TigerSoft News

Service 2/14/2008 www.tigersoft.com

TigerSoft News

Service 2/14/2008 www.tigersoft.com See 2/4/2008 NEM technical study. revised 3/4/2008 -

Indonesia will terminate NEM's copper mine.

More on recent Insider Selling at Newmont.

THE ENVIRONMENTAL COSTS OF GOLD MINING ARE VERY HIGH.

Buy and Hold Is Dangerous: See All The Peerless Real-Time Signals: 1981-2008

====================================================================================

Newmont's Gold Mining Brings Protests All over the World:

Widespread Environmental Degradation and Health Hazards

by William Schmidt, Ph.D. (Columbia University)

From Indonesia to Peru to Turkey, to Nevada. Newmont Mining (NEM) is

accused of contaminating land and water with arsenic, mercury and other heavy metals,

causing severe health problems, killing local fish, bribing local governments and destroying

the local ecosystem and the longer term viability of local communities. There are many,

many articles on the internet, each repeating the same story: Newmont claims it cares

about the environment and local people, but everywhere it covers up the severe environmental

pollution and health problems its mining creates. Numerous lawsuits, internal company

documents, regulatory filings show this. Investors in gold and silver stocks should see the real

costs of mining and demand their companies behave responsibly, openly and humanely. It's

getting to the point where one cannot do an internet search on Newmont without seeing the outcries

its activities provoke. Clearly that works to depress its shares. But they can go down more, if its

leases are withdrawn and their mines expropriated. Already, its mines in Uzbekistan have been nationalized,

in part because that country's officials could readily claim that Newmont's operations were not operating

at safety and environmental standards like those in the US. Now Indonesia is threatening to

cancel its lease operations. If Peru follows Indonesia's lead, NEM's stock will be in big trouble. In

2006, Peru nationalized natural gas production. In 1973, Peru nationalized most of Cerro de Pasco

Corporation's mining properties along with those of other foreign mining companies. The mines were

then privatized in 1990.

Though the candidate seeking

to nationalize the mines

Though the candidate seeking

to nationalize the mineswas defeated in Peru's 2006 election, investors should see the risks. Ollanta Humala won

45% of the vote. He won 14 of Peru's 24 departments (administrative regions) and swept his

stronghold in the southern highlands, where the country's poor and indigenous population is

concentrated, receiving 80 percent of the votes there. Peru's new President now sees a broad

chasm representing Peru's social divide. "it is a distinct possibility that he will try to fall back

on the populism of his first presidential term, perhaps in order to fend off direct action by

Humala's forces." The shadow of Venezuela's Chavez is ever present. Nationalism and

nationalizations are on the rise.

(Source: http://www.pinr.com/report.php?ac=view_report&report_id=506&language_id=1 )

Newmont is the world's top gold producer.industry. It employs 15,000 people around the world.

It had revenues of $5.6 billion and produced more than 300 tons of gold last year. With gold prices at

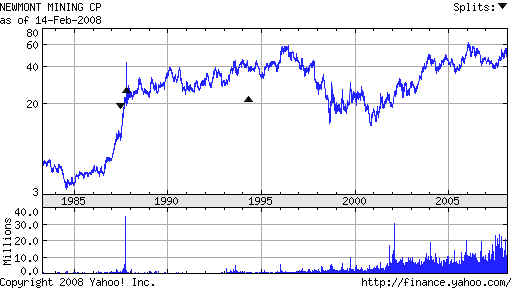

record highs, one might expect Newmont to be trading near or at its all-time high. It is not. It is 12

points, or 20%, below its high of 1996. Its costs are rising steeply. Each ounce of gold cost NEM $406 in

2007 compared to $303 in 2006. Capital (direct mining costs) expenditures were $100 million to $300 million

below what was predicted by the company. On February 15, a day after this Blog was written, Moody's

cut Newmont's ratings.

"Moody's Investors Service on Friday cut its investment grade senior unsecured ratings for

Newmont Mining Corp. to "Baa2" from "Baa1" and of its subsidiary, Newmont USA, to "Baa3"

from "Baa2," citing a jump in their operating costs. The action affects about $1.1 billion of

NEM debt. Moody's said the downgrade also reflects uncertainty about the costs at the

company's Phoenix (Nevada) mine and the need to accomplish major objectives at some of its large

operations to improve its overall cost position."

2/15/2008: http://biz.yahoo.com/ap/080215/newmont_mining_credit_rating.html?.v=1

The Yanacocha gold mine in Peru piles up ore and drips cyanide through its vast hillside:

Critics say the government granted the concession only after accepting bribes from Newmont,

and without consulting local communities, which are now suffering because the area has many

farms that rely on water coming from the mountains in the mine area. Source. See also.

What is causing non-direct mining costs to rise so sharply? Executive Pay is high. Richard

O'Brien, the company's CEO total compensation was $3.56 million in 2007, up $1.52 million the year

before, despite the sub-par performance of his company's stock, compared to other Gold stocks or

Gold. Higher still is the "hidden payroll", which includes very high Legal expenses and PR campaigns

to ward off the dozens of law suits and government claims against NEM. In Indonesia, the company has

spent a $1 million a month on legal expenses alone. So is Bribery.in Indonesia, Turkey and Peru. All the

while, proven and probable gold reserves are down from 93.9 million ounces in 2006 to 86.5 million ounces

in 2007. ( Source: http://biz.yahoo.com/bizj/080207/1588572.html?.v=1 ) And add in Spying on

Environmental Opponents. ( Source: http://www.corpwatch.org/article.php?id=12985 ) (NEM is

one of many multinational corporations, like Monsanto and Freeport, which have large hidden payrolls and

increasingly expensive Environmental Insurance. Then there are the Work Stoppages

and Road-Blocking Mass Protests. NEM had to shut down its vast Yanacocha gold mine in

northern Peru because 200 protested blocked the main road to the site. It is the largest gold mine in Latin

America.

Yanacocha is the world's second-largest gold mine. It produced 1.55 million ounces in the first six months

of 2006. With gold at $900/ounce, that's $135 Billion dollars worth of gold. NEM cannot afford to

lose this mine. (See http://www.denverpost.com/business/ci_4253289 )

WHY IS NEWMONT NOT ADVANCING WITH THE PRICE OF GOLD?

Professional investment managers are concerned that NEM has not set aside

sufficient funds to cover the

growing legal liabilities its mining operations pose. Year after year, Newmont

has had to pay millions to its lawyers to fight off environmental degradation lawsuits in

Indonesia and Peru..

Community protests in Peru nearly forced the

closing of the company's most profitable mine, Yanacocha, in

September 2004. NEM is accused of intimidating its critics. It filed a

"defamation lawsuit against an Indonesian

professor, Dr. Rignolda Djamaluddin, who spoke publicly about Newmont's practice of

dumping mine waste

in Buyat Bay. "I am here because Dr. Rignolda cannot be here as a result of this

lawsuit that is meant to

intimidate us and stifle our voice," said Nur Hidayati of Indonesian Forum for the

Environment (WALHI).

"Our communities demand Newmont end its practice of dumping mine wastes into the

ocean. This irresponsible

practice poses high risks to the environment and the community -- and it is not allowed in

the United States

where Newmont is based." *Source: http://www.nodirtygold.org/newmont_agm.cfm

)

INSIDER SELLING IN NEM

The stock of Newmont now shows steady red Distribution on the TigerSoft chart below.

When the Tiger Accumulation indicator drops below -.25, we label that significant insider

selling, in the

sense that someone on the inside has probably passed along bearish information which is

causing

unusually heavy and persistent daily selling on intra-day strength. Back in the

Summer of 2006, such

steady Red selling pressure from our indicator correctly foretold the stock would go down

on news

which had not yet been released. The news that was belatedly released, after the

stock has already

dropped 20%, was the nationalization of NEM's gold mines in Uzbekistan. The story of

this insider

trading in NEM and a chart showing the heavy RED selling pressure BEFORE the stock fell

20%

is seen at the bottom of page on this link: http://www.tigersoft.com/--5--/index.html

We don't know

what the bearish news is that the present insider selling shows, but we can expect it

after the stock

has already seen a significant drop. The public is

often the last to know something important with

this stock. That's why you should

TigerSoft! As it turns out, insiders of record are selling NEM.

Wayne W Murdy, NEM's CEO, sold 125,000

shares between 50.29 and 50.5 on December 6, 2007.

Murdy sold 52,000

more on December 17th, 2007. Murdy says NEM is

committed to being a

good steward and

protecting the environment.. The reader can judge if this is just more

"PR".

2/4/2008 NEM technical

study

International delegations have protested the hardships faced by hundreds of farmers in

Rosia

Montana, Romania and in the Ahafo region of Ghana. They were being displaced from their

homes

to make way

for large, industrial gold mines owned by Newmont and its partners.

Villagers in Ghana

claim that

Newmont has contaminated local water supplies Bribing local officials to let them

proceed

is a

recurrent accusation. "I have come from Romania to tell Newmont that the

people of Rosia Montana

will not be

forced from our homes and our land," stated Stephanie Roth of Alburnus Maior, a

community

group of farmers

and property owners in Rosia Montana. "Newmont has not obtained the

community's

consent to

operate in Rosia Montana. It's time for them to cut their losses and leave the

project." "We have

been trying to

engage with Newmont for several years and have yet to see real change in

their practices," said

Father Marco

Arana of Grufides, an environmental and social justice organization based in Cajamarca, Peru.

"It took

30,000 people protesting in the streets of Cajamarca for them to finally recognize there

were serious

problems."

In Turkey,

"production has been off and on at the Ovacik gold mine near Bergama in

western Turkey

for more than a decade amid environmental protests and legal challenges from local

people over the

use of a cyanide-leaching method for extracting gold. Newmont draws outcry in Asia

Mine in Greece to shut

down. As a new high court

decision in Greece puts an end to mining

underneath the village

of Stratoniki, Greek and Turkish anti-mining activists join forces

against

NEM's giant mines. Asterix and the

Turkish gold Thousands of peasants

resist Newmont-owned

goldmine in Bergama,

Turkey (Ustun Reinart.

(See also http://www.minesandcommunities.org/Action/press612.htm

)

Newmont has had plenty of trouble with its operations here in the

US. In Nevada, the Western Shoshone

people continue

to defend their right to live off of their own land, in their traditional lifestyle.

"Any damage to

our land has a

direct impact on our people, our home, and our cultural and spiritual way of life, said

Kristi

Begay, a member

of the Western Shoshone Nation, and a Wells Band Council Chairwoman. Stephen D’Esposito,

President of

Mineral Policy Center remarked, “Our research shows that mining companies operating

in the U.S.

have consistently

underestimated their environmental reclamation liabilities" "Newmont

continues to invest in risky

projects as shown

by the current plans for developing the Phoenix project in Nevada", said Tom Myers,

executive

director of

Nevada-based Great Basin Mine Watch. "Newmont

risks its shareholders' money by planning to treat acid

runoff

from the site for 20,000 years."

NEWMONT AND INDONESIA

Indonesia is the hottest trouble-spot for

Newmont. Here is a November 9, 2004 report in the NY Times

Indonesian

government panel presents report on water quality in Buyat Bay, which residents and some

environmental experts hold has been toxically polluted by Newmont Mining Corporation...

(The) report

holds

that mine waste deposits have significant levels of arsenic and mercury. As a

result, villagers have

filed

a $543 million lawsuit against Newmont. Reuters reports

that in 2004 Indonesia's Environment Ministry

found

that arsenic and mercury content in waste dumped by Newmont had contaminated sediment and

entered the food chain. And Newmont itself admits that it dumped 5 million tons of

heavy-metal-laden mine

waste

into Buyat Bay, and released approximately 17 tons of mercury into the air.

"In 1994, newmont mining—then a midsize

Nevada gold producer striving to become a global leader—broke

ground in the mountains above Buyat Bay. Over the mine's eight years in operation, the

company extracted $672

million worth of gold from its $200 million investment. Locals, too, hoped for a payoff.

In a place where

zinc-roofed huts cram every inhabitable flatland, where most survive on what fishermen in

flimsy outriggers

can

haul from the sea, jobs paying a few dollars a day seemed a godsend... To dispose of its waste, Newmont

built

a pipe that channeled the waste to the bottom of Buyat Bay; it assured residents that the

fish

would

be fine. But just months after the mine opened, villagers began complaining that schools

of

silvery carcasses were washing up on the beach, putrid and stiff. On the fish they caught,

the men

found

strange tumors that oozed an oily black goop under their fillet knives. Villagers took the

dead

fish

to the local university (one of many beneficiaries of Newmont's largesse), which refused

to test

them.

At one point, the pipe burst, spewing waste into shallow water. Villagers protested,

occupying

Newmont's office for several hours. The mine's community outreach workers—smart

men with

college educations—told the villagers the fish were safe, and so they ate them....For

a while, Indonesia's

U.S.-backed strongman, Suharto, kept a lid on the controversy. But things got tougher for

Newmont after

Suharto was toppled in 1998. The newly empowered environment ministry demanded that the

company abide

by

hazardous-waste regulations and produce an environmental risk assessment. Neither mandate

was fulfilled to

regulators' satisfaction, but with the country reeling from the Asian financial crisis,

the government was not

inclined to push the matter".... Then in July 2004, "a five-month-old girl

named Andini died in the quiet fishing

village of Buyat Beach. From birth, she had been small and sickly, with a grotesque scaly

rash covering her body.

Photos circulated of the baby in her last days—tiny, chafed, and seemingly writhing

in pain—and Indonesian

reporters swarmed Buyat Beach, broadcasting footage of residents with tumors, debilitating

cramps, and severe

headaches. Lab tests showed mercury levels in some villagers' bodies that were triple the

level the U.S.

government considers safe, and police investigators found mercury and arsenic in the bay.

(Newmont's own

analysis of the same water samples found them to be clean.)...

"Here's the rub: Independent scientists say another few miles of pipe would have put

the waste over the

continental shelf and into deep water, drastically reducing the chance for contamination.

This would have cost

around $15 million, according to Jim Kuipers, a Montana-based engineering consultant who

has worked in the

mining industry and now advises watchdog groups. "The culture in mining is to

save money wherever they can,"

says

Dave Chambers, an engineer with Montana-based mining-watchdog group Center for Science in

Public

Participation. "Newmont took a risk and they got burned."

(Source: http://www.motherjones.com/news/feature/2007/09/rick-ness-mr-clean.html

)

Indonesian Corruption

The Economist and Wall Street Journal admit that NEM exploited for a while Indonesia's

reputation for corruption and that it may have paid off a number of government officials.

But this

is

merely the

way business is done there. They point to the fact that an Indonesian

Court

has

dismissed charges of pollution against NEM, leaving the matter up to an Arbitration Court.

But

this leaves unanswered the question of whether this Court was itself bribed.

Here

is another link suggesting bribery may have played a role in he Court's decision.

A

Wall Street Journal article written by a 21-year old intern who had never been to

Indonesia then

claimed the charges were groundless. The local problems were of long standing and

exaggerated by

extortionists and politicians who wanted to nationalize the mines.

"Mother Jones found that "the waste on Buyat's seafloor had

arsenic concentrations 16 times higher, and

mercury levels 8 times higher, than those at which adverse environmental effects are

frequently expected"

The

2004 study by the Indonesian government found that wells in Buyat Village had

"arsenic concentrations up

to

six times the Indonesian drinking water standard" and that "tests Newmont

conducted before opening the

mine

found no arsenic." And 17 tons of mercury released into the air can't be good for the

environment:

"That's like having 15 to 20 coal-fired power plants in your back yard."

( http://www.motherjones.com/mojoblog/archives/2007/12/6613_newmont_cleared.html

)

"SELL or LEAVE"

On February 12, 2008, the Indonesian

government has threatened to terminate Newmont Mining Corp.'s

30-year

contract to run a huge copper and gold mine on Sumbawa Island because NEM has not stuck to

a timetable

to divest itself of a 51% stake to local authorities. See also

( http://www.forbes.com/2008/02/12/newmont-mining-indonesia-markets-equity-cx_vk_0212markets03.html?partner=yahootix

)

PERU

. The World's Largest Mercury Spill

"In 2000, campesinos were directly confronted with the dangers of living with toxic

chemicals, when

they endured what has

been labeled the world’s largest mercury spill. A (Newmont) truck that was hauling

away canisters of

mercury, a byproduct of cyanide gold mining, spilled 330 pounds of the poisonous metal

on a road running

through the towns of Choropampa, Magdalena and San Juan, 53 miles from the mine.

Thinking the mercury

contained gold, thousands of villagers took pieces of it home, some cooking it on their

stoves. The result was

mercury poisoning: impaired hearing and vision, central nervous system disorders, birth

defects, miscarriages,

and liver and kidney damage. The Peruvian government fined Yanacocha $500,000 for

an incident it

initially tried to downplay. The mine eventually offered to pay some restitution if the

townspeople

would sign documents

clearing the mining company of further responsibility. But more than 1,100 residents

decided instead to file

a class action lawsuit against Newmont. The suit is still pending."

Newmont

Bribery in Peru

"This was not the first high profile legal dispute Newmont faced. Yanacocha was

initially founded by a

partnership of

the American company Newmont, the Peruvian company Buenaventura, and a French

government-owned

company, Bureau de Recherches Géologiques et Minières (BRGM). These partners

were later joined

by the World Bank. Conflict arose when BRGM decided to sell most of its share to Normandy

Poseidon, an

Australian company. Newmont filed suit in Peruvian court, claiming that BRGM could not

sell to

a new company

without first offering its shares to the original stakeholders. The lower courts ruled in

favor of

Newmont, but the

Peruvian Supreme Court agreed to review the decision. Peruvian courts were notoriously

corrupt at the

time and Newmont suspected that the French government had intervened in an attempt to get

a

favorable ruling.

Newmont representative Larry Kurlander went to talk with a high-level Peruvian official

who

had a reputation

for bribery, and their

conversation was captured on videotape as part of a larger corruption

scandal that

brought down the government of former Peruvian President Alberto Fujimori. While Newmont

denies any

illegal influence, the Supreme Court eventually voted to allow Newmont to buy out BRGM at

a

bargain price in

1998. Now, Newmont owns the majority of the mine, with smaller shares controlled by

Buenaventura and

the World Bank. Neither the United States Foreign Corrupt Practices Act, which forbids

American

companies from bribing officials of foreign governments, nor the World Bank’s unit on

fraud and

corruption has

been brought to bear on this case."

(Source: http://www.sacredland.org/world_sites_pages/MtQuilish.html

)

In Peru, the Denver Post review (mentioned below) found of NEM's

mine's sediment controls

were vastly

inadequate and that the mine repeatedly poured sediment laced with heavy metals and other

contaminants into

streams. The mine's cyanide treatment facilities, including a treatment plant and holding

ponds,

were too small

and sometimes released more cyanide than permitted into waterways, the internal review

said. The

urgency of the

problem was highlighted by the company's insurer, which around the same time found that a

sustained storm

might lead to a significant cyanide spill at the mine.

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

Widespread Environmental Degradation and Health Hazards

Continued....

| NEWMONT'S CYANIDE MINING HAZARDS IMPERIL NEVADA Consider the Denver Post's investigation. In Lone Tree, Nevada, giant drills pierce holes in rock that will be crumbled by explosives. Massive shovels load earth onto dump trucks, which carry it to a mound where sprinklers will spray it with millions of gallons of cyanide and water. From each 200-ton load of rock and ore, Denver-based Newmont, the world's largest gold producer, will extract an average of about $3,000 worth of gold. Just enough to make a dozen wedding rings! Former employees complained that Newmont concealed, understated or ignored the very environmental concerns that were raised within the company. It even retaliated against very people who pointed out the dangers its mining operations were creating. Among the Post's findings, in Nevada, Newmont violated water-quality standards at the Lone Tree mine for at least four years, releasing greater- than-permitted quantities of contaminants such as arsenic and boron, according to the mine's own monitoring reports. Ainsworth and another employee say they were fired after they took environmental problems at the mine to their bosses. Later, Newmont temporarily blocked a state investigation into the issue....These employees raised public concerns about the dumping of contaminants into Nevada waterways...Newmont's internal review highlighted these problems for senior company managers. But the problem wasn't fixed until after it became public.

|

|

THE HIGH ENVIRONMENTAL COST OF GOLD MINING ELSEWHERE Venezuela Gold miners in Venezuela are wreaking havoc on the Amazon rain forest, and its inhabitants, because of their destructive mining techniques. These miners are the same ones who were expelled for damaging the Amazon and the Yanomami Indian reservations in the Brazilian state of Roraima in 1990. The central government has been debating methods of enforcing tougher border controls, as well as tougher statutes on the export of gold from Venezuela, however, at present, the state is powerless to intervene... As most of Venezuela's proven gold reserves lie near the surface, its extraction is easy and profitable for large scale mining operations. These garimpeiros utilize high power water cannons, connected to nearby rivers, to blast away vast amounts of soil and vegetation. As the soil in the Amazon rain forest is of poor quality, and fragile, the deforestation caused by the miners is, in essence, irreversible. The removed soil is carried away, leaving open pits which are filled with water. The resulting mud holes are a breeding ground for malaria-carrying mosquitoes. Also, the soil which is removed causes increased sedimentary silt build ups which clog the turbines at the Guri Dam on the Caroni River, the nation's main source of hydroelectric power. This has caused the abandonment of plans to further expand the facility. In addition, mercury has been extensively utilized as it aids in the gold amalgamation process. This mercury has turned up in unsafe quantities in the livers of widely-consumed fish, as well as at popular beaches and in the water taps of local residents. http://american.edu/TED/VENGOLD.HTM |

| Guyana International Human Rights Clinic (IHRC) of Harvard Law School’s Human Rights Program: A report, titled “All that Glitters: Gold Mining in Guyana,” notes that the Guyanese government has failed to reign in wildcat miners and protect the rights of indigenous populations. It also says the mining has caused deforestation and mercury pollution, which can cause severe public health problems, and worsened malaria in the region. “Our observations confirmed that the areas around mines resemble a moonscape of barren, mounded sand and mud,” Docherty said. “Since small scale miners typically wash the topsoil away in order to get to the gold-bearing clayey soil underneath, the sites of former mines are quite infertile and incapable of supporting regenerated rainforest.” |

El Salvador - underground mine

|

...

... Gold mining may be employed

on a larger scale by constructing a short sluice box, with barriers along the bottom to trap the heavier gold

particles as water washes them and the other material along the box. This method better

suits excavation with shovels

or similar implements to feed ore into the device. Similar in principle to a sluice is a rocker,

a cradle-like piece of equipment that could be rocked like a cradle to sift sands through

screens, which was introduced by Chinese miners in British Columbia and Australia, where

the practice was referred to as "rocking the golden baby". . Another Chinese

technique was the use of blankets to filter sand and gravels, catching fine gold in the

fabric's weave, then burning the blankets to smelt the gold. Chinese were noted for the

thoroughness of their placer extraction techniques, which included hand-washing of

individual rocks as well as the complete displacement of streambeds and advanced flume and

ditching techniques which became copied by other miners.

Gold mining may be employed

on a larger scale by constructing a short sluice box, with barriers along the bottom to trap the heavier gold

particles as water washes them and the other material along the box. This method better

suits excavation with shovels

or similar implements to feed ore into the device. Similar in principle to a sluice is a rocker,

a cradle-like piece of equipment that could be rocked like a cradle to sift sands through

screens, which was introduced by Chinese miners in British Columbia and Australia, where

the practice was referred to as "rocking the golden baby". . Another Chinese

technique was the use of blankets to filter sand and gravels, catching fine gold in the

fabric's weave, then burning the blankets to smelt the gold. Chinese were noted for the

thoroughness of their placer extraction techniques, which included hand-washing of

individual rocks as well as the complete displacement of streambeds and advanced flume and

ditching techniques which became copied by other miners.

Using a sluice box to extract gold from placer deposits has been a common practice in prospecting and small-scale mining throughout history to the modern day. A sluice box is essentially a man-made channel with riffles set in the bottom. The riffles are designed to create dead zones in the current to allow gold to drop out of suspension. The box is placed in the stream to catch water-flow and gold bearing material is placed at the top of the box. The material is carried by water through the box where gold and other heavy material settles out behind the riffles. Lighter material flows out of the box as tailings.

A trammel is composed of a slightly-inclined rotating metal tube (the 'scrubber section') with a screen at its discharge end. Lifter bars, sometimes in the form of bolted in angle iron, are attached to the interior of the scrubber section. The ore is fed into the elevated end of the trammel. Water (often under pressure) is provided to the scrubber and screen sections and the combination of water and mechanical action frees the valuable minerals from the ore. The mineral containing ore that passes through the screen is then further concentrated in smaller devices such as sluices and jigs. The larger pieces of ore that do not pass through the screen can be carried to a waste stack by a conveyer.

Hydraulic mining

Hydraulic mining is a type of placer mining used in areas where large amounts of loose gravel and sand or soil are poorly packed and may be washed away with a heavy stream of water. Fire hoses (Water cannons) are sometimes used to strip away entire hills of loose gravel, which are then run through a sluice (a wooden trough with riffles). Gold, being heavier, does not move as easily as other material in the sluice. This technique can damage the environment, causing mud in streams below the mining site and erosion damage at the site itself.

In earlier times the process water was not generally recycled and the spent ore was not reclaimed. Environmental activists describe the hydraulic mining form of placer mining as environmentally destructive because of the large amounts of silt that it adds to previously clear running streams. Most placer mines today use settling ponds, if only to ensure that they have sufficient water to run their sluicing operations.

In California, from 1853 to 1884, "hydraulicking" of placers removed an enormous amount of material from the gold fields, material that was carried downstream and raised the level of the Central Valley by some seven feet in some areas and settled in a huge layer at the bottom of San Francisco Bay. The process raised an opposition calling themselves the "Anti-Debris Association". In January of 1884, a United States District Court banned the flushing of debris into streams, and the hydraulic mining mania in California's gold country came to an end.

Hard rock mining

Hard rock gold mining is done when the gold is encased in rock, rather than as

particles in loose sediment. Sometimes open-pit

mining is used, such as the Ft. Knox Mine in central Alaska. Barrick Gold Corporation has one of the largest

open-pit gold mines in North America, located on its Goldstrike property in northeastern Nevada. Other gold mines use

underground mining, where the ore is extracted through tunnels or shafts. Hard rock mining

produces most of the world's gold. In placer mines, the gold is recovered by gravity

separation. For hardrock mining, other methods are usually used.

Cyanide process

Cyanide extraction of gold may be used in areas where fine-gold bearing rocks are found. Sodium cyanide solution is mixed with finely-ground rock that is proven to contain gold and/or silver, and is then separated from the ground rock as gold cyanide and/or silver cyanide solution. Zinc is added to the solution, precipitating out residual zinc, as well as the desirable silver and gold metals. The zinc is removed with sulphuric acid, leaving a silver and/or gold sludge that is generally smelted into an ingot that is shipped to a metals refinery for final processing into 99.9999% pure metals.

Advancements in the 1970s have seen activated carbon used in extracting gold from the leach solution. The gold is absorbed into the porous matrix of the carbon. Activated carbon has so much internal surface area[1], that fifteen grams (half an ounce) has the equivalent surface area of the Melbourne Cricket Ground (18,100 square meters). The gold can be removed from the carbon by using a strong solution of caustic soda and cyanide. This is known as elution. Gold is then plated out onto steel wool through electrowinning. Gold specific resins can also be used in place of activated carbon, or where selective separation of gold from copper or other dissolved metals is required.

The cyanide technique is very simple and straightforward to apply and a popular method for low-grade gold and silver ore processing. Like most industrial chemical processes, there are potential environmental hazards presented with this extraction method in addition to the high toxicity presented by the cyanide itself. This was seen in the environmental disaster in Central-Eastern Europe in year 2000, when during the night of 30 January, a dam at a goldmine reprocessing facility in Romania released approximately 100,000 m³ of wastewater contaminated with heavy metal sludge and up to 120 tonnes of cyanide into the rivers of Tisza.