TigerSoft News Service 5/5/2009

www.tigersoft.com

TigerSoft News Service 5/5/2009

www.tigersoft.com WHY BANK STOCKS ARE RISING: Part II

CREDIT DEFAULT SWAPS ARE A FRAUD.

LIKE GAMBLING DEBTS, THEY SHOULD

BE DECLARED UNENFORCEABLE

WHY ARE THEY NOT?

"BECAUSE BANKS OWN THE US GOVERNMENT"

by William Schmidt, Ph.D. (Columbia University)

(C) 2009All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

|

Tiger

Software Helping Investors since 1981

|

| CREDIT DEFAULT SWAPS SHOULD BE DECLARED ILLEGAL BUT THAT WOULD HURT GOLDMAN SACHS! by William Schmidt, Ph.D - www.tigersoft.com Credit Default Swaps - guarantee the owner of the CDS against the nonpayment of a debt by a second party. How realistically can any entity guarantee thousands and thousands of contracts, mortgages and loans against default when a housing, real estate or stock market "boom" turns into a bust? Would it not be fraud for me to take in money guaranteeing all comers against some monstrous catastrophe? In the event of a giant earthquake, tidal wave or meteor, I would have no way of ever paying those I "insured". I know this. It would be fraud for me to take in money in this fashion. CDS, have for years been an unregulated $62 trillion market. Until 2000, many states prohibited them, much like stock market side-bets were banned in the 1930s. Yet, amazingly, Obama's Treasury Secretary would have the US government guarantee them all. He has urged this in meeting after meeting since June 2008. "He (Geithner) proposed asking Congress to give the president broad power to guarantee all the debt in the banking system, according to two participants, including Michele Davis, then an assistant Treasury secretary. The proposal quickly died amid protests that it was politically untenable because it could put taxpayers on the hook for trillions of dollars. “People thought, ‘Wow, that’s kind of out there,’ ” said John C. Dugan, the comptroller of the currency, who heard about the idea afterward. Mr. Geithner says, “I don’t remember a serious discussion on that proposal then.” "But in the 10 months since then, the government has in many ways embraced his blue-sky prescription. Step by step, through an array of new programs, the Federal Reserve and Treasury have assumed an unprecedented role in the banking system, using unprecedented amounts of taxpayer money, to try to save the nation’s financiers from their own mistakes. And more often than not, Mr. Geithner has been a leading architect of those bailouts, the activist at the head of the pack. He was the federal regulator most willing to “push the envelope,” said H. Rodgin Cohen, a prominent Wall Street lawyer who spoke frequently with Mr. Geithner." (Source - New York Times). So, the US Government guaranteed the debts of AIG, and its many credit default swaps, in September 2008 after a hurried and secret Saturday meeting between Paulson (US Treasury Secretary), Geithner (NY Fed Chairman) and Lloyd Blankfein, the Chairman of Goldman Sachs. The US takeover of AIG and all its financial responsibilities amounted to the taxpayer providing Goldman Sachs a $13 billion handout in return for the credit default swaps that Goldman had bought from AIG. No effort was made by AIG, or its CEO Edward Libby, an ex-Goldman guy, or the Paulson regime at the Treasury or more recently by the Obama Administration to question the very legality of these Credit Default Swaps or seek to reduce the taxpayer payment to Goldman based on their lack of legal sanction. Many folks think that this was a massive fraud, that it shows how corrupt both Bush-Paulson and the Obama-Geithner Administrations were and are. More dangerously, it clearly demonstrates that the US Government is little more than a tool for Wall Street and Goldman Sachs, in particular. AIG sold billions of dollars worth of Credit Default Swaps. In doing so, it guaranteed against the owner against a financial failure by various issuers of debts like banks and GM and other corporations. It was in no financial position to do that, especially since as the economy weakened, it had agreed to put up more and more collateral against its own default. It made these arrangements fraudulently. Executives at AIG urged its salesmen to sell these CDS because they wanted more short-term revenue - despite the risks - to bring them outrageously high salaries. AIG and others thus collected money to guard against an eventuality which they could see would end up making them insolvent. They would never have enough money to pay all that they would owe in this case. They knew this. But they were happy collecting money as long as possible to shore up their profits and executive bonuses. I would like to see the government declare that ALL Credit Default Swaps are illegal private gambling and fraud. As such no court could require them to be honored. Realize that Credit Default Swaps have never been certified by an appropriate government entity to be valid insurance policies. Credit default swaps were fraudulent wagers that should be declared null, void and unenforceable, just as illegal gambling debts are.  Obama contends without investigation that no laws were violated by bankers and insurance companies in crashing down the entire world financial system.. It can reasonably be contended that when AIG and others sold these, they knew that there was always a risk of wisdespread financial disaster, in which case they would not be able to pay what the CDS agreements required of them. Therefore, these CDS contracts were entered into in a fraudulent way. It is the biggest banks that Bernanke, Paulson Obama, Geithner and Summers are closest to that have made nearly all these transactions. Trillions of tax payer money is going to bail out the very culprits who engaged in these transactions to prolong the financial bubble. Analysis Shows Megabanks Have 23,000 Times More Exposure to Credit Default Swaps Than Community Banks

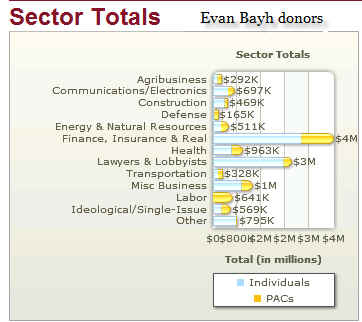

Goldman is also the top

donor to Bayh over the course of his Congressional career, during which

|

FROM THE OFFICE OF SATAN

"Prince of Lies and proud of it"

Dear Hank:

You have outdone yourself once again, my loyal servant, with these fraudulent, deliciously

deceptive proposals to reform the utterly corrupt financial system you exploited so

profitably as head of Goldman Sachs.

My plans for the destruction of the United States of America have been going along rather

swimmingly until we rushed things a bit with Bear Stearns--ah, the wondrous power of pure,

unmitigated greed! It remains my favorite tool--and calls for reform were suddenly

everywhere.

The rules which would have undone us were simple indeed, as you know all too well:

1.

complete transparency of risk and leverage in all financial documents and financial

instruments

2.

the marking to market of all financial instruments and assets at the close of the trading

day, as is currently done with commodities futures and stock options

3.

the banning of "off balance sheet" accounting

4.

the banning of offshore accounts and holding companies

5.

the uniform enforcement of these regulations across all financial classes, assets, firms,

brokers and banks

As you know, Hank, transparency, mark-to-market and strictly enforced regulations of all

banks, broker-dealers and financial institutions would deal a death blow to my plans to

destroy the U.S. via destruction of its financial system. Having sold your soul to me for

the glory and riches you received at Goldman Sachs, you had to comply with my orders to

destroy any such useful regulations with cunning "fixes" of your own.

Though I counted on your native feral survival instincts, I did not expect a plan of such

evil genius. Imagine how foolish and naive humans must be to accept your "fix"!

My mind boggles at the ease with which you have conned the gullible gallery of idiots in

Congress and the mainstream media:

1.

You diminish the powers of the Federal agencies and favor the "shadow

government" Federal Reserve, which is not even a government agency but a private

institution.

2.

Instead of proposing transparency, you are adding another layer of secrecy in what the Fed

can investigate and do to "fix" future problems.

3.

Enable more "self-regulation" (hahahaha, I can't stop laughing at this one! You

really are a comedian!)

I am still amused that the American populace hasn't noticed that you, Master of the Dark

Arts at Goldman Sachs, have been duly appointed as the wolf assigned to guard the sheep.

Now you have suggested opening the rusty wire fencing and lighting the opening so your

brethren can more easily slip in and slaughter as many sheep as they wish--and the

American sheep sit there mesmerized by my other crowning achievement, the TV, blithely

accepted that the most voracious, cleverest wolf is now their "guardian." Never

in my wildest imaginations did I hope for such gross stupidity, ignorance and naiveté.

Keep up the fine work--

Your Lord and Master,

Lucifer

Source.

"Why on earth not a single Wall Street CEO behind bars? Only logical explanation is

Obama has been paid off handsomely." toulouse_20...

"

VS.

VS.