Should We Trust Paulson and

His

Goldman Sachs Cronies

To Administer The $700 Billion Bailout

by William Schmidt,

Ph.D.

(C) 2008 www.tigersoft.com

Right away, something stinks in the

administration

of the bailout. We are told that all the biggest banks are to get

$25 billion, whether they need it or not, to conceal the identity

of the banks that need capital the most. Bank of America

insists it does not need the money. But it will get the $25 billion

anyway.

This means that $80.00 will come out of the pocket of

every living American and will go to Bank of America alone,

no matter that the country is in recession and many ordinary

people would could really use the $80 much better, for food,

needed medicine, a doctor's visit, a new tire...

Paulson is crazy! If they don't even need the money,

don't give it to them. He is just being palsy-walsy with his buds

at our expense.

US Treasury faces, from

left: Steve Shafran (formerly of Goldman),

Kendrick Wilson III (ditto), Henry Paulson Jr. (you guessed it), Edward Forst (yep)

and Neel Kashkari (right again!)

Paulson Helped Create The Mess!

Why Should We Trust Him?

Paulson's lobbied repeatedly from 2000 to 2004 for

increasing

the allowable leverage that hedge funds could

use.

He got a special exemption for Goldman Sachs in

that

allowed them and other investment bankers to give

hedge funds

significantly higher leverage. His victory

won Wall

Street huge profits, but it lost the American people

TRILLIONs

when hedge funds went BUST in the Fall of 2008

and they

rushed to "deleverage".

Paulson is man used to getting his

way. Arrogant men

don't

quickly admit their shortcomings or the limits of

what they

know. As US Treasury Secretary, repeatedly denied

that there

could be a financial melt-down and a recession.

January 8,

2008. No recession is in sight.

February 14, 2008 - "Rate cuts and rebates should

keep the economy out of recession."

(1) Others

knew better. (2) "Bull

Shit"

August

16, 2008 "A recession is preventable"

"In Paulson's eyes there isn't much more that the U.S.

government can do to help the economy and stock market."

Not one to take responsibility for himself, Paulson said

on September 23rd

that Congress would be to blame for the

recession if they did

not pass the $700 billion bankers' bailout .

Wall Street's

Pimp

Look at what Paulson originally sought to get from Congress.

- Advisers from Wall Street to be retained to decide who gets what.

"Huh?

Let the architects of this mess figure out how to fix it?

Really, I think it just means they get to figure out how to best enrich themselves."

- No limits for executive compensation.

- No equity share for the government. "If

the government is going to bail these guys out, there

should be at least some sort of way for the government to recover something."

- Decisions not reviewable. Unbelievable! One guy gets the

final say??!

He wants a dictatorship, not responsible government. Congress better wake up!

- Protections from lawsuits. "Everyone

involved cannot be held accountable for the results of the outcomes from whatever action

is taken. Sounds like what is happening now. Great risks taken, but accountability is

limited and the losses are socialized and spread amongst even the innocent."

Freedom for the Pike is Death for the Minnows.

He refused to urge tighter regulations of commodity hedge

funds, to

seek a limit on the size of their positions in individual

commodities, to require that hedge funds' short positions

be a matter

of public record. He would not support an increase

in margin

requirements to curb dangerous speculation in

Gold,

Silver, Platinum, Wheat, Corn, Rice, etc. - all the

commodities

that boomed and went bust recently.

His

solution for the collapse of banks' stocks is to

bail them

out with $700 billion. And his office will

administer the largesse to his cronies. But accountability

is

limited to what he chooses to tell the public.

So, who

has Paulson hired to give the $700 billion away?

How

did you know. Lots of Goldman Sachs cronies!

GOLDMAN SACHS CRONYISM

From the NY Times - 10/17/2008

"(E)arlier

this month, when Mr. Paulson needed someone to oversee the government’s

proposed $700 billion bailout fund,

he again recruited someone with a Goldman pedigree,

giving the post to a

35-year-old former investment banker who, before coming to the Treasury

Department, had little

background in housing finance. Indeed, Goldman’s presence in the

department and around the

federal response to the financial crisis is so ubiquitous that

other

bankers and competitors

have given the star-studded firm a new nickname: Government Sachs.

"The

power and influence that Goldman wields at the nexus of politics and finance is no

accident. Long regarded

as the savviest and most admired firm among the ranks — now

decimated — of

Wall Street investment banks, it has a history and culture of encouraging its

partners to take

leadership roles in public service.

"It is

a widely held view within the bank that no matter how much money you pile up,

you are not a true

Goldman star until you make your mark in the political sphere. While Goldman

sees this as little

more than giving back to the financial world, outside executives and analysts wonder

about potential

conflicts of interest presented by the firm’s unique perch. They note

that the decisions

that Mr. Paulson and

other Goldman alumni make at Treasury directly affect the firm’s own

fortunes. They also

question why Goldman, which with other firms may have helped fuel the

financial crisis

through the use of exotic securities, has such a strong hand in trying to resolve

the problem. The

very scale of the financial calamity and the historic government response to it have

spawned a host of other

questions about Goldman’s role.

"Analysts

wonder why Mr. Paulson hasn’t hired more individuals from other banks to limit the

appearance that the

Treasury Department has become a de facto Goldman division. Others ask

whose interests Mr.

Paulson and his coterie of former Goldman executives have in mind: those

overseeing tottering

financial services firms, or average homeowners squeezed by the crisis?

Still others question

whether Goldman alumni leading the federal bailout have the breadth and

depth of experience

needed to tackle financial problems of such complexity — and whether Mr. "

Paulson has cast his

net widely enough to ensure that innovative responses are pursued.

“He’s

brought on people who have the same life experiences and ideologies as he does,” said

William K. Black,

an associate professor of law and economics at the University of Missouri and

counsel to the

Federal Home Loan Bank Board during the savings and loan crisis of

the 1980s.

“These

people were trained by Paulson, evaluated by Paulson so their mind-set is not just shaped

in

generalized group think — it’s specific Paulson group think.”...

"MR. PAULSON himself landed atop Treasury because of a Goldman tie. Joshua B. Bolten,

a

former Goldman executive and President Bush’s chief of staff, helped recruit him to

the post in 2006.

(Source

of this quote - NY Times 10/17/2008 )

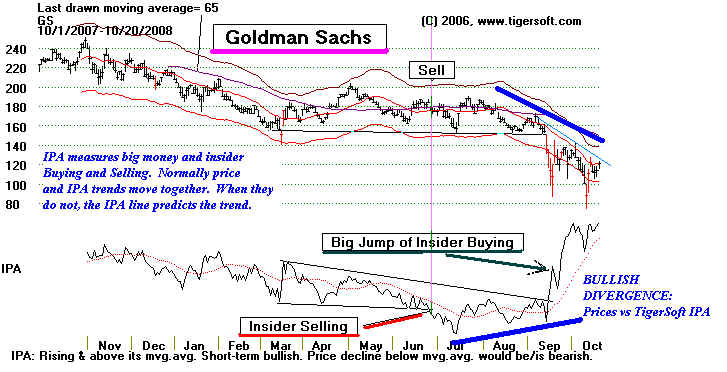

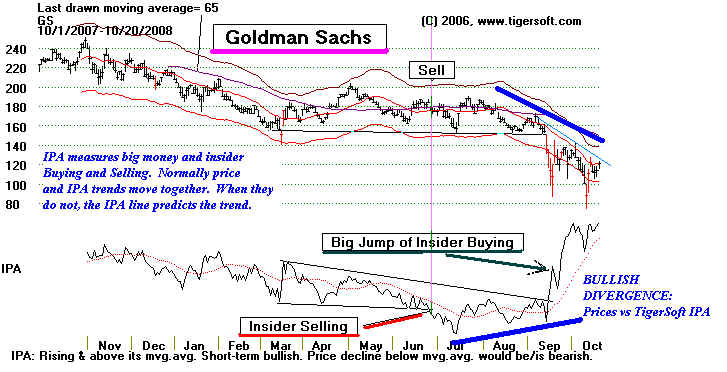

Insiders Are Now Buying Goldman Sachs

Not surprisingly, its people now run

the country's finances from

Washington as well as from Wall Street

WHAT's GOOD FOR GOLDMAN IS NOT GOOD FOR THE US

I remember that Henry Ford, besides saying "history

was bunk", is famous saying that "what is good for Ford

is good for the US". Ford and GM are Main Street America.

So, as long as wages were good there, the statement

had appeal. But, I seriously doubt that what's good for

Goldman is good for America. We do NOT need more

Wall Street billionaires. WE do NOT need more exotic

derivatives. We do NOT need more leverage for hedge funds.

We do NOT need de-regulation and laissez-faire on Wall Street.

Just the opposite.

The bailout and its administration are the height of

arrogance, cronyism, elitism. Plutocracy runs the US.

We cannot be cynical enough. And the precedent is

horrendous. The foxes should not run the hen house.

And they certainly should be NOT be given a trillion dollars

when Main Street is hurting this much.

Paulson was not elected to any position, anywhere.

Yet he and the Federal Reserve will be giving away

the equivalent to 1/12th of the nation's entire annual

goods and services with only such accountability as

he chooses to offer. The Congresspersons who voted

for this abandonment of democracy and accountability

do not deserve re-election.

Not surprisingly, reactions are very negative in many

quarters.

From Yahoo - 10/20/2008

"Many

issues about the rescue plan and the economy remain unanswered, but a more

fundamental question remains: Are the Fed chairman and Treasury secretary up to the job?

A resounding "no" is the answer from Christopher Whalen, managing director at Institutional Risk

Analytics, who is

particularly critical of Paulson. The Treasury secretary is "grotesquely

conflicted"

in his efforts to bail out his former employer, as detailed

here, and has found "common cause" with

an overly lenient Fed chairman. "They have a bias to preserve the

derivatives market" --

the riskiest part of Wall Street, Whalen says, noting the government let Lehman and Bear

fail

but bailed

out AIG and (according to Whalen) rescued Goldman Sachs and Morgan --

at least for the time being."

( http://finance.yahoo.com/tech-ticker/Newsmakers

)

All this publicity of the political and financial power is surey helping

Goldman Sachs' stock.

|

TigerSoft

News Service 10/20/2008 www.tigersoft.com

TigerSoft

News Service 10/20/2008 www.tigersoft.com