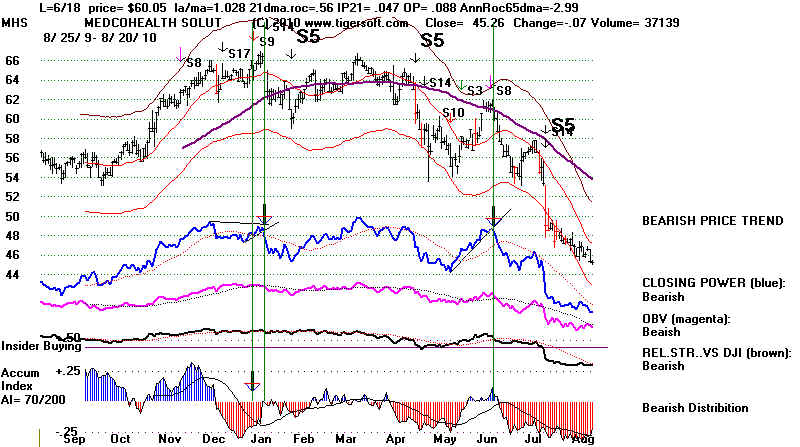

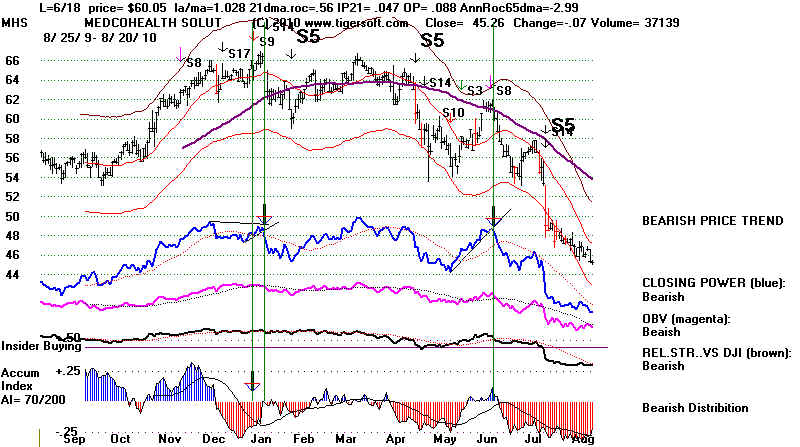

MHS

MedcoHealth Solutions Inc.

Medco Health Solutions, Inc., a healthcare company, provides clinically driven pharmacy

services for private and public employers, health plans, labor unions, government

agencies, and individuals in the United States and internationally. Customers

do not like them. Cramer

misleads viewers.

Shareholders

are being destroyed by mediocrs management get too many shares through options.

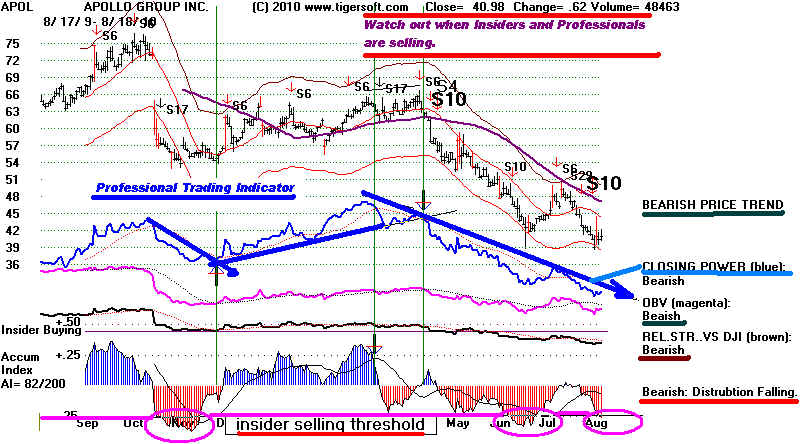

INSIDERs SOLD more than $48 million worth of MHS from November

2009 to May 2010.

Why would they do this so unanimously and still

try to talk up their stock by promising

shareholders buy back programs and 17%-21%

growth. The chart shows massive dumping

by institutions and professionals. What

bad news is management keeping to itself while

they dump shares on the naive public? If

you know, contact us. Be a whistleblower!Wednesday, 12 May 2010 10:20am

EDT

Medco Health Solutions, Inc. announced that continues to expect GAAP earnings per share

(EPS) growth

of 17%-21% in fiscal 2010. The Company reported EPS of $2.83 in fiscal 2009. According to

Reuters Estimates,

analysts on an average are expecting the Company to report EPS of $3.36 for fiscal 2010.

SELL

Insiders reported selling $46 million worth of MHS in last 11 months.

| May 25, 2010 |

EPSTEIN ROBERT SOfficer |

16,089 |

Direct |

Disposition (Non Open Market) at $55.10 per share. |

$886,503 |

| May 25, 2010 |

CASSIS JOHN LDirector |

1,400 |

Direct |

Sale at $55 per share. |

$77,000 |

| May 3, 2010 |

SMITH JACK ALLENOfficer |

7,813 |

Direct |

Disposition (Non Open Market) at $58.92 per share. |

$460,341 |

| Mar 18, 2010 |

WENTWORTH TIMOTHY COfficer |

14,678 |

Direct |

Automatic Sale at $65 per share. |

$954,070 |

| Mar 11, 2010 |

GRIFFIN BRIAN TOfficer |

12,081 |

Direct |

Automatic Sale at $64 per share. |

$773,184 |

| Mar 4, 2010 |

PRINCIVALLE KARINOfficer |

8,835 |

Direct |

Automatic Sale at $62.90 per share. |

$555,721 |

| Mar 1, 2010 |

CAPPUCCI GABRIEL R.Officer |

12,136 |

Direct |

Automatic Sale at $63.03 - $63.23 per share. |

$766,0002 |

| Mar 1, 2010 |

PRINCIVALLE KARINOfficer |

20,621 |

Direct |

Automatic Sale at $63.19 - $63.23 per share. |

$1,303,0002 |

| Mar 1, 2010 |

EPSTEIN ROBERT SOfficer |

51,440 |

Direct |

Automatic Sale at $64 per share. |

$3,292,160 |

| Mar 1, 2010 |

CASSIS JOHN LDirector |

16,000 |

Direct |

Automatic Sale at $63.08 per share. |

$1,009,280 |

| Mar 1, 2010 |

GOLDSTEIN MICHAELDirector |

16,000 |

Direct |

Automatic Sale at $63.05 per share. |

$1,008,800 |

| Feb 26, 2010 |

KORNWASSER LAIZEROfficer |

7,847 |

Direct |

Automatic Sale at $62.72 per share. |

$492,163 |

| Feb 25, 2010 |

MORIARTY THOMAS MOfficer |

2,694 |

Direct |

Disposition (Non Open Market) at $62.92 per share. |

$169,506 |

| Feb 25, 2010 |

WENTWORTH TIMOTHY COfficer |

9,829 |

Direct |

Automatic Sale at $62.44 per share. |

$613,722 |

| Feb 23, 2010 |

DASCHNER MARYOfficer |

2,562 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$159,868 |

| Feb 23, 2010 |

CAPPUCCI GABRIEL R.Officer |

1,025 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$63,960 |

| Feb 23, 2010 |

MORIARTY THOMAS MOfficer |

2,752 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$171,724 |

| Feb 23, 2010 |

KORNWASSER LAIZEROfficer |

4,533 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$282,859 |

| Feb 23, 2010 |

WENTWORTH TIMOTHY COfficer |

5,641 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$351,998 |

| Feb 23, 2010 |

TAYLOR GLENN COfficer |

4,577 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$285,604 |

| Feb 23, 2010 |

SMITH JACK ALLENOfficer |

4,540 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$283,296 |

| Feb 23, 2010 |

RUBINO RICHARD JOfficer |

2,667 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$166,420 |

| Feb 23, 2010 |

PRINCIVALLE KARINOfficer |

4,545 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$283,608 |

| Feb 23, 2010 |

KLEPPER KENNETH OOfficer |

16,836 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$1,050,566 |

| Feb 23, 2010 |

GRIFFIN BRIAN TOfficer |

5,644 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$352,185 |

| Feb 23, 2010 |

EPSTEIN ROBERT SOfficer |

4,536 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$283,046 |

| Feb 23, 2010 |

DRISCOLL JOHN PATRICKOfficer |

10,304 |

Direct |

Disposition (Non Open Market) at $62.40 per share. |

$642,969 |

| Nov 30, 2009 |

GRIFFIN BRIAN TOfficer |

118,208 |

Direct |

Sale at $63.07 per share. |

$7,455,378 |

| Nov 6, 2009 |

STEVENS DAVID DDirector |

140,000 |

Direct |

Automatic Sale at $60 per share. |

$8,400,000 |

| Nov 6, 2009 |

BARKER HOWARD W JRDirector |

40,000 |

Direct |

Automatic Sale at $59 - $60 per share. |

$2,380,0002 |

| Nov 6, 2009 |

BARKER HOWARD W JRDirector |

2,024 |

Direct |

Sale at $58.70 - $59.69 per share. |

$120,0002 |

| Nov 6, 2009 |

EPSTEIN ROBERT SOfficer |

30,000 |

Direct |

Automatic Sale at $59.01 - $59.68 per share. |

$1,780,0002 |

| Nov 5, 2009 |

SMITH JACK ALLENOfficer |

24,000 |

Direct |

Sale at $58.28 per share. |

$1,398,720 |

|

TigerSoft

News Service 8/31/2010 www.tigersoftware.com

TigerSoft

News Service 8/31/2010 www.tigersoftware.com

Under little-noticed new provisions of the

Dodd-Frank Wall Street reform

Under little-noticed new provisions of the

Dodd-Frank Wall Street reform