TigerSoft

Insider Charting Service 2/14/2011

www.tigersoft.com

TigerSoft

Insider Charting Service 2/14/2011

www.tigersoft.com

PROFITABLE SHORT SALES IN

A BULL MARKET

SEAHAWK'S INSIDER SELLING WAS

EASY TO SPOT

USING TIGERSOFT's ACCUMULATION INDEX

AND

PRO-CLOSING POWER

Investors and members

of the investing public

do

not have to lose money to Wall Street crooks,

thieves

and insiders. But they do have to use unique

TigerSoft

charts to protect themselves. Tiger's cost is

miniscule

compared to how much it can and will save the

average

investor.

TigerSoft

$295 Automatic Signals, Charting of Everything,

3

Mo. data, All TigerSoft Indicators.

TigerSoft

charts spot insider selling and Professional Selling

using our "bearish" scan of the nightly

"MINCP" stocks posted

on our Tiger Data Page. These stocks show lots

of red "Distribution"

from our Tiger Accumulation Index and have a Tiger

Closing Power

that is making new lows far ahead of price. The

automatic Sell S7s

show that the Public has been fooled into being

bullish, but Professionals

are very bearish.

Below are many more examples of insider selling

before a big sell-off.

TigerSoft charts easily spotted the insider selling.

Tiger traders

could easily have sold these stocks shorts using our

insider selling

chart alerts. Insider selling rampant.

The SEC does little more

than try to give the appearance that it is leveling

Wall Street's playing

field. See:

TigerSoft's

Killer Short Sales Insider

Trading Is Rampant

Bearish MINCP

Stocks

August

30, 2011 - DGIT's (DGFast

Channel) Shareholders Should Be Mad as Hell

at CEO Scott

Ginsburg. The CEO sold $30 million shares and only then

had

his company issue earning warnngs. As a result, the stock fell 37%

in

one day. In 2002, the SEC upheld a civil fine of $1 million against him

for

insider trading. See the same materials at the bottom of this Blog

July

4, 2009 The Corporate Hall of Shame

Is Getting Crowded.

Corporate Insider Trading

Is Rampant. Fight Back with TigerSoft.

November

25, 2008 Easily Spot Key

Insider Selling Using TigerSoft.

Compare The Insider Selling

Shown on The TigerSoft Charts of

Citibank with Those of Bear Stearns,

Lehman Brothers,

Washington Mutual, Freddie Mac, Fannie Mae, Trump,

Northern Rock and

General Motors.

by William Schmidt, Ph.D. (Columbia University)

|

Tiger

Software

|

|

Research on Individual Stocks upon

Request: Includes Composite

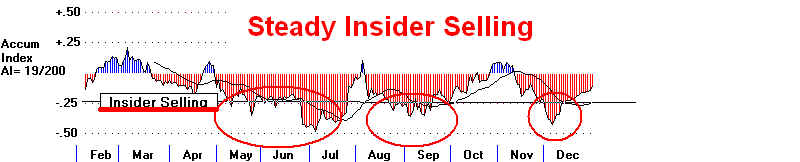

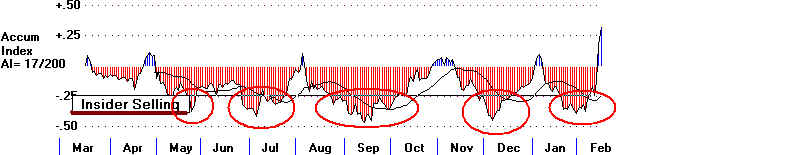

Seasonality Graph of Any Stock for $125. Example of historical research NEM - Newmont Mining. Order Here. ======================================================== PROFITABLE SHORT SALES IN A BULL MARKET SEAHAWK'S INSIDER SELLING WAS EASY TO SPOT USING TIGERSOFT's ACCUMULATION INDEX AND PRO-CLOSING POWER There are always some stocks that insiders and professionals are dumping into the otherwise rising tides of a bull market. SEAHAWK (HAWK) shows this to be true, even though most other drilling and oil stocks rose substantially in the last eighteen months when HAWK was steadily declining from 20 to 4.5. Can there be any doubt that Insiders knew HAWK would be filing for bankruptcy protection and were busy selling their own shares while keeping this information from the public. If the SEC were worth anything, they would launch a full scale investigation, but odds are overhwelming that they will do nothing. That is par for them... Seahawk Drilling Files Chapter 11 Seeking Alpha(Tue, Feb 15) TigerSoft spots sigificant Insider Selling using our Accumulation Index. This we invented in 1981. See below how the Accumlation Index stays negative (red) and frequently falls below -.25, our threshold for signifying important unofficial and official insider selling. In addition, Wall Street Professionals were privy to the extreme bearishness of WAWK's stock. See how the blue Tiger Closing Power kept falling and falling, all the while the general Public were fooled by the apparent "cheapness" of the stock to steadily buy all the way down. This is absolutely typical of insiders selling before they announce the bad news. Compare SEAHAWK's case below with the insider selling by Peter Sperling of Apollo. Or the bankers' insider selling at CitiGroup or Washington Mutual before they plunged into the abyss because of the recklessness of CEO's use of leverage in the mortgage debacle of 2008-2009. HAWK - Seahawk - 2010-2011   Seahawk Drilling, Inc. 5 Greenway Plaza

Suite 2700 Houston, TX 77046 Website:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||