BAC, The Bank That Stank And Sank The Whole Market

What will the market do if the US

Government must nationalize (buy out a majority

of the stock in) BAC? Socialism for the non-rich scares Wall Street to its

core. But

what will the market do if the Government just allows BAC to go out of business?

Also very bad. Today the DJI dropped below 8000. Perhaps, it will

recover from 7500

like it did 7 weeks ago. But what if it does not? There's very little support below 7500

until the DJI is down to 6000. Obama may wish he had lost the Election!

Bank of America

(BAC) has an estimated 24.6 million on-line customers. The

next biggest bank, measured this way, is Chase/Morgan/Wamu with 21.4 million.

Wells Fargo/Wachovia with 17 million is next. Only the government can

save

BAC. No other entity is big enough.

As losses mount at CitiGroup and Bank of America, it becomes more and

more mathematically impossible to inject enough capital into these banks without

taking a majority stake. Obama has said he wants the banks to not pay dividends

and give executives big bonuses. He has said he wants the banks to start making

loans with the money they are given. For the Government simply to buy all

the worthless and defaulting mortgages does not hold the banks accountable

for their misguided, bad loans. It will be a lot easier to accomplish these

goals

if the government runs these banks directly. At least, then it will start to

understand

the ways banks have concealed their worthless loans and wasted millions on

executive perks. Ownership bestows managerial control. That is the only way

way the government can start taking steps to advance credit again, something

which the biggest banks are unwilling to do and can get the banks to stop paying

unworthy executives ridiculous and wasteful sums for imprudent decisions.

The Stock Market and The Economy

Must Not Be Dependent on Banks Like BAC and CitGroup

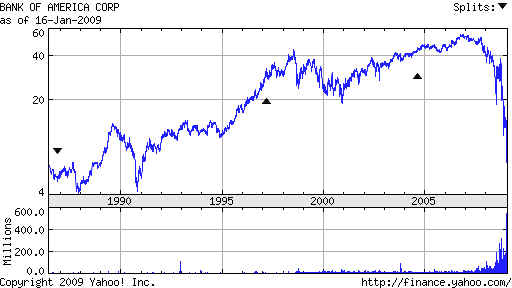

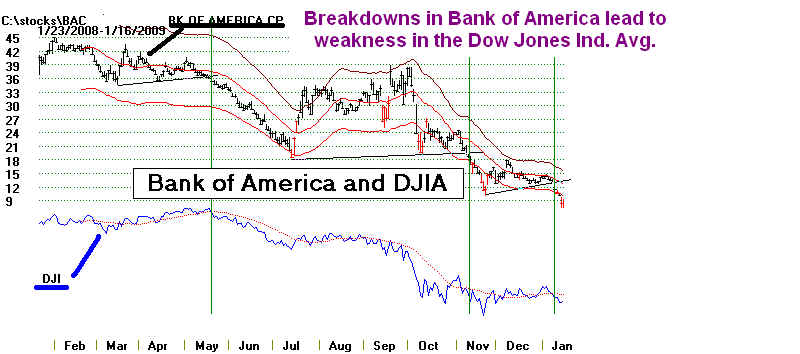

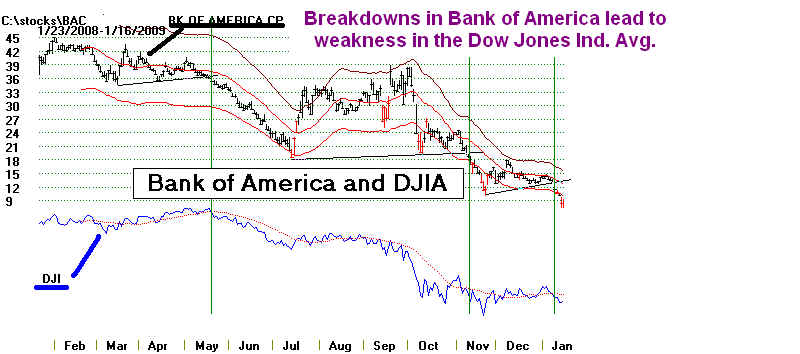

Bank of America's stock has led the US

Stock market down. It's price

breakdown last May began the long 2008-2009 slide in equities in the US and

around the world. The company is too big to have this power. And it is too

badly run to be allowed to exist under its present management. Its CEO

has almost single-handedly destroyed a company that had previously withstood the

the turmoil of the 1970s, the Crash of 1987, the Bush bear market of 2001-2003...

Insiders at BAC have been dumping the stock since early 2007. They still are.

Should Obama bail out a bank whose stock is being heavily sold by its own

Board of Directors? BAC, as presently run, is a public menace. Its

overpaid

CEO, Ken Lewis, has made one terrible decision after another. BAC now poses a clear

and present danger to the global market and certainly the US economy. What will

Obama do about its impending insolvency?

News - 1/21/2008 - BAC Board fo Directors heard this

criticism. Today it is

reported that they bought 200,000 shares. We will report the facts here as

they emerge. That's a start! But just one director, John Thain, sold

93,374

on 1/9/2009 for 13.56. Thain has just resigned in scandal form BAC.

He spent

more

than a million in the last month decorating his Merrill Lynch office and

quickly

dishing out millions in bonuses (for what?) in the days right before

BAC

took over. Conveniently, BAC's CEO, Ken Lewis, looked the other way,

making

American taxpayers pick up the tab. Lewis clearly worked in connivance

with

John Thain! Sources: (1)

(2)

Bank of America will be the first test for the new Obama administration. Waffling

and lofty words will not solve the problem it poses.

BAC and DJIA - 2007-2008

BANK OF AMERICA'S COLLAPSE ACCELERATES

BAC closed at 5.10 today, down 2.08 and 29% in just one day!

"Effectively

Insolvent"

"Effectively

Insolvent"

NYU Professor, Nouriel Roubini, said today that "I’ve found that

credit losses

could peak at a level of $3.6 trillion for U.S. institutions, half of them by banks and

broker dealers..

If that’s true, it means the U.S. banking system is effectively insolvent because it

starts with a capital

of $1.4 trillion. This is a systemic banking crisis.” At least another trillion

dollars more in public

funds will be needed to shore up the banks." (Source.) Roubini has had a remarkably

accurate crystal ball since late 2006 when he warned the IMF that a financial meltdown

would follow the burting of the housing bubble.

FDIC's Sheila Blair's Rejects Robini's Fears.

FDIC's Sheila Blair's Rejects Robini's Fears.

"Banks have some real challenges," Bair said during a CNBC

interview. "But I think it needs

to be emphasized and re-emphasized these banks are solvent, they're well-capitalized

overwhelmingly,

and that really is what creditors and depositors seem to be focusing on right now."

Though she did

acknowledge problems. She said 98 percent of all banks are well-capitalized, representing

99 percent

of all assets. My sense is

that she has a static view. She is assuming that

housing turns around immediately and does not keep falling. Unfortunately,

housing prices are still falling and confidence is still worsening. That will

make the "troubled assets", i.e. bad mortgage loans increase and worsen.

Home Builder Sentiment

Continues to Erode

"The National Association of Home Builders said its preliminary

NAHB/Wells Fargo Housing

Market Index was 8 in January, down from 9 in December. That is the lowest level on record

since

the gauge was launched in January 1985. Readings

below 50 indicate more builders view market

conditions as poor than favorable. The January index was below expectations of 9, based on

a

Reuters survey of economists... " See also - http://www.iasreo.com/ias360update.html

Google your community and housing prices. Here is what I found for San Diego.

Home prices down

26.7% from year ago

A TARP BY ANY NAME IS STILL A

BANK BAILOUT!

Blair is a proponent of the idea wherein a US government Aggregate Bank would

"buy the (delinquent or foreclosed mortgage, which - my question)) assets at fair

value. Some are

concerned that you’d have to mark the assets down to purchase them, but I think it

could help

provide some rational pricing, actually, for the market in some of these assets because we

don’t have

really any rational pricing right now for some of these asset categories...

"The idea would be to set up a facility, it could be structured as a bank, to

capitalize it with

some portion of the TARP funds. Financial institutions that wanted to sell assets into the

bank

could also perhaps take part of their payment as an equity interest in the aggregator bank

to

provide an additional cushion. If you sold $1 of assets into the bank, you would get 80

cents in

cash and you would get 20 cents in an equity interest in the bank. So that would be an

additional

cushion against loss."

(Source)

My reaction to this idea is very negative. It takes banks off the hook for

their bad decisions. It lets them sell their worst loans to the taxpayer. Many

of these mortgage loans are worthless. Why is no one looking at how other

countries have dealt with bad banks? Because nationalziation smacks of

socialism for the non-rich! A national bank, like Andrew Jackson wanted,

would make loans now and not pay ridiculously high salaries to the arrogant

idiots who got us in this mess!

The Massive Insider Selling Suggests Roubini Is Correct

Nothing in the TigerSoft charts of Bank America show a bottom now,

unless you believe that trading volume has risen to panic levels and the new Obama

Administration will protect it with $80 billion more in taxpayer handouts. That's

probably what it will take to bring its cash levels up to the levels needed to

permit it to keep operating as a bank.

Will Obama see that Bank of America is too big? It now has 243,000

employees. Its vastly over-paid executives have a long history of truly

terrible decisions, from "zero-down" home loans for anyone willing to lie about

their incomes, to buying mortgage-giant Country Wide exactly at the worst possible

time and then buying Merrill Lynch also at the worst possible time. Its executives

are not prudent bankers. They are reckless gamblers, rolling dice with shareholders'

and now tax-payers' money.

Can BAC's CEO be trusted? Paulson thought he had a deal and that

US banks would start lending the $300 billion the Government gave them last year.

They did not. Recently, BAC bought out Merrill Lynch. BAC's CEO

Ken Lewis

"knew of (Merrill's) massive losses before the deal closed and

declined to

inform Bank of America shareholders. Merrill recorded an operating loss of $21.5 billion

in the Q4 2008, requiring an additional $20 billion cash infusion from the U.S.

government,

bringing the government's total investment to $45 billion."

Clearly BAC's CEO did not dilligently

examine Merrill's books in the weekend of Sept.

13-14, 2008 when the BAC-MER deal was made or in the following 3 months before

BAC shareholders voted to accept Lewis's deal on December 5. (Source.)

Leadership like Ken Lewis has shown is dangerously reckless. But BAC's

Board of Directors fawn all over him and paid him about $43 million in 2006 and 2007.

An honorable man would resign. He may be certifiable. Insiders close to BAC's

bossman write: "Senior management is arrogant. Ken Lewis runs

this place as if it were his personal

empire instead of a shareholder-owned company that is successful because of its employees

and not his

"leadership". Many of us own stock in the company, and his personal hunger for

Merrill-Lynch caused him

to pay far too much for it. That has hurt our stock...Ken Lewis should resign...More often

than not, people

get to those positions more through the "good ole boy" method than by talent and

hard work. There are a

lot of people out there who could do Ken Lewis' job for far less money and do it more

effectively". (Source.)

Ken Lewis, of course, is not the only

CEO in America who runs his company

like a medeival fiefdoms, where the king owns everything and everybody and can

do no wrong. His predecessor at Country Wide. Angelo Mozilo took $470 million in

"compensation" from that company while ruining it. "His

compensation also includes payment

of his annual country club dues at Sherwood Country Club in Thousand Oaks, CA, The Quarry

at La Quinta

golf club in La Quinta, CA and Robert Trent Jones Golf Club in Gainesville, VA... Shortly

after (the)

University of San Diego (a private Catholic school) invited Mozilo to be the keynote

speaker at a conference

for "a sustainable real estate" DisinviteMozilo.com was created in

protest on January 10, 2008. Mozilo pulled

out six days later. Shortly after that, Congress invited Mozilo to (justify)... his

compensation....Over many years,

Mozilo sold hundreds of millions of dollars in stock personally, even while publicly

touting the stock and

using shareholder funds to buy back stock to support the share price."

UNBRIDLED GREED AT BAC

UNBRIDLED GREED AT BAC

Despite BAC's getting $25 billion in taxpayer

bailout, Bank of America would

not lend Republic Windows and Doors the money it need to continue. That caused

the Chicago company to halt operations and terminate its 250 workers with only

three days. That spawned a successful workers' in Chicago, a lot of bad publicity

and even Obama intruded on the side of the workers. BAC eventually relented.

( Source.

)

"Over the past couple of months I missed a couple of payments on my Bank of America card.

I was out of town for some of the time and just forgot to make a payment. They put my

interest rate at

10 times what it had been before. I pointed out that I had sent them 600.00 all of my fees

and penalties

but informed them that i would not be able to pay the higher interest rate which is now

30%. They refused

and closed my credit card hurting my credit but keeping the new 30% interest fee intact. Bank of America

has little mercy or patience for their customers and they are burying people like me and

at the same time

getting massive government welfare. Obviously Bank of America is a dark

enterprise whose ambition

for money and power has created a significant negative influence on the lives hundreds of

thousands

of people. I do not know what can be done about them But I do wish that something is done

change

this company into something much worthy of its name. "

( http://baselinescenario.com/2009/01/16/bank-of-america-gets-quite-a-deal/

_

Obama's Speech at his inauguration gave few

clues what he will do. Obama's Speech at his inauguration gave few

clues what he will do.

"Our economy is badly weakened, a

consequence of greed and irresponsibility on the part of

some, but also our collective failure to make hard choices and prepare the nation for a

new age.

Homes have been lost; jobs shed; businesses shuttered."

HEAVY INSIDER SELLING AT BAC CONTINUES

The Yahoo table below shows that official insiders at BAC sold 4.5 times

more shares than they bought in the last six months, despite the much lower

stock prices. TigerSoft charts show that their friends at institutions continue to

sell

heavily. This raises a question of confidence. Why should the taxpayer

bailout

a company run by executives who themseves show no confidence?

| NET SHARE PURCHASE ACTIVITY |

| Insider Purchases - Last 6 Months |

|

Shares |

Trans |

| Purchases |

6,728 |

3 |

| Sales |

31,629 |

2 |

Net Shares Purchased

(Sold) |

(24,901) |

5 |

| Total Insider Shares Held |

28.05M |

N/A |

% Net Shares Purchased

(Sold) |

(0.1%) |

N/A |

|

( http://finance.yahoo.com/q/it?s=BAC )

Traders are betting there will be no bailout for Bank of America to save shareholders.

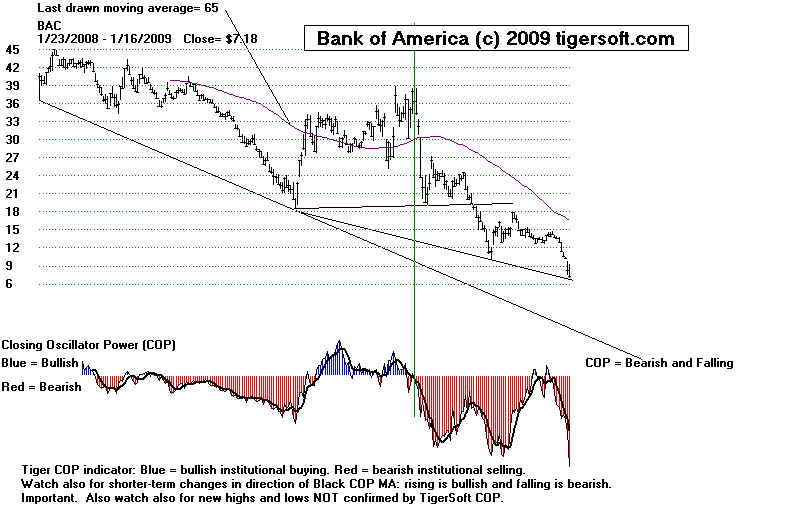

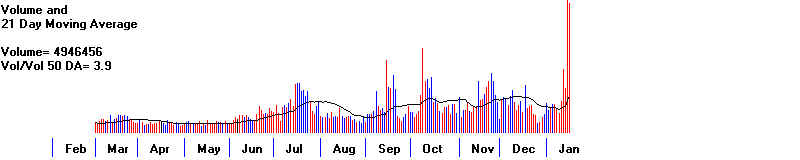

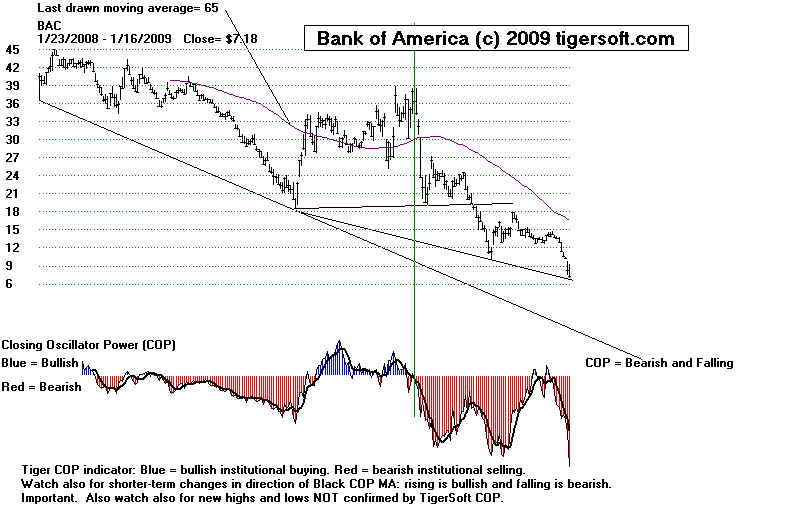

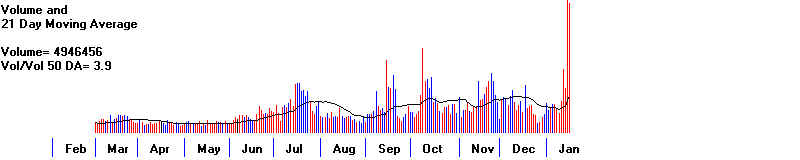

BAC remains on a TigerSoft Sell. These automatic trading signals have been

nearly

perfect except when a Buy arrow flashes right after the price breakdowns April and

and November. (In this technical situation, we have long advised not using the

Buy arrows.

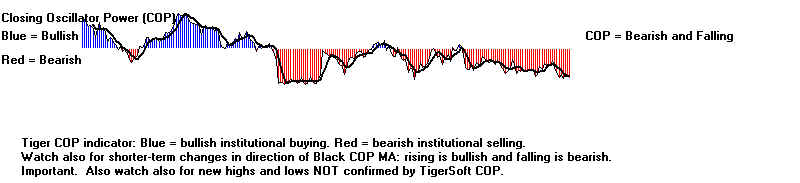

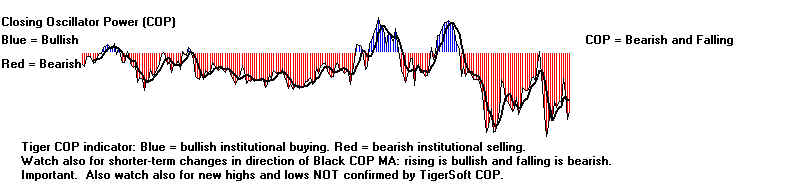

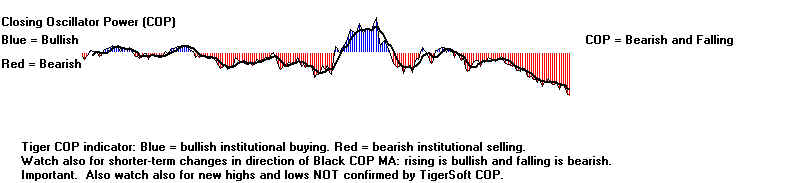

The Blue TigerSoft Closing Power is declining steeply. The magenta OBV Line has

bearishly made a confirming new lows. The green relative strength line is also

confirming the new lows. The COP indicators is in bearish red territory and its

black ma is in a free fall.

|

"Effectively

Insolvent"

"Effectively

Insolvent" FDIC's Sheila Blair's Rejects Robini's Fears.

FDIC's Sheila Blair's Rejects Robini's Fears.

UNBRIDLED GREED AT BAC

UNBRIDLED GREED AT BAC Obama's Speech at his inauguration gave few

clues what he will do.

Obama's Speech at his inauguration gave few

clues what he will do.