TigerSoft

News Service 1/12/2009 www.tigersoft.com More

information later today.

TigerSoft

News Service 1/12/2009 www.tigersoft.com More

information later today.Obama' s Scare Tactics Stop The Rally Cold.

Why We Are Seeing The Stock Market Decline Again?

.... Obama Leaves Many Unanswered Questions.

.... His Thinking Is Too Narrow. Too Timid. Too Orthodox.

.... Banks That Are Too Big To Fail ARE TOO BIG and Should Be Broken up!

.... FDR Took on The Banks. Why Won't Obama?

.... American Needs A People's Bank To Loan To People and Businesses, not just Banks!

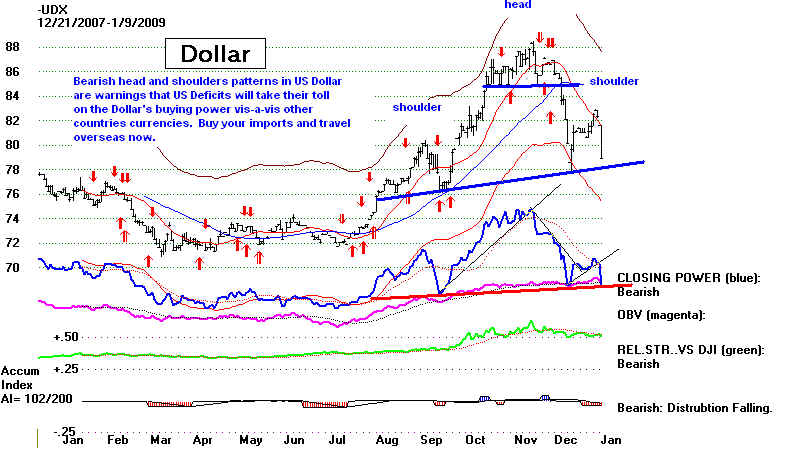

.... Why Does The Dollar Look So Weak?

.... Why Are Professionals Still Selling CitiGroup Short?

There's A New COP on The Beat

It's The New TigerSoft "COP" Indicator.

by William Schmidt, Ph.D. (C) 2009 www.tigersoft.com

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

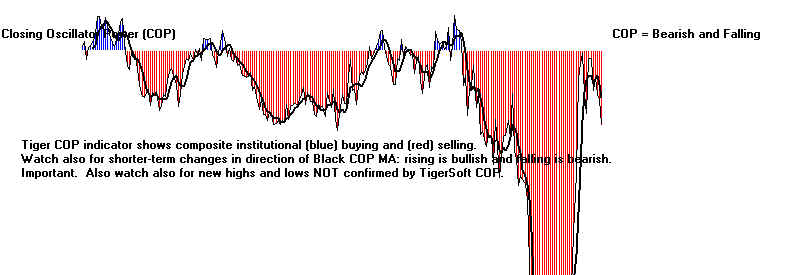

There's a new cop on the beat, it's the TigerSoft "COP" Indicator and it's flashing some new warnings. The Santa Claus rally only lasted 2 days into January. The market, here measured by SPY (the ETF for the SP-500) and our key internal strength indicators is now in decline-mode again. The recovery high by the DJI over 9000 was not confirmed by the blue Tiger Closing Power, by the magenta OBV (measure of aggressive buying/selling) or by the new TigerSoft COP-on-the-beat indicator. The TigerSoft COP's Black MA Indicator is now falling. If it falls into negative territory, it will become "BEARISH". What has caused the market to drop so sharply?

Obama' s Scare Tactics Stop The Rally Cold. Why Is The DJI Going Down Again? So Many Unanswered Questions about Obama. Obama Needs To Take on The Banks like FDR! by William Schmidt, Ph.D. The simple answer is that the stock market, having tested for resistance and found it could not be taken out (DJI 9100), now must test for support to regain confidence. That support is presumably is still to be discovered, Until a price level is now reached that holds, many traders will avoid long positions and even go short. I should note that Obama has said nothing to indicate that he will change the rules that Bush's SEC has enacted that makes it so easy to sell short aggressively and massively. This is a mistake. And it needlessly hurts the stock market and teh economy. (See the articles I have written about how the SEC has facilitated extensive anti-social short-selling.) Traders watch for clues from Obama. There is nothing from him that makes them afraid. Instead, his words of dear strengthen them. Of course, the talking heads on TV explain the decline based on the higher unemployment and much lower retail sales at Christmas, But there's a lot more. Pessimistic economists are scaring the daylights out of the stock market, too. Listen to the much heard Nouriel Roibimi of NYU. Each day's new bad economics' news gives him an opprtunity to promote his his research services and get still more publicity. Since late 2006, Roubini has been correctly, but also unendingly, bearish. "Dr. Doom" is making financial matters worse. He is downright frightening. Fear sells and now he sells his research to a fast growing and increasingly frightened audience. It's not fair, I know, to say that Roubini is only negative. He has set out a long list of government policies that, he says, will limit the world economic decline. In particular, he says that a vast new US public works programs is absolutely vital. The trouble is that all his incessant fear-mongering has become quite self-serving, not necessarily self-correcting and definitely self-fulfilling, because it hurts business and investor confidence. And what is worse? Now Roubini has the ear of Obama, who himself seems to regale in telling us how bad things are likely to get economically. While its true that Bush has left us the country severely in debt and facing bigger national problems in nearly every arena, Obama should see that he can make things even worse, if he does not stop scaring us by repeating ad nauseum, too, how bad the economic outlook is, in order to get get 80% Congressional backing for his "stimulus" proposals and completely away from a number of Bush policies. Last Thursday, with 200 DJI points higher, Obama made a major speech on the economy. He was in a stern and scary mood. Far from expressing confidence in American enterprise and ingenuity, the sense of the speech was, in essence, "Either you do what I say or the economy will collapse further and be weak for years." How is this different than Paulson's scare tactics? Like Bush scaring Congress to get the $700 billion for banks last October, Obama was busy scaring a much more Democratic Congress to get $700 or more billion in tax cuts and public works programs, as quickly as possible after January 20th. Scare tactics may help politically, but this is not what Wall Street needs. I wish he had talked about the positives, all the things that need being done, like building bridges, clinics, schools, etc.... to let people think more optimistically. He did not smile once in the 20 minute speech. Stern. Austere. He reminded me of a preacher giving a sermon to wayward children. Four years of this will depress everyone! He probably thinks that this tone serves his political purposes to keep expectations low. But it badly hurts confidence. And Fear makes for a longer, deeper recession. How could he forget how effective Roosevelt was in 1933 when he stressed in his inaugural address that the "only thing we have to fear is fear iself". We are starting to see a big contrast between Obama and Roosevelt.  From the time

FDR was elected Governor of New York, he had From the time

FDR was elected Governor of New York, he hadchallenged Wall Street and the big banks there had tried to thwart him. In contrast Obama received very large campaign contributions from Goldman Sachs and the like. Time will tell if Obama's non-threatening approach to Wall Street works. Here are Roosevelt's words in March 1933 as he took the oath of| office. "Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men. "True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish. "The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit." ( http://historymatters.gmu.edu/d/5057/ )

Many US banks

Still Look Desperate, |

| |