TigerSoft

News Service 8/14/2010

www.tigersoftware.com

TigerSoft

News Service 8/14/2010

www.tigersoftware.com

For-Profit Colleges Are Getting An "FF"

Fraud and Failure To Educate.

Shareholders should be MAD AS HELL at the INSIDER SELLING

Insiders Got The Word First, Ahead of The Public

GAO Finds Evidence of Criminal Fraud.

These Colleges Depend on Government Subsidized Tuitions.

by William Schmidt, Ph.D. (Columbia University)

(C) 2010 www.tigersoft.com

Call 858-273-5900.

Email us: william_schmidt@hotmail.com

About Us

See also 8/7/2010

DAILY COMMENTS ON

BREAKING NEWs, TIGER INSIDER TRADING CHARTS

and EARLIER

TIGERSOFT BLOGS

http://www.tigersoftware.com/news_updates_to_tigersoft_blogs_.htm

WHY IS ESI COLLAPSING? WHEN DID

INSIDERS DECIDE TO SELL?

WHEN

DID PROFESSIONALS ON WALL STREET START SELLING SHORT?

If

you only had looked at the published insider buying

and selling statistics,

you

probably would never have seen this decline coming.

For

TigerSoft it was easy:

1)

heavy red Distribution,

2)

blue TigerSoft CLosing Power making a string of new lows.

3)

Multiple TigerSoft Sells.

Only

TigerSoft offers these indicators. Get Them. Level the playing field.

For-Profit Jail Should Get The Heat Next. Guess who is the biggest financial backer of

Arizona's new arrest on sight anyone who looks like they are an illegal allien. The for-Profit Prisons.

would be very big gainers if Arizona starts arresting everyone who looks like they could be an illegal

allien. . Source.

Other for profit "public" industries like for-profit-prisons are sure to be treated to the

same type of questions that the for profit-schools are, especially in view of the recent escape

of killers ftom Arizona's for-profit prison system..

Warden, security chief resign after prison escape from a prison ran

for profit by a contracting company called Management & Training Corporation

Criminal Prosecution of these For-Profit Schools for Fraud is very likely.

Some of the schools have even instructed students about how to lie in order to get Federal Govertnment

student aid. In an era of retrenchment, their lobbyists will have to start doling out a lot

of huge bribes to Congressmen. But that's what unlimited corporate campaign contributions

are for, thanks to the Supreme Court. See original article in Barrons.

Kahn Swick & Foti, LLC and Former Louisiana State Attorney General Announce Filing of First Securities Fraud Class Action Against Apollo Group.

Lawyers representing shareholders are getting in the act, too. APOL's officers are

charged with

"making a series of materially false and misleading statements related to the

Company's business

and operations in violation of the Securities Exchange Act of 1934....In particular, the

Complaint

alleges that despite extensive positive statements by defendants in press releases and SEC

filings

during the Class Period regarding the Company's operational performance and future growth

projections, these statements were false because: (1) defendants had propped up the

Company's

results by fraudulently inducing students to enroll in APOL's scholastic and educational

programs

and engaged in other manipulative recruiting tactics; (2) defendants had materially

overstated

the Company's growth prospects by failing to properly disclose that defendants had engaged

in illicit and improper recruiting activities, which also had the effect of artificially

inflating the

Company's reported results and future growth prospects; and (3) APOL did not maintain

adequate systems of internal operational or financial controls, which would have permitted

APOL's reported operational statements and foreseeable growth prospects to be true,

accurate

or reliable.

It was only on August 3, 2010 that investors finally began to learn the truth about APOL

after the United States General Accounting Office ("GAO") issued a report that

concluded

that for-profit educational institutions like APOL had engaged in an illegal and

fraudulent course

of action designed to recruit students and over-charge the federal government for the cost

of

such education. Following these disclosures, shares of the Company declined precipitously

over

just a few trading days -- falling almost 10% between August 3 and August 5, 2010, on

unusually

high trading volume, thereby eradicating over $684.53 million of the Company's market

capitalization

in only four trading days.: (Source

)

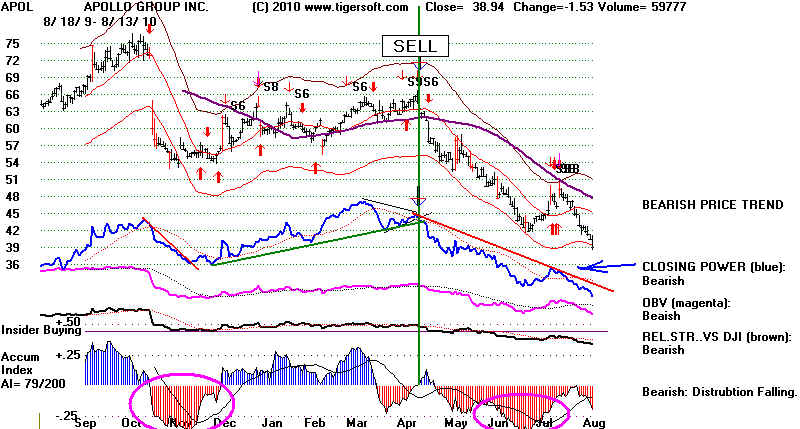

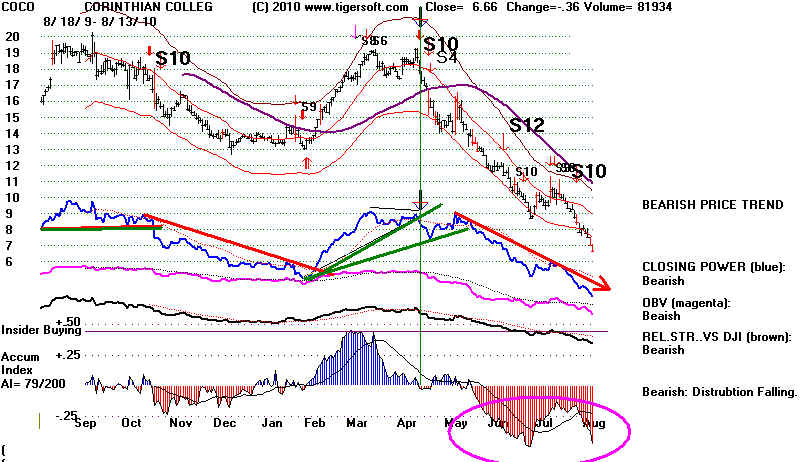

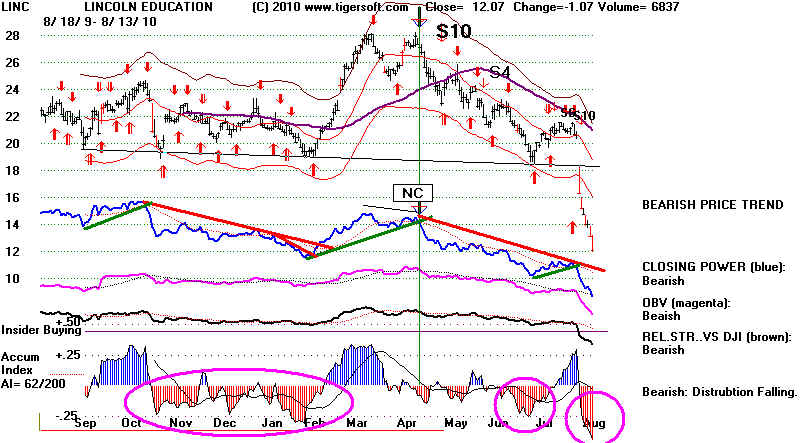

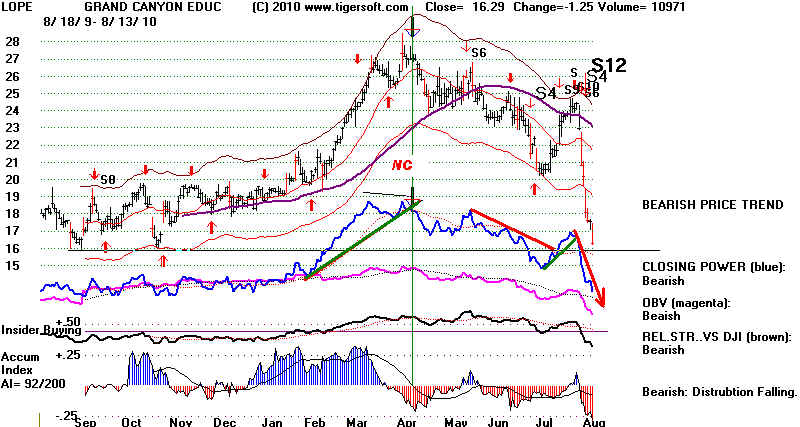

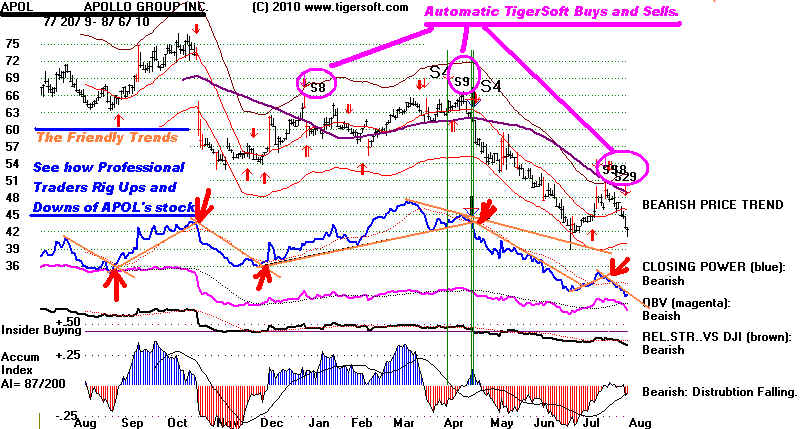

Below is the Tiger Index for these education stocks. Note the heavy insider selling

in the deeply red

readings from TigerSoft's Insider Ttrading Indicator - the Tiger Accumulation Index. Sell

short

on rallies after you see this and on red Sell Signals. See our warnings and

news about this industry

on 8/7/2010.

This is definitely a time when investors should be watching how Wall Street Professionals

are treating these stocks. They are becoming pariahs. They now have a stench of criminal

fraud. Watch TigerSoft's now red Accumulation Index for these stocks and the (blue)

downtrend of their Professional Closing Power. Click on the links to see these stocks

Reported Insider Sales:

APOL Apollo Group

IINSIDER SELLER

His apparent core belief: I find I must have more money, no matter that

I am

His apparent core belief: I find I must have more money, no matter that

I am one of the 313 richest Americans. Insider selling? No moral problem, at all, here.

"Sperling, who is so very concerned about California’s carbon footprint, owns more

than 30 homes."

His San Franscisco $65 million house - no one lives there.

Sperling sold 700,000 shares of APOL. Did he know of coming collapse of APOL

because of Congressional investigation's then unreported findings.

| Jul 29, 2010 | SPERLING PETER VOfficer | 55,000 | Direct | Sale at $47.01 per share. | $2,585,550 |

| Jul 23, 2010 | SPERLING PETER VOfficer | 75,000 | Direct | Sale at $50.55 per share. | $3,791,250 |

| Jul 22, 2010 | SPERLING PETER VOfficer | 20,000 | Direct | Sale at $46.56 per share. | $931,200 |

| Jul 20, 2010 | SPERLING PETER VOfficer | 100,000 | Direct | Sale at $47.67 per share. | $4,767,000 |

| Jul 13, 2010 | SPERLING PETER VOfficer | 100,000 | Direct | Sale at $43.84 per share. | $4,384,000 |

| Jul 8, 2010 | SPERLING PETER VOfficer | 150,000 | Direct | Sale at $43.77 per share. | $6,565,500 |

| Apr 30, 2010 | SPERLING PETER VOfficer | 113,821 | Direct | Sale at $57.44 - $58.2 per share. | $6,581,0002 |

| Apr 29, 2010 | SPERLING PETER VOfficer | 106,279 | Direct | Sale at $57.80 per share. | $6,142,926 |

Peter V. Sperling (born 1960) is one of the 400 wealthiest Americans, and the

son of John

Sperling[1].

He is Senior Vice President and a Director of Apollo Group,

and a co-founder and Chairman of CallWave, Inc.[2]

Reported nsider selling varied from one

company to another, as measured

by SEC filings. But when you look at the TigerSoft charts you can see

how similar

they all were. The unofficial selling was rampant. Insiders

always know first. They tell

their friends on Wall Street. Then the collapses began in

earnest, long before the GAO

report was made public.

DV DeVry

ESI ITT Education

LOPE Grand Canyon Education

CECO Career Education

CPLA

Capella Education

| Aug 3, 2010 | HENKEL SCOTT MOfficer | 1,200 | Direct | Option Exercise at $20 per share. | $24,000 |

| Aug 3, 2010 | HENKEL SCOTT MOfficer | 1,200 | Direct | Sale at $91.55 per share. | $109,860 |

| Aug 2, 2010 | OFFERMAN MICHAEL JOfficer | 4,521 | Direct | Option Exercise at $20 per share. | $90,420 |

| Aug 2, 2010 | OFFERMAN MICHAEL JOfficer | 4,521 | Direct | Sale at $92.65 per share. | $418,870 |

| Jul 29, 2010 | RONNEBERG AMY LOfficer | 11,922 | Direct | Option Exercise at $20 - $53.91 per share. | N/A |

| Jul 29, 2010 | RONNEBERG AMY LOfficer | 11,922 | Direct | Sale at $92.44 per share. | $1,102,069 |

| Jul 29, 2010 | HENKEL SCOTT MOfficer | 6,631 | Direct | Option Exercise at $15.13 - $20 per share. | N/A |

| Jul 29, 2010 | HENKEL SCOTT MOfficer | 6,631 | Direct | Sale at $92.70 per share. | $614,693 |

| Jul 29, 2010 | THOM GREGORY WOfficer | 2,500 | Direct | Option Exercise at $11.92 per share. | $29,800 |

| Jul 29, 2010 | THOM GREGORY WOfficer | 2,500 | Direct | Sale at $91.58 per share. | $228,950 |

| Jul 29, 2010 | TUKUA DARRELL RDirector | 10,000 | Indirect | Option Exercise at $15.13 per share. | $151,300 |

| Jul 29, 2010 | TUKUA DARRELL RDirector | 10,000 | Indirect | Sale at $91.86 per share. | $918,600 |

| Jun 14, 2010 | THOM GREGORY WOfficer | 500 | Direct | Option Exercise at $20 per share. | $10,000 |

| Jun 14, 2010 | THOM GREGORY WOfficer | 500 | Direct | Sale at $83.37 per share. | $41,685 |

COCO Corinthian Colleges

STRA Strayer Education linc

| Aug 13, 2010 | BROCK WILLIAM EDirector | 700 | Direct | Sale at $201.02 per share. | $140,714 |

| Jul 30, 2010 | MCDONNELL RAYMOND KARLOfficer | 17,800 | Direct | Sale at $236.25 per share. | $4,205,250 |

LINC Lincoln Educational Services

| May 27, 2010 | ABRAMS EDWARD BOfficer | 13,469 | Direct | Option Exercise at $14 per share. | $188,566 |

| May 27, 2010 | ABRAMS EDWARD BOfficer | 13,469 | Direct | Sale at $24.18 per share. | $325,680 |

| May 26, 2010 | MCHUGH THOMAS FOfficer | 2,029 | Direct | Sale at $24 per share. | $48,696 |

| May 26, 2010 | ABRAMS EDWARD BOfficer | 3,989 | Direct | Option Exercise at $11.96 - $14 per share. | $52,0002 |

| May 26, 2010 | ABRAMS EDWARD BOfficer | 3,989 | Direct | Sale at $24.18 per share. | $96,454 |

| May 21, 2010 | SHAW SCOTT MOfficer | 71,453 | Direct | Option Exercise at $3.10 per share. | $221,504 |

| May 21, 2010 | CARNEY DAVID FOfficer | 25,000 | Direct | Option Exercise at $11.96 per share. | $299,000 |

| May 17, 2010 | SHAW SCOTT MOfficer | 3,896 | Direct | Option Exercise at $3.10 per share. | $12,077 |

| May 17, 2010 | SHAW SCOTT MOfficer | 3,896 | Direct | Sale at $25 per share. | $97,400 |

| May 17, 2010 | CARNEY DAVID FOfficer | 7,500 | Direct | Option Exercise at $3.10 per share. | $23,250 |

| May 17, 2010 | CARNEY DAVID FOfficer | 32,800 | Direct | Sale at $24.98 per share. | $819,344 |

| May 17, 2010 | CARNEY DAVID FOfficer | 7,500 | Direct | Automatic Sale at $24.70 per share. | $185,250 |

| May 13, 2010 | SHAW SCOTT MOfficer | 12,104 | Direct | Option Exercise at $3.10 per share. | $37,522 |

| May 13, 2010 | SHAW SCOTT MOfficer | 12,104 | Direct | Sale at $25.09 per share. | $303,689 |

| May 13, 2010 | CARNEY DAVID FOfficer | 40,000 | Direct | Sale at $24.91 per share. | $996,400 |

| May 3, 2010 | CARNEY DAVID FOfficer | 7,500 | Direct | Option Exercise at $3.10 per share. | $23,250 |

| May 3, 2010 | CARNEY DAVID FOfficer | 7,500 | Direct | Automatic Sale at $24.83 per share. | $186,225 |

See how the Blue Accumulation Index turned Red, showing insiders

knew

of the GAO investigation's criminal fraud findings. See how Wall Street Pros

shofted from buying (uptrending blue

Tiger Pro-Closing Power)

to showing Wall Street selling and

selling short (falling blue Tiger

Pro-CLosing Power)

The way to play these stocks is simple. Trade the trend of the TigerSoft

Pro-Closing Power