TigerSoft Freedom News Service 12/25/2008 www.tigersoft.com

Dickens' Scrooge Has Nothing on

Greedy American Bankers.

Remember The Christmas Spirit - Read Dicken's Christmas Carol Again.

http://www.sew-custom-embroidery.com/images/bah%20humbug%20scrooge2.jpg

NO MORE MONEY FOR BIG BANKS

STOP THE WORLD'S BIGGEST HEIST!

PAULSON IS NOTHING MORE THAN A PIMP FOR

AMERICA's GREEDIEST CEOs.

TRUST GOLDMAN SACHS AT YOUR OWN RISK.

PAULSON AND HIS ILK HAVE ROBBED THE US TREASURY DRY!

CONGRESS, SHOULD GET THE MONEY BACK AND GIVE IT TO THE PEOPLE!

PAULSON HAS MADE THE PUBLIC HATE WALL STREET.

HOW DOES THAT HELP INVESTORS?

PUBLIC COMMENTS

Comments and Ideas from The American People that

you will not hear from Finance-Industry Dominated Congress.

Email me. Your comments will be posted here. william_schmidt@hotmail.com

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

---------------------------------------------------------------------

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

|

Tiger

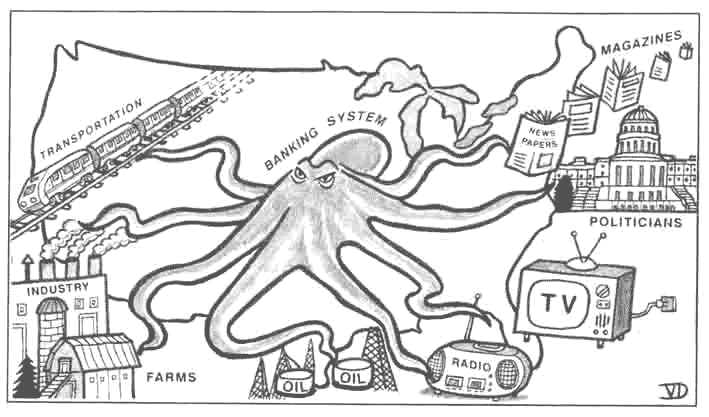

Software Helping Investors since 1981 More Oil

Profits' Cartoons.

|

http://michaeljournal.org/images/004--The-Big-Banker.jpg

NO MORE MONEY FOR BANKS!!!!

by William Schmidt, Ph.D

Months ago I said flatly that Paulson was a crook, that his emergency bank bailout plan

was designed to give his crony-bankers all the money still left in the US Treasury and that

this scheme was nothing more than a ruse to get at that money. That was the primary reason

he was in such a hurry and wanted "immunity" with no judicial or administrative second-guessing

about how he would give the money away. I also warned that the so-called "bailout" would not stop

the stock market from declining, because there were no guarantees that banks would even loan

the money. I warned that Fear Tactics like those used in getting the bailout were also used to

start the Iraq war blunder and they should not be trusted now. I noted that Paulson's nervous

blinking 2-3 times a second showed how nervous and unsure he was that he was being honest

and this bailout money would save the economy. I warned it might even be the ruin of

American credit.

Only a banker could trust another banker. Why give the money to the same corrupt

"no-goods" who made the current financial mess. These over-paid banking clods (How hard is it to

run a bank? How much incentive do they need? Where else could they get a job, given

their incompetence? All these bankers know how to really do is schmooze with politicians

to get zero regulations and government handouts. Too harsh? Hardly. These top bankers at

Citigroup, Bank of America and Goldman Sachs should be tried for insider trading, embezzlement

and abrogation of their responsibilities to shareholders. Paulson and the Fed's trillion dollar

giveaways should be stopped cold until the whole mess is investigated. If they refuse, put them

in jail for contempt of Congress and throw the key away! What I a saying here, millions of

Americans re also saying.

My earlier writing on this subject.

TigerSoft Blog - September 20, 2008 - Paulson Takes Corruption To New Highs...

TigerSoft News Service - 9/26/2008 - TigerSoft Warned Investors about Inside Selling by Bankers ...

TigerSoft Blog and News Service - 10/20/2008 - Goldman Sachs Foxes Robbing US Treasury Bare...

TigerSoft Blog - November 14, 2008 - The US Is Doomed with Paulson ...

TigerSoft Blog and News Service - Massive Insider Selling at Citigroup...

"Do I hate bankers? Not the honest ones that play by the rules. But then that eliminates the

Federal Reserve and 90% of all United States based banks." Source. I don't hate the ones that

are now serving French fries. None that I know are serving time. I am not alone here in

condemning Paulson and his thieving friends. Google altogether

"Paulson", "Corruption", "Bribes", "Cronyism" and "Scare tactics".

You would be dancing, too, if you were given $300 billion

with no strings attached. The game is MONOPOLY!

BANK CEOs STEAL MANY MILLION FOR

THEMSELVES

FROM AMERICAN TAXPAYERS!

Look at the pay and bonuses grabbed by CEOs at some of the banks getting billions

in public bailout money.

Richard D. Fairbank, the chairman of Capital One Financial Corp.,

took a $1 million hit in

compensation after his company had a disappointing year, but still got $17 million in

stock options.

Capital One got $3.56 billion in bailout money on Nov. 14.

_

John A. Thain, chief executive of Merrill Lynch, topped all

corporate bank bosses with $83 million

in earnings last year. Thain, a former chief operating officer for Goldman Sachs, came to Merrill Lynch

in December 2007, avoiding the blame for a year in which Merrill lost $7.8 billion. Since

he began

work late in the year, he earned $57,692 in salary, a $15 million signing bonus and an

additional $68 "

million in stock options. Like Goldman, Merrill tapped taxpayers for $10 billion on

Oct. 28.

At Bank of New York Mellon Corp., chief executive Robert P. Kelly's stipend for financial planning

services came to $66,748, on top of his $975,000 salary and $7.5 million bonus. His car

and driver

cost $178,879. Kelly also received $846,000 in relocation expenses, including help selling

his home

in Pittsburgh and purchasing one in Manhattan, the company said.

Goldman Sachs, paying as much as $233,000 for an

executive's car and driver, told its shareholders

that financial counseling and chauffeurs were needed so executives would have more time to

focus

on their jobs. If they can't focus on their jobs

for a fraction of what they are paid, fire them!

(Source.

)

Banking

Crooks, Like Insane Dictators, Must Be Stopped Early

or They Will Take Everything!

With the

nerve of an arrogant and manic pig, Paulson declared on December 19th

that he wants to give a new $350 Billion more to banks. Congress had previously

voted to let

the second half of the TARP $700 bailout be under the control of the new

Administration.

He seems not to have noticed that not one American consumer or homeowner has benefited

from the $330 given to bankers, so far. They are hoarding the money or giving to

themselves

as higher pay! The economy would be a lot stronger if the US Government had just

given

the $700 billion bailout, or $2300 to each American citizen on condition that they spend

the money

within 3 months!

Paulson

says he's already given "his" share of the bailout away and now wants control

of the second half now! "Financial market stability requires it", he

declares. Otherwise,

there may be a "significant

disruption to our economy". More FEAR TACTICS. Just

what the economy does not

need. No wonder the DJI has lost nearly 10% since he made

these remarks. He is

holding the US Economy ransom. Give me the money or I will

continue to scare the daylight out of

it.

He is saying, in effect, that the first $350 billion of

taxpayer money, was ineffective and now

the banks should be given more

money. But why should we think this additional money

will make any difference? Like

Bush, he always wrong. The first gift to the bankers did not

work. They did not lend the money. Why should we think they will now!

Is he crazy? Or does he know that Congress has been bought out by Big Banks and

this is a mere formality?

Did you note that the Democrats got most of Madoff's campaign

contributions. Goldman Sachs executives gave a million to Hillary Clinton and Obama

in 2008. However crazy or arrogant Paulson is. either way, he is

giving taxpayer money

to the very crooks that have caused the crisis. He is giving it to them when they

have

squandered the first $350 billion on executive bonuses, private air planes and buy-outs,

NOT extending much

needed credit! These are the very banks and CEOs that put their

own greed ahead of the

interests of shareholders and made foolish home loans without

bothering to consider what would

happen when the housing bubble broke!

Where Things Stand? The Deck Is Stacked in Favor of

The Banks/

What

A Surprise!?

The US Treasury under Paulson is obliged under terms of the $700 billion rescue fund that

Congress

approved on Oct 3, to submit a report to Congress detailing how it plans to use the

additional funds. Congress will likely cave in. After all, it is led by the

spineless Nancy

Pelosi ( "impeachment is off the table") and Harry, the weak, Reid (pronounced

like "reed", an

easily bent and twisted form of vegetation.). The money automatically will become

available

unless both houses of Congress pass legislation blocking the funds within 15 days of

receiving the

administration's report. And even then, the White Hoyse will cwerainly veto any

Cingressional

"no"

vote on the second part of the bailout, thereby making it available. Who created

this round-about

way

of gettign around the opposition to the bailout? Nancy Pelosi and Harry Reed run the

two

houses

of Congress/ So devious! No wonder Americans also hate Congress!

House Financial Services Committee Chairman Barney

Frank, D-Mass., says the administration

must allocate some of the new money for borrowers facing foreclosure, and impose more

conditions

to make sure banks actually use their rescue funds to increase lending. He promises

"They're not going

to get the (money) unless they get very serious about the foreclosure modifications and

showing us

how we're going to get some lending out of the banks."

MAKE THE BANKS GIVE THE MONEY BACK!

Paulson's and his cronies from Goldman Sachs, who now run

the government's TARP program,

have given the bailout money away with no strings. Worse, the banks were not even

obliged

to extend more credit. And still worse, they are not even required to declare what

they have

spent their money on! Instead, the receiving banks have given much of the TARP money

away

to their top executives as bonuses! For what? To show an unbridled arrogance!

And to show

that they run the show, not Congress!

Goldman Sachs Tower in Jersey City

Trading on Inside Information Is An Old Tradition at Goldman Sachs'

Trading on inside information, which is illegal, has made Goldman Sachs many hundreds

of millions over the years. No exaggeration. They distribute most of it to their top

executives.

That way, the illegal activities of Goldman Sachs are kept silent. Even so, every

now and then, one

of them gets caught. As a primary dealer in US Treasury securities, they frequently

facilitate US

Government's financing. As such, they are in a privileged position. Their

investment banking

division makes deals and has privileged information in the area of mergers and

acquisitions.

They launch public offering and they offer investment advise to wealthy individuals,

universities and other institutions. The opportunities to trade for their own

account

on inside information are enormous. How can they not make billions? They are

also

market makers in many of the securities of firms that come to them to buy another company

out, or that seek them to make a public offering, or to raise other forms of

financing.

And if these were not enough, they put out buy and sell recommendations for big clients

and have set up the industries' largest Hedge Funds to profit from falling markets.

Should they be trusted? Are you kidding? There are potential conflicts of interest

everywhere you look in these activities. And, showing how greedy they are, with all

these

existing advantages, rheir employees have frequently been found guilty of insider

trading.

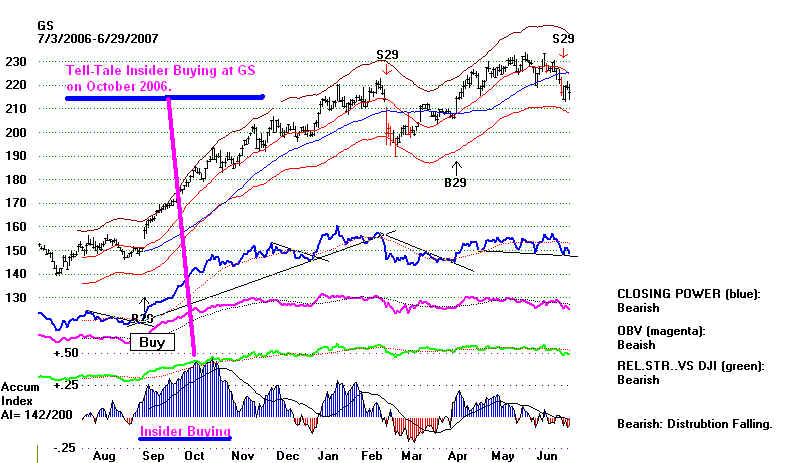

And their own stock frequently shows key, well-informed insider buying (2006) and insider

selling (end of 2007 and early 2008)

Insider Buying at GS

Goldman Sachs 2006-2007

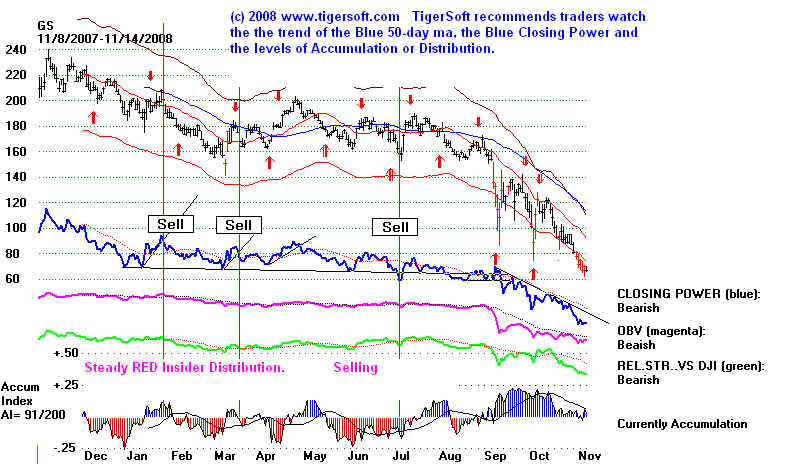

Insider Selling of GS stock

Gold Man Sachs 2008

Treasury Secretary Paulson, an ex CEO of Goldman Sachs, says that the bank is too

big to fail! If anything, they are too big to safely be allowed to continue.

Goldman Sachs was not to be trusted in 1970, when the Penn Central Railroad

went bankrupt. Goldman Sachs had sold over $80 million in its commercial paper and

was sued because it had not been sufficiently forthright regarding the risks. (Source. )

In 1986, "David Brown was

convicted of passing inside information to Ivan Boesky on a

takeover

deal.[35]

Robert

Freeman, who was a senior Partner, the (GS) Head of Risk Arbitrage, and a protégé of

Robert Rubin

and was also convicted of insider trading, with his own account and with the firms.[36

(Source.

)

In 2007, two Goldman traders, Michael Swenson and Josh Birnbaum, part of

Goldman's

structured

products group in New York, made a profit of $4bn by "betting" on a collapse

in the

sub-prime market, and shorting mortgage-related securities. Paulson, as

Treasury Secretary,

claimed until 2008 that the economy was basically sound! (Source. )

In November 11, 2008, the Los Angeles Times reported that Goldman Sachs, which earned

$25 M from underwriting California bonds, had advised other clients to "short"

those bonds. (Source. )

A US Treasury official in 2001, Peter Davis, pled guilty to giving a Goldman

Sachs employee, John Youngdahl, a lucrative heads-up, minutes before key news that

the US Treasury was going to stop selling 30-year bonds. (Source. )

In 2007, Eugene Plotkin, a bond analyst at Goldman, pled guilty to insider trading.

He recruited two workers at the plant where Business Week is printed to get advance

knowledge about the companies to be discussed each week. (Source. )

Another Goldman Sachs employee, David Pajcin who was sentenced to 5 years

in prison in 2007 for insider trading, but then fled the country. For 3 years he was

fed tips

illegally from a man who served on a New Jersey Grand jury in Bristol Myers securities. ( Source.

)

These last two Goldman Sachs employees are alleged to have made

$6.7

million from their illegal sales. (Source.

) One can only imagine how much money has made

because of its inside knowledge gained via its underwriting and institutional business.

The Paulson Credit Opportunities Find, a Goldman Sachs mortgage trading

firm. was up 410% as of August 2007. The people who ran this firm had been appointed

by the

Treasury Secretary. How much did their inside track with Paulson, the Treasury

Secretary

help. "Paulson has been among the most aggressive

hedge funds betting against the subprime

mortgage business, which caters to poorer borrowers with blemished credit records. As

delinquencies have increased and turmoil has spread across other parts of the credit

market,

some hedge funds have done well, while others have collapsed."

( Source.

)

BILLIONS IN BONUSES FOR THE GREEDIEST CEOs!

Wall Street CEOs put pigs to shame. Their bonuses are obscenely, contemptuously

high.

The regal world they live in is profoundly in conflict with a democratic society.

They are

indirectly stealing money from those that cannot afford food, medicine or shelter.

On this

Christmas day, they should be put in prison and made to listen to Dickens' A Christmas

Carol.

They are the Scrooges of our age. Dickens wrote:

"He was a tight-fisted hand at the grindstone, Scrooge! a squeezing, wrenching,

grasping,

scraping, clutching, covetous, old sinner! Hard and sharp as flint, from which no steel

has

ever struck out generous fire; secret, and self-contained, and solitary as an

oyster."

Regarding bonuses, in 2005, an observer wrote "Starting

sometime after Labor Day and

ending before Christmas, everybody in the financial industry is on their best, most

obsequious

behavior, hoping to curry the favor of those who divvy up the spoils. And what spoils

there are

this year—the 2005 bonus season looks to be Wall Street’s biggest haul in five

years. Last year,

the New York State Comptroller’s office estimated the average bonus on Wall Street to

be a

clean $100,600 (or $15.9 billion split among 158,000 employees). Early estimates of the

2005

bonus pool reach as high as $19 billion. " In

2005, Goldman Sachs set aside $9.25 BILLION for

bonuses, or if distributed equally (which they definitely not) that would be $420,000 per

employee.

(Source )

In 2007, Goldman Sachs recorded its highest ever revenue and earnings. It paid its

CEO

Lloyd C. Blankfein, $68.7 million - the most ever for a Wall Street C.E.O. ( Source.

)

In 2006, he received $53.4 million, including a clash bonus of $27.3 million. (Blankfein

has

contributed at least $7000 to Democratic Party candidate Hillary

Rodham Clinton in 2008.[4]

)

In 2007, the top five executives at Goldman received a total of $242

million. This year, Goldman's

seven top-paid executives will work for their base salaries of $600,000, with no stock or

cash bonuses.

| GOLDMAN SACHS CEO HAS BEEN

PAID $150 MILLION in BONUSES and PAY SINCE 2006. Look at the expensive Hollywood teeth!  CEO Lloyd C. Blankfein gave $7000 to Hillary Clinton. Don't expect the Democrats to regulate CEO pay or limit bonuses. |

THE PUBLIC NOW HATES WALL STREET OUTRAGE AT OBSCENELY HIGH CEO PAY IS REACHING FEVER PITCH! "Some New York City politicians are

outraged by these stupendous bonus payments |

Disillusionment with Wall Street  "As I was taught in junior high school, Wall Street is America’s capital source: the money raised on Wall Street helps for companies and fuels their growth and expansion while they provide goods and services to the people of the world. I was also taught that the markets were self-regulating and that supply and demand was the operative principle. If nobody purchased your products or services, you went out of business, innovated other solutions, penetrated other markets – and moved forward in a positive manner. "The reality … At the time, I did not even consider that the markets could be rigged or that the market could be manipulated with disastrous consequences.... But what makes me really mad is … Wall Street’s attitude that decent companies who (sic) are associated with problematical industries can be artificially manipulated (and sold short) to the point where their survival is questionable... (Consider the harm to a ) "company struggling to survive amid a catastrophe not of its making. Employees dependent upon their paychecks, insurance and retirement benefits. All placed at risk so the Wall Street Wizards who produce nothing can line their pockets. And I am not talking about the individual investor … I am speaking about the middleman: the person who takes a chunk of change for buying and selling stocks, bonds and commodities. Chaos and confusion are their friends as it maximizes both buying and selling opportunities....These are the slimeballs that caused the current crisis with their artificially engineered financial products which they assured everybody were of investment grade with iron-clad risk management built in. They kept talking and collecting their bonuses right through the crash. " Source. More comments. The man is correct. Short selling is very destructive to Main Street. And derivative vehicles channels investment money into the biggest companies, encouraging monopolies. And it causes the tail to wag the dog. Derivatives caused the crash in 1987. And leveraged short sale vehicles are destroying the US economy now. When I started TigerSoft in 1981, there were none of these derivative vehicles and short selling was strictly limited. Stock has to first be borrowed and all short sales had to be done on up ticks or zero-plus ticks. The distance Wall Street has fallen in public esteem is directly related to its power over government. De-regulation is wrong. "Freedom for the pike is death for the minnows". |

AMERICANS TELL CONGRESS TO SAY "NO AND INVESTIGATE THE USE OF THE MONEY THAT BEEN GIVEN AWAY! It's easy to see on the internet or talking to people, just how hostile they are to Paulson and the bailout so far. These are quotes from the Huffington Post. We can mainly blame the members of Congress (on both sides) who gave Paulson and pals the absolute powers he now has, but who now lamely complain and wag their fingers meekly, saying "Whillikers, Mr. Paulson--I'm miffed! (but I'm not going to do anything about it)." Since there's practically no accounting for

the money Paulson is getting, maybe we should get a look inside his wallet He might get it even though it is pure looting. Pelosi and friends have an opportunity

to show they are different than There are a lot more opinions like this at: |

ferraye.blogspot.com/

ferraye.blogspot.com/