OBAMA IS A TOOL OF WALL STREET.

by William Schmidt,

Ph.D.

If you own a lot of stocks, stop complaining! Obama has saved

you from DJIA 4000

and has brought about a huge rally in secondary

stocks. The market has been rallying ever

since he got up on the Jay Leonard show in early

March 2009 and said that no one on

Wall Street committed a single criminal offense -

before there was any official investigation -

in bringing about and bursting the Housing Bubble or

in driving the stock market down

54% between October 2007 and March 2009. Obama

did exactly what his biggest campaign

contributors - Wall Street - wanted him to do.

He gave billions to banks and gave full support

to an unaccountable Federal Reserve and ot Chairman,

Ben Bernanke, in oarticular.

At the

time, the Tiger Blog caught the reason for the turn upwards in the stock market.

See March 25,

2009 Why Is The Stock

Market Rallying? Wall Street Now Sees That Obama's

Populist Rhetoric

Is Designed To Fool The Angry Public. Obama Is Signaling Wall Street He Will

Protect Them.

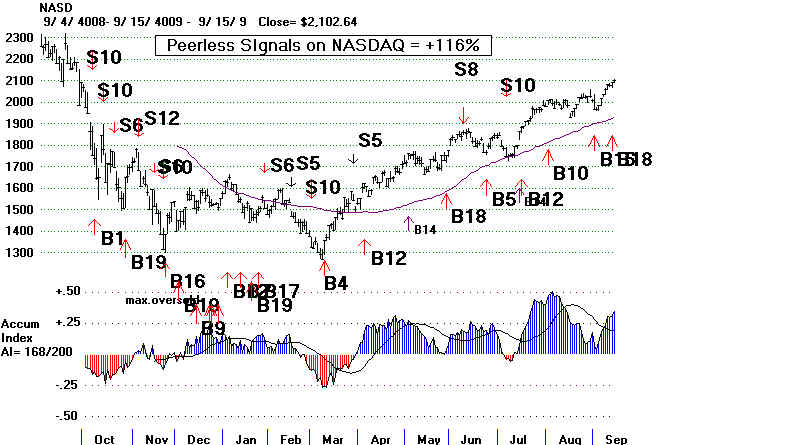

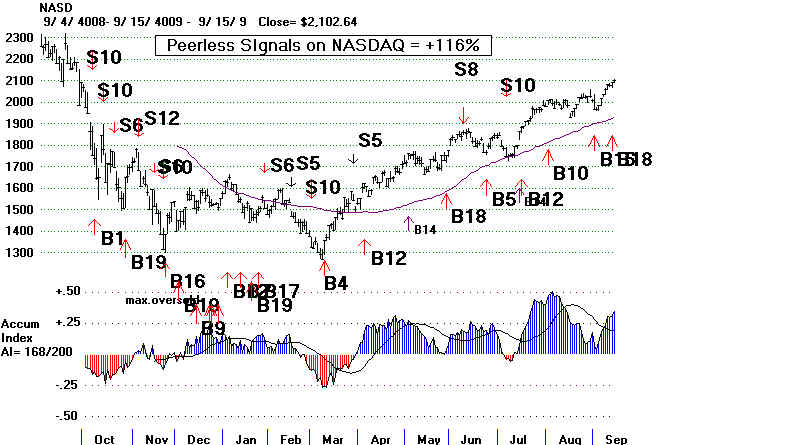

Here is the

Peerless chart of the Dow Jones Industrial Average. The red Buy and Sell

signals occur automatically. These were the Buy and

Sell signals, TigerSoft's Peerless

offers it customers, either through use of the software or

on a nightly hotline. These signals

gained 80% between October 7th, 2008 and September 15th,

2009 if one bought, sold on

sold short the DJIA according to these Buys and Sells.

Except for the June decline, Peerless

has kept traders properly "long" the market since

March 9th for all but a few days.

The broader based NASDAQ has risen 61% since its March

bottom. The Peerless

Buys and Sells

would have gained a trader 116% since October.

The rally since March has been much more generous with secondary stocks.

These are the 1000s

of smaller companies that do not make it into "blue

chip multinationals' " DJI-30. Low priced

stocks are up 200% since March. Their volatility

makes them too risky and dangerous for most

investors. TigerSoft users of Peerless mastered their

swings this past year, gaining +316% on

this group's swings with the Peerless Buys and Sells.

On June 8th, I penned a Blog entitled

The Great 2009 Bull

Market. Why Is Wall Street Concealing The Huge Surges in

Low Priced Stocks?

OBAMA IS A TOOL OF WALL

STREET.

Bankers' Bailout:

Trader, Andrew J. Hall of Citigroup was recently paid $100

million by US taxpayers

with Obama's approval.

CitiGroup

has received more than $387 billion in government support and

$45 billion in TARP funds.

There is no restriction on executve pay and bonues.

So far, that's $1,269 for

every man, woman and child in the country!

(Source

)

The Obama Administration should rightfully be the target of a backlash.

While the administration has done much to be commended, the people they hired to fix this

mess are sadly some of the same who got us there. Their actions reek of hubris and

continued self-interest. Consider:

1) Tim Geithner was the chairman of the NY Fed and an active participant in the fumbled,

lurching responses of the Bush administration. Similarly, Larry Summers, although he says

he is outraged by the meltdown, was a principle architect of the deregulation fest that

got us here.

2) Geithner's initial hires are dominated by investment bankers and especially recent

employees of Goldman Sachs, the alma mater of Secretary Paulson. Goldman played a pivotal

role in promoting credit default swaps and other sketchy derivatives (although they were

nimble enough to sell early and avoid the worst of the tsunami). GS has not only taken

billions directly from taxpayers; but they are a Primary Beneficiary of the billions of

taxpayers' dollars given by AIG to its "secret" trading partners. (The outrages

never cease - we own 80% of AIG, yet even Congress can't find out who is getting billions

of dollars of payola.) In other words, Geithner and his team of Goldman alumni are

donating billions of our dollars to their friends and former employer under the cloak of

secrecy. This is the kind of "deal" for the taxpayers that Boss Tweed would have

been proud of.

3) The administration's unwillingness to take forceful and timely action on behalf of the

taxpayers by nationalizing the most disabled banks is scandalous. The delays in action

only prolong the recession while the steady drip, drip of taxpayer funds continue to bail

out the wealthiest of the wealthy. And the reason given for inaction is disturbing - they

don't want to hurt the shareholders. Well what about the rest of us - the taxpayers?!

4) And perhaps the most disturbing thing is that these "master of our universe"

have no sense of the outrage they are perpetrating. Instead, they take it for granted that

they are entitled to be bailed out ad infinitum and keep getting their swollen bonuses.

Their outrage at anyone questioning their entitlement is evidenced by the absurd

statement, "we need to pay huge bonuses to retain the most talented

individuals". Never mind that these "most talented" have brought down our

economy, thrust ordinary Americans and the rest of the world into the worst hardship since

the Great Depression. They are so completely out of touch, that they actually believe

their own self-serving nonsense and argue that they deserve the billions they continue to

pillage. And, as friends and colleagues of these people, administration officials will

spare no (taxpayer) expense to make the "talented" comfortable. Geithner, Inc.

will take care of their own while the rest of us go to hell in a rather cracked teapot.

Also, don't count on Congress to take any meaningful action. They will not bite the hands

of their masters - the ones who gave and continue to give millions (of our money) to their

campaign funds. One of the most egregious outrages of recent years is that hedge fund

managers, who contributed heartily to our economic collapse, continue to be taxed at 15%

MAXIMUM. The rest of us chumps pay full freight; but the wealthiest billionaires among us

continue to pay the lowest possible rate. How is this possible? Well, when Congress

considered taxing hedge funds at a higher rate, Senator Chuck Schumer used his

considerable clout to protect the thieves (and yes, wealthy people who pay less than the

rest of us are simply thieves) by blocking any legislation. As I said, don't expect

Congress to take action anytime soon.

The picture is complete and it's quite clear. The greed-obsessed and heedless crowd who

wrecked our economy continue to be in power and not only duck punishment, but continue to

be rewarded with billions of dollars in taxpayer funds. These people are criminals in the

classic sense of the word - i.e., they knowingly endanger others with their actions and

are incapable of remorse. We need to be protected from such and they should be in jail -

not for reasons of vengeance - but to protect the community at large.

The officials hired to fix this situation are too enmeshed in this world and therefore

will do nothing that might harm their cronies at the expense of the rest of us. And last,

our elected officials are utterly compromised by the corrupting influence of campaign

donations from said "masters" and will do little, other than spouting fine

platitudes, to challenge the status quo.

As some great, unknown philosopher put it, "we are SO screwed".

— DHanig, Olympia http://funkyfantom.blogspot.com/

|

Ever since

the Fed. bailout

of Wall Street, my view of politics has taken quite a turn. I now

think Ralph Nader is actually right about there being no difference

between Republicans and Democrats- they have both proved themselves to

be whores of Wall Street.

Although I am still a theoretical free-market conservative- all that

stuff has proven to be just abstract theory.

I am absolutely convinced that Wall Street runs the government. They

bankrolled both Presidential candidates.

The Bush/Obama transition has been seamless in what concerns Wall

Street. And it seems not to bother the public too much that the very

group who told us that Wall Street's downfall would be the nations' (

if we didn't pay up quickly with no strings attached) were the very

group who directed benefitted.

Look at the latest AIG bailout. Go to the NY Times website - read the

1500 letters- people are angry.

Forget about Obama. He is a weakling and a tool of Wall Street.

They financed his campaign.

I saw Bernanke lie on TV. We are told that giving hundreds of

billions to AIG is analogous to putting out a fire in our neighbors

house so that our own won't burn down.

The bailout money is not only going to big corporate salaries and

bonuses, but also as shareholder dividends- to the greedy scumbags who

brought down the American economy.

He at least admitted that the trillion dollar credit default market

that AIG was involved in was simply a big casino game based on greed

and was completely divorced from healthy financial activity necessary

for the economy.

And we all know now that the counterparty investment banks to these

casino bets were conducting their own masssive frauds in the real

estate market.

The real-estate fraud aspect of it was well-documented in great detail

in John Talbott's 2003 book "The Coming Crash in the Real Estate

Market".

The free market, left alone, would have punished the perpetrators the

way they deserved to be punished.

You cannot possibly believe WALL STREET'S warnings, parroted by

Goldman Sachs flunkies in the government, that if American doesn't

given trillions to WALL STREET that Main Street is doomed?

You know that this is not free market capitalism- and this is

not socialism either. It is an evil, stinking hybrid which exists only

to benefit the ruling class.

|

Obama has no compunctions about using taxpayer money to buy up toxic

assets and taking the heat off hedge funds.

The Administration's Auto Task Force, rejecting the recovery plans of Chrysler and General

Motors, has put heightened pressure on the industry to hammer the auto workers union,

force brutal cuts on wages, benefits and pensions.

Even more scurrilous are Obama's repeated assurances to Wall Street that he will slash

social spending, including Medicare, Medicaid and Social Security.

It's out in the open, now--top Obama advisors directly involved in setting these policies,

have received millions from Wall Street firms, including those that have received huge

taxpayer bailouts.

Lawrence Summers, Obama's top economic advisor, a glaring example, pocketed $5 million as

a managing director of D.E. Shaw, one of the biggest hedge funds in the world, and another

$2.7 million for speeches delivered to Wall Street firms that have received government

bailout money. This includes $45,000 from Citigroup and $67,500 each from JPMorgan Chase

and the now-liquidated Lehman Brothers. Last year, Summers walked away with $135,000 for a

speech to Goldman Sachs executives.

The New York Times noted Saturday (4-4-09) "Mr. Summers, the director of the National

Economic Council, wields important influence over Mr. Obama's policy decisions for the

troubled financial industry, including firms from which he recently received

payments."

Any conflict of interest here?

It's no secret that Summers was a leading advocate of banking deregulation. The Times

article notes that among his current responsibilities is deciding "whether--and

how--to tighten regulation of hedge funds."

Summers is not an exception. He's typical of the Wall Street insiders who make up the

White House team, filled with multi-millionaires, presided over by a president who

parlayed his own political career into a multi-million-dollar fortune, according to

investigative reporter, Tom Eley.

There is Michael Froman, deputy national security adviser for international economic

affairs, who worked for Citigroup and received more than $7.4 million from the bank from

January of 2008 until he entered the Obama administration this year. This included a $2.25

million year-end bonus handed him this past January, within weeks of his joining the Obama

administration. Citigroup has thus far been the beneficiary of $45 billion in cash and

over $300 billion in government guarantees of its bad debts. Can this be called "quid

pro quo"?

David Axelrod, senior adviser to the president, was paid $1.55 million last year from two

consulting firms he controls. He has agreed to buyouts that will garner him another $3

million over the next five years. His disclosure claims personal assets of between $7 and

$10 million.

Obama's deputy national security adviser, Thomas E. Donilon, was paid $3.9 million by a

Washington law firm whose major clients include Citigroup, Goldman Sachs and the private

equity firm Apollo Management.

Donilon worked as Executive Vice President for Law and Policy at Fannie Mae. The

Washington Times reported that Donilon made millions for work that included supervising

Fannie Mae's lobbying against increased regulation.

Another member of the gang, Louis Caldera, director of the White House Military Office,

made $227,155 last year from IndyMac Bancorp, the California bank that heavily promoted

subprime mortgages. It collapsed last summer and was placed under federal receivership.

And that's not all.

Multi-millionaire Wall Street insiders populate second and third-tier positions in the

Obama administration as well.

David Stevens, tapped by Obama to head the Federal Housing Administration, is the

president of a real estate brokerage firm. From 1999 to 2005 Stevens served as a top

executive for Freddie Mac.

Neal Wolin, Obama's deputy counsel for economic policy, is a top executive at the

insurance giant Hartford Financial Services, where his salary was $4.5 million.

The story goes on...

Are you shocked--shocked!

A parallel set of characters can be found in the war, excuse me, defense department, lined

up in the cabinet.

Remember "Change you can believe in!"

From the start, Obama played the populist, critic of the war in Iraq and won over a youth

and liberal base, all the while being backed by the oligarchy with massive campaign funds.

tp://www.organicconsumers.org/articles/article_17504.cfm |

|

September 11, 2009, 7:34 pm

Why Wall Street Reforms Have Stalled

Thursday, September

17, 2009

Too Much Power for the Few

Yves Smith has written the blog Naked

Capitalism since 2006. She has spent more than 25 years in the financial services

industry and currently is head of Aurora Advisors,

a management consulting firm.

Wall Street has become hard to regulate because we’ve allowed it to evolve that

way. Credit is vital to any economy beyond the barter stage. As commerce became large

scale and more interconnected, bank failures, which were once local affairs, increasingly

led to widespread panics that produced considerable harm. As a result, government not only

started to provide more safety nets for banks but also supervised them and placed limits

on their activities.

It is pretty hard to regulate someone

who has a knife at your throat.

Since the 1980s, lending has shifted from banks to the capital markets.

While many loans do remain with the bank that originated them, in the U.S., what Treasury

Secretary Timothy Geithner has called “market-based credit” has become

prevalent. Even though a bank initially extends the loan, it is often on-sold through

capital markets firms to investors.

That process gives major financial players control over the all-important

over-the-counter debt markets. Most of these deals do not trade much once sold, making

them ill-suited to shift on to exchanges that would be easier to police. But these

over-the-counter markets have, for a host of reasons, strong scale economies and network

effects, so absent intervention, it was inevitable that they would become increasingly

concentrated, with a comparatively small number of firms becoming dominant.

It is pretty hard to regulate someone who has a knife at your throat.

http://roomfordebate.blogs.nytimes.com/2009/09/11/why-wall-street-reforms-have-stalled/

|

May 24, 2009 ... Geithner is not a tool of Wall Street! ...

Obama Promises NO MORE TRICKLE DOWN: .... Obama's #1 campaign

contributor= Goldman Sachs ...

www.huffingtonpost.com/.../geithner-adopts-part-of-w_n_207199.html - Cached

- Similar

|

Aug 24, 2009 ... We need to save Obama from his own

economic team, which is acting more and more like a ... PostSeptember 16, 2009

.... It will cause even more people to conclude that the Obama

Administration is a tool of Wall Street. ...

www.huffingtonpost.com/.../can-we-stop-wall-streets_b_266733.html - Similar

|

Jul 21, 2009 ... Sunday, September 6, 2009 ...

have just another politician who is nothing more or less than a tool of Wall Street,

Big Oil and the military. ...

www.usnews.com/blogs/.../2009/.../obamas.../comments/ - Cached

- Similar

|

Mar 12, 2009 ... Obama Praises Trickle-Down

Economics! Huh? - At the end of September, 2008, presidential candidate Barack Obama

released a two minute ...

www.bloggersbase.com/.../obama-praises-trickle-down-economics-huh/ - Cached

- Similar

Obama Trickle Down Stimulus Plan - Obama Trickle down

economics - The World's News.

www.theworldsnews.net/obama-trickle-down-economics/ - Cached

- Similar

Jul 16, 2009 ... Article: President Obama chose a trickle

down, politically correct attack on the economic crisis--that isn\'t workin--and the

natives are ...

www.opednews.com/.../Obama-s-trickle-down-stimu-by-Chaz-Valenza-090716-898.html

- Cached

- Similar

|

|

TigerSoft

News Service 9/17/2009 www.tigersoft.com

TigerSoft

News Service 9/17/2009 www.tigersoft.com