner,

with no experience in private banking or finance, had been too reliant on Wall Street

leaders to show him the ropes.

Giving a trillion dollars will not save these banks. Their losses from falling

housing

prices could easily be tow or three trillion, says NYU Professor Nouriel Roubini.

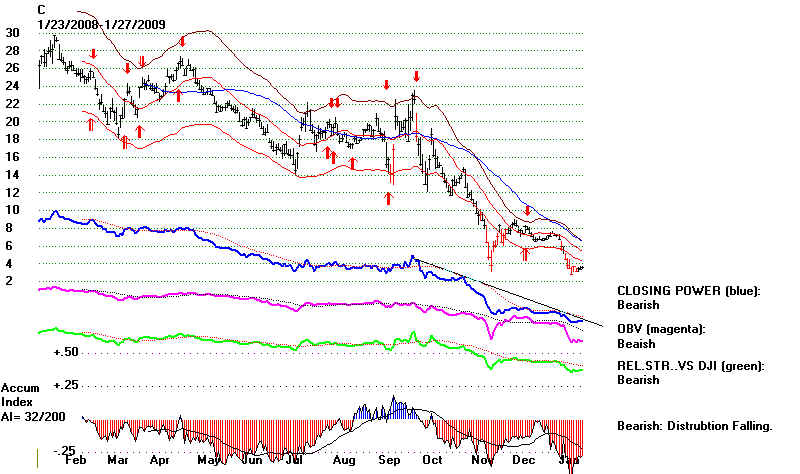

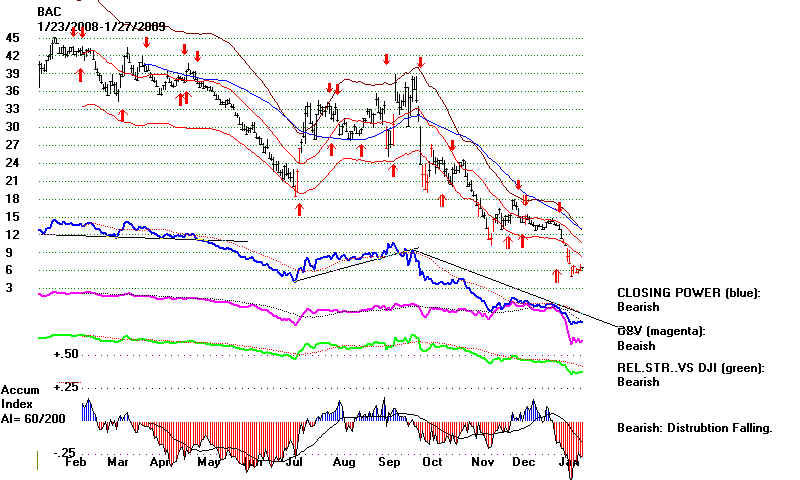

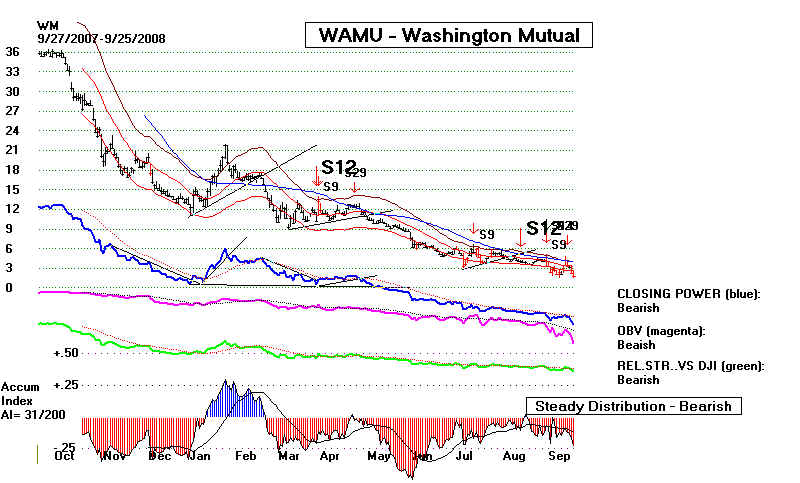

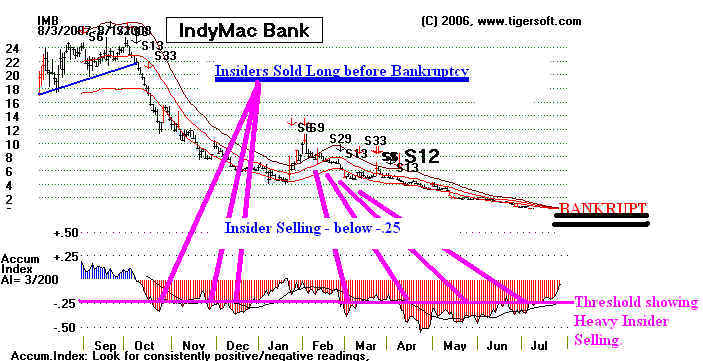

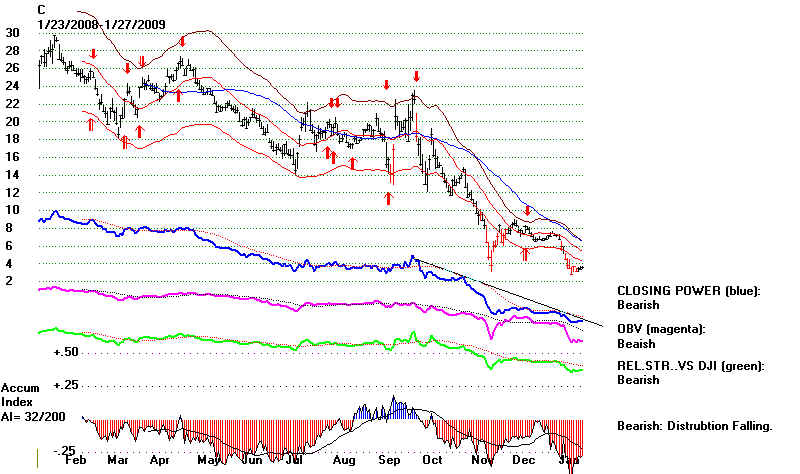

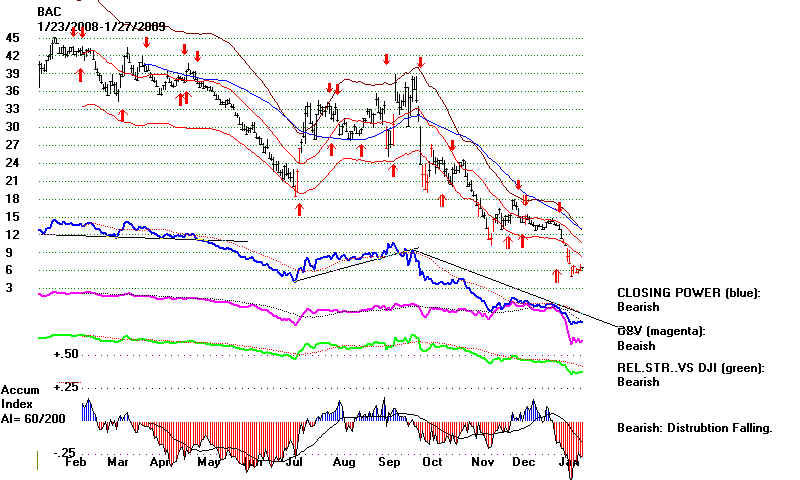

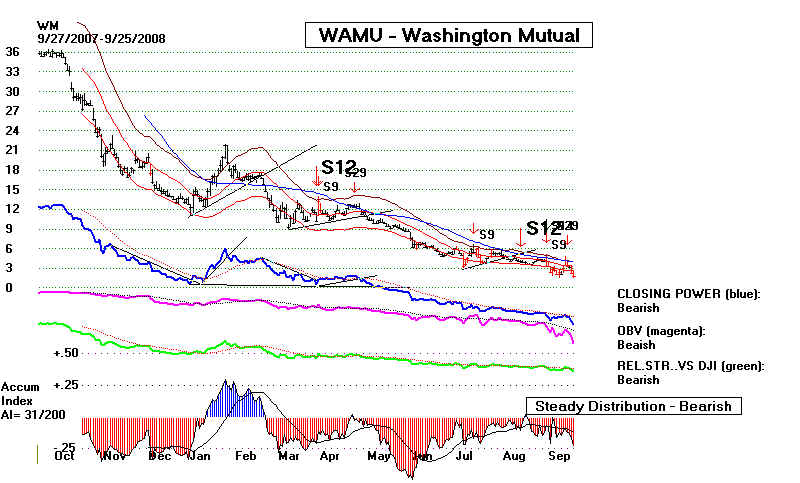

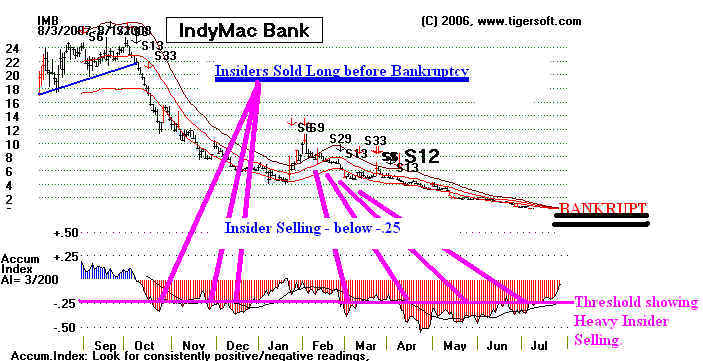

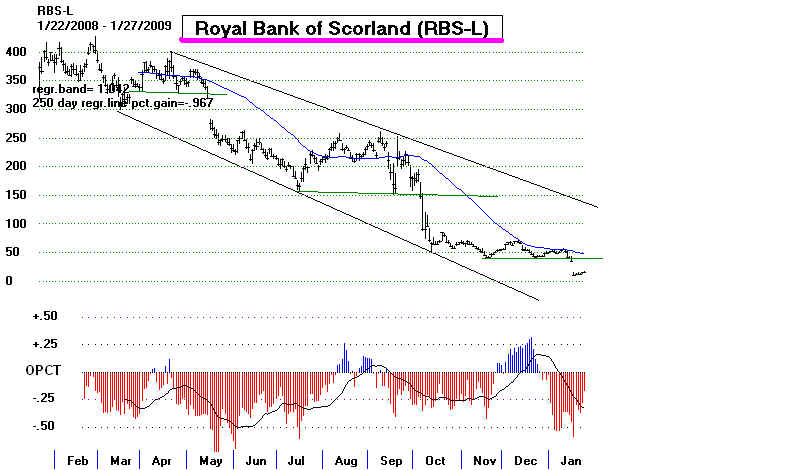

Compare the high Insider Selling (red Distribution) charts of

CitiGroup and

Bank of America with now defunct Washington Mutual or Indy Bank in the US

or the UK's nationalized Northern Rock or Bank of Scotland

CITIGROUP (C) - (C) 2009

www.tigersoft.com

BANK OF AMERICA (BAC) - (C) 2009

www.tigersoft.com

WASHINGTON MUTUAL (WM) - (C) 2009 www.tigersoft.com

TigerSoft's inventions, the "Accumulation Index" and

"Closing Power",

show you what insiders are doing with their own money. Forget

what they are saying, watch whether they are buying or selling, It

is vital to your investment survival that you understand the degree

to which the stock market is rigged by insiders and market professionals

against the unwary investor. Step

#1, memorize below what a stock

looks like on its way to bankruptcy. WAMU and IndyMac Bank illustrate

this. Google "TigerSoft"

"Bankruptcy" to see many other examples.

INDY BANK (INDY) - (C) 2009

www.tigersoft.com

|

CLOSING

POWER

CLOSING

POWER